Key Insights

The Industrial Air Quality Control Systems market is experiencing robust growth, driven by stringent environmental regulations globally and increasing industrialization, particularly in developing economies. A compound annual growth rate (CAGR) of 4.55% from 2019 to 2024 suggests a continuously expanding market, projected to further expand over the forecast period (2025-2033). Key drivers include the rising demand for cleaner air in urban areas, coupled with the escalating need to comply with emission standards across various sectors. Power generation, cement manufacturing, and the chemical industry are major consumers of these systems, reflecting their substantial contributions to air pollution. Technological advancements in areas like Electrostatic Precipitators (ESPs), Scrubbers and Flue Gas Desulfurization (FGD), Selective Catalytic Reduction (SCR), and Fabric Filters are further stimulating market expansion, offering increasingly efficient and cost-effective solutions. While the market faces challenges like high initial investment costs and ongoing maintenance requirements, the long-term benefits of improved air quality and regulatory compliance outweigh these limitations. The market is segmented by application (Power Generation, Cement Industry, Chemical Industry, Metal and Metallurgy, Other Applications) and type (Electrostatic Precipitators (ESP), Scrubbers and Flue Gas Desulfurization (FGD), Selective Catalytic Reduction (SCR), Fabric Filters, Other Types), offering opportunities for specialized solutions tailored to specific industry needs. Leading companies such as Ducon Technologies Inc, Amec Foster Wheeler PLC, Siemens AG, Babcock & Wilcox Enterprises Inc, General Electric Company, Mitsubishi Heavy Industries Ltd, and Thermax Ltd are actively shaping market competition through technological innovation and strategic partnerships. Regional analysis indicates strong growth potential across North America, Europe, and the Asia-Pacific region, fueled by different levels of industrial activity and regulatory frameworks.

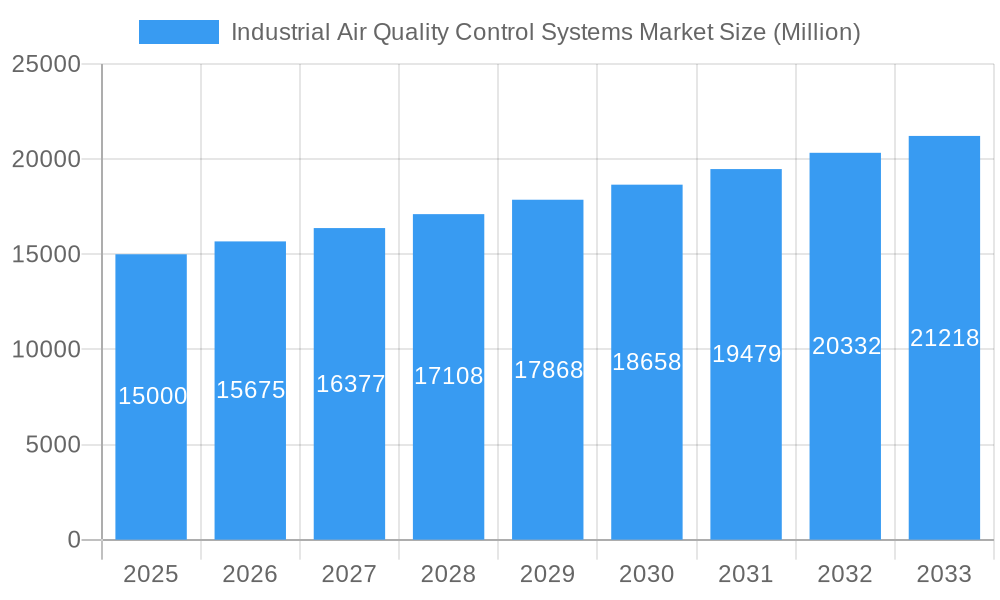

Industrial Air Quality Control Systems Market Market Size (In Billion)

The market's future trajectory is expected to remain positive, influenced by government incentives promoting cleaner technologies, increasing awareness of air pollution's health impacts, and the growing adoption of sustainable industrial practices. However, economic fluctuations and variations in raw material prices could pose some challenges. The diverse range of applications and the continuous development of innovative air quality control technologies will ensure the market’s continued expansion throughout the forecast period. Specific regional growth will be contingent upon individual governmental policies, industrial growth rates, and the pace of technological adoption within each sector. The competitive landscape will likely witness further consolidation, driven by mergers, acquisitions, and the development of advanced technologies.

Industrial Air Quality Control Systems Market Company Market Share

Industrial Air Quality Control Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Air Quality Control Systems market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future opportunities. The market is segmented by application (Power Generation, Cement Industry, Chemical Industry, Metal and Metallurgy, Other Applications) and type (Electrostatic Precipitators (ESP), Scrubbers and Flue Gas Desulfurization (FGD), Selective Catalytic Reduction (SCR), Fabric Filters, Other Types). Key players analyzed include Ducon Technologies Inc, Amec Foster Wheeler PLC, Siemens AG, Babcock & Wilcox Enterprises Inc, General Electric Company, Mitsubishi Heavy Industries Ltd, and Thermax Ltd. The report forecasts significant growth, driven by stringent environmental regulations and technological advancements.

Industrial Air Quality Control Systems Market Market Dynamics & Concentration

The Industrial Air Quality Control Systems market is characterized by a moderately concentrated competitive landscape, with a few major players holding significant market share. The market share of the top 5 players is estimated at xx% in 2025. Innovation is a key driver, with continuous advancements in technologies like Electrostatic Precipitators (ESPs), Scrubbers, and Selective Catalytic Reduction (SCR) systems. Stringent environmental regulations globally are pushing industries to adopt advanced air quality control systems, significantly influencing market growth. The substitution of older, less efficient technologies with modern, environmentally friendly systems is another prominent factor. End-user trends, particularly the increasing focus on sustainability and corporate social responsibility (CSR) initiatives, are shaping demand. Furthermore, mergers and acquisitions (M&A) activity within the sector is contributing to market consolidation. An estimated xx M&A deals occurred between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Innovation Drivers: Advancements in ESPs, Scrubbers, SCR, and Fabric Filters.

- Regulatory Frameworks: Stringent emission standards driving adoption of advanced systems.

- Product Substitutes: Replacement of older technologies with modern, efficient solutions.

- End-User Trends: Growing focus on sustainability and CSR initiatives.

- M&A Activities: xx M&A deals between 2019 and 2024, leading to market consolidation.

Industrial Air Quality Control Systems Market Industry Trends & Analysis

The Industrial Air Quality Control Systems market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing industrialization, particularly in developing economies, coupled with stricter environmental regulations. Technological disruptions, such as the development of more efficient and cost-effective air pollution control technologies, are also playing a vital role. Consumer preferences are shifting towards environmentally responsible practices, leading to increased demand for advanced air quality control systems. Competitive dynamics are intense, with established players investing heavily in R&D and expanding their product portfolios. Market penetration of advanced technologies like SCR and FGD systems is steadily increasing, particularly in the power generation and cement industries. The market shows a high level of penetration in developed countries but is exhibiting considerable growth potential in developing nations.

Leading Markets & Segments in Industrial Air Quality Control Systems Market

The Power Generation segment is currently the dominant application, accounting for xx% of the market in 2025, driven by stringent emission regulations and the need for cleaner energy production. Geographically, the market in [Dominant Region, e.g., North America] holds a leading position, contributing xx% of the global market share in 2025. Within the types of systems, Electrostatic Precipitators (ESPs) hold a significant market share, followed by Fabric Filters.

Dominant Application: Power Generation (xx% market share in 2025)

Key Drivers for Power Generation: Stringent emission norms, increasing demand for cleaner energy.

Dominant Type: Electrostatic Precipitators (ESP)

Key Drivers for ESPs: Established technology, relatively lower initial investment (compared to some alternatives)

Dominant Region: [Dominant Region, e.g., North America] (xx% market share in 2025)

Key Drivers for [Dominant Region]: Stringent environmental regulations, robust industrial base.

Cement Industry: Significant growth due to increasing cement production and environmental regulations.

Chemical Industry: Growing demand for advanced systems due to the diverse range of pollutants generated.

Metal and Metallurgy: Significant adoption driven by the release of harmful particulate matter and gases during metal processing.

Other Applications: Growth driven by increasing awareness of air pollution in various industries.

Scrubbers and Flue Gas Desulfurization (FGD): Growing adoption due to their effectiveness in removing sulfur dioxide.

Selective Catalytic Reduction (SCR): Increasing adoption driven by its effectiveness in reducing NOx emissions.

Fabric Filters: High market share due to high efficiency and versatility.

Other Types: Growth driven by innovation in new and specialized air quality control technologies.

Industrial Air Quality Control Systems Market Product Developments

Recent innovations have focused on enhancing the efficiency, cost-effectiveness, and environmental friendliness of air quality control systems. This includes the development of advanced filter materials, more efficient energy recovery systems, and AI-driven monitoring and control technologies. These advancements cater to the growing demand for sustainable and environmentally conscious solutions, aligning with the industry's shift towards improved environmental performance and reduced operational costs. The market is witnessing a trend towards smart, digitally-enabled systems for predictive maintenance and optimized performance.

Key Drivers of Industrial Air Quality Control Systems Market Growth

The market's growth is significantly propelled by several factors: stringent government regulations mandating emission reductions (e.g., the Clean Air Act in the US), increasing industrialization across developing nations, and a rising awareness of air pollution's health impacts. Technological advancements, leading to more efficient and cost-effective systems, are also boosting adoption. Further growth is anticipated from investments in renewable energy projects and the growing demand for cleaner energy sources.

Challenges in the Industrial Air Quality Control Systems Market Market

The market faces challenges such as high initial investment costs for advanced systems, complexities in integrating them into existing infrastructure, and the potential for supply chain disruptions impacting component availability. Furthermore, intense competition and the need for continuous technological upgrades can impact profitability. Fluctuations in raw material prices and variations in regulatory frameworks across regions further compound the challenges.

Emerging Opportunities in Industrial Air Quality Control Systems Market

Significant long-term growth opportunities lie in the development and adoption of innovative technologies, including AI-powered monitoring and control systems, advanced filtration materials, and energy-efficient designs. Strategic partnerships between technology providers and end-users, coupled with expansions into emerging markets, are key to unlocking future potential. Focus on providing comprehensive solutions integrating air quality monitoring, control, and data analytics is set to be another major opportunity.

Leading Players in the Industrial Air Quality Control Systems Market Sector

Key Milestones in Industrial Air Quality Control Systems Market Industry

- October 2021: TSI Incorporated expands its AirAssure Indoor Air Quality (IAQ) Monitor product line with the launch of the AirAssure 8144-2, a two-gas model using low-cost sensor technology. This demonstrates a trend toward more affordable and accessible IAQ monitoring solutions, potentially influencing the industrial market as well.

- September 2021: DPD Ireland launches a real-time air quality monitoring program using smart sensors on delivery vans and buildings in Dublin. This highlights the increasing use of IoT and smart technologies for air quality management and data collection, potentially leading to more informed decision-making in industrial settings.

Strategic Outlook for Industrial Air Quality Control Systems Market Market

The future of the Industrial Air Quality Control Systems market is bright, with significant growth potential driven by technological advancements, stringent environmental regulations, and a growing focus on sustainability. Companies that strategically invest in R&D, focus on developing innovative and cost-effective solutions, and build strong partnerships will be well-positioned to capitalize on the market's long-term growth opportunities. Expansion into emerging markets and the development of comprehensive, data-driven solutions will be crucial for success in this rapidly evolving landscape.

Industrial Air Quality Control Systems Market Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Cement Industry

- 1.3. Chemical Industry

- 1.4. Metal and Metallurgy

- 1.5. Other Applications

-

2. Type

- 2.1. Electrostatic Precipitators (ESP)

- 2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 2.3. Selective Catalytic Reduction (SCR)

- 2.4. Fabric Filters

- 2.5. Other Types

Industrial Air Quality Control Systems Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Industrial Air Quality Control Systems Market Regional Market Share

Geographic Coverage of Industrial Air Quality Control Systems Market

Industrial Air Quality Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Exports of Fast Moving Consumer Goods 4.; Rising Adoption of Refrigeration Compressors in Logistics and Supply Chains

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs and Limited Electricity Access in Rural Areas

- 3.4. Market Trends

- 3.4.1. Power generation Industry is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Cement Industry

- 5.1.3. Chemical Industry

- 5.1.4. Metal and Metallurgy

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Electrostatic Precipitators (ESP)

- 5.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 5.2.3. Selective Catalytic Reduction (SCR)

- 5.2.4. Fabric Filters

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Generation

- 6.1.2. Cement Industry

- 6.1.3. Chemical Industry

- 6.1.4. Metal and Metallurgy

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Electrostatic Precipitators (ESP)

- 6.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 6.2.3. Selective Catalytic Reduction (SCR)

- 6.2.4. Fabric Filters

- 6.2.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Generation

- 7.1.2. Cement Industry

- 7.1.3. Chemical Industry

- 7.1.4. Metal and Metallurgy

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Electrostatic Precipitators (ESP)

- 7.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 7.2.3. Selective Catalytic Reduction (SCR)

- 7.2.4. Fabric Filters

- 7.2.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Generation

- 8.1.2. Cement Industry

- 8.1.3. Chemical Industry

- 8.1.4. Metal and Metallurgy

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Electrostatic Precipitators (ESP)

- 8.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 8.2.3. Selective Catalytic Reduction (SCR)

- 8.2.4. Fabric Filters

- 8.2.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power Generation

- 9.1.2. Cement Industry

- 9.1.3. Chemical Industry

- 9.1.4. Metal and Metallurgy

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Electrostatic Precipitators (ESP)

- 9.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 9.2.3. Selective Catalytic Reduction (SCR)

- 9.2.4. Fabric Filters

- 9.2.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power Generation

- 10.1.2. Cement Industry

- 10.1.3. Chemical Industry

- 10.1.4. Metal and Metallurgy

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Electrostatic Precipitators (ESP)

- 10.2.2. Scrubbers and Flue Gas Desulfurization (FGD)

- 10.2.3. Selective Catalytic Reduction (SCR)

- 10.2.4. Fabric Filters

- 10.2.5. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ducon Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amec Foster Wheeler PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Babcock & Wilcox Enterprises Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Heavy Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thermax Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Ducon Technologies Inc

List of Figures

- Figure 1: Global Industrial Air Quality Control Systems Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: Europe Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Asia Pacific Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 17: Asia Pacific Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: South America Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 23: South America Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: South America Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Air Quality Control Systems Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Industrial Air Quality Control Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Industrial Air Quality Control Systems Market Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East and Africa Industrial Air Quality Control Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East and Africa Industrial Air Quality Control Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Air Quality Control Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Industrial Air Quality Control Systems Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Air Quality Control Systems Market?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the Industrial Air Quality Control Systems Market?

Key companies in the market include Ducon Technologies Inc, Amec Foster Wheeler PLC, Siemens AG, Babcock & Wilcox Enterprises Inc, General Electric Company, Mitsubishi Heavy Industries Ltd, Thermax Ltd.

3. What are the main segments of the Industrial Air Quality Control Systems Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Exports of Fast Moving Consumer Goods 4.; Rising Adoption of Refrigeration Compressors in Logistics and Supply Chains.

6. What are the notable trends driving market growth?

Power generation Industry is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs and Limited Electricity Access in Rural Areas.

8. Can you provide examples of recent developments in the market?

In October 2021, TSI Incorporated announced the expansion of the TSI AirAssure Indoor Air Quality (IAQ) Monitor product line. The new product - AirAssure 8144-2, is a two-gas model designed to provide common indoor air pollutants and utilizes low-cost sensor technology to monitor carbon dioxide, total volatile organic compounds, particulate matter, and other indoor air conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Air Quality Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Air Quality Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Air Quality Control Systems Market?

To stay informed about further developments, trends, and reports in the Industrial Air Quality Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence