Key Insights

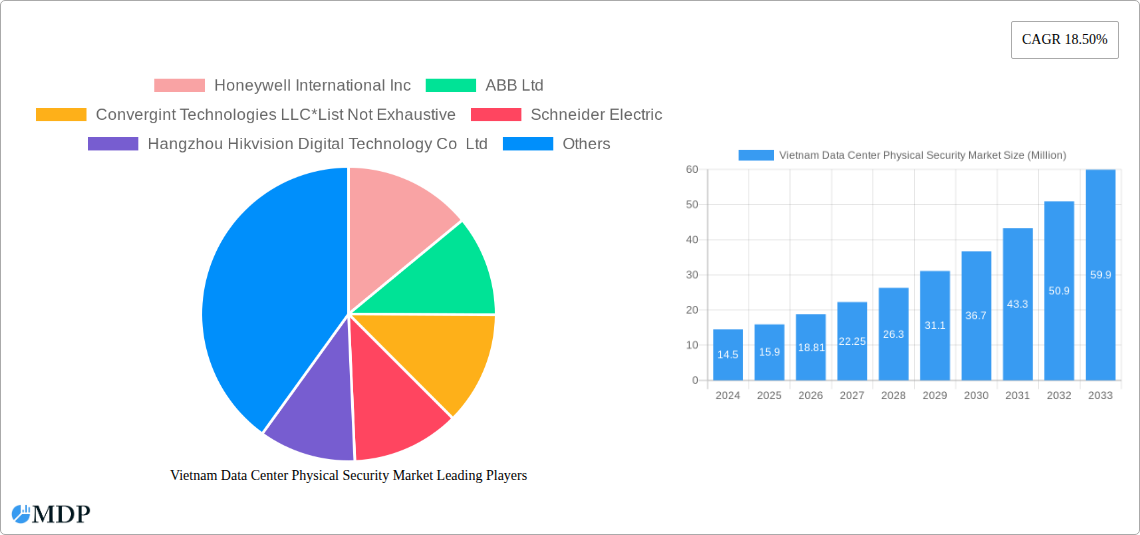

The Vietnam Data Center Physical Security Market is poised for substantial expansion, with a current market size of approximately $15.90 million and a projected Compound Annual Growth Rate (CAGR) of 18.50% throughout the forecast period (2025-2033). This robust growth is primarily driven by the escalating demand for data center infrastructure in Vietnam, fueled by rapid digitalization across various sectors. Key growth enablers include the increasing adoption of cloud computing services, the burgeoning e-commerce landscape, and the government's strategic initiatives to develop a digital economy. The expansion of the IT & Telecommunication, BFSI, and Government sectors, all of which rely heavily on secure and robust data center facilities, further propels market growth. Moreover, increasing investments in smart city projects and the proliferation of IoT devices are generating immense volumes of data, necessitating advanced physical security solutions to protect these critical assets.

Vietnam Data Center Physical Security Market Market Size (In Million)

The market is witnessing significant trends such as the integration of advanced video surveillance systems with AI-powered analytics for real-time threat detection and response, and the growing deployment of sophisticated access control solutions to ensure only authorized personnel can enter sensitive areas. Consulting services and professional services, including system integration, are also gaining traction as organizations seek expert guidance in designing, implementing, and maintaining complex physical security architectures. While the market exhibits strong growth potential, potential restraints could include the initial high cost of advanced security solutions and the availability of skilled professionals to manage and operate these systems. However, the continuous technological advancements and increasing awareness of data security imperatives are expected to mitigate these challenges, ensuring the sustained growth trajectory of the Vietnam Data Center Physical Security Market.

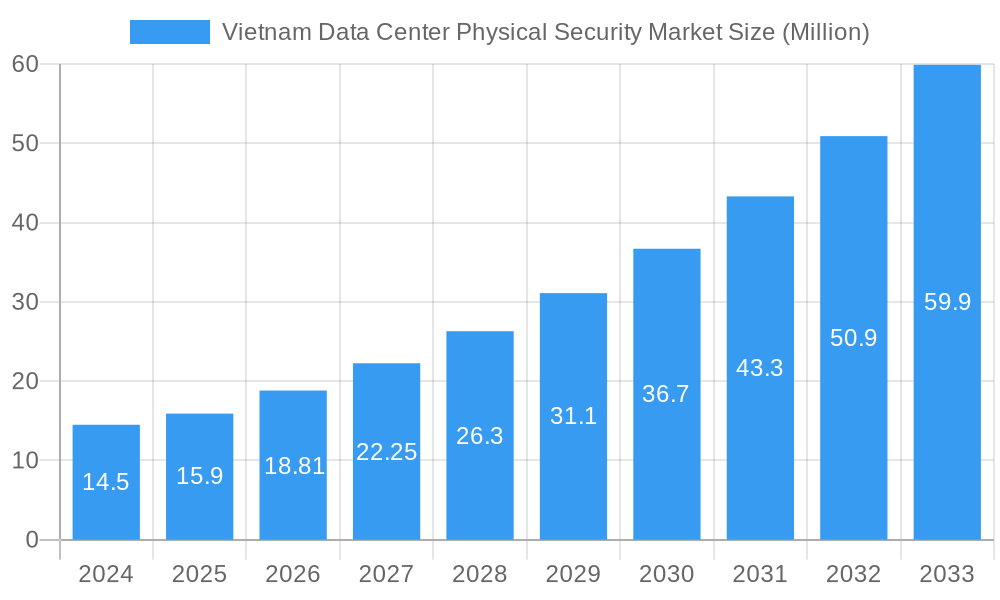

Vietnam Data Center Physical Security Market Company Market Share

Gain unparalleled insights into the rapidly evolving Vietnam Data Center Physical Security Market with our in-depth report. This comprehensive study, spanning from 2019 to 2033 with a base year of 2025, provides a detailed examination of market dynamics, industry trends, leading players, and future opportunities. We forecast significant growth driven by increasing data center investments, stringent security mandates, and the adoption of advanced physical security solutions. Our analysis focuses on key segments including Video Surveillance, Access Control Solutions, Consulting Services, Professional Services, and System Integration Services, catering to diverse end-users like IT & Telecommunication, BFSI, Government, and Healthcare sectors.

This report leverages high-traffic keywords such as "Vietnam data center security," "physical security solutions," "access control systems," "video surveillance for data centers," "cybersecurity infrastructure," and "IT security market Vietnam," ensuring maximum visibility for industry stakeholders seeking critical market intelligence. We have meticulously analyzed market concentration, innovation drivers, regulatory frameworks, and emerging trends to equip you with actionable insights for strategic decision-making.

Vietnam Data Center Physical Security Market Market Dynamics & Concentration

The Vietnam Data Center Physical Security Market is characterized by a moderate to high concentration, with a few key players holding significant market share, alongside a growing number of specialized solution providers. Innovation drivers are primarily fueled by the escalating need for robust protection against physical threats, sophisticated cyber-physical attacks, and the increasing adoption of cloud computing and IoT technologies, which necessitate secure data infrastructure. Regulatory frameworks are becoming more stringent, with government mandates pushing for advanced security measures in critical infrastructure, including data centers, to ensure data integrity and national security. Product substitutes, while present in the form of basic security measures, are increasingly being outpaced by integrated, intelligent physical security systems that offer comprehensive protection. End-user trends highlight a growing demand for centralized, intelligent security management platforms that can seamlessly integrate various security functions. Merger and acquisition activities are anticipated to rise as larger players seek to expand their geographical reach and technological capabilities, aiming to consolidate market position. M&A deal counts are projected to increase by approximately 15-20% over the forecast period, driven by strategic consolidation and technology acquisition. The market share distribution is currently led by integrated security solution providers, followed by specialized vendors in video surveillance and access control.

Vietnam Data Center Physical Security Market Industry Trends & Analysis

The Vietnam Data Center Physical Security Market is poised for substantial growth, driven by a confluence of technological advancements, escalating cybersecurity threats, and the burgeoning digital economy. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This robust growth is underpinned by the rapid expansion of data center infrastructure across Vietnam, fueled by increased cloud adoption, the proliferation of 5G networks, and the digital transformation initiatives of businesses across various sectors. The demand for advanced physical security solutions is paramount as data centers become critical hubs for sensitive information. Technological disruptions are playing a pivotal role, with innovations in AI-powered video analytics, biometric access control, drone surveillance, and integrated security management platforms transforming the landscape. These technologies offer enhanced threat detection, real-time monitoring, and automated response capabilities, significantly improving the overall security posture of data centers. Consumer preferences are shifting towards comprehensive, end-to-end security solutions that provide seamless integration of multiple security layers, offering both deterrence and rapid incident response. The market penetration of advanced physical security solutions is expected to climb from an estimated 45% in the base year 2025 to over 70% by 2033. Competitive dynamics are intensifying, with both established global security providers and agile local players vying for market dominance. Key market growth drivers include the increasing number of hyperscale data centers, the rise of colocation facilities, and government initiatives aimed at enhancing cybersecurity resilience. Furthermore, the growing awareness among businesses regarding the financial and reputational risks associated with data breaches is compelling them to invest more heavily in robust physical security measures. The market penetration for video surveillance solutions is estimated at 85%, while access control solutions stand at 70%, with other specialized solutions showing a growth of 10% year-on-year.

Leading Markets & Segments in Vietnam Data Center Physical Security Market

The Vietnam Data Center Physical Security Market is segmented across various solution types, service types, and end-users, each exhibiting unique growth trajectories.

Solution Type Dominance:

- Video Surveillance: This segment currently holds the largest market share, estimated at 45% of the total market value.

- Key Drivers: The increasing need for continuous monitoring, evidence collection, and advanced analytics such as facial recognition and anomaly detection are fueling the demand for high-definition, AI-enabled video surveillance systems. Economic policies promoting industrialization and infrastructure development indirectly boost the demand for surveillance in emerging data center hubs.

- Access Control Solutions: This segment represents approximately 35% of the market share.

- Key Drivers: Stringent regulations on data access, coupled with the growing adoption of multi-factor authentication and biometric technologies (fingerprint, iris scanners), are driving growth. The BFSI and Government sectors are significant contributors to the demand for secure access control. Infrastructure development projects also necessitate robust access management for restricted areas.

- Other Solutions (e.g., Intrusion Detection Systems, Perimeter Security): This segment accounts for the remaining 20% of the market.

- Key Drivers: The need for a holistic security approach, encompassing detection of unauthorized entry, environmental monitoring, and perimeter protection, is driving the adoption of these solutions.

Service Type Dominance:

- Professional Services (System Integration Services): This segment is a dominant force, comprising an estimated 50% of the services market.

- Key Drivers: The complexity of integrating diverse physical security systems with existing IT infrastructure necessitates expert system integration services. The rapid pace of technological adoption requires skilled professionals for seamless implementation and ongoing support.

- Consulting Services: This segment accounts for approximately 25% of the market.

- Key Drivers: Businesses are increasingly seeking expert advice on security strategy, risk assessment, and compliance with evolving regulations.

- Other Service Types (e.g., Maintenance, Managed Services): This segment makes up the remaining 25%.

- Key Drivers: The need for ongoing system maintenance, updates, and remote monitoring to ensure optimal performance and security.

End User Dominance:

- IT & Telecommunication: This sector is the largest consumer of data center physical security solutions, representing approximately 40% of the end-user market.

- Key Drivers: The proliferation of data centers, cloud services, and digital infrastructure development within this sector creates a significant demand for advanced physical security.

- BFSI (Banking, Financial Services, and Insurance): This sector constitutes about 30% of the market.

- Key Drivers: The high sensitivity of financial data and stringent regulatory requirements for data protection drive substantial investments in robust physical security.

- Government: This sector accounts for approximately 20% of the market.

- Key Drivers: National security concerns, the protection of critical infrastructure, and the increasing digitization of government services necessitate secure data storage and handling.

- Healthcare: This sector represents about 10% of the market.

- Key Drivers: The increasing volume of sensitive patient data and evolving healthcare regulations are driving the need for secure data center facilities.

Vietnam Data Center Physical Security Market Product Developments

Product development in the Vietnam Data Center Physical Security Market is characterized by a strong focus on intelligent, integrated, and automated solutions. Innovations are geared towards enhancing threat detection accuracy, streamlining access management, and providing comprehensive situational awareness. AI and machine learning are increasingly being integrated into video surveillance systems for advanced analytics, such as behavioral detection and facial recognition, improving the ability to identify potential threats in real-time. Biometric authentication, including fingerprint and iris scanning, is becoming more prevalent in access control systems, offering higher security and convenience. Furthermore, the development of unified security platforms that integrate video surveillance, access control, intrusion detection, and other security subsystems is a key trend, enabling centralized management and a holistic view of security operations. These product developments offer competitive advantages by providing enhanced security, operational efficiency, and compliance with evolving industry standards.

Key Drivers of Vietnam Data Center Physical Security Market Growth

The Vietnam Data Center Physical Security Market is propelled by several critical growth drivers. The rapid expansion of the digital economy and the increasing adoption of cloud computing services are creating an unprecedented demand for secure data center infrastructure. Government initiatives promoting digital transformation and cybersecurity awareness are further bolstering investments in physical security solutions. Technological advancements, particularly in AI-powered video analytics, biometric access control, and integrated security management platforms, are offering more effective and efficient security measures. The rising concerns over data breaches and the need to comply with increasingly stringent data protection regulations are compelling organizations to prioritize robust physical security. Additionally, the growth of the IT & Telecommunication, BFSI, and Government sectors, all of which are heavy users of data center services, directly fuels the demand for advanced physical security solutions.

Challenges in the Vietnam Data Center Physical Security Market Market

Despite the promising growth trajectory, the Vietnam Data Center Physical Security Market faces several challenges. A primary concern is the upfront cost associated with implementing advanced physical security systems, which can be a deterrent for some small and medium-sized enterprises. Skill shortages in cybersecurity and physical security management pose another significant hurdle, making it difficult for organizations to find qualified personnel to operate and maintain sophisticated systems. Rapid technological advancements also create a challenge, requiring continuous investment in upgrades and training to stay ahead of emerging threats. Furthermore, fragmented regulatory landscapes and evolving compliance requirements can create complexity for businesses operating across different sectors or regions. Supply chain disruptions for specialized security hardware can also impact deployment timelines and project costs.

Emerging Opportunities in Vietnam Data Center Physical Security Market

The Vietnam Data Center Physical Security Market is ripe with emerging opportunities driven by several catalysts. The increasing trend towards edge computing and the deployment of smaller, distributed data centers present a demand for localized and intelligent physical security solutions. The growing adoption of smart city initiatives across Vietnam will lead to an increased need for secure data management and, consequently, robust data center physical security. Strategic partnerships between technology providers, system integrators, and cloud service providers are creating opportunities for bundled security offerings. Furthermore, the government's focus on developing Vietnam as a regional digital hub is expected to attract significant foreign investment in data center infrastructure, creating a substantial market for physical security solutions. The development of secure and compliant facilities for emerging industries like Artificial Intelligence and Blockchain will also open new avenues.

Leading Players in the Vietnam Data Center Physical Security Market Sector

- Honeywell International Inc

- ABB Ltd

- Convergint Technologies LLC

- Schneider Electric

- Hangzhou Hikvision Digital Technology Co Ltd

- Securitas Technology

- Bosch Sicherheitssysteme GmbH

- Dahua Technology Co Ltd

- Cisco Systems Inc

- Siemens AG

- Johnson Controls

Key Milestones in Vietnam Data Center Physical Security Market Industry

- October 2023: Zwipe partnered with Schneider Electric’s Security Solutions Group. The France-based multinational Schneider Electric plans to introduce the Zwipe Access fingerprint-scanning smart card to its clientele. This card will be integrated with Schneider Electric’s Continuum and Security Expert platforms, serving a client base from sectors including airports, transportation, healthcare, data centers, and more. This partnership signifies a move towards enhanced biometric authentication in critical infrastructure security.

- April 2023: Securitas signed an expanded five-year agreement to provide Microsoft with data center security in 31 countries. The agreement includes risk management, comprehensive security technology as a system integrator, specialized safety and security resources, guarding services, and digital interfaces. This landmark agreement highlights the increasing reliance on integrated security services for global data center operations.

Strategic Outlook for Vietnam Data Center Physical Security Market Market

The strategic outlook for the Vietnam Data Center Physical Security Market is exceptionally positive, driven by sustained demand for secure digital infrastructure. The market will witness continued innovation in AI-driven security, biometric authentication, and integrated management platforms. Strategic partnerships and collaborations will be crucial for market players to offer comprehensive solutions and expand their reach. The growing emphasis on cybersecurity compliance and data protection regulations will further solidify the importance of physical security investments. Opportunities exist for vendors who can provide scalable, adaptable, and cost-effective solutions tailored to the evolving needs of hyperscale, colocation, and enterprise data centers in Vietnam. The government's commitment to digital infrastructure development will serve as a significant growth accelerator, creating a dynamic and expanding market landscape for physical security providers.

Vietnam Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Other So

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Other Service Types (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Vietnam Data Center Physical Security Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Physical Security Market Regional Market Share

Geographic Coverage of Vietnam Data Center Physical Security Market

Vietnam Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Innovation in Video Surveillance among the Market Players; Increasing Data Center Projects

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Video Surveillance is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Physical Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Other So

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Other Service Types (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Convergint Technologies LLC*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Securitas Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch Sicherheitssysteme GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dahua Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cisco Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siemens AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Johnson Controls

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Vietnam Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Data Center Physical Security Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: Vietnam Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Vietnam Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Vietnam Data Center Physical Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Vietnam Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 6: Vietnam Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Vietnam Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Vietnam Data Center Physical Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Physical Security Market?

The projected CAGR is approximately 18.50%.

2. Which companies are prominent players in the Vietnam Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Convergint Technologies LLC*List Not Exhaustive, Schneider Electric, Hangzhou Hikvision Digital Technology Co Ltd, Securitas Technology, Bosch Sicherheitssysteme GmbH, Dahua Technology Co Ltd, Cisco Systems Inc, Siemens AG, Johnson Controls.

3. What are the main segments of the Vietnam Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Innovation in Video Surveillance among the Market Players; Increasing Data Center Projects.

6. What are the notable trends driving market growth?

Video Surveillance is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

The High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2023: Zwipe partnered with Schneider Electric’s Security Solutions Group. The France-based multinational Schneider Electric plans to introduce the Zwipe Access fingerprint-scanning smart card to its clientele. This card will be integrated with Schneider Electric’s Continuum and Security Expert platforms, serving a client base from sectors including airports, transportation, healthcare, data centers, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence