Key Insights

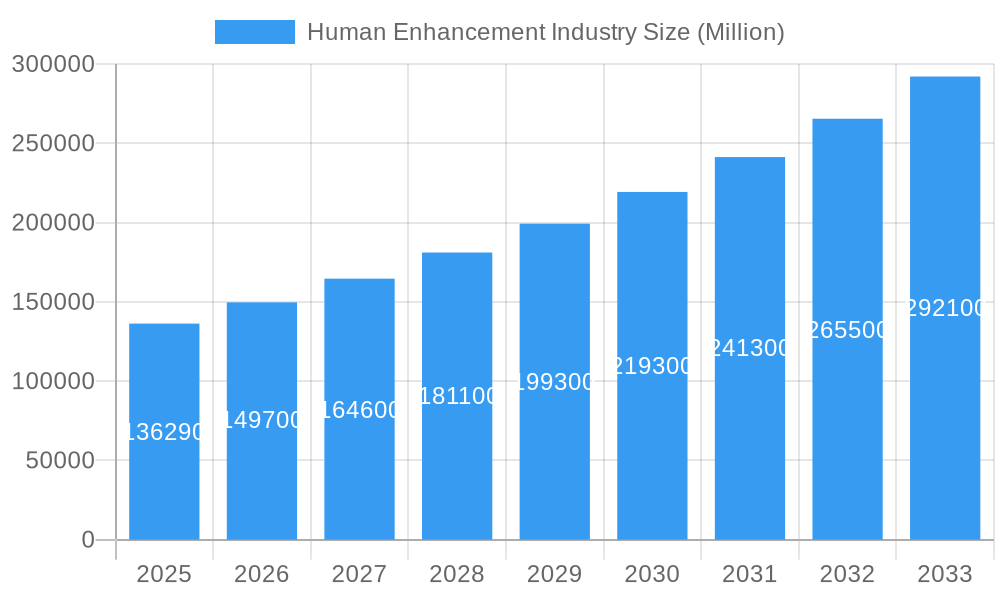

The Human Enhancement Industry is poised for significant expansion, with a projected market size of $136.29 billion in 2025, driven by rapid technological advancements and increasing consumer interest in improving human capabilities. This sector encompasses a diverse range of innovative products, including smartwatches, head-mounted displays, smart clothing, ear-worn devices, fitness trackers, body-worn cameras, exoskeletons, and advanced medical devices. The burgeoning demand for personalized health monitoring, cognitive augmentation, and physical performance enhancement is fueling this growth. Key players like Google LLC, Samsung Electronics Co. Ltd, and Rewalk Robotics Ltd are actively investing in research and development, introducing groundbreaking solutions that cater to both consumer and medical needs. The industry's trajectory is further bolstered by an impressive CAGR of 10.9%, indicating a sustained and robust upward trend throughout the forecast period of 2025-2033. This strong growth is expected to persist as new applications emerge and the adoption of existing technologies becomes more widespread across various demographics.

Human Enhancement Industry Market Size (In Billion)

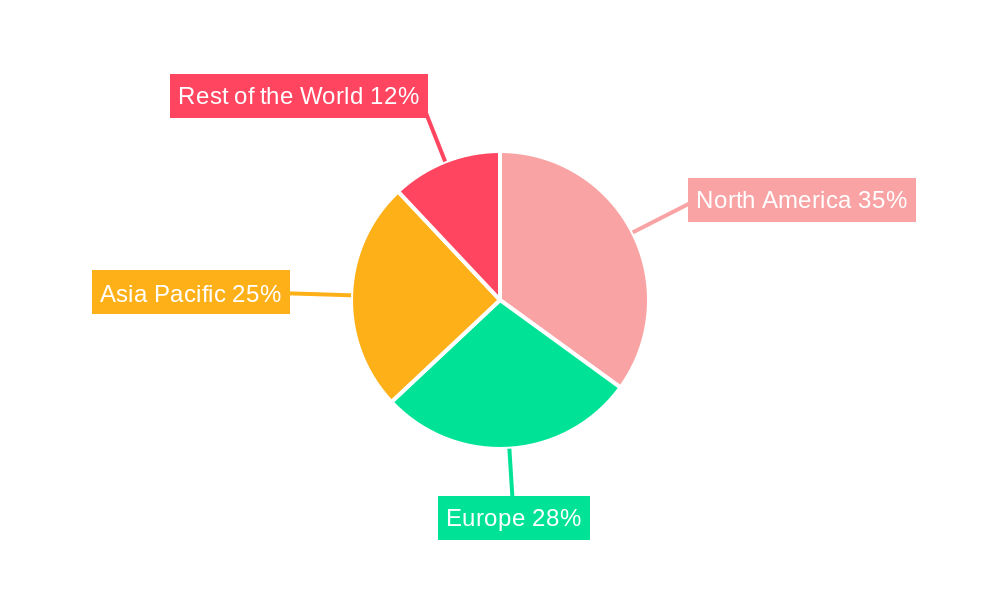

The market's expansion is propelled by several critical drivers, including the escalating prevalence of chronic diseases, a growing aging population, and a heightened awareness of proactive health and wellness. Furthermore, significant investments in wearable technology and the integration of artificial intelligence and virtual reality are opening new avenues for human enhancement. Emerging trends such as the development of brain-computer interfaces for neurological conditions and the rise of personalized medicine are expected to further catalyze market penetration. While the industry faces potential restraints related to high product costs, stringent regulatory frameworks for medical devices, and concerns surrounding data privacy and ethical implications, the overwhelming potential for improved quality of life and performance is likely to outweigh these challenges. North America currently leads the market, with Asia Pacific anticipated to exhibit the fastest growth due to increasing disposable incomes and a strong focus on technological innovation.

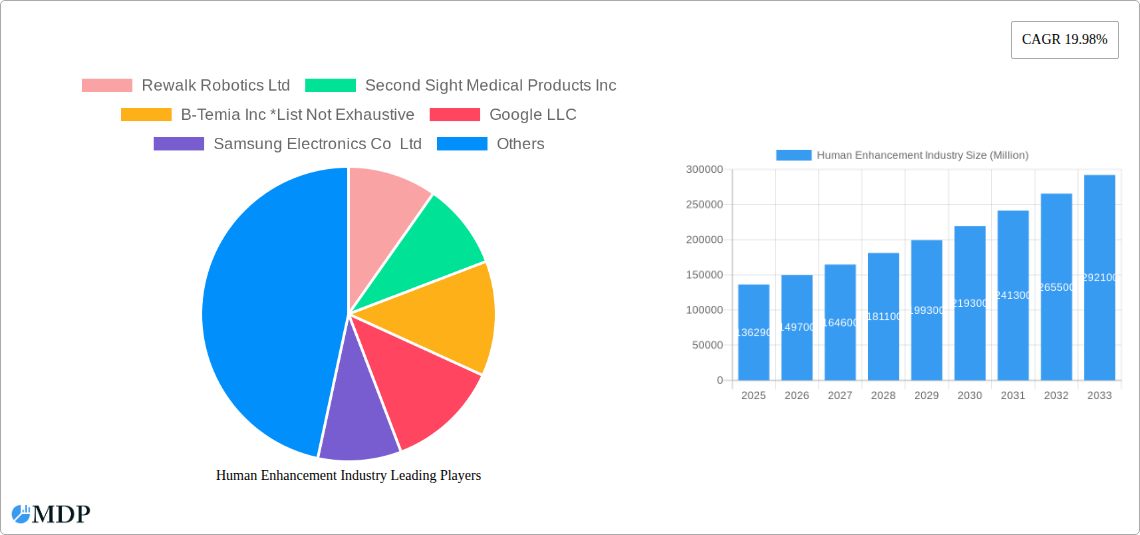

Human Enhancement Industry Company Market Share

Human Enhancement Industry Market Research Report: Unlocking the Future of Human Potential

Gain critical insights into the rapidly evolving Human Enhancement Industry with this comprehensive market research report. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, this report delivers actionable intelligence for industry stakeholders, investors, and innovators. Explore market dynamics, technological advancements, leading segments, and strategic opportunities shaping the future of human augmentation, projected to reach a valuation exceeding one billion dollars.

Human Enhancement Industry Market Dynamics & Concentration

The Human Enhancement Industry is characterized by a dynamic and increasingly concentrated market landscape. Innovation drivers are propelled by relentless technological advancements in AI, biotechnology, and miniaturization, fostering the development of sophisticated wearables and implantable devices. Regulatory frameworks, while evolving, present a significant factor influencing market entry and product approval, particularly for medical devices. Product substitutes, ranging from traditional assistive technologies to advanced digital interfaces, are constantly emerging, compelling companies to innovate rapidly. End-user trends highlight a growing demand for personalized health monitoring, performance optimization, and improved quality of life, particularly among aging populations and individuals seeking to overcome physical limitations. Mergers and acquisitions (M&A) are a notable trend, with larger tech conglomerates and established healthcare companies strategically acquiring innovative startups to expand their portfolios and gain market share. For instance, recent M&A activities indicate a consolidation pattern, with estimated deal counts exceeding a few dozen annually, signifying a strong drive towards market control by key players. Market share is gradually shifting as specialized companies in areas like prosthetics and neurotechnology gain traction.

Human Enhancement Industry Industry Trends & Analysis

The Human Enhancement Industry is poised for exponential growth, driven by a confluence of factors that are fundamentally reshaping human capabilities and well-being. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx%, significantly exceeding broader technology market benchmarks. This surge is fueled by escalating consumer interest in proactive health management, performance enhancement for both physical and cognitive domains, and the increasing prevalence of age-related conditions requiring assistive technologies. Technological disruptions are at the forefront, with advancements in artificial intelligence, machine learning, and biosensors enabling the creation of increasingly sophisticated and personalized enhancement solutions. From AI-powered self-care advisors integrated into smartwatches to advanced brain-computer interfaces, the industry is pushing the boundaries of what is considered humanly possible. Consumer preferences are shifting towards seamless integration of technology into daily life, demanding devices that are not only functional but also aesthetically pleasing and intuitive to use. The competitive dynamics are intensifying, with a blend of established tech giants like Google LLC and Samsung Electronics Co Ltd, and specialized innovators like Rewalk Robotics Ltd and Second Sight Medical Products Inc, vying for market dominance. Market penetration is rapidly increasing across various segments, as the affordability and accessibility of human enhancement technologies continue to improve, making them available to a wider demographic.

Leading Markets & Segments in Human Enhancement Industry

The Human Enhancement Industry exhibits a strong regional dominance in North America, driven by robust research and development infrastructure, a high disposable income, and a proactive regulatory environment that supports innovation. Within North America, the United States stands out as a leading country, boasting a high concentration of key industry players and a significant consumer base receptive to advanced technologies.

The Product segment showcasing the most significant growth and market penetration is Medical Devices. This dominance is attributable to the critical need for assistive technologies that improve the quality of life for individuals with disabilities, chronic illnesses, and age-related impairments. Key drivers for this segment include:

- Aging Global Population: The increasing life expectancy worldwide translates to a larger demographic requiring medical devices for mobility, sensory restoration, and cognitive support.

- Advancements in Prosthetics and Bionics: Innovations in materials science, robotics, and AI have led to the development of highly sophisticated and responsive prosthetics and exoskeletons, restoring lost function and enhancing physical capabilities. Companies like Ekso Bionics Holdings Inc and Rewalk Robotics Ltd are at the forefront of this revolution.

- Neurotechnology Breakthroughs: Progress in understanding the human brain and developing brain-computer interfaces (BCIs) is opening new avenues for treating neurological disorders and enabling communication and control for individuals with severe motor impairments. Braingate Company is a key player in this domain.

- Wearable Health Monitoring: The integration of advanced sensors into devices like smartwatches and fitness trackers allows for continuous monitoring of vital signs, early detection of health issues, and personalized health management, aligning with the growing trend of preventative healthcare.

- Investment in Healthcare Innovation: Significant investment from both public and private sectors in healthcare R&D fuels the development and adoption of cutting-edge medical devices.

While Smartwatch and Head-mounted Display segments are experiencing substantial growth due to consumer electronics adoption and burgeoning AR/VR applications, their current market share and immediate impact on human enhancement are primarily focused on lifestyle and productivity enhancements rather than direct medical or critical functional restoration. However, their integration with medical data and applications is rapidly blurring these lines, positioning them as crucial components of the broader human enhancement ecosystem.

Human Enhancement Industry Product Developments

Product innovations in the Human Enhancement Industry are rapidly accelerating, focusing on miniaturization, increased functionality, and seamless user integration. Key developments include advanced smartwatches like CITIZEN's CZ Smart, offering AI-driven self-care advisors, and Samsung's Galaxy Watch 4 series, integrating vital health metrics like blood pressure and ECG. The emergence of sophisticated Head-mounted Displays from companies like Magic Leap Inc and Vuzix Corporation promises to revolutionize augmented reality applications for training, rehabilitation, and assistive tasks. Furthermore, the evolution of smart clothing and ear-worn devices is enabling discreet and continuous biometric monitoring and sensory augmentation. The competitive advantage lies in offering personalized, data-driven solutions that enhance physical capabilities, cognitive functions, and overall well-being, addressing unmet needs in both healthcare and performance optimization.

Key Drivers of Human Enhancement Industry Growth

Several key drivers are propelling the growth of the Human Enhancement Industry. Technological advancements, particularly in artificial intelligence, machine learning, and miniaturized sensor technology, are enabling the creation of more sophisticated and accessible enhancement solutions. Economic factors, such as increasing disposable income and a growing global emphasis on preventative healthcare and personal well-being, are boosting consumer spending on enhancement technologies. Regulatory support for innovative medical devices and assistive technologies, coupled with government initiatives promoting research and development, further catalyze market expansion. The increasing prevalence of age-related conditions and physical disabilities creates a sustained demand for solutions that improve quality of life and restore lost functions.

Challenges in the Human Enhancement Industry Market

Despite its promising trajectory, the Human Enhancement Industry faces several significant challenges. Stringent and evolving regulatory hurdles, particularly for invasive or high-risk technologies, can impede product development and market entry, leading to extended approval timelines and substantial compliance costs. Supply chain complexities for specialized components and manufacturing processes can lead to production bottlenecks and increased costs. Intense competitive pressures from both established technology giants and emerging startups necessitate continuous innovation and significant R&D investment, impacting profit margins. Furthermore, ethical considerations surrounding privacy, data security, and potential societal inequalities related to access and affordability of enhancement technologies remain critical areas requiring careful navigation.

Emerging Opportunities in Human Enhancement Industry

Emerging opportunities in the Human Enhancement Industry are abundant, driven by continuous technological breakthroughs and evolving societal needs. The burgeoning field of neurotechnology, including advanced brain-computer interfaces and neuro-modulation devices, presents transformative potential for treating neurological disorders and enhancing cognitive functions. Strategic partnerships between tech companies, healthcare providers, and research institutions are accelerating the development and adoption of integrated human enhancement solutions. Market expansion into developing economies, as accessibility and affordability improve, offers significant untapped potential. Furthermore, the growing demand for personalized and preventative health solutions is creating lucrative opportunities for companies offering data-driven wearable devices and biofeedback systems.

Leading Players in the Human Enhancement Industry Sector

- Rewalk Robotics Ltd

- Second Sight Medical Products Inc

- B-Temia Inc

- Google LLC

- Samsung Electronics Co Ltd

- Magic Leap Inc

- Raytheon Company

- Braingate Company

- Vuzix Corporation

- Ekso Bionics Holdings Inc

Key Milestones in Human Enhancement Industry Industry

- January 2023: CITIZEN, a watchmaking company, announced the launch of the new version of CZ Smart, the Smarter Smartwatch, at CES (Consumer Electronics Show) 2023. It provides a built-in self-care advisor through the proprietary CZ Smart YouQ application, developed using research pioneered by NASA's Ames Research Center and AI built through CITIZEN partnerships utilizing the environment and tools within IBM Watson® Studio on IBM Cloud.

- April 2022: After a recent firmware update, Samsung announced the Blood Pressure Monitor and ECG (Electrocardiography) features on the Galaxy Watch 4 series in Canada.

Strategic Outlook for Human Enhancement Industry Market

The strategic outlook for the Human Enhancement Industry market is exceptionally strong, driven by an unprecedented convergence of technological advancements and growing societal demand for improved human capabilities. Future market potential will be significantly shaped by continued innovation in AI-powered personalization, miniaturized bio-integrated devices, and advanced neuro-enhancement technologies. Companies that focus on developing ethical, accessible, and user-centric solutions, while forging strategic alliances across the tech and healthcare ecosystems, are best positioned for long-term success. The increasing integration of these technologies into everyday life and healthcare systems suggests a sustained period of growth and transformative impact on human potential and well-being.

Human Enhancement Industry Segmentation

-

1. Product

- 1.1. Smartwatch

- 1.2. Head-mounted Display

- 1.3. Smart Clothing

- 1.4. Ear-worn

- 1.5. Fitness Tracker

- 1.6. Body-worn Camera

- 1.7. Exoskeleton

- 1.8. Medical Devices

Human Enhancement Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Human Enhancement Industry Regional Market Share

Geographic Coverage of Human Enhancement Industry

Human Enhancement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Incremental Technological Advancements in Wearables Aiding the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Costs and Data Security Concerns

- 3.4. Market Trends

- 3.4.1. Smartwatch to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Human Enhancement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Smartwatch

- 5.1.2. Head-mounted Display

- 5.1.3. Smart Clothing

- 5.1.4. Ear-worn

- 5.1.5. Fitness Tracker

- 5.1.6. Body-worn Camera

- 5.1.7. Exoskeleton

- 5.1.8. Medical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Human Enhancement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Smartwatch

- 6.1.2. Head-mounted Display

- 6.1.3. Smart Clothing

- 6.1.4. Ear-worn

- 6.1.5. Fitness Tracker

- 6.1.6. Body-worn Camera

- 6.1.7. Exoskeleton

- 6.1.8. Medical Devices

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Human Enhancement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Smartwatch

- 7.1.2. Head-mounted Display

- 7.1.3. Smart Clothing

- 7.1.4. Ear-worn

- 7.1.5. Fitness Tracker

- 7.1.6. Body-worn Camera

- 7.1.7. Exoskeleton

- 7.1.8. Medical Devices

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Human Enhancement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Smartwatch

- 8.1.2. Head-mounted Display

- 8.1.3. Smart Clothing

- 8.1.4. Ear-worn

- 8.1.5. Fitness Tracker

- 8.1.6. Body-worn Camera

- 8.1.7. Exoskeleton

- 8.1.8. Medical Devices

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Human Enhancement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Smartwatch

- 9.1.2. Head-mounted Display

- 9.1.3. Smart Clothing

- 9.1.4. Ear-worn

- 9.1.5. Fitness Tracker

- 9.1.6. Body-worn Camera

- 9.1.7. Exoskeleton

- 9.1.8. Medical Devices

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Rewalk Robotics Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Second Sight Medical Products Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 B-Temia Inc *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Google LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Magic Leap Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Raytheon Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Braingate Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vuzix Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ekso Bionics Holdings Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Rewalk Robotics Ltd

List of Figures

- Figure 1: Global Human Enhancement Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Human Enhancement Industry Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Human Enhancement Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Human Enhancement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Human Enhancement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Human Enhancement Industry Revenue (undefined), by Product 2025 & 2033

- Figure 7: Europe Human Enhancement Industry Revenue Share (%), by Product 2025 & 2033

- Figure 8: Europe Human Enhancement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Human Enhancement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Human Enhancement Industry Revenue (undefined), by Product 2025 & 2033

- Figure 11: Asia Pacific Human Enhancement Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Asia Pacific Human Enhancement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Human Enhancement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Human Enhancement Industry Revenue (undefined), by Product 2025 & 2033

- Figure 15: Rest of the World Human Enhancement Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Rest of the World Human Enhancement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Human Enhancement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Human Enhancement Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Human Enhancement Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Human Enhancement Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 4: Global Human Enhancement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Human Enhancement Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Human Enhancement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Human Enhancement Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 8: Global Human Enhancement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Human Enhancement Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Global Human Enhancement Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Enhancement Industry?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the Human Enhancement Industry?

Key companies in the market include Rewalk Robotics Ltd, Second Sight Medical Products Inc, B-Temia Inc *List Not Exhaustive, Google LLC, Samsung Electronics Co Ltd, Magic Leap Inc, Raytheon Company, Braingate Company, Vuzix Corporation, Ekso Bionics Holdings Inc.

3. What are the main segments of the Human Enhancement Industry?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Incremental Technological Advancements in Wearables Aiding the Market Growth.

6. What are the notable trends driving market growth?

Smartwatch to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Costs and Data Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2023: CITIZEN, a watchmaking company, announced the launch of the new version of CZ Smart, the Smarter Smartwatch, at CES (Consumer Electronics Show) 2023. It provides a built-in self-care advisor through the proprietary CZ Smart YouQ application, developed using research pioneered by NASA's Ames Research Center and AI built through CITIZEN partnerships utilizing the environment and tools within IBM Watson® Studio on IBM Cloud.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Enhancement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Enhancement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Enhancement Industry?

To stay informed about further developments, trends, and reports in the Human Enhancement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence