Key Insights

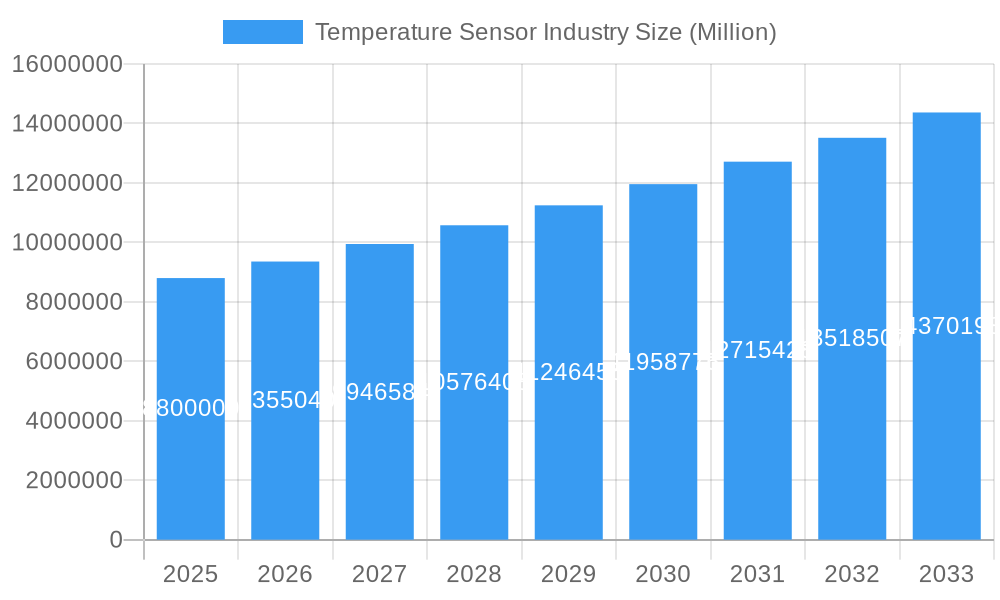

The global Temperature Sensor market is poised for significant expansion, projected to reach $8.80 million by 2025 and further grow at a robust Compound Annual Growth Rate (CAGR) of 6.28% through 2033. This upward trajectory is fueled by an increasing demand for precise temperature monitoring across a multitude of industries, driven by stringent quality control requirements, the need for enhanced operational efficiency, and the pervasive integration of IoT devices. Advancements in sensor technology, leading to smaller, more accurate, and cost-effective solutions, are also key contributors to this market’s growth. The burgeoning adoption of smart manufacturing, sophisticated medical devices, and advanced automotive systems are creating substantial opportunities for temperature sensor manufacturers.

Temperature Sensor Industry Market Size (In Million)

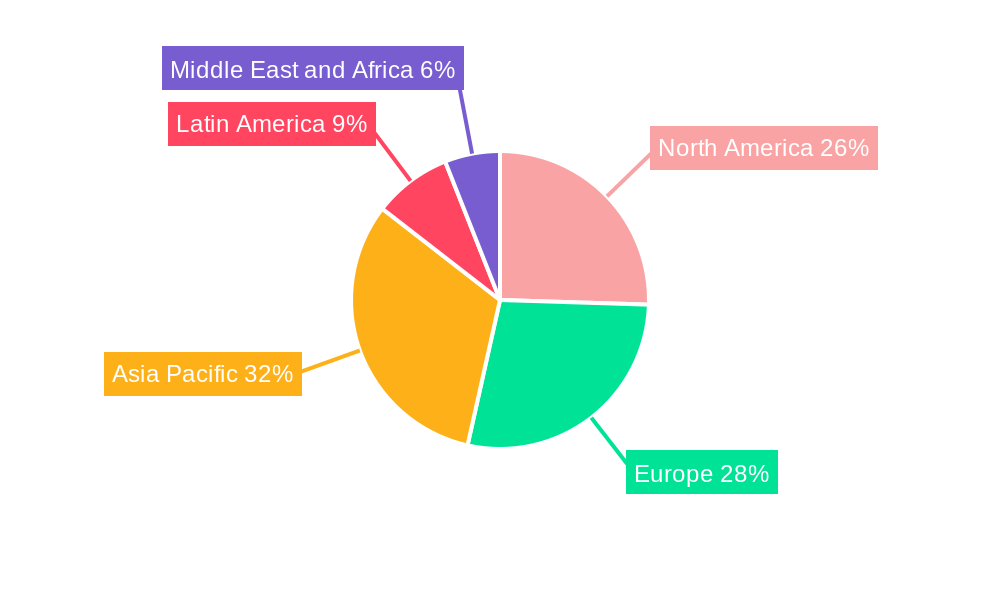

The market is segmented by Type, Technology, and End-User Industry, showcasing diverse application landscapes. Wired sensors continue to hold a significant share due to their reliability, while wireless sensors are rapidly gaining traction owing to their flexibility and ease of deployment, especially in complex or hazardous environments. Key technologies like Thermocouple, Resistance Temperature Detectors (RTD), and Thermistors are widely adopted, with Thermistors and RTDs offering high accuracy for various industrial applications. Emerging technologies like Fiber Optic sensors are also witnessing growing interest for specialized uses. The Chemical and Petrochemical, Oil and Gas, Power Generation, and Automotive sectors represent the largest end-user industries, leveraging temperature sensors for process control, safety, and performance optimization. Regions like Asia Pacific, led by China and India, are emerging as significant growth hubs due to rapid industrialization and increasing investments in manufacturing and infrastructure.

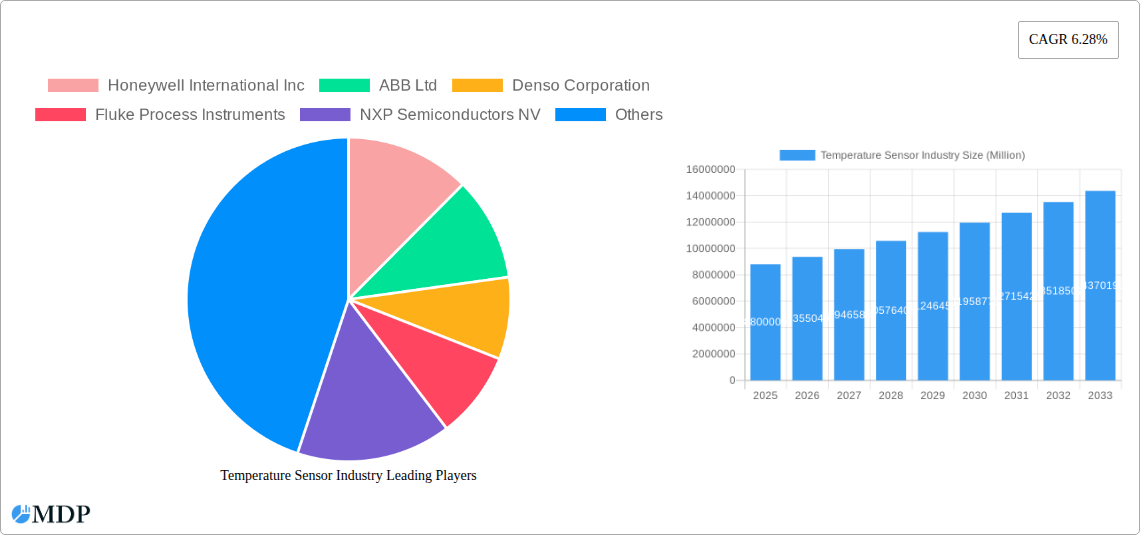

Temperature Sensor Industry Company Market Share

Dive into the dynamic temperature sensor market with this in-depth report, meticulously detailing its trajectory from 2019 to 2033. Explore critical industry insights, market drivers, and the latest technological advancements shaping the future of temperature measurement. This report is an indispensable resource for industry stakeholders, investors, and strategists seeking to capitalize on the burgeoning temperature sensor industry, featuring an estimated market size of over xx Million by 2025 and a projected CAGR of xx% during the forecast period of 2025–2033.

Temperature Sensor Industry Market Dynamics & Concentration

The global temperature sensor market exhibits moderate to high concentration, with key players like Honeywell International Inc, ABB Ltd, and Siemens AG dominating significant market share. Innovation remains a primary driver, fueled by the escalating demand for precise temperature monitoring in critical applications across industries such as automotive, medical, and industrial automation. Regulatory frameworks, while evolving, generally support the adoption of advanced sensing technologies to enhance safety and efficiency. Product substitutes, though present in niche applications, are increasingly being outpaced by the superior performance and versatility of modern temperature sensors. End-user trends lean towards miniaturization, wireless connectivity, and enhanced data analytics capabilities, pushing manufacturers to develop more sophisticated solutions. Merger and acquisition activities are strategic, aimed at consolidating market presence, acquiring new technologies, and expanding geographical reach. For instance, the historical period (2019-2024) witnessed approximately xx M&A deals valued at over xx Million, indicating active consolidation and investment. Understanding these dynamics is crucial for navigating the competitive landscape and identifying growth opportunities within the temperature sensor industry.

Temperature Sensor Industry Industry Trends & Analysis

The temperature sensor industry is experiencing robust growth, driven by an insatiable demand for accurate and reliable temperature monitoring across a multitude of sectors. The market penetration of temperature sensors is steadily increasing, projected to reach over xx% by 2025. This expansion is largely attributed to escalating advancements in technology, such as the development of highly sensitive thermistor and RTD sensors, alongside the integration of wireless temperature sensor solutions for enhanced data accessibility and remote monitoring. Consumer preferences are shifting towards smart devices and IoT-enabled systems, where temperature sensing plays a pivotal role in functionality and user experience, particularly in consumer electronics and automotive applications. Competitive dynamics are characterized by a race for innovation, with companies investing heavily in R&D to offer differentiated products with improved accuracy, faster response times, and lower power consumption. The global temperature sensor market size is projected to reach over xx Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the 2025–2033 forecast period. Key growth drivers include the increasing adoption of automation in manufacturing, the growing need for precise temperature control in food and beverage processing, and the critical requirements in the healthcare sector for patient monitoring and medical device calibration. The technological disruption in fiber optic temperature sensors and advanced infrared temperature sensor technologies are also contributing to market expansion, opening new avenues for application and revenue generation.

Leading Markets & Segments in Temperature Sensor Industry

North America currently leads the temperature sensor market, driven by strong economic policies and substantial investments in industrial automation and advanced healthcare. Within this region, the United States is a dominant country, owing to its large manufacturing base and cutting-edge technological research. The Automotive end-user industry is a significant segment, with an increasing demand for integrated temperature transmitters and wireless sensors for engine management, cabin climate control, and battery temperature monitoring in electric vehicles.

- Dominant Technology: Resistance Temperature Detectors (RTDs) and Thermistors continue to hold a substantial market share due to their cost-effectiveness and reliability in a wide range of applications. However, advancements in Infrared and Fiber Optic technologies are rapidly gaining traction, particularly in non-contact and harsh environment applications.

- Key Segment Drivers in Automotive:

- Stringent emission control regulations pushing for more precise engine temperature management.

- The rise of Electric Vehicles (EVs) requiring sophisticated battery thermal management systems.

- Increased adoption of advanced driver-assistance systems (ADAS) that rely on accurate environmental sensing.

- Dominant Segment in End-User Industry: The Chemical and Petrochemical industry remains a crucial market, demanding high-accuracy and robust temperature sensors for process control and safety. However, the Medical sector is exhibiting a remarkable growth trajectory, fueled by the need for precise temperature monitoring in diagnostics, therapeutics, and pharmaceutical manufacturing. The Food and Beverage industry also presents significant opportunities, with increasing emphasis on maintaining optimal temperatures throughout the supply chain to ensure product quality and safety. The Power Generation sector’s demand for reliable sensors to monitor critical equipment temperatures is also a consistent growth factor. The Wired segment is expected to maintain its dominance due to its reliability and cost-effectiveness in industrial settings, while the Wireless segment is poised for accelerated growth due to the ease of installation and flexibility it offers, particularly in retrofitting older facilities and in applications requiring mobility.

Temperature Sensor Industry Product Developments

Recent product innovations in the temperature sensor industry highlight a strong focus on enhanced performance and application-specific solutions. Companies are actively developing ultra-compact, high-accuracy sensors with faster response times and reduced power consumption. For instance, the introduction of relative humidity and temperature sensors with superior accuracy and rapid measurement capabilities caters to the growing demand in portable devices and harsh environments. Furthermore, the integration of temperature monitoring technology into wearable consumer electronics, like earbuds, signifies a trend towards ubiquitous sensing for personalized health and wellness applications. These advancements provide competitive advantages by enabling new functionalities, improving existing product performance, and opening up novel market segments for temperature sensor manufacturers.

Key Drivers of Temperature Sensor Industry Growth

The temperature sensor industry is propelled by several key factors. Technological advancements, such as the development of novel sensing materials and miniaturization techniques, are creating more accurate, reliable, and cost-effective sensors. Economic growth, particularly in emerging markets, is driving industrialization and infrastructure development, increasing the demand for temperature monitoring in various sectors like manufacturing, energy, and construction. Regulatory mandates promoting safety and efficiency standards across industries, such as stringent temperature control requirements in food and pharmaceuticals, also act as significant growth catalysts. The burgeoning Internet of Things (IoT) ecosystem, with its extensive need for connected devices and data acquisition, is a major driver, enabling widespread deployment of smart temperature sensors for real-time monitoring and analysis.

Challenges in the Temperature Sensor Industry Market

Despite its promising growth, the temperature sensor industry faces several challenges. Stringent regulatory hurdles in certain niche applications can slow down product development and market entry. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and costs, as witnessed during recent global events. Intense competitive pressures from numerous global and regional players can lead to price wars and reduced profit margins, especially for standard sensor types. The high initial investment required for advanced R&D and manufacturing facilities can also be a barrier for smaller companies. Moreover, the need for continuous innovation to keep pace with evolving technological demands and evolving customer requirements presents a persistent challenge.

Emerging Opportunities in Temperature Sensor Industry

The temperature sensor industry is ripe with emerging opportunities, primarily fueled by rapid technological breakthroughs and expanding market applications. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in conjunction with sensor data presents a significant opportunity for predictive maintenance and advanced process optimization. Strategic partnerships between sensor manufacturers and original equipment manufacturers (OEMs) are crucial for co-developing integrated solutions tailored for specific end-user industries, such as smart agriculture and advanced renewable energy systems. Market expansion into underdeveloped regions, coupled with the growing demand for smart building solutions and personalized healthcare devices, offers substantial long-term growth potential. The continued miniaturization and integration of sensors into everyday objects will further broaden the market reach for temperature sensing solutions.

Leading Players in the Temperature Sensor Industry Sector

- Honeywell International Inc

- ABB Ltd

- Denso Corporation

- Fluke Process Instruments

- NXP Semiconductors NV

- Kongsberg Gruppen

- GE Sensing & Inspection Technologies GmbH

- Maxim Integrated Products

- STMicroelectronics

- Siemens AG

- Omron Corporation

- TE Connectivity Ltd

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Microchip Technology Incorporated

- Günther GmbH Temperaturmesstechnik

- Analog Devices Inc

- FLIR Systems

- Panasonic Corporation

- Thermometris

- Emerson Electric Company

Key Milestones in Temperature Sensor Industry Industry

- June 2022: Renesas Electronics announced a new family of relative humidity, temperature sensors, and related solutions. The sensors provide high accuracy, fast measurement response time, and ultra-low power consumption in a small package size to support deployment in portable devices or products designed for harsh environments.

- March 2022: Honor launched Earbuds 3 Pro with integrated temperature monitoring technology. Honor's buds would include a temperature sensor combined with an AI temperature algorithm that can measure with approximately 80% chance of achieving approximately ±0.3 degrees Celcius or less error.

Strategic Outlook for Temperature Sensor Industry Market

The strategic outlook for the temperature sensor industry is exceptionally positive, driven by sustained innovation and expanding applications. Growth accelerators include the continued integration of sensors into IoT devices, the increasing demand for precise temperature control in critical sectors like healthcare and food safety, and the development of smart manufacturing processes. Strategic opportunities lie in focusing on high-growth segments such as electric vehicles, wearable technology, and advanced industrial automation. The market is set to benefit from investments in R&D for next-generation sensor technologies, including non-contact sensing and self-calibrating sensors. Furthermore, strategic collaborations with technology providers and end-users will be vital for developing bespoke solutions that address evolving market needs and capitalize on the expanding global market for temperature measurement solutions.

Temperature Sensor Industry Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Technology

- 2.1. Infrared

- 2.2. Thermocouple

- 2.3. Resistance Temperature Detectors (RTD)

- 2.4. Thermistor

- 2.5. Temperature Transmitters

- 2.6. Fiber Optic

- 2.7. Others

-

3. End-User Industry

- 3.1. Chemical and Petrochemical

- 3.2. Oil and Gas

- 3.3. Metal and Mining

- 3.4. Power Generation

- 3.5. Food and Beverage

- 3.6. Automotive

- 3.7. Medical

- 3.8. Aerospace and Military

- 3.9. Consumer Electronics

- 3.10. Other End-User Industries

Temperature Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Temperature Sensor Industry Regional Market Share

Geographic Coverage of Temperature Sensor Industry

Temperature Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Industry 4.0 & Rapid Factory Automation; Increasing Demand for Wearable in Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Infrared Temperature Sensors to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Temperature Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Infrared

- 5.2.2. Thermocouple

- 5.2.3. Resistance Temperature Detectors (RTD)

- 5.2.4. Thermistor

- 5.2.5. Temperature Transmitters

- 5.2.6. Fiber Optic

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Chemical and Petrochemical

- 5.3.2. Oil and Gas

- 5.3.3. Metal and Mining

- 5.3.4. Power Generation

- 5.3.5. Food and Beverage

- 5.3.6. Automotive

- 5.3.7. Medical

- 5.3.8. Aerospace and Military

- 5.3.9. Consumer Electronics

- 5.3.10. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Temperature Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Infrared

- 6.2.2. Thermocouple

- 6.2.3. Resistance Temperature Detectors (RTD)

- 6.2.4. Thermistor

- 6.2.5. Temperature Transmitters

- 6.2.6. Fiber Optic

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Chemical and Petrochemical

- 6.3.2. Oil and Gas

- 6.3.3. Metal and Mining

- 6.3.4. Power Generation

- 6.3.5. Food and Beverage

- 6.3.6. Automotive

- 6.3.7. Medical

- 6.3.8. Aerospace and Military

- 6.3.9. Consumer Electronics

- 6.3.10. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Temperature Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Infrared

- 7.2.2. Thermocouple

- 7.2.3. Resistance Temperature Detectors (RTD)

- 7.2.4. Thermistor

- 7.2.5. Temperature Transmitters

- 7.2.6. Fiber Optic

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Chemical and Petrochemical

- 7.3.2. Oil and Gas

- 7.3.3. Metal and Mining

- 7.3.4. Power Generation

- 7.3.5. Food and Beverage

- 7.3.6. Automotive

- 7.3.7. Medical

- 7.3.8. Aerospace and Military

- 7.3.9. Consumer Electronics

- 7.3.10. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Temperature Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Infrared

- 8.2.2. Thermocouple

- 8.2.3. Resistance Temperature Detectors (RTD)

- 8.2.4. Thermistor

- 8.2.5. Temperature Transmitters

- 8.2.6. Fiber Optic

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Chemical and Petrochemical

- 8.3.2. Oil and Gas

- 8.3.3. Metal and Mining

- 8.3.4. Power Generation

- 8.3.5. Food and Beverage

- 8.3.6. Automotive

- 8.3.7. Medical

- 8.3.8. Aerospace and Military

- 8.3.9. Consumer Electronics

- 8.3.10. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Temperature Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Infrared

- 9.2.2. Thermocouple

- 9.2.3. Resistance Temperature Detectors (RTD)

- 9.2.4. Thermistor

- 9.2.5. Temperature Transmitters

- 9.2.6. Fiber Optic

- 9.2.7. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Chemical and Petrochemical

- 9.3.2. Oil and Gas

- 9.3.3. Metal and Mining

- 9.3.4. Power Generation

- 9.3.5. Food and Beverage

- 9.3.6. Automotive

- 9.3.7. Medical

- 9.3.8. Aerospace and Military

- 9.3.9. Consumer Electronics

- 9.3.10. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Temperature Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Infrared

- 10.2.2. Thermocouple

- 10.2.3. Resistance Temperature Detectors (RTD)

- 10.2.4. Thermistor

- 10.2.5. Temperature Transmitters

- 10.2.6. Fiber Optic

- 10.2.7. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Chemical and Petrochemical

- 10.3.2. Oil and Gas

- 10.3.3. Metal and Mining

- 10.3.4. Power Generation

- 10.3.5. Food and Beverage

- 10.3.6. Automotive

- 10.3.7. Medical

- 10.3.8. Aerospace and Military

- 10.3.9. Consumer Electronics

- 10.3.10. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denso Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fluke Process Instruments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NXP Semiconductors NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kongsberg Gruppen*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GE Sensing & Inspection Technologies GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxim Integrated Products

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 STMicroelectronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Siemens AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TE Connectivity Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Robert Bosch GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Texas Instruments Incorporated

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Microchip Technology Incorporated

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Günther GmbH Temperaturmesstechnik

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Analog Devices Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 FLIR Systems

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Panasonic Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Thermometris

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Emerson Electric Company

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Temperature Sensor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Temperature Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Temperature Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Temperature Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Temperature Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Temperature Sensor Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: North America Temperature Sensor Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Temperature Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Temperature Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Temperature Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Temperature Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Temperature Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Temperature Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Temperature Sensor Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: Europe Temperature Sensor Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Temperature Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Temperature Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Temperature Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Temperature Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Temperature Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Temperature Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Temperature Sensor Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Asia Pacific Temperature Sensor Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Pacific Temperature Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Temperature Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Temperature Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Temperature Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Temperature Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Latin America Temperature Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Temperature Sensor Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 31: Latin America Temperature Sensor Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Temperature Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Temperature Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Temperature Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Temperature Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Temperature Sensor Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Middle East and Africa Temperature Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa Temperature Sensor Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Temperature Sensor Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Temperature Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Temperature Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Temperature Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Temperature Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Temperature Sensor Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Temperature Sensor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Temperature Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Temperature Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Temperature Sensor Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Temperature Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Temperature Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Temperature Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Temperature Sensor Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Temperature Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Temperature Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Temperature Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global Temperature Sensor Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 22: Global Temperature Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Temperature Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Temperature Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 30: Global Temperature Sensor Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 31: Global Temperature Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Mexico Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Temperature Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Temperature Sensor Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 37: Global Temperature Sensor Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 38: Global Temperature Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: United Arab Emirates Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Temperature Sensor Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Temperature Sensor Industry?

The projected CAGR is approximately 6.28%.

2. Which companies are prominent players in the Temperature Sensor Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Denso Corporation, Fluke Process Instruments, NXP Semiconductors NV, Kongsberg Gruppen*List Not Exhaustive, GE Sensing & Inspection Technologies GmbH, Maxim Integrated Products, STMicroelectronics, Siemens AG, Omron Corporation, TE Connectivity Ltd, Robert Bosch GmbH, Texas Instruments Incorporated, Microchip Technology Incorporated, Günther GmbH Temperaturmesstechnik, Analog Devices Inc, FLIR Systems, Panasonic Corporation, Thermometris, Emerson Electric Company.

3. What are the main segments of the Temperature Sensor Industry?

The market segments include Type, Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Industry 4.0 & Rapid Factory Automation; Increasing Demand for Wearable in Consumer Electronics.

6. What are the notable trends driving market growth?

Infrared Temperature Sensors to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

June 2022: Renesas Electronics announced a new family of relative humidity, temperature sensors, and related solutions. The sensors provide high accuracy, fast measurement response time, and ultra-low power consumption in a small package size to support deployment in portable devices or products designed for harsh environments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Temperature Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Temperature Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Temperature Sensor Industry?

To stay informed about further developments, trends, and reports in the Temperature Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence