Key Insights

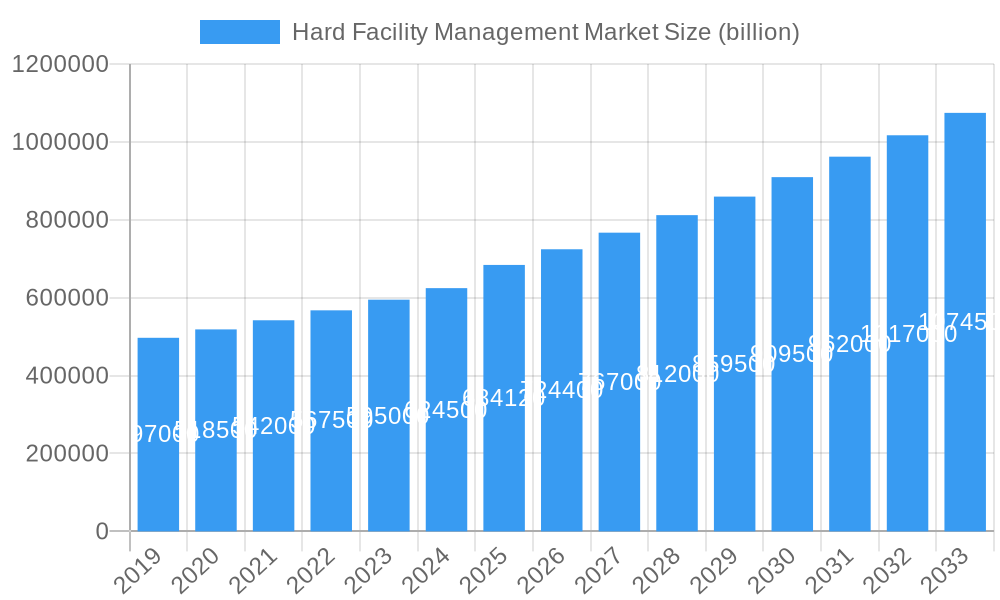

The global Hard Facility Management (FM) market is poised for robust expansion, projected to reach $684.12 billion by 2025. This impressive growth is underpinned by a Compound Annual Growth Rate (CAGR) of 5.8% from 2019 to 2033, indicating sustained upward momentum. A primary driver for this surge is the increasing demand for specialized Mechanical, Electrical, and Plumbing (MEP) services, essential for maintaining the operational integrity and energy efficiency of commercial and industrial buildings. Furthermore, the growing adoption of Enterprise Asset Management (EAM) solutions is enabling organizations to optimize asset lifecycles, reduce downtime, and enhance overall facility performance. The rising awareness among businesses regarding the importance of maintaining a safe, secure, and well-functioning physical environment is also a significant catalyst, pushing companies to invest more in outsourced hard FM services.

Hard Facility Management Market Market Size (In Billion)

The market's expansion is further fueled by key trends such as the integration of smart building technologies and the growing emphasis on sustainability within facility operations. These advancements allow for predictive maintenance, energy optimization, and improved resource management, leading to cost savings and enhanced operational efficiency. While the market is largely driven by these positive factors, certain restraints, such as initial high investment costs for sophisticated FM technologies and a shortage of skilled labor in specific regions, may temper growth in localized areas. However, the overarching trend points towards a market that is increasingly vital for businesses across commercial, institutional, public/infrastructure, and industrial sectors, seeking to streamline operations, ensure compliance, and maximize the value of their physical assets.

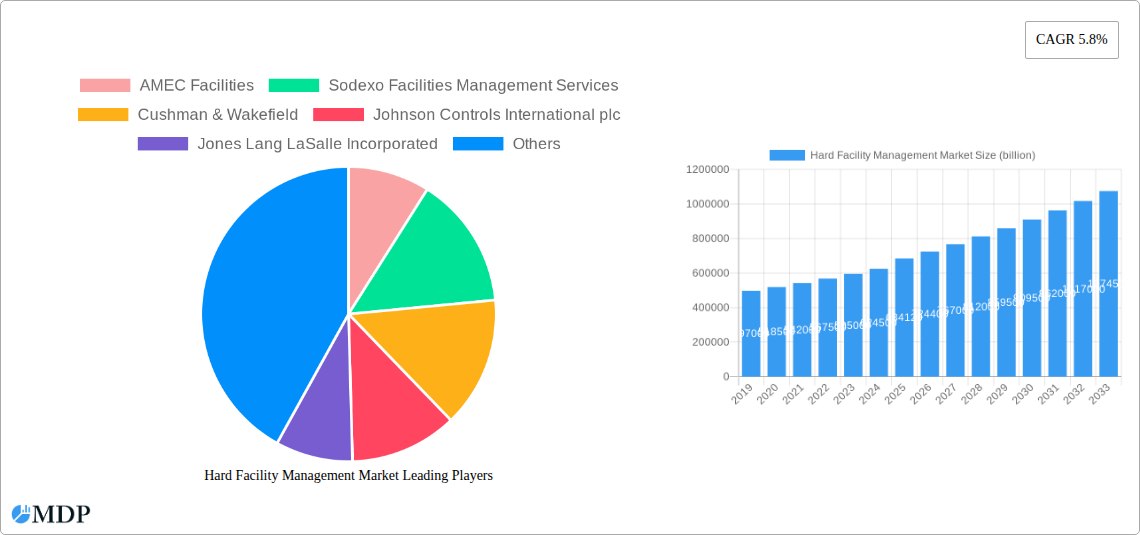

Hard Facility Management Market Company Market Share

Hard Facility Management Market: Global Industry Analysis and Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Hard Facility Management Market, providing critical insights for industry stakeholders. Explore market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and strategic outlook from 2019 to 2033, with a base and estimated year of 2025. The report leverages high-traffic keywords to maximize search visibility, covering segments like MEP, Enterprise Asset Management, and Other Hard FM Services, and end-users including Commercial, Institutional, Public/Infrastructure, Industrial, and Other End Users. Discover how companies such as AMEC Facilities, Sodexo Facilities Management Services, Cushman & Wakefield, Johnson Controls International plc, Jones Lang LaSalle Incorporated, Mitie Group PLC, Aramark Corporation, CB Richard Ellis (CBRE), ISS A/S, and Compass Group PLC are shaping the future of hard facility management.

Hard Facility Management Market Market Dynamics & Concentration

The Hard Facility Management Market is characterized by moderate to high concentration, with leading players like Cushman & Wakefield, Jones Lang LaSalle Incorporated, and CB Richard Ellis (CBRE) holding significant market share, estimated at over 30% collectively in 2025. Innovation is a key driver, fueled by the increasing adoption of digital technologies such as IoT for predictive maintenance and AI for operational efficiency. Regulatory frameworks, particularly around health, safety, and sustainability, are becoming more stringent, influencing service delivery and investment priorities. While product substitutes are limited for core hard FM services like MEP, advancements in smart building technology are offering integrated solutions that could potentially impact standalone service demand. End-user trends are shifting towards demand for integrated, sustainable, and technologically advanced FM solutions across Commercial, Institutional, and Industrial sectors. Mergers and Acquisitions (M&A) are a notable aspect of market dynamics, with an estimated 15-20 M&A deals projected annually during the forecast period, driven by the pursuit of market expansion, service diversification, and economies of scale.

Hard Facility Management Market Industry Trends & Analysis

The Hard Facility Management Market is experiencing robust growth, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033). This expansion is primarily driven by increasing urbanization, a growing emphasis on operational efficiency and cost optimization within businesses, and the rising demand for sophisticated building maintenance and management services across diverse end-user segments. Technological disruptions are at the forefront of this evolution, with the integration of the Internet of Things (IoT), Artificial Intelligence (AI), and Building Information Modeling (BIM) revolutionizing how hard FM services are delivered and managed. IoT sensors enable real-time monitoring of building systems, facilitating predictive maintenance and minimizing downtime. AI is being employed for data analytics to optimize energy consumption, improve resource allocation, and enhance overall facility performance. BIM provides a digital representation of a building, offering invaluable data for lifecycle management and maintenance planning. Consumer preferences are evolving from basic maintenance to a demand for holistic facility management solutions that encompass sustainability, employee well-being, and enhanced occupant experience. Companies are increasingly seeking partners who can offer integrated services, reduce operational burdens, and contribute to their environmental, social, and governance (ESG) goals. The competitive landscape is characterized by intense rivalry among global players and regional specialists, with a strong focus on service differentiation, technological innovation, and strategic partnerships. Market penetration is steadily increasing, particularly in developing economies where the adoption of modern facility management practices is gaining momentum, further contributing to the overall market growth trajectory. The estimated market size is expected to reach over $1.5 trillion by 2033.

Leading Markets & Segments in Hard Facility Management Market

The Commercial end-user segment stands as the dominant force within the Hard Facility Management Market, projected to account for over 35% of the market share by 2025. This dominance is fueled by the extensive infrastructure of office buildings, retail spaces, and hospitality venues, all of which require continuous and sophisticated hard FM services to ensure operational continuity, occupant safety, and a positive user experience. Economic policies promoting business growth and urban development directly correlate with increased demand for FM services in commercial properties. Furthermore, the growing trend of outsourcing non-core functions by commercial enterprises further bolsters this segment.

Within the Type segmentation, MEP (Mechanical, Electrical, and Plumbing) services represent the largest and most critical component, capturing an estimated 45% of the market in 2025. The intricate and vital nature of MEP systems in modern buildings, encompassing everything from HVAC and power distribution to water management and sanitation, necessitates specialized expertise and consistent maintenance. Aging infrastructure in many regions also drives demand for MEP upgrades and repairs. The Enterprise Asset Management segment is also experiencing significant growth, driven by the need for comprehensive management of an organization's physical assets throughout their lifecycle, from acquisition to disposal, to optimize their performance and lifespan.

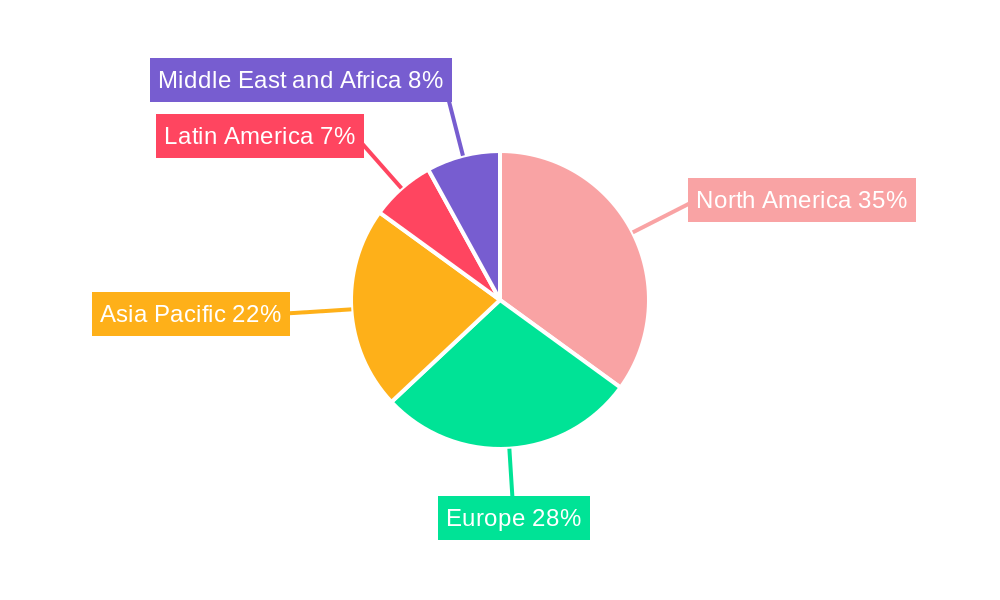

Geographically, North America is projected to remain the leading market, driven by its established commercial real estate sector, high adoption of advanced technologies, and stringent regulatory standards. However, the Asia Pacific region is exhibiting the fastest growth, propelled by rapid urbanization, significant infrastructure development projects, and increasing foreign investment, leading to a surge in demand for high-quality hard FM services across Industrial and Institutional sectors. In the Public/Infrastructure segment, governments are increasingly investing in the maintenance and modernization of public facilities, transportation networks, and utilities, creating substantial opportunities for hard FM providers.

- Key Drivers in Commercial Segment: Business expansion, office space utilization, retail footfall, hospitality demand, ESG initiatives.

- Key Drivers in MEP Segment: Building age, energy efficiency mandates, regulatory compliance, technological upgrades.

- Key Drivers in Enterprise Asset Management: Asset lifecycle cost reduction, operational efficiency, risk mitigation, data-driven decision making.

- Key Drivers in North America: Mature market, technological adoption, regulatory rigor, strong private sector investment.

- Key Drivers in Asia Pacific: Rapid urbanization, infrastructure development, foreign investment, growing middle class.

Hard Facility Management Market Product Developments

Product developments in the Hard Facility Management Market are increasingly focused on intelligent solutions that enhance efficiency and sustainability. The integration of IoT sensors into building systems allows for real-time data collection on performance and potential issues, enabling proactive maintenance and reducing costly downtime. AI-powered analytics are being developed to optimize energy consumption in HVAC systems, predict equipment failures, and automate routine tasks. Furthermore, advancements in Building Information Modeling (BIM) are facilitating more accurate lifecycle management and predictive maintenance strategies. These innovations offer competitive advantages by reducing operational costs, improving building performance, and enhancing occupant comfort and safety, directly aligning with market demand for smarter, more efficient facilities.

Key Drivers of Hard Facility Management Market Growth

Several key drivers are propelling the Hard Facility Management Market forward. Technologically, the increasing adoption of IoT, AI, and data analytics for predictive maintenance and operational efficiency is a significant catalyst. Economically, global urbanization and the expansion of commercial and industrial sectors necessitate robust facility management to support business operations and infrastructure. Regulatory factors, such as stricter health, safety, and environmental standards (e.g., energy efficiency mandates), are compelling organizations to invest in advanced FM solutions. Furthermore, the growing trend of outsourcing non-core activities by businesses to focus on their core competencies significantly boosts demand for professional hard FM services.

Challenges in the Hard Facility Management Market Market

Despite robust growth, the Hard Facility Management Market faces several challenges. Regulatory hurdles, including complex compliance requirements across different regions, can increase operational costs and implementation timelines. Supply chain issues, particularly for specialized equipment and skilled labor, can lead to project delays and increased expenses. The competitive pressure from both large global players and smaller, specialized service providers can impact pricing and profit margins. Additionally, resistance to adopting new technologies and a shortage of skilled professionals adept at managing advanced FM systems can hinder market penetration and innovation. The estimated impact of these challenges on market growth is a potential reduction of 1-2% in projected CAGR.

Emerging Opportunities in Hard Facility Management Market

Emerging opportunities in the Hard Facility Management Market are largely driven by technological breakthroughs and evolving business needs. The increasing demand for sustainable and green building practices presents a significant opportunity for FM providers to offer eco-friendly solutions, energy management services, and waste reduction strategies, aligning with global ESG goals. Strategic partnerships between technology providers and FM companies are creating integrated smart building solutions, offering end-to-end management capabilities. Furthermore, the expansion of emerging economies and the ongoing development of infrastructure in these regions offer substantial untapped market potential for hard FM services. The growing focus on occupant well-being and the creation of smart, connected workplaces also opens avenues for specialized FM services.

Leading Players in the Hard Facility Management Market Sector

- AMEC Facilities

- Sodexo Facilities Management Services

- Cushman & Wakefield

- Johnson Controls International plc

- Jones Lang LaSalle Incorporated

- Mitie Group PLC

- Aramark Corporation

- CB Richard Ellis (CBRE)

- ISS A/S

- Compass Group PLC

Key Milestones in Hard Facility Management Market Industry

- September 2022: Sodexo India announced its expansion into employee-providing services, a strategic move that garnered global publicity and enhanced its service portfolio.

- August 2022: ISS AS revealed plans for a significant expansion of its India business over the next three years, aiming to increase its employee headcount by 25-30% to capitalize on robust economic growth and increased activity in both office and production sectors.

Strategic Outlook for Hard Facility Management Market Market

The strategic outlook for the Hard Facility Management Market is highly positive, driven by continuous technological advancements and increasing organizational reliance on efficient and sustainable facility operations. Growth accelerators include the ongoing digitalization of building management systems, leading to greater automation and predictive capabilities. The rising emphasis on ESG compliance and corporate sustainability will further propel demand for green FM solutions. Strategic opportunities lie in developing integrated service offerings that combine hard and soft FM, catering to clients seeking a single point of accountability. Furthermore, market expansion into developing economies and strategic acquisitions to gain market share and technological capabilities will be crucial for sustained growth in the coming years. The projected market size is expected to reach over $1.5 trillion by 2033.

Hard Facility Management Market Segmentation

-

1. Type

- 1.1. MEP

- 1.2. Enterprise Asset Management

- 1.3. Other Hard FM Services

-

2. End User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End Users

Hard Facility Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Hard Facility Management Market Regional Market Share

Geographic Coverage of Hard Facility Management Market

Hard Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Post-COVID Demand for HFM; Rise in Use of Enterprise Asset Management (EAM)

- 3.3. Market Restrains

- 3.3.1. Staff Shortage Across the Globe

- 3.4. Market Trends

- 3.4.1. Robust Post-COVID Demand for HFM

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hard Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. MEP

- 5.1.2. Enterprise Asset Management

- 5.1.3. Other Hard FM Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hard Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. MEP

- 6.1.2. Enterprise Asset Management

- 6.1.3. Other Hard FM Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Institutional

- 6.2.3. Public/Infrastructure

- 6.2.4. Industrial

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Hard Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. MEP

- 7.1.2. Enterprise Asset Management

- 7.1.3. Other Hard FM Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Institutional

- 7.2.3. Public/Infrastructure

- 7.2.4. Industrial

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. MEP

- 8.1.2. Enterprise Asset Management

- 8.1.3. Other Hard FM Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Institutional

- 8.2.3. Public/Infrastructure

- 8.2.4. Industrial

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Hard Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. MEP

- 9.1.2. Enterprise Asset Management

- 9.1.3. Other Hard FM Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Institutional

- 9.2.3. Public/Infrastructure

- 9.2.4. Industrial

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Hard Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. MEP

- 10.1.2. Enterprise Asset Management

- 10.1.3. Other Hard FM Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Institutional

- 10.2.3. Public/Infrastructure

- 10.2.4. Industrial

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AMEC Facilities

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sodexo Facilities Management Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cushman & Wakefield

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson Controls International plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jones Lang LaSalle Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitie Group PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aramark Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CB Richard Ellis (CBRE )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ISS A/S

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Compass Group PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AMEC Facilities

List of Figures

- Figure 1: Global Hard Facility Management Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hard Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Hard Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hard Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Hard Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Hard Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hard Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Hard Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Hard Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Hard Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Hard Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Hard Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Hard Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Hard Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Hard Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Hard Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Hard Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Hard Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Hard Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Hard Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Hard Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Hard Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Latin America Hard Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Hard Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Hard Facility Management Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Hard Facility Management Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Hard Facility Management Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Hard Facility Management Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East and Africa Hard Facility Management Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Hard Facility Management Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Hard Facility Management Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hard Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Hard Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Hard Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hard Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Hard Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Hard Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Hard Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Hard Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Hard Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Hard Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Hard Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Hard Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Hard Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Hard Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Hard Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Hard Facility Management Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Hard Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Hard Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hard Facility Management Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Hard Facility Management Market?

Key companies in the market include AMEC Facilities, Sodexo Facilities Management Services, Cushman & Wakefield, Johnson Controls International plc, Jones Lang LaSalle Incorporated, Mitie Group PLC, Aramark Corporation, CB Richard Ellis (CBRE ), ISS A/S, Compass Group PLC.

3. What are the main segments of the Hard Facility Management Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 684.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Robust Post-COVID Demand for HFM; Rise in Use of Enterprise Asset Management (EAM).

6. What are the notable trends driving market growth?

Robust Post-COVID Demand for HFM.

7. Are there any restraints impacting market growth?

Staff Shortage Across the Globe.

8. Can you provide examples of recent developments in the market?

September 2022: Sodexo India announced that it was extending its service avenues by adding employee-providing services to its portfolio. This national movement provided Sodexo with global publicity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hard Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hard Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hard Facility Management Market?

To stay informed about further developments, trends, and reports in the Hard Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence