Key Insights

The Denmark offshore oil and gas decommissioning market offers significant investment potential, driven by aging infrastructure and stringent regulatory mandates for end-of-life asset management. With a projected market size of $11.1 billion in 2025 and an estimated CAGR of 6.5%, the market is set for substantial expansion through 2033. Key growth catalysts include rigorous environmental regulations focused on minimizing ecological impact and a rising number of offshore platforms reaching their operational limits. The market is segmented by water depth (shallow, deep, and ultra-deep) and operation type (plugging and abandonment, topside and substructure removal, and subsea infrastructure removal). While shallow-water projects currently lead, increasing deep-water activity is expected, creating opportunities for specialized service providers. Challenges such as skilled labor availability and potential project delays are being addressed through technological advancements in subsea decommissioning and innovative recycling solutions, enhancing efficiency and mitigating risks. The increasing emphasis on sustainable decommissioning practices is further attracting investment and fostering innovation.

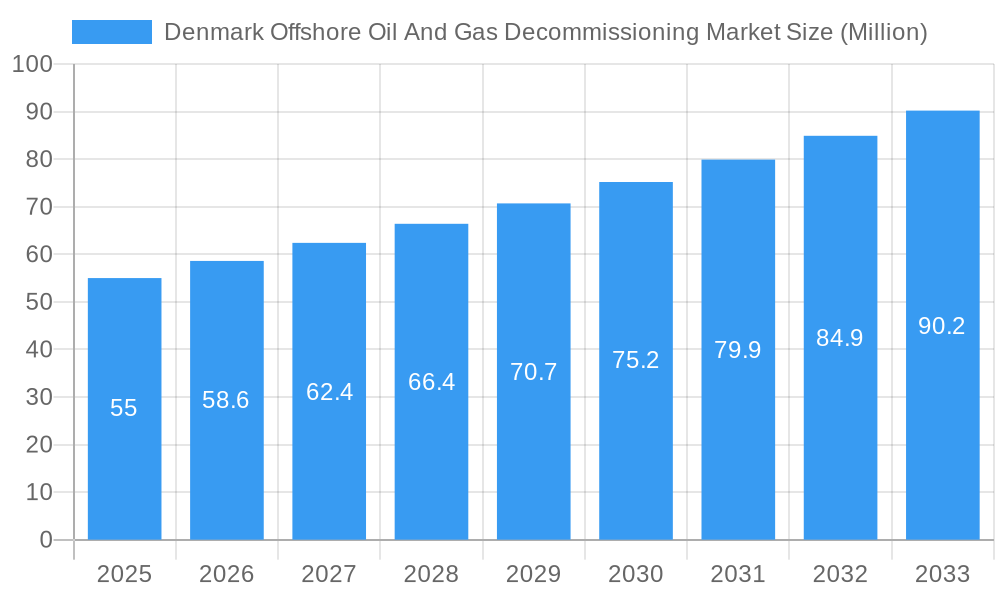

Denmark Offshore Oil And Gas Decommissioning Market Market Size (In Billion)

The forecast period (2025-2033) anticipates consistent growth, fueled by ongoing decommissioning of aging infrastructure and evolving regulatory frameworks. Market size will be influenced by decommissioning project timelines, with sustained investment in advanced technologies and sustainable practices being vital for efficient and environmentally sound operations. The Danish government's proactive promotion of responsible decommissioning supports market stability and growth. Intense competition among service providers necessitates a focus on cost-effectiveness, technical proficiency, and adherence to environmental best practices. The geographical concentration of offshore oil and gas assets in specific Danish regions shapes localized market dynamics and opportunities for niche service providers.

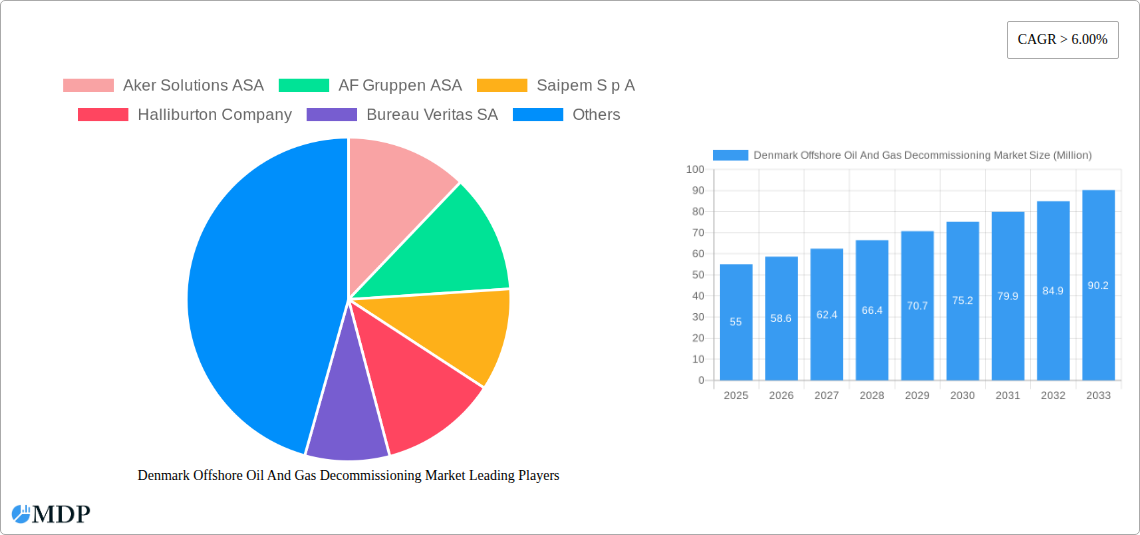

Denmark Offshore Oil And Gas Decommissioning Market Company Market Share

Denmark Offshore Oil & Gas Decommissioning Market: A Comprehensive Report (2019-2033)

Unlocking Growth Potential in the Booming Danish Offshore Decommissioning Sector

This in-depth report provides a comprehensive analysis of the Denmark offshore oil and gas decommissioning market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, leading players, technological advancements, and future opportunities within this rapidly evolving landscape. Benefit from actionable intelligence to navigate the complexities of this lucrative sector.

Denmark Offshore Oil And Gas Decommissioning Market Market Dynamics & Concentration

This section analyzes the competitive landscape, regulatory environment, and market trends influencing the Danish offshore oil and gas decommissioning market. The market is characterized by a moderate level of concentration, with key players like Aker Solutions ASA, AF Gruppen ASA, Saipem S p A, Halliburton Company, Bureau Veritas SA, A P Moller - Maersk B A/S, and Schlumberger Limited vying for market share. Market share distribution in 2025 is estimated as follows: Aker Solutions ASA (15%), AF Gruppen ASA (12%), Saipem S p A (10%), Halliburton Company (8%), Bureau Veritas SA (7%), A P Moller - Maersk B A/S (6%), Schlumberger Limited (6%), and Others (36%).

The market's growth is driven by several factors:

- Stringent Regulatory Framework: Denmark's strict environmental regulations are accelerating decommissioning activities, creating a substantial demand for specialized services.

- Technological Advancements: Innovations in decommissioning technologies, such as remotely operated vehicles (ROVs) and advanced recycling techniques, are improving efficiency and reducing costs.

- End-User Trends: A shift towards sustainable practices within the oil and gas industry is boosting demand for environmentally responsible decommissioning solutions.

- Mergers and Acquisitions (M&A): The sector has witnessed a moderate level of M&A activity in recent years, with xx deals recorded between 2019 and 2024, primarily focused on consolidating expertise and expanding service portfolios. This consolidation is expected to continue, further shaping the market's competitive landscape.

- Product Substitutes: While there are limited direct substitutes for specialized decommissioning services, the industry faces indirect competition from companies offering alternative waste management and recycling solutions.

Denmark Offshore Oil And Gas Decommissioning Market Industry Trends & Analysis

The Denmark offshore oil and gas decommissioning market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) estimated at xx%. This growth is fueled by several key factors:

- Aging Infrastructure: A large number of aging offshore oil and gas installations in the Danish North Sea require decommissioning, representing a substantial market opportunity.

- Increasing Decommissioning Costs: The cost of decommissioning is rising due to increased regulatory requirements and technological complexity, leading to greater investment in specialized services.

- Government Incentives: Government initiatives and financial incentives aimed at promoting safe and environmentally sound decommissioning practices further stimulate market growth.

- Technological Disruptions: The adoption of innovative technologies like robotics and AI is increasing the efficiency and safety of decommissioning operations, further driving market expansion.

- Market Penetration: The market penetration of advanced decommissioning technologies is expected to increase substantially by 2033, leading to improved operational efficiency and cost reduction.

Leading Markets & Segments in Denmark Offshore Oil And Gas Decommissioning Market

The Danish North Sea is the dominant market for offshore oil and gas decommissioning, driven by a high concentration of aging platforms and infrastructure.

Water Depth: Deepwater and shallow water segments are currently the most active segments, with the deepwater segment projected to witness faster growth during the forecast period.

Operations: The Plug and Abandonment segment holds the largest market share, followed by Topside Substructure and Subsea Infrastructure Removal. Other Operations, such as well plugging and abandonment, represent a growing niche market.

Key Drivers:

- Robust regulatory framework and environmental compliance requirements.

- Government funding and incentives for decommissioning projects.

- High concentration of aging offshore oil and gas infrastructure.

- Development of specialized expertise and technical capabilities.

Denmark Offshore Oil And Gas Decommissioning Market Product Developments

Recent technological advances are transforming the decommissioning landscape. Improved remotely operated vehicles (ROVs) allow for more precise and efficient removal of subsea infrastructure, while advanced recycling techniques minimize waste and environmental impact. This focus on sustainability and technological innovation enhances the market competitiveness and allows service providers to offer more cost-effective and environmentally sound solutions.

Key Drivers of Denmark Offshore Oil And Gas Decommissioning Market Growth

The Danish offshore oil and gas decommissioning market is driven by a confluence of factors: stringent government regulations mandating safe and environmentally sound decommissioning practices, the increasing age of offshore platforms necessitating decommissioning, and technological innovations offering more efficient and cost-effective solutions. These factors combine to create a robust and growing market.

Challenges in the Denmark Offshore Oil And Gas Decommissioning Market Market

The market faces challenges including high decommissioning costs, complexities of operating in harsh North Sea conditions, and potential supply chain disruptions. These factors can impact project timelines and overall profitability. The availability of specialized skilled labor is another potential constraint. The estimated impact of these challenges on overall market growth is projected to be around xx% reduction in projected growth during the forecast period.

Emerging Opportunities in Denmark Offshore Oil And Gas Decommissioning Market

Emerging opportunities include the development of innovative decommissioning technologies like robotics and AI, strategic partnerships to share expertise and reduce costs, and expansion into adjacent markets such as offshore wind farm decommissioning. The potential for green technology adoption and circular economy principles in decommissioning presents significant long-term growth prospects.

Leading Players in the Denmark Offshore Oil And Gas Decommissioning Market Sector

Key Milestones in Denmark Offshore Oil And Gas Decommissioning Market Industry

- April 2023: ABL Group secures a decommissioning contract in the Danish North Sea from TotalEnergies SE, signifying growing industry activity and highlighting the demand for specialized services.

Strategic Outlook for Denmark Offshore Oil And Gas Decommissioning Market Market

The Danish offshore oil and gas decommissioning market holds immense potential. Strategic partnerships, investment in innovative technologies, and a focus on sustainable practices will be crucial for companies seeking long-term success. The market's growth trajectory is expected to remain strong throughout the forecast period, driven by an aging offshore infrastructure and a growing emphasis on responsible decommissioning.

Denmark Offshore Oil And Gas Decommissioning Market Segmentation

-

1. Water Depth

- 1.1. Shallow Water

- 1.2. Deepwater and Ultra-Deepwater

-

2. Operation

- 2.1. Plug and Abandonment

- 2.2. Topside

- 2.3. Other Operations

Denmark Offshore Oil And Gas Decommissioning Market Segmentation By Geography

- 1. Denmark

Denmark Offshore Oil And Gas Decommissioning Market Regional Market Share

Geographic Coverage of Denmark Offshore Oil And Gas Decommissioning Market

Denmark Offshore Oil And Gas Decommissioning Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Shallow Water Projects to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Offshore Oil And Gas Decommissioning Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 5.1.1. Shallow Water

- 5.1.2. Deepwater and Ultra-Deepwater

- 5.2. Market Analysis, Insights and Forecast - by Operation

- 5.2.1. Plug and Abandonment

- 5.2.2. Topside

- 5.2.3. Other Operations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aker Solutions ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AF Gruppen ASA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saipem S p A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Halliburton Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bureau Veritas SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A P Moller - Maersk B A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schlumberger Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Denmark Offshore Oil And Gas Decommissioning Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Denmark Offshore Oil And Gas Decommissioning Market Share (%) by Company 2025

List of Tables

- Table 1: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 2: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 3: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 5: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 6: Denmark Offshore Oil And Gas Decommissioning Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Offshore Oil And Gas Decommissioning Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Denmark Offshore Oil And Gas Decommissioning Market?

Key companies in the market include Aker Solutions ASA, AF Gruppen ASA, Saipem S p A, Halliburton Company, Bureau Veritas SA, A P Moller - Maersk B A/S, Schlumberger Limited.

3. What are the main segments of the Denmark Offshore Oil And Gas Decommissioning Market?

The market segments include Water Depth, Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

Shallow Water Projects to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

April 2023: ABL Group announced that the company won a decommissioning contract in the Danish North Sea from TotalEnergies SE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Offshore Oil And Gas Decommissioning Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Offshore Oil And Gas Decommissioning Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Offshore Oil And Gas Decommissioning Market?

To stay informed about further developments, trends, and reports in the Denmark Offshore Oil And Gas Decommissioning Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence