Key Insights

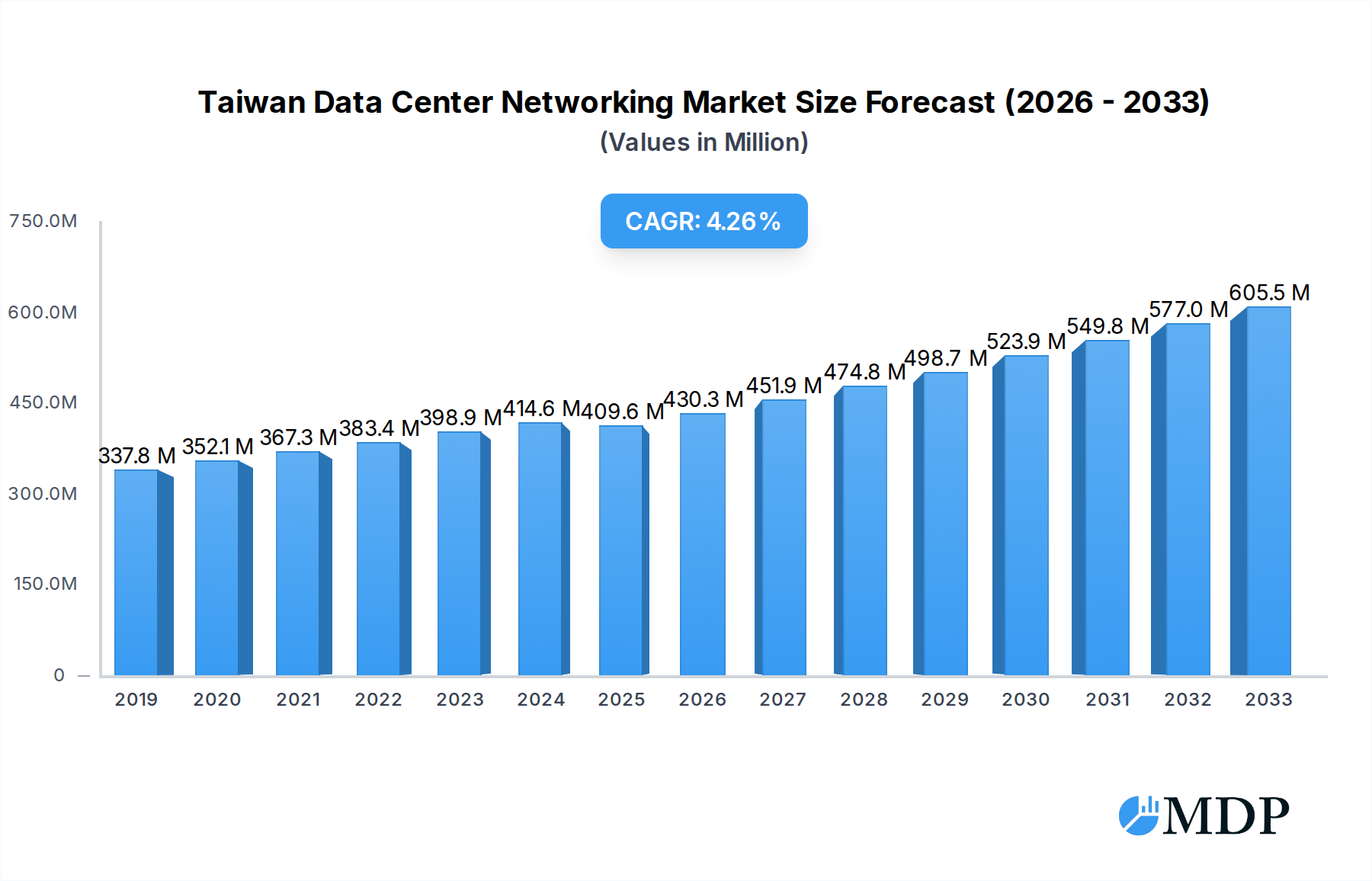

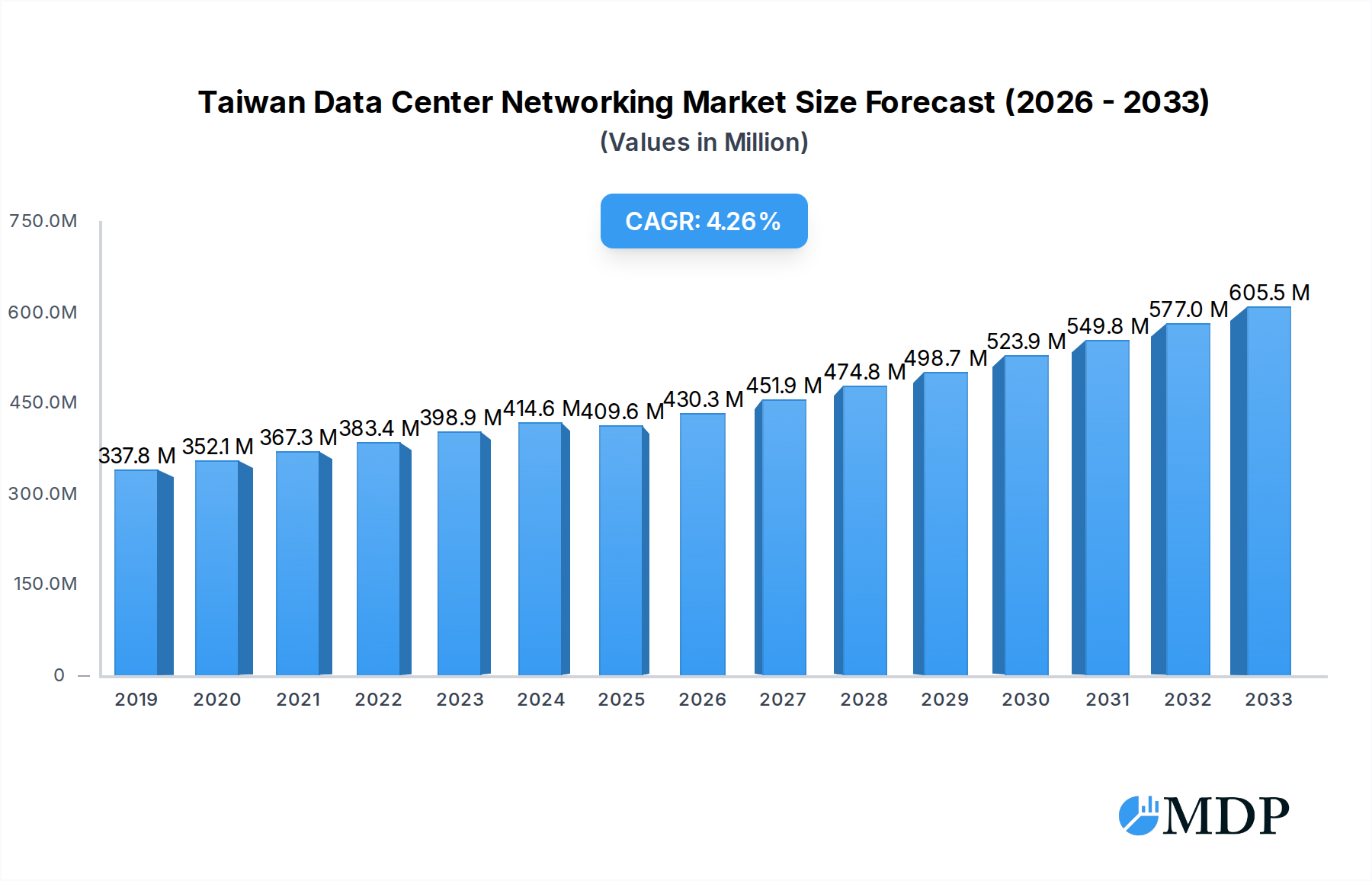

The Taiwan Data Center Networking Market is poised for significant expansion, driven by the burgeoning demand for robust and scalable network infrastructure to support the nation's rapidly growing digital economy. With a current market size estimated at 409.61 Million and a projected Compound Annual Growth Rate (CAGR) of 5.03% over the forecast period of 2025-2033, the market demonstrates a healthy upward trajectory. This growth is primarily fueled by the increasing adoption of cloud computing, big data analytics, and the proliferation of Internet of Things (IoT) devices, all of which necessitate advanced networking solutions. Key components like Ethernet switches and routers are experiencing strong demand, as are essential services such as installation, integration, and support & maintenance. The IT & Telecommunication and BFSI sectors are leading the charge in adopting these technologies, underscoring their critical role in digital transformation initiatives.

Taiwan Data Center Networking Market Market Size (In Million)

Furthermore, strategic investments in data center infrastructure by both domestic and international players are expected to amplify market opportunities. While the adoption of cutting-edge technologies presents immense growth potential, challenges such as the high cost of advanced networking equipment and the need for skilled IT professionals to manage complex networks need to be addressed. Nevertheless, the increasing focus on cybersecurity and the development of Software-Defined Networking (SDN) are expected to further stimulate market growth. The trend towards hyperscale data centers and the ongoing digital transformation across various industries in Taiwan will continue to be the primary catalysts for sustained market expansion, ensuring the nation remains at the forefront of technological innovation in data center networking.

Taiwan Data Center Networking Market Company Market Share

Taiwan Data Center Networking Market Report: Unlocking Growth in the Digital Era (2019–2033)

This comprehensive report delves into the dynamic Taiwan Data Center Networking Market, forecasting significant expansion from 2025 to 2033. With a base year of 2025, the study meticulously analyzes market trends, key players, and emerging opportunities, offering invaluable insights for industry stakeholders. Our research leverages high-traffic keywords such as "Taiwan data center networking," "Ethernet switches Taiwan," "400G connectivity," "data center infrastructure," "IT and telecommunication networking," and "BFSI data center solutions" to ensure maximum search visibility and engagement.

Taiwan Data Center Networking Market Market Dynamics & Concentration

The Taiwan Data Center Networking Market is characterized by a moderate to high level of concentration, driven by a few dominant players and a growing ecosystem of innovative solution providers. Innovation is a primary driver, fueled by the escalating demand for higher bandwidth and lower latency to support AI, cloud computing, and big data analytics. Regulatory frameworks, while generally supportive of technological advancement, can influence market entry and expansion. Product substitutes, though present in niche areas, are largely outpaced by the rapid evolution of specialized networking hardware and software. End-user trends showcase a strong preference for scalable, secure, and cost-effective networking solutions, particularly within the IT & Telecommunication and BFSI sectors. Mergers and acquisitions (M&A) activities are anticipated to play a role in market consolidation, with key players seeking to expand their portfolios and geographical reach. We estimate the M&A deal count in the historical period (2019-2024) to be around 5-10, with an expected CAGR of xx% for the forecast period. Market share distribution shows the top 3 players holding approximately 60-70% of the market in the base year 2025.

Taiwan Data Center Networking Market Industry Trends & Analysis

The Taiwan Data Center Networking Market is experiencing robust growth, projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 12.5% between 2025 and 2033. This expansion is underpinned by several critical trends. The insatiable demand for data, driven by the proliferation of IoT devices, the exponential growth of cloud services, and the burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) applications, is compelling enterprises to upgrade their networking infrastructure. This translates into a significant increase in the deployment of high-speed networking equipment, particularly Ethernet switches supporting 200GbE, 400GbE, and even 800GbE connectivity.

Technological disruptions are at the forefront, with advancements in silicon photonics, programmable ASICs, and disaggregated networking solutions reshaping the market landscape. These innovations are enabling lower power consumption, increased port density, and enhanced programmability, crucial for the agility and efficiency demanded by modern data centers. Consumer preferences are increasingly shifting towards Software-Defined Networking (SDN) and Network Function Virtualization (NFV) solutions, which offer greater flexibility, automation, and centralized control over network operations. The emphasis is on creating more intelligent and adaptable network architectures that can seamlessly integrate with cloud environments and support dynamic workloads.

Competitive dynamics are intensifying, with both established networking giants and emerging players vying for market share. Companies are focusing on offering comprehensive solutions that encompass hardware, software, and advanced services, aiming to provide end-to-end networking capabilities. The market penetration of advanced networking technologies is expected to accelerate, as businesses recognize the strategic imperative of a robust and future-proof data center network. The rise of hyperscale data centers and colocation facilities, driven by the digital transformation initiatives across various industries, is further fueling the demand for sophisticated networking equipment and services.

Leading Markets & Segments in Taiwan Data Center Networking Market

Within the Taiwan Data Center Networking Market, the Component: By Product - Ethernet Switches segment is anticipated to dominate, driven by its pivotal role in facilitating high-speed data transfer and interconnectivity within data centers. The relentless demand for increased bandwidth from sectors like IT & Telecommunication and BFSI is the primary catalyst for this dominance. For instance, the IT & Telecommunication sector's continuous expansion and the adoption of cloud-native architectures necessitate high-performance Ethernet switches to handle massive data flows and support a growing number of connected devices and services. Similarly, the BFSI sector relies heavily on low-latency, high-throughput networks for trading, transactions, and data analytics, making Ethernet switches a critical component.

The End-User: IT & Telecommunication segment is projected to be the largest market contributor. Taiwan's status as a global hub for semiconductor manufacturing and technology innovation, coupled with its robust telecommunications infrastructure, fuels a perpetual need for cutting-edge data center networking. Government initiatives aimed at promoting digital transformation and smart city development further bolster this segment. Key drivers for the dominance of this segment include:

- Economic Policies: Pro-technology government policies, incentives for R&D, and investment in digital infrastructure create a fertile ground for data center expansion.

- Infrastructure Development: Significant investments in optical fiber networks and the availability of reliable power supply are essential prerequisites for advanced data center operations.

- Technological Ecosystem: Taiwan's strong presence in semiconductor manufacturing provides access to advanced components and a skilled workforce, accelerating the adoption of next-generation networking technologies.

The Services: Support & Maintenance segment is also expected to witness substantial growth, as the complexity of modern data center networks necessitates ongoing professional support to ensure optimal performance, security, and uptime.

Taiwan Data Center Networking Market Product Developments

Product innovation in the Taiwan Data Center Networking Market is intensely focused on enhancing speed, efficiency, and programmability. Companies are developing next-generation Ethernet switches and ASICs capable of supporting 400GbE and 800GbE speeds, driven by the need for greater bandwidth in AI and high-performance computing environments. advancements in network virtualization and software-defined networking (SDN) solutions are offering greater agility and centralized control. Product developments also emphasize reduced power consumption and improved thermal management for eco-friendly data center operations. These innovations provide a competitive advantage by enabling organizations to handle ever-increasing data volumes and complex workloads with greater efficiency and lower operational costs.

Key Drivers of Taiwan Data Center Networking Market Growth

The Taiwan Data Center Networking Market is propelled by a confluence of powerful drivers. The relentless surge in data generation from cloud computing, big data analytics, and IoT devices necessitates continuous network upgrades. Government initiatives focused on digital transformation and the development of smart cities are creating significant demand for robust data center infrastructure. Furthermore, Taiwan's leading position in the global semiconductor industry fosters a strong ecosystem for advanced networking technology development and adoption. The increasing adoption of AI and machine learning applications requires high-speed, low-latency networking capabilities, further accelerating market growth.

Challenges in the Taiwan Data Center Networking Market Market

Despite its promising growth, the Taiwan Data Center Networking Market faces several challenges. The rapid pace of technological evolution requires substantial and continuous capital investment for infrastructure upgrades. Skilled labor shortages in specialized networking and cybersecurity roles can hinder efficient deployment and management. Evolving cybersecurity threats necessitate constant vigilance and investment in advanced security solutions. Global supply chain disruptions, exacerbated by geopolitical factors, can impact the availability and cost of critical networking components. Regulatory complexities and compliance requirements, particularly concerning data privacy and sovereignty, can also present hurdles for market expansion.

Emerging Opportunities in Taiwan Data Center Networking Market

Emerging opportunities in the Taiwan Data Center Networking Market are abundant, driven by technological breakthroughs and strategic market shifts. The accelerating adoption of AI and high-performance computing (HPC) presents a significant opportunity for providers of ultra-high-speed networking solutions, including 400GbE and beyond. The growing demand for edge computing infrastructure, to process data closer to its source, opens avenues for decentralized networking solutions. Strategic partnerships between networking hardware vendors, software providers, and cloud service providers can unlock new integrated solutions. Furthermore, the increasing focus on sustainability and energy efficiency in data centers creates opportunities for innovative, low-power networking technologies.

Leading Players in the Taiwan Data Center Networking Market Sector

- Broadcom Corp

- NVIDIA Corporation (Cumulus Networks Inc)

- IBM Corporation

- Arista Networks Inc

- Cisco Systems Inc

- HP Development Company L P

- Extreme Networks Inc

- Dell Inc

- Siemens

- NEC Corporation

- Schneider Electric

- Huawei Technologies Co Ltd

- VMware Inc

- Intel Corporation

Key Milestones in Taiwan Data Center Networking Market Industry

- July 2023: Broadcom introduced a new software-programmable Trident 4-X7 Ethernet switch ASIC to support the growing need for 400G connectivity inside enterprise data centers as demand for increasing bandwidth levels increases.

- April 2023: To expand their capabilities in a broader range of data centers, IBM introduced new single frame and rack mounting configurations of IBM z16 and IBM LinuxONE 4. Based on IBM's Telum processor, New options enable clients to adapt to the digital economy and are designed sustainably for highly efficient data centers.

Strategic Outlook for Taiwan Data Center Networking Market Market

The strategic outlook for the Taiwan Data Center Networking Market is exceptionally positive, driven by the nation's pivotal role in the global technology landscape. Continued investment in digital infrastructure, coupled with strong government support for innovation, will fuel the demand for advanced networking solutions. The market will likely witness a greater emphasis on integrated, intelligent networks that leverage AI and automation for enhanced efficiency and agility. Strategic collaborations and the development of specialized solutions for emerging technologies like edge computing and 5G infrastructure will be crucial for sustained growth. The focus on sustainability will also drive the adoption of energy-efficient networking technologies, presenting a significant long-term opportunity for market players.

Taiwan Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Taiwan Data Center Networking Market Segmentation By Geography

- 1. Taiwan

Taiwan Data Center Networking Market Regional Market Share

Geographic Coverage of Taiwan Data Center Networking Market

Taiwan Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Computing Services Drives the Market Growth; Growing Demand for Green Data Center Facilities Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds the Major Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Broadcom Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NVIDIA Corporation (Cumulus Networks Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arista Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HP Development Company L P

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dell Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Siemens

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NEC Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Schneider Electric

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Huawei Technologies Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VMware Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Intel Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Broadcom Corp

List of Figures

- Figure 1: Taiwan Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Taiwan Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Taiwan Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Taiwan Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Taiwan Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Taiwan Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Taiwan Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Data Center Networking Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the Taiwan Data Center Networking Market?

Key companies in the market include Broadcom Corp, NVIDIA Corporation (Cumulus Networks Inc ), IBM Corporation, Arista Networks Inc, Cisco Systems Inc, HP Development Company L P, Extreme Networks Inc, Dell Inc, Siemens, NEC Corporation, Schneider Electric, Huawei Technologies Co Ltd, VMware Inc, Intel Corporation.

3. What are the main segments of the Taiwan Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 409.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Computing Services Drives the Market Growth; Growing Demand for Green Data Center Facilities Drives the Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds the Major Share..

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

July 2023: Broadcom introduced a new software-programmable Trident 4-X7 Ethernet switch ASIC to support the growing need for 400G connectivity inside enterprise data centers as demand for increasing bandwidth levels increases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Data Center Networking Market?

To stay informed about further developments, trends, and reports in the Taiwan Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence