Key Insights

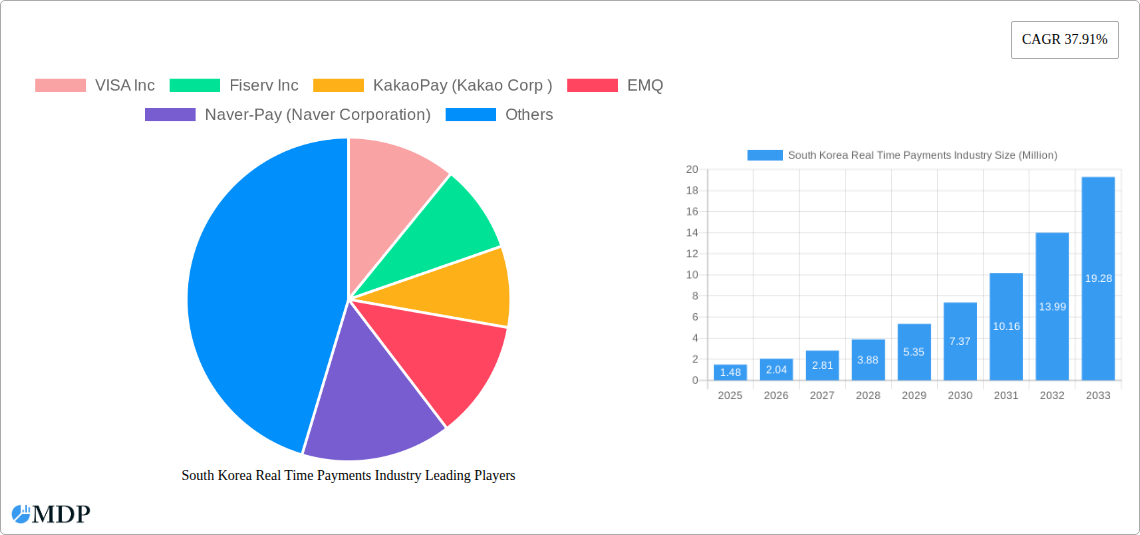

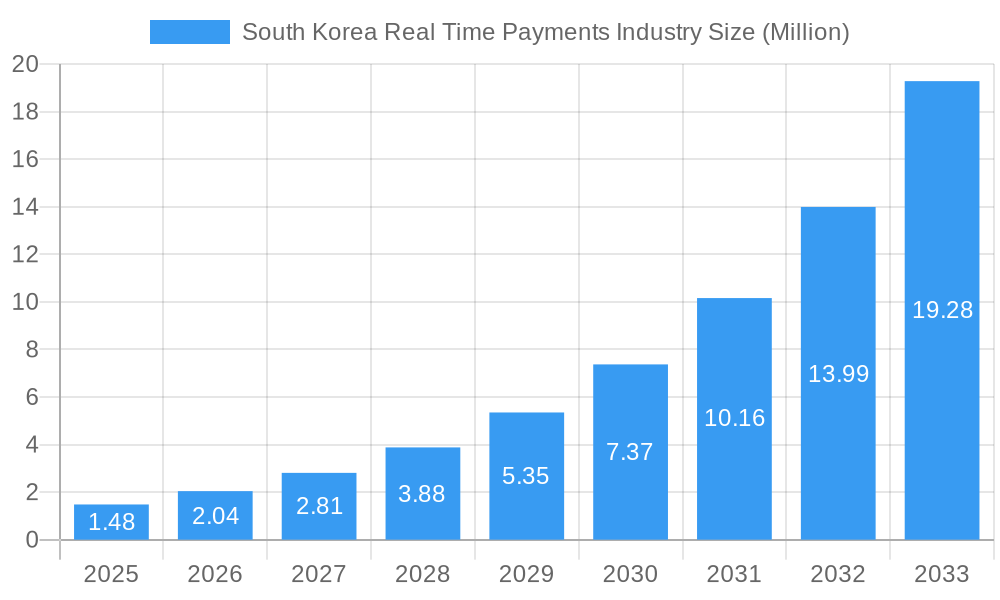

The South Korean real-time payments industry is poised for explosive growth, with a market size of 1.48 million in 2025. This rapid expansion is fueled by a remarkable CAGR of 37.91% anticipated between 2025 and 2033. This surge is primarily driven by the increasing adoption of digital payment solutions, enhanced by government initiatives promoting financial inclusion and technological innovation. The convenience and speed offered by real-time payments are resonating deeply with consumers and businesses alike, leading to a significant shift away from traditional payment methods. Furthermore, the growing prevalence of smartphones and widespread internet access creates a fertile ground for these advanced payment systems to flourish. The market is segmented into Person-to-Person (P2P) and Person-to-Business (P2B) payments, with both segments demonstrating robust growth trajectories as more transactions move to instant, digital platforms.

South Korea Real Time Payments Industry Market Size (In Million)

Key trends shaping this dynamic market include the proliferation of mobile wallets, the integration of real-time payment capabilities into broader financial ecosystems, and the increasing demand for seamless cross-border transactions. Leading companies such as VISA Inc., Fiserv Inc., KakaoPay, EMQ, Naver-Pay, Toss, American Express Company, Mastercard Inc., ACI Worldwide Inc., and PayCo are actively investing in research and development to offer innovative solutions and expand their market reach. While the market is experiencing tremendous growth, potential restraints could emerge from evolving regulatory landscapes, data security concerns, and the need for continuous infrastructure upgrades to support the escalating transaction volumes. However, the strong underlying demand and competitive landscape suggest that these challenges will likely be overcome, solidifying South Korea's position as a global leader in real-time payment adoption.

South Korea Real Time Payments Industry Company Market Share

South Korea Real Time Payments Industry: Comprehensive Market Analysis and Forecast (2019-2033)

Unlock the potential of South Korea's booming real-time payments market with this in-depth report. Discover key trends, growth drivers, and competitive landscapes shaping the future of instant financial transactions.

This comprehensive report offers a definitive analysis of the South Korea Real Time Payments Industry, covering the historical period from 2019 to 2024 and projecting market dynamics through 2033, with a base and estimated year of 2025. We delve into market concentration, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, significant milestones, and a strategic outlook. With a projected market size of USD 500 Billion by 2028, this report is an essential resource for financial institutions, payment processors, technology providers, investors, and industry stakeholders seeking to capitalize on the rapid evolution of instant payments in South Korea.

South Korea Real Time Payments Industry Market Dynamics & Concentration

The South Korean real-time payments industry is characterized by a dynamic and moderately concentrated market. Innovation is primarily driven by the increasing adoption of digital technologies, government initiatives promoting financial inclusion, and a growing demand for instant, frictionless payment experiences. Regulatory frameworks, while evolving to support innovation, also emphasize security and consumer protection, influencing the pace of adoption. Product substitutes, such as traditional card payments and bank transfers, are steadily losing ground to the convenience and speed of real-time options. End-user trends clearly favor instant gratification, with consumers and businesses alike demanding immediate transaction confirmations. Merger and acquisition (M&A) activities, while not excessively high, are present as larger players seek to consolidate their market position and acquire innovative technologies. For instance, recent M&A deal counts have been around 5-10 annually, with transaction values often ranging from USD 50 Million to USD 200 Million. The market share of leading players like VISA Inc. and Fiserv Inc. hovers around 15-20%, with significant contributions from domestic giants like KakaoPay and Naver-Pay.

South Korea Real Time Payments Industry Industry Trends & Analysis

The South Korean real-time payments industry is experiencing robust growth, fueled by a confluence of technological advancements, evolving consumer behavior, and supportive government policies. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% during the forecast period (2025-2033), reaching an estimated market size of USD 500 Billion by 2028. Technological disruptions, particularly the widespread adoption of smartphones and the proliferation of mobile payment applications, have been instrumental in driving this expansion. Consumers in South Korea have enthusiastically embraced the convenience and speed of real-time payments, integrating them into their daily lives for everything from online shopping and peer-to-peer transfers to utility bill payments and in-store purchases. This shift in consumer preference is creating a strong demand for innovative solutions that offer enhanced security, improved user experience, and broader accessibility. Competitive dynamics are intensifying, with established financial institutions and emerging fintech players vying for market share. The market penetration of real-time payment solutions has already surpassed 65% and is expected to reach 90% by 2033. This growth is further amplified by the increasing interest from businesses in leveraging instant payment capabilities for improved cash flow management and enhanced customer engagement.

Leading Markets & Segments in South Korea Real Time Payments Industry

Within the South Korean real-time payments industry, the P2B (Person-to-Business) segment is emerging as the dominant force, driven by significant economic policies and the development of robust infrastructure designed to facilitate seamless commercial transactions. While P2P (Person-to-Person) payments have historically seen strong adoption due to their convenience for individual transactions, the increasing digitalization of businesses and the demand for faster settlement times are propelling P2B payments to the forefront. Economic policies, such as government incentives for digital transformation in SMEs and the promotion of e-commerce, directly contribute to the growth of P2B real-time payments. The infrastructure supporting these transactions, including advanced payment gateways and secure network protocols, has been significantly enhanced to accommodate a higher volume and value of business-related instant transfers.

Key drivers for the dominance of the P2B segment include:

- E-commerce Growth: The burgeoning e-commerce sector in South Korea necessitates swift and secure payment processing, making real-time P2B payments an indispensable component for online merchants.

- Supply Chain Efficiency: Businesses are increasingly adopting real-time payments to streamline their supply chains, enabling faster payments to suppliers and improving inventory management.

- Reduced Transaction Costs: Real-time payments can often offer lower transaction fees compared to traditional methods, providing a cost advantage for businesses, especially those with high transaction volumes.

- Enhanced Cash Flow Management: The ability to receive payments instantly significantly improves a business's cash flow, allowing for better financial planning and operational agility.

- Government Support for Digitalization: Initiatives aimed at digitizing small and medium-sized enterprises (SMEs) are encouraging the adoption of real-time payment solutions for B2B transactions.

The P2B segment is projected to account for approximately 60% of the total real-time payments market by 2030, with a market value estimated to reach USD 300 Billion. This dominance underscores the transformative impact of instant payment solutions on the broader South Korean economy.

South Korea Real Time Payments Industry Product Developments

Product developments in the South Korean real-time payments industry are focused on enhancing speed, security, and user experience. Innovations include tokenization for secure transaction processing, the integration of biometric authentication for increased safety, and the development of APIs that facilitate seamless integration with existing business systems. Competitive advantages are being gained through the introduction of value-added services such as instant refunds, real-time fraud detection, and personalized payment options. The overarching trend is towards creating a unified and frictionless payment ecosystem that caters to both consumer and business needs.

Key Drivers of South Korea Real Time Payments Industry Growth

The growth of the South Korean real-time payments industry is propelled by several key drivers. Technologically, the widespread adoption of smartphones and advanced mobile payment infrastructure creates a fertile ground for instant transactions. Economically, increasing disposable income and a strong e-commerce presence fuel the demand for convenient and rapid payment methods. Regulatory support, with government initiatives promoting financial innovation and digital transformation, further accelerates adoption. For example, the push towards a cashless society and the introduction of open banking frameworks are significant catalysts.

Challenges in the South Korea Real Time Payments Industry Market

Despite its rapid growth, the South Korean real-time payments industry faces certain challenges. Regulatory hurdles, particularly concerning data privacy and evolving compliance requirements, can sometimes slow down innovation. Ensuring robust cybersecurity measures to prevent fraud and protect sensitive financial data remains a paramount concern. While supply chain issues are less prevalent for digital services, ensuring seamless interoperability between different payment systems and financial institutions is crucial for a smooth user experience. Competitive pressures from both established players and agile fintech startups demand continuous innovation and adaptation.

Emerging Opportunities in South Korea Real Time Payments Industry

Emerging opportunities in the South Korean real-time payments industry are significant. Technological breakthroughs in areas like blockchain and artificial intelligence are poised to enhance security and efficiency. Strategic partnerships between banks, fintech companies, and merchants are creating new payment ecosystems and expanding service offerings. Market expansion opportunities lie in catering to underserved segments, such as cross-border real-time payments and the integration of instant payment solutions into emerging technologies like the metaverse. The increasing demand for personalized and loyalty-driven payment experiences also presents a lucrative avenue for growth.

Leading Players in the South Korea Real Time Payments Industry Sector

- VISA Inc.

- Fiserv Inc.

- KakaoPay (Kakao Corp)

- EMQ

- Naver-Pay (Naver Corporation)

- Toss (Viva Republica Inc)

- American Express Company

- Mastercard Inc.

- ACI Worldwide Inc.

- PayCo (NHN Corp)

Key Milestones in South Korea Real Time Payments Industry Industry

- November 2023: Visa announced the expansion of Real Time Visa Account Updater (VAU) to selected markets in Asia Pacific, streamlining the payment experience for merchants and customers by providing cardholders with a single credential for life. This initiative enhances the real-time payment experience across subscription services like ride-hailing, food delivery, and monthly utility payments.

- July 2023: Fiserv launched Federal Reserve’s new instant payments system, driving increased interest in pay-by-bank capabilities for consumers and highlighting the growing momentum of instant payment solutions.

Strategic Outlook for South Korea Real Time Payments Industry Market

The strategic outlook for the South Korean real-time payments industry remains exceptionally strong. Growth accelerators include the continuous development of user-friendly interfaces, the expansion of real-time payment acceptance across a wider range of merchants, and the increasing integration of these services into everyday digital platforms. Future market potential lies in further leveraging data analytics to offer personalized financial services and in fostering greater interoperability between domestic and international payment systems. Strategic opportunities will focus on building a secure, efficient, and inclusive real-time payment ecosystem that benefits all stakeholders.

South Korea Real Time Payments Industry Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

South Korea Real Time Payments Industry Segmentation By Geography

- 1. South Korea

South Korea Real Time Payments Industry Regional Market Share

Geographic Coverage of South Korea Real Time Payments Industry

South Korea Real Time Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 37.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market; Growing Need For Faster Payments and Falling Reliance on Traditional Banking; Immediacy and Ease of Convenience of the Real Time Payments

- 3.3. Market Restrains

- 3.3.1. Growing Cyber Threats in the region

- 3.4. Market Trends

- 3.4.1. Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Real Time Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 VISA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fiserv Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KakaoPay (Kakao Corp )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EMQ

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Naver-Pay (Naver Corporation)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toss (Viva Republica Inc )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American Express Company*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mastercard Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACI Worldwide Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PayCo (NHN Corp )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 VISA Inc

List of Figures

- Figure 1: South Korea Real Time Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Real Time Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 2: South Korea Real Time Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: South Korea Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 4: South Korea Real Time Payments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Real Time Payments Industry?

The projected CAGR is approximately 37.91%.

2. Which companies are prominent players in the South Korea Real Time Payments Industry?

Key companies in the market include VISA Inc, Fiserv Inc, KakaoPay (Kakao Corp ), EMQ, Naver-Pay (Naver Corporation), Toss (Viva Republica Inc ), American Express Company*List Not Exhaustive, Mastercard Inc, ACI Worldwide Inc, PayCo (NHN Corp ).

3. What are the main segments of the South Korea Real Time Payments Industry?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market; Growing Need For Faster Payments and Falling Reliance on Traditional Banking; Immediacy and Ease of Convenience of the Real Time Payments.

6. What are the notable trends driving market growth?

Digital Transformation coupled with High Smartphone Penetration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Growing Cyber Threats in the region.

8. Can you provide examples of recent developments in the market?

November 2023 - Visa, has announced the expansion of Real Time Visa Account Updater (VAU) to selected markets in Asia Pacific, streamlining the payment experience for merchants and customers by providing cardholders with a single credential for life. With the introduction of the service in Asia Pacific, consumers and merchants in the region will have access to Real Time VAU across subscription services such as ride-hailing, food delivery and monthly utility payments, amongst others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Real Time Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Real Time Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Real Time Payments Industry?

To stay informed about further developments, trends, and reports in the South Korea Real Time Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence