Key Insights

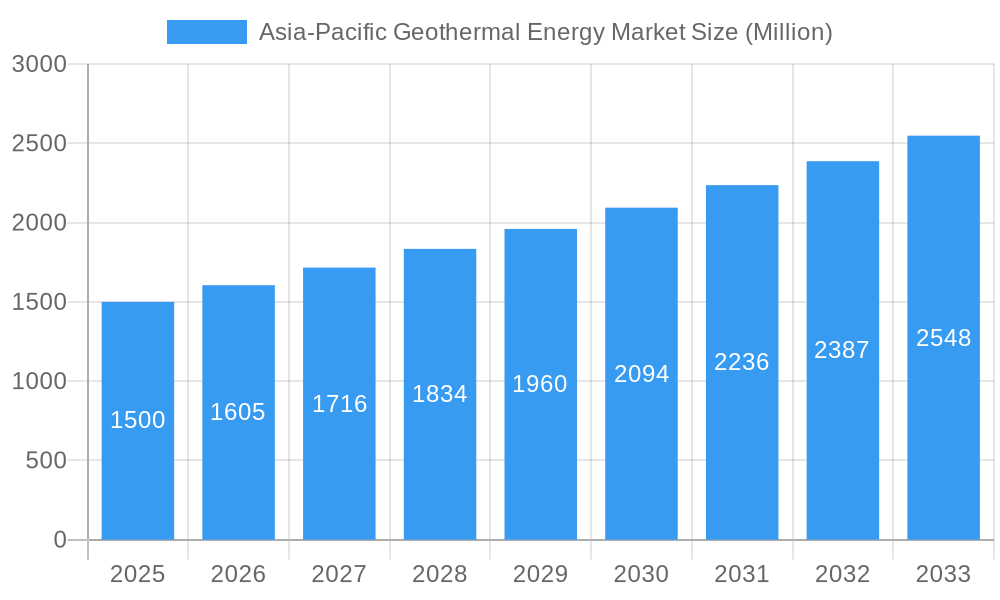

The Asia-Pacific geothermal energy market is experiencing significant expansion, fueled by escalating energy requirements, adherence to renewable energy mandates, and favorable government initiatives throughout the region. The market, valued at $8.14 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.47% from 2025 to 2033. Key growth catalysts include the region's abundant geothermal resources in nations such as Indonesia, the Philippines, and Japan, alongside heightened awareness of climate change and the imperative for sustainable energy. Technological advancements in geothermal power plant designs, particularly binary plants, are enhancing efficiency and broadening resource applicability, further stimulating market growth. While dry steam and flash steam plants currently dominate, a gradual shift towards more varied plant types is anticipated with technological maturation and advanced resource exploration.

Asia-Pacific Geothermal Energy Market Market Size (In Billion)

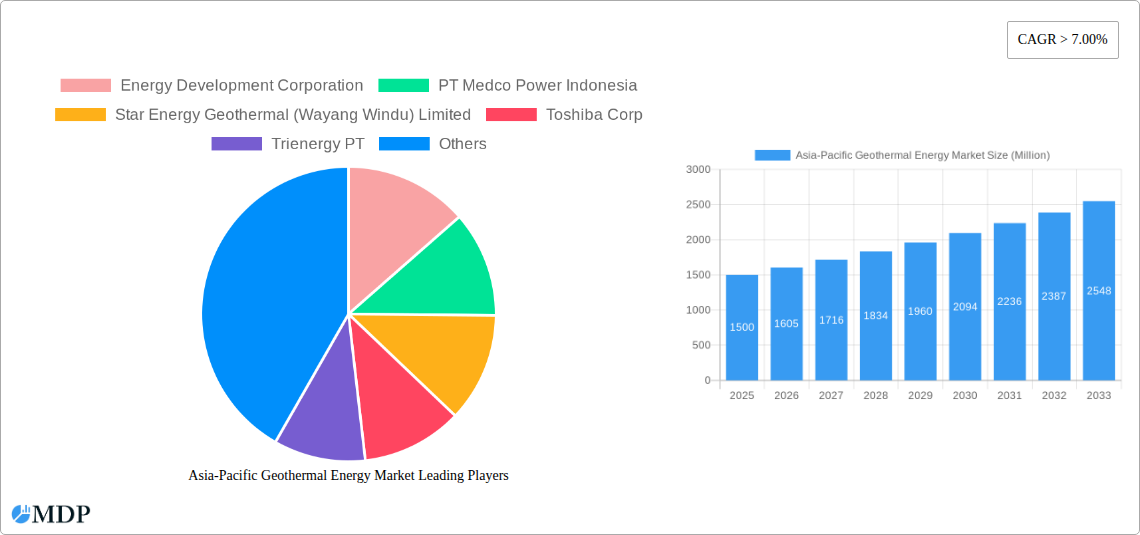

The market, however, is not without its challenges. Substantial initial capital investments for geothermal power plant development and inherent geological risks during exploration and operation can present significant restraints. Additionally, limitations in grid infrastructure in certain areas and the necessity for effective energy storage to manage geothermal energy's inherent variability pose ongoing obstacles. Nevertheless, sustained governmental support, continuous technological innovation, and declining costs are expected to counterbalance these challenges. Market segmentation by plant type (dry steam, flash, binary) offers a detailed perspective on technological advancements and resource utilization, while a regional analysis highlighting major economies like China, Japan, and India, alongside other key markets, provides crucial insights into regional market dynamics. Leading industry players, including Energy Development Corporation and PT Medco Power Indonesia, are making substantial investments in new projects and innovative technologies, underscoring the sector's robust growth trajectory.

Asia-Pacific Geothermal Energy Market Company Market Share

Asia-Pacific Geothermal Energy Market Report: 2019-2033

Unlocking the Untapped Potential of Geothermal Energy in the Asia-Pacific Region: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the Asia-Pacific geothermal energy market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, emerging trends, and future growth prospects, empowering stakeholders to make informed strategic decisions. With a focus on key segments like Dry Steam, Flash Plants, and Binary Plants, and detailed analysis of leading companies including Energy Development Corporation, PT Medco Power Indonesia, and others, this report is an essential resource for investors, industry professionals, and policymakers.

Asia-Pacific Geothermal Energy Market Market Dynamics & Concentration

The Asia-Pacific geothermal energy market is experiencing dynamic growth, driven by increasing energy demand, supportive government policies, and technological advancements. Market concentration is moderate, with several large players and a significant number of smaller companies competing for market share. The region's diverse geological landscape presents both opportunities and challenges, influencing the distribution of geothermal resources and project development costs.

Market Concentration Metrics:

- Market Share of Top 5 Players (2024): xx%

- Number of M&A Deals (2019-2024): xx

Innovation Drivers:

- Enhanced drilling technologies leading to improved efficiency and reduced costs.

- Development of binary cycle power plants for harnessing low-enthalpy resources.

- Advancements in geothermal reservoir simulation and modeling.

Regulatory Frameworks:

Variations across countries impact project feasibility, influencing investment decisions and project timelines. Supportive policies and streamlined permitting processes are crucial for accelerating market growth.

Product Substitutes: Solar, wind, and fossil fuels present competition, although geothermal's baseload capability and reduced environmental impact provide a competitive edge.

End-User Trends: Growing demand from industrial and commercial sectors, coupled with government support for renewable energy, drives geothermal energy adoption.

M&A Activities: Strategic mergers and acquisitions are reshaping the market landscape, consolidating resources and expertise, with xx major deals observed in the historical period.

Asia-Pacific Geothermal Energy Market Industry Trends & Analysis

The Asia-Pacific geothermal energy market exhibits strong growth momentum, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors:

- Increasing Energy Demand: The region's rapidly expanding economies necessitate secure and reliable energy sources. Geothermal energy offers a sustainable and stable solution.

- Government Support for Renewables: Many governments are implementing policies to promote renewable energy adoption, incentivizing geothermal development through subsidies, tax breaks, and regulatory support.

- Technological Advancements: Ongoing innovations are reducing the cost and increasing the efficiency of geothermal power generation.

- Growing Environmental Awareness: The increasing focus on climate change mitigation and environmental sustainability is driving the shift towards cleaner energy sources.

- Market Penetration: The market penetration rate of geothermal energy is currently at xx%, with projections to reach xx% by 2033.

The competitive dynamics are characterized by intense competition among established players and emerging companies, leading to continuous innovation and optimization of project development strategies.

Leading Markets & Segments in Asia-Pacific Geothermal Energy Market

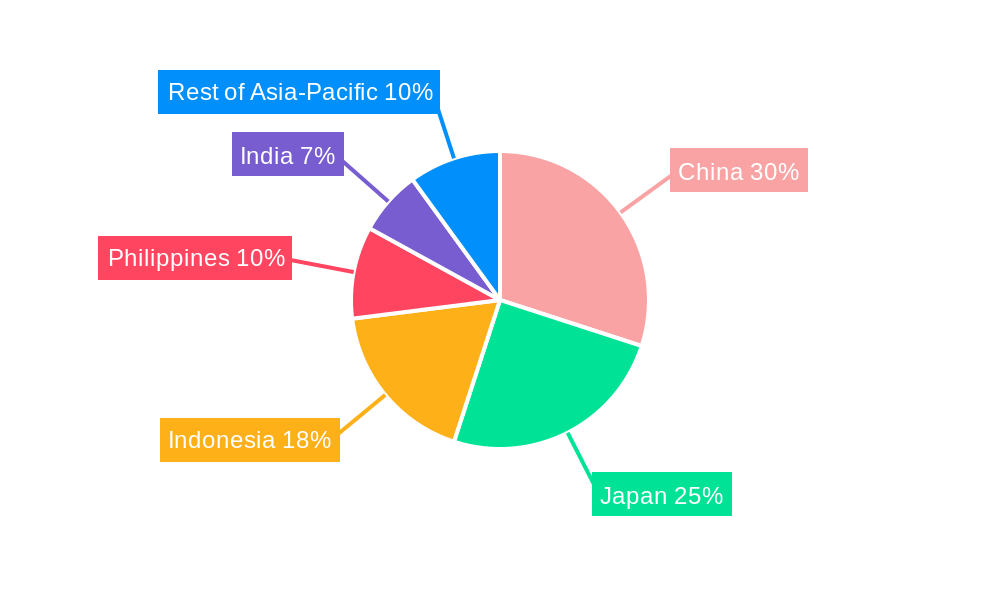

Indonesia and the Philippines are currently the leading markets for geothermal energy in the Asia-Pacific region. However, other countries with significant geothermal potential, such as Indonesia, are witnessing increasing investment and development activity.

Dominant Geothermal Power Plant Types:

Flash plants currently hold the largest market share, followed by binary plants and dry steam.

Key Drivers for Leading Markets:

Indonesia: Abundant geothermal resources, supportive government policies, and substantial investments by both domestic and international companies.

Philippines: Established geothermal industry, strong expertise, and government incentives driving further expansion.

Dry Steam: Established technology, relatively high efficiency, and suitability for specific geological conditions contribute to its market share.

Flash Plants: Adaptable to various resource types, cost-effective for mid-to-high enthalpy resources.

Binary Plants: Growing interest due to their ability to utilize low-enthalpy resources, opening up new opportunities in areas previously considered uneconomical.

Asia-Pacific Geothermal Energy Market Product Developments

Recent advancements focus on improving efficiency, reducing costs, and expanding the range of exploitable geothermal resources. Innovations include enhanced geothermal systems (EGS) to tap into hotter, deeper resources, and advanced binary cycle technologies for lower-enthalpy reservoirs. These developments broaden the applicability of geothermal energy and enhance its competitiveness against other renewable energy sources.

Key Drivers of Asia-Pacific Geothermal Energy Market Growth

Several factors are driving the growth of the Asia-Pacific geothermal energy market:

- Technological advancements: Improved drilling techniques, enhanced resource exploration methods, and more efficient power generation technologies are reducing costs and increasing efficiency.

- Economic incentives: Government subsidies, tax breaks, and feed-in tariffs are making geothermal power generation more attractive to investors.

- Environmental concerns: The growing awareness of climate change is leading to increased demand for renewable energy sources.

Challenges in the Asia-Pacific Geothermal Energy Market Market

Despite significant potential, the market faces challenges:

- High upfront capital costs: Geothermal power plant construction requires substantial investment.

- Geological risks: Uncertainties in subsurface conditions can increase project risks and costs.

- Environmental concerns: Potential impacts on local ecosystems and communities require careful environmental management.

Emerging Opportunities in Asia-Pacific Geothermal Energy Market

Significant opportunities exist for geothermal energy in the Asia-Pacific region. Technological breakthroughs, particularly in EGS, could unlock vast untapped resources. Strategic partnerships between governments, private companies, and international organizations will be crucial for accelerating the adoption of this sustainable energy source. Market expansion into new regions with untapped geothermal potential will drive further growth.

Leading Players in the Asia-Pacific Geothermal Energy Market Sector

- Energy Development Corporation

- PT Medco Power Indonesia

- Star Energy Geothermal (Wayang Windu) Limited

- Toshiba Corp

- Trienergy PT

- Pertamina Geothermal Energy PT

- PT WIJAYA KARYA (Persero) Tbk

- Mercury NZ Ltd

- PT Bali Energy Ltd

- PT Supreme Energy

Key Milestones in Asia-Pacific Geothermal Energy Market Industry

- 2021 (Q4): Allfirst Kalinga, Aragorn Power and Energy, and Guidance Management announce the well development phase for the Kalinga Geothermal Power Plant in the Philippines. Construction is anticipated to begin in 2025, with commissioning in 2026.

- 2021 (Q4): PT Geo Dipa commences drilling operations for the Patuha and Dieng 2 geothermal power plant expansion projects in Central Java, targeting completion by 2023.

Strategic Outlook for Asia-Pacific Geothermal Energy Market Market

The future of the Asia-Pacific geothermal energy market is bright. With continued technological advancements, supportive government policies, and increasing investor interest, the sector is poised for rapid expansion. Strategic partnerships, regional cooperation, and sustainable development practices will be key to unlocking the full potential of this clean and reliable energy resource. The focus on tapping low-enthalpy resources and optimizing existing infrastructure will be critical for long-term success.

Asia-Pacific Geothermal Energy Market Segmentation

-

1. Geothermal Power Plant Type

- 1.1. Dry Steam

- 1.2. Flash Plants

- 1.3. Binary Plants

-

2. Geography

- 2.1. Indonesia

- 2.2. Philippines

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific Geothermal Energy Market Segmentation By Geography

- 1. Indonesia

- 2. Philippines

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Geothermal Energy Market Regional Market Share

Geographic Coverage of Asia-Pacific Geothermal Energy Market

Asia-Pacific Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Electricity Demand from Manufacturing

- 3.2.2 Construction

- 3.2.3 and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Phasing Out of Coal-based Power Plants

- 3.4. Market Trends

- 3.4.1. Binary Plants Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 5.1.1. Dry Steam

- 5.1.2. Flash Plants

- 5.1.3. Binary Plants

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Philippines

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Philippines

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 6. Indonesia Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 6.1.1. Dry Steam

- 6.1.2. Flash Plants

- 6.1.3. Binary Plants

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Philippines

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 7. Philippines Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 7.1.1. Dry Steam

- 7.1.2. Flash Plants

- 7.1.3. Binary Plants

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Philippines

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 8. Japan Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 8.1.1. Dry Steam

- 8.1.2. Flash Plants

- 8.1.3. Binary Plants

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Philippines

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 9. Rest of Asia Pacific Asia-Pacific Geothermal Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 9.1.1. Dry Steam

- 9.1.2. Flash Plants

- 9.1.3. Binary Plants

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Philippines

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Geothermal Power Plant Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Energy Development Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PT Medco Power Indonesia

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Star Energy Geothermal (Wayang Windu) Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toshiba Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Trienergy PT

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pertamina Geothermal Energy PT

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PT WIJAYA KARYA (Persero) Tbk

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mercury NZ Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PT Bali Energy Ltd *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 PT Supreme Energy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Energy Development Corporation

List of Figures

- Figure 1: Asia-Pacific Geothermal Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Geothermal Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 2: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 3: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 8: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 9: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 14: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 15: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 17: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 20: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 21: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 26: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geothermal Power Plant Type 2020 & 2033

- Table 27: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Geothermal Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Geothermal Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Geothermal Energy Market?

The projected CAGR is approximately 14.47%.

2. Which companies are prominent players in the Asia-Pacific Geothermal Energy Market?

Key companies in the market include Energy Development Corporation, PT Medco Power Indonesia, Star Energy Geothermal (Wayang Windu) Limited, Toshiba Corp, Trienergy PT, Pertamina Geothermal Energy PT, PT WIJAYA KARYA (Persero) Tbk, Mercury NZ Ltd, PT Bali Energy Ltd *List Not Exhaustive, PT Supreme Energy.

3. What are the main segments of the Asia-Pacific Geothermal Energy Market?

The market segments include Geothermal Power Plant Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.14 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Demand from Manufacturing. Construction. and Mining Industries4.; The Availability of a Broad Range of Fuel Sources for Electricity Generation.

6. What are the notable trends driving market growth?

Binary Plants Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Phasing Out of Coal-based Power Plants.

8. Can you provide examples of recent developments in the market?

In 2021, the Philippines's Kalinga Geothermal Power Plant developers Allfirst Kalinga, Aragorn Power and Energy and Guidance Management announced that the power plant is currently under well development phase after completing the exploration phase. The power plant construction is expected to start in 2025 and the commissioning is likely to take place in 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence