Key Insights

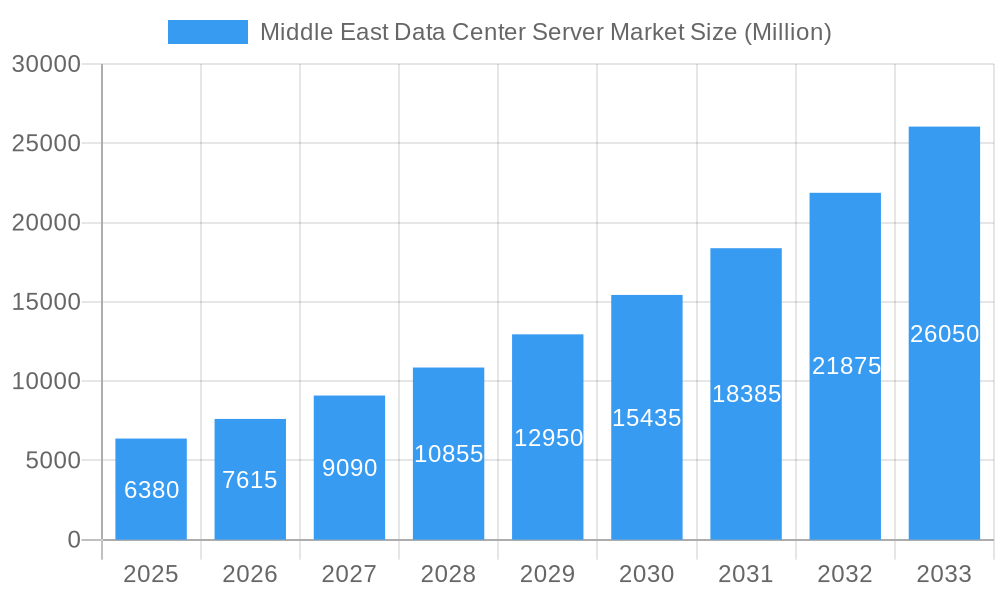

The Middle East Data Center Server Market is poised for significant expansion, with a projected market size of USD 6.38 billion in 2025, and is expected to witness a robust CAGR of 16.8% through 2033. This remarkable growth is fueled by a confluence of factors, including the escalating digital transformation initiatives across the region, particularly within the IT & Telecommunication, BFSI, and Government sectors. The increasing adoption of cloud computing services, the burgeoning demand for big data analytics, and the rapid deployment of 5G infrastructure are all contributing to a surge in the need for advanced and high-performance data center servers. Furthermore, substantial investments in smart city projects and the growing e-commerce landscape are creating a sustained demand for scalable and efficient server solutions. The market's trajectory is strongly supported by the increasing enterprise reliance on robust IT infrastructure to drive innovation and maintain a competitive edge in the rapidly evolving digital economy.

Middle East Data Center Server Market Market Size (In Billion)

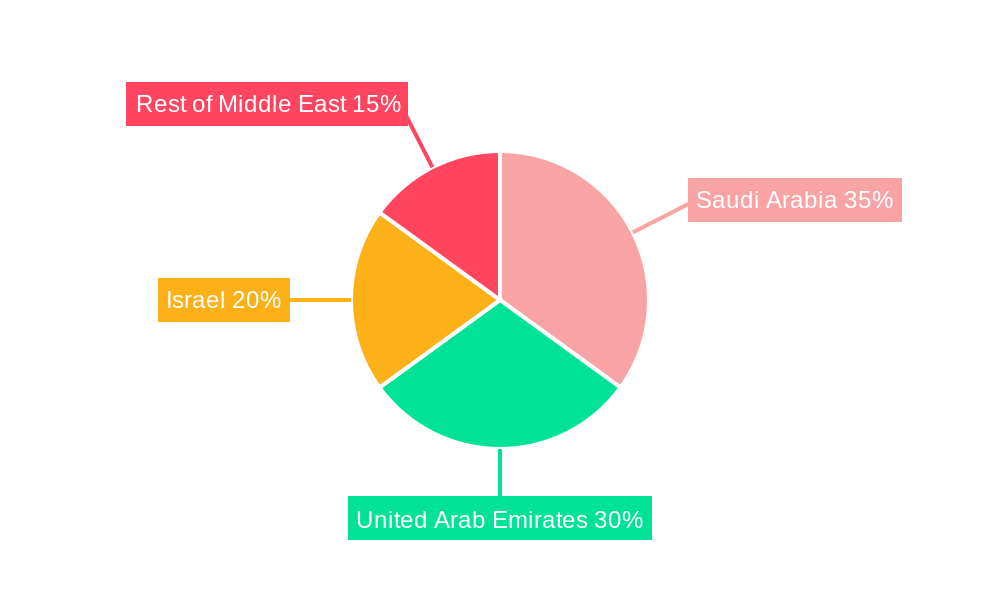

The market segmentation reveals a diversified demand across various server form factors, with Blade Servers and Rack Servers expected to dominate due to their density and scalability advantages, aligning with the needs of modern data centers. The Middle East region, encompassing key markets like Saudi Arabia, the United Arab Emirates, and Israel, is at the forefront of this server market expansion, driven by government visions for economic diversification and the development of advanced technological ecosystems. While the market benefits from strong growth drivers, potential restraints could include the initial capital expenditure required for high-end server deployments and the ongoing need for skilled IT professionals to manage and maintain these complex infrastructures. However, the overarching trend towards cloud-native architectures and hyper-converged infrastructure solutions is expected to mitigate these challenges, positioning the Middle East Data Center Server Market for sustained and dynamic growth over the forecast period.

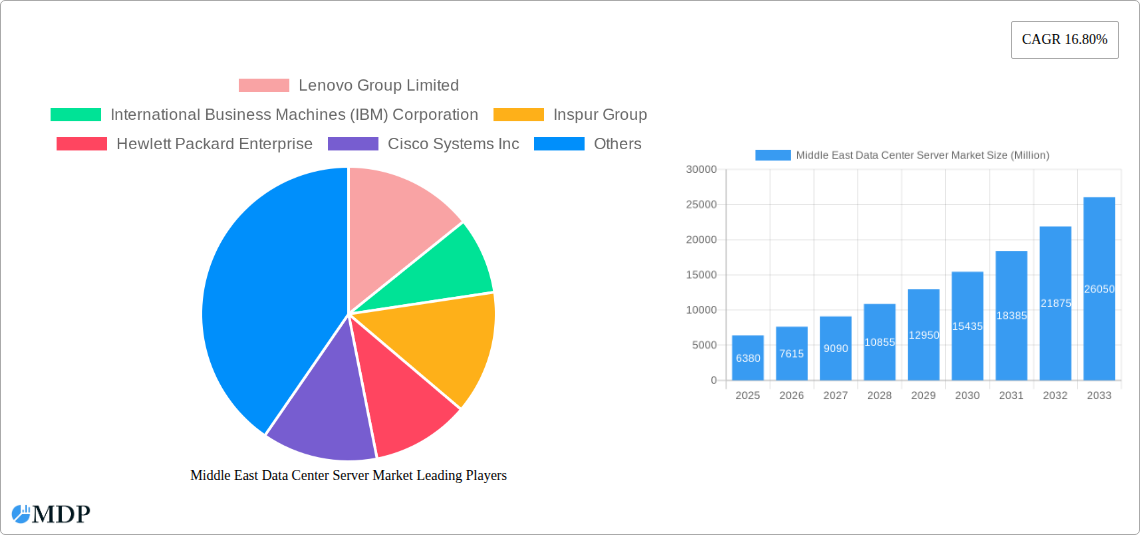

Middle East Data Center Server Market Company Market Share

Gain unparalleled insights into the rapidly evolving Middle East Data Center Server Market, a critical component fueling the region's digital transformation and burgeoning AI ambitions. This in-depth report provides a complete market landscape analysis from 2019 to 2033, with a detailed forecast for 2025-2033, and an estimated year of 2025. We dissect the market by Form Factor (Blade Server, Rack Server, Tower Server) and End-User (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-User), while highlighting key geographical segments like Saudi Arabia, United Arab Emirates, Israel, and the Rest of Middle East. Discover market dynamics, industry trends, leading players, product developments, growth drivers, challenges, opportunities, and strategic outlooks essential for stakeholders navigating this dynamic sector.

Middle East Data Center Server Market Market Dynamics & Concentration

The Middle East Data Center Server Market is characterized by moderate to high concentration, with a few key players dominating market share. Innovation drivers are primarily fueled by the escalating demand for cloud computing, artificial intelligence (AI), and high-performance computing (HPC) solutions across various industries. Regulatory frameworks are progressively becoming more conducive to data center development, with governments actively promoting digital infrastructure investments. Product substitutes exist, particularly in the realm of cloud-based server solutions, but dedicated on-premise and hybrid solutions remain crucial for specific security and performance needs. End-user trends indicate a significant shift towards hyperscale data centers and edge computing deployments to support an increasing volume of data generated by IoT devices and advanced analytics. Mergers and acquisitions (M&A) activities are anticipated to play a role in market consolidation and expansion, though specific deal counts for the Middle East data center server segment require further granular analysis within the report. The market is witnessing significant investments by both regional entities and international tech giants, aiming to capture a substantial share of this high-growth sector.

- Market Concentration: Dominated by a few global server manufacturers, with increasing regional player involvement.

- Innovation Drivers: AI/ML, Cloud Computing, 5G deployment, IoT, Big Data Analytics.

- Regulatory Frameworks: Evolving data localization policies, government incentives for digital infrastructure.

- Product Substitutes: Public cloud services, edge computing solutions.

- End-User Trends: Growing adoption of hybrid cloud, demand for specialized AI servers, increasing data sovereignty concerns.

- M&A Activities: Potential for strategic acquisitions to enhance market presence and technological capabilities.

Middle East Data Center Server Market Industry Trends & Analysis

The Middle East Data Center Server Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025-2033. This expansion is primarily driven by the region's ambitious digital transformation agendas and the escalating adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics. Governments across the Middle East are heavily investing in building state-of-the-art digital infrastructure to foster innovation and economic diversification, directly translating into increased demand for advanced server solutions. The burgeoning IT and Telecommunication sector, along with the BFSI (Banking, Financial Services, and Insurance) and Government segments, are leading the charge in adopting high-density, high-performance servers to manage vast datasets and complex computational workloads.

Technological disruptions are continuously reshaping the market. The increasing integration of AI and ML workloads is driving the demand for specialized servers equipped with powerful GPUs and high-speed interconnects. Furthermore, the widespread rollout of 5G networks is creating a need for more distributed computing capabilities, leading to the growth of edge data centers and the servers that power them. Consumer preferences are leaning towards more efficient, scalable, and energy-conscious server solutions. Manufacturers are responding by developing servers with improved power efficiency, higher processing capabilities within smaller form factors, and enhanced cooling technologies. The competitive dynamics are intense, with global giants like Lenovo Group Limited, International Business Machines (IBM) Corporation, Inspur Group, Hewlett Packard Enterprise, Cisco Systems Inc, Super Micro Computer Inc, Fujitsu Limited, Dell Inc, and Huawei Technologies Co Ltd vying for market share. The market penetration of advanced server technologies is expected to deepen as more enterprises and government entities recognize the strategic advantage of robust data center infrastructure. The overall market size is estimated to reach several billion dollars in the coming years, underscoring its significant economic impact.

Leading Markets & Segments in Middle East Data Center Server Market

The Middle East Data Center Server Market exhibits significant dominance across key geographical regions and specific segments, driven by distinct economic, technological, and policy-related factors.

Dominant Geography:

- Saudi Arabia: A leading market, propelled by its Vision 2030 initiative, which prioritizes massive investments in digital infrastructure, smart cities (e.g., NEOM), and the diversification of its economy away from oil. The government's commitment to fostering a knowledge-based economy and attracting foreign investment in technology is a primary catalyst for data center server demand. The country is actively developing hyperscale data centers to support its growing digital services and AI ambitions.

- United Arab Emirates (UAE): A well-established technology hub, the UAE continues to be a strong contender due to its advanced digital government initiatives, thriving FinTech sector, and a growing ecosystem of startups and established businesses reliant on robust data processing capabilities. Its strategic location and proactive approach to adopting new technologies further bolster its position.

Dominant Segments:

- Form Factor:

- Rack Server: Continues to be the most dominant form factor due to its versatility, scalability, and cost-effectiveness for a wide range of enterprise workloads. Its modular design allows for easy deployment and expansion in traditional data center environments.

- Blade Server: Witnessing significant growth, particularly in environments requiring high-density computing and power efficiency for demanding applications like AI, HPC, and large-scale virtualization. The ability to consolidate multiple servers into a single chassis, sharing power and cooling, makes it attractive for organizations seeking optimized space utilization.

- End-User:

- IT & Telecommunication: This segment is the primary driver of demand, fueled by the continuous need for network infrastructure upgrades, cloud service expansion, and the deployment of new digital services. The increasing data traffic and the rise of digital platforms necessitate powerful and scalable server solutions.

- BFSI: Driven by the need for secure, reliable, and high-performance computing for transaction processing, risk management, fraud detection, big data analytics, and the adoption of digital banking services. Data sovereignty and compliance requirements also play a crucial role in their server purchasing decisions.

- Government: Governments are increasingly investing in modernizing their IT infrastructure to enhance public services, improve citizen engagement, and support national security initiatives. Smart city projects and e-governance platforms are significant demand generators.

Middle East Data Center Server Market Product Developments

The Middle East Data Center Server Market is witnessing a rapid pace of product innovation aimed at enhancing performance, efficiency, and supporting emerging workloads. Key developments focus on increasing processing power, improving memory capabilities, and optimizing form factors for density and energy savings. Companies are introducing servers with next-generation CPUs and GPUs specifically designed for AI and HPC applications, offering accelerated data analytics and complex simulations. Advances in memory technology, such as the launch of higher capacity and faster DDR5 ECC Unbuffered DIMMs by manufacturers like Kingston Technology Company Inc., are critical for handling vast datasets. Furthermore, innovations in server architecture, including highly integrated blade server systems that offer superior computational performance in a smaller footprint with shared, redundant components, are designed to meet the demands of cloud computing, AI, and enterprise applications. These product developments are crucial for providing competitive advantages and meeting the evolving needs of the market.

Key Drivers of Middle East Data Center Server Market Growth

The Middle East Data Center Server Market is experiencing significant growth propelled by several key factors. Foremost among these is the aggressive digital transformation initiatives undertaken by governments across the region, aimed at diversifying economies and fostering innovation. This includes substantial investments in building smart cities and enhancing digital public services. The rapid adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Big Data Analytics across sectors like IT & Telecommunication, BFSI, and Government is creating an insatiable demand for high-performance computing power, directly benefiting the server market. Furthermore, the ongoing deployment of 5G networks is necessitating a robust and scalable data center infrastructure to support increased data traffic and new applications. Growing investments in cloud computing services, both public and private, also contribute significantly to the demand for server hardware.

Challenges in the Middle East Data Center Server Market Market

Despite the promising growth trajectory, the Middle East Data Center Server Market faces several challenges. Regulatory hurdles, particularly concerning data localization laws and evolving compliance standards across different countries, can add complexity and cost to deployments. Supply chain disruptions, exacerbated by global geopolitical factors and the specialized nature of server components, can lead to extended lead times and increased costs. Intense competitive pressures from established global players and emerging regional manufacturers can squeeze profit margins. The skilled workforce shortage in specialized IT infrastructure management and data center operations also presents a significant restraint. Furthermore, the high initial capital investment required for setting up and maintaining advanced data center server infrastructure can be a barrier for smaller enterprises.

Emerging Opportunities in Middle East Data Center Server Market

The Middle East Data Center Server Market is ripe with emerging opportunities, primarily driven by technological breakthroughs and strategic market expansion. The rapid advancement and adoption of AI and Machine Learning are creating a substantial demand for specialized, high-performance servers, presenting a significant growth avenue. The continued expansion of cloud computing services, both hyperscale and private cloud deployments, will drive ongoing server hardware procurement. Furthermore, the increasing focus on edge computing, fueled by the proliferation of IoT devices and the demand for real-time data processing, offers a new frontier for server deployments. Strategic partnerships between technology providers, telecommunication companies, and government entities are crucial for co-developing and deploying innovative data center solutions. The growing trend of data sovereignty and the need for localized data processing will also encourage the establishment of more regional data centers, creating further opportunities for server vendors.

Leading Players in the Middle East Data Center Server Market Sector

- Lenovo Group Limited

- International Business Machines (IBM) Corporation

- Inspur Group

- Hewlett Packard Enterprise

- Cisco Systems Inc

- Super Micro Computer Inc

- Fujitsu Limited

- Dell Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

Key Milestones in Middle East Data Center Server Market Industry

- June 2023: Kingston Technology Company, Inc. announced the launch of its 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs, enhancing memory performance for server applications.

- January 2023: Super Micro Computer Inc. announced the launch of its new server and storage portfolio with more than 15 families of performance-optimized systems. This includes SuperBlade systems designed for cloud computing, AI, HPC, enterprise, media, and 5G/telco/edge workloads, delivering high computational performance in a compact footprint with shared, redundant components, and featuring GPU-enabled blades for AI, Data Analytics, HPC, Cloud, and Enterprise applications.

Strategic Outlook for Middle East Data Center Server Market Market

The strategic outlook for the Middle East Data Center Server Market is overwhelmingly positive, with growth accelerators poised to drive sustained expansion. Continued government support for digital transformation, coupled with increasing private sector investment in cloud infrastructure and AI capabilities, will be the primary growth engines. The market is expected to see a rise in demand for specialized servers catering to AI, HPC, and edge computing workloads, necessitating continuous innovation from vendors. Strategic partnerships and collaborations will be key for market players to expand their reach and offer integrated solutions. Furthermore, the increasing emphasis on data security and sovereignty will likely lead to further development of regional data center hubs. Vendors focusing on energy-efficient, high-density, and scalable server solutions will be well-positioned to capitalize on the evolving demands of this dynamic market.

Middle East Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Israel

- 3.4. Rest of Middle East

Middle East Data Center Server Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Israel

- 4. Rest of Middle East

Middle East Data Center Server Market Regional Market Share

Geographic Coverage of Middle East Data Center Server Market

Middle East Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Technologies; Large-scale commercialization of 5G networks

- 3.3. Market Restrains

- 3.3.1. Rising CapEx for data center construction

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds the Major Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Israel

- 5.3.4. Rest of Middle East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Israel

- 5.4.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Saudi Arabia Middle East Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 6.1.1. Blade Server

- 6.1.2. Rack Server

- 6.1.3. Tower Server

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. IT & Telecommunication

- 6.2.2. BFSI

- 6.2.3. Government

- 6.2.4. Media & Entertainment

- 6.2.5. Other End-User

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Israel

- 6.3.4. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Form Factor

- 7. United Arab Emirates Middle East Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 7.1.1. Blade Server

- 7.1.2. Rack Server

- 7.1.3. Tower Server

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. IT & Telecommunication

- 7.2.2. BFSI

- 7.2.3. Government

- 7.2.4. Media & Entertainment

- 7.2.5. Other End-User

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Israel

- 7.3.4. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Form Factor

- 8. Israel Middle East Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 8.1.1. Blade Server

- 8.1.2. Rack Server

- 8.1.3. Tower Server

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. IT & Telecommunication

- 8.2.2. BFSI

- 8.2.3. Government

- 8.2.4. Media & Entertainment

- 8.2.5. Other End-User

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Israel

- 8.3.4. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Form Factor

- 9. Rest of Middle East Middle East Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form Factor

- 9.1.1. Blade Server

- 9.1.2. Rack Server

- 9.1.3. Tower Server

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. IT & Telecommunication

- 9.2.2. BFSI

- 9.2.3. Government

- 9.2.4. Media & Entertainment

- 9.2.5. Other End-User

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Israel

- 9.3.4. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Form Factor

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lenovo Group Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Business Machines (IBM) Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Inspur Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hewlett Packard Enterprise

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cisco Systems Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Super Micro Computer Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fujitsu Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dell Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Kingston Technology Company Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Huawei Technologies Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Middle East Data Center Server Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Data Center Server Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Data Center Server Market Revenue undefined Forecast, by Form Factor 2020 & 2033

- Table 2: Middle East Data Center Server Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: Middle East Data Center Server Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle East Data Center Server Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle East Data Center Server Market Revenue undefined Forecast, by Form Factor 2020 & 2033

- Table 6: Middle East Data Center Server Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 7: Middle East Data Center Server Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle East Data Center Server Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle East Data Center Server Market Revenue undefined Forecast, by Form Factor 2020 & 2033

- Table 10: Middle East Data Center Server Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 11: Middle East Data Center Server Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle East Data Center Server Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle East Data Center Server Market Revenue undefined Forecast, by Form Factor 2020 & 2033

- Table 14: Middle East Data Center Server Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 15: Middle East Data Center Server Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle East Data Center Server Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle East Data Center Server Market Revenue undefined Forecast, by Form Factor 2020 & 2033

- Table 18: Middle East Data Center Server Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 19: Middle East Data Center Server Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle East Data Center Server Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Server Market?

The projected CAGR is approximately 16.8%.

2. Which companies are prominent players in the Middle East Data Center Server Market?

Key companies in the market include Lenovo Group Limited, International Business Machines (IBM) Corporation, Inspur Group, Hewlett Packard Enterprise, Cisco Systems Inc, Super Micro Computer Inc, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd.

3. What are the main segments of the Middle East Data Center Server Market?

The market segments include Form Factor, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Technologies; Large-scale commercialization of 5G networks.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds the Major Share..

7. Are there any restraints impacting market growth?

Rising CapEx for data center construction.

8. Can you provide examples of recent developments in the market?

June 2023: Kingston Technology Company, Inc., a significant provider of memory products and technology solutions, announced the launch of its 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Server Market?

To stay informed about further developments, trends, and reports in the Middle East Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence