Key Insights

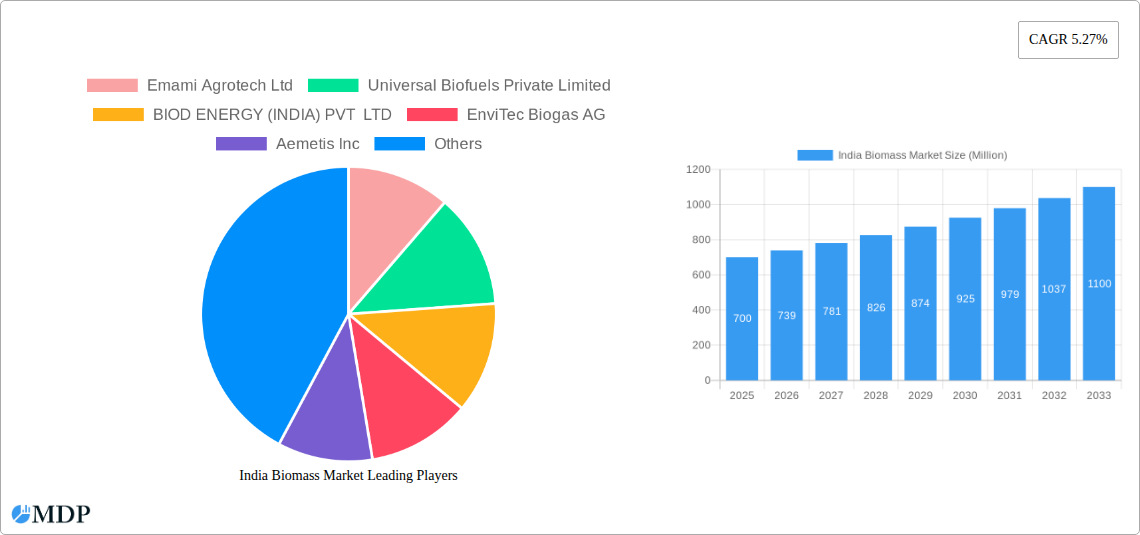

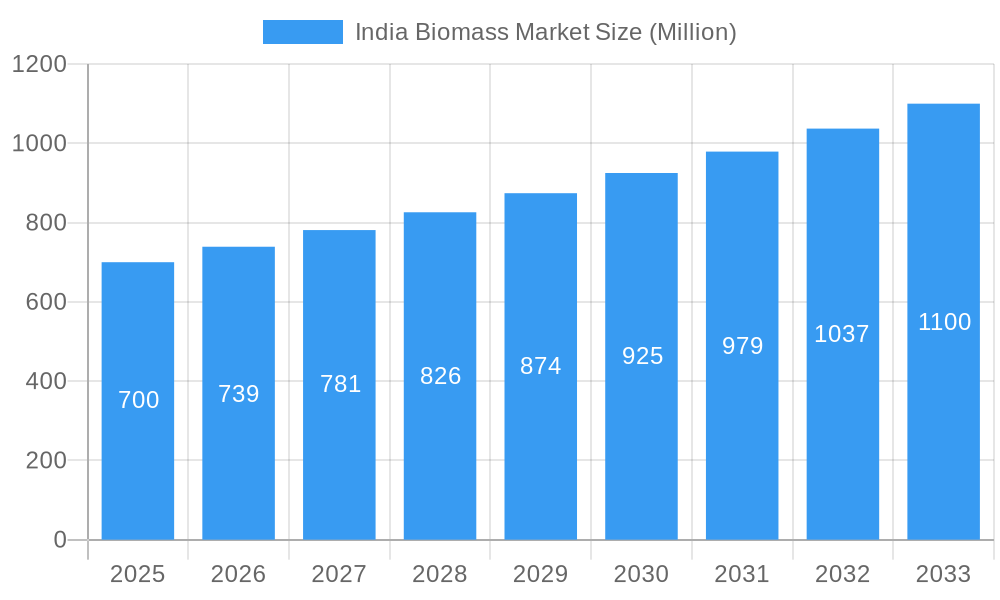

India's biomass market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 5.2%. The current market size is valued at $2.5 billion in the base year of 2024. This expansion is propelled by robust government initiatives promoting renewable energy, escalating energy demands across sectors, and a vast availability of agricultural biomass residue. Technological advancements in biomass conversion are further enhancing efficiency and cost-effectiveness, solidifying biomass energy's viability. Key growth drivers include increasing policy support for renewables, rising industrial and residential energy needs, and abundant agricultural waste. Emerging trends focus on optimizing feedstock utilization and exploring advanced conversion technologies. Despite this positive outlook, challenges such as policy implementation consistency, high initial investment for biomass power plants, and infrastructure gaps in biomass collection and logistics require attention to fully realize market potential.

India Biomass Market Market Size (In Billion)

The market is segmented by feedstock types (agricultural residues, forestry waste), conversion technologies (biogas, bioethanol, direct combustion for power), and end-use applications (power generation, biofuels for transport, industrial heating). Prominent companies like Emami Agrotech Ltd and Universal Biofuels Private Limited are key contributors, driving innovation and market expansion. Continued government support, technological progress, and heightened sustainability awareness will fuel future growth through to 2033. Strategic collaborations, innovative solutions, and clear regulatory frameworks are essential for sustained market development. Expanding into new regions and diversifying biomass sources will further accelerate market penetration. Addressing infrastructural deficits and ensuring policy stability are critical for unlocking the full potential of India's burgeoning biomass sector.

India Biomass Market Company Market Share

India Biomass Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India biomass market, offering crucial insights for investors, industry stakeholders, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report leverages a robust data analysis methodology, incorporating historical data (2019-2024) to project future market trends accurately. The market size is projected to reach xx Million USD by 2033, showcasing substantial growth potential.

India Biomass Market Dynamics & Concentration

This section delves into the competitive landscape of the India biomass market, analyzing market concentration, innovation drivers, regulatory frameworks, and significant M&A activities. We examine the interplay between various factors shaping market dynamics.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top 5 players account for approximately xx% of the total market share in 2025, while the remaining share is distributed among numerous smaller players. This concentration is expected to slightly decrease by 2033 due to the entry of new players and increased competition.

- Innovation Drivers: Technological advancements in biomass conversion technologies, particularly in bioenergy and biofuels, are major drivers of market growth. The development of efficient and cost-effective technologies is attracting significant investments and fueling innovation.

- Regulatory Framework: Government policies promoting renewable energy and sustainable practices create a favorable regulatory environment for the biomass market. Incentives, subsidies, and supportive regulations are encouraging market expansion. The recent benchmark price announcement for biomass pellets further strengthens this positive regulatory impact.

- Product Substitutes: Competition from other renewable energy sources and traditional fossil fuels exists, yet the growing demand for sustainable energy solutions and the cost advantages of biomass in certain applications limit this pressure.

- End-User Trends: The increasing demand from power generation, industrial applications, and residential heating sectors drives market growth. The shift towards sustainable and eco-friendly practices among end-users further strengthens the market's upward trajectory.

- M&A Activities: The past five years have witnessed xx M&A deals in the India biomass market, indicating significant consolidation activity and strategic expansion moves by major players.

India Biomass Market Industry Trends & Analysis

This section provides a detailed analysis of market trends, examining growth drivers, technological disruptions, consumer preferences, and competitive dynamics impacting the Indian biomass sector.

The Indian biomass market is experiencing robust growth, driven by factors such as government support for renewable energy, rising environmental concerns, and increasing energy demand. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological advancements in biomass gasification, pyrolysis, and torrefaction are enhancing efficiency and cost-effectiveness. Market penetration of biomass-based energy solutions is steadily increasing, particularly in rural areas with limited access to conventional energy sources. The competitive landscape is characterized by both established players and emerging companies vying for market share through technological innovations, strategic partnerships, and cost optimization strategies. Consumer preferences are shifting towards sustainable and environmentally friendly energy solutions, driving demand for biomass products. This shift, coupled with supportive government policies, contributes significantly to market expansion.

Leading Markets & Segments in India Biomass Market

This section identifies the dominant regions, countries, and segments within the India biomass market.

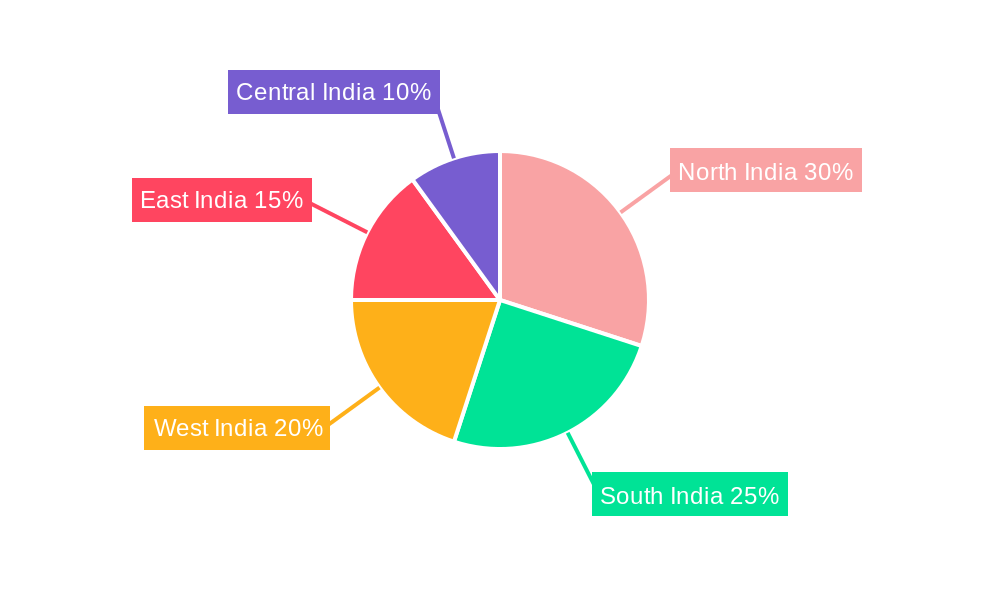

Dominant Regions: The northern and western regions of India currently dominate the market due to higher agricultural residue availability and supportive government initiatives.

Key Drivers:

- Favorable Government Policies: Government incentives and policies aimed at promoting renewable energy sources are a significant driver.

- Abundant Biomass Resources: India possesses vast agricultural residues, making it an ideal location for biomass utilization.

- Developing Infrastructure: Improvements in transportation and logistics are reducing the costs associated with biomass transportation and processing.

- Economic Growth: Rising energy demands from the industrial and residential sectors fuel market growth.

The continued dominance of the northern and western regions is projected to persist through the forecast period, although other regions are expected to experience accelerated growth as the infrastructure for biomass utilization expands.

India Biomass Market Product Developments

Recent years have witnessed significant advancements in biomass processing technologies. Innovations include improved gasification systems for enhanced energy efficiency, advanced pyrolysis techniques for biochar production, and torrefaction processes for improved fuel properties. These innovations directly address the need for cost-effective and sustainable energy solutions, enhancing the market appeal of biomass products. The market is witnessing a trend towards developing specialized biomass products tailored to specific end-user needs. This focus on product differentiation is driving competition and fostering innovation within the sector.

Key Drivers of India Biomass Market Growth

Several key factors propel the growth of the India biomass market. These include the government's commitment to renewable energy targets, the abundance of agricultural residues, and the increasing need for sustainable energy solutions. Technological advancements and cost reductions in biomass conversion technologies further enhance market attractiveness. The rising environmental concerns and the push towards carbon neutrality are also significant drivers, creating a favorable policy and investment landscape for the biomass sector. These factors are expected to fuel sustained market growth over the forecast period.

Challenges in the India Biomass Market

Several challenges hinder the full potential of the India biomass market. These include the inconsistent quality of biomass feedstock, logistical challenges in biomass transportation and collection, and the lack of awareness among potential end-users. The high capital costs associated with establishing biomass processing facilities and navigating the complex regulatory landscape also pose obstacles to market growth. The variability in government policies and the competition from established fossil fuels add further complexity. These constraints directly affect market penetration and the expansion of the biomass sector.

Emerging Opportunities in India Biomass Market

Despite challenges, the India biomass market presents exciting opportunities. Technological advancements such as improved biomass gasification and pyrolysis techniques offer enhanced efficiency and cost-effectiveness. Strategic partnerships between biomass companies and energy providers can accelerate market penetration. Expansion into new applications, such as bio-based chemicals and materials, creates further growth potential. Government support, coupled with increasing environmental consciousness, is creating a positive investment climate, presenting significant opportunities for market expansion and innovation.

Leading Players in the India Biomass Market Sector

- Emami Agrotech Ltd

- Universal Biofuels Private Limited

- BIOD ENERGY (INDIA) PVT LTD

- EnviTec Biogas AG

- Aemetis Inc

- Monopoly Innovations Private Limited

- List Not Exhaustive

- List of Other Prominent Companies

- Market Ranking Analysis

Key Milestones in India Biomass Market Industry

- November 2023: The Ministry of Power announced a benchmark price of INR 2.27/1,000 kcal (USD 0.027/1,000 kcal) for non-torrefied biomass pellets in northern India (excluding the national capital region), setting a standard for the industry and impacting pricing strategies.

- February 2023: Aranayak Fuel and Power launched a USD 6 Million biomass-based green hydrogen plant, demonstrating the sector's diversification into new, high-value applications.

Strategic Outlook for India Biomass Market

The India biomass market is poised for significant growth, driven by supportive government policies, technological advancements, and the increasing demand for sustainable energy solutions. Strategic investments in research and development, efficient supply chains, and innovative marketing strategies are crucial for maximizing the market's potential. Companies focused on efficient biomass conversion technologies and developing specialized products catering to specific end-user needs will be particularly well-positioned for success. The market's trajectory indicates promising long-term prospects for growth and innovation.

India Biomass Market Segmentation

-

1. Feedstock

- 1.1. Agriculture Waste

- 1.2. Wood and Woody Residue

- 1.3. Solid Municipal Waste

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Power Generation

- 2.2. Heating

- 2.3. Other Applications

India Biomass Market Segmentation By Geography

- 1. India

India Biomass Market Regional Market Share

Geographic Coverage of India Biomass Market

India Biomass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks

- 3.3. Market Restrains

- 3.3.1. 4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks

- 3.4. Market Trends

- 3.4.1. The Power Generation Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Biomass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 5.1.1. Agriculture Waste

- 5.1.2. Wood and Woody Residue

- 5.1.3. Solid Municipal Waste

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation

- 5.2.2. Heating

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Feedstock

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Emami Agrotech Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Universal Biofuels Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BIOD ENERGY (INDIA) PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnviTec Biogas AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aemetis Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Monopoly Innovations Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 1 *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Emami Agrotech Ltd

List of Figures

- Figure 1: India Biomass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Biomass Market Share (%) by Company 2025

List of Tables

- Table 1: India Biomass Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 2: India Biomass Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: India Biomass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Biomass Market Revenue billion Forecast, by Feedstock 2020 & 2033

- Table 5: India Biomass Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Biomass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Biomass Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the India Biomass Market?

Key companies in the market include Emami Agrotech Ltd, Universal Biofuels Private Limited, BIOD ENERGY (INDIA) PVT LTD, EnviTec Biogas AG, Aemetis Inc, Monopoly Innovations Private Limited, 1 *List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi.

3. What are the main segments of the India Biomass Market?

The market segments include Feedstock, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks.

6. What are the notable trends driving market growth?

The Power Generation Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Favorable Government Support to Drive the Market4.; Abundant Availability of Feedstocks.

8. Can you provide examples of recent developments in the market?

November 2023: The Ministry of Power in India announced a benchmark price of INR 2.27/1,000 kcal (USD 0.027/1,000 kcal) for non-torrefied biomass pellets, which is applicable to northern India, excluding the national capital region. The pellets should have a moisture content below 14 pc and a gross calorific value between 2,800 and 4,000 kcal/kg. The price excludes tax and transportation costs for goods and services.February 2023: Aranayak Fuel and Power, an Indian-based biomass company, broke the ground on its INR 50-crore (~USD 6 million), one tonne-per-day, biomass-based green hydrogen plant in the Mirzapur district of Uttar Pradesh. The company signed an MoU with the state government during the ‘global investors’ meet’ in Uttar Pradesh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Biomass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Biomass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Biomass Market?

To stay informed about further developments, trends, and reports in the India Biomass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence