Key Insights

The Power-to-Gas (PtG) market is poised for significant expansion, projected to reach $78.9 billion by 2033, with a compound annual growth rate (CAGR) of 6.4% from a 2024 base year. This growth is driven by the imperative to decarbonize energy systems, the increasing integration of renewable energy sources like wind and solar, and the demand for advanced energy storage solutions. Supportive government policies, including incentives and emissions reduction targets, are further stimulating market development. Technological advancements are enhancing PtG efficiency and cost-effectiveness, making it a compelling option for utilities and industrial users. Key applications like Power-to-Hydrogen (PtH) for industrial processes and Power-to-Methane (PtM) for natural gas grid injection offer flexible and sustainable energy pathways. Despite challenges such as initial capital expenditure and infrastructure needs, the long-term economic and environmental advantages are driving substantial investment and innovation.

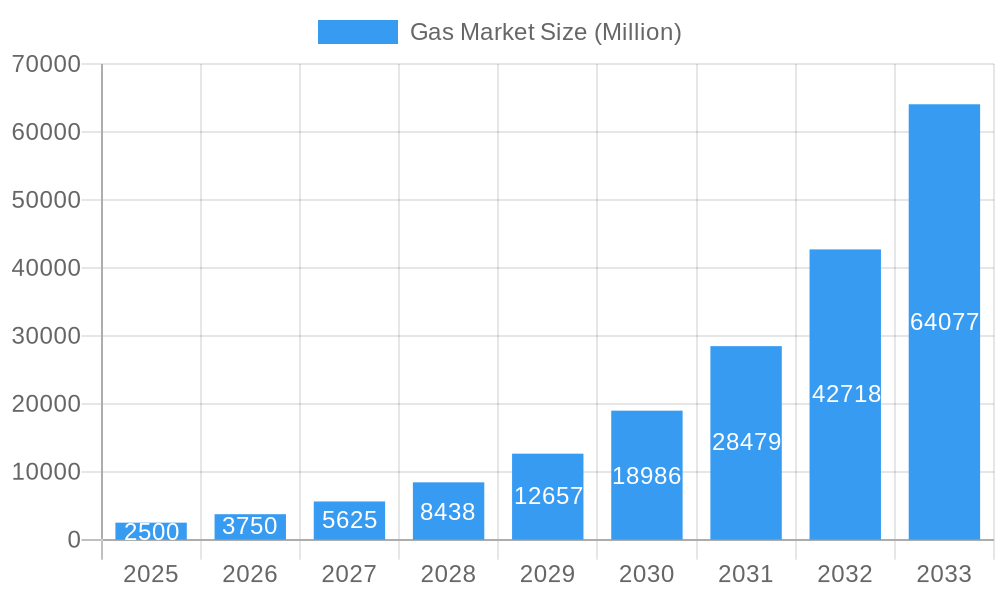

Gas Market Market Size (In Billion)

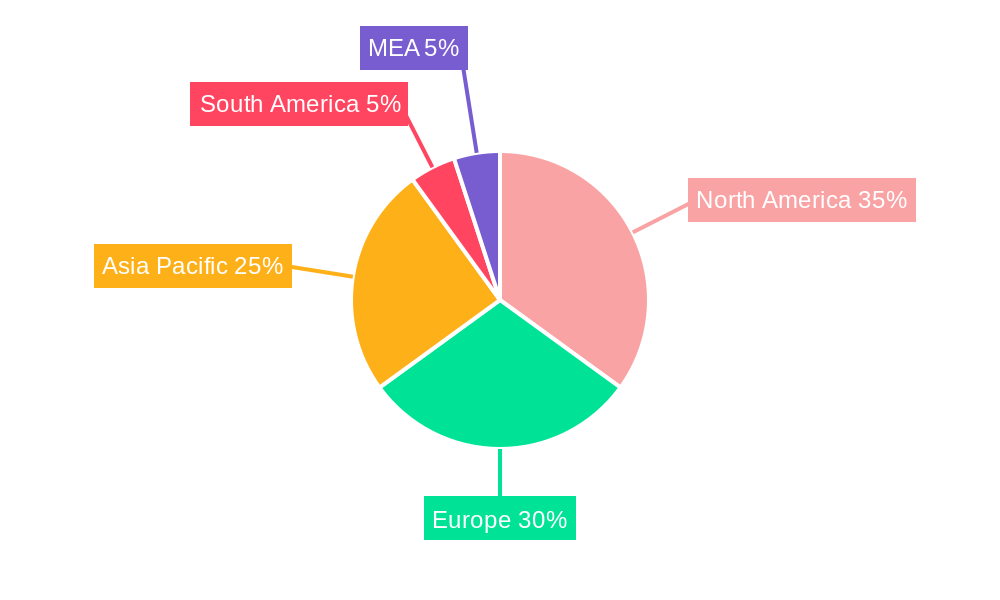

The PtG market is segmented by technology (PtH and PtM), capacity (over 1000 KW, 100-1000 KW, and under 100 KW), and end-user (utilities, industrial, and commercial). While larger capacity segments currently dominate, smaller-scale solutions are gaining traction, especially in commercial sectors. Key markets include North America, Europe, and Asia-Pacific, supported by government initiatives and major players like MAN Energy Solutions and Siemens Energy AG. Emerging markets in the Middle East and Africa show strong growth potential due to rising renewable energy adoption and favorable policies. The competitive landscape is characterized by rapid technological innovation and strategic collaborations. The forecast period (2025-2033) anticipates substantial market growth fueled by technological progress, policy backing, and heightened sustainability awareness.

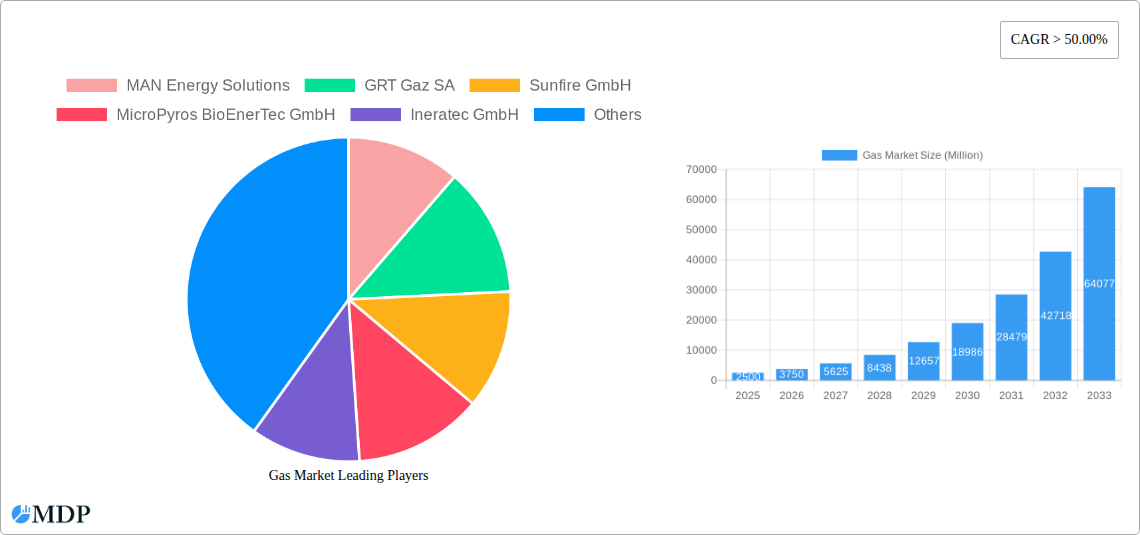

Gas Market Company Market Share

Gas Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Gas Market, covering market dynamics, industry trends, leading players, and future growth opportunities from 2019 to 2033. With a focus on Power-to-Hydrogen and Power-to-Methane technologies, across diverse capacities and end-user segments, this report is essential for industry stakeholders, investors, and strategic decision-makers. The report leverages a robust dataset, including historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033.

Gas Market Market Dynamics & Concentration

The Gas Market is experiencing significant transformation driven by increasing demand for cleaner energy sources and stringent environmental regulations. Market concentration is moderate, with several key players vying for market share. Innovation in electrolysis technologies, particularly Power-to-X solutions, is a major driver of growth. Stringent emission standards globally are shaping the regulatory landscape, favoring companies investing in sustainable gas production. Competition from renewable energy sources and advancements in energy storage solutions pose challenges, impacting market dynamics. M&A activity has been notable, with xx deals recorded between 2019 and 2024, leading to some consolidation within the sector. Key metrics, including market share for major players and deal volume, illustrate market concentration and competitive intensity.

- Market Share: Siemens Energy AG holds an estimated xx% market share in 2025, followed by Nel ASA at xx%, and Hitachi Zosen Inova AG at xx%. (Note: These are estimates based on available data and market trends)

- M&A Activity: The number of M&A transactions in the Gas Market increased by xx% from 2022 to 2024, indicating increasing consolidation.

Gas Market Industry Trends & Analysis

The Gas Market exhibits a robust CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several factors, including the increasing adoption of renewable energy sources, government incentives for green hydrogen production, and the rising demand from diverse end-users across utilities, industrial, and commercial sectors. Technological advancements, particularly in electrolysis and Power-to-Methane technologies, are significantly improving efficiency and reducing production costs. Consumer preference is shifting toward environmentally friendly energy solutions, further driving market expansion. Competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative startups. Market penetration of Power-to-Hydrogen technology is expected to reach xx% by 2033, while Power-to-Methane is projected to achieve xx% penetration.

Leading Markets & Segments in Gas Market

The North American region is expected to dominate the Gas Market in 2025, driven by significant government investments in clean energy infrastructure and supportive policy frameworks. Europe follows closely, exhibiting substantial growth fueled by stringent environmental regulations and a strong commitment to renewable energy integration.

By Technology: Power-to-Hydrogen currently holds the largest market share, driven by increasing demand for green hydrogen in various sectors. However, Power-to-Methane is expected to witness faster growth due to its efficient energy storage capabilities.

By Capacity: The segment of systems with capacities exceeding 1000 KW holds a significant market share due to the economies of scale and suitability for large-scale industrial applications. However, the 100-1000 KW segment is experiencing rapid growth, especially in decentralized energy applications.

By End-User: The industrial sector is the largest end-user of gas, followed by the utilities sector. However, the commercial sector is showing significant growth potential driven by decarbonization initiatives.

Key Drivers:

- Economic Policies: Government incentives and subsidies for clean energy technologies are boosting market growth.

- Infrastructure Development: Investments in pipeline infrastructure and storage facilities are facilitating market expansion.

Gas Market Product Developments

Significant advancements in electrolysis technology are driving product innovation, leading to the development of more efficient and cost-effective systems. This includes improvements in electrolyzer design, membrane technology, and catalyst materials. Applications are expanding beyond traditional energy sectors, encompassing transportation, chemicals, and industrial processes. Companies are focusing on developing integrated solutions combining renewable energy generation, electrolysis, and hydrogen storage, enabling optimized system performance and minimizing costs.

Key Drivers of Gas Market Growth

Technological advancements in electrolysis and renewable energy sources are key growth drivers, lowering production costs and enhancing efficiency. Supportive government policies and regulations, including incentives for green hydrogen adoption and carbon emission reduction targets, are significantly boosting market expansion. Growing demand from diverse end-users, particularly in the industrial and transportation sectors, is further fueling market growth.

Challenges in the Gas Market Market

Regulatory uncertainty and inconsistent policy frameworks across different regions pose challenges to market development. Supply chain disruptions and the availability of critical raw materials, such as platinum group metals used in electrolyzers, can impede growth. High initial capital investment costs for large-scale projects can create barriers to entry for smaller companies, leading to market concentration. Competition from traditional fossil fuels and other renewable energy sources also presents a significant challenge.

Emerging Opportunities in Gas Market

Emerging opportunities lie in the integration of green hydrogen into existing energy infrastructure and the development of novel applications across various sectors. Strategic partnerships between technology providers, energy companies, and end-users will play a crucial role in unlocking market potential. Expansion into new geographical markets, especially in developing economies, offers substantial growth prospects. Advancements in storage solutions and transportation technologies will further enable the broader adoption of green hydrogen.

Leading Players in the Gas Market Sector

- MAN Energy Solutions

- GRT Gaz SA

- Sunfire GmbH

- MicroPyros BioEnerTec GmbH

- Ineratec GmbH

- AquahydreX Inc

- Siemens Energy AG

- Electrochaea GmbH

- Hitachi Zosen Inova AG

- Sempra Energy

- Nel ASA

Key Milestones in Gas Market Industry

- June 2022: The United States Department of Energy announced a USD 504.4 million investment in the Advanced Clean Energy Storage project, significantly boosting the clean hydrogen infrastructure.

- February 2022: Mitsubishi Power's purchase contract with HydrogenPro for a large-scale electrolyzer system demonstrated growing industry confidence in green hydrogen production.

Strategic Outlook for Gas Market Market

The Gas Market is poised for significant growth in the coming years, driven by technological advancements, supportive government policies, and increasing demand across various sectors. Strategic partnerships and collaborations among industry players will be critical for unlocking the full potential of the market. Investments in research and development, along with efforts to reduce production costs and improve efficiency, will be essential for sustained growth. The market's future success hinges on addressing the challenges related to infrastructure development, regulatory frameworks, and supply chain stability.

Gas Market Segmentation

-

1. Technology

- 1.1. Power-to-Hydrogen

- 1.2. Power-to-Methane

-

2. Capacity (Qualitative Analysis Only)

- 2.1. More than 1000 KW

- 2.2. 100 to 1000 KW

- 2.3. Less than 100 KW

-

3. y End-User

- 3.1. Utilities

- 3.2. Industrial

- 3.3. Commercial

Gas Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Gas Market Regional Market Share

Geographic Coverage of Gas Market

Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Power-to-hydrogen to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Power-to-Hydrogen

- 5.1.2. Power-to-Methane

- 5.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 5.2.1. More than 1000 KW

- 5.2.2. 100 to 1000 KW

- 5.2.3. Less than 100 KW

- 5.3. Market Analysis, Insights and Forecast - by y End-User

- 5.3.1. Utilities

- 5.3.2. Industrial

- 5.3.3. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Gas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Power-to-Hydrogen

- 6.1.2. Power-to-Methane

- 6.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 6.2.1. More than 1000 KW

- 6.2.2. 100 to 1000 KW

- 6.2.3. Less than 100 KW

- 6.3. Market Analysis, Insights and Forecast - by y End-User

- 6.3.1. Utilities

- 6.3.2. Industrial

- 6.3.3. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Gas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Power-to-Hydrogen

- 7.1.2. Power-to-Methane

- 7.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 7.2.1. More than 1000 KW

- 7.2.2. 100 to 1000 KW

- 7.2.3. Less than 100 KW

- 7.3. Market Analysis, Insights and Forecast - by y End-User

- 7.3.1. Utilities

- 7.3.2. Industrial

- 7.3.3. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Gas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Power-to-Hydrogen

- 8.1.2. Power-to-Methane

- 8.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 8.2.1. More than 1000 KW

- 8.2.2. 100 to 1000 KW

- 8.2.3. Less than 100 KW

- 8.3. Market Analysis, Insights and Forecast - by y End-User

- 8.3.1. Utilities

- 8.3.2. Industrial

- 8.3.3. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Gas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Power-to-Hydrogen

- 9.1.2. Power-to-Methane

- 9.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 9.2.1. More than 1000 KW

- 9.2.2. 100 to 1000 KW

- 9.2.3. Less than 100 KW

- 9.3. Market Analysis, Insights and Forecast - by y End-User

- 9.3.1. Utilities

- 9.3.2. Industrial

- 9.3.3. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Gas Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Power-to-Hydrogen

- 10.1.2. Power-to-Methane

- 10.2. Market Analysis, Insights and Forecast - by Capacity (Qualitative Analysis Only)

- 10.2.1. More than 1000 KW

- 10.2.2. 100 to 1000 KW

- 10.2.3. Less than 100 KW

- 10.3. Market Analysis, Insights and Forecast - by y End-User

- 10.3.1. Utilities

- 10.3.2. Industrial

- 10.3.3. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MAN Energy Solutions

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GRT Gaz SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunfire GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MicroPyros BioEnerTec GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ineratec GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AquahydreX Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens Energy AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Electrochaea GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hitachi Zosen Inova AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sempra Energy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nel ASA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 MAN Energy Solutions

List of Figures

- Figure 1: Global Gas Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 5: North America Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 6: North America Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 7: North America Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 8: North America Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 13: Europe Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 14: Europe Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 15: Europe Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 16: Europe Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 19: Asia Pacific Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 21: Asia Pacific Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 22: Asia Pacific Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 23: Asia Pacific Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 24: Asia Pacific Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 27: South America Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: South America Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 29: South America Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 30: South America Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 31: South America Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 32: South America Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Gas Market Revenue (billion), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Gas Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Gas Market Revenue (billion), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 37: Middle East and Africa Gas Market Revenue Share (%), by Capacity (Qualitative Analysis Only) 2025 & 2033

- Figure 38: Middle East and Africa Gas Market Revenue (billion), by y End-User 2025 & 2033

- Figure 39: Middle East and Africa Gas Market Revenue Share (%), by y End-User 2025 & 2033

- Figure 40: Middle East and Africa Gas Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Gas Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 3: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 4: Global Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 7: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 8: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 11: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 12: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 15: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 16: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 19: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 20: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Gas Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 22: Global Gas Market Revenue billion Forecast, by Capacity (Qualitative Analysis Only) 2020 & 2033

- Table 23: Global Gas Market Revenue billion Forecast, by y End-User 2020 & 2033

- Table 24: Global Gas Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Gas Market?

Key companies in the market include MAN Energy Solutions, GRT Gaz SA, Sunfire GmbH, MicroPyros BioEnerTec GmbH, Ineratec GmbH, AquahydreX Inc *List Not Exhaustive, Siemens Energy AG, Electrochaea GmbH, Hitachi Zosen Inova AG, Sempra Energy, Nel ASA.

3. What are the main segments of the Gas Market?

The market segments include Technology, Capacity (Qualitative Analysis Only), y End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Power-to-hydrogen to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

June 2022- The United States Department of Energy announced a USD 504.4 million investment to finance Advanced Clean Energy Storage, a clean hydrogen and energy storage facility capable of providing long-term energy storage. Located in Delta, Utah, the facility will combine 220 megawatts of alkaline electrolysis with two 4.5-million-barrel salt caverns to store clean hydrogen. When operational, the projects will capture excess renewable energy, store it as hydrogen, and deploy it as fuel for the Intermountain Power Agency's (IPA) Renewed Project-a hydrogen-capable gas turbine combined cycle power plant that intends to be fueled by 100% clean hydrogen by 2045 incrementally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Market?

To stay informed about further developments, trends, and reports in the Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence