Key Insights

India's solar inverter market is poised for substantial growth, propelled by ambitious renewable energy mandates and expanding solar power integration across residential, commercial & industrial (C&I), and utility-scale segments. The market, valued at $426.9 million in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.92% between 2025 and 2033. This expansion is driven by government incentives, declining solar panel costs, and escalating energy demands. While string inverters currently lead due to their cost-efficiency and suitability for large-scale deployments, the microinverter segment is experiencing rapid growth, attributed to advanced performance monitoring and enhanced module-level energy yield. The C&I sector spearheads this growth, closely followed by the rapidly expanding residential segment driven by increasing awareness of solar benefits. All regions of India exhibit strong growth potential, influenced by state-specific policies and solar irradiance. Key players like GoodWe, ABB, SMA, Delta Electronics, and Sungrow are fostering innovation and price competitiveness. Challenges such as grid infrastructure limitations and the need for a skilled workforce persist.

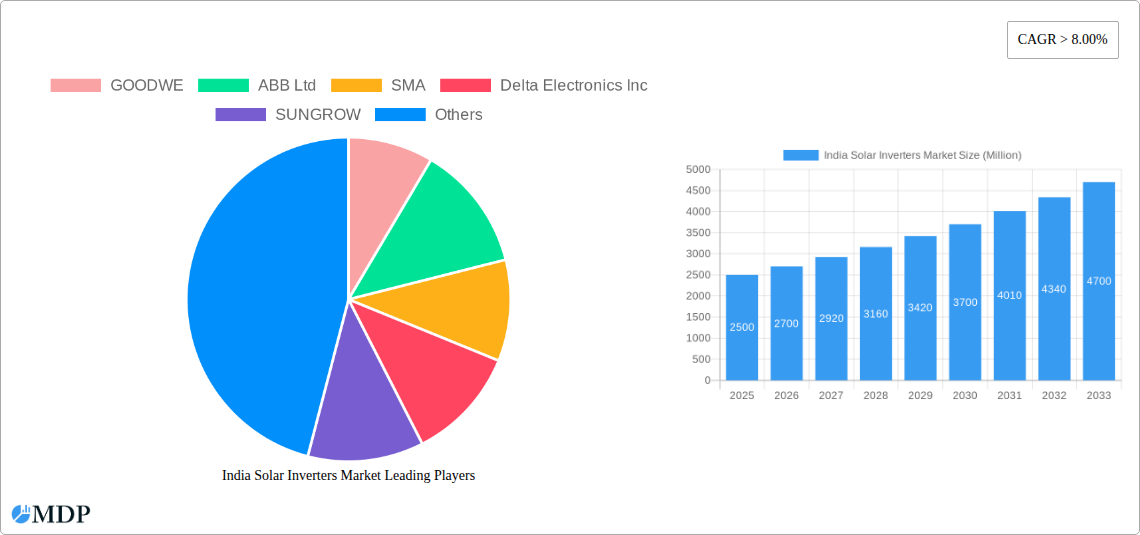

India Solar Inverters Market Market Size (In Million)

Future prospects for the Indian solar inverter market are exceptionally bright. Sustained government support via favorable policies and financial incentives will continue to stimulate demand. The integration of smart grid technologies and energy storage solutions with solar inverters will further accelerate market expansion. Growing consumer focus on sustainable energy and environmental consciousness will boost residential adoption, presenting a highly attractive investment opportunity. Continuous technological advancements in efficiency, reliability, and smart functionalities will shape the competitive landscape, compelling vendors to deliver optimized solutions for India's diverse market needs.

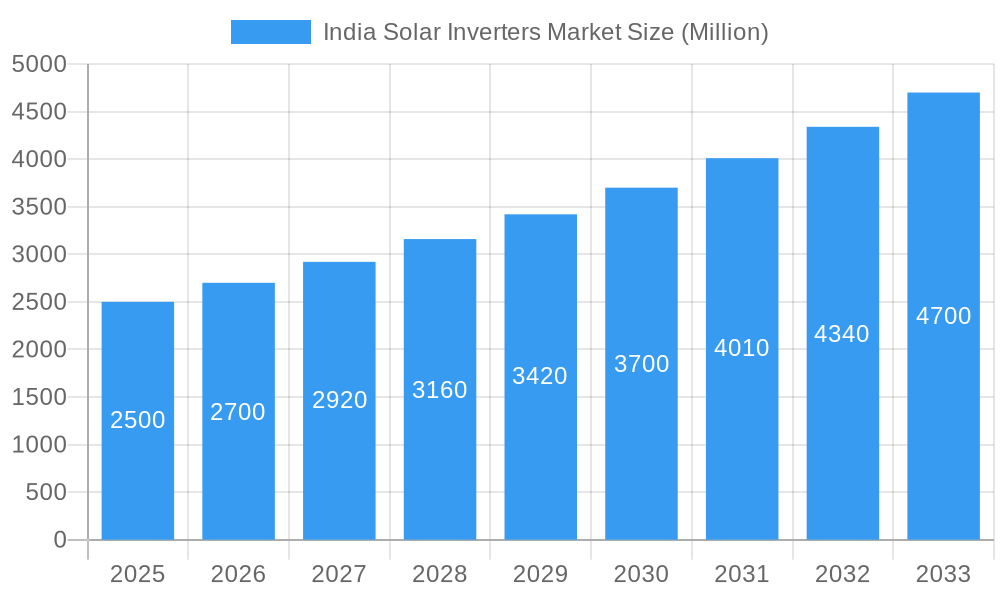

India Solar Inverters Market Company Market Share

India Solar Inverters Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India solar inverters market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a focus on market dynamics, leading players, and future projections, this report is essential for navigating the rapidly evolving landscape of India's solar energy sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report analyzes a market expected to reach xx Million by 2033, driven by robust government policies and increasing renewable energy adoption.

India Solar Inverters Market Market Dynamics & Concentration

The Indian solar inverter market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderately high, with several key players dominating significant market shares. GOODWE, ABB Ltd, SMA, Delta Electronics Inc, and SUNGROW currently hold the largest shares, collectively accounting for approximately xx% of the market in 2025. However, the market displays signs of increasing competition from both domestic and international players.

Innovation Drivers: Technological advancements, particularly in efficiency, power output, and grid integration capabilities, are major growth drivers. The increasing adoption of string inverters and microinverters is transforming the market landscape. String inverters dominate currently, holding about xx% share due to their cost-effectiveness and suitability for various applications. However, the adoption of microinverters is expected to increase steadily at a CAGR of xx% during the forecast period due to their enhanced performance and safety features.

Regulatory Frameworks: Supportive government policies and initiatives aimed at promoting renewable energy adoption, such as the Jawaharlal Nehru National Solar Mission (JNNSM), are crucial in driving market growth. These policies create incentives for solar power generation and infrastructure development, directly influencing the demand for solar inverters.

Product Substitutes: While solar inverters currently hold a dominant position in the market, other technologies, like battery energy storage systems (BESS), are emerging as potential substitutes in certain segments. However, the overall market penetration of BESS is still relatively low, creating a solid market presence for solar inverters in the near-to-mid term.

End-User Trends: The rising adoption of solar energy across residential, commercial & industrial (C&I), and utility-scale applications is a key growth driver. The residential segment is expected to experience significant growth, driven by declining inverter costs and increasing awareness of the benefits of solar energy.

M&A Activities: The number of mergers and acquisitions (M&A) in the Indian solar inverter market has been relatively moderate during the historical period (2019-2024), with approximately xx deals recorded. However, increased consolidation is anticipated in the coming years, driven by the need for market expansion and technological integration.

India Solar Inverters Market Industry Trends & Analysis

The India solar inverters market is experiencing robust growth, propelled by several key trends. The market size, estimated at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is driven by a confluence of factors, including:

- Government Support: Continued government support through subsidies, tax incentives, and favorable policies for renewable energy development is a major catalyst.

- Declining Costs: The decreasing cost of solar panels and inverters is making solar energy increasingly affordable, thus broadening its adoption.

- Technological Advancements: Improvements in inverter efficiency, power handling capacity, and smart grid integration capabilities are enhancing the appeal of solar energy solutions.

- Energy Security Concerns: Growing concerns about energy security and reliance on fossil fuels are pushing towards a greater adoption of renewable energy sources, like solar.

- Increasing Energy Demand: The rapidly growing energy demand in India, particularly in urban areas, creates a compelling need for sustainable energy solutions.

- Growing Awareness: Enhanced public awareness about climate change and the environmental benefits of solar energy is driving consumer adoption.

The market penetration of solar inverters is continuously increasing, with a significant portion of new solar installations incorporating these crucial components. The competitive dynamics are intensifying, with existing players focusing on product innovation, partnerships, and market expansion strategies.

Leading Markets & Segments in India Solar Inverters Market

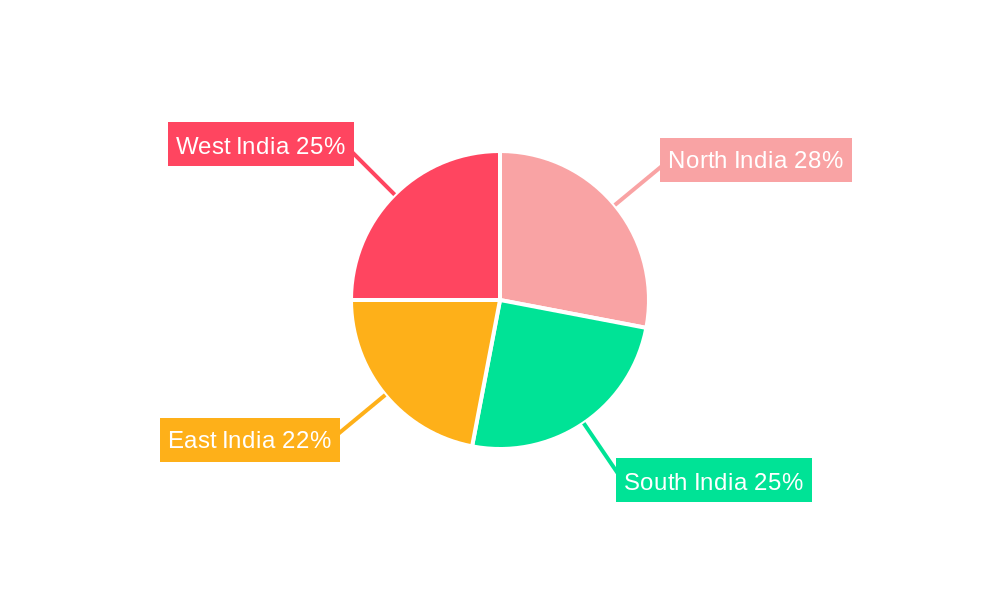

The Indian solar inverter market is geographically diverse, with significant growth across various regions. However, states with robust solar energy policies and considerable solar irradiation levels experience higher adoption rates.

Dominant Segment Analysis:

Inverter Type: String inverters currently hold the largest market share due to their cost-effectiveness and suitability for diverse applications. However, the microinverter segment is poised for substantial growth due to its superior performance and safety features. Central inverters continue to maintain a strong presence in large-scale utility projects.

Application: The utility-scale segment currently dominates, driven by large-scale solar power plant projects. However, the residential and C&I segments are expected to exhibit rapid growth in the coming years, fueled by increasing adoption of rooftop solar systems and decentralized energy solutions.

Key Drivers for Dominant Segments:

Utility-Scale: Government policies promoting large-scale renewable energy projects, along with the availability of land and suitable solar irradiation levels, drive the utility-scale segment's dominance.

Residential: Declining inverter costs, rising electricity tariffs, and government incentives are key drivers for the residential segment's expansion.

C&I: Corporates are adopting solar energy to reduce their carbon footprint, benefit from cost savings, and enhance their brand image. Government incentives and supportive policies further accelerate C&I segment growth.

India Solar Inverters Market Product Developments

Recent product developments in the Indian solar inverter market are characterized by a focus on higher efficiency, enhanced power handling capabilities, improved grid integration, and smart features. The introduction of string inverters with higher power ratings and optimized MPPT (Maximum Power Point Tracking) algorithms is enhancing the efficiency and performance of solar energy systems. Similarly, the emergence of smart inverters with advanced monitoring and control features is improving system performance and maintenance. Several companies are also focusing on developing inverters with improved safety features to meet stricter regulatory requirements.

Key Drivers of India Solar Inverters Market Growth

The growth of the India solar inverter market is fueled by a confluence of factors:

- Government Initiatives: The government's ambitious renewable energy targets and supportive policies, including subsidies and tax benefits, incentivize solar energy adoption.

- Falling Costs: The declining cost of solar panels and inverters significantly increases the affordability of solar energy systems.

- Technological Advancements: Continuous improvements in inverter efficiency and functionality, along with the introduction of smart inverters, enhance the attractiveness of solar power.

- Energy Security: Concerns about energy security and dependence on fossil fuels promote the adoption of domestically generated renewable energy.

Challenges in the India Solar Inverters Market Market

The growth of the India solar inverter market faces several challenges:

- Intermittency of Solar Power: The intermittent nature of solar power requires effective grid integration and energy storage solutions.

- Land Acquisition: Securing sufficient land for large-scale solar power projects can be challenging due to land ownership issues.

- Grid Infrastructure Limitations: Inadequate grid infrastructure in some areas can constrain the integration of solar power into the electricity network.

- Supply Chain Disruptions: Global supply chain disruptions can lead to delays and increased costs for solar inverters.

Emerging Opportunities in India Solar Inverters Market

The Indian solar inverter market offers several exciting opportunities for growth:

- Smart Grid Integration: The integration of smart inverters into smart grid technologies presents significant opportunities for improving grid stability and efficiency.

- Energy Storage Solutions: The increasing adoption of battery energy storage systems coupled with solar inverters presents significant opportunities for improving reliability and optimizing energy usage.

- Rural Electrification: Providing solar power solutions to rural areas lacking access to electricity offers vast untapped potential for market expansion.

- Strategic Partnerships: Collaborations between inverter manufacturers, EPC contractors, and energy storage companies can drive market growth.

Leading Players in the India Solar Inverters Market Sector

Key Milestones in India Solar Inverters Market Industry

- March 2022: SUNGROW inaugurated its expanded manufacturing capacity in India, aiming for a 10GW/annum capacity. This significantly boosts the domestic supply of solar inverters.

- April 2022: Delta launched its new M100A Flex three-phase inverter, offering high efficiency (98.7%) for residential and commercial rooftop PV projects. This enhances the competitiveness and choices in the market.

Strategic Outlook for India Solar Inverters Market Market

The Indian solar inverter market holds immense growth potential, driven by favorable government policies, falling costs, technological advancements, and rising energy demand. Strategic partnerships, focus on innovation, and expansion into underserved markets present significant opportunities for players seeking to establish a strong presence in this dynamic sector. The market is poised for continued expansion, with strong growth anticipated across various segments and regions.

India Solar Inverters Market Segmentation

-

1. Inverter Type

- 1.1. Central Inverters

- 1.2. String Inverters

- 1.3. Micro Inverters

-

2. Application

- 2.1. Residential

- 2.2. Commercial and Industrial (C&I)

- 2.3. Utility-scale

India Solar Inverters Market Segmentation By Geography

- 1. India

India Solar Inverters Market Regional Market Share

Geographic Coverage of India Solar Inverters Market

India Solar Inverters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Need for Efficient Energy Management Systems4.; Growing Penetration of Renewable Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Privacy Concerns on the Industrial Demand Response Management Systems

- 3.4. Market Trends

- 3.4.1. Central Inverters have dominated the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Solar Inverters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Inverter Type

- 5.1.1. Central Inverters

- 5.1.2. String Inverters

- 5.1.3. Micro Inverters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial (C&I)

- 5.2.3. Utility-scale

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Inverter Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GOODWE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SMA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SUNGROW

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schneider Electric SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TMEIC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fronius International GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GOODWE

List of Figures

- Figure 1: India Solar Inverters Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Solar Inverters Market Share (%) by Company 2025

List of Tables

- Table 1: India Solar Inverters Market Revenue million Forecast, by Inverter Type 2020 & 2033

- Table 2: India Solar Inverters Market Volume Gigawatt Forecast, by Inverter Type 2020 & 2033

- Table 3: India Solar Inverters Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: India Solar Inverters Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 5: India Solar Inverters Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Solar Inverters Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: India Solar Inverters Market Revenue million Forecast, by Inverter Type 2020 & 2033

- Table 8: India Solar Inverters Market Volume Gigawatt Forecast, by Inverter Type 2020 & 2033

- Table 9: India Solar Inverters Market Revenue million Forecast, by Application 2020 & 2033

- Table 10: India Solar Inverters Market Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 11: India Solar Inverters Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Solar Inverters Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Solar Inverters Market?

The projected CAGR is approximately 7.92%.

2. Which companies are prominent players in the India Solar Inverters Market?

Key companies in the market include GOODWE, ABB Ltd, SMA, Delta Electronics Inc, SUNGROW, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, TMEIC, Fronius International GmbH.

3. What are the main segments of the India Solar Inverters Market?

The market segments include Inverter Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 426.9 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Need for Efficient Energy Management Systems4.; Growing Penetration of Renewable Energy Sources.

6. What are the notable trends driving market growth?

Central Inverters have dominated the market.

7. Are there any restraints impacting market growth?

4.; Privacy Concerns on the Industrial Demand Response Management Systems.

8. Can you provide examples of recent developments in the market?

In March 2022, SUNGROW inaugurated its expanded scale of manufacturing capacity in India. The company established the plant in India in 2018 and, with this expansion, aims to achieve a 10GW/annum capacity. Hence, with the help of this plant, the company could to cater the rising demand for solar inverters from residential, commercial & industrial, and utility-scale Indian and global markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Solar Inverters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Solar Inverters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Solar Inverters Market?

To stay informed about further developments, trends, and reports in the India Solar Inverters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence