Key Insights

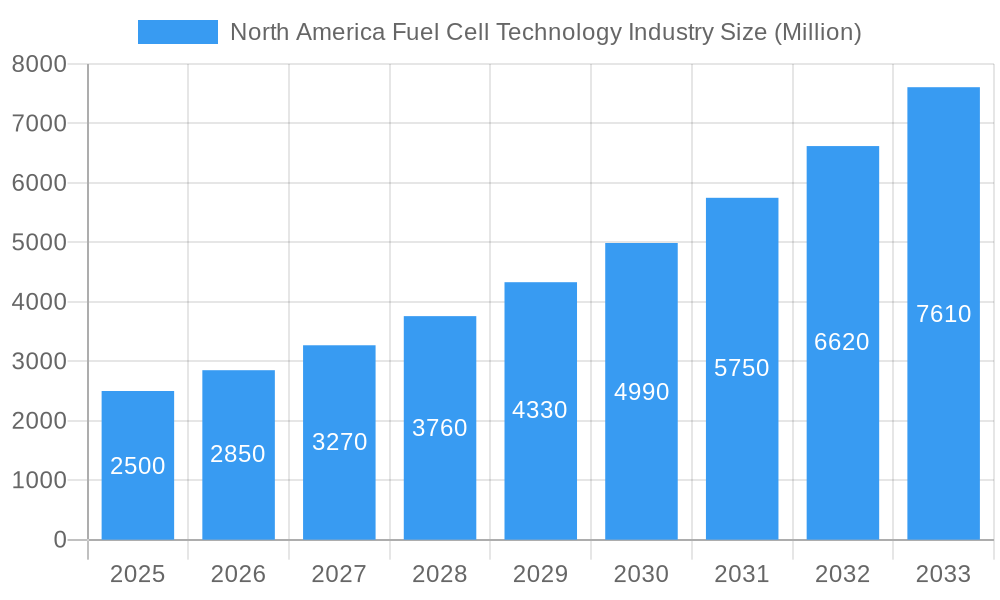

The North American fuel cell technology market is experiencing robust growth, driven by increasing demand for clean energy solutions and supportive government policies. With a Compound Annual Growth Rate (CAGR) exceeding 14.97% from 2019 to 2024, the market is projected to continue its upward trajectory throughout the forecast period (2025-2033). Significant growth drivers include the rising adoption of fuel cells in portable devices, stationary power generation (particularly in data centers and backup power systems), and the burgeoning transportation sector (e.g., fuel cell electric vehicles). The Polymer Electrolyte Membrane Fuel Cell (PEMFC) segment currently dominates due to its mature technology and suitability for various applications. However, Solid Oxide Fuel Cells (SOFCs) are gaining traction due to their higher efficiency and potential for stationary applications, indicating a promising future for diversification within the market. While the market faces challenges such as high initial investment costs and the need for further infrastructure development for hydrogen fuel, government incentives and technological advancements are mitigating these restraints. The United States, being a major player in fuel cell research and development, is expected to remain the dominant regional market within North America. Canada and Mexico are also showing increasing interest, fostering regional growth across the entire North American landscape.

North America Fuel Cell Technology Industry Market Size (In Billion)

The substantial market size in 2025 (exact figure requires further specification within the original data) is projected to substantially expand by 2033 based on the continued strong CAGR. The segment breakdown reveals a dynamic market landscape. Portable fuel cells, benefiting from miniaturization and increased efficiency, are experiencing consistent growth. Stationary applications, especially within the renewable energy sector, show strong potential for expansion as they offer reliable and emission-free power solutions. The transportation segment's growth is heavily dependent on the advancement of fuel cell vehicle technology and the expansion of hydrogen refueling infrastructure. The competitive landscape is marked by several established players like FuelCell Energy Inc., Ballard Power Systems Inc., and Plug Power Inc., contributing to innovation and market expansion. However, emerging companies and technological advancements continue to shape the future of this competitive and rapidly evolving industry.

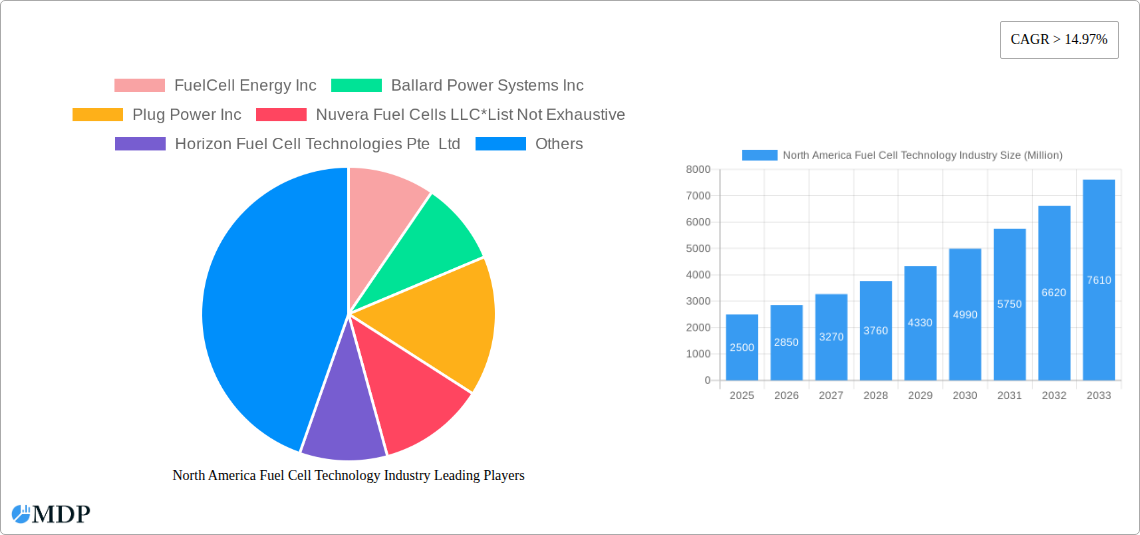

North America Fuel Cell Technology Industry Company Market Share

North America Fuel Cell Technology Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America fuel cell technology industry, covering market dynamics, leading players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving sector.

North America Fuel Cell Technology Industry Market Dynamics & Concentration

The North American fuel cell technology market is characterized by moderate concentration, with several key players vying for market share. Market concentration is estimated at xx% in 2025, with FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, and Nuvera Fuel Cells LLC holding significant positions. However, the presence of numerous smaller companies and startups indicates a dynamic competitive landscape. Innovation drivers include government incentives, increasing demand for clean energy, and technological advancements in fuel cell efficiency and durability. Stringent environmental regulations are pushing adoption, while the availability of alternative energy sources acts as a substitute. End-user trends indicate a growing preference for sustainable and reliable power solutions across various sectors. The market has witnessed xx M&A deals in the historical period (2019-2024), indicating a strategic push for consolidation and expansion.

- Market Share (2025 Estimate): FuelCell Energy Inc (xx%), Ballard Power Systems Inc (xx%), Plug Power Inc (xx%), Nuvera Fuel Cells LLC (xx%), Others (xx%).

- M&A Activity (2019-2024): xx deals, indicating significant industry consolidation.

- Key Innovation Drivers: Government incentives, clean energy demand, technological advancements.

- Regulatory Framework: Stringent emission regulations driving adoption.

- Substitute Technologies: Renewable energy sources (solar, wind).

North America Fuel Cell Technology Industry Industry Trends & Analysis

The North American fuel cell technology market exhibits robust growth, driven by the increasing demand for clean and efficient power generation. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Key growth drivers include government initiatives promoting renewable energy, rising environmental concerns, and advancements in fuel cell technology, leading to improved efficiency and cost-effectiveness. Technological disruptions, such as the development of more efficient and durable fuel cells, are driving market penetration. Consumer preferences are shifting towards sustainable energy solutions, fueling the demand for fuel cell technologies in diverse applications. Competitive dynamics are characterized by intense competition among established players and emerging startups, leading to product innovation and price competition. Market penetration is projected to reach xx% by 2033 across key segments.

Leading Markets & Segments in North America Fuel Cell Technology Industry

The transportation segment is currently the dominant application area for fuel cell technology in North America, driven by the growing need for zero-emission vehicles. The Polymer Electrolyte Membrane Fuel Cell (PEMFC) technology holds the largest market share due to its versatility and suitability for various applications.

- Dominant Application Segment: Transportation

- Key Drivers: Stringent emission regulations, government incentives for electric vehicles.

- Dominant Fuel Cell Technology: PEMFC

- Key Drivers: High efficiency, versatility, and relatively low operating temperature.

- Leading Regions/Countries: California, New York, and other states with supportive policies.

The stationary segment is experiencing significant growth, driven by increasing adoption of fuel cells in backup power systems and distributed generation. The SOFC technology is witnessing increasing adoption in stationary applications due to its high efficiency and potential for cogeneration. Economic policies and infrastructure development play a significant role in the growth of the stationary segment, with favorable policies promoting grid modernization and renewable energy integration.

North America Fuel Cell Technology Industry Product Developments

Recent product innovations include the development of more efficient and durable fuel cells with increased power density and reduced cost. These advancements are improving the market fit of fuel cells in various applications, making them more competitive with traditional energy sources. Loop Energy’s 120 kW fuel cell system, offering a 20% efficiency gain, showcases the rapid technological progress. The entry of major players like Bosch into the US fuel cell market signals increased investment and a focus on scaling up production, further enhancing competitiveness.

Key Drivers of North America Fuel Cell Technology Industry Growth

Technological advancements in fuel cell efficiency and durability are a primary driver. Government incentives, such as tax credits and grants, are encouraging adoption. Stringent environmental regulations, aimed at reducing greenhouse gas emissions, are creating a favorable regulatory environment. The increasing demand for clean and reliable power solutions across various sectors is further boosting growth.

Challenges in the North America Fuel Cell Technology Industry Market

High initial investment costs for fuel cell systems remain a significant barrier to entry. The limited availability of hydrogen infrastructure hinders widespread adoption, particularly in the transportation sector. Intense competition from established energy providers and alternative clean energy technologies pose challenges to market penetration. The fluctuating cost of platinum group metals used in fuel cell catalysts also presents a challenge.

Emerging Opportunities in North America Fuel Cell Technology Industry

Technological breakthroughs, such as advancements in catalyst materials and membrane technology, hold immense potential. Strategic partnerships between fuel cell manufacturers and energy companies are paving the way for large-scale deployment. Expansion into new markets, such as material handling and marine applications, is creating further opportunities for growth.

Leading Players in the North America Fuel Cell Technology Industry Sector

- FuelCell Energy Inc

- Ballard Power Systems Inc

- Plug Power Inc

- Nuvera Fuel Cells LLC

- Horizon Fuel Cell Technologies Pte Ltd

- Hydrogenics Corporation

Key Milestones in North America Fuel Cell Technology Industry Industry

- September 2022: Loop Energy unveils a 120 kW fuel cell system with a 20% efficiency gain. This significantly improves the competitiveness of fuel cell technology.

- August 2022: Bosch announces a USD 200 million investment in a US fuel cell production facility, signaling increased industry confidence and a commitment to expanding manufacturing capacity.

Strategic Outlook for North America Fuel Cell Technology Industry Market

The North American fuel cell technology market is poised for significant growth, driven by technological advancements, supportive government policies, and increasing demand for clean energy solutions. Strategic partnerships, focused innovation, and expansion into new applications will be crucial for players to capitalize on emerging market opportunities and achieve sustainable growth. The market is predicted to experience significant expansion over the forecast period, driven by increasing investments in renewable energy and growing concerns about climate change.

North America Fuel Cell Technology Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

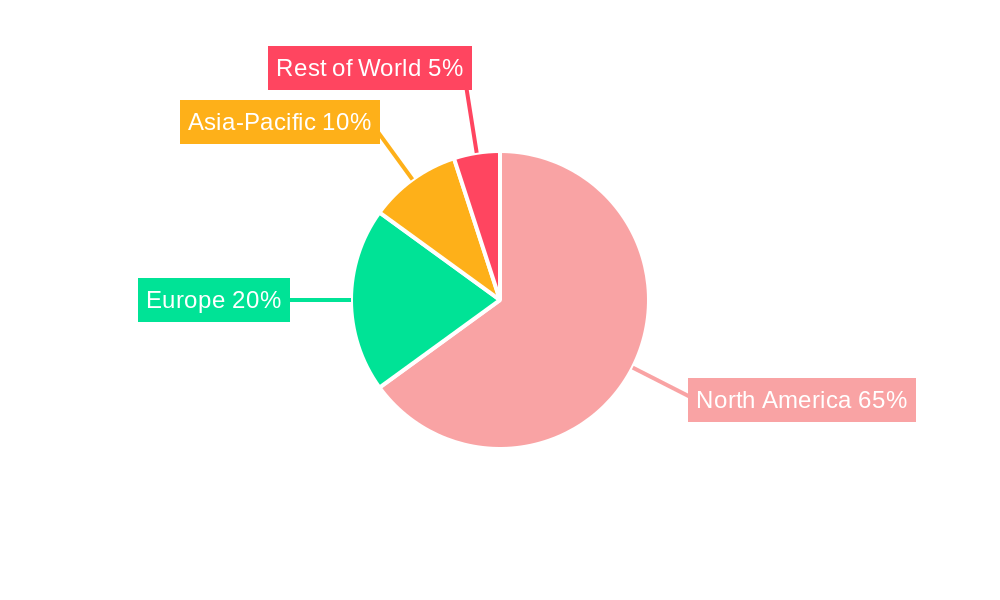

North America Fuel Cell Technology Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Fuel Cell Technology Industry Regional Market Share

Geographic Coverage of North America Fuel Cell Technology Industry

North America Fuel Cell Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Falling Costs of Green And Blue Hydrogen Generation4.; Rising Demand from The Automotive Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Competition for Alternative Energy Source

- 3.4. Market Trends

- 3.4.1. Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of North America North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 FuelCell Energy Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ballard Power Systems Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Plug Power Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nuvera Fuel Cells LLC*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Horizon Fuel Cell Technologies Pte Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hydrogenics Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 FuelCell Energy Inc

List of Figures

- Figure 1: North America Fuel Cell Technology Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Fuel Cell Technology Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 7: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 15: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fuel Cell Technology Industry?

The projected CAGR is approximately 25.17%.

2. Which companies are prominent players in the North America Fuel Cell Technology Industry?

Key companies in the market include FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Nuvera Fuel Cells LLC*List Not Exhaustive, Horizon Fuel Cell Technologies Pte Ltd, Hydrogenics Corporation.

3. What are the main segments of the North America Fuel Cell Technology Industry?

The market segments include Application, Fuel Cell Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Falling Costs of Green And Blue Hydrogen Generation4.; Rising Demand from The Automotive Sector.

6. What are the notable trends driving market growth?

Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition for Alternative Energy Source.

8. Can you provide examples of recent developments in the market?

In September 2022, Loop Energy unveiled a 120 kW fuel cell system that reportedly provides an additional efficiency gain of 20% when it generates electricity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fuel Cell Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fuel Cell Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fuel Cell Technology Industry?

To stay informed about further developments, trends, and reports in the North America Fuel Cell Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence