Key Insights

The Asia-Pacific Direct Methanol Fuel Cell (DMFC) market is experiencing robust growth, driven by increasing demand for portable power solutions and the region's commitment to cleaner energy technologies. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 14% from 2025 to 2033. This significant expansion is fueled by several key factors. Firstly, the rising adoption of DMFCs in portable electronic devices, such as laptops and smartphones, particularly in rapidly developing economies like India and China, is a major contributor. Secondly, the increasing focus on reducing carbon emissions and promoting sustainable energy sources within the region is creating a favorable regulatory environment for DMFC technology. The transportation sector is also emerging as a promising application area, with ongoing research and development efforts focusing on integrating DMFCs into electric vehicles and other transportation systems. Finally, continuous advancements in DMFC technology, leading to improved efficiency, reduced costs, and enhanced durability, are further stimulating market growth.

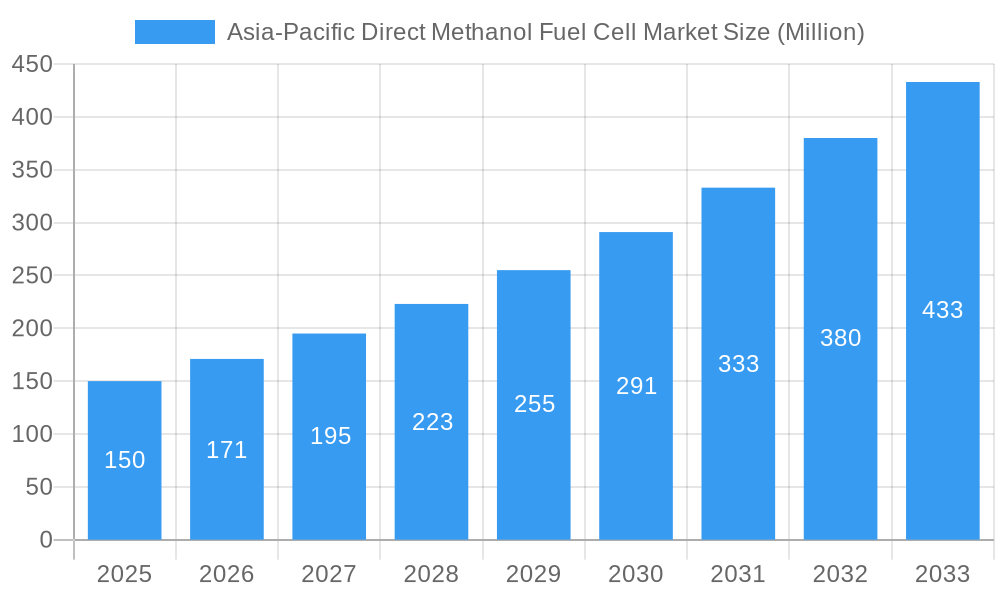

Asia-Pacific Direct Methanol Fuel Cell Market Market Size (In Million)

However, certain challenges hinder wider market penetration. The relatively high cost of DMFCs compared to traditional batteries remains a significant barrier, particularly for consumers in price-sensitive markets. Furthermore, concerns regarding methanol toxicity and the need for improved infrastructure for methanol distribution and refueling pose obstacles to broader adoption. Despite these challenges, the long-term prospects for the Asia-Pacific DMFC market remain positive, with substantial growth potential across diverse applications, including stationary power generation and specialized transportation niches. The key players—SFC Energy AG, XNRGI Inc, Ballard Power Systems Inc, Fujikura Ltd, Antig Technology Co Ltd, Guangzhou Neerg Eco Technologies Co Ltd, Oorja Protonics Inc, Horizon Fuel Cell Technologies, Viaspace Inc, and FC TecNrgy Pvt Ltd—are actively involved in innovation and expansion, contributing to market dynamism. The Asia-Pacific region's unique combination of high growth potential and technological advancements positions it as a crucial market for DMFC technology in the coming years.

Asia-Pacific Direct Methanol Fuel Cell Market Company Market Share

Asia-Pacific Direct Methanol Fuel Cell Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Direct Methanol Fuel Cell (DMFC) market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, trends, leading players, and future growth prospects. The report leverages extensive primary and secondary research to deliver actionable intelligence and accurate market sizing in Millions.

Asia-Pacific Direct Methanol Fuel Cell Market Dynamics & Concentration

The Asia-Pacific DMFC market exhibits a moderately concentrated landscape, with key players like SFC Energy AG, XNRGI Inc, Ballard Power Systems Inc, Fujikura Ltd, Antig Technology Co Ltd, Guangzhou Neerg Eco Technologies Co Ltd, Oorja Protonics Inc, Horizon Fuel Cell Technologies, Viaspace Inc, and FC TecNrgy Pvt Ltd vying for market share. Market concentration is influenced by factors such as technological advancements, R&D investments, and strategic partnerships. The market share of the top five players is estimated to be xx% in 2025, indicating a moderately consolidated market structure. Innovation in DMFC technology, particularly in areas like improved catalyst efficiency and durability, is a key driver. Stringent emission regulations across several Asia-Pacific nations are further boosting market growth. The presence of readily available substitutes, such as lithium-ion batteries, poses a challenge. However, the inherent advantages of DMFCs, such as higher energy density and lower operating temperatures, are expected to mitigate this challenge. Recent years have witnessed a notable increase in M&A activity within the sector, with approximately xx deals recorded between 2019 and 2024, signifying consolidation and expansion strategies among key players. End-user trends show a growing preference for portable and stationary DMFC applications, fueled by rising demand for reliable power sources in remote areas and backup power solutions.

Asia-Pacific Direct Methanol Fuel Cell Market Industry Trends & Analysis

The Asia-Pacific DMFC market is poised for significant growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including the increasing demand for clean and sustainable energy sources, coupled with supportive government policies promoting renewable energy adoption across the region. Technological advancements, particularly in improving DMFC efficiency and reducing production costs, are further accelerating market penetration. Consumer preferences are shifting towards more efficient, portable, and eco-friendly power solutions, aligning well with the advantages offered by DMFCs. The competitive landscape is dynamic, with both established players and emerging companies investing heavily in R&D and expanding their product portfolios. Market penetration is currently estimated at xx% in 2025 and is projected to reach xx% by 2033, indicating substantial growth potential. This growth trajectory is underpinned by technological advancements, supportive government initiatives, and increasing consumer awareness about sustainable energy solutions.

Leading Markets & Segments in Asia-Pacific Direct Methanol Fuel Cell Market

China reigns supreme in the Asia-Pacific Direct Methanol Fuel Cell (DMFC) market, commanding approximately [Insert Updated Percentage]% of the total market share in 2025. This dominance stems from a confluence of factors:

- Robust Government Support: Substantial investments in renewable energy infrastructure and proactive policies championing clean energy adoption are fueling market growth. Specific policy initiatives, such as [Insert specific policy examples, e.g., tax credits, subsidies, mandates], are directly impacting DMFC deployment.

- Large-scale Industrial Applications: DMFCs are finding increasing utility across diverse industrial sectors, including [Insert specific sectors, e.g., backup power for telecommunications, power for remote sensing equipment], creating significant demand.

- Technological Advancements: China's substantial commitment to research and development (R&D) is fostering continuous technological innovation in DMFC technology, leading to improved efficiency, durability, and cost-effectiveness.

- Growing Awareness of Environmental Concerns: Increasing awareness of air pollution and the need for cleaner energy sources is driving the adoption of DMFCs as a sustainable alternative.

In terms of application segments, the stationary sector holds the largest market share in 2025, estimated at approximately [Insert Updated Percentage]%, propelled by the escalating demand for reliable backup power solutions and off-grid power generation in remote and underserved areas. The portable segment exhibits substantial growth potential, fueled by the ever-expanding market for portable electronic devices and the need for dependable power sources in remote locations. The transportation sector, while currently facing challenges due to the relatively high cost of DMFCs compared to other fuel cell technologies, shows moderate growth potential driven by ongoing advancements in DMFC technology and a rising focus on sustainable transportation.

Asia-Pacific Direct Methanol Fuel Cell Market Product Developments

Recent product innovations focus on enhancing DMFC efficiency, durability, and cost-effectiveness. Manufacturers are exploring new materials and designs to improve catalyst performance, reduce methanol crossover, and extend the lifespan of fuel cells. Several companies are developing DMFC systems integrated with advanced power management systems for enhanced energy utilization and improved user experience. These innovations cater to diverse applications, ranging from portable power sources to stationary power generation systems, creating a wider market appeal.

Key Drivers of Asia-Pacific Direct Methanol Fuel Cell Market Growth

The Asia-Pacific DMFC market growth is propelled by several key factors:

- Stringent Emission Regulations: Government regulations aimed at reducing greenhouse gas emissions are pushing the adoption of cleaner energy sources, including DMFCs.

- Increasing Demand for Portable Power: The growing popularity of portable electronic devices and the need for reliable power in remote areas drive demand for DMFC-based portable power solutions.

- Technological Advancements: Continuous improvements in DMFC technology, such as higher efficiency and lower costs, are making them more competitive.

- Growing Investment in Renewable Energy: Significant investments in renewable energy infrastructure are further supporting the growth of the DMFC market.

Challenges in the Asia-Pacific Direct Methanol Fuel Cell Market

Despite significant growth potential, several challenges hinder the widespread adoption of DMFCs:

- High Manufacturing Costs: The high cost of DMFCs compared to other fuel cell technologies remains a major obstacle.

- Methanol Storage and Handling: The safe storage and handling of methanol require specific infrastructure and safety measures, which can be challenging.

- Limited Infrastructure: Lack of supporting infrastructure for methanol distribution and refueling can hamper the growth of DMFC-powered vehicles.

- Technological Limitations: Further advancements are needed to overcome certain limitations of DMFC technology, such as methanol crossover and catalyst degradation.

Emerging Opportunities in Asia-Pacific Direct Methanol Fuel Cell Market

Long-term growth in the Asia-Pacific DMFC market is projected to be driven by several key factors:

- The development of more efficient and cost-effective DMFCs with enhanced performance and longer lifespans.

- Strategic partnerships between fuel cell manufacturers and energy companies, facilitating wider distribution and market penetration.

- Expansion into novel applications, such as unmanned aerial vehicles (UAVs), microgrids, and portable medical devices, creating new revenue streams.

- Increasing government support for clean energy technologies, coupled with favorable regulatory frameworks.

- Growing demand from emerging markets within the region.

Leading Players in the Asia-Pacific Direct Methanol Fuel Cell Market Sector

- SFC Energy AG

- XNRGI Inc

- Ballard Power Systems Inc

- Fujikura Ltd

- Antig Technology Co Ltd

- Guangzhou Neerg Eco Technologies Co Ltd

- Oorja Protonics Inc

- Horizon Fuel Cell Technologies

- Viaspace Inc

- FC TecNrgy Pvt Ltd

- [Add other relevant players]

Key Milestones in Asia-Pacific Direct Methanol Fuel Cell Market Industry

- April 2022: TecNrgy and SFC Energy signed a joint venture agreement to manufacture hydrogen and methanol fuel cells in India, significantly bolstering manufacturing capacity and R&D capabilities within the region. This collaboration highlights the increasing focus on regional manufacturing and supply chain development.

- February 2023: Sinopec launched China's first methanol-to-hydrogen and hydrogen refueling station, showcasing the potential for integrated energy solutions and driving demand for related technologies, including DMFCs. This demonstrates a strategic shift towards a more comprehensive hydrogen ecosystem.

- [Add other relevant milestones with dates and brief descriptions]

Strategic Outlook for Asia-Pacific Direct Methanol Fuel Cell Market Market

The Asia-Pacific DMFC market presents considerable growth potential, fueled by the rising demand for clean energy solutions, continuous technological advancements, and supportive government policies. Key strategies for success include forging strategic partnerships to expand market reach, focusing on cost reduction to enhance competitiveness, and diversifying into a broader range of applications. The market is poised for a period of dynamic expansion and consolidation, with both established players and new entrants vying for market share. [Add insights on market forecasts and future trends].

Asia-Pacific Direct Methanol Fuel Cell Market Segmentation

-

1. Application

- 1.1. Stationary

- 1.2. Portable

- 1.3. Transportation

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia Pacific

Asia-Pacific Direct Methanol Fuel Cell Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Direct Methanol Fuel Cell Market Regional Market Share

Geographic Coverage of Asia-Pacific Direct Methanol Fuel Cell Market

Asia-Pacific Direct Methanol Fuel Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing LNG Trade4.; Rising Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuations in Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Portable Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Stationary

- 5.1.2. Portable

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Stationary

- 6.1.2. Portable

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Stationary

- 7.1.2. Portable

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Stationary

- 8.1.2. Portable

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Stationary

- 9.1.2. Portable

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Asia Pacific Asia-Pacific Direct Methanol Fuel Cell Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Stationary

- 10.1.2. Portable

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SFC Energy AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 XNRGI Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ballard Power Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujikura Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Antig Technology Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guangzhou Neerg Eco Technologies Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oorja Protonics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Horizon Fuel Cell Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Viaspace Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FC TecNrgy Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SFC Energy AG

List of Figures

- Figure 1: Asia-Pacific Direct Methanol Fuel Cell Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Direct Methanol Fuel Cell Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Direct Methanol Fuel Cell Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Direct Methanol Fuel Cell Market?

The projected CAGR is approximately 10.79%.

2. Which companies are prominent players in the Asia-Pacific Direct Methanol Fuel Cell Market?

Key companies in the market include SFC Energy AG, XNRGI Inc *List Not Exhaustive, Ballard Power Systems Inc, Fujikura Ltd, Antig Technology Co Ltd, Guangzhou Neerg Eco Technologies Co Ltd, Oorja Protonics Inc, Horizon Fuel Cell Technologies, Viaspace Inc, FC TecNrgy Pvt Ltd.

3. What are the main segments of the Asia-Pacific Direct Methanol Fuel Cell Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing LNG Trade4.; Rising Marine Transportation.

6. What are the notable trends driving market growth?

Portable Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuations in Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

February 2023: China Petroleum & Chemical Corporation (Sinopec) launched the country's first methanol-to-hydrogen and hydrogen refueling station in Dalian, China. An advancement from the previous fueling station offering oil, gas, hydrogen, and electric charging services, the integrated complex can deliver 1,000 kg of hydrogen a day, with a purity of 99.99%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Direct Methanol Fuel Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Direct Methanol Fuel Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Direct Methanol Fuel Cell Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Direct Methanol Fuel Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence