Key Insights

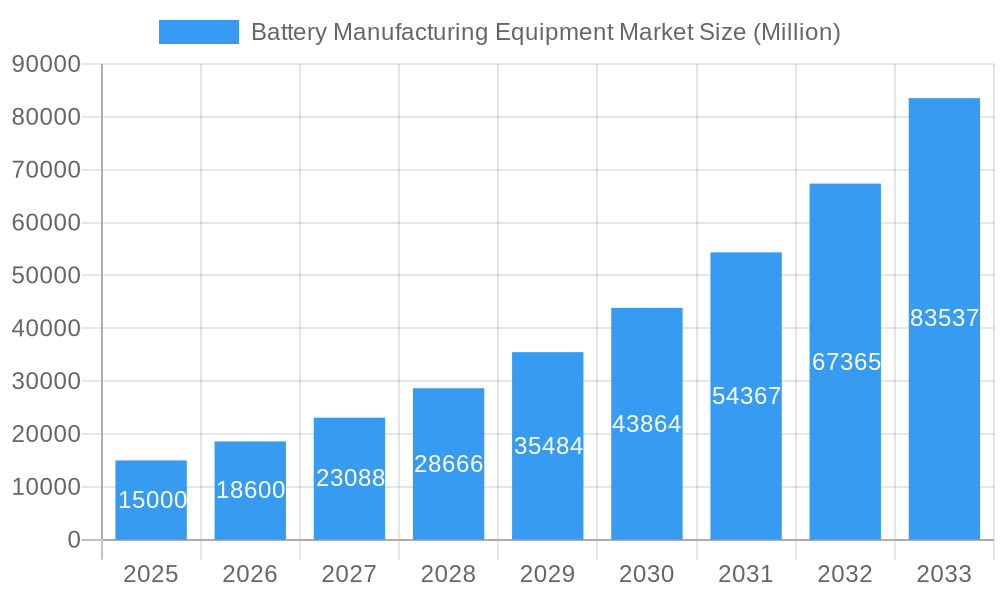

The Battery Manufacturing Equipment market is experiencing robust growth, driven by the surging demand for electric vehicles (EVs) and energy storage systems (ESS). The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 24% from 2025 to 2033. This rapid expansion is fueled by several key factors. Firstly, the global shift towards sustainable energy solutions is accelerating the adoption of EVs and ESS, creating a significant demand for sophisticated and efficient battery manufacturing equipment. Secondly, technological advancements in battery chemistry, particularly in lithium-ion batteries, are driving the need for specialized equipment capable of handling new materials and processes. This includes innovations in coating and drying, calendaring, and electrode stacking technologies, leading to higher production capacities and improved battery performance. Furthermore, government incentives and regulations promoting EV adoption in regions like North America, Europe, and Asia-Pacific are further stimulating market growth. While supply chain constraints and potential material price fluctuations could pose challenges, the long-term outlook remains positive, with substantial growth expected across all major segments, including automotive, industrial, and other end-user applications.

Battery Manufacturing Equipment Market Market Size (In Billion)

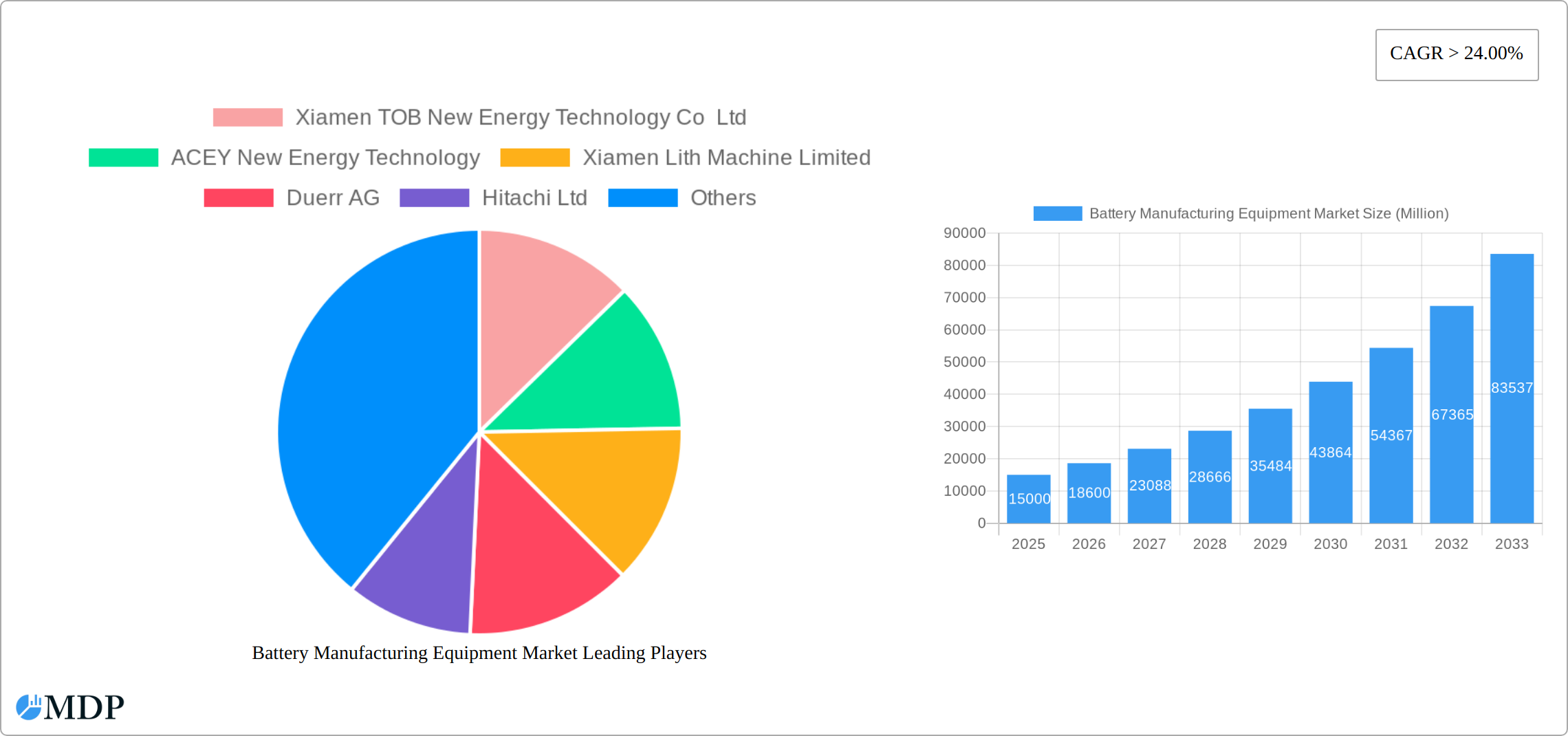

The market segmentation highlights the importance of diverse equipment types within the manufacturing process. Coating & drying, calendaring, and slitting machines are crucial for creating high-quality battery components. Mixing and electrode stacking machines are essential for precise assembly, while formation & testing equipment ensures the quality and performance of the final product. The geographic distribution of the market reflects the concentration of EV and ESS manufacturing in key regions. North America and Asia-Pacific, particularly China, are expected to dominate the market due to their strong presence in the automotive and renewable energy sectors. However, Europe is also a significant player, with growing investments in battery production facilities and supportive government policies. Leading companies such as Xiamen TOB, ACEY, Dürr, Hitachi, and Schuler are at the forefront of innovation, driving technological advancements and expanding their market share through strategic partnerships and acquisitions. The market's continuous evolution, driven by technological progress and increasing demand, presents lucrative opportunities for both established players and new entrants.

Battery Manufacturing Equipment Market Company Market Share

Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Battery Manufacturing Equipment Market, covering market dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry stakeholders, investors, and businesses seeking to understand and capitalize on the burgeoning opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Battery Manufacturing Equipment Market Market Dynamics & Concentration

The Battery Manufacturing Equipment Market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is currently [Insert Market Concentration Metric, e.g., moderately high/low], with key players holding significant market share. However, the entry of new players and technological advancements are fostering increased competition. Innovation is a crucial driver, with continuous developments in automation, AI-powered processes, and improved materials leading to increased efficiency and production capacity. Stringent regulatory frameworks focused on environmental sustainability and safety are shaping manufacturing practices and product standards. The market also faces pressure from potential substitute technologies, requiring manufacturers to continuously innovate and adapt. End-user trends, particularly the surging demand for electric vehicles (EVs) and energy storage systems (ESS), are acting as significant growth catalysts. Furthermore, the market witnesses considerable mergers and acquisitions (M&A) activity, reflecting strategic moves by established companies to expand their market presence and technological capabilities.

- Market Share: [Insert Market Share data for top 3-5 players if available, otherwise provide a qualitative description. e.g., "Top three players account for approximately 60% of the market." ]

- M&A Activity: [Insert Number of M&A deals in the last 5 years if available, otherwise state "Significant M&A activity observed in recent years."]

- Innovation Drivers: Automation, AI, material science advancements.

- Regulatory Frameworks: Environmental regulations, safety standards.

- Product Substitutes: [List potential substitutes, e.g., alternative battery technologies]

Battery Manufacturing Equipment Market Industry Trends & Analysis

The Battery Manufacturing Equipment Market is experiencing robust growth, driven primarily by the exponential rise in demand for electric vehicles, renewable energy storage solutions, and portable electronics. Technological advancements such as the development of high-energy-density batteries and improved manufacturing processes are further accelerating market expansion. Consumer preferences for environmentally friendly and sustainable technologies are also fueling market demand. The competitive landscape is highly dynamic, with both established players and new entrants vying for market share. This necessitates continuous innovation and adaptation to stay ahead of the curve. The market is segmented by machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users), each exhibiting unique growth dynamics and trends. The global market is expected to experience significant growth in the coming years, driven by favorable government policies, increasing investments in R&D, and technological advancements. This expansion is projected to continue at a healthy CAGR during the forecast period. [Insert CAGR if available]. Market penetration is expected to increase significantly, driven primarily by the rising adoption of electric vehicles and the expansion of the renewable energy sector. The market is likely to experience strong competition, with both established players and new entrants competing for market share, driving innovation and efficiency improvements in the industry.

Leading Markets & Segments in Battery Manufacturing Equipment Market

The Automotive segment holds the largest market share within the end-user category, fueled by the rapidly growing EV industry. Asia-Pacific is expected to be the dominant region, primarily due to the significant manufacturing base for batteries in countries like China, South Korea, and Japan. The Coating & Dryer machine type segment is witnessing the highest growth, attributable to the crucial role it plays in the battery manufacturing process.

- Key Drivers in Asia-Pacific: Strong government support for EV adoption, robust manufacturing infrastructure, large-scale investments in battery production facilities.

- Key Drivers in Automotive Segment: The global transition to electric vehicles (EVs) is the major driving force behind the growth of the automotive segment. This is further driven by government regulations promoting electric mobility and consumer preference for eco-friendly vehicles.

- Key Drivers in Coating & Dryer Segment: The increasing demand for high-performance and cost-effective battery production processes, enhanced efficiency, and automation in coating and drying stages.

Battery Manufacturing Equipment Market Product Developments

Recent product innovations are intensely focused on augmenting automation levels, dramatically boosting production throughput and overall efficiency, and meticulously optimizing energy consumption across the manufacturing lifecycle. This paradigm shift includes the seamless integration of cutting-edge sensor technologies, sophisticated AI-driven process control systems that enable real-time adjustments and predictive maintenance, and the pioneering use of novel materials engineered for superior durability, enhanced performance characteristics, and extended operational lifespan. The paramount competitive advantages in this evolving landscape are increasingly centered on the capacity to deliver highly customized, bespoke solutions tailored to specific client needs, the implementation of advanced, intelligent automation that minimizes human intervention while maximizing precision, and the provision of exceptional, responsive technical support and after-sales service. These innovations are a direct and potent response to the market's insistent demand for cost-effective, high-volume, and exceptionally high-quality battery production capabilities.

Key Drivers of Battery Manufacturing Equipment Market Growth

The robust and sustained growth of the battery manufacturing equipment market is being significantly propelled by a confluence of powerful, interconnected factors. Foremost among these is the explosive expansion of the electric vehicle (EV) industry, which is creating an unprecedented demand for battery production capacity. Simultaneously, the escalating global imperative for reliable and scalable energy storage systems, essential for renewable energy integration and grid stability, further fuels this demand. Crucially, supportive government policies worldwide, actively promoting the adoption of renewable energy sources and incentivizing domestic battery production, are creating a favorable regulatory environment. Technological advancements, particularly in areas like advanced robotics, machine learning, and artificial intelligence, are not merely enhancing production efficiency but are fundamentally redefining it. The heightened global awareness of critical environmental concerns and the urgent need for sustainable energy solutions are acting as powerful accelerators for the battery manufacturing sector. As a testament to the substantial capital inflows and the burgeoning investor confidence, the recent USD 210 Million investment by Recharge Industries Pty in Australia underscores the immense financial momentum building within this sector.

Challenges in the Battery Manufacturing Equipment Market Market

The market faces challenges like fluctuating raw material prices, supply chain disruptions, and intense competition. Regulatory complexities related to environmental standards and safety regulations pose significant hurdles for manufacturers. These factors can lead to increased production costs and potential delays in project implementation. The current estimate of the impact of these challenges on the market is xx Million in lost revenue annually.

Emerging Opportunities in Battery Manufacturing Equipment Market

The landscape of the battery manufacturing equipment market is ripe with transformative opportunities, most notably driven by the groundbreaking development of solid-state batteries and the exploration of novel, next-generation battery chemistries. These advancements necessitate entirely new manufacturing processes and equipment, opening vast uncharted territories for innovation. Strategic, synergistic partnerships forged between forward-thinking equipment manufacturers and pioneering battery producers are proving to be potent catalysts for accelerated innovation and the co-creation of advanced manufacturing solutions. Furthermore, the substantial market expansion into emerging economies, characterized by rapidly growing demand for electric vehicles and robust energy storage infrastructure, presents significant avenues for substantial growth and market penetration. The relentless pursuit of technological advancements, particularly in sophisticated process automation and the profound impact of AI-driven optimization techniques, promises to unlock new dimensions of enhanced productivity, significantly reduced operational costs, and the potential for disruptive advancements, thereby profoundly shaping the future trajectory of the entire industry.

Leading Players in the Battery Manufacturing Equipment Market Sector

- Xiamen TOB New Energy Technology Co Ltd

- ACEY New Energy Technology

- Xiamen Lith Machine Limited

- Duerr AG

- Hitachi Ltd

- Schuler AG

- InoBat

- Wuxi Lead Intelligent Equipment Co Ltd

- IPG Photonics Corporation

- Andritz AG

- Xiamen Tmax Battery Equipments Limited

Key Milestones in Battery Manufacturing Equipment Market Industry

- January 2023: Recharge Industries Pty unveiled ambitious plans for a state-of-the-art lithium-ion battery factory in Australia, with an impressive projected annual capacity of 30 GWh, marking a significant step in regional battery production expansion.

- December 2022: Amara Raja Batteries Limited announced a substantial investment plan for a cutting-edge 16 GWh Lithium Cell Gigafactory, complemented by a 5 GWh battery pack assembly unit, strategically located in Telangana, India, signaling a major boost to India's battery manufacturing capabilities.

- December 2022: A landmark Memorandum of Understanding (MOU) was signed between Hyundai Motor Group and SK On for the establishment of a new, large-scale EV battery manufacturing facility in Georgia, USA. This collaborative venture is expected to represent a monumental investment of USD 4-5 Billion, underscoring the significant global commitment to EV battery production.

Strategic Outlook for Battery Manufacturing Equipment Market Market

The Battery Manufacturing Equipment Market is definitively poised for a period of substantial and sustained growth, primarily fueled by the insatiable and ever-increasing global demand for electric vehicles and comprehensive energy storage solutions. This growth trajectory is further bolstered by continuous and significant investments in research and development, driving innovation at an unprecedented pace. To secure and enhance a competitive advantage in this dynamic arena, strategic partnerships, relentless technological innovation, and proactive expansion into burgeoning new markets will be absolutely crucial. A forward-thinking strategic focus on advanced automation, the integration of sustainable manufacturing practices, and the dedicated development of sophisticated equipment specifically designed for the next generation of battery technologies will be the defining factors in the future success of all companies operating within this rapidly evolving industry.

Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

Battery Manufacturing Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Poland

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. Qatar

- 4.3. South Africa

- 4.4. Rest of Middle East and Africa

-

5. South America

- 5.1. Chile

- 5.2. Brazil

- 5.3. Argentina

- 5.4. Rest of South America

Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of Battery Manufacturing Equipment Market

Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Cheap and Alternative Pumps

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. North America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machine Type

- 6.1.1. Coating & Dryer

- 6.1.2. Calendaring

- 6.1.3. Slitting

- 6.1.4. Mixing

- 6.1.5. Electrode Stacking

- 6.1.6. Assembly & Handling Machines

- 6.1.7. Formation & Testing Machines

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Machine Type

- 7. Europe Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machine Type

- 7.1.1. Coating & Dryer

- 7.1.2. Calendaring

- 7.1.3. Slitting

- 7.1.4. Mixing

- 7.1.5. Electrode Stacking

- 7.1.6. Assembly & Handling Machines

- 7.1.7. Formation & Testing Machines

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Machine Type

- 8. Asia Pacific Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machine Type

- 8.1.1. Coating & Dryer

- 8.1.2. Calendaring

- 8.1.3. Slitting

- 8.1.4. Mixing

- 8.1.5. Electrode Stacking

- 8.1.6. Assembly & Handling Machines

- 8.1.7. Formation & Testing Machines

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Machine Type

- 9. Middle East and Africa Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machine Type

- 9.1.1. Coating & Dryer

- 9.1.2. Calendaring

- 9.1.3. Slitting

- 9.1.4. Mixing

- 9.1.5. Electrode Stacking

- 9.1.6. Assembly & Handling Machines

- 9.1.7. Formation & Testing Machines

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Machine Type

- 10. South America Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machine Type

- 10.1.1. Coating & Dryer

- 10.1.2. Calendaring

- 10.1.3. Slitting

- 10.1.4. Mixing

- 10.1.5. Electrode Stacking

- 10.1.6. Assembly & Handling Machines

- 10.1.7. Formation & Testing Machines

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Automotive

- 10.2.2. Industrial

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Machine Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Xiamen TOB New Energy Technology Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ACEY New Energy Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Xiamen Lith Machine Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Duerr AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schuler AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 InoBat

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wuxi Lead Intelligent Equipment Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IPG Photonics Corporation*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Andritz AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Xiamen Tmax Battery Equipments Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Xiamen TOB New Energy Technology Co Ltd

List of Figures

- Figure 1: Global Battery Manufacturing Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Battery Manufacturing Equipment Market Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Battery Manufacturing Equipment Market Revenue (Million), by Machine Type 2025 & 2033

- Figure 4: North America Battery Manufacturing Equipment Market Volume (Gigawatt), by Machine Type 2025 & 2033

- Figure 5: North America Battery Manufacturing Equipment Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 6: North America Battery Manufacturing Equipment Market Volume Share (%), by Machine Type 2025 & 2033

- Figure 7: North America Battery Manufacturing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 8: North America Battery Manufacturing Equipment Market Volume (Gigawatt), by End User 2025 & 2033

- Figure 9: North America Battery Manufacturing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Battery Manufacturing Equipment Market Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Battery Manufacturing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Battery Manufacturing Equipment Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 13: North America Battery Manufacturing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Battery Manufacturing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Battery Manufacturing Equipment Market Revenue (Million), by Machine Type 2025 & 2033

- Figure 16: Europe Battery Manufacturing Equipment Market Volume (Gigawatt), by Machine Type 2025 & 2033

- Figure 17: Europe Battery Manufacturing Equipment Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 18: Europe Battery Manufacturing Equipment Market Volume Share (%), by Machine Type 2025 & 2033

- Figure 19: Europe Battery Manufacturing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Europe Battery Manufacturing Equipment Market Volume (Gigawatt), by End User 2025 & 2033

- Figure 21: Europe Battery Manufacturing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Battery Manufacturing Equipment Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Battery Manufacturing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Battery Manufacturing Equipment Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 25: Europe Battery Manufacturing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Battery Manufacturing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Battery Manufacturing Equipment Market Revenue (Million), by Machine Type 2025 & 2033

- Figure 28: Asia Pacific Battery Manufacturing Equipment Market Volume (Gigawatt), by Machine Type 2025 & 2033

- Figure 29: Asia Pacific Battery Manufacturing Equipment Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 30: Asia Pacific Battery Manufacturing Equipment Market Volume Share (%), by Machine Type 2025 & 2033

- Figure 31: Asia Pacific Battery Manufacturing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 32: Asia Pacific Battery Manufacturing Equipment Market Volume (Gigawatt), by End User 2025 & 2033

- Figure 33: Asia Pacific Battery Manufacturing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Battery Manufacturing Equipment Market Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Battery Manufacturing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Battery Manufacturing Equipment Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 37: Asia Pacific Battery Manufacturing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Battery Manufacturing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Battery Manufacturing Equipment Market Revenue (Million), by Machine Type 2025 & 2033

- Figure 40: Middle East and Africa Battery Manufacturing Equipment Market Volume (Gigawatt), by Machine Type 2025 & 2033

- Figure 41: Middle East and Africa Battery Manufacturing Equipment Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 42: Middle East and Africa Battery Manufacturing Equipment Market Volume Share (%), by Machine Type 2025 & 2033

- Figure 43: Middle East and Africa Battery Manufacturing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Middle East and Africa Battery Manufacturing Equipment Market Volume (Gigawatt), by End User 2025 & 2033

- Figure 45: Middle East and Africa Battery Manufacturing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Middle East and Africa Battery Manufacturing Equipment Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Middle East and Africa Battery Manufacturing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Battery Manufacturing Equipment Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 49: Middle East and Africa Battery Manufacturing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Battery Manufacturing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Battery Manufacturing Equipment Market Revenue (Million), by Machine Type 2025 & 2033

- Figure 52: South America Battery Manufacturing Equipment Market Volume (Gigawatt), by Machine Type 2025 & 2033

- Figure 53: South America Battery Manufacturing Equipment Market Revenue Share (%), by Machine Type 2025 & 2033

- Figure 54: South America Battery Manufacturing Equipment Market Volume Share (%), by Machine Type 2025 & 2033

- Figure 55: South America Battery Manufacturing Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 56: South America Battery Manufacturing Equipment Market Volume (Gigawatt), by End User 2025 & 2033

- Figure 57: South America Battery Manufacturing Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: South America Battery Manufacturing Equipment Market Volume Share (%), by End User 2025 & 2033

- Figure 59: South America Battery Manufacturing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Battery Manufacturing Equipment Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 61: South America Battery Manufacturing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Battery Manufacturing Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 8: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 9: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 11: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: United States Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 15: Canada Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 19: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 20: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 21: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 23: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Germany Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 27: France Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 31: Poland Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 35: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 36: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 37: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 38: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 39: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 41: China Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: China Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 43: India Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 45: South Korea Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 47: Japan Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 49: Rest of Asia Pacific Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Asia Pacific Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 51: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 52: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 53: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 54: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 55: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 57: Saudi Arabia Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Saudi Arabia Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 59: Qatar Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Qatar Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 61: South Africa Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: South Africa Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 63: Rest of Middle East and Africa Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Middle East and Africa Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 65: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 66: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 67: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 69: Global Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 71: Chile Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Chile Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 73: Brazil Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 75: Argentina Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Battery Manufacturing Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Battery Manufacturing Equipment Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Battery Manufacturing Equipment Market?

The projected CAGR is approximately > 24.00%.

2. Which companies are prominent players in the Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen TOB New Energy Technology Co Ltd, ACEY New Energy Technology, Xiamen Lith Machine Limited, Duerr AG, Hitachi Ltd, Schuler AG, InoBat, Wuxi Lead Intelligent Equipment Co Ltd, IPG Photonics Corporation*List Not Exhaustive, Andritz AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Water Treatment by Developing Countries4.; Growing Demand for the Various End-Use Sectors.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Availability of Cheap and Alternative Pumps.

8. Can you provide examples of recent developments in the market?

In January 2023, an Australia-based start-up, Recharge Industries Pty, announced plans to construct a USD 210 million factory to build lithium-ion batteries. The company aims to start construction in Geelong in south-eastern Australia in the second half of 2023 and begin production by late 2024. The operation will have an initial annual capacity of 2 gigawatt-hours - rising to an eventual planned total of 30 gigawatt-hours.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence