Key Insights

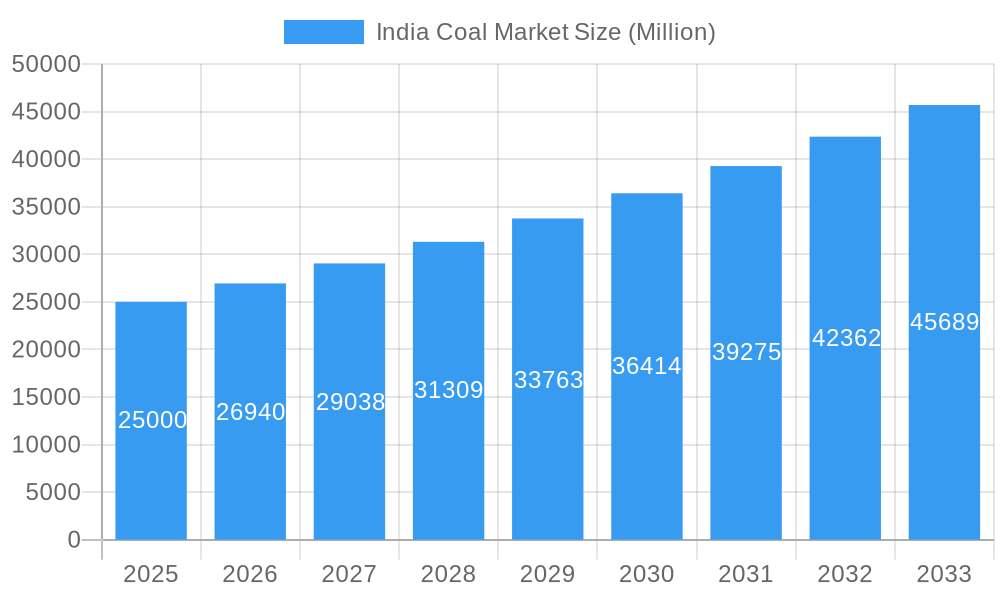

The Indian coal market is projected for significant expansion, expected to reach $1.04 billion by 2025 and grow at a compound annual growth rate (CAGR) of 7.57% from 2025 to 2033. This robust growth is driven by escalating energy demands from India's expanding industrial sector and its crucial role in power generation. Key growth catalysts include increasing electricity consumption due to population growth and economic development, continued reliance on coal for thermal power, and sustained demand for coking coal in steel production. While the long-term shift towards cleaner energy presents a potential restraint, coal consumption will remain substantial in the near to medium term, particularly in key industrial regions like East and North India. The market is primarily segmented by application, with thermal coal for power generation leading, followed by coking coal for industrial feedstock. Major industry players such as Coal India Limited, Adani Power Ltd, and NTPC Ltd are pivotal in shaping market dynamics through their extensive production capabilities and strategic investments.

India Coal Market Market Size (In Billion)

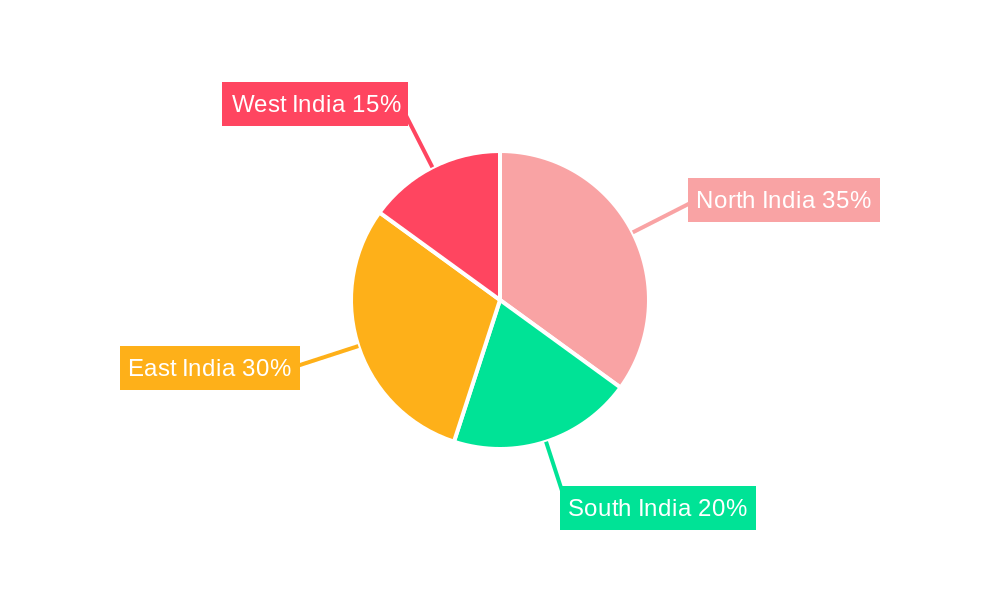

Geographically, North and East India are anticipated to lead coal consumption due to established industrial infrastructure and numerous power generation facilities. While South and West India are also experiencing growth, their consumption levels are expected to be comparatively lower. The forecast period (2025-2033) presents a dynamic environment where companies must address environmental regulations, invest in advanced mining and logistics technologies, and strategically manage the increasing integration of renewable energy sources. Despite governmental support for renewables, coal is projected to maintain a critical position within India's energy mix. While energy efficiency improvements and diversification efforts may moderate growth rates, substantial market expansion is still anticipated over the forecast horizon.

India Coal Market Company Market Share

India Coal Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the India Coal Market, covering the period 2019-2033. With a focus on key players like Coal India Limited, NTPC Ltd, and Adani Power Ltd, this report offers invaluable insights for investors, industry stakeholders, and strategic decision-makers. Uncover crucial market trends, growth drivers, and challenges shaping the future of India's coal industry. Download now to gain a competitive edge.

India Coal Market Dynamics & Concentration

The Indian coal market, valued at xx Million in 2024, exhibits a moderately concentrated structure. Coal India Limited holds a significant market share, estimated at xx%, followed by private players like Adani Power Ltd and JSW Energy Limited. The market is characterized by increasing consolidation through mergers and acquisitions (M&A) activities. Between 2019 and 2024, approximately xx M&A deals were recorded, primarily driven by the need to secure coal resources and expand production capacity.

- Market Concentration: High concentration with Coal India Limited dominating.

- Innovation Drivers: Focus on improving mining techniques, enhancing coal quality, and exploring cleaner coal technologies.

- Regulatory Framework: Government policies and regulations heavily influence coal production, transportation, and pricing. Recent emphasis on environmental compliance is driving changes within the industry.

- Product Substitutes: Renewable energy sources like solar and wind power are emerging as significant substitutes, impacting coal demand.

- End-User Trends: The power generation sector remains the primary consumer, while the steel industry's demand for coking coal plays a crucial role.

- M&A Activity: A steady stream of mergers and acquisitions points to the industry’s ongoing consolidation and growth.

India Coal Market Industry Trends & Analysis

The Indian coal market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by robust demand from the power generation sector, particularly thermal power plants, which account for a significant portion of India's electricity generation. Technological advancements in coal mining and processing are also contributing to efficiency gains. However, rising concerns about environmental pollution and the government's push towards renewable energy sources pose considerable challenges. Market penetration of cleaner coal technologies remains low, though increasing. Competitive dynamics are intense, with both public and private sector players vying for market share.

Leading Markets & Segments in India Coal Market

The power generation segment, specifically thermal coal, dominates the Indian coal market, accounting for approximately xx% of total consumption. This high demand is driven by India's burgeoning energy needs and the significant role of coal in its energy mix. Coking coal, primarily used in the steel industry, constitutes another significant segment. Other applications, such as industrial and domestic use, hold a smaller share.

- Power Generation (Thermal Coal):

- Key Drivers: Rapid industrialization, increasing urbanization, and a growing population driving electricity demand. Significant government investment in power generation infrastructure.

- Coking Feedstock (Coking Coal):

- Key Drivers: Growth in the steel industry, particularly in construction and infrastructure development.

- Others:

- Key Drivers: Industrial applications and domestic consumption, though significantly smaller compared to power generation and coking coal segments.

Geographic dominance is largely influenced by the location of coal mines and power plants, with significant production and consumption concentrated in eastern and central India.

India Coal Market Product Developments

Recent product innovations focus on improving coal quality, enhancing extraction efficiency, and developing cleaner coal technologies. Companies are investing in advanced mining equipment, upgrading processing facilities, and exploring carbon capture and storage solutions to meet environmental regulations. These innovations aim to enhance the competitiveness of coal while mitigating its environmental impact. The market fit is driven by the need to balance energy security with sustainability goals.

Key Drivers of India Coal Market Growth

The Indian coal market’s growth is fueled by several factors:

- Growing Energy Demand: India's rapidly expanding economy and population drive increased electricity demand, making coal a crucial energy source.

- Government Infrastructure Investments: Significant government spending on power plants and infrastructure projects supports coal consumption.

- Technological Advancements: Improved mining and processing techniques enhance efficiency and reduce costs.

Challenges in the India Coal Market Market

Several challenges hinder the India coal market's growth:

- Environmental Concerns: Coal's environmental impact, including air and water pollution, faces increasing scrutiny and stricter regulations.

- Supply Chain Constraints: Transportation bottlenecks and logistical challenges impact coal delivery and availability.

- Competition from Renewables: The rising adoption of renewable energy sources puts pressure on coal's market share. The estimated impact on coal demand due to renewables is xx Million by 2033.

Emerging Opportunities in India Coal Market

Emerging opportunities include:

- Cleaner Coal Technologies: Investment in carbon capture and storage technologies can mitigate coal's environmental impact and extend its viability.

- Strategic Partnerships: Collaborations between coal companies and renewable energy developers can create synergies and diversify energy portfolios.

- Market Expansion: Exploring new coal reserves and expanding into international markets could create new growth avenues.

Leading Players in the India Coal Market Sector

- Coal India Limited

- NTPC Ltd

- Adani Power Ltd

- JSW Energy Limited

- Singareni Collieries Company Limited (SCCL)

- Jindal Steel & Power Ltd

- NLC India Ltd

Key Milestones in India Coal Market Industry

- November 2022: NTPC Ltd secured contracts for four additional coal-fired power projects, expanding its capacity by 4.8 GW. This signifies continued investment in coal-based power generation despite the growing focus on renewable energy.

- February 2023: The inauguration of the 2600 MW Singareni Thermal Power Plant (STPP) marks a significant milestone for South India's power sector, highlighting the continued role of coal in meeting energy demands.

Strategic Outlook for India Coal Market Market

The future of the Indian coal market hinges on balancing energy security with sustainability goals. While coal will likely remain a significant energy source in the near term, its long-term prospects are influenced by the growth of renewable energy and stricter environmental regulations. Companies focusing on cleaner coal technologies and strategic partnerships will be better positioned for sustainable growth in this evolving landscape. Opportunities exist in enhancing efficiency, exploring new coal reserves, and adapting to evolving government policies.

India Coal Market Segmentation

-

1. Application

- 1.1. Power Generation (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

India Coal Market Segmentation By Geography

- 1. India

India Coal Market Regional Market Share

Geographic Coverage of India Coal Market

India Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Thermal Power Generation is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NLC India Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Singareni Collieries Company Limited (SCCL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSW Energy Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coal India Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jindal Steel & Power Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NTPC Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NLC India Ltd

List of Figures

- Figure 1: India Coal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Coal Market Share (%) by Company 2025

List of Tables

- Table 1: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: India Coal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Coal Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Coal Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Coal Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Coal Market?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the India Coal Market?

Key companies in the market include NLC India Ltd, Adani Power Ltd, Singareni Collieries Company Limited (SCCL), JSW Energy Limited, Coal India Limited, Jindal Steel & Power Ltd, NTPC Ltd.

3. What are the main segments of the India Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Increasing Thermal Power Generation is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023, the 2600 megawatt Singareni Thermal Power Plant (STPP) at Pegadapalli in Mancherial district is all set to become South India's first public sector coal-based power generating station and the country's first among State Public Sector Undertakings (PSU).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Coal Market?

To stay informed about further developments, trends, and reports in the India Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence