Key Insights

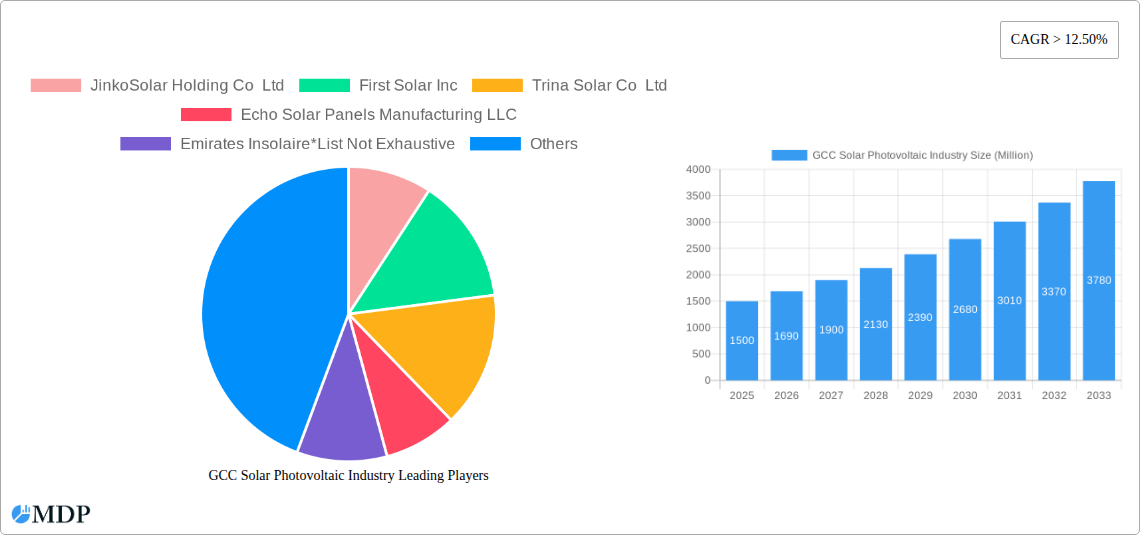

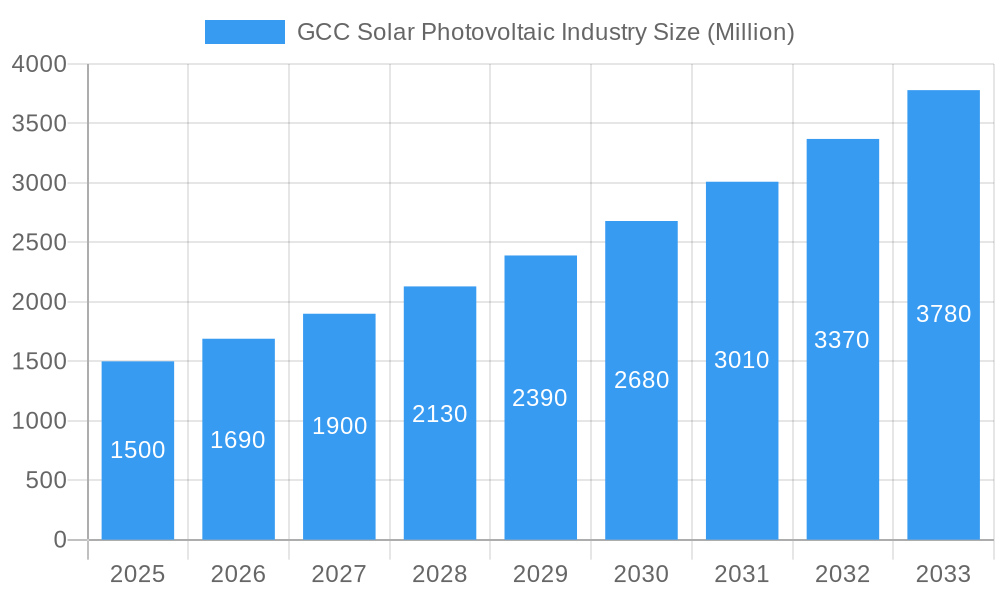

The GCC solar photovoltaic (PV) industry is experiencing robust growth, driven by supportive government policies aimed at diversifying energy sources and reducing carbon emissions. The region's abundant sunlight and increasing energy demand create a fertile ground for solar PV adoption. A CAGR exceeding 12.50% indicates a significant expansion of the market, projected to reach substantial value within the forecast period (2025-2033). Key drivers include ambitious renewable energy targets set by various GCC nations, decreasing solar PV technology costs, and rising investments in large-scale solar projects. Government incentives, such as feed-in tariffs and tax breaks, further stimulate market growth. While the residential segment is showing gradual growth, the utility and commercial & industrial sectors are currently leading the market, fueled by large-scale projects and corporate sustainability initiatives. Challenges include land availability for large-scale projects and the need for advanced grid infrastructure to accommodate the influx of renewable energy. However, ongoing investments in grid modernization and the development of innovative energy storage solutions are mitigating these restraints. The competitive landscape is characterized by a mix of international and domestic players, with companies like JinkoSolar, First Solar, and Trina Solar vying for market share alongside regional players. This dynamic environment fosters innovation and price competition, ultimately benefiting consumers and accelerating the adoption of solar PV technology across the GCC.

GCC Solar Photovoltaic Industry Market Size (In Billion)

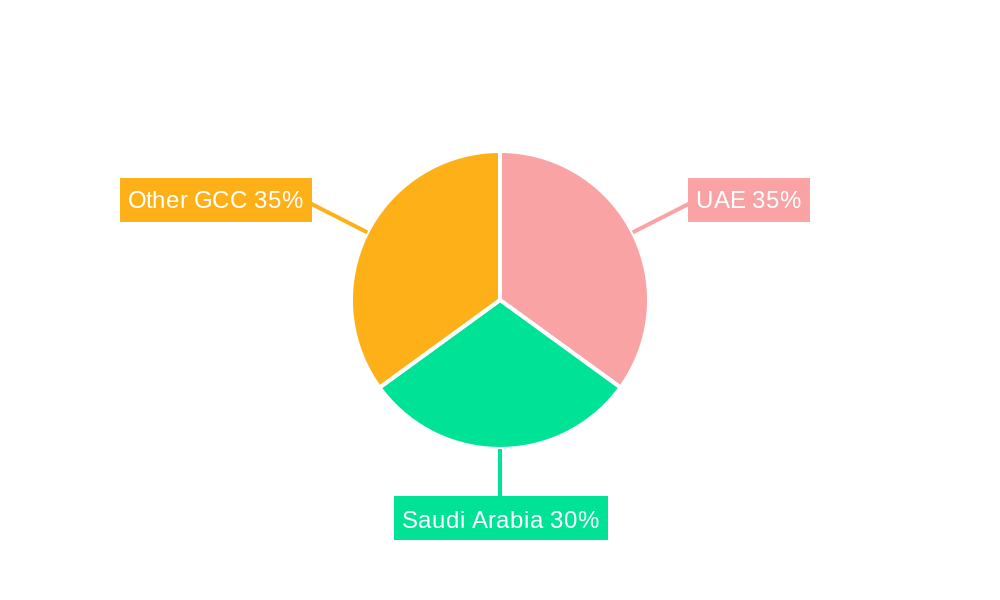

The GCC solar PV market segmentation reveals a strong focus on utility-scale projects, indicative of government-led initiatives. Commercial and industrial sectors are actively adopting solar PV to reduce operational costs and improve their environmental footprint. The residential market, while smaller compared to the others, shows potential for future expansion as awareness of solar energy benefits and affordability increase. Geographical distribution reveals that the UAE and Saudi Arabia, given their ambitious renewable energy goals and economic strength, are expected to dominate the regional market. However, other GCC nations are also making significant strides in solar PV deployment, contributing to overall market growth. The historical period (2019-2024) likely saw considerable market development establishing a strong foundation for the significant growth predicted through 2033. Continued policy support, technological advancements, and increased private sector investment are likely to sustain the impressive growth trajectory of the GCC solar PV industry.

GCC Solar Photovoltaic Industry Company Market Share

GCC Solar Photovoltaic Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the GCC solar photovoltaic (PV) industry, covering market dynamics, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and policymakers. The report leverages extensive data analysis to project a xx Million market size by 2033, revealing significant growth opportunities in this dynamic sector.

GCC Solar Photovoltaic Industry Market Dynamics & Concentration

The GCC solar PV market is experiencing robust growth, driven by several factors. Market concentration is moderate, with a few major players holding significant shares, while numerous smaller companies and regional players contribute to a competitive landscape. Innovation in PV technology, particularly in efficiency and cost reduction, is a key driver. Supportive government policies, including feed-in tariffs and renewable energy targets, are accelerating adoption. While there are limited direct substitutes for solar PV in large-scale electricity generation, other renewable energy sources like wind power compete for investment. End-user trends show a strong preference for cost-effective and reliable solar solutions across utility, commercial & industrial (C&I), and residential sectors. M&A activity in the GCC solar PV sector has been steadily increasing, with xx deals recorded between 2019 and 2024, signifying consolidation and expansion. Key metrics analyzed include:

- Market Share: JinkoSolar, First Solar, and Trina Solar hold a significant portion of the market share, with smaller players competing intensely.

- M&A Deal Counts: An upward trend in M&A activity reflects increasing industry consolidation and expansion strategies.

- Innovation Drivers: Technological advancements driving efficiency gains and cost reductions are paramount for market growth.

GCC Solar Photovoltaic Industry Industry Trends & Analysis

The GCC solar PV market demonstrates impressive growth, with a compound annual growth rate (CAGR) of xx% projected from 2025 to 2033. Market penetration is increasing rapidly, driven by falling solar PV costs, government incentives, and rising energy demand. Technological disruptions, such as advancements in thin-film technology and improved energy storage solutions, are transforming the industry. Consumer preferences are shifting towards aesthetically pleasing and efficient solar PV systems, particularly in the residential sector. Competitive dynamics are characterized by intense competition among global and regional players, with pricing strategies, technological innovation, and project development capabilities playing pivotal roles. The industry landscape is marked by both large multinational corporations and smaller specialized companies. The transition to cleaner energy sources and increasing public awareness on environmental issues is acting as a catalyst for greater adoption rates.

Leading Markets & Segments in GCC Solar Photovoltaic Industry

The Utility segment dominates the GCC solar PV market, driven by large-scale projects and supportive government policies. Saudi Arabia and the UAE are the leading markets, benefitting from substantial investments in renewable energy infrastructure.

Key Drivers for the Utility Segment:

- Economic Policies: Government subsidies, attractive feed-in tariffs, and long-term power purchase agreements incentivize utility-scale solar PV deployment.

- Infrastructure Development: Significant investments in grid infrastructure and transmission lines are crucial for integrating large-scale renewable energy projects.

- Abundant Solar Resources: The GCC region enjoys high solar irradiance, making it highly suitable for solar energy generation.

The C&I segment is also experiencing considerable growth, driven by cost savings and corporate sustainability goals. Residential solar PV adoption is also expanding, although at a slower pace compared to the Utility and C&I segments, due to higher initial investment costs.

GCC Solar Photovoltaic Industry Product Developments

Recent product innovations focus on improving efficiency, durability, and aesthetics of solar PV panels. Manufacturers are introducing high-efficiency monocrystalline silicon panels and bifacial solar panels that capture light from both sides. Technological trends include advancements in thin-film solar technology and the integration of solar PV with energy storage systems. The market fit for these innovations is strong, driven by the increasing demand for cost-effective and reliable solar power solutions.

Key Drivers of GCC Solar Photovoltaic Industry Growth

Several factors fuel the expansion of the GCC solar PV industry. Decreasing solar PV module costs are making solar power increasingly competitive with conventional energy sources. Supportive government policies, including ambitious renewable energy targets and investment incentives, are significantly accelerating solar PV adoption. Furthermore, rising energy demand and concerns about climate change are creating a strong impetus for the transition to cleaner and more sustainable energy solutions.

Challenges in the GCC Solar Photovoltaic Industry Market

The GCC solar PV market faces several challenges. Land acquisition for large-scale solar PV projects can be complex and time-consuming. Supply chain disruptions and the availability of skilled labor can impact project timelines and costs. Furthermore, intense competition among numerous players exerts downward pressure on prices. These challenges, while significant, are not insurmountable and are being actively addressed by stakeholders.

Emerging Opportunities in GCC Solar Photovoltaic Industry

Significant growth opportunities exist in the GCC solar PV sector. Technological advancements, including the development of more efficient and cost-effective solar PV technologies, will continue to drive market expansion. Strategic partnerships between international and regional companies are fostering innovation and accelerating project development. Market expansion into new segments, such as agrivoltaics and floating solar PV systems, presents additional avenues for growth.

Leading Players in the GCC Solar Photovoltaic Industry Sector

- JinkoSolar Holding Co Ltd

- First Solar Inc

- Trina Solar Co Ltd

- Echo Solar Panels Manufacturing LLC

- Emirates Insolaire

- Sunergy Solar

- Canadian Solar Inc

- Dubai Electricity and Water Authority

- Masdar Abu Dhabi Future Energy Company

- ACWA Power

Key Milestones in GCC Solar Photovoltaic Industry Industry

- April 2021: ACWA Power inaugurated the 300 MW Sakaka PV IPP, Saudi Arabia's first utility-scale renewable energy project, at a cost of SAR 1.2 billion (USD xx Million), achieving a record-breaking tariff.

- Early 2020: Hanergy Thin Film Power Group announced plans to build a USD 1 billion (EUR xx Million) thin-film industrial park in Saudi Arabia, a first for the Middle East.

Strategic Outlook for GCC Solar Photovoltaic Industry Market

The future of the GCC solar PV market is exceptionally promising. Continued technological advancements, supportive government policies, and rising energy demand will drive substantial market expansion. Strategic partnerships and investments in innovative technologies will play a crucial role in shaping the industry's future. The market is poised for significant growth, with opportunities for both established players and new entrants.

GCC Solar Photovoltaic Industry Segmentation

-

1. Deployment

- 1.1. Utility

- 1.2. Commercial and Industrial

- 1.3. Residential

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Rest of GCC

GCC Solar Photovoltaic Industry Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Rest of GCC

GCC Solar Photovoltaic Industry Regional Market Share

Geographic Coverage of GCC Solar Photovoltaic Industry

GCC Solar Photovoltaic Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Strong Dependence on Prevailing Weather Condition

- 3.4. Market Trends

- 3.4.1. Utility Sector as a Significant Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Solar Photovoltaic Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Utility

- 5.1.2. Commercial and Industrial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Rest of GCC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of GCC

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. United Arab Emirates GCC Solar Photovoltaic Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Utility

- 6.1.2. Commercial and Industrial

- 6.1.3. Residential

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. Rest of GCC

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Saudi Arabia GCC Solar Photovoltaic Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Utility

- 7.1.2. Commercial and Industrial

- 7.1.3. Residential

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. Rest of GCC

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Rest of GCC GCC Solar Photovoltaic Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Utility

- 8.1.2. Commercial and Industrial

- 8.1.3. Residential

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. Rest of GCC

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 JinkoSolar Holding Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 First Solar Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Trina Solar Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Echo Solar Panels Manufacturing LLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Emirates Insolaire*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sunergy Solar

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Canadian Solar Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dubai Electricity and Water Authority

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Masdar Abu Dhabi Future Energy Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 ACWA Power

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Global GCC Solar Photovoltaic Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: United Arab Emirates GCC Solar Photovoltaic Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 3: United Arab Emirates GCC Solar Photovoltaic Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: United Arab Emirates GCC Solar Photovoltaic Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 5: United Arab Emirates GCC Solar Photovoltaic Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: United Arab Emirates GCC Solar Photovoltaic Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: United Arab Emirates GCC Solar Photovoltaic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Saudi Arabia GCC Solar Photovoltaic Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 9: Saudi Arabia GCC Solar Photovoltaic Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Saudi Arabia GCC Solar Photovoltaic Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 11: Saudi Arabia GCC Solar Photovoltaic Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Saudi Arabia GCC Solar Photovoltaic Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Saudi Arabia GCC Solar Photovoltaic Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of GCC GCC Solar Photovoltaic Industry Revenue (undefined), by Deployment 2025 & 2033

- Figure 15: Rest of GCC GCC Solar Photovoltaic Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Rest of GCC GCC Solar Photovoltaic Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 17: Rest of GCC GCC Solar Photovoltaic Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Rest of GCC GCC Solar Photovoltaic Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Rest of GCC GCC Solar Photovoltaic Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 2: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 5: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 8: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 11: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Solar Photovoltaic Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Solar Photovoltaic Industry?

The projected CAGR is approximately 12.8%.

2. Which companies are prominent players in the GCC Solar Photovoltaic Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, First Solar Inc, Trina Solar Co Ltd, Echo Solar Panels Manufacturing LLC, Emirates Insolaire*List Not Exhaustive, Sunergy Solar, Canadian Solar Inc, Dubai Electricity and Water Authority, Masdar Abu Dhabi Future Energy Company, ACWA Power.

3. What are the main segments of the GCC Solar Photovoltaic Industry?

The market segments include Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems.

6. What are the notable trends driving market growth?

Utility Sector as a Significant Sector.

7. Are there any restraints impacting market growth?

4.; Strong Dependence on Prevailing Weather Condition.

8. Can you provide examples of recent developments in the market?

In April 2021, ACWA Power inaugurated the 300 MW Sakaka PV IPP, the country's first utility-scale renewable energy project, at an investment cost of SAR 1.2 billion. The project was awarded to ACWA Power at a record-breaking tariff of USD 2.3417 cents/kWh (8.781 halalas/kWh).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Solar Photovoltaic Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Solar Photovoltaic Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Solar Photovoltaic Industry?

To stay informed about further developments, trends, and reports in the GCC Solar Photovoltaic Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence