Key Insights

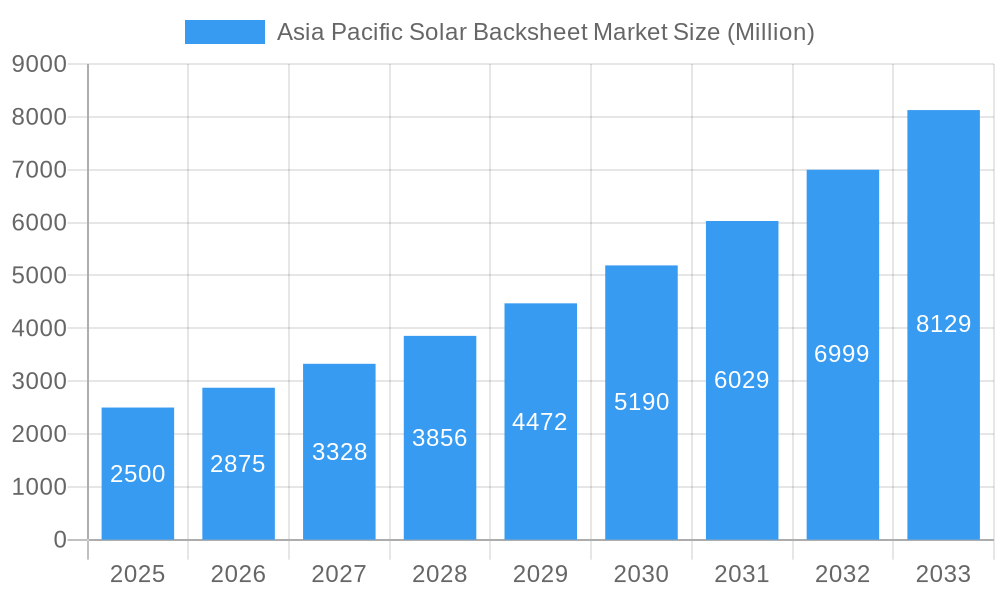

The Asia Pacific solar backsheet market is experiencing robust expansion, propelled by the region's dynamic solar energy sector and strategic government initiatives promoting renewable energy adoption. The market is projected to achieve a size of $1.8 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 7.2%. This growth is underpinned by escalating investments in utility-scale solar power projects and the widespread adoption of rooftop solar solutions across residential and commercial segments. Key growth catalysts include the decreasing cost of solar electricity, rising utility prices, and growing environmental consciousness. Market segmentation highlights the significant dominance of fluoropolymer backsheets, valued for their exceptional durability and weather resilience. However, cost-effective non-fluoropolymer alternatives are gaining momentum. Leading companies such as Arkema SA, Toray Industries Inc., and DuPont de Nemours Inc. are instrumental in shaping the market through innovation and strategic alliances. Regional variations are pronounced, with China, Japan, India, and South Korea standing out as pivotal markets. Despite challenges like raw material price volatility and supply chain intricacies, the market outlook remains highly positive, presenting substantial growth opportunities.

Asia Pacific Solar Backsheet Market Market Size (In Billion)

The market's growth trajectory is anticipated to be particularly strong in developing Asia Pacific economies, driven by increasing energy demand and governmental efforts to expand solar energy infrastructure. Furthermore, advancements in backsheet technology, focusing on enhanced efficiency and durability, are expected to accelerate market expansion. While fluoropolymer backsheets are projected to maintain their leading position, a gradual shift towards non-fluoropolymer options is likely as technological progress and cost-effectiveness improve. Competitive pressures among established players are expected to intensify, fostering innovation and potentially leading to industry consolidation. The persistent expansion of the solar industry and favorable policy frameworks throughout the Asia Pacific region fortify the long-term growth prospects for the solar backsheet market. A comprehensive understanding of regional nuances and technological developments is essential for market participants aiming for success in this evolving landscape.

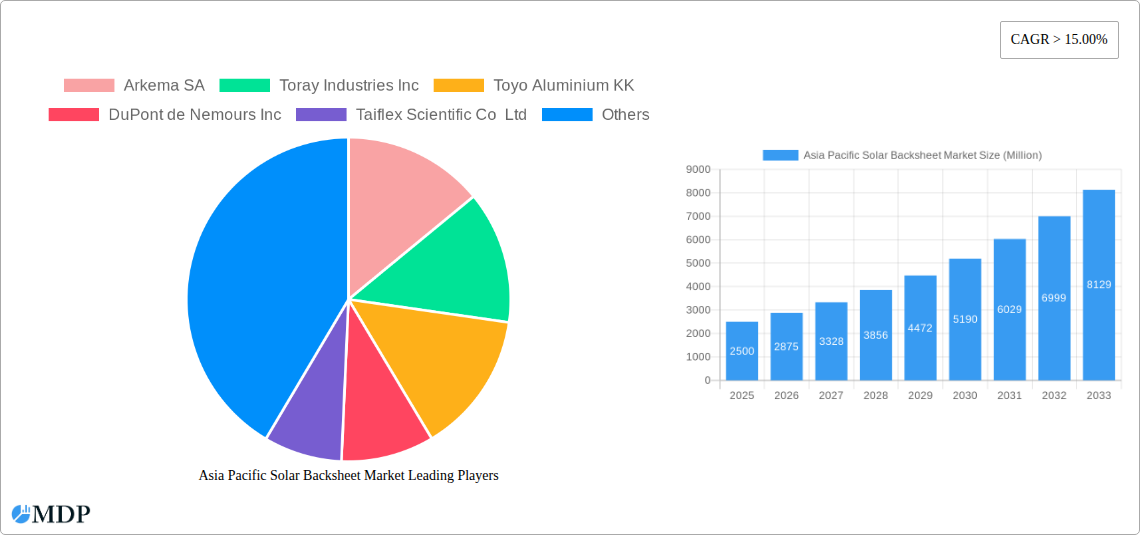

Asia Pacific Solar Backsheet Market Company Market Share

Asia Pacific Solar Backsheet Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific solar backsheet market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, trends, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Key players analyzed include Arkema SA, Toray Industries Inc, Toyo Aluminium KK, DuPont de Nemours Inc, Taiflex Scientific Co Ltd, Brij Encapsulants, 3M Co, ZTT International Limited, Hanwha Group, and Hangzhou First Applied Material Co Ltd. This report offers unparalleled detail into market segmentation (Fluoropolymer and Non-fluoropolymer backsheets) and regional performance across the Asia Pacific region.

Asia Pacific Solar Backsheet Market Dynamics & Concentration

The Asia Pacific solar backsheet market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Market concentration is influenced by factors such as economies of scale in manufacturing, technological advancements, and the presence of established players with strong brand recognition. Innovation is a key driver, with companies continuously developing new materials and technologies to improve efficiency, durability, and cost-effectiveness. Regulatory frameworks, including those related to environmental compliance and safety standards, also play a crucial role. The market witnesses increasing adoption of product substitutes, mainly driven by cost considerations and material availability, leading to competitive pressure. End-user trends, such as a preference for high-efficiency modules and increasing demand for larger-scale projects, significantly impact the demand for backsheets. Mergers and acquisitions (M&A) activity remains moderate, with strategic alliances and partnerships playing a greater role in shaping the market dynamics. In 2024, approximately xx M&A deals were recorded, resulting in a market share consolidation of approximately xx%.

Asia Pacific Solar Backsheet Market Industry Trends & Analysis

The Asia Pacific solar backsheet market is experiencing robust growth, fueled by several factors. The rising adoption of renewable energy sources, driven by government policies promoting solar power, is a primary growth driver. Technological advancements, such as the development of more efficient and durable backsheets, are enhancing market penetration. Consumer preferences are shifting towards environmentally friendly and cost-effective solutions, leading to increased demand for high-quality backsheets. The competitive landscape is dynamic, with players focusing on innovation, cost reduction, and expanding their market reach. This intense competition further fosters innovation and drives market expansion. The market has shown a CAGR of xx% during the historical period (2019-2024) and is expected to maintain strong growth throughout the forecast period (2025-2033). Market penetration is highest in countries with strong solar energy policies and significant infrastructure investment.

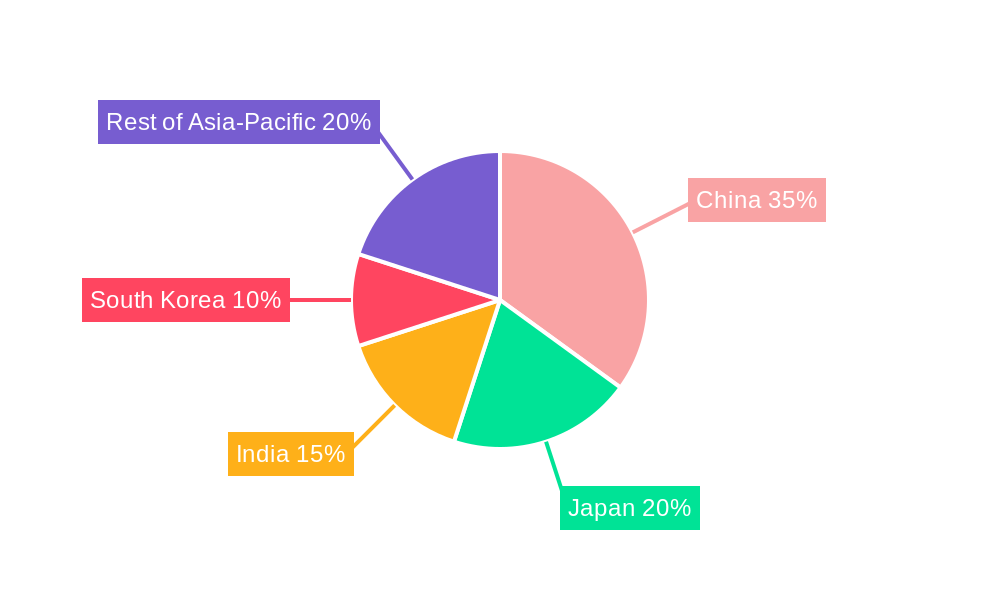

Leading Markets & Segments in Asia Pacific Solar Backsheet Market

China and India are currently the dominant markets within the Asia Pacific region, driven by large-scale solar energy projects and supportive government policies. Within the product segments, Fluoropolymer backsheets currently hold a larger market share compared to Non-fluoropolymer backsheets due to their superior performance characteristics, including higher durability and weather resistance.

- Key Drivers for China:

- Massive investments in renewable energy infrastructure.

- Stringent government regulations promoting solar energy adoption.

- Well-established manufacturing base for solar PV components.

- Key Drivers for India:

- Government initiatives like the Performance-Linked Incentive (PLI) scheme for solar PV manufacturing. This scheme, with its USD 11.35 billion investment commitment, is poised to significantly boost the local manufacturing of solar backsheets.

- Increasing demand for rooftop solar installations in residential and commercial sectors.

- Fluoropolymer Dominance: Superior performance in terms of weather resistance, UV resistance, and durability justifies its higher price point. The preference for long-term reliability in solar panel operation makes Fluoropolymer backsheets the leading choice.

- Non-fluoropolymer Growth: Cost-effectiveness and the exploration of alternative materials drive the growth of the Non-fluoropolymer segment, especially in projects with shorter lifespans or where cost optimization is a priority.

Asia Pacific Solar Backsheet Market Product Developments

Recent product innovations focus on enhancing backsheet durability, UV resistance, and overall efficiency. New materials and manufacturing processes are being explored to improve cost-effectiveness and reduce environmental impact. These advancements are primarily driven by the need for longer-lasting solar panels and increased cost-competitiveness in the overall solar energy market. The introduction of new backsheet designs tailored for specific applications, such as high-temperature environments or high-humidity regions, is further widening the scope of the market.

Key Drivers of Asia Pacific Solar Backsheet Market Growth

The Asia Pacific solar backsheet market is experiencing significant growth driven by a confluence of factors. Technological advancements, particularly the development of highly efficient and durable backsheets, contribute substantially to market expansion. Supportive government policies and financial incentives aimed at promoting renewable energy sources are crucial catalysts for this growth. The increasing awareness of climate change and the global push for carbon reduction further fuels demand for solar energy solutions, boosting the market for backsheets. Finally, the declining cost of solar energy makes it an increasingly attractive option, driving further market growth.

Challenges in the Asia Pacific Solar Backsheet Market

The Asia Pacific solar backsheet market faces challenges primarily related to raw material costs and availability, impacting manufacturing costs. Supply chain disruptions and potential geopolitical instability can cause volatility in pricing and product availability. Moreover, intense competition necessitates constant innovation and efficient cost management, demanding continuous technological improvements and process optimizations. Stringent environmental regulations also add to the complexities of manufacturing and distribution.

Emerging Opportunities in Asia Pacific Solar Backsheet Market

Significant opportunities exist for market expansion in untapped regions with growing solar energy adoption. Strategic partnerships between backsheet manufacturers and solar panel producers can lead to customized solutions and improved market penetration. Technological advancements such as the development of biodegradable and recyclable backsheets offer considerable long-term growth potential, aligning with environmental sustainability goals. The rising demand for bifacial solar panels also presents a growth opportunity for specialized backsheet designs.

Leading Players in the Asia Pacific Solar Backsheet Market Sector

- Arkema SA

- Toray Industries Inc

- Toyo Aluminium KK

- DuPont de Nemours Inc

- Taiflex Scientific Co Ltd

- Brij Encapsulants

- 3M Co

- ZTT International Limited

- Hanwha Group

- Hangzhou First Applied Material Co Ltd

Key Milestones in Asia Pacific Solar Backsheet Market Industry

- September 2022: The Indian government's approval of the second tranche of the Performance-Linked Incentive (PLI) scheme for solar PV module manufacturing, attracting USD 11.35 billion in investment and creating 65 GW of annual manufacturing capacity, significantly impacts the backsheet market.

- September 2022: Sharp's launch of the NU-JC410B solar panel, featuring a white backsheet, showcases the increasing demand for aesthetically pleasing solar panels, influencing backsheet design and market trends.

Strategic Outlook for Asia Pacific Solar Backsheet Market

The Asia Pacific solar backsheet market is poised for continued expansion, driven by favorable government policies, technological innovation, and rising environmental awareness. Strategic partnerships, investments in R&D, and expansion into new markets will play a vital role in shaping future growth. The focus on sustainable and cost-effective solutions will be critical for sustained success in this dynamic market.

Asia Pacific Solar Backsheet Market Segmentation

-

1. Type

- 1.1. Fluoropolymer

- 1.2. Non-fluoropolymer

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia Pacific Solar Backsheet Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Solar Backsheet Market Regional Market Share

Geographic Coverage of Asia Pacific Solar Backsheet Market

Asia Pacific Solar Backsheet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Fluoropolymer is Expected to Become a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fluoropolymer

- 5.1.2. Non-fluoropolymer

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fluoropolymer

- 6.1.2. Non-fluoropolymer

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fluoropolymer

- 7.1.2. Non-fluoropolymer

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fluoropolymer

- 8.1.2. Non-fluoropolymer

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fluoropolymer

- 9.1.2. Non-fluoropolymer

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fluoropolymer

- 10.1.2. Non-fluoropolymer

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arkema SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toray Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toyo Aluminium KK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont de Nemours Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taiflex Scientific Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brij Encapsulants*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZTT International Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hanwha Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hangzhou First Applied Material Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Arkema SA

List of Figures

- Figure 1: Asia Pacific Solar Backsheet Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Solar Backsheet Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Solar Backsheet Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Asia Pacific Solar Backsheet Market?

Key companies in the market include Arkema SA, Toray Industries Inc, Toyo Aluminium KK, DuPont de Nemours Inc, Taiflex Scientific Co Ltd, Brij Encapsulants*List Not Exhaustive, 3M Co, ZTT International Limited, Hanwha Group, Hangzhou First Applied Material Co Ltd.

3. What are the main segments of the Asia Pacific Solar Backsheet Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Fluoropolymer is Expected to Become a Significant Segment.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

September 2022: The government of India approved the second tranche of the performance-linked incentive (PLI) scheme to boost the manufacturing of solar photovoltaic (PV) modules in India. This scheme is expected to attract direct investment of approximately USD 11.35 billion and create manufacturing capacity for various materials, including EVA, solar glass, backsheet, etc. According to the government, the second tranche of the PLI scheme is expected to manufacture 65 GW per annum of fully integrated and partially integrated solar PV modules in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Solar Backsheet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Solar Backsheet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Solar Backsheet Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Solar Backsheet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence