Key Insights

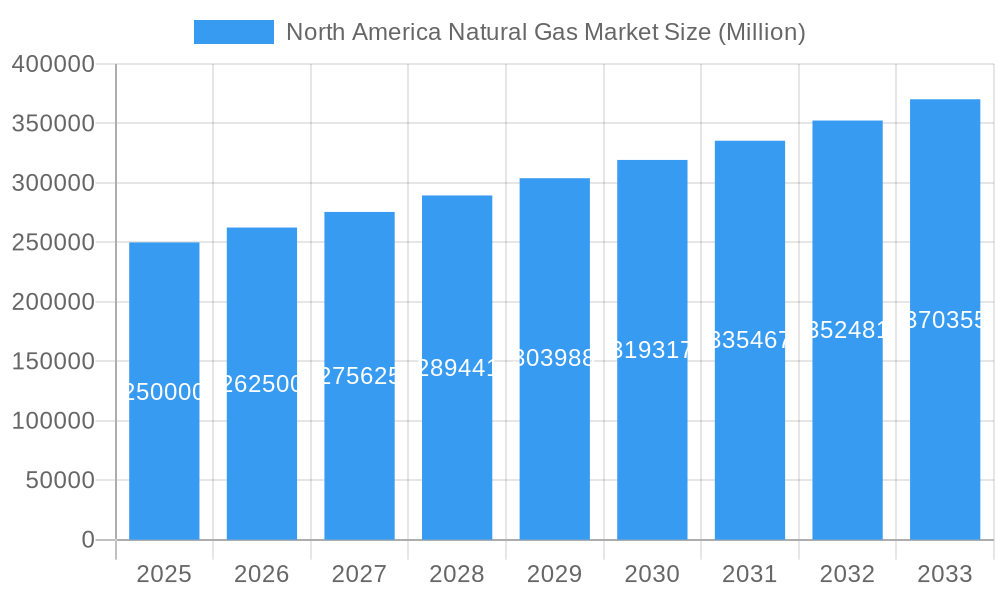

The North American natural gas market, encompassing the United States, Canada, and Mexico, is experiencing robust growth, driven by increasing demand across diverse sectors. The market's size in 2025 is estimated at $XXX million (assuming a reasonable market size based on publicly available data for similar markets and the given CAGR of >5.00%). This growth is fueled primarily by the automotive industry's shift towards cleaner fuels, the expanding power generation sector relying on natural gas for electricity production, and the consistent demand from the industrial and household sectors. Further expansion is anticipated from unconventional gas sources, which are becoming increasingly economical and accessible. While regulatory hurdles and fluctuating energy prices present challenges, technological advancements in extraction and transportation are mitigating these restraints. Significant investments in infrastructure and exploration activities are anticipated to further bolster market expansion throughout the forecast period (2025-2033).

North America Natural Gas Market Market Size (In Billion)

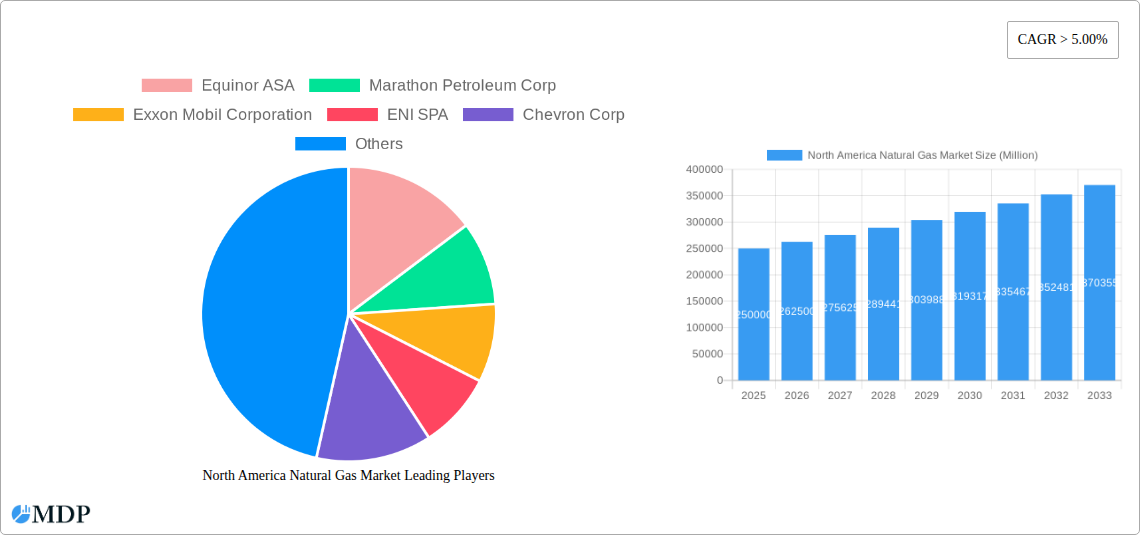

The market segmentation reveals considerable diversity. The automotive sector is a significant driver, with the increasing adoption of Compressed Natural Gas (CNG) vehicles. Power generation remains a cornerstone of demand, benefiting from natural gas's role as a cleaner-burning fuel compared to coal. Household consumption is consistent, while the industrial fuel segment shows varied growth patterns across sectors. Geographically, the United States dominates the market, followed by Canada and Mexico. The presence of major players like Equinor ASA, Marathon Petroleum Corp, Exxon Mobil Corporation, Eni SPA, Chevron Corp, BP PLC, Total SA, and Royal Dutch Shell indicates a high level of competition and investment in the sector. The projected CAGR of >5.00% suggests a continuously expanding market, promising significant opportunities for industry participants. However, successful navigation of environmental regulations and market volatility will be crucial for sustained growth.

North America Natural Gas Market Company Market Share

North America Natural Gas Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North American natural gas market, covering the period 2019-2033. It offers invaluable insights into market dynamics, industry trends, leading players, and future growth potential, equipping stakeholders with the knowledge to navigate this dynamic sector effectively. The report leverages extensive data analysis and expert insights to provide actionable intelligence for strategic decision-making. Key segments analyzed include application (automotive, power generation, household, industrial fuel), sources (conventional and unconventional gas), and geographic regions (USA, Canada, Mexico).

North America Natural Gas Market Market Dynamics & Concentration

This section analyzes the competitive landscape of the North American natural gas market, considering market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The historical period (2019-2024) and the forecast period (2025-2033) are examined to identify key trends and future trajectories.

Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share data for each company is proprietary, it's estimated that the top five players collectively hold approximately xx% of the market in 2025.

Innovation Drivers: Technological advancements in exploration, extraction, and transportation of natural gas are key drivers of market growth. The increasing adoption of unconventional gas extraction techniques, such as hydraulic fracturing, has significantly expanded the available gas reserves.

Regulatory Frameworks: Governmental policies and regulations play a significant role in shaping the market dynamics. Environmental regulations, particularly concerning methane emissions, are influencing the adoption of cleaner technologies and practices.

Product Substitutes: Renewable energy sources, such as solar and wind power, pose a competitive challenge to natural gas. However, natural gas retains its importance as a reliable and flexible energy source for power generation and industrial applications.

End-User Trends: The growing demand for natural gas in power generation and industrial fuel applications is driving market expansion. The transition to cleaner energy sources is expected to impact the future demand trajectory, but it is anticipated to remain a primary source for several applications through 2033.

M&A Activities: The number of M&A deals in the North American natural gas sector has fluctuated in recent years. The estimated number of deals concluded between 2019 and 2024 was approximately xx, influenced by factors such as consolidation trends and investor sentiment. Forecast for 2025-2033 shows xx M&A deals projected.

North America Natural Gas Market Industry Trends & Analysis

This section provides a comprehensive analysis of the industry trends shaping the North American natural gas market. It explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing detailed insights for the period 2019-2033. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%, driven by various factors.

The market is experiencing significant changes, influenced by factors such as shifts in energy policy, technological advancements, environmental concerns, and economic growth. The increasing adoption of natural gas in various applications is driving overall market growth. While the penetration of renewables is influencing the demand for natural gas, it still remains a crucial fuel source, particularly in power generation. Competitive dynamics involve not only existing companies but also the entry of new players investing in innovative technologies and infrastructure.

Leading Markets & Segments in North America Natural Gas Market

This section identifies the leading regions, countries, and segments within the North American natural gas market. The analysis considers factors driving dominance in each segment.

Dominant Regions & Countries:

USA: Remains the largest market in North America, owing to its extensive natural gas reserves and robust infrastructure. Key drivers include the abundance of shale gas resources, supportive regulatory frameworks, and large-scale industrial and power generation sectors.

Canada: Holds a significant position in the market, characterized by its substantial conventional and unconventional gas resources. Export opportunities to the US further enhance its market share.

Mexico: The market is experiencing moderate growth, largely influenced by energy reforms and increasing demand for electricity and industrial fuel.

Dominant Segments:

Application: Power generation is the largest segment, driven by the increasing demand for electricity and the competitiveness of natural gas against coal. Industrial fuel applications contribute substantially, while the household segment is experiencing steady growth.

Source: Unconventional gas (shale gas) is the most dominant source of natural gas, largely driven by the development of hydraulic fracturing technologies. Conventional gas continues to be an important source, especially in regions with existing infrastructure.

Key Drivers:

- Robust economic growth in North America fuels the energy demand driving natural gas consumption.

- Supportive government policies and regulations for natural gas infrastructure development.

- Technological advancements in exploration, extraction, and transportation boosting efficiency and reducing costs.

North America Natural Gas Market Product Developments

Recent product developments in the North America natural gas market primarily revolve around enhancing extraction efficiency and reducing environmental impact. New technologies improve drilling techniques, optimize gas processing, and minimize methane emissions. These advancements have resulted in increased output and reduced operational costs, making natural gas a more competitive energy source. Further research is focusing on gas-to-liquids (GTL) technologies to broaden natural gas applications in transportation fuels.

Key Drivers of North America Natural Gas Market Growth

Several key factors drive the growth of the North America natural gas market. Firstly, the abundance of shale gas reserves in the US and Canada has ensured a consistent supply. Secondly, the relative affordability of natural gas compared to other fuels makes it attractive for various applications. Finally, government policies supporting domestic natural gas production and infrastructure development further contribute to its growth.

Challenges in the North America Natural Gas Market Market

The North America natural gas market faces significant challenges, including environmental concerns around methane emissions, price volatility due to geopolitical factors, and pipeline infrastructure limitations. Regulatory hurdles related to environmental protection and land access can also create delays and increase project costs. Furthermore, the emergence of renewable energy sources represents a competitive threat to the long-term dominance of natural gas. These challenges are expected to impact overall market growth by xx% in the forecast period.

Emerging Opportunities in North America Natural Gas Market

The North America natural gas market presents substantial opportunities for growth. Advancements in gas processing technologies, such as carbon capture and storage, are reducing the environmental impact of natural gas production. Furthermore, strategic partnerships between energy companies and technology providers are driving innovation and efficiency improvements. Expansion into new markets and applications of natural gas, such as liquefied natural gas (LNG) exports, provides additional opportunities.

Leading Players in the North America Natural Gas Market Sector

Key Milestones in North America Natural Gas Market Industry

- July 2022: Sempra Infrastructure's agreement with Mexico's Federal Electricity Commission to develop critical energy infrastructure, including pipeline rerouting and potential LNG terminals, signals significant expansion in the Mexican market and strengthens regional integration. This milestone is projected to add xx Million USD to the market value by 2033.

Strategic Outlook for North America Natural Gas Market Market

The North America natural gas market is poised for sustained growth in the forecast period (2025-2033), driven by strong demand from power generation, industrial sectors, and household consumers. While the transition to cleaner energy sources will continue to influence market dynamics, natural gas's affordability, reliability, and versatility will ensure its continued relevance. Strategic opportunities exist in developing efficient gas processing technologies, expanding LNG export capabilities, and fostering partnerships to address environmental concerns and enhance market competitiveness.

North America Natural Gas Market Segmentation

-

1. Source

- 1.1. Conventional Gas

- 1.2. Unconventional gas

-

2. Application

- 2.1. Automotive

- 2.2. Power generation

- 2.3. Household

- 2.4. Industrial Fuel

-

3. Countries

- 3.1. Canada

- 3.2. USA

- 3.3. Mexico

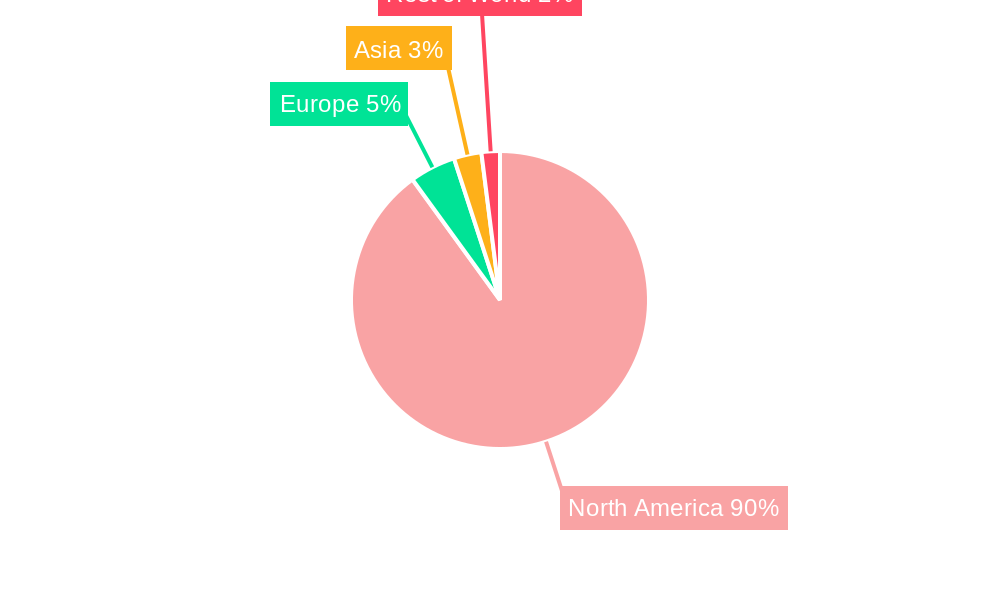

North America Natural Gas Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Natural Gas Market Regional Market Share

Geographic Coverage of North America Natural Gas Market

North America Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Power generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Natural Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Conventional Gas

- 5.1.2. Unconventional gas

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Power generation

- 5.2.3. Household

- 5.2.4. Industrial Fuel

- 5.3. Market Analysis, Insights and Forecast - by Countries

- 5.3.1. Canada

- 5.3.2. USA

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marathon Petroleum Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENI SPA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BP PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: North America Natural Gas Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Natural Gas Market Share (%) by Company 2025

List of Tables

- Table 1: North America Natural Gas Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: North America Natural Gas Market Volume Tonnes Forecast, by Source 2020 & 2033

- Table 3: North America Natural Gas Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America Natural Gas Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 5: North America Natural Gas Market Revenue undefined Forecast, by Countries 2020 & 2033

- Table 6: North America Natural Gas Market Volume Tonnes Forecast, by Countries 2020 & 2033

- Table 7: North America Natural Gas Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: North America Natural Gas Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 9: North America Natural Gas Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 10: North America Natural Gas Market Volume Tonnes Forecast, by Source 2020 & 2033

- Table 11: North America Natural Gas Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: North America Natural Gas Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 13: North America Natural Gas Market Revenue undefined Forecast, by Countries 2020 & 2033

- Table 14: North America Natural Gas Market Volume Tonnes Forecast, by Countries 2020 & 2033

- Table 15: North America Natural Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Natural Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 17: United States North America Natural Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States North America Natural Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Natural Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Natural Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Natural Gas Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Natural Gas Market Volume (Tonnes) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Natural Gas Market?

The projected CAGR is approximately 6.15%.

2. Which companies are prominent players in the North America Natural Gas Market?

Key companies in the market include Equinor ASA, Marathon Petroleum Corp, Exxon Mobil Corporation, ENI SPA, Chevron Corp, BP PLC, Total SA, Royal Dutch Shell.

3. What are the main segments of the North America Natural Gas Market?

The market segments include Source, Application, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Power generation to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

In July 2022, Sempra Infrastructure signed an agreement with Mexico's Federal Electricity Commission to advance the joint development of critical energy infrastructure projects in Mexico, including the rerouting of the Guaymas-El Oro pipeline in Sonora, the proposed Vista Pacífico LNG project in Topolobampo, Sinaloa, and the potential development of a liquefied natural gas (LNG) terminal in Salina Cruz, Oaxaca.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Natural Gas Market?

To stay informed about further developments, trends, and reports in the North America Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence