Key Insights

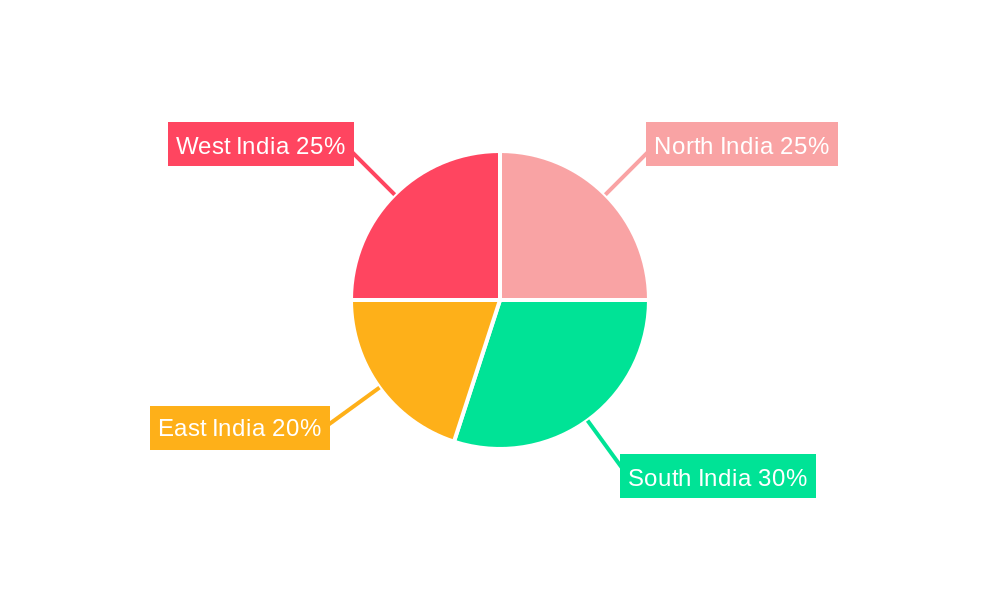

The India Battery Energy Storage Systems (BESS) market is poised for significant expansion, projected to reach 385 million by 2033. Driven by a robust compound annual growth rate (CAGR) of 14% from the base year 2025, this growth is propelled by key market dynamics. The increasing integration of renewable energy sources like solar and wind power necessitates advanced BESS for managing intermittency. Government initiatives supporting electric vehicle (EV) adoption and grid modernization are also fueling demand for cutting-edge battery technologies, particularly lithium-ion. Furthermore, growing energy security concerns and the demand for reliable power in underserved regions are accelerating the adoption of off-grid BESS solutions. The market is segmented by battery chemistry (lithium-ion, lead-acid, flow, others) and connection type (on-grid, off-grid). Lithium-ion is anticipated to lead due to its superior energy density and lifespan, while off-grid systems are gaining prominence in rural electrification. Key industry players, including Delta Electronics, Toshiba, Panasonic, Exide Industries, and AES Corporation, are strategically investing in this evolving market. Growth potential is distributed across all Indian regions (North, South, East, and West), influenced by regional renewable energy penetration and infrastructure development.

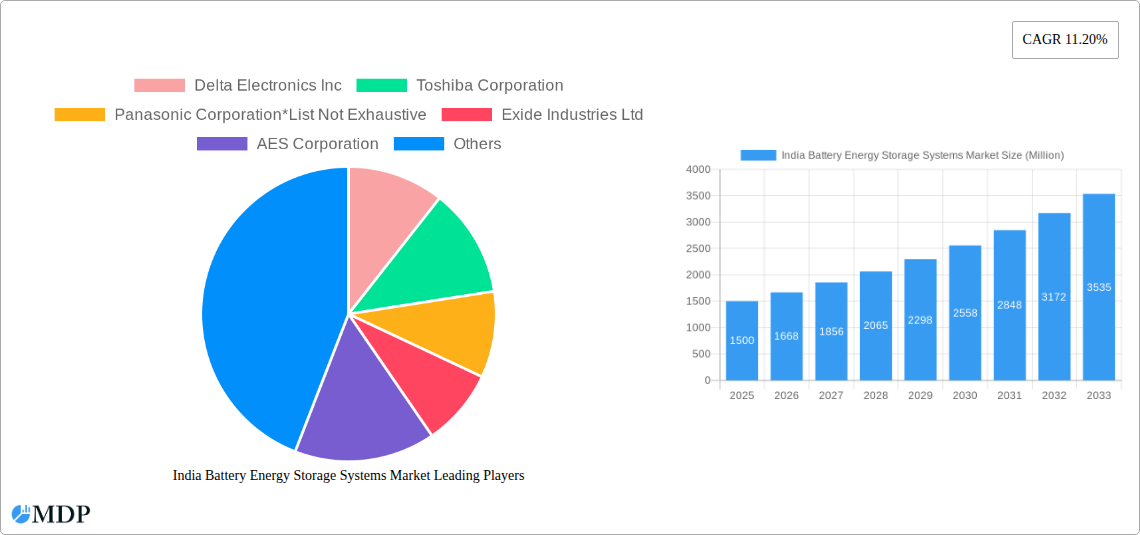

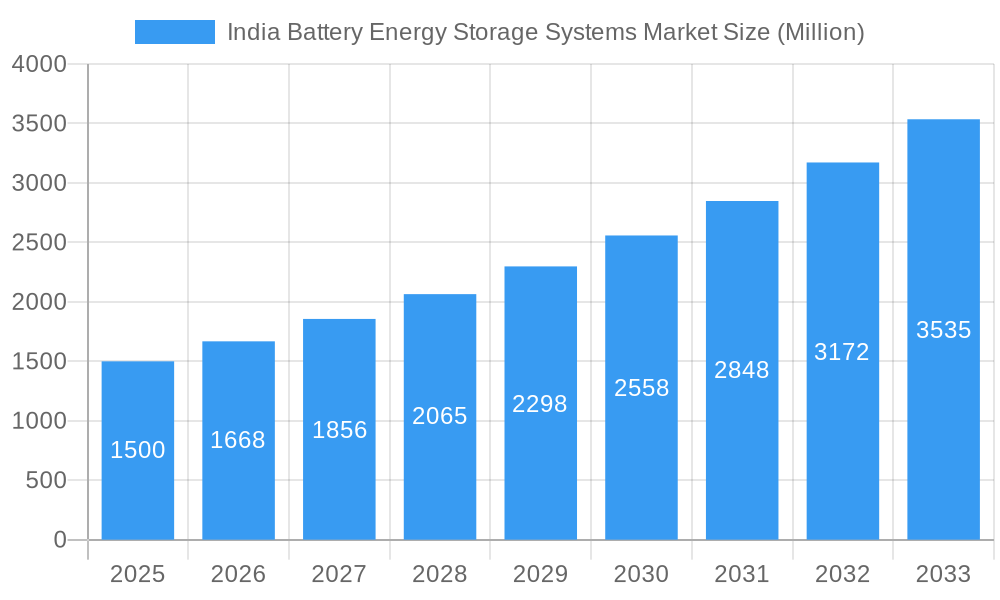

India Battery Energy Storage Systems Market Market Size (In Million)

The competitive environment features a blend of global and domestic BESS providers. While lithium-ion batteries dominate current market share, lead-acid batteries remain relevant for cost-sensitive applications. Future market evolution will be shaped by technological innovation, supportive government policies, and shifting consumer demands. Declining lithium-ion battery costs and advancements in flow battery technology are expected to further transform the market. The sustained growth of the EV sector and the increasing need for backup power solutions will continue to drive the India BESS market forward.

India Battery Energy Storage Systems Market Company Market Share

India Battery Energy Storage Systems Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning India Battery Energy Storage Systems (BESS) market, offering invaluable insights for stakeholders across the energy sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and opportunities, equipping businesses with the knowledge needed to navigate this rapidly evolving landscape. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

India Battery Energy Storage Systems Market Market Dynamics & Concentration

The Indian BESS market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with several key players vying for dominance. However, increasing investments and technological advancements are likely to lead to consolidation in the coming years. Innovation in battery chemistries (Lithium-ion, Lead-acid, Flow, and others) and grid integration technologies are key drivers. The regulatory environment, particularly government incentives and policies promoting renewable energy integration, significantly shapes market dynamics. Product substitutes, primarily conventional energy storage solutions, face increasing competition due to the superior efficiency and scalability of BESS. End-user trends reveal a growing preference for sustainable energy solutions, fueling demand. Furthermore, mergers and acquisitions (M&A) are expected to increase as larger companies seek to expand their market share and acquire specialized technologies. The average M&A deal count during the historical period (2019-2024) was approximately xx, projected to increase to xx annually during the forecast period. Market share data indicates that [Insert dominant player and approximate market share], with other players holding smaller but significant shares.

India Battery Energy Storage Systems Market Industry Trends & Analysis

The Indian BESS market exhibits robust growth, driven by several key factors. The increasing penetration of renewable energy sources, notably solar and wind, necessitates efficient energy storage solutions to address intermittency challenges. Technological advancements in battery technologies, such as improved energy density and lifespan of Lithium-ion batteries, are also propelling market expansion. Consumer preference is shifting towards reliable and sustainable energy solutions, boosting demand for BESS. Competitive dynamics are intense, with both domestic and international players striving for market leadership. The market is witnessing a CAGR of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% by 2033. Technological disruptions, such as the emergence of solid-state batteries and advanced energy management systems, are expected to further reshape the market landscape.

Leading Markets & Segments in India Battery Energy Storage Systems Market

- Battery Type: Lithium-ion batteries dominate the market due to their higher energy density and longer lifespan, though lead-acid batteries still hold a significant share in the off-grid segment. Flow batteries are emerging as a niche technology for large-scale applications. Other battery types are currently under development.

- Connection Type: The on-grid segment is experiencing rapid growth due to government initiatives promoting grid integration of renewable energy. The off-grid segment caters mainly to remote areas with limited grid access and is also witnessing substantial growth, particularly in rural electrification projects.

Key Drivers for Lithium-ion Dominance:

- Government incentives favoring renewable energy integration.

- Technological advancements leading to improved battery performance and cost reduction.

- Growing demand for reliable power supply in urban and industrial sectors.

Key Drivers for Off-grid Segment Growth:

- Need for reliable electricity in remote and underserved areas.

- Government initiatives aimed at rural electrification.

- Falling prices of battery systems making them more accessible.

India Battery Energy Storage Systems Market Product Developments

Recent product innovations focus on improving battery efficiency, lifespan, and safety. Advanced battery management systems (BMS) are being incorporated to enhance energy storage performance and optimize system longevity. New applications are emerging in microgrids, electric vehicle charging infrastructure, and backup power for critical facilities. The key competitive advantage lies in offering cost-effective and reliable solutions tailored to specific end-user needs. The market is characterized by increasing adoption of modular and scalable BESS designs, allowing for easy expansion and customization.

Key Drivers of India Battery Energy Storage Systems Market Growth

Several factors contribute to the market's robust growth trajectory. Firstly, the Indian government's strong push for renewable energy integration through policies such as the USD 455.2 Million incentive program announced in June 2023, for installing 400 MWh of battery energy storage projects, is a major driver. Secondly, the decreasing cost of battery technologies is making BESS more economically viable. Finally, technological advancements enhance performance, efficiency, and safety, further boosting market adoption.

Challenges in the India Battery Energy Storage Systems Market Market

The market faces certain challenges. Regulatory hurdles related to grid interconnection and safety standards can hinder project development. Supply chain issues, especially concerning raw materials for battery manufacturing, can affect production capacity and costs. Intense competition from both domestic and international players puts pressure on profit margins. The initial high capital investment cost for BESS projects also remains a barrier for some potential customers.

Emerging Opportunities in India Battery Energy Storage Systems Market

The long-term growth potential is significant. Technological breakthroughs, such as the development of advanced battery chemistries and improved energy management systems, will open new avenues for market expansion. Strategic partnerships between battery manufacturers, energy developers, and grid operators will facilitate seamless integration of BESS into the energy ecosystem. Market expansion into underserved regions and the increasing adoption of BESS in various applications will drive further growth.

Leading Players in the India Battery Energy Storage Systems Market Sector

- Delta Electronics Inc

- Toshiba Corporation

- Panasonic Corporation

- Exide Industries Ltd

- AES Corporation

- Amara Raja Group

Key Milestones in India Battery Energy Storage Systems Market Industry

- June 2023: The Indian government announces a USD 455.2 Million incentive program for 400 MWh of battery energy storage projects, significantly boosting market growth.

- April 2023: India Grid Trust completes its first BESS project in Maharashtra, demonstrating the growing feasibility of grid-integrated BESS projects.

Strategic Outlook for India Battery Energy Storage Systems Market Market

The Indian BESS market is poised for substantial growth over the next decade, fueled by government support, technological advancements, and increasing demand for reliable and sustainable energy solutions. Strategic opportunities exist in developing innovative battery technologies, optimizing grid integration strategies, and expanding into new market segments. Companies that can offer cost-effective, reliable, and safe BESS solutions will be well-positioned to capitalize on this significant market potential.

India Battery Energy Storage Systems Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion

- 1.2. Lead-acid

- 1.3. Flow

- 1.4. Other Battery Types

-

2. Connection Type

- 2.1. On-grid

- 2.2. Off-grid

India Battery Energy Storage Systems Market Segmentation By Geography

- 1. India

India Battery Energy Storage Systems Market Regional Market Share

Geographic Coverage of India Battery Energy Storage Systems Market

India Battery Energy Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Energy Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion

- 5.1.2. Lead-acid

- 5.1.3. Flow

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Connection Type

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exide Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AES Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amara Raja Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics Inc

List of Figures

- Figure 1: India Battery Energy Storage Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Battery Energy Storage Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 3: India Battery Energy Storage Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 5: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 6: India Battery Energy Storage Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Energy Storage Systems Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the India Battery Energy Storage Systems Market?

Key companies in the market include Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation*List Not Exhaustive, Exide Industries Ltd, AES Corporation, Amara Raja Group.

3. What are the main segments of the India Battery Energy Storage Systems Market?

The market segments include Battery Type, Connection Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 385 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

June 2023: The Indian government shall offer USD 455.2 million as incentives to the companies for installing battery energy storage projects of 400 MWh. The government intends to reach its 2030 goal of 500 MW of renewable capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Energy Storage Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Energy Storage Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Energy Storage Systems Market?

To stay informed about further developments, trends, and reports in the India Battery Energy Storage Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence