Key Insights

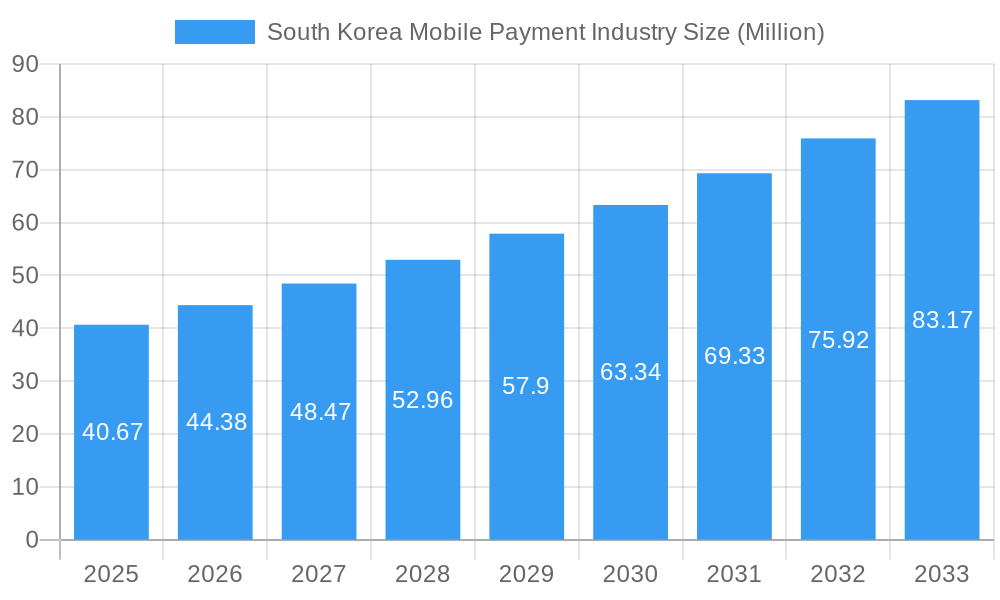

The South Korean mobile payment market is poised for significant expansion, driven by increasing smartphone penetration, the convenience offered by digital transactions, and a growing embrace of contactless payment solutions. With a current estimated market size of 40.67 Million value units, the industry is projected to witness a robust compound annual growth rate (CAGR) of 9.13% from 2025 to 2033. This sustained growth is fueled by several key factors, including government initiatives promoting digital transformation, the widespread adoption of e-commerce, and the continuous innovation in mobile payment technologies by leading players. The market benefits from a dynamic ecosystem where established conglomerates like Samsung Electronics and SK Group, alongside digital disruptors such as Kakao Corporation and Toss, are fiercely competing to capture market share. This competition fosters innovation, leading to enhanced user experiences and a broader range of payment functionalities, from proximity-based payments to seamless remote transactions. The proliferation of sophisticated mobile wallets and the increasing trust consumers place in secure digital platforms further solidify the upward trajectory of this market.

South Korea Mobile Payment Industry Market Size (In Million)

While the growth prospects are bright, the market also faces certain restraints that could influence its pace. Increased competition, while driving innovation, can also lead to pricing pressures and a need for significant investment in marketing and customer acquisition. Furthermore, evolving regulatory landscapes concerning data privacy and security, though crucial for consumer trust, can introduce compliance challenges for businesses. Emerging trends like the integration of AI for personalized payment experiences, the rise of super-apps consolidating various financial services, and the potential for blockchain-based payment solutions are set to redefine the competitive arena. Leading companies such as Naver Corporation, PayCo, Coupang, and SSG com Corp are actively exploring these frontiers to maintain their edge. The South Korean market's sophisticated digital infrastructure and tech-savvy consumer base provide fertile ground for these advancements, suggesting a future characterized by increasingly intelligent and integrated mobile payment ecosystems.

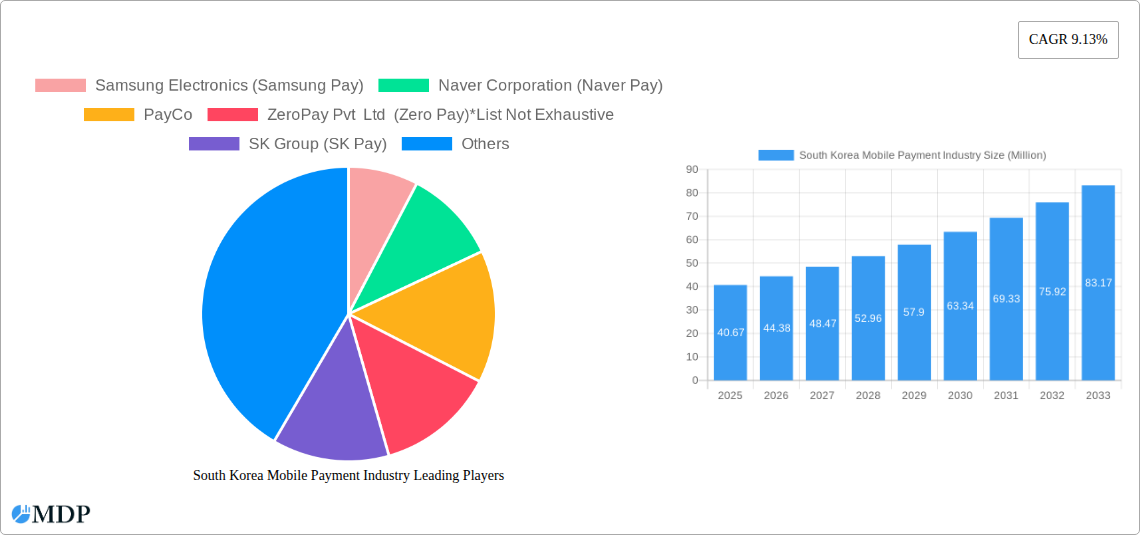

South Korea Mobile Payment Industry Company Market Share

South Korea Mobile Payment Industry: Market Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic South Korea Mobile Payment Industry, providing in-depth analysis and actionable insights for stakeholders. From analyzing market concentration and innovation drivers to forecasting future growth, this report equips you with the knowledge to navigate this rapidly evolving landscape. We examine key segments, leading players, and pivotal industry developments, offering a strategic outlook for the coming decade. The study period spans from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

South Korea Mobile Payment Industry Market Dynamics & Concentration

The South Korean mobile payment market exhibits a dynamic concentration, driven by intense competition and rapid innovation. Leading players such as Samsung Electronics (Samsung Pay), Naver Corporation (Naver Pay), Kakao Corporation (Kakao Pay), and Toss are continuously vying for market share, which is estimated to be fragmented with the top 5 players holding approximately 70% of the market. Innovation is a key driver, fueled by advancements in NFC, QR code technology, and biometric authentication, allowing for seamless and secure transactions. Regulatory frameworks, overseen by the Bank of Korea and the Financial Services Commission, are evolving to support and govern the burgeoning mobile payment ecosystem, balancing consumer protection with fostering innovation. Product substitutes, including traditional credit cards and bank transfers, are facing increasing pressure from the convenience and speed offered by mobile payment solutions. End-user trends are leaning towards increased adoption of contactless payments, in-app purchases, and personalized payment experiences. Mergers and acquisitions (M&A) activities are anticipated to play a significant role in shaping market concentration, with an estimated 3-5 significant M&A deals expected in the forecast period, totaling over USD 50 Million.

South Korea Mobile Payment Industry Industry Trends & Analysis

The South Korean mobile payment industry is experiencing robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive economic policies. The market penetration for mobile payments in South Korea is projected to reach an impressive 85% by 2033, a significant increase from its current level of approximately 65%. This expansion is propelled by a compound annual growth rate (CAGR) of over 15% during the forecast period. Technological disruptions, such as the widespread adoption of 5G networks, the integration of AI for fraud detection and personalized offers, and the continued development of secure biometric authentication methods, are transforming the payment experience. Consumer preferences are shifting towards convenience, speed, and security, with a growing demand for integrated payment solutions that offer loyalty programs, budgeting tools, and peer-to-peer transfer capabilities. Competitive dynamics are characterized by fierce competition among established tech giants, financial institutions, and innovative startups. The emergence of new payment technologies and business models, such as the recent launch of the TWQR mobile payment service, further intensifies this landscape. The increasing use of smartphones for daily transactions, including retail purchases, transportation, and digital services, underscores the pervasive influence of mobile payments in South Korea's digital economy. The market is also witnessing a growing interest in cross-border mobile payment solutions, driven by tourism and global e-commerce.

Leading Markets & Segments in South Korea Mobile Payment Industry

The Proximity payment segment is currently the dominant force within the South Korean mobile payment industry, accounting for an estimated 65% of the total market share. This dominance is attributed to the widespread adoption of contactless payment terminals in physical retail environments across the country. Key drivers for the Proximity segment include:

- Ubiquitous NFC Infrastructure: The extensive deployment of NFC-enabled point-of-sale (POS) terminals in convenience stores, supermarkets, cafes, and restaurants facilitates seamless tap-to-pay transactions.

- Government Initiatives: Supportive government policies and initiatives aimed at promoting cashless societies and digital transactions have further encouraged the adoption of proximity payment methods.

- Consumer Habit Formation: Consumers have become accustomed to the ease and speed of tapping their smartphones to make payments, making it their preferred method for everyday purchases.

- Technological Advancements: The continuous improvement in NFC and MST (Magnetic Secure Transmission) technologies by players like Samsung Electronics ensures broad compatibility and reliability.

The Remote payment segment, while currently smaller with an estimated 35% market share, is experiencing rapid growth, driven by the burgeoning e-commerce and online service landscape in South Korea. Key drivers for the Remote segment's growth include:

- E-commerce Boom: The ever-increasing volume of online shopping and the demand for convenient online checkout experiences are directly fueling the growth of remote payment solutions.

- In-App Purchases: The popularity of mobile gaming, digital content subscriptions, and other in-app purchases relies heavily on integrated remote payment functionalities.

- Digital Service Adoption: The proliferation of digital services, including ride-sharing, food delivery, and streaming platforms, necessitates efficient remote payment mechanisms.

- Cross-border E-commerce: As South Koreans increasingly shop from international e-commerce platforms, the demand for secure and efficient remote payment solutions that facilitate cross-border transactions is growing.

South Korea Mobile Payment Industry Product Developments

Recent product developments in the South Korean mobile payment industry highlight a strong focus on enhanced user experience, security, and integration. Companies are actively innovating to offer more than just transactional capabilities. Innovations include the integration of loyalty programs directly within payment apps, personalized discount offers based on spending habits, and streamlined in-app purchase flows for digital services and e-commerce. Competitive advantages are being carved out through advanced security features like tokenization and multi-factor authentication, alongside user-friendly interfaces that simplify complex transactions. The push towards unified payment platforms that consolidate various financial services, from peer-to-peer transfers to investment options, is a significant trend, fostering greater user engagement and ecosystem lock-in.

Key Drivers of South Korea Mobile Payment Industry Growth

The South Korean mobile payment industry is propelled by several key drivers. Technologically, the widespread adoption of high-speed mobile internet (5G) and advanced smartphone capabilities creates a fertile ground for seamless mobile transactions. Economically, a digitally savvy population with a high disposable income is more inclined to embrace convenient digital payment solutions. Regulatory support, with government initiatives aimed at fostering a cashless economy and ensuring consumer data protection, further bolsters trust and adoption. The increasing prevalence of e-commerce and the demand for frictionless online and in-app purchases are significant catalysts. Furthermore, the constant innovation by major players like Samsung Electronics and Kakao Corporation in developing user-friendly and feature-rich payment platforms continues to drive market expansion.

Challenges in the South Korea Mobile Payment Industry Market

Despite its robust growth, the South Korean mobile payment industry faces several challenges. Regulatory hurdles, while generally supportive, can sometimes introduce complexities and compliance costs for new entrants. While generally secure, ongoing concerns about data privacy and the potential for cyberattacks necessitate continuous investment in robust security infrastructure. Intense competitive pressures among a multitude of players can lead to price wars and reduced profit margins. Furthermore, ensuring interoperability between different payment platforms and legacy systems can be a technical challenge. The digital divide, though shrinking, means that a segment of the population may still prefer traditional payment methods, presenting a barrier to complete market penetration.

Emerging Opportunities in South Korea Mobile Payment Industry

Emerging opportunities in the South Korean mobile payment industry are abundant, driven by technological breakthroughs and evolving consumer needs. The burgeoning fintech sector offers avenues for startups to introduce niche payment solutions and innovative services. Strategic partnerships between mobile payment providers and retailers, e-commerce platforms, and even public transport operators can unlock new revenue streams and enhance user convenience. The increasing demand for cross-border mobile payment solutions presents a significant market expansion opportunity, particularly with the rise of global e-commerce and international travel. Furthermore, the integration of advanced technologies like blockchain for enhanced security and transparency, and AI for hyper-personalized financial services, will likely shape the future of the industry and create new avenues for growth.

Leading Players in the South Korea Mobile Payment Industry Sector

- Samsung Electronics

- Naver Corporation

- PayCo

- ZeroPay Pvt Ltd

- SK Group

- Coupang

- SSG com Corp

- Smile Pay

- Kakao Corporation

- L Pay

- Toss

Key Milestones in South Korea Mobile Payment Industry Industry

- February 2024: TWQR mobile payment service launched in South Korea, a collaboration between Taiwanese organizations and BC Card Co, available at 35,000 merchants, significantly expanding contactless payment options.

- April 2023: Kakao Corporation acquired a 19.9% stake in Siebert Financial, a New York-based brokerage firm, for USD 17 Million, signaling its strategic expansion into broader financial services beyond its core messaging and internet platforms.

Strategic Outlook for South Korea Mobile Payment Industry Market

The strategic outlook for the South Korean mobile payment industry remains exceptionally positive, characterized by sustained growth and increasing sophistication. The market is poised for further expansion as technological advancements continue to enhance user experience and security. Key growth accelerators include the ongoing digital transformation of traditional businesses, the increasing demand for integrated financial services within payment platforms, and the potential for cross-border payment solutions. Strategic opportunities lie in fostering greater interoperability, leveraging AI for personalized services, and exploring innovative business models that cater to the evolving needs of both consumers and merchants. The focus will increasingly shift towards providing holistic digital financial ecosystems rather than just transactional services, promising a dynamic and prosperous future for the industry.

South Korea Mobile Payment Industry Segmentation

-

1. Type

- 1.1. Proximity

- 1.2. Remote

South Korea Mobile Payment Industry Segmentation By Geography

- 1. South Korea

South Korea Mobile Payment Industry Regional Market Share

Geographic Coverage of South Korea Mobile Payment Industry

South Korea Mobile Payment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Mobile Devices; The Growing Demand and Inclination Towards E-commerce and Online Shopping

- 3.3. Market Restrains

- 3.3.1. Growing Cyber Threats in the region

- 3.4. Market Trends

- 3.4.1. E-commerce Industry is expected to drive the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Mobile Payment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity

- 5.1.2. Remote

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung Electronics (Samsung Pay)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Naver Corporation (Naver Pay)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PayCo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZeroPay Pvt Ltd (Zero Pay)*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SK Group (SK Pay)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coupang (Rocket Pay)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SSG com Corp (SSG Pay)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smile Pay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kakao Coporation (Kakao Pay)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 L Pay

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Toss

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Samsung Electronics (Samsung Pay)

List of Figures

- Figure 1: South Korea Mobile Payment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Mobile Payment Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Mobile Payment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South Korea Mobile Payment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: South Korea Mobile Payment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: South Korea Mobile Payment Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Mobile Payment Industry?

The projected CAGR is approximately 9.13%.

2. Which companies are prominent players in the South Korea Mobile Payment Industry?

Key companies in the market include Samsung Electronics (Samsung Pay), Naver Corporation (Naver Pay), PayCo, ZeroPay Pvt Ltd (Zero Pay)*List Not Exhaustive, SK Group (SK Pay), Coupang (Rocket Pay), SSG com Corp (SSG Pay), Smile Pay, Kakao Coporation (Kakao Pay), L Pay, Toss.

3. What are the main segments of the South Korea Mobile Payment Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Mobile Devices; The Growing Demand and Inclination Towards E-commerce and Online Shopping.

6. What are the notable trends driving market growth?

E-commerce Industry is expected to drive the growth of the market.

7. Are there any restraints impacting market growth?

Growing Cyber Threats in the region.

8. Can you provide examples of recent developments in the market?

Frebruary 2024 - TWQR mobile payment service launched in South Korea. The mobile payment service, available at 35,000 merchants in the East Asian country, is a collaboration between the two Taiwanese organizations and the South Korean financial services company BC Card Co, per the statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Mobile Payment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Mobile Payment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Mobile Payment Industry?

To stay informed about further developments, trends, and reports in the South Korea Mobile Payment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence