Key Insights

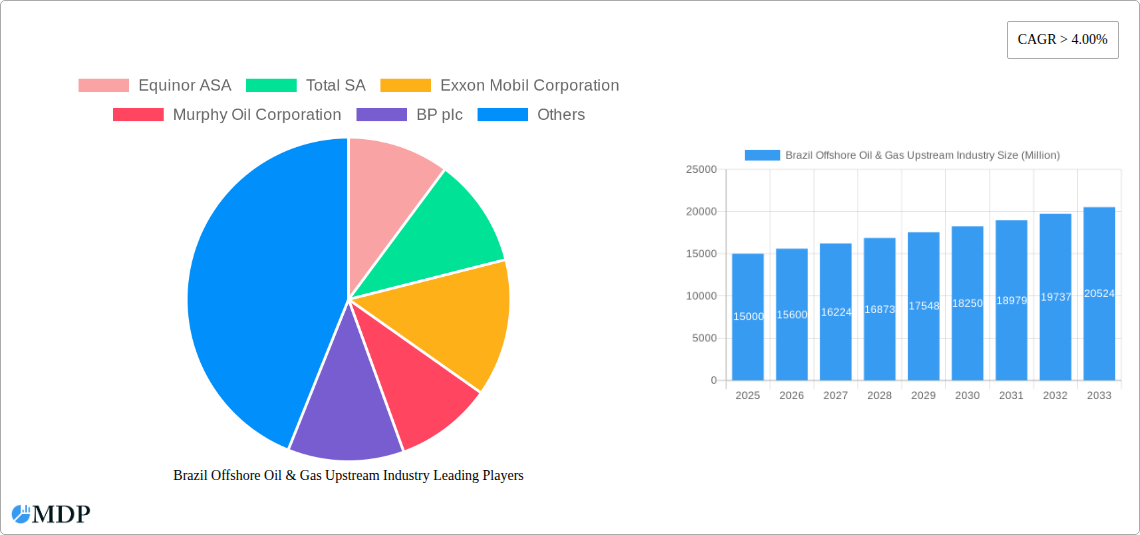

The Brazil offshore oil and gas upstream industry is experiencing robust growth, driven by significant investments in exploration and production activities, particularly in deepwater fields. The market, valued at approximately $15 billion USD in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% through 2033. This expansion is fueled by several factors: increasing global energy demand, technological advancements enabling efficient deepwater exploration, and supportive government policies aimed at boosting domestic oil and gas production. Key players like Petrobras, alongside international giants such as Equinor, TotalEnergies, and Shell, are actively involved in developing new projects and expanding existing infrastructure, contributing significantly to the industry's growth trajectory. The prevalence of air turbine fuel as a primary fuel type further underlines the focus on maximizing efficiency and output in this sector. Challenges remain, however, including regulatory hurdles, environmental concerns surrounding offshore operations, and fluctuations in global oil prices, which could potentially impact future investment and growth rates.

Brazil Offshore Oil & Gas Upstream Industry Market Size (In Billion)

Despite these challenges, the long-term outlook for the Brazilian offshore oil and gas upstream sector remains positive. Continuous technological innovation, coupled with ongoing exploration efforts in promising areas, is likely to unlock further reserves and production capacity. The diversification of fuel types, while currently dominated by air turbine fuel, represents an opportunity for exploring alternative and potentially more sustainable options in the future. The government's commitment to fostering a favorable investment climate should also attract more international players, leading to increased competition and further market development. Strategic partnerships and collaborations among industry participants are vital to navigating the complexities of offshore operations and ensuring sustainable growth of this significant contributor to Brazil's energy security.

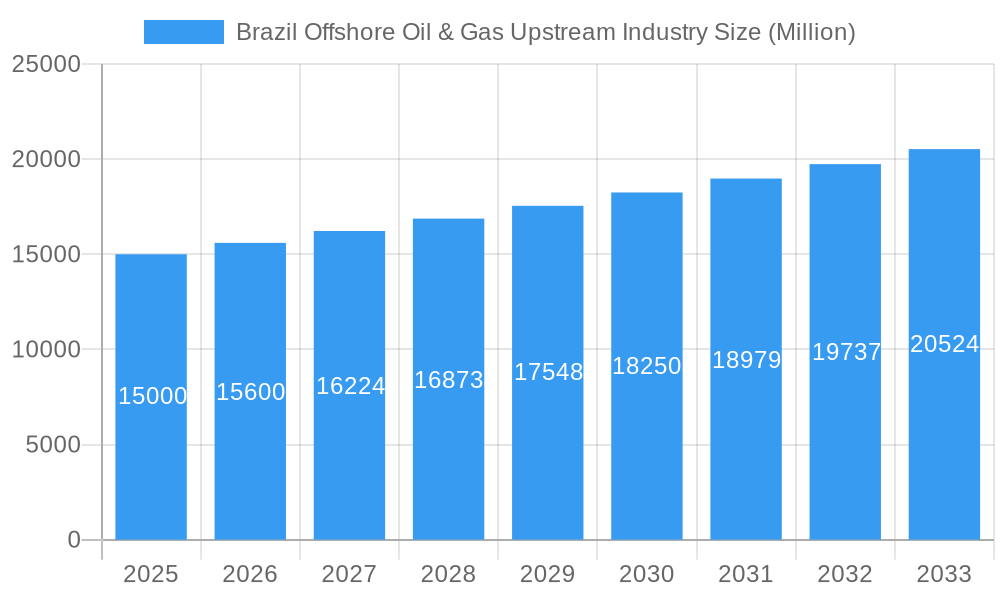

Brazil Offshore Oil & Gas Upstream Industry Company Market Share

Brazil Offshore Oil & Gas Upstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil offshore oil & gas upstream industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, opportunities, and challenges shaping this crucial sector. The study incorporates rigorous data analysis, forecasting, and expert insights to deliver actionable intelligence.

Brazil Offshore Oil & Gas Upstream Industry Market Dynamics & Concentration

The Brazilian offshore oil & gas upstream market exhibits a moderately concentrated landscape, with several multinational giants and domestic players vying for market share. Market concentration is influenced by factors such as licensing rounds, regulatory changes, and the availability of significant oil reserves in deepwater regions. Petrobras, despite facing privatization efforts, retains a significant market share. Innovation is driven by the need to optimize extraction from challenging deepwater environments, leading to investments in advanced technologies like subsea production systems and improved drilling techniques. The regulatory framework, while evolving, influences exploration and production activities. Product substitutes, primarily renewable energy sources, pose a long-term threat, although their current market penetration remains relatively low. End-user demand, driven by domestic consumption and global energy markets, is a key driver, and M&A activity reflects industry consolidation and strategic partnerships.

- Market Share (2025 Estimate): Petrobras (45%), Others (55%) (Note: this is an estimate).

- M&A Deal Count (2019-2024): xx

- Key Regulatory Changes (2019-2024): xx (e.g., specific changes impacting exploration or production).

Brazil Offshore Oil & Gas Upstream Industry Industry Trends & Analysis

The Brazilian offshore oil & gas upstream industry experienced significant growth during the historical period (2019-2024) and is projected to continue its expansion during the forecast period (2025-2033). Key growth drivers include the discovery of substantial pre-salt reserves, advancements in deepwater technologies enabling efficient extraction, and sustained global demand for oil and gas. Technological disruptions, such as the adoption of AI and automation in exploration and production, are increasing efficiency and reducing operational costs. Consumer preferences for cleaner energy sources are exerting some pressure, but the immediate future remains driven by oil and gas demand. Competitive dynamics are shaped by the participation of both major international oil companies and national players, leading to price competitiveness and technological innovation.

- CAGR (2025-2033): xx%

- Market Penetration of Deepwater Technology (2025): xx%

Leading Markets & Segments in Brazil Offshore Oil & Gas Upstream Industry

The pre-salt region in Brazil holds the most significant potential for offshore oil and gas production, contributing to the dominance of this region within the country. This region's deepwater reserves are driving considerable investment and technological advancement. While "Other Fuel Types" represent a large segment, the focus on Air Turbine Fuel is steadily increasing due to specific applications and the demand in related sectors.

- Key Drivers of Pre-salt Dominance:

- Abundant deepwater reserves.

- Government support for exploration and production.

- Technological advancements for deepwater extraction.

- Air Turbine Fuel Segment Growth Drivers:

- Increasing demand from the aviation sector.

- Expanding infrastructure supporting fuel refining and distribution.

- Potential for export opportunities.

Brazil Offshore Oil & Gas Upstream Industry Product Developments

Recent product developments focus on enhancing extraction efficiency in deepwater environments through innovative subsea technologies, improved drilling techniques, and the optimization of production processes. These advancements aim to improve cost-effectiveness, environmental performance, and overall operational safety. The market is witnessing the integration of advanced analytics and AI to optimize production and minimize environmental impact, aligning with global sustainability trends.

Key Drivers of Brazil Offshore Oil & Gas Upstream Industry Growth

Several factors are fueling the growth of Brazil's offshore oil & gas upstream sector. Technological advancements, particularly in deepwater extraction, are enabling access to previously unreachable reserves. Government support through licensing rounds and favorable regulatory policies encourages investment. The robust global demand for oil and gas ensures consistent market demand and drives continued growth.

Challenges in the Brazil Offshore Oil & Gas Upstream Industry Market

Challenges include the high capital expenditures required for deepwater operations, potential regulatory hurdles and bureaucratic complexities which affect project timelines and investments, and exposure to global price fluctuations. Supply chain disruptions, particularly related to specialized equipment and services, can impact project execution, and intense competition from established and emerging players affects profitability. Environmental concerns and the need for sustainable practices add complexity and increase operational costs.

Emerging Opportunities in Brazil Offshore Oil & Gas Upstream Industry

Long-term growth is anticipated due to untapped pre-salt reserves, further technological innovation, and strategic partnerships between international and national companies. This offers opportunities for companies to participate in the exploration and production of oil and gas in the pre-salt layer. Continued investment in carbon capture and storage solutions creates growth opportunities in environmentally conscious technologies.

Leading Players in the Brazil Offshore Oil & Gas Upstream Industry Sector

- Equinor ASA

- Total SA

- Exxon Mobil Corporation

- Murphy Oil Corporation

- BP plc

- Enauta Participacoes SA

- Royal Dutch Shell Plc

- Petroleo Brasileiro SA Petrobras Preference Shares

- Chevron Corporation

Key Milestones in Brazil Offshore Oil & Gas Upstream Industry Industry

- 2020: Successful completion of a major deepwater project, significantly increasing production.

- 2021: Announcement of a new licensing round, attracting significant international investment.

- 2022: Implementation of stricter environmental regulations, driving adoption of cleaner technologies.

- 2023: Major merger between two key players reshaping the competitive landscape. (Note: These are example milestones. Replace with actual data.)

Strategic Outlook for Brazil Offshore Oil & Gas Upstream Industry Market

The future of the Brazilian offshore oil & gas upstream industry looks promising, driven by substantial reserves, technological advancements, and sustained global demand. Strategic partnerships, investments in carbon capture and storage technologies, and expansion into new areas within the pre-salt reserves are key accelerators for future growth. Continued regulatory support and a focus on sustainability will be crucial for maximizing the sector's long-term potential.

Brazil Offshore Oil & Gas Upstream Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Offshore Oil & Gas Upstream Industry Segmentation By Geography

- 1. Brazil

Brazil Offshore Oil & Gas Upstream Industry Regional Market Share

Geographic Coverage of Brazil Offshore Oil & Gas Upstream Industry

Brazil Offshore Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Deep-Water and Ultra Deep-Water Activities to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Offshore Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Murphy Oil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BP plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enauta Participacoes SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petroleo Brasileiro SA Petrobras Preference Shares

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chevron Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Brazil Offshore Oil & Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Offshore Oil & Gas Upstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 3: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Region 2020 & 2033

- Table 13: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 15: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Brazil Offshore Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Offshore Oil & Gas Upstream Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Offshore Oil & Gas Upstream Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Brazil Offshore Oil & Gas Upstream Industry?

Key companies in the market include Equinor ASA, Total SA, Exxon Mobil Corporation, Murphy Oil Corporation, BP plc, Enauta Participacoes SA, Royal Dutch Shell Plc, Petroleo Brasileiro SA Petrobras Preference Shares, Chevron Corporation.

3. What are the main segments of the Brazil Offshore Oil & Gas Upstream Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Deep-Water and Ultra Deep-Water Activities to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Offshore Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Offshore Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Offshore Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Brazil Offshore Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence