Key Insights

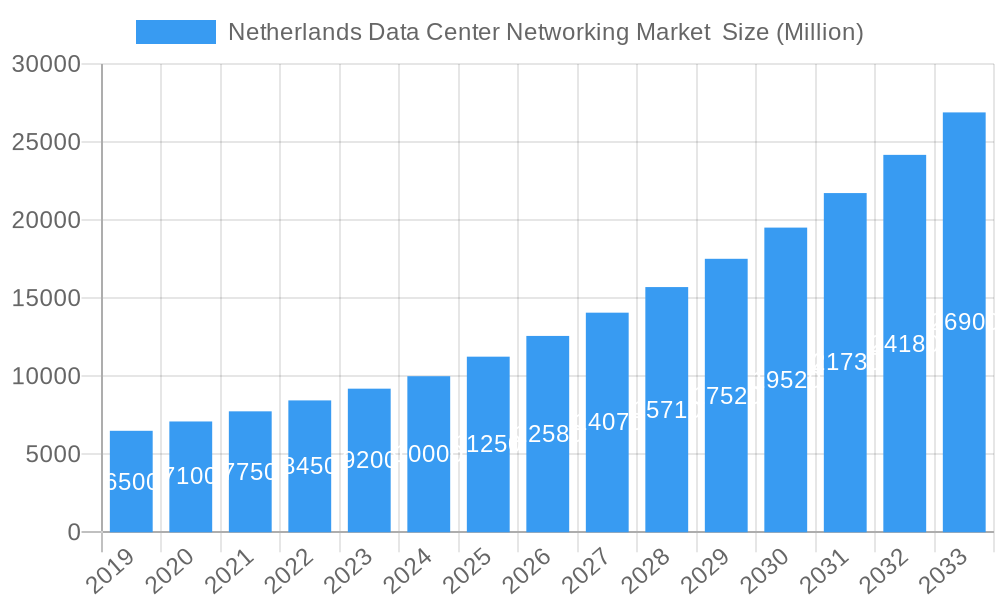

The Netherlands Data Center Networking market is poised for significant expansion, projected to reach USD 11.25 billion by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 9.67%, indicating a robust and dynamic market landscape. The demand for advanced networking solutions is being driven by the relentless digital transformation across key industries, including IT & Telecommunication, BFSI, and Government sectors. Increased adoption of cloud computing, the burgeoning Internet of Things (IoT) ecosystem, and the ever-growing volume of data are necessitating more powerful, scalable, and efficient data center networks. Furthermore, the ongoing expansion of existing data centers and the construction of new, hyperscale facilities within the Netherlands are directly contributing to the demand for sophisticated networking equipment and services. The market’s trajectory suggests a strong focus on high-performance Ethernet switches, advanced routers, and robust Storage Area Networks (SANs) to support these evolving infrastructure needs.

Netherlands Data Center Networking Market Market Size (In Billion)

The market's expansion is further supported by the increasing reliance on comprehensive networking services such as installation, integration, training, and ongoing support and maintenance, underscoring a shift towards end-to-end solutions. While the market benefits from strong growth drivers, potential restraints could emerge from the evolving regulatory landscape concerning data privacy and security, as well as the significant capital investment required for upgrading or building state-of-the-art data center networks. However, the Netherlands' strategic location in Europe, coupled with its advanced digital infrastructure and a strong commitment to innovation, positions it as a leading hub for data center operations, thus mitigating these challenges. The competitive environment is characterized by the presence of major global players like NVIDIA, IBM, HP, Dell EMC, Cisco Systems, Juniper Networks, and Huawei, all vying to capture market share through product innovation and strategic partnerships.

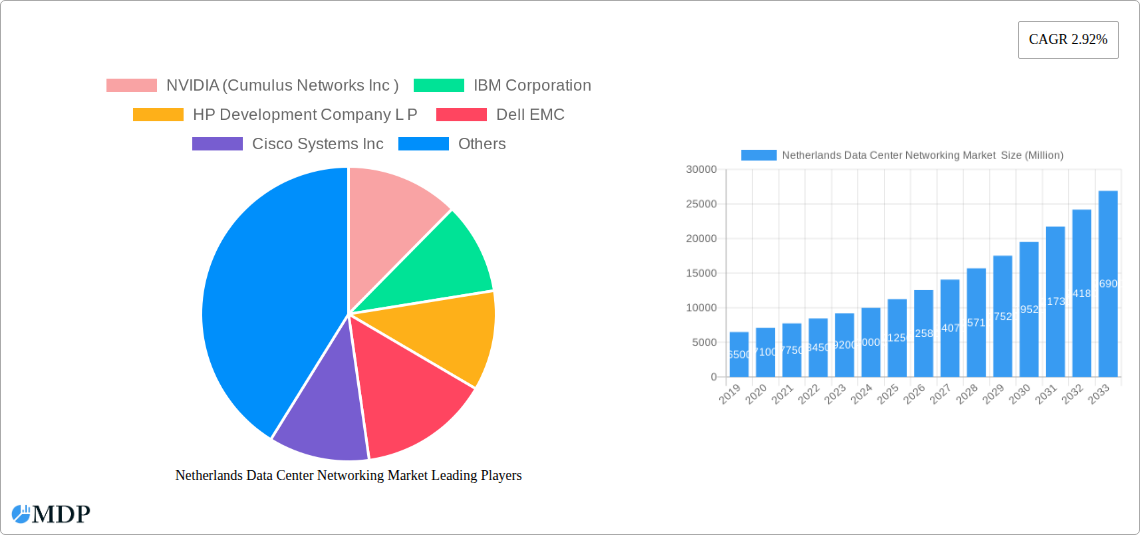

Netherlands Data Center Networking Market Company Market Share

Dive deep into the dynamic Netherlands data center networking market, a pivotal European hub for digital infrastructure. This comprehensive report, spanning from 2019 to 2033 with a base year of 2025, delivers critical insights into market dynamics, technological advancements, and strategic opportunities. With an estimated market size projected to reach billions by 2033, this analysis is essential for stakeholders seeking to capitalize on the burgeoning demand for robust and scalable data center networking solutions in the Netherlands. Discover key trends, leading players, and future projections for Ethernet Switches, Routers, SAN, ADCs, and vital services like Installation & Integration and Support & Maintenance.

Netherlands Data Center Networking Market Market Dynamics & Concentration

The Netherlands data center networking market exhibits a moderately concentrated landscape, driven by a few dominant global players alongside agile local integrators. Innovation is a primary driver, fueled by the relentless demand for higher bandwidth, lower latency, and enhanced security in data processing. NVIDIA (Cumulus Networks Inc) is pushing boundaries in software-defined networking, while Cisco Systems Inc and Juniper Networks Inc continue to lead in hardware innovation and integrated solutions. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR) and environmental sustainability for data centers, are shaping market entry and operational strategies. Product substitutes, such as cloud-based networking solutions, present a competitive pressure, necessitating continuous differentiation through specialized on-premise capabilities. End-user trends are overwhelmingly towards hyper-scalability, edge computing adoption, and the increasing integration of AI and IoT, demanding more sophisticated networking architectures. Mergers and acquisitions (M&A) activity, though not consistently high, plays a crucial role in market consolidation and technology acquisition. For instance, past acquisitions of networking software companies by larger hardware vendors have significantly influenced product portfolios. Industry developments are continuously reshaping the competitive environment, with ongoing investments in research and development from key players like Dell EMC and HP Development Company L.P. to meet evolving data center needs.

Netherlands Data Center Networking Market Industry Trends & Analysis

The Netherlands data center networking market is experiencing robust growth, driven by an accelerating digital transformation across all sectors. The estimated CAGR for the forecast period is substantial, reflecting the nation's ambition to be a leading European digital hub. Several key trends are shaping this expansion. Firstly, the proliferation of cloud computing and hybrid cloud adoption is a significant growth driver. Enterprises are increasingly migrating workloads to the cloud, demanding sophisticated networking solutions that can seamlessly connect on-premise data centers with public and private cloud environments. This necessitates advanced routing and switching capabilities to manage traffic flow efficiently and securely. Secondly, the surge in data generation from IoT devices and Big Data analytics is pushing the boundaries of current networking infrastructure. The need for higher bandwidth and lower latency to process and analyze vast datasets in real-time is creating demand for high-performance Ethernet switches and robust Storage Area Networks (SANs). Thirdly, the growing adoption of AI and machine learning within data centers requires specialized networking architectures capable of handling massive inter-processor communication. This includes technologies like InfiniBand and advanced Ethernet protocols, further driving the market for sophisticated networking equipment.

Furthermore, government initiatives and investments in digital infrastructure are playing a pivotal role. The Dutch government's commitment to fostering a strong digital economy is evident in its support for data center development and the expansion of high-speed internet connectivity. This creates a favorable environment for market penetration and growth. Edge computing, driven by the demand for localized data processing to reduce latency for applications like autonomous vehicles and real-time industrial automation, is another burgeoning trend. This decentralization of computing power necessitates a robust and distributed networking infrastructure, creating opportunities for new deployment models and specialized networking solutions. The competitive dynamics within the market are characterized by intense innovation, with companies like IBM Corporation and NEC Corporation vying for market share through advanced solutions and strategic partnerships. The focus is shifting towards intelligent, automated, and highly resilient networking solutions that can adapt to dynamic workloads and evolving security threats.

Leading Markets & Segments in Netherlands Data Center Networking Market

The Netherlands data center networking market is segmented by Component (Product and Services) and End-User.

Component: By Product

- Ethernet Switches: This segment consistently leads the market, driven by their ubiquity in data center networks for connecting servers, storage, and other network devices. The increasing demand for higher speeds (100GbE, 400GbE, and beyond) and software-defined networking (SDN) capabilities fuels its dominance. Key drivers include:

- The exponential growth of data traffic generated by cloud computing and Big Data.

- The need for efficient inter-server communication in high-performance computing (HPC) and AI workloads.

- Technological advancements offering increased port density, lower latency, and enhanced power efficiency.

- Routers: Routers remain crucial for inter-data center connectivity, internet peering, and traffic management. The expansion of network edge and the increasing complexity of traffic routing due to hybrid cloud environments contribute to this segment's sustained importance. Key drivers include:

- The growth of hybrid and multi-cloud strategies requiring sophisticated inter-network routing.

- The need for secure and efficient traffic aggregation and distribution.

- The expansion of peering points and direct internet access within the Netherlands.

- Storage Area Network (SAN): As data volumes continue to explode, the demand for high-performance and reliable storage networking solutions is on the rise. SANs are critical for providing block-level storage access to servers, ensuring data integrity and speed for critical applications. Key drivers include:

- The exponential growth of data requiring robust storage solutions.

- The need for high-speed, low-latency access to critical data for applications like databases and analytics.

- The increasing adoption of software-defined storage solutions that integrate seamlessly with SAN infrastructure.

- Application Delivery Controller (ADC): ADCs are essential for optimizing application performance, ensuring availability, and providing security. Their role in load balancing, SSL offloading, and traffic management makes them indispensable in modern data centers, especially with the rise of web-scale applications. Key drivers include:

- The increasing complexity of application architectures and the need for seamless user experiences.

- The growing importance of application security and the demand for advanced threat protection.

- The rise of microservices and containerized applications requiring dynamic traffic management.

- Other Networking Equipment: This category encompasses a range of devices like network interface cards (NICs), firewalls, and network management tools, all vital for a complete data center networking ecosystem.

Component: By Services

- Installation & Integration: This is a critical service segment, as the complexity of modern data center networks requires expert deployment and seamless integration of various hardware and software components. Key drivers include:

- The intricate nature of deploying advanced networking technologies like SDN and NFV.

- The need for specialized expertise to ensure optimal performance and security during setup.

- The rapid pace of technological evolution, requiring up-to-date integration knowledge.

- Support & Maintenance: Ensuring the continuous operation and uptime of data center networks is paramount. Comprehensive support and maintenance services are crucial for mitigating risks and optimizing performance. Key drivers include:

- The critical nature of data center uptime for businesses.

- The need for proactive monitoring, troubleshooting, and hardware/software updates.

- The increasing complexity of network architectures, requiring specialized support.

- Training & Consulting: As networking technologies evolve rapidly, organizations require continuous training and expert consulting to leverage their infrastructure effectively and stay ahead of the curve.

End-User

- IT & Telecommunication: This sector is the largest consumer of data center networking solutions, driven by the massive infrastructure needs of cloud providers, telecommunications companies, and IT service providers.

- BFSI (Banking, Financial Services, and Insurance): This sector demands highly secure, reliable, and low-latency networking for its critical operations, including trading platforms and customer transactions.

- Government: Government agencies are increasingly investing in modernizing their IT infrastructure to enhance public services, improve cybersecurity, and manage vast amounts of data.

- Media & Entertainment: This sector requires high-bandwidth networking for content delivery, streaming services, and large-scale media production.

- Other End-Users: This includes sectors like manufacturing, healthcare, and retail, all of which are increasingly relying on data center infrastructure for their operations and digital initiatives.

Netherlands Data Center Networking Market Product Developments

Product development in the Netherlands data center networking market is characterized by a relentless pursuit of higher speeds, lower latency, enhanced automation, and increased security. Companies are investing heavily in technologies that support the growing demands of AI, machine learning, and edge computing. Innovations are focusing on software-defined networking (SDN) and network function virtualization (NFV) to provide greater agility and programmability. Advancements in optical networking components and high-density switch fabrics are enabling organizations to scale their data center bandwidth effectively. Furthermore, there's a growing emphasis on AI-driven network management and security solutions that can proactively detect and respond to threats, ensuring business continuity and data integrity. These developments are crucial for maintaining a competitive edge in this rapidly evolving market.

Key Drivers of Netherlands Data Center Networking Market Growth

The growth of the Netherlands data center networking market is propelled by several interconnected factors. Firstly, the escalating demand for cloud services and hybrid cloud adoption necessitates robust and scalable networking infrastructure to connect distributed environments. Secondly, the ever-increasing volume of data generated by Big Data analytics, IoT devices, and AI applications requires higher bandwidth and lower latency networking solutions. Thirdly, significant government investments in digital infrastructure and initiatives to position the Netherlands as a leading European digital hub create a fertile ground for data center expansion and technological adoption. Finally, the continuous evolution of networking technologies, such as 5G deployment and the rise of edge computing, is driving the need for more advanced and distributed networking capabilities, further fueling market growth.

Challenges in the Netherlands Data Center Networking Market Market

Despite the strong growth trajectory, the Netherlands data center networking market faces several challenges. Intense price competition among vendors can impact profit margins and limit investment in next-generation technologies. The scarcity of skilled IT professionals capable of designing, deploying, and managing complex networking infrastructures poses a significant bottleneck. Increasingly stringent environmental regulations and energy efficiency mandates add complexity and cost to data center operations. Furthermore, evolving cybersecurity threats and the need for robust data protection require continuous investment in advanced security solutions, adding to operational expenses. Supply chain disruptions, as witnessed in recent years, can also impact the availability and cost of critical networking components.

Emerging Opportunities in Netherlands Data Center Networking Market

The Netherlands data center networking market presents several emerging opportunities for growth and innovation. The continued expansion of hyperscale data centers to meet the growing demand for cloud services offers significant potential for networking equipment and solutions providers. The burgeoning adoption of edge computing, driven by the need for real-time data processing, is creating a demand for distributed and intelligent networking architectures at the network's edge. Furthermore, the increasing integration of AI and machine learning in data center operations, including network management and security, opens up avenues for advanced software and analytics solutions. Strategic partnerships between networking vendors, cloud providers, and end-users can unlock new market segments and accelerate the adoption of cutting-edge technologies, fostering a more connected and efficient digital ecosystem.

Leading Players in the Netherlands Data Center Networking Market Sector

- NVIDIA (Cumulus Networks Inc)

- IBM Corporation

- HP Development Company L P

- Dell EMC

- Cisco Systems Inc

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- Huawei Technologies Co Ltd

- VMware Inc

Key Milestones in Netherlands Data Center Networking Market Industry

- September 2023: Juniper Networks introduced new capabilities for Juniper Apstra aimed at enhancing operator experiences and streamlining the deployment and management of private data center infrastructures. This development underscores the ongoing innovation in network automation and management, crucial for the efficient operation of complex data center environments.

- January 2022: IBM launched the IBM Z and Cloud Modernization Center, a digital platform dedicated to expediting the adoption of hybrid clouds within the IBM Z customer base. This initiative offers a comprehensive array of resources, including tools, training, and ecosystem partnerships, to facilitate the digital transformation of customer applications, processes, and data within a hybrid cloud environment, directly impacting the demand for integrated networking solutions that support hybrid cloud strategies.

Strategic Outlook for Netherlands Data Center Networking Market Market

The strategic outlook for the Netherlands data center networking market remains highly promising, driven by sustained digital transformation and increasing data demands. The market is poised for continued expansion, fueled by investments in next-generation networking technologies such as 5G, Wi-Fi 6E, and the ongoing evolution of optical networking. The growing adoption of AI-powered network management and security solutions presents a significant opportunity for vendors offering intelligent and automated platforms. Furthermore, the Netherlands' strategic location and robust digital infrastructure position it as a key player in the European data center landscape, attracting further investment and innovation. Collaborations between hardware manufacturers, software providers, and cloud service providers will be crucial in navigating the evolving market demands and capitalizing on emerging opportunities.

Netherlands Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

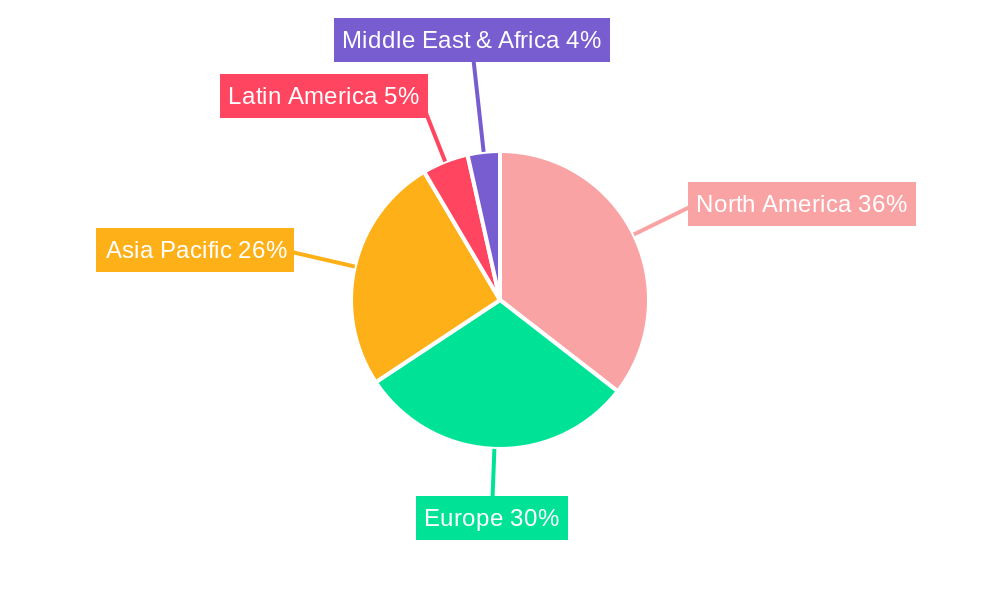

Netherlands Data Center Networking Market Segmentation By Geography

- 1. Netherlands

Netherlands Data Center Networking Market Regional Market Share

Geographic Coverage of Netherlands Data Center Networking Market

Netherlands Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals is Hindering the Market Demand

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NVIDIA (Cumulus Networks Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP Development Company L P

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 NVIDIA (Cumulus Networks Inc )

List of Figures

- Figure 1: Netherlands Data Center Networking Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Netherlands Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Data Center Networking Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Netherlands Data Center Networking Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: Netherlands Data Center Networking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Netherlands Data Center Networking Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Netherlands Data Center Networking Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: Netherlands Data Center Networking Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Data Center Networking Market ?

The projected CAGR is approximately 9.67%.

2. Which companies are prominent players in the Netherlands Data Center Networking Market ?

Key companies in the market include NVIDIA (Cumulus Networks Inc ), IBM Corporation, HP Development Company L P , Dell EMC, Cisco Systems Inc, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, Huawei Technologies Co Ltd, VMware Inc.

3. What are the main segments of the Netherlands Data Center Networking Market ?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals is Hindering the Market Demand.

8. Can you provide examples of recent developments in the market?

September 2023: Juniper Networks introduced new capabilities for Juniper Apstra aimed at enhancing operator experiences and streamlining the deployment and management of private data center infrastructures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Data Center Networking Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Data Center Networking Market ?

To stay informed about further developments, trends, and reports in the Netherlands Data Center Networking Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence