Key Insights

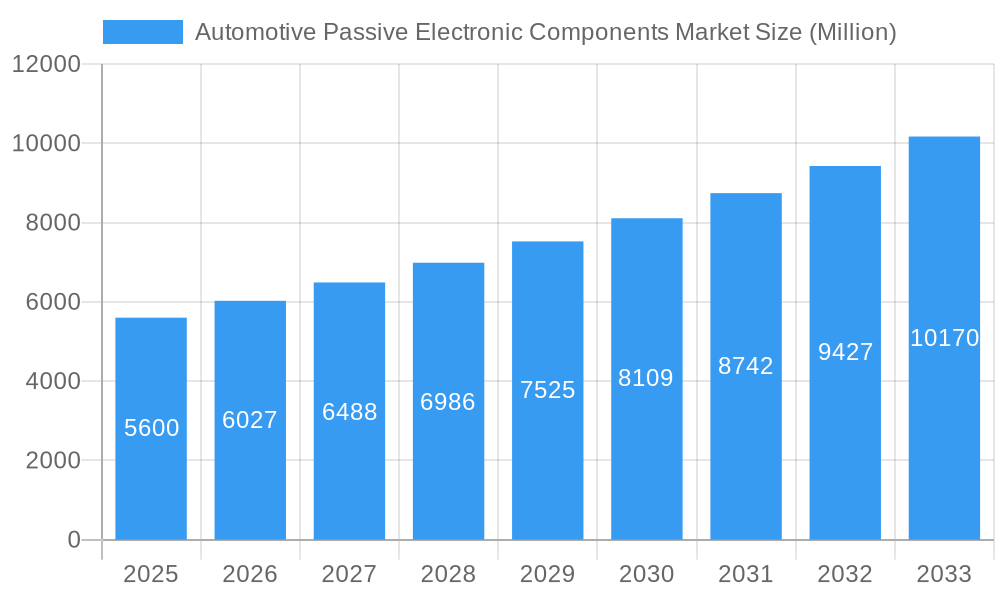

The Automotive Passive Electronic Components Market is poised for significant expansion, projecting a substantial market size of $5.60 Billion in 2025, driven by the accelerating adoption of advanced automotive technologies. This robust growth is underscored by an anticipated Compound Annual Growth Rate (CAGR) of 7.60% through 2033. Key growth drivers include the escalating demand for electric and hybrid vehicles, which rely heavily on sophisticated power management and control systems that, in turn, necessitate a vast array of passive components. The increasing integration of sophisticated driver-assistance systems (ADAS), infotainment, and connectivity features further fuels this demand, as these systems require precise and reliable electronic circuitry. Furthermore, the ongoing trend towards vehicle electrification and the development of autonomous driving technologies are creating new opportunities for specialized passive components, such as high-performance capacitors and inductors capable of handling increased power and voltage. The market's evolution is also shaped by the constant pursuit of miniaturization and higher efficiency, pushing manufacturers to innovate in the development of smaller, more powerful, and more energy-efficient passive components.

Automotive Passive Electronic Components Market Market Size (In Billion)

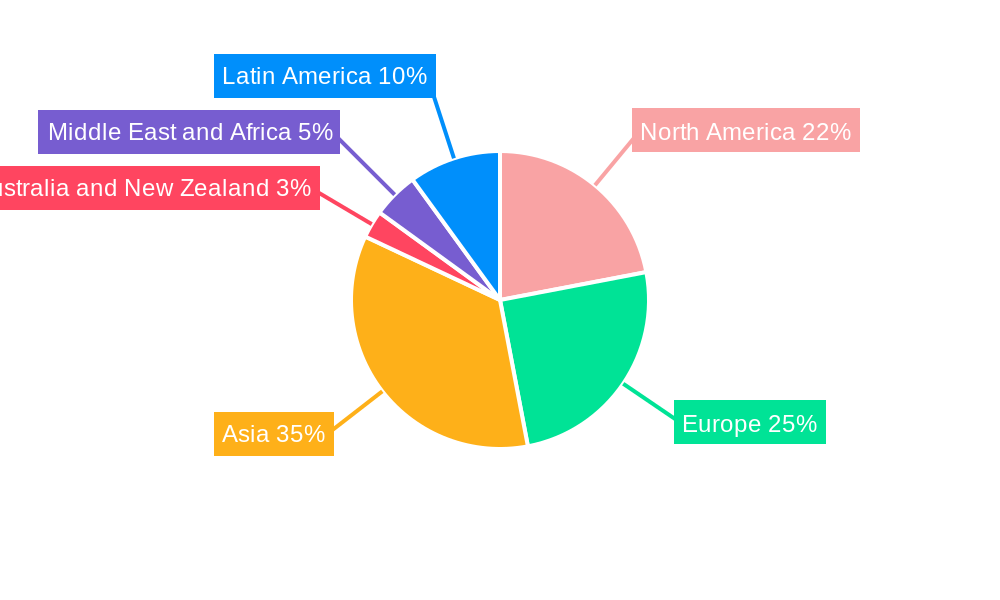

The market segmentation reveals a diversified landscape, with Capacitors, particularly Ceramic, Tantalum, and Aluminum Electrolytic Capacitors, leading the charge due to their ubiquitous application in power supply filtering, energy storage, and signal coupling across all vehicle sub-systems. Inductors and Resistors, including Surface-mounted Chips and Network/Array types, are also critical segments, vital for current sensing, filtering, and circuit protection. The growing emphasis on electromagnetic compatibility (EMC) is also driving the demand for EMC Filters, essential for ensuring the reliable operation of increasingly complex electronic architectures. Geographically, Asia is expected to dominate market share, propelled by its strong automotive manufacturing base and rapid technological advancements. North America and Europe also represent significant markets, driven by stringent safety regulations and a strong consumer appetite for advanced vehicle features. While the market demonstrates strong upward momentum, potential restraints could include supply chain disruptions for raw materials, increasing price volatility, and the ongoing challenge of developing passive components that can withstand the harsh automotive environment in terms of temperature, vibration, and moisture.

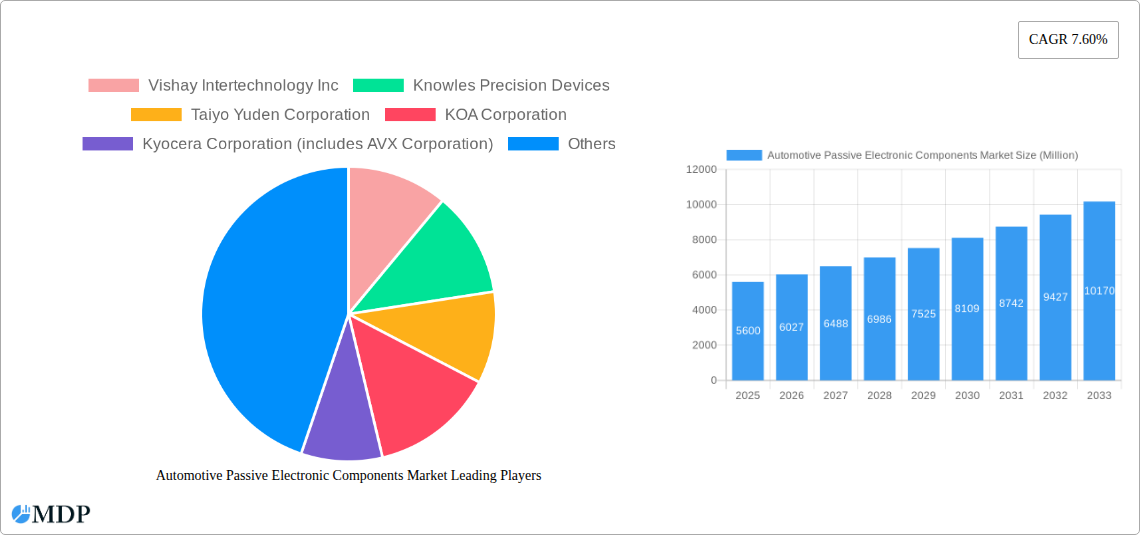

Automotive Passive Electronic Components Market Company Market Share

Gain a definitive edge in the burgeoning Automotive Passive Electronic Components Market. This in-depth report provides critical analysis and actionable intelligence for automotive electronic suppliers, EV component manufacturers, automotive Tier 1 suppliers, and automotive OEMs. Delve into market dynamics, key trends, segment dominance, and strategic imperatives shaping the future of automotive capacitors, automotive inductors, automotive resistors, and automotive EMC filters. With a robust study period from 2019 to 2033, including a 2025 base year and forecast period, this report offers unparalleled foresight into this rapidly evolving sector.

Automotive Passive Electronic Components Market Market Dynamics & Concentration

The Automotive Passive Electronic Components Market is characterized by a moderate to high concentration, with a few dominant players controlling significant market share. Innovation is a key driver, fueled by the relentless pursuit of enhanced vehicle performance, safety, and efficiency, particularly in the electric vehicle (EV) components market. Regulatory frameworks, such as stricter emissions standards and safety mandates, are compelling automakers to integrate more sophisticated electronic systems, thereby boosting demand for passive components. Product substitutes are limited for core passive functions, but advancements in integrated circuits and novel materials present potential long-term challenges. End-user trends are heavily influenced by the shift towards autonomous driving and advanced driver-assistance systems (ADAS), necessitating higher reliability and miniaturization of components. Mergers and acquisitions (M&A) activities are prevalent as larger companies aim to consolidate their portfolios and expand their technological capabilities, with an estimated xx M&A deals in the historical period. Market share for key players varies across different component segments, but top innovators consistently capture a larger portion of the growth.

Automotive Passive Electronic Components Market Industry Trends & Analysis

The Automotive Passive Electronic Components Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period (2025-2033). This expansion is primarily driven by the accelerating adoption of electric vehicles (EVs), which require significantly more passive electronic components than their internal combustion engine (ICE) counterparts. The increasing integration of advanced driver-assistance systems (ADAS), infotainment systems, and connectivity features in modern vehicles further fuels this demand. Technological disruptions, such as the miniaturization of components, improved thermal management capabilities, and the development of high-reliability materials, are enabling smaller, lighter, and more efficient electronic architectures. Consumer preferences are shifting towards smarter, safer, and more sustainable vehicles, pushing manufacturers to invest heavily in these areas. Competitive dynamics are intense, with established players continuously innovating to maintain their market position and new entrants vying for market share. The automotive capacitors market is a significant contributor to overall growth, with ceramic and supercapacitors seeing particularly strong demand. The market penetration of passive components in new vehicle production is estimated to reach over 90% by 2025, highlighting the indispensable role of these components in the automotive industry.

Leading Markets & Segments in Automotive Passive Electronic Components Market

The Automotive Passive Electronic Components Market is experiencing significant regional growth, with Asia Pacific emerging as the dominant market due to its strong manufacturing base and the rapid expansion of its automotive industry, particularly in China. Within the product segments, Capacitors hold the largest market share.

Capacitors: This segment is further categorized, with:

- Ceramic Capacitors dominating due to their versatility, small size, and suitability for high-frequency applications in modern vehicles, including ADAS and infotainment. The increasing complexity of automotive electronics directly translates to higher demand for ceramic capacitors.

- Supercapacitors are witnessing substantial growth driven by their application in regenerative braking systems in EVs and as backup power sources for critical automotive functions.

- Aluminum Electrolytic Capacitors remain crucial for power supply filtering and energy storage in various automotive modules.

- Tantalum Capacitors are favored for their high capacitance density and stability in demanding automotive environments.

- Paper and Plastic Film Capacitors continue to find applications in specific filtering and coupling circuits.

Resistors: The Surface-mounted Chips (SMD) resistors segment is the largest within resistors, driven by the trend towards miniaturization and automated manufacturing processes. Network and array resistors are gaining traction for their space-saving benefits in complex circuitry.

Inductors: Essential for power management and filtering in automotive power electronics, inductors are experiencing steady growth, particularly those designed for higher current and temperature ratings.

EMC Filters: With increasing electronic complexity and the need to mitigate electromagnetic interference, the demand for robust EMC Filters is on the rise, ensuring the reliable operation of sensitive automotive systems.

Key drivers for regional and segment dominance include favorable government policies promoting electric vehicle adoption, substantial investments in automotive manufacturing infrastructure, and the presence of leading automotive component manufacturers.

Automotive Passive Electronic Components Market Product Developments

Recent product developments in the Automotive Passive Electronic Components Market highlight a strong focus on enhanced performance, miniaturization, and reliability for the demanding automotive environment. Companies are innovating to create components that can withstand extreme temperatures, vibrations, and voltage fluctuations. For instance, advancements in material science are leading to the development of higher capacitance density capacitors and more efficient inductors. The integration of passive components into smaller, more robust packages is crucial for supporting the increasing electronic content in vehicles, particularly for EV powertrains and autonomous driving systems. These innovations are critical for meeting the evolving needs of automotive manufacturers and driving the future of vehicle electronics.

Key Drivers of Automotive Passive Electronic Components Market Growth

The Automotive Passive Electronic Components Market is propelled by several key drivers. The rapid adoption of Electric Vehicles (EVs) is paramount, as EVs utilize a significantly higher number of passive components for their battery management systems, power converters, and charging infrastructure. The increasing integration of Advanced Driver-Assistance Systems (ADAS) and the push towards autonomous driving necessitate sophisticated electronic control units, which in turn require a greater quantity and variety of passive components. Furthermore, stringent automotive safety regulations and emissions standards are mandating more complex electronic architectures, thereby boosting demand. Technological advancements in component miniaturization and enhanced performance capabilities allow for more integrated and efficient vehicle designs, acting as another significant growth catalyst.

Challenges in the Automotive Passive Electronic Components Market Market

Despite robust growth, the Automotive Passive Electronic Components Market faces several challenges. Supply chain disruptions, including raw material shortages and logistical complexities, can impact production timelines and costs. Evolving regulatory landscapes and the need for continuous compliance with new standards require ongoing investment in research and development. Intense competitive pressures can lead to price erosion, squeezing profit margins for manufacturers. The high cost of R&D for developing next-generation components capable of meeting stringent automotive requirements also presents a significant barrier. Additionally, the slow adoption rate of certain advanced technologies in some markets can create uneven demand patterns.

Emerging Opportunities in Automotive Passive Electronic Components Market

Emerging opportunities within the Automotive Passive Electronic Components Market are plentiful and poised to drive long-term growth. The accelerating transition to electric mobility will continue to be a primary catalyst, creating sustained demand for high-performance capacitors, inductors, and filters essential for EV powertrains and battery systems. The ongoing development and deployment of 5G connectivity in vehicles will spur the need for advanced passive components for communication modules and in-vehicle networks. Furthermore, strategic partnerships between passive component manufacturers and automotive OEMs and Tier 1 suppliers can foster co-development of tailored solutions, leading to significant market penetration. The expansion of the market into emerging economies with growing automotive sectors also presents substantial untapped potential.

Leading Players in the Automotive Passive Electronic Components Market Sector

- Vishay Intertechnology Inc

- Knowles Precision Devices

- Taiyo Yuden Corporation

- KOA Corporation

- Kyocera Corporation

- Rubycon Corporation

- Yageo Corporation

- TDK Corporation

- Nippon Chemi-Con Corporation

- Murata Manufacturing Co Ltd

- Panasonic Corporation

- Samsung Electro-Mechanical

Key Milestones in Automotive Passive Electronic Components Market Industry

- March 2024: Knowles Precision Devices released its newest Electric double-layer capacitor (EDLC) modules (supercapacitor modules) under its Cornell Dubilier brand (DGH and DSF Series), offering increased operating voltages and space savings on PCBs, well-suited for EV transportation and energy storage.

- February 2024: Taiyo Yuden Co. Ltd completed a new material building at its Yawatabara Plant for manufacturing barium titanate, a key raw material for multilayer ceramic capacitors, ensuring a consistent supply for enhanced electronic devices.

Strategic Outlook for Automotive Passive Electronic Components Market Market

The strategic outlook for the Automotive Passive Electronic Components Market is exceptionally positive, driven by megatrends in electrification, connectivity, and automation. Companies that focus on developing highly reliable, miniaturized, and energy-efficient passive components will be best positioned for success. Strategic partnerships and vertical integration, particularly in securing raw material supplies, will be crucial for navigating supply chain complexities. Investing in research and development for next-generation technologies, such as solid-state capacitors and advanced filtering solutions for higher frequency applications, will unlock new market opportunities. The continuous evolution of vehicle architectures and the demand for enhanced in-car experiences will ensure a sustained and robust growth trajectory for the automotive passive electronic components sector.

Automotive Passive Electronic Components Market Segmentation

-

1. Type

-

1.1. Capacitors

- 1.1.1. Ceramic Capacitors

- 1.1.2. Tantalum Capacitors

- 1.1.3. Aluminum Electrolytic Capacitors

- 1.1.4. Paper and Plastic Film Capacitors

- 1.1.5. Supercapacitors

- 1.2. Inductors

-

1.3. Resistors

- 1.3.1. Surface-mounted Chips

- 1.3.2. Network and Array

- 1.3.3. Other Specialty

- 1.4. EMC Filters

-

1.1. Capacitors

Automotive Passive Electronic Components Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Automotive Passive Electronic Components Market Regional Market Share

Geographic Coverage of Automotive Passive Electronic Components Market

Automotive Passive Electronic Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Advanced Electronic Devices in the Industry; Increasing Preference for Miniaturized Designs

- 3.3. Market Restrains

- 3.3.1. Fluctuating Prices of Critical Metals Used in Manufacturing of Passive Electronic Components/ Challenges in the manufacturing of various Passive Components

- 3.4. Market Trends

- 3.4.1. Capacitors to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Capacitors

- 5.1.1.1. Ceramic Capacitors

- 5.1.1.2. Tantalum Capacitors

- 5.1.1.3. Aluminum Electrolytic Capacitors

- 5.1.1.4. Paper and Plastic Film Capacitors

- 5.1.1.5. Supercapacitors

- 5.1.2. Inductors

- 5.1.3. Resistors

- 5.1.3.1. Surface-mounted Chips

- 5.1.3.2. Network and Array

- 5.1.3.3. Other Specialty

- 5.1.4. EMC Filters

- 5.1.1. Capacitors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Middle East and Africa

- 5.2.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Capacitors

- 6.1.1.1. Ceramic Capacitors

- 6.1.1.2. Tantalum Capacitors

- 6.1.1.3. Aluminum Electrolytic Capacitors

- 6.1.1.4. Paper and Plastic Film Capacitors

- 6.1.1.5. Supercapacitors

- 6.1.2. Inductors

- 6.1.3. Resistors

- 6.1.3.1. Surface-mounted Chips

- 6.1.3.2. Network and Array

- 6.1.3.3. Other Specialty

- 6.1.4. EMC Filters

- 6.1.1. Capacitors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Capacitors

- 7.1.1.1. Ceramic Capacitors

- 7.1.1.2. Tantalum Capacitors

- 7.1.1.3. Aluminum Electrolytic Capacitors

- 7.1.1.4. Paper and Plastic Film Capacitors

- 7.1.1.5. Supercapacitors

- 7.1.2. Inductors

- 7.1.3. Resistors

- 7.1.3.1. Surface-mounted Chips

- 7.1.3.2. Network and Array

- 7.1.3.3. Other Specialty

- 7.1.4. EMC Filters

- 7.1.1. Capacitors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Capacitors

- 8.1.1.1. Ceramic Capacitors

- 8.1.1.2. Tantalum Capacitors

- 8.1.1.3. Aluminum Electrolytic Capacitors

- 8.1.1.4. Paper and Plastic Film Capacitors

- 8.1.1.5. Supercapacitors

- 8.1.2. Inductors

- 8.1.3. Resistors

- 8.1.3.1. Surface-mounted Chips

- 8.1.3.2. Network and Array

- 8.1.3.3. Other Specialty

- 8.1.4. EMC Filters

- 8.1.1. Capacitors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Capacitors

- 9.1.1.1. Ceramic Capacitors

- 9.1.1.2. Tantalum Capacitors

- 9.1.1.3. Aluminum Electrolytic Capacitors

- 9.1.1.4. Paper and Plastic Film Capacitors

- 9.1.1.5. Supercapacitors

- 9.1.2. Inductors

- 9.1.3. Resistors

- 9.1.3.1. Surface-mounted Chips

- 9.1.3.2. Network and Array

- 9.1.3.3. Other Specialty

- 9.1.4. EMC Filters

- 9.1.1. Capacitors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Capacitors

- 10.1.1.1. Ceramic Capacitors

- 10.1.1.2. Tantalum Capacitors

- 10.1.1.3. Aluminum Electrolytic Capacitors

- 10.1.1.4. Paper and Plastic Film Capacitors

- 10.1.1.5. Supercapacitors

- 10.1.2. Inductors

- 10.1.3. Resistors

- 10.1.3.1. Surface-mounted Chips

- 10.1.3.2. Network and Array

- 10.1.3.3. Other Specialty

- 10.1.4. EMC Filters

- 10.1.1. Capacitors

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Latin America Automotive Passive Electronic Components Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Capacitors

- 11.1.1.1. Ceramic Capacitors

- 11.1.1.2. Tantalum Capacitors

- 11.1.1.3. Aluminum Electrolytic Capacitors

- 11.1.1.4. Paper and Plastic Film Capacitors

- 11.1.1.5. Supercapacitors

- 11.1.2. Inductors

- 11.1.3. Resistors

- 11.1.3.1. Surface-mounted Chips

- 11.1.3.2. Network and Array

- 11.1.3.3. Other Specialty

- 11.1.4. EMC Filters

- 11.1.1. Capacitors

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vishay Intertechnology Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Knowles Precision Devices

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Taiyo Yuden Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 KOA Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kyocera Corporation (includes AVX Corporation)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Rubycon Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Yageo Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 TDK Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nippon Chemi-Con Corporatio

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Murata Manufacturing Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Panasonic Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Samsung Electro-Mechanical

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Automotive Passive Electronic Components Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Passive Electronic Components Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automotive Passive Electronic Components Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Automotive Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Automotive Passive Electronic Components Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Automotive Passive Electronic Components Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Automotive Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Automotive Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Automotive Passive Electronic Components Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Automotive Passive Electronic Components Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Automotive Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Automotive Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Automotive Passive Electronic Components Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Australia and New Zealand Automotive Passive Electronic Components Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Australia and New Zealand Automotive Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Automotive Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Automotive Passive Electronic Components Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Automotive Passive Electronic Components Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Automotive Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Automotive Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Latin America Automotive Passive Electronic Components Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Automotive Passive Electronic Components Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Automotive Passive Electronic Components Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Automotive Passive Electronic Components Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Automotive Passive Electronic Components Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Passive Electronic Components Market?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Automotive Passive Electronic Components Market?

Key companies in the market include Vishay Intertechnology Inc, Knowles Precision Devices, Taiyo Yuden Corporation, KOA Corporation, Kyocera Corporation (includes AVX Corporation), Rubycon Corporation, Yageo Corporation, TDK Corporation, Nippon Chemi-Con Corporatio, Murata Manufacturing Co Ltd, Panasonic Corporation, Samsung Electro-Mechanical.

3. What are the main segments of the Automotive Passive Electronic Components Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Advanced Electronic Devices in the Industry; Increasing Preference for Miniaturized Designs.

6. What are the notable trends driving market growth?

Capacitors to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fluctuating Prices of Critical Metals Used in Manufacturing of Passive Electronic Components/ Challenges in the manufacturing of various Passive Components.

8. Can you provide examples of recent developments in the market?

March 2024: Knowles Precision Devices, a provider of top-quality components and solutions, released its newest Electric double-layer capacitor (EDLC) modules, also known as supercapacitor modules. These advanced capacitors, constructed using Knowles' Cornell Dubilier brand DGH and DSF Series supercapacitors, come in a three-cell package for increased operating voltages and save space on printed circuit boards. The high capacity of these supercapacitors enables them to support additional batteries or even replace batteries in various applications. These supercapacitors are well-suited for providing power for electric vehicle transportation, powering pulse battery packs, creating battery/capacitor hybrids, or any situation requiring substantial energy storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Passive Electronic Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Passive Electronic Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Passive Electronic Components Market?

To stay informed about further developments, trends, and reports in the Automotive Passive Electronic Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence