Key Insights

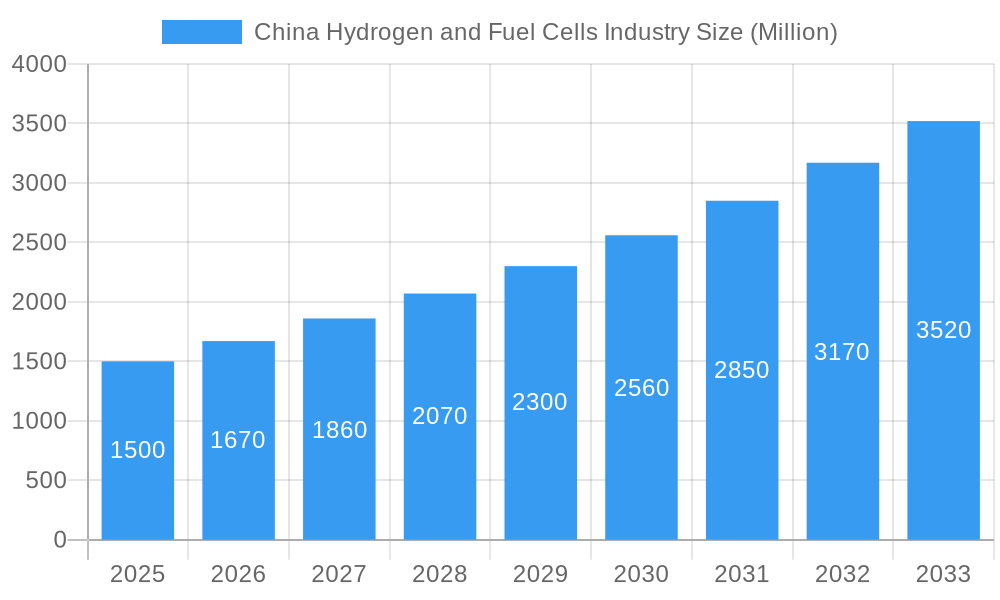

The China hydrogen and fuel cell market is poised for substantial expansion, projecting a Compound Annual Growth Rate (CAGR) of 12.3%. This robust growth, forecast from a base year of 2025, is underpinned by strong government endorsement of renewable energy, a heightened emphasis on emission reduction to meet stringent environmental standards, and escalating demand for sustainable energy solutions across diverse sectors. Key applications driving this market surge include portable power, stationary power generation for data centers and critical infrastructure, and the burgeoning transportation sector with fuel cell electric vehicles (FCEVs) and fuel cell buses. Advancements in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs) are enhancing efficiency and reducing costs. Despite challenges such as high initial infrastructure investment and the need for expanded refueling networks, the long-term outlook remains exceptionally promising. Leading companies including Horizon Fuel Cell Technologies Pte Ltd, Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, and Toshiba Fuel Cell Power Systems Corporation are actively influencing market dynamics through innovation and strategic alliances. China's significant market size, estimated at 12.94 billion, combined with proactive governmental policies, positions it as a critical region in the global hydrogen and fuel cell industry's evolution.

China Hydrogen and Fuel Cells Industry Market Size (In Billion)

PEMFC technology is anticipated to maintain its leadership in the near to mid-term, owing to its maturity and versatility. Conversely, SOFC technology is set for considerable long-term growth, driven by its superior efficiency and suitability for stationary power generation. Regionally, China's market share within the Asia-Pacific is substantial and expected to grow, fueled by ambitious renewable energy objectives and industrial development. Ongoing investment in research and development, alongside supportive government policies fostering the hydrogen economy, will be pivotal for sustained market expansion throughout the forecast period. The competitive environment is dynamic, with both established and emerging companies competing through technological innovation, strategic collaborations, and diversification into new application areas.

China Hydrogen and Fuel Cells Industry Company Market Share

China Hydrogen and Fuel Cells Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China hydrogen and fuel cell industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, technological advancements, key players, and future growth opportunities. Expect detailed forecasts, actionable data, and strategic recommendations to navigate this rapidly evolving landscape.

China Hydrogen and Fuel Cells Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of China's hydrogen and fuel cell market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user trends, and merger & acquisition (M&A) activities. The report quantifies market share distribution amongst key players and explores the impact of government policies and technological advancements on market concentration.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025. This is expected to shift to xx% by 2033 due to anticipated M&A activity and the emergence of new players.

- Innovation Drivers: Significant R&D investments, particularly in PEMFC technology, are driving innovation. Government support programs and incentives further accelerate technological advancements.

- Regulatory Framework: China’s supportive regulatory environment, including subsidies and emission reduction targets, plays a critical role in shaping market growth. The report details the specifics of these regulations and their impact.

- Product Substitutes: The report analyzes the competitive pressures from alternative energy technologies such as batteries and examines their potential impact on market growth.

- End-User Trends: Analysis of end-user adoption across transportation, stationary power, and portable applications, highlighting evolving preferences and demand patterns.

- M&A Activities: The report documents the number of M&A deals (xx in the period 2019-2024, projected xx in 2025-2033) and analyzes their impact on market consolidation and technological advancements.

China Hydrogen and Fuel Cells Industry Industry Trends & Analysis

The China hydrogen and fuel cell market is experiencing dynamic growth, driven by a confluence of factors. This section analyzes the key trends shaping this burgeoning sector, including market expansion drivers, technological advancements, evolving policy landscapes, and the competitive dynamics among industry players. We project a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% from 2025 to 2033, fueled by substantial government investment, decreasing production costs, and a heightened focus on environmental sustainability. Our detailed analysis examines market penetration across diverse application segments, providing a granular view of each sector's growth trajectory. Furthermore, we explore the transformative impact of technological innovations—such as enhanced fuel cell durability and efficiency—and shifts in consumer preferences on overall market expansion.

Leading Markets & Segments in China Hydrogen and Fuel Cells Industry

This section pinpoints the leading geographical regions, key application segments, and dominant fuel cell technologies within the vibrant Chinese hydrogen and fuel cell market. The analysis identifies areas of greatest market strength and future potential.

Dominant Segments:

- Application: Transportation remains a leading application segment, propelled by ambitious government initiatives promoting fuel cell electric vehicles (FCEVs), particularly fuel cell buses, and hydrogen-powered trucking. Stationary power generation, particularly in industrial settings, and portable power applications also showcase considerable growth potential, driven by demand for clean and reliable energy sources.

- Fuel Cell Technology: Polymer Electrolyte Membrane Fuel Cells (PEMFCs) maintain their market dominance due to their technological maturity and suitability across multiple applications. However, Solid Oxide Fuel Cells (SOFCs) are gaining significant traction, especially in stationary power generation, benefitting from advancements in efficiency and durability, and are projected for substantial growth within the forecast period. Other fuel cell technologies, while still in earlier stages of development, show promise for niche applications and are actively being researched and developed within the Chinese market.

Key Drivers:

- Economic Policies and Regulations: Supportive government policies, including comprehensive subsidy programs, attractive tax incentives, and strategic infrastructure development initiatives, are pivotal in driving market expansion. The evolving regulatory landscape plays a crucial role in shaping market dynamics.

- Infrastructure Development: Significant investments in hydrogen refueling infrastructure are fundamental to accelerating the adoption of FCEVs and other hydrogen-powered transportation solutions. This report provides a detailed analysis of the current state of infrastructure development and projections for future investments, highlighting key challenges and opportunities.

- Technological Advancements: Continuous innovation in fuel cell technology, focusing on enhanced efficiency, durability, and cost reduction, are crucial for widening market adoption. Advancements in materials science and manufacturing processes are leading to more competitive fuel cell systems.

China Hydrogen and Fuel Cells Industry Product Developments

Recent product innovations are centered around enhancing fuel cell efficiency, extending operational lifespan, and lowering production costs. This involves the development of novel materials, optimized manufacturing processes, and improved system integration. These advancements translate to superior fuel cell performance, wider applicability across diverse sectors, amplified market penetration, and enhanced competitiveness for Chinese manufacturers. Miniaturization of fuel cells for portable applications remains a significant area of development, alongside advancements in SOFC technology for stationary power generation.

Key Drivers of China Hydrogen and Fuel Cells Industry Growth

Several factors drive the growth of China's hydrogen and fuel cell industry. These include:

- Government Support: Significant policy support and financial incentives from the Chinese government are paramount.

- Technological Advancements: Continuous improvements in fuel cell efficiency and durability reduce costs and expand applications.

- Environmental Concerns: Growing awareness of environmental issues and the need for clean energy solutions are driving demand.

- Energy Security: Hydrogen fuel cells offer a path to energy independence and security for China.

Challenges in the China Hydrogen and Fuel Cells Industry Market

The industry faces challenges, including:

- High Initial Costs: The high upfront cost of fuel cell systems remains a barrier to wider adoption.

- Hydrogen Infrastructure: The lack of a widespread hydrogen refueling infrastructure hinders the growth of fuel cell vehicles.

- Supply Chain Issues: Securing a reliable and cost-effective supply of hydrogen is crucial for industry growth.

- Technological hurdles: Improving the lifespan and reliability of fuel cells remains an ongoing challenge.

Emerging Opportunities in China Hydrogen and Fuel Cells Industry

Significant long-term growth opportunities exist. Technological breakthroughs in fuel cell materials and manufacturing processes are expected to further drive down costs and improve performance. Strategic partnerships between domestic and international companies will foster innovation and market expansion. The increasing focus on decarbonization and energy security will fuel growth, opening up vast market potential across various sectors.

Leading Players in the China Hydrogen and Fuel Cells Industry Sector

Key Milestones in China Hydrogen and Fuel Cells Industry Industry

- 2020 Q4: Launch of a significant government-backed project to develop hydrogen refueling infrastructure.

- 2021 Q2: Successful demonstration of a large-scale fuel cell power generation project.

- 2022 Q3: Announcement of a major partnership between a Chinese and a foreign fuel cell company.

- 2023 Q1: Introduction of new government regulations to support the development of hydrogen production.

- [Insert Year] Q[Insert Quarter]: [Insert significant milestone]

- [Insert Year] Q[Insert Quarter]: [Insert significant milestone]

Strategic Outlook for China Hydrogen and Fuel Cells Industry Market

The future of the China hydrogen and fuel cell market is bright. Continued government support, technological advancements, and growing environmental concerns will propel market expansion. Strategic partnerships, focusing on innovation and infrastructure development, will be crucial for long-term success. The market presents significant opportunities for both domestic and international players. By 2033, the market is poised for substantial growth, driven by a confluence of factors that will make it a major contributor to China's energy transition.

China Hydrogen and Fuel Cells Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

China Hydrogen and Fuel Cells Industry Segmentation By Geography

- 1. China

China Hydrogen and Fuel Cells Industry Regional Market Share

Geographic Coverage of China Hydrogen and Fuel Cells Industry

China Hydrogen and Fuel Cells Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Trend of Renewable Power Generation

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Hydrogen and Fuel Cells Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Horizon Fuel Cell Technologies Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ballard Power System Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plug Power Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuelcell Energy Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba Fuel Cell Power Systems Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Horizon Fuel Cell Technologies Pte Ltd

List of Figures

- Figure 1: China Hydrogen and Fuel Cells Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Hydrogen and Fuel Cells Industry Share (%) by Company 2025

List of Tables

- Table 1: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Hydrogen and Fuel Cells Industry?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the China Hydrogen and Fuel Cells Industry?

Key companies in the market include Horizon Fuel Cell Technologies Pte Ltd, Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Toshiba Fuel Cell Power Systems Corporation.

3. What are the main segments of the China Hydrogen and Fuel Cells Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.94 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator.

6. What are the notable trends driving market growth?

Transportation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Trend of Renewable Power Generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Hydrogen and Fuel Cells Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Hydrogen and Fuel Cells Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Hydrogen and Fuel Cells Industry?

To stay informed about further developments, trends, and reports in the China Hydrogen and Fuel Cells Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence