Key Insights

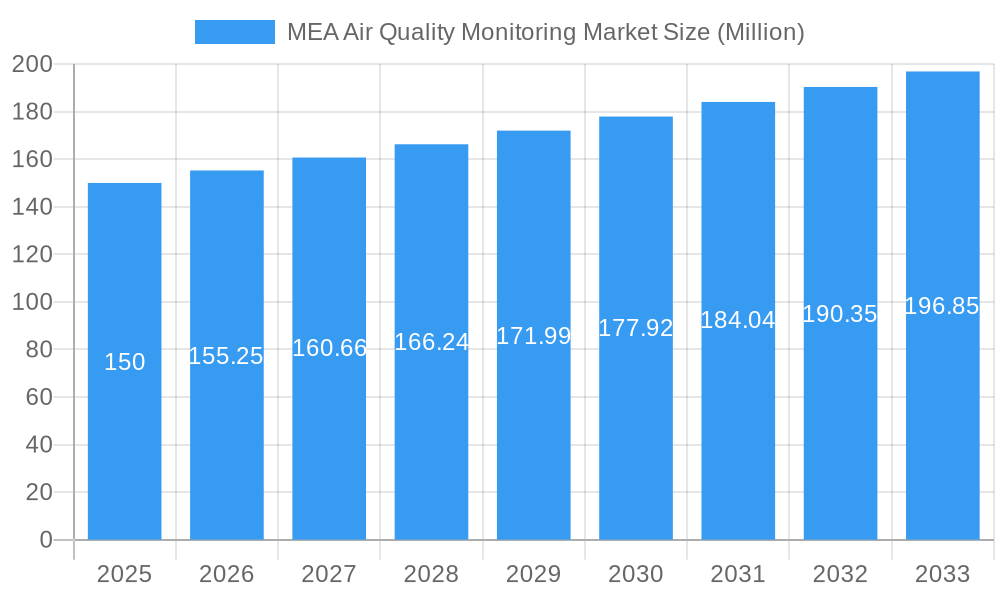

The Middle East & Africa (MEA) Air Quality Monitoring market is poised for significant expansion, driven by heightened environmental awareness, evolving regulatory frameworks, and escalating urbanization. The market, projected to reach $5.5 billion by 2025, is anticipated to grow at a robust CAGR of 6.2% from 2025 to 2033. Key growth drivers include increased government investment in advanced monitoring systems due to rising respiratory illnesses, the energy sector's adoption of sophisticated technologies for emission compliance and operational efficiency, and the proliferation of smart city initiatives coupled with growing public awareness. Segments such as continuous monitoring and chemical pollutant detection are particularly dynamic due to their precision and analytical capabilities.

MEA Air Quality Monitoring Market Market Size (In Billion)

Despite considerable growth potential, challenges such as high initial investment costs and regional awareness gaps may temper expansion. Reliance on advanced technology and skilled personnel for data interpretation also presents adoption hurdles. However, advancements in IoT-enabled sensors and cloud-based data analytics are actively addressing these constraints. Leading companies are innovating to meet regional demands, fostering a competitive environment that promises further technological progress and enhanced accessibility to monitoring solutions.

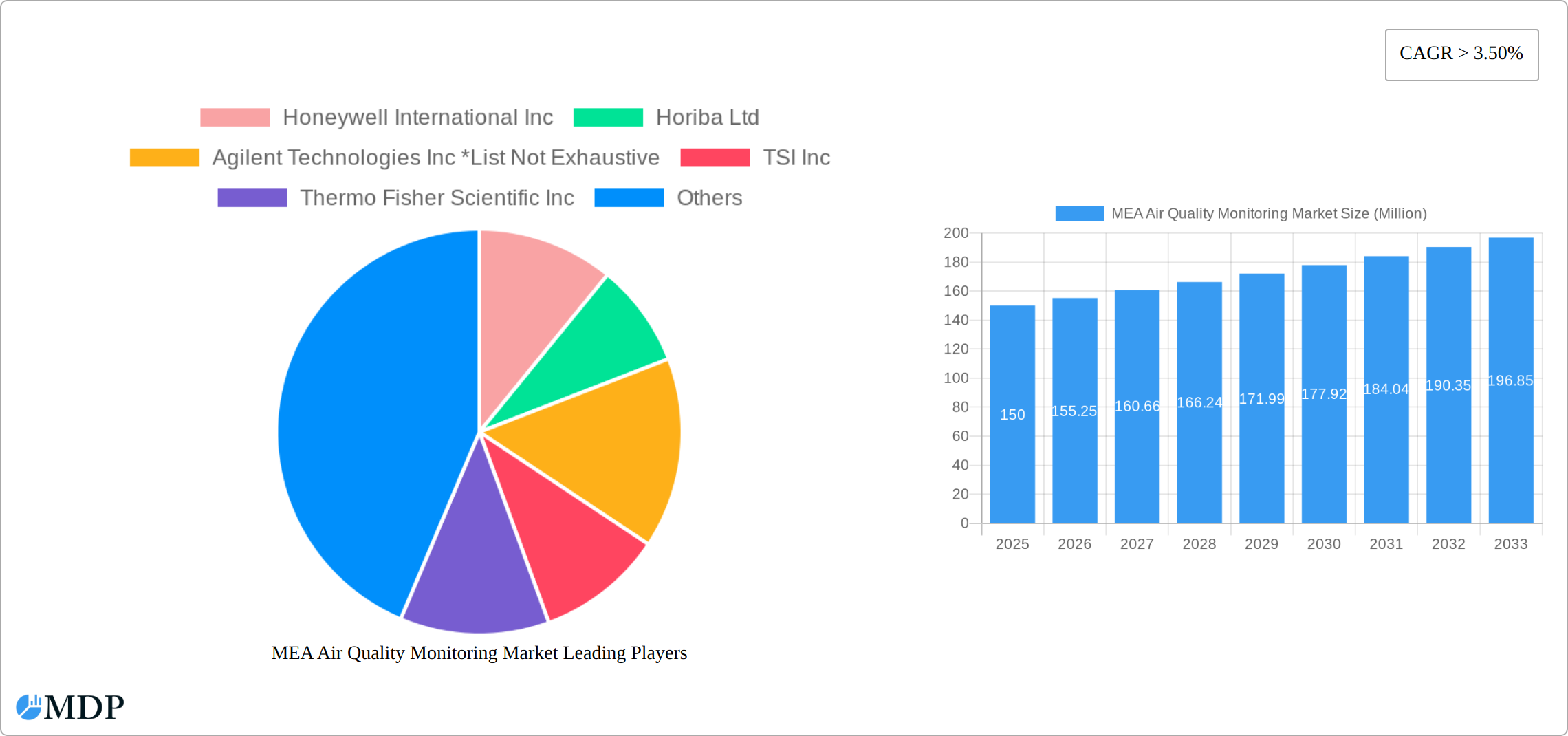

MEA Air Quality Monitoring Market Company Market Share

MEA Air Quality Monitoring Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the MEA Air Quality Monitoring Market, offering invaluable insights for stakeholders, investors, and industry professionals. With a focus on market dynamics, key players, and future trends, this report is an essential resource for navigating this rapidly evolving sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

MEA Air Quality Monitoring Market Market Dynamics & Concentration

The MEA Air Quality Monitoring Market is characterized by a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, the market also features several regional players and specialized niche companies. Market concentration is expected to shift slightly towards larger players due to ongoing M&A activity and increased investment in R&D by established companies. Innovation drivers, including advancements in sensor technology, data analytics, and IoT integration, are significantly impacting market growth. Stringent environmental regulations across the MEA region, driven by increasing concerns over air pollution and its health impacts, are further fueling demand. The market experiences competition from substitute technologies, particularly in niche applications, although the overall dominance of air quality monitoring solutions remains strong. End-user trends indicate a strong preference for continuous monitoring systems in critical sectors like power generation and petrochemicals, while residential and commercial segments are driving demand for compact and user-friendly indoor air quality monitors.

- Market Share: Honeywell International Inc., Horiba Ltd., and Agilent Technologies Inc. collectively hold approximately xx% of the market share in 2025.

- M&A Activity: The number of M&A deals in the MEA air quality monitoring market increased by xx% in the period 2021-2024. This indicates consolidation and increased competition.

MEA Air Quality Monitoring Market Industry Trends & Analysis

The MEA Air Quality Monitoring market is experiencing robust growth, fueled by rapid urbanization, industrial expansion, and a heightened awareness of air pollution's detrimental health effects. This expansion is being revolutionized by technological advancements, including sophisticated sensor technologies, AI-driven data analytics, and cloud-based monitoring platforms offering real-time insights and predictive capabilities. Market demand is shifting towards user-friendly, cost-effective, and feature-rich monitoring solutions that deliver accurate and reliable data. The competitive landscape is characterized by continuous product innovation, strategic alliances, and mergers & acquisitions, creating a dynamic and evolving market. Despite significant progress, the market penetration rate for advanced air quality monitoring systems remains relatively low in some MEA countries, representing a substantial untapped market potential ripe for exploitation.

- Market Growth Drivers: Stringent government regulations enforcing stricter emission standards, escalating health concerns linked to poor air quality, and continuous technological advancements offering improved monitoring capabilities.

- CAGR: The MEA Air Quality Monitoring market is projected to demonstrate a significant CAGR of [Insert Updated CAGR Percentage]% during the forecast period (2025-2033). This robust growth reflects the increasing urgency to address air pollution challenges across the region.

- Market Penetration: The market penetration of continuous monitoring systems within the power generation sector is estimated at [Insert Updated Percentage]% in 2025 and is forecast to reach [Insert Updated Percentage]% by 2033, highlighting the increasing adoption of continuous monitoring technologies in critical sectors.

Leading Markets & Segments in MEA Air Quality Monitoring Market

The UAE, Saudi Arabia, and Qatar are currently at the forefront of the MEA Air Quality Monitoring market, driven by substantial investments in infrastructure development, the implementation of stringent environmental regulations, and a growing commitment to environmental sustainability. The outdoor monitoring segment retains its dominance within the product type category due to increased regulatory oversight on ambient air quality. Continuous monitoring methods hold a substantial market share, particularly in critical infrastructure and industrial applications where real-time data is crucial for operational efficiency and regulatory compliance. Chemical pollutants remain the largest segment of pollutant types monitored, reflecting the prevalence of industrial emissions and vehicular exhaust in the region. The power generation and petrochemicals end-user sectors are key drivers of demand, due to their substantial emission profiles and stringent regulatory compliance requirements. Furthermore, the growing awareness among citizens is leading to an increased demand for personal air quality monitoring devices.

- Key Drivers in Leading Markets:

- UAE: Strong government support for environmental initiatives, including the comprehensive National Air Quality Agenda 2031, which sets ambitious targets and provides a clear regulatory framework.

- Saudi Arabia: The nation's Vision 2030 sustainability goals are driving significant investments in environmental protection measures, including air quality monitoring. Increased industrial activity is further fueling demand for reliable monitoring solutions.

- Qatar: Continued investments in large-scale infrastructure projects and robust environmental monitoring programs are key drivers of market growth in the country.

- Dominant Segments: Outdoor monitors, continuous sampling methods, and chemical pollutant monitoring remain the dominant segments; however, the increasing adoption of smart sensors and IoT-enabled devices is creating opportunities for new market entrants.

MEA Air Quality Monitoring Market Product Developments

Recent product innovations focus on improving sensor accuracy, enhancing data analytics capabilities, and developing more compact and user-friendly monitoring systems. New applications are emerging in smart cities, precision agriculture, and indoor environmental quality management. Competitive advantages are driven by superior sensor technology, data processing algorithms, and comprehensive software platforms offering real-time monitoring and reporting capabilities. Technological trends point toward increased integration of IoT, AI, and cloud computing to optimize data collection, analysis, and dissemination.

Key Drivers of MEA Air Quality Monitoring Market Growth

Technological advancements, encompassing the miniaturization of sensors, the sophistication of data analytics capabilities, and seamless IoT integration, are accelerating market expansion. Stringent government regulations and the rising public awareness of air pollution's health consequences are significantly boosting the demand for reliable and accurate air quality monitoring solutions. Furthermore, sustained economic growth and industrialization across the MEA region are creating lucrative opportunities for air quality monitoring solutions, particularly in rapidly developing economies. Initiatives such as the UAE's National Air Quality Agenda 2031 are providing crucial regulatory impetus and driving market growth through targeted investments and policy frameworks.

Challenges in the MEA Air Quality Monitoring Market

High initial investment costs for advanced monitoring systems can be a barrier to entry, especially for smaller companies and developing economies. Supply chain disruptions, particularly concerning specialized components, can affect market growth. Competition from established multinational corporations can pose a challenge for smaller players. Furthermore, inconsistencies in regulatory frameworks across different MEA countries create complexities for market players. The market experiences a xx% impact on growth due to regulatory inconsistencies.

Emerging Opportunities in MEA Air Quality Monitoring Market

The integration of AI and machine learning for predictive modelling and early warning systems presents significant opportunities. Strategic partnerships between technology providers and government agencies are accelerating market growth. Market expansion in less-developed countries, with a focus on affordable and sustainable solutions, offers untapped potential. Advancements in mobile monitoring systems enable wider monitoring coverage and increase accessibility for various sectors.

Leading Players in the MEA Air Quality Monitoring Market Sector

Key Milestones in MEA Air Quality Monitoring Market Industry

- July 2022: Ajman Free Zone's implementation of AirSense technology underscores the adoption of cutting-edge technologies in air quality monitoring and showcases the willingness to invest in innovative solutions.

- June 2022: The UAE's launch of the National Air Quality Agenda 2031 provides a long-term strategic framework, guiding investments and fostering the development of a robust air quality monitoring sector.

- March 2022: The expansion of Abu Dhabi's air quality monitoring network demonstrates a significant government commitment to improving air quality through comprehensive monitoring and data-driven decision-making.

- [Add more recent milestones with details]

Strategic Outlook for MEA Air Quality Monitoring Market Market

The MEA Air Quality Monitoring Market is poised for substantial growth, driven by the confluence of rising environmental consciousness, stricter regulations, and continuous technological advancements. Strategic partnerships focused on developing innovative solutions tailored to specific regional needs and challenges will be crucial for success. Companies that effectively leverage AI-powered data analytics and seamless IoT integration to provide actionable insights will gain a distinct competitive advantage. Expanding into underserved markets and focusing on developing sustainable, cost-effective solutions will be key to driving long-term growth and contributing to a healthier environment across the MEA region. The increasing focus on data-driven decision-making and proactive environmental management will continue to shape the strategic outlook of the market.

MEA Air Quality Monitoring Market Segmentation

-

1. Product Type

- 1.1. Indoor Monitor

- 1.2. Outdoor Monitor

-

2. Sampling Method

- 2.1. Continuous

- 2.2. Manual

- 2.3. Intermittent

-

3. Pollutant Type

- 3.1. Chemical Pollutants

- 3.2. Physical Pollutants

- 3.3. Biological Pollutants

-

4. End User

- 4.1. Residential and Commercial

- 4.2. Power Generation

- 4.3. Petrochemicals

- 4.4. Other End Users

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle-East and Africa

MEA Air Quality Monitoring Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Rest of Middle East and Africa

MEA Air Quality Monitoring Market Regional Market Share

Geographic Coverage of MEA Air Quality Monitoring Market

MEA Air Quality Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs of Air Quality Monitoring Systems

- 3.4. Market Trends

- 3.4.1. The Outdoor Monitor Segment is Expected to be the Fastest growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Indoor Monitor

- 5.1.2. Outdoor Monitor

- 5.2. Market Analysis, Insights and Forecast - by Sampling Method

- 5.2.1. Continuous

- 5.2.2. Manual

- 5.2.3. Intermittent

- 5.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 5.3.1. Chemical Pollutants

- 5.3.2. Physical Pollutants

- 5.3.3. Biological Pollutants

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential and Commercial

- 5.4.2. Power Generation

- 5.4.3. Petrochemicals

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. United Arab Emirates

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Indoor Monitor

- 6.1.2. Outdoor Monitor

- 6.2. Market Analysis, Insights and Forecast - by Sampling Method

- 6.2.1. Continuous

- 6.2.2. Manual

- 6.2.3. Intermittent

- 6.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 6.3.1. Chemical Pollutants

- 6.3.2. Physical Pollutants

- 6.3.3. Biological Pollutants

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Residential and Commercial

- 6.4.2. Power Generation

- 6.4.3. Petrochemicals

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. United Arab Emirates

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Indoor Monitor

- 7.1.2. Outdoor Monitor

- 7.2. Market Analysis, Insights and Forecast - by Sampling Method

- 7.2.1. Continuous

- 7.2.2. Manual

- 7.2.3. Intermittent

- 7.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 7.3.1. Chemical Pollutants

- 7.3.2. Physical Pollutants

- 7.3.3. Biological Pollutants

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Residential and Commercial

- 7.4.2. Power Generation

- 7.4.3. Petrochemicals

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. United Arab Emirates

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Indoor Monitor

- 8.1.2. Outdoor Monitor

- 8.2. Market Analysis, Insights and Forecast - by Sampling Method

- 8.2.1. Continuous

- 8.2.2. Manual

- 8.2.3. Intermittent

- 8.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 8.3.1. Chemical Pollutants

- 8.3.2. Physical Pollutants

- 8.3.3. Biological Pollutants

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Residential and Commercial

- 8.4.2. Power Generation

- 8.4.3. Petrochemicals

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. United Arab Emirates

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Honeywell International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Horiba Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Agilent Technologies Inc *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 TSI Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Thermo Fisher Scientific Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Emerson Electric Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Siemens AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 3M Co

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Teledyne Technologies Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Honeywell International Inc

List of Figures

- Figure 1: MEA Air Quality Monitoring Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEA Air Quality Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 3: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 4: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: MEA Air Quality Monitoring Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 9: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 10: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 15: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 16: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 17: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 21: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 22: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Air Quality Monitoring Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the MEA Air Quality Monitoring Market?

Key companies in the market include Honeywell International Inc, Horiba Ltd, Agilent Technologies Inc *List Not Exhaustive, TSI Inc, Thermo Fisher Scientific Inc, Emerson Electric Co, Siemens AG, 3M Co, Teledyne Technologies Inc.

3. What are the main segments of the MEA Air Quality Monitoring Market?

The market segments include Product Type, Sampling Method, Pollutant Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution.

6. What are the notable trends driving market growth?

The Outdoor Monitor Segment is Expected to be the Fastest growing Segment.

7. Are there any restraints impacting market growth?

4.; High Costs of Air Quality Monitoring Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Ajman Free Zone established an ambient air quality monitoring system in Gate 2 of its industrial sector in collaboration with the Municipality and Planning Department of Ajman. As part of the project, the free zone implemented cutting-edge AirSense technology to measure and evaluate the industrial area's pollution levels by current international regulations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Air Quality Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Air Quality Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Air Quality Monitoring Market?

To stay informed about further developments, trends, and reports in the MEA Air Quality Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence