Key Insights

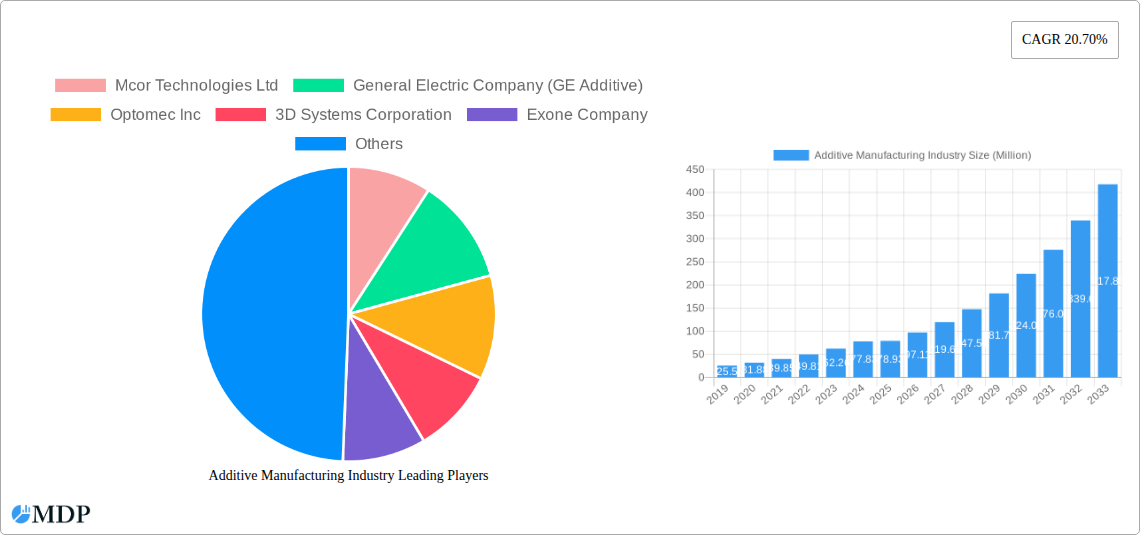

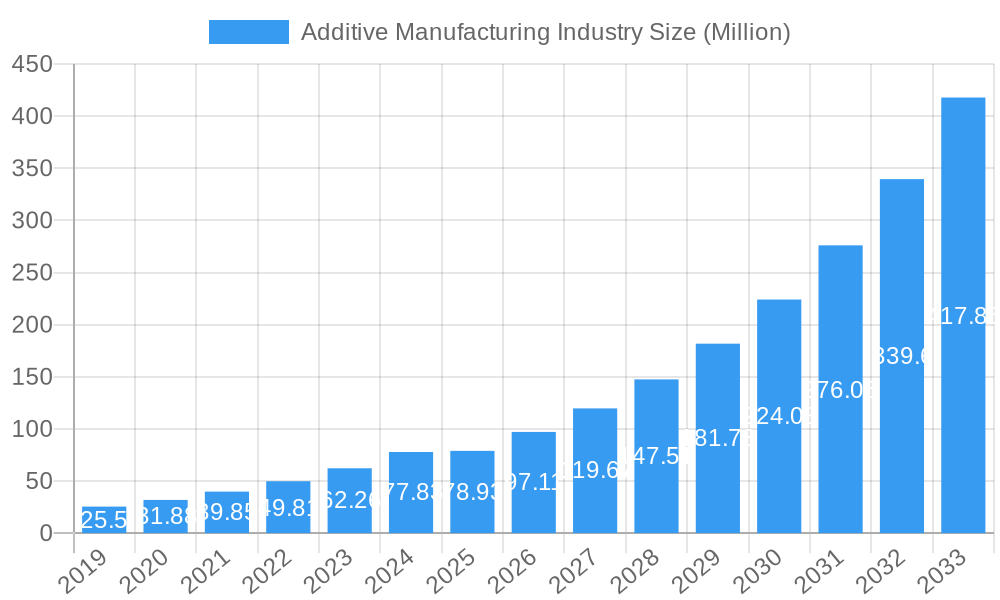

The Additive Manufacturing (AM) industry is experiencing robust growth, projected to reach $78.93 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 20.70% through 2033. This surge is fueled by a confluence of transformative drivers, most notably the increasing adoption of 3D printing in high-value sectors like aerospace and defense, and the automotive industry for rapid prototyping and complex part production. Advancements in AM technologies, including Stereo Lithography, Fused Deposition Modelling, Laser Sintering, and Binder Jetting Printing, are continuously expanding the material capabilities and precision, allowing for the creation of intricate designs with enhanced performance. The healthcare sector is a significant beneficiary, leveraging AM for personalized medical devices, prosthetics, and surgical guides, thereby driving innovation and patient outcomes. Furthermore, the expanding range of printable materials, from advanced plastics and metals to ceramics, unlocks new application possibilities and performance enhancements across industrial manufacturing.

Additive Manufacturing Industry Market Size (In Million)

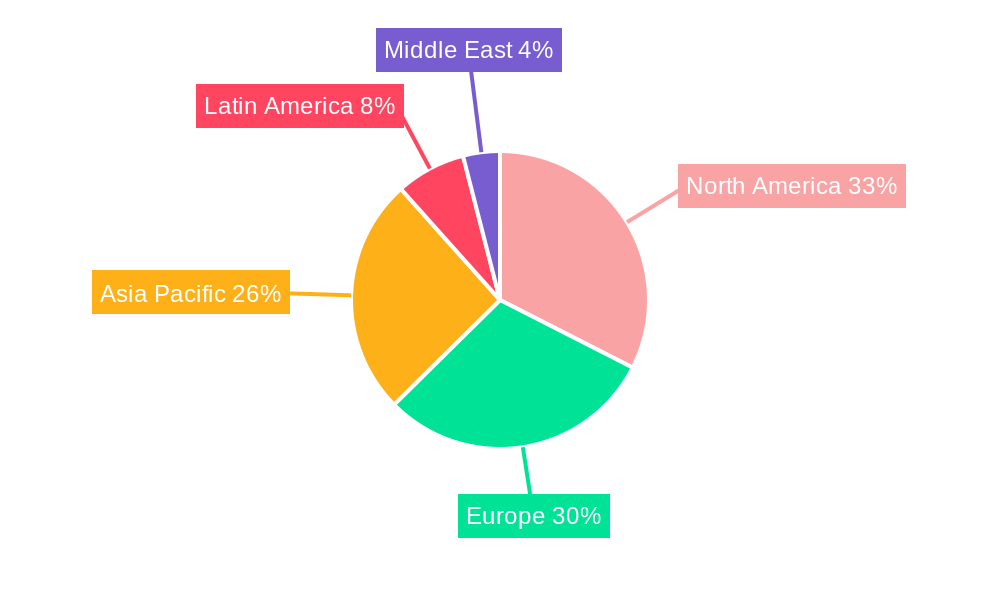

The market's trajectory is further shaped by evolving trends such as the decentralization of manufacturing, enabling on-demand production closer to the point of need, and the growing demand for sustainable manufacturing solutions through reduced waste and optimized material usage. While the sector faces some restraints, including initial capital investment and the need for skilled personnel, the overriding growth momentum is driven by technological sophistication and increasing industrial integration. Key players like General Electric Company (GE Additive), 3D Systems Corporation, and Stratasys Ltd. are at the forefront of innovation, investing heavily in research and development to address these challenges and capitalize on the expansive opportunities presented by this dynamic market. Regions like North America and Europe are leading in adoption due to established industrial bases and strong R&D ecosystems, with Asia Pacific rapidly emerging as a significant growth hub.

Additive Manufacturing Industry Company Market Share

Dive into the dynamic world of Additive Manufacturing with our comprehensive market analysis. This report provides critical insights for industry stakeholders, investors, and innovators seeking to capitalize on the rapid advancements in 3D printing technology.

Study Period: 2019–2033 | Base Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Additive Manufacturing Industry Market Dynamics & Concentration

The additive manufacturing market exhibits moderate to high concentration, with key players like General Electric Company (GE Additive), Stratasys Ltd, and 3D Systems Corporation holding significant market share. Innovation remains the primary driver, fueled by advancements in materials science, printer technology, and software solutions. Regulatory frameworks are evolving, focusing on material certification, safety standards, and intellectual property protection. Product substitutes, while present in some niche applications, are increasingly being outperformed by the customization and efficiency benefits of additive manufacturing. End-user adoption is accelerating across diverse sectors, with strong demand for on-demand production, complex geometries, and lightweight components. Mergers and acquisitions (M&A) activity is a significant trend, with an estimated xx M&A deals in the historical period, indicating industry consolidation and strategic expansion. The market share distribution highlights the ongoing competition and the drive for technological superiority.

- Market Share Snapshot: Key players dominate specific technology segments, creating pockets of high concentration.

- Innovation Drivers: New material development, enhanced printer speed and resolution, and advanced simulation software are paramount.

- Regulatory Landscape: Focus on standardization, safety certifications, and compliance with industry-specific regulations.

- End-User Centricity: Tailored solutions for Aerospace and Defense, Automotive, Healthcare, and Industrial sectors are driving adoption.

- M&A Activity: Strategic acquisitions are consolidating market power and expanding technological portfolios.

Additive Manufacturing Industry Industry Trends & Analysis

The additive manufacturing industry is experiencing robust growth, propelled by a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Market penetration is steadily increasing across various sectors, driven by the inherent advantages of 3D printing, including design freedom, reduced lead times, and on-demand production capabilities. Technological disruptions are at the forefront, with continuous improvements in printing speed, material compatibility, and post-processing techniques. Consumer preferences are shifting towards customized, high-performance parts, directly aligning with the core strengths of additive manufacturing. The competitive landscape is dynamic, characterized by both established players and emerging startups vying for market dominance through innovation and strategic partnerships. The increasing demand for personalized products and localized manufacturing further amplifies the market's growth trajectory.

- Market Growth Drivers:

- Demand for lightweight and complex parts in aerospace and automotive.

- Personalized medical devices and implants in healthcare.

- Prototyping and on-demand production in industrial applications.

- Advancements in metal 3D printing and high-performance polymers.

- Technological Disruptions:

- Advancements in multi-material printing.

- Development of novel, high-performance printing materials.

- Integration of AI and machine learning for design optimization and process control.

- Increased accessibility and affordability of industrial-grade 3D printers.

- Consumer Preferences:

- Growing demand for mass customization and personalized products.

- Emphasis on sustainability and reduced material waste.

- Preference for faster production cycles and localized supply chains.

- Competitive Dynamics:

- Intense competition among printer manufacturers, material suppliers, and software providers.

- Strategic collaborations and partnerships to expand market reach and technological capabilities.

- Emergence of specialized additive manufacturing service bureaus.

Leading Markets & Segments in Additive Manufacturing Industry

The Aerospace and Defense sector stands out as a dominant end-user segment, driven by the critical need for lightweight, high-strength components and the ability to produce complex geometries for aircraft and defense systems. Within this segment, Metals are a key material, with widespread adoption in engine parts, structural components, and tooling.

The Automotive industry is also a significant growth area, leveraging additive manufacturing for prototyping, tooling, and increasingly, for the production of end-use parts. Here, Plastics and Metals are both crucial, with applications ranging from interior components to powertrain parts.

Healthcare is another rapidly expanding segment, particularly for patient-specific implants, prosthetics, and surgical guides. Ceramics and Plastics play vital roles in this segment, enabling biocompatible and intricate designs.

In terms of technology, Laser Sintering and Fused Deposition Modelling (FDM) are widely adopted, offering a balance of speed, material versatility, and cost-effectiveness. However, Binder Jetting Printing is rapidly gaining traction for its potential in high-volume metal part production.

- Dominant End User Segments:

- Aerospace and Defense: Essential for lightweighting, complex designs, and rapid prototyping of critical components.

- Automotive: Driving innovation in prototyping, tooling, and the production of customized end-use parts.

- Healthcare: Revolutionizing patient care with personalized implants, prosthetics, and surgical aids.

- Key Material Adoption:

- Metals: Crucial for high-strength aerospace, automotive, and industrial applications.

- Plastics: Versatile for prototyping, tooling, and consumer goods, with advanced polymers enabling high-performance applications.

- Ceramics: Growing in demand for specialized healthcare and industrial applications requiring high temperature resistance and biocompatibility.

- Dominant Technologies:

- Laser Sintering: Widely used for polymer and metal parts requiring excellent mechanical properties.

- Fused Deposition Modelling (FDM): Cost-effective and versatile for prototyping and functional parts.

- Binder Jetting Printing: Emerging as a strong contender for high-volume metal part production.

Additive Manufacturing Industry Product Developments

Recent product developments in additive manufacturing are focused on enhancing speed, accuracy, and material capabilities. Innovations include the introduction of faster printing technologies, expanded ranges of engineering-grade plastics and advanced metal alloys, and more sophisticated software for design optimization and simulation. Companies are also focusing on developing integrated solutions that streamline the entire additive manufacturing workflow, from design to finished part. These advancements cater to the growing demand for complex, customized components across industries, offering significant competitive advantages through reduced lead times and improved product performance.

Key Drivers of Additive Manufacturing Industry Growth

The additive manufacturing industry's growth is propelled by several key factors. Technologically, continuous advancements in 3D printer hardware, software, and material science are expanding the possibilities of what can be produced. Economically, the ability to reduce manufacturing costs, shorten supply chains, and enable on-demand production is a significant advantage. Regulatory developments, while sometimes a hurdle, are increasingly supporting the adoption of additive manufacturing through standardization and certification for critical applications, particularly in aerospace and healthcare. The growing demand for personalized and complex products across industries further fuels this expansion.

Challenges in the Additive Manufacturing Industry Market

Despite its rapid growth, the additive manufacturing industry faces several challenges. Regulatory hurdles, particularly regarding standardization and certification for critical applications, can slow down adoption. Supply chain issues, including the availability and cost of specialized raw materials, can impact scalability. Furthermore, the high initial investment cost for industrial-grade 3D printing equipment and the need for skilled personnel to operate and maintain these systems present barriers. Intense competition also pressures pricing and margins, requiring continuous innovation to maintain market position.

Emerging Opportunities in Additive Manufacturing Industry

Emerging opportunities in the additive manufacturing industry are vast, driven by ongoing technological breakthroughs and strategic market expansion. The development of novel, high-performance materials, such as advanced composites and bio-inks, is opening new application frontiers. Strategic partnerships between printer manufacturers, material suppliers, and end-users are crucial for co-developing tailored solutions and accelerating market adoption. Furthermore, the increasing focus on sustainability and circular economy principles presents opportunities for additive manufacturing to contribute to reduced waste and localized production. The digitalization of manufacturing and the integration of AI are also poised to unlock new levels of efficiency and customization.

Leading Players in the Additive Manufacturing Industry Sector

- Mcor Technologies Ltd

- General Electric Company (GE Additive)

- Optomec Inc

- 3D Systems Corporation

- Exone Company

- SLM Solutions Group AG

- EOS GmbH

- Materialise NV

- Stratasys Ltd

- EnvisionTEC GmbH

Key Milestones in Additive Manufacturing Industry Industry

- March 2023: Merz Dental partnered with Nexa 3D, enhancing professional and dental desktop 3D printing use in Germany with fast and accurate platforms for orthodontic models, splints, and surgical guides.

- October 2022: GE Additive launched its Series 3 binder jet platform, enabling industrial-scale metal part creation, with over 140,000 fuel-efficient components manufactured.

- July 2022: Toyota began producing stock parts using HP Multi Jet Fusion 3D printing, selling them alongside conventional spares to optimize design and lead times.

Strategic Outlook for Additive Manufacturing Industry Market

The strategic outlook for the additive manufacturing market is exceptionally promising, driven by its inherent ability to foster innovation, efficiency, and customization. Future growth accelerators will include the continued development of advanced materials with enhanced properties, further digitalization of the manufacturing process through AI and IoT integration, and the expansion of additive manufacturing into new industrial sectors. Strategic opportunities lie in developing integrated end-to-end solutions, building robust partnerships across the value chain, and focusing on sustainability to meet evolving global demands. The market is poised for sustained expansion as it continues to redefine product design, manufacturing processes, and supply chain logistics.

Additive Manufacturing Industry Segmentation

-

1. Technology

- 1.1. Stereo Lithography

- 1.2. Fused Deposition Modelling

- 1.3. Laser Sintering

- 1.4. Binder Jetting Printing

- 1.5. Other Technologies

-

2. End User

- 2.1. Aerospace and Defense

- 2.2. Automotive

- 2.3. Healthcare

- 2.4. Industrial

- 2.5. Other End Users

-

3. Material

- 3.1. Plastic

- 3.2. Metals

- 3.3. Ceramics

Additive Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

- 5. Middle East

-

6. UAE

- 6.1. Saudi Arabia

- 6.2. Israel

- 6.3. South Africa

- 6.4. Rest of Middle East

Additive Manufacturing Industry Regional Market Share

Geographic Coverage of Additive Manufacturing Industry

Additive Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. New and Improved Technologies to Drive Product Customization; Demand for Lightweight Construction in Automotive and Aerospace Industries

- 3.3. Market Restrains

- 3.3.1. Concerns over Intellectual Property Protection

- 3.4. Market Trends

- 3.4.1. Automotive to is expected Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereo Lithography

- 5.1.2. Fused Deposition Modelling

- 5.1.3. Laser Sintering

- 5.1.4. Binder Jetting Printing

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Aerospace and Defense

- 5.2.2. Automotive

- 5.2.3. Healthcare

- 5.2.4. Industrial

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Plastic

- 5.3.2. Metals

- 5.3.3. Ceramics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.4.6. UAE

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereo Lithography

- 6.1.2. Fused Deposition Modelling

- 6.1.3. Laser Sintering

- 6.1.4. Binder Jetting Printing

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Aerospace and Defense

- 6.2.2. Automotive

- 6.2.3. Healthcare

- 6.2.4. Industrial

- 6.2.5. Other End Users

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Plastic

- 6.3.2. Metals

- 6.3.3. Ceramics

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereo Lithography

- 7.1.2. Fused Deposition Modelling

- 7.1.3. Laser Sintering

- 7.1.4. Binder Jetting Printing

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Aerospace and Defense

- 7.2.2. Automotive

- 7.2.3. Healthcare

- 7.2.4. Industrial

- 7.2.5. Other End Users

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Plastic

- 7.3.2. Metals

- 7.3.3. Ceramics

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereo Lithography

- 8.1.2. Fused Deposition Modelling

- 8.1.3. Laser Sintering

- 8.1.4. Binder Jetting Printing

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Aerospace and Defense

- 8.2.2. Automotive

- 8.2.3. Healthcare

- 8.2.4. Industrial

- 8.2.5. Other End Users

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Plastic

- 8.3.2. Metals

- 8.3.3. Ceramics

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereo Lithography

- 9.1.2. Fused Deposition Modelling

- 9.1.3. Laser Sintering

- 9.1.4. Binder Jetting Printing

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Aerospace and Defense

- 9.2.2. Automotive

- 9.2.3. Healthcare

- 9.2.4. Industrial

- 9.2.5. Other End Users

- 9.3. Market Analysis, Insights and Forecast - by Material

- 9.3.1. Plastic

- 9.3.2. Metals

- 9.3.3. Ceramics

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stereo Lithography

- 10.1.2. Fused Deposition Modelling

- 10.1.3. Laser Sintering

- 10.1.4. Binder Jetting Printing

- 10.1.5. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Aerospace and Defense

- 10.2.2. Automotive

- 10.2.3. Healthcare

- 10.2.4. Industrial

- 10.2.5. Other End Users

- 10.3. Market Analysis, Insights and Forecast - by Material

- 10.3.1. Plastic

- 10.3.2. Metals

- 10.3.3. Ceramics

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. UAE Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Stereo Lithography

- 11.1.2. Fused Deposition Modelling

- 11.1.3. Laser Sintering

- 11.1.4. Binder Jetting Printing

- 11.1.5. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Aerospace and Defense

- 11.2.2. Automotive

- 11.2.3. Healthcare

- 11.2.4. Industrial

- 11.2.5. Other End Users

- 11.3. Market Analysis, Insights and Forecast - by Material

- 11.3.1. Plastic

- 11.3.2. Metals

- 11.3.3. Ceramics

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mcor Technologies Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 General Electric Company (GE Additive)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Optomec Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 3D Systems Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Exone Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SLM Solutions Group AG*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 EOS GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Materialise NV

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Stratasys Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 EnvisionTEC GmbH

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Mcor Technologies Ltd

List of Figures

- Figure 1: Global Additive Manufacturing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Additive Manufacturing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Additive Manufacturing Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Additive Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Additive Manufacturing Industry Revenue (Million), by Material 2025 & 2033

- Figure 7: North America Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 8: North America Additive Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Additive Manufacturing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Additive Manufacturing Industry Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Additive Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Additive Manufacturing Industry Revenue (Million), by Material 2025 & 2033

- Figure 15: Europe Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Additive Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Additive Manufacturing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Additive Manufacturing Industry Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Pacific Additive Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Additive Manufacturing Industry Revenue (Million), by Material 2025 & 2033

- Figure 23: Asia Pacific Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 24: Asia Pacific Additive Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Additive Manufacturing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Latin America Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Latin America Additive Manufacturing Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Latin America Additive Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Additive Manufacturing Industry Revenue (Million), by Material 2025 & 2033

- Figure 31: Latin America Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 32: Latin America Additive Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Additive Manufacturing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 35: Middle East Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East Additive Manufacturing Industry Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East Additive Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East Additive Manufacturing Industry Revenue (Million), by Material 2025 & 2033

- Figure 39: Middle East Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 40: Middle East Additive Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: UAE Additive Manufacturing Industry Revenue (Million), by Technology 2025 & 2033

- Figure 43: UAE Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 44: UAE Additive Manufacturing Industry Revenue (Million), by End User 2025 & 2033

- Figure 45: UAE Additive Manufacturing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: UAE Additive Manufacturing Industry Revenue (Million), by Material 2025 & 2033

- Figure 47: UAE Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 48: UAE Additive Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: UAE Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Global Additive Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 8: Global Additive Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Additive Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 21: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Additive Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 29: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 30: Global Additive Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Mexico Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 36: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 37: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 38: Global Additive Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Global Additive Manufacturing Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 40: Global Additive Manufacturing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 41: Global Additive Manufacturing Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 42: Global Additive Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Saudi Arabia Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Israel Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East Additive Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Additive Manufacturing Industry?

The projected CAGR is approximately 20.70%.

2. Which companies are prominent players in the Additive Manufacturing Industry?

Key companies in the market include Mcor Technologies Ltd, General Electric Company (GE Additive), Optomec Inc, 3D Systems Corporation, Exone Company, SLM Solutions Group AG*List Not Exhaustive, EOS GmbH, Materialise NV, Stratasys Ltd, EnvisionTEC GmbH.

3. What are the main segments of the Additive Manufacturing Industry?

The market segments include Technology, End User, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.93 Million as of 2022.

5. What are some drivers contributing to market growth?

New and Improved Technologies to Drive Product Customization; Demand for Lightweight Construction in Automotive and Aerospace Industries.

6. What are the notable trends driving market growth?

Automotive to is expected Hold a Significant Share.

7. Are there any restraints impacting market growth?

Concerns over Intellectual Property Protection.

8. Can you provide examples of recent developments in the market?

March 2023 - Merz Dental, a digital dentistry company, partnered with Nexa 3D, the polymer 3D printing leader. The partnership will support the consumers of Nexa 3D throughout Germany. The 3D printing platform is fast and accurate to increase professional and dental desktop 3D printing use. The desktop 3D printer serves a wide variety of engineering and dental applications, including orthodontic models, splints, and surgical guides

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Additive Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Additive Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Additive Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Additive Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence