Key Insights

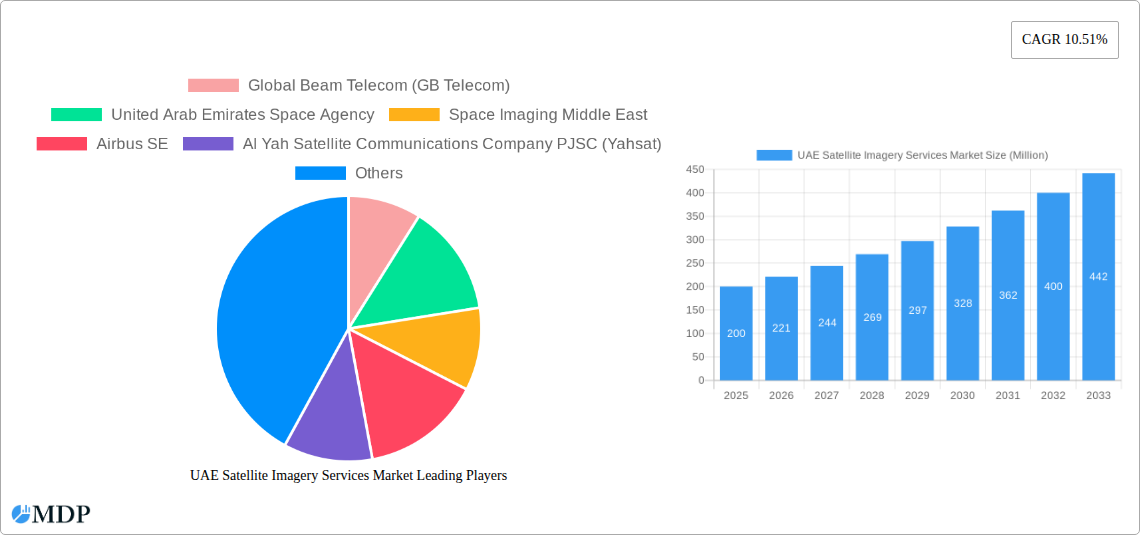

The UAE Satellite Imagery Services Market is poised for significant expansion, driven by a market size of approximately USD 200 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of 10.51%. This upward trajectory is underpinned by a confluence of factors, including increasing government initiatives focused on smart city development, infrastructure expansion, and national security. The demand for high-resolution satellite imagery is escalating across various sectors, from meticulous natural resource management and precision agriculture to advanced surveillance and vital disaster response planning. The nation's strategic investment in space technology and a burgeoning ecosystem of local and international players are further fueling this growth. Key applications such as geospatial data acquisition and mapping, natural resource management, and surveillance and security are expected to be major contributors to this market's expansion. Furthermore, the increasing adoption of satellite imagery for urban planning, environmental monitoring, and defense purposes highlights the growing recognition of its strategic importance.

UAE Satellite Imagery Services Market Market Size (In Million)

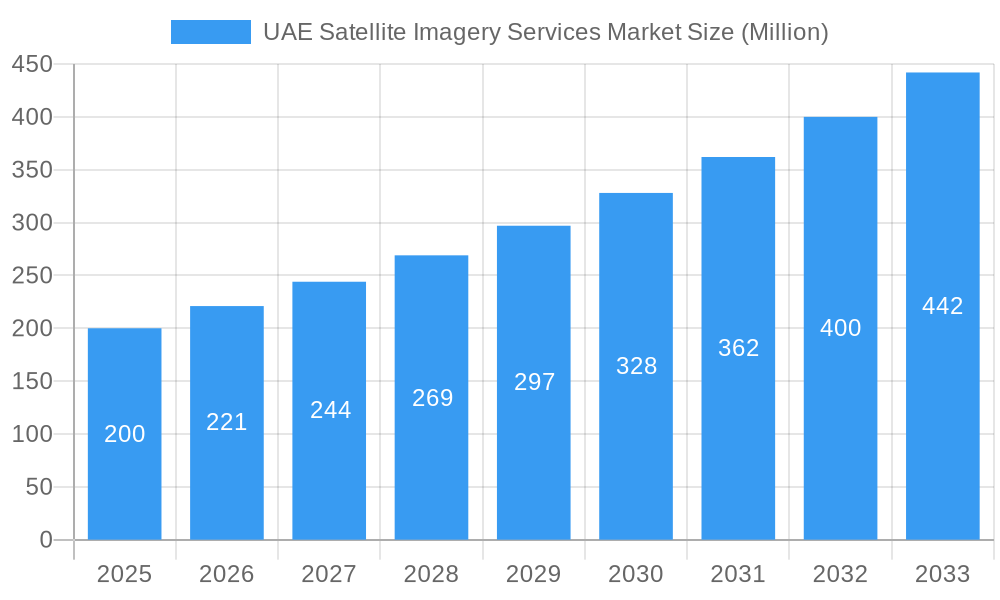

The competitive landscape is characterized by the presence of both established global players and prominent regional entities, including the United Arab Emirates Space Agency, Airbus SE, and Al Yah Satellite Communications Company PJSC (Yahsat). These companies are actively involved in developing advanced satellite technologies and providing comprehensive imagery services. Emerging trends like the integration of AI and machine learning with satellite data for enhanced analytics and the increasing use of Earth observation satellites for climate change monitoring are expected to shape the market's future. However, potential restraints such as the high cost of satellite deployment and data acquisition, coupled with regulatory complexities and the need for skilled personnel, may present challenges. Despite these hurdles, the market is anticipated to witness sustained innovation and growth, with a focus on providing value-added services and addressing the evolving needs of end-users across government, defense, and commercial sectors. The ongoing diversification of applications and the continuous technological advancements in satellite capabilities will ensure a dynamic and promising outlook for the UAE's satellite imagery services sector.

UAE Satellite Imagery Services Market Company Market Share

This in-depth market research report provides an exhaustive analysis of the UAE Satellite Imagery Services Market, offering critical insights into its current landscape and future trajectory. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period spanning 2025-2033, this report delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities. It is an indispensable resource for industry stakeholders including government agencies, satellite service providers, technology developers, investors, and end-users seeking to capitalize on the burgeoning UAE satellite imagery market.

UAE Satellite Imagery Services Market Market Dynamics & Concentration

The UAE Satellite Imagery Services Market is characterized by moderate concentration, with a growing emphasis on indigenous capabilities and strategic international partnerships. Innovation drivers are primarily fueled by the UAE's ambitious vision for space exploration and its commitment to leveraging advanced technologies for national development. Regulatory frameworks are evolving to support commercial space ventures and data utilization, fostering a more conducive environment for market participants. While direct product substitutes for high-resolution satellite imagery are limited, advancements in aerial drone technology present a competitive edge in specific, localized applications. End-user trends indicate a significant demand surge from government sectors for national security and urban planning, alongside increasing adoption by construction and transportation industries for infrastructure monitoring and logistics optimization. Mergers and acquisitions (M&A) activities are anticipated to play a crucial role in market consolidation, with an estimated XX M&A deals projected over the forecast period. Key players are actively seeking to enhance their market share through strategic alliances and technological advancements, aiming to capture a larger portion of the projected market size of approximately XX Million by 2033.

UAE Satellite Imagery Services Market Industry Trends & Analysis

The UAE Satellite Imagery Services Market is poised for substantial growth, driven by a confluence of technological advancements, increasing government investment in space infrastructure, and a widening array of commercial applications. The market is experiencing a remarkable Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This expansion is significantly propelled by the nation's strategic focus on building robust national Earth Observation (EO) capabilities, as highlighted by recent initiatives aimed at commercializing EO market business opportunities. Technological disruptions, including the proliferation of high-resolution sensors, AI-powered data analytics, and cloud-based platforms, are revolutionizing how satellite imagery is processed and utilized. These innovations enable faster, more accurate, and cost-effective insights across various sectors. Consumer preferences are shifting towards integrated geospatial solutions that offer end-to-end services, from data acquisition to actionable intelligence. The competitive dynamics within the market are intensifying as both established global players and emerging local entities vie for market dominance. Market penetration is projected to reach approximately XX% by the end of the forecast period, indicating a strong adoption rate across diverse industries. The increasing demand for precise geospatial data for applications such as urban planning, environmental monitoring, and infrastructure development further bolsters market expansion.

Leading Markets & Segments in UAE Satellite Imagery Services Market

The UAE Satellite Imagery Services Market is dominated by the Government end-user segment, driven by national security imperatives, smart city initiatives, and extensive urban development projects. This segment is expected to account for a significant market share, estimated at over XX% of the total market value by 2033. Key drivers include the UAE's strong economic policies, substantial investments in advanced defense and surveillance systems, and the continuous need for accurate mapping and monitoring of critical infrastructure.

Within the Application segments, Geospatial Data Acquisition and Mapping is the largest contributor, fueled by the demand for high-resolution imagery for cartography, land surveying, and urban planning. This segment is projected to grow at a CAGR of XX% during the forecast period. The Surveillance and Security application also holds a substantial market share, driven by the need for real-time monitoring of borders, critical assets, and public spaces.

The Construction sector is a rapidly growing end-user segment, utilizing satellite imagery for site selection, progress monitoring, and project management. Similarly, the Transportation and Logistics sector is increasingly relying on satellite data for route optimization, fleet management, and infrastructure planning. The Military and Defense sector remains a key consumer, leveraging satellite imagery for intelligence, reconnaissance, and situational awareness.

Key Drivers for Dominance:

- Governmental Support and Investment: The UAE government's proactive stance on space technology and significant budgetary allocations for national space programs are paramount.

- Economic Diversification Initiatives: Projects aimed at reducing oil dependency and fostering knowledge-based economies inherently drive demand for advanced geospatial solutions.

- Infrastructure Development Boom: Ambitious projects in smart cities, transportation networks, and real estate require precise and continuous geospatial data.

- Technological Adoption: The UAE's readiness to adopt cutting-edge technologies, including AI and advanced satellite imaging capabilities, further propels market growth.

UAE Satellite Imagery Services Market Product Developments

Product developments in the UAE Satellite Imagery Services Market are largely focused on enhancing resolution, acquiring multispectral and hyperspectral capabilities, and integrating advanced data processing techniques. Companies are introducing innovative solutions that offer higher temporal resolution for near real-time monitoring and advanced analytical tools powered by artificial intelligence. These advancements provide a competitive advantage by enabling more precise object detection, change analysis, and predictive modeling. The market fit is strong as these developments directly address the growing demand for detailed and actionable insights across diverse applications, from environmental monitoring to urban planning and security.

Key Drivers of UAE Satellite Imagery Services Market Growth

The UAE Satellite Imagery Services Market is propelled by several key drivers. Technologically, the continuous advancement in satellite sensor technology, leading to higher resolution and more frequent revisits, is a significant factor. Economically, the UAE's strong economic diversification policies and substantial investments in smart city projects, infrastructure development, and defense capabilities create a robust demand for geospatial data. Regulatory factors, including supportive government initiatives for space exploration and data utilization, further facilitate market expansion. For instance, the government's commitment to developing national Earth Observation capabilities directly translates into increased demand for satellite imagery services and related technologies.

Challenges in the UAE Satellite Imagery Services Market Market

Despite robust growth, the UAE Satellite Imagery Services Market faces certain challenges. Regulatory hurdles related to data privacy and dissemination policies can sometimes slow down market penetration. While indigenous capabilities are growing, a reliance on international satellite operators for certain high-end specifications can pose supply chain challenges and impact cost-effectiveness. Furthermore, intense competition from both global players and emerging local start-ups puts pressure on pricing and necessitates continuous innovation to maintain market share. The high initial investment cost for acquiring and launching satellites can also be a barrier for smaller market entrants.

Emerging Opportunities in UAE Satellite Imagery Services Market

Emerging opportunities in the UAE Satellite Imagery Services Market are manifold, driven by technological breakthroughs and strategic market expansion. The increasing integration of artificial intelligence and machine learning with satellite imagery analysis is opening new avenues for predictive analytics in areas like climate change monitoring and resource management. Strategic partnerships between UAE space agencies, technology providers, and international entities are fostering innovation and expanding service offerings. Furthermore, the growing focus on sustainable development and smart city initiatives across the GCC region presents significant opportunities for specialized satellite imagery services related to environmental monitoring, urban planning, and resource optimization.

Leading Players in the UAE Satellite Imagery Services Market Sector

- Global Beam Telecom (GB Telecom)

- United Arab Emirates Space Agency

- Space Imaging Middle East

- Airbus SE

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Emirates Institution for Advanced Science and Technology (EIAST)

- Mohammad Bin Rashid Space Centre (MBRSC)

- HawkEye 360 Inc

- Thuraya Telecommunications Company

- SATPALDA International F Z E

Key Milestones in UAE Satellite Imagery Services Market Industry

- May 2023: Bayanat and Al Yah Satellite Communications Company PJSC (Yahsat) announced a comprehensive space program to build national satellite remote sensing and Earth Observation (EO) capabilities within the UAE, aiming to address commercial EO market business opportunities.

- May 2023: Emirates Global Aluminium (EGA) announced that its CelestiAL solar aluminum will be sent into space through a partnership between Gulf Extrusions and the Mohammed Bin Rashid Space Centre (MBRSC), with the metal from EGA being transformed into components for MBZ-SAT, the region's high-resolution satellite imaging system.

Strategic Outlook for UAE Satellite Imagery Services Market Market

The strategic outlook for the UAE Satellite Imagery Services Market is highly positive, characterized by sustained growth and increasing sophistication. The market will likely witness a greater emphasis on developing localized end-to-end geospatial solutions, integrating advanced analytics, and fostering greater collaboration between government, academia, and the private sector. Strategic opportunities lie in leveraging the UAE's position as a regional hub to expand services across the Middle East and North Africa (MENA) region, particularly in sectors like smart agriculture, water resource management, and disaster resilience. Continuous investment in R&D and human capital development will be crucial for maintaining a competitive edge and capitalizing on the evolving demands of the global geospatial landscape.

UAE Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Other End-Users

UAE Satellite Imagery Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

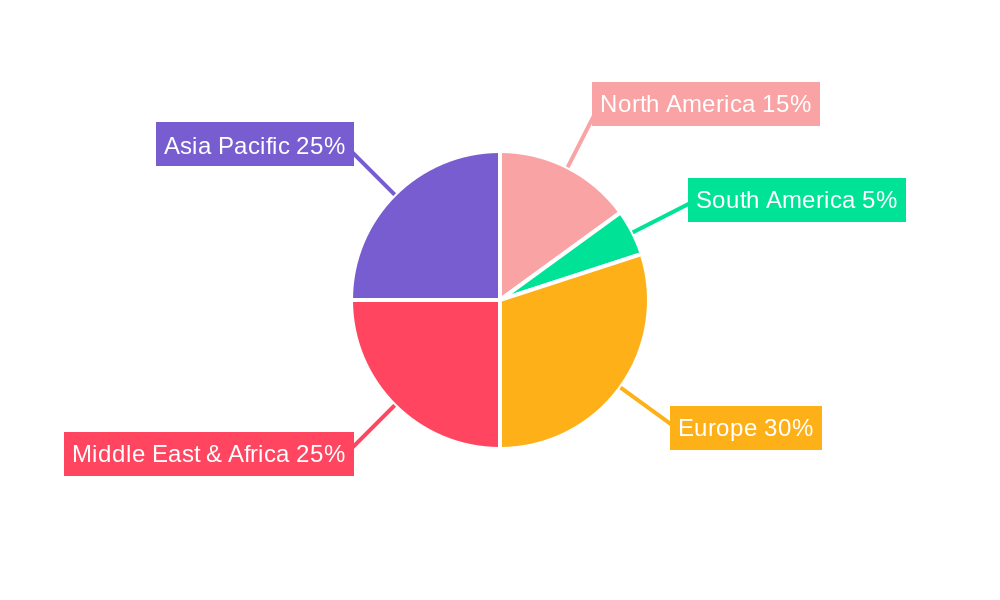

UAE Satellite Imagery Services Market Regional Market Share

Geographic Coverage of UAE Satellite Imagery Services Market

UAE Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Government Initiatives and Substantial Investments to Drive the Market Growth; Infrastructure Development and Smart Cities

- 3.3. Market Restrains

- 3.3.1. Data Processing and Analytics Capabilities; Data Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. Strategic Government Initiatives and Substantial Investments to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America UAE Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Geospatial Data Acquisition and Mapping

- 6.1.2. Natural Resource Management

- 6.1.3. Surveillance and Security

- 6.1.4. Conservation and Research

- 6.1.5. Disaster Management

- 6.1.6. Intelligence

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Government

- 6.2.2. Construction

- 6.2.3. Transportation and Logistics

- 6.2.4. Military and Defense

- 6.2.5. Forestry and Agriculture

- 6.2.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America UAE Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Geospatial Data Acquisition and Mapping

- 7.1.2. Natural Resource Management

- 7.1.3. Surveillance and Security

- 7.1.4. Conservation and Research

- 7.1.5. Disaster Management

- 7.1.6. Intelligence

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Government

- 7.2.2. Construction

- 7.2.3. Transportation and Logistics

- 7.2.4. Military and Defense

- 7.2.5. Forestry and Agriculture

- 7.2.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe UAE Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Geospatial Data Acquisition and Mapping

- 8.1.2. Natural Resource Management

- 8.1.3. Surveillance and Security

- 8.1.4. Conservation and Research

- 8.1.5. Disaster Management

- 8.1.6. Intelligence

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Government

- 8.2.2. Construction

- 8.2.3. Transportation and Logistics

- 8.2.4. Military and Defense

- 8.2.5. Forestry and Agriculture

- 8.2.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa UAE Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Geospatial Data Acquisition and Mapping

- 9.1.2. Natural Resource Management

- 9.1.3. Surveillance and Security

- 9.1.4. Conservation and Research

- 9.1.5. Disaster Management

- 9.1.6. Intelligence

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Government

- 9.2.2. Construction

- 9.2.3. Transportation and Logistics

- 9.2.4. Military and Defense

- 9.2.5. Forestry and Agriculture

- 9.2.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific UAE Satellite Imagery Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Geospatial Data Acquisition and Mapping

- 10.1.2. Natural Resource Management

- 10.1.3. Surveillance and Security

- 10.1.4. Conservation and Research

- 10.1.5. Disaster Management

- 10.1.6. Intelligence

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Government

- 10.2.2. Construction

- 10.2.3. Transportation and Logistics

- 10.2.4. Military and Defense

- 10.2.5. Forestry and Agriculture

- 10.2.6. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Global Beam Telecom (GB Telecom)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Arab Emirates Space Agency

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Space Imaging Middle East

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Al Yah Satellite Communications Company PJSC (Yahsat)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emirates Institution for Advanced Science and Technology (EIAST)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mohammad Bin Rashid Space Centre (MBRSC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HawkEye 360 Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thuraya Telecommunications Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SATPALDA International F Z E

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Global Beam Telecom (GB Telecom)

List of Figures

- Figure 1: Global UAE Satellite Imagery Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Satellite Imagery Services Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America UAE Satellite Imagery Services Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America UAE Satellite Imagery Services Market Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America UAE Satellite Imagery Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America UAE Satellite Imagery Services Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America UAE Satellite Imagery Services Market Revenue (Million), by End-User 2025 & 2033

- Figure 8: North America UAE Satellite Imagery Services Market Volume (K Unit), by End-User 2025 & 2033

- Figure 9: North America UAE Satellite Imagery Services Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America UAE Satellite Imagery Services Market Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America UAE Satellite Imagery Services Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America UAE Satellite Imagery Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America UAE Satellite Imagery Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UAE Satellite Imagery Services Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America UAE Satellite Imagery Services Market Revenue (Million), by Application 2025 & 2033

- Figure 16: South America UAE Satellite Imagery Services Market Volume (K Unit), by Application 2025 & 2033

- Figure 17: South America UAE Satellite Imagery Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America UAE Satellite Imagery Services Market Volume Share (%), by Application 2025 & 2033

- Figure 19: South America UAE Satellite Imagery Services Market Revenue (Million), by End-User 2025 & 2033

- Figure 20: South America UAE Satellite Imagery Services Market Volume (K Unit), by End-User 2025 & 2033

- Figure 21: South America UAE Satellite Imagery Services Market Revenue Share (%), by End-User 2025 & 2033

- Figure 22: South America UAE Satellite Imagery Services Market Volume Share (%), by End-User 2025 & 2033

- Figure 23: South America UAE Satellite Imagery Services Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America UAE Satellite Imagery Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: South America UAE Satellite Imagery Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America UAE Satellite Imagery Services Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe UAE Satellite Imagery Services Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe UAE Satellite Imagery Services Market Volume (K Unit), by Application 2025 & 2033

- Figure 29: Europe UAE Satellite Imagery Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe UAE Satellite Imagery Services Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe UAE Satellite Imagery Services Market Revenue (Million), by End-User 2025 & 2033

- Figure 32: Europe UAE Satellite Imagery Services Market Volume (K Unit), by End-User 2025 & 2033

- Figure 33: Europe UAE Satellite Imagery Services Market Revenue Share (%), by End-User 2025 & 2033

- Figure 34: Europe UAE Satellite Imagery Services Market Volume Share (%), by End-User 2025 & 2033

- Figure 35: Europe UAE Satellite Imagery Services Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe UAE Satellite Imagery Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Europe UAE Satellite Imagery Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe UAE Satellite Imagery Services Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa UAE Satellite Imagery Services Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Middle East & Africa UAE Satellite Imagery Services Market Volume (K Unit), by Application 2025 & 2033

- Figure 41: Middle East & Africa UAE Satellite Imagery Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa UAE Satellite Imagery Services Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa UAE Satellite Imagery Services Market Revenue (Million), by End-User 2025 & 2033

- Figure 44: Middle East & Africa UAE Satellite Imagery Services Market Volume (K Unit), by End-User 2025 & 2033

- Figure 45: Middle East & Africa UAE Satellite Imagery Services Market Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Middle East & Africa UAE Satellite Imagery Services Market Volume Share (%), by End-User 2025 & 2033

- Figure 47: Middle East & Africa UAE Satellite Imagery Services Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa UAE Satellite Imagery Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East & Africa UAE Satellite Imagery Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa UAE Satellite Imagery Services Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific UAE Satellite Imagery Services Market Revenue (Million), by Application 2025 & 2033

- Figure 52: Asia Pacific UAE Satellite Imagery Services Market Volume (K Unit), by Application 2025 & 2033

- Figure 53: Asia Pacific UAE Satellite Imagery Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific UAE Satellite Imagery Services Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific UAE Satellite Imagery Services Market Revenue (Million), by End-User 2025 & 2033

- Figure 56: Asia Pacific UAE Satellite Imagery Services Market Volume (K Unit), by End-User 2025 & 2033

- Figure 57: Asia Pacific UAE Satellite Imagery Services Market Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Asia Pacific UAE Satellite Imagery Services Market Volume Share (%), by End-User 2025 & 2033

- Figure 59: Asia Pacific UAE Satellite Imagery Services Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific UAE Satellite Imagery Services Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific UAE Satellite Imagery Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific UAE Satellite Imagery Services Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 23: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Brazil UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Argentina UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 34: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 35: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: United Kingdom UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Germany UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Russia UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Benelux UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Nordics UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 56: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 57: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 58: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 59: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Turkey UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Israel UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: GCC UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: North Africa UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: South Africa UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 74: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 75: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 76: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 77: Global UAE Satellite Imagery Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global UAE Satellite Imagery Services Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 79: China UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: India UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Japan UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: South Korea UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: ASEAN UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Oceania UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific UAE Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific UAE Satellite Imagery Services Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Satellite Imagery Services Market?

The projected CAGR is approximately 10.51%.

2. Which companies are prominent players in the UAE Satellite Imagery Services Market?

Key companies in the market include Global Beam Telecom (GB Telecom), United Arab Emirates Space Agency, Space Imaging Middle East, Airbus SE, Al Yah Satellite Communications Company PJSC (Yahsat), Emirates Institution for Advanced Science and Technology (EIAST), Mohammad Bin Rashid Space Centre (MBRSC), HawkEye 360 Inc, Thuraya Telecommunications Company, SATPALDA International F Z E .

3. What are the main segments of the UAE Satellite Imagery Services Market?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Government Initiatives and Substantial Investments to Drive the Market Growth; Infrastructure Development and Smart Cities.

6. What are the notable trends driving market growth?

Strategic Government Initiatives and Substantial Investments to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Data Processing and Analytics Capabilities; Data Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

May 2023: A comprehensive space program to build national satellite remote sensing and Earth Observation (EO) capabilities within the UAE was announced by Bayanat, a prominent AI-powered geospatial solutions supplier, and Al Yah Satellite Communications Company PJSC (Yahsat), the UAE's prominent satellite solutions provider. The program aims to address local and global EO market business opportunities commercially.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the UAE Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence