Key Insights

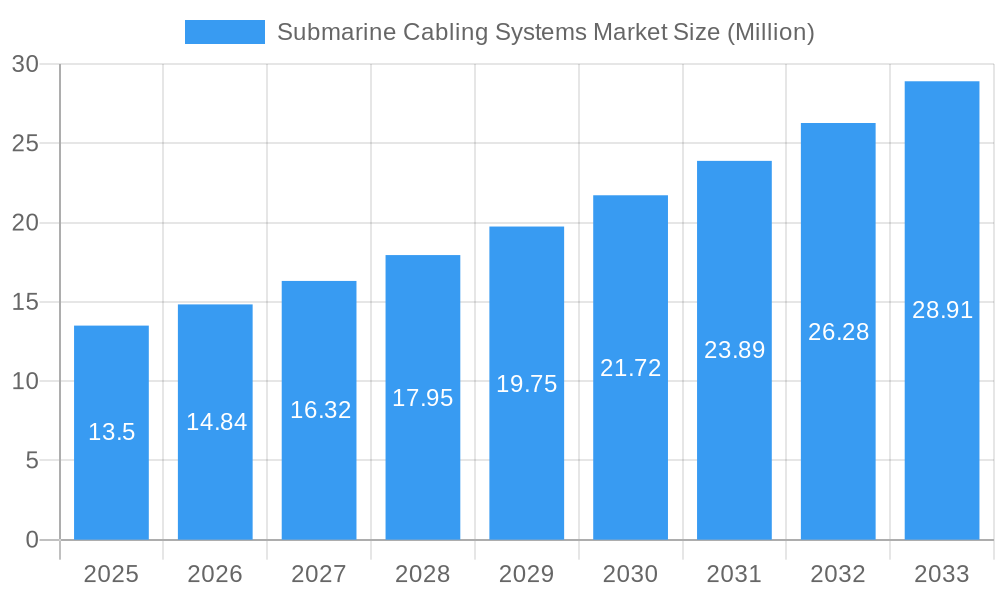

The global Submarine Cabling Systems Market is poised for substantial expansion, projected to reach a valuation of $13.5 million in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 10.20%, indicating a dynamic and expanding sector. The market is significantly driven by the escalating demand for enhanced global connectivity, fueled by the burgeoning digital economy, cloud computing adoption, and the increasing deployment of subsea data centers. Furthermore, the continuous expansion of offshore renewable energy projects, particularly wind farms, necessitates extensive submarine cable infrastructure for power transmission, acting as a powerful secondary driver. Emerging economies are also contributing to market growth through investments in new subsea cable routes to improve their digital capabilities and facilitate international trade.

Submarine Cabling Systems Market Market Size (In Million)

The market's segmentation reveals a healthy interplay between different product types and ownership structures. Dry Plant Products and Wet Plant Products are both crucial components, with advancements in technology leading to more efficient and durable subsea cable solutions. The ownership landscape, featuring a blend of Multiple Ownership Systems, Single Ownership Systems, and support from Multilateral Development Banks, highlights the collaborative and strategic investments shaping the market. Key players like JDR Cable Systems LLC, NTT Communications Corporation, Nexans SA, Google LLC, and Alcatel Submarine Networks are at the forefront, innovating and expanding their global footprint. While the market is strong, potential restraints such as high installation costs, complex regulatory environments, and the threat of accidental damage or natural disasters require strategic mitigation to ensure sustained growth. The study period from 2019-2033, with a base year of 2025, provides a comprehensive outlook on this vital infrastructure sector.

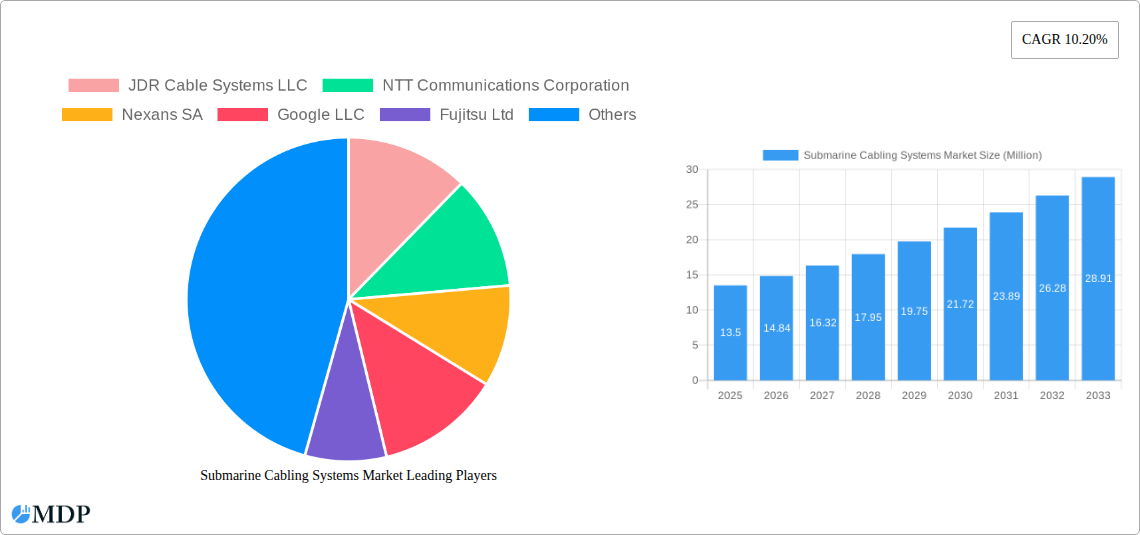

Submarine Cabling Systems Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Submarine Cabling Systems Market, providing critical insights into market dynamics, technological advancements, leading players, and future opportunities. With a Study Period of 2019–2033, a Base Year and Estimated Year of 2025, and a Forecast Period of 2025–2033, this report leverages historical data from 2019–2024 to deliver actionable intelligence for industry stakeholders. Explore the escalating demand for robust subsea cables, undersea data transmission, and international connectivity solutions driven by the exponential growth in cloud computing, 5G deployment, and digital transformation. Understand the market segmentation by Dry Plant Products and Wet Plant Products, and analyze ownership structures including Multiple Ownership System and Single Ownership System, alongside the role of Multilateral Development Banks.

Submarine Cabling Systems Market Market Dynamics & Concentration

The global Submarine Cabling Systems Market is characterized by a moderate to high concentration, with a few key players dominating the manufacturing and installation of these critical infrastructure components. Innovation drivers are primarily fueled by the relentless demand for increased bandwidth, lower latency, and enhanced network resilience to support burgeoning digital services and data traffic. Regulatory frameworks, while generally supportive of infrastructure development, can vary significantly by region, influencing project timelines and investment. Product substitutes are largely non-existent for long-haul subsea data transmission, cementing the indispensable role of submarine cables. End-user trends highlight a growing preference for direct subsea connections by major tech giants for enhanced performance and security. Mergers and acquisitions (M&A) activities, though infrequent, are strategic and often aimed at consolidating expertise or expanding geographical reach. For instance, recent M&A activities have seen established players acquiring smaller technology firms to enhance their capabilities in areas like specialized cable manufacturing or installation technology. The market share distribution is skewed, with companies like Nexans SA, SubCom LLC, and NEC Corporation holding significant portions due to their extensive project portfolios and technological prowess. The number of significant M&A deals in the last five years has been approximately 5-10, primarily involving acquisitions of specialized engineering firms or smaller cable manufacturers.

Submarine Cabling Systems Market Industry Trends & Analysis

The Submarine Cabling Systems Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). This expansion is primarily driven by the insatiable global demand for data, fueled by the proliferation of cloud services, the widespread adoption of the Internet of Things (IoT), and the continuous evolution of telecommunication networks, including the rollout of 5G technology. Technological disruptions are at the forefront, with continuous advancements in fiber optic technology leading to higher capacity cables, enabling the transmission of petabits of data per second. Innovations in subsea repeater technology are also crucial, allowing for longer unrepe الآخر segments and reducing the overall cost of deployment. Consumer preferences, though indirectly influencing the submarine cable market, are shaped by the demand for seamless, high-speed internet access, uninterrupted video streaming, and low-latency gaming experiences – all of which are underpinned by a strong subsea cable infrastructure. Competitive dynamics are intense, with leading companies vying for lucrative contracts to lay new cables and upgrade existing ones. The strategic importance of these cables for national security and economic competitiveness also drives government investment and policy support in many regions. Market penetration is steadily increasing as more countries and regions recognize the necessity of robust international connectivity. The increasing number of hyperscale data centers and content delivery networks (CDNs) further necessitates the expansion and modernization of submarine cable networks to ensure efficient data flow and reduce transit times. The development of new cable landing stations and the expansion of existing ones are also indicative of this growing trend.

Leading Markets & Segments in Submarine Cabling Systems Market

The Asia Pacific region is emerging as a dominant market in the Submarine Cabling Systems sector, driven by rapid economic growth, increasing digitalization initiatives, and a burgeoning internet user base across countries like China, India, and Southeast Asian nations. Specifically, the Multiple Ownership System segment is experiencing significant traction. This model, where multiple entities like telecom operators, content providers, and even governments co-invest in and share the capacity of a submarine cable, offers a cost-effective solution for consortiums seeking to establish critical international links.

- Dominant Region: Asia Pacific, with significant investment in new cable routes connecting to North America and Europe.

- Key Drivers in Asia Pacific:

- Economic Policies: Government support for digital infrastructure development and economic diversification.

- Infrastructure Growth: Rapid expansion of data centers and the increasing need for intercontinental data transfer.

- Technological Adoption: High mobile penetration and growing demand for cloud-based services.

- Dominant Segment (Ownership Type): Multiple Ownership System. This is favored due to the immense cost of laying transatlantic and transpacific cables, making shared investment a logical approach for a wider range of stakeholders.

- Key Drivers for Multiple Ownership:

- Risk Sharing: Spreading the substantial financial risk associated with large-scale subsea projects.

- Capacity Optimization: Ensuring sufficient bandwidth for all consortium members.

- Strategic Alliances: Fostering collaboration between technology companies, telecommunication providers, and governments.

- Key Drivers for Multiple Ownership:

- Leading Segments (Type):

- Wet Plant Products: This segment, encompassing subsea cables themselves, repeaters, and associated subsea equipment, commands the largest market share due to its fundamental role in any submarine cable system deployment. The demand for higher capacity and more resilient subsea cables directly fuels this segment.

- Dry Plant Products: While smaller in value, dry plant products, including shore-end cables, cable landing stations, and associated terrestrial infrastructure, are crucial for the complete functioning of a submarine cable system. Investments in these areas are growing in tandem with new cable deployments.

Submarine Cabling Systems Market Product Developments

Recent product developments in the Submarine Cabling Systems Market are focused on enhancing data transmission capabilities and system resilience. Innovations include the development of higher-fiber-count cables, capable of carrying significantly more data, and advanced repeater designs that improve signal integrity over longer distances. Furthermore, there's a growing emphasis on developing more environmentally friendly manufacturing processes and materials for subsea components, aligning with global sustainability initiatives. These advancements offer competitive advantages by enabling faster, more reliable, and cost-effective connectivity solutions, crucial for meeting the escalating demands of global data consumption.

Key Drivers of Submarine Cabling Systems Market Growth

The growth of the Submarine Cabling Systems Market is propelled by several key factors. Firstly, the exponential increase in global data traffic, driven by cloud computing, streaming services, and the expanding digital economy, necessitates greater subsea capacity. Secondly, the ongoing digital transformation across industries, coupled with the rollout of 5G networks, requires robust and low-latency international connectivity. Thirdly, strategic investments by major technology companies and governments in building new subsea cable systems to enhance network resilience and expand digital reach are significant accelerators. Finally, the growing demand for reliable intercontinental data transfer for financial markets, scientific research, and global communication continues to fuel expansion.

Challenges in the Submarine Cabling Systems Market Market

Despite robust growth, the Submarine Cabling Systems Market faces several challenges. The immense capital expenditure required for laying new subsea cables presents a significant financial barrier, often necessitating complex consortium arrangements. Navigating diverse and evolving regulatory frameworks across different jurisdictions for permits and environmental approvals can lead to project delays and increased costs. Supply chain complexities, particularly for specialized components and vessels, can also impact project timelines and cost-effectiveness. Furthermore, the inherent risks associated with subsea operations, such as accidental damage from fishing activities or seismic events, pose ongoing challenges to maintaining uninterrupted service.

Emerging Opportunities in Submarine Cabling Systems Market

Emerging opportunities in the Submarine Cabling Systems Market are primarily driven by the expansion of connectivity into under-served regions, particularly in emerging economies and island nations. The development of novel cable technologies, such as those incorporating artificial intelligence for network monitoring and maintenance, presents a significant growth avenue. Strategic partnerships between telecom operators, hyperscale cloud providers, and content delivery networks are creating new avenues for co-investment and capacity sharing, leading to more efficient and widespread network coverage. The increasing focus on renewable energy sources for powering subsea infrastructure also opens up opportunities for innovative solutions in this domain.

Leading Players in the Submarine Cabling Systems Market Sector

- JDR Cable Systems LLC

- NTT Communications Corporation

- Nexans SA

- Google LLC

- Fujitsu Ltd

- Alcatel Submarine Networks

- SubCom LLC

- NEC Corporation

- Sumitomo Electronics Industries Ltd

- PT Communication Cable System Indonesia Tb

Key Milestones in Submarine Cabling Systems Market Industry

- September 2023: Google LLC announced the launch of Nuvem, a novel transatlantic subsea cable system designed to interconnect Portugal, Bermuda, and the United States. This initiative aims to bolster network resiliency across the Atlantic, meeting the burgeoning demand for digital services. The new cable route will introduce international route diversity, supporting the advancement of information and communications technology (ICT) infrastructure across the involved continents and countries.

- July 2023: Alcatel Submarine Networks (ASN), Elettra Tlc, Medusa, and Orange unveiled construction contracts for the Medusa submarine cable system, marking a significant milestone in fortifying connectivity across the Mediterranean Sea. The expansive Medusa network is set to link Morocco, Portugal, Spain, France, Algeria, Tunisia, Italy, Greece, Cyprus, and Egypt.

Strategic Outlook for Submarine Cabling Systems Market Market

The strategic outlook for the Submarine Cabling Systems Market remains exceptionally strong, fueled by persistent global demand for enhanced digital connectivity. Future growth will be significantly shaped by the increasing deployment of subsea cables for intercontinental data transfer, driven by the burgeoning cloud computing sector and the expansion of AI-driven applications. Strategic initiatives will focus on developing higher-capacity, more resilient, and environmentally sustainable cable systems. Partnerships between technology giants and infrastructure providers will continue to be crucial for funding and executing large-scale projects. Furthermore, the exploration of new routes and the development of advanced installation and maintenance technologies will be key to unlocking future market potential and ensuring the continuous evolution of the global digital infrastructure.

Submarine Cabling Systems Market Segmentation

-

1. Type

- 1.1. Dry Plant Products

- 1.2. Wet Plant Products

-

2. Ownership Type

- 2.1. Multiple Ownership System

- 2.2. Single Ownership System

- 2.3. Multilateral Development Banks

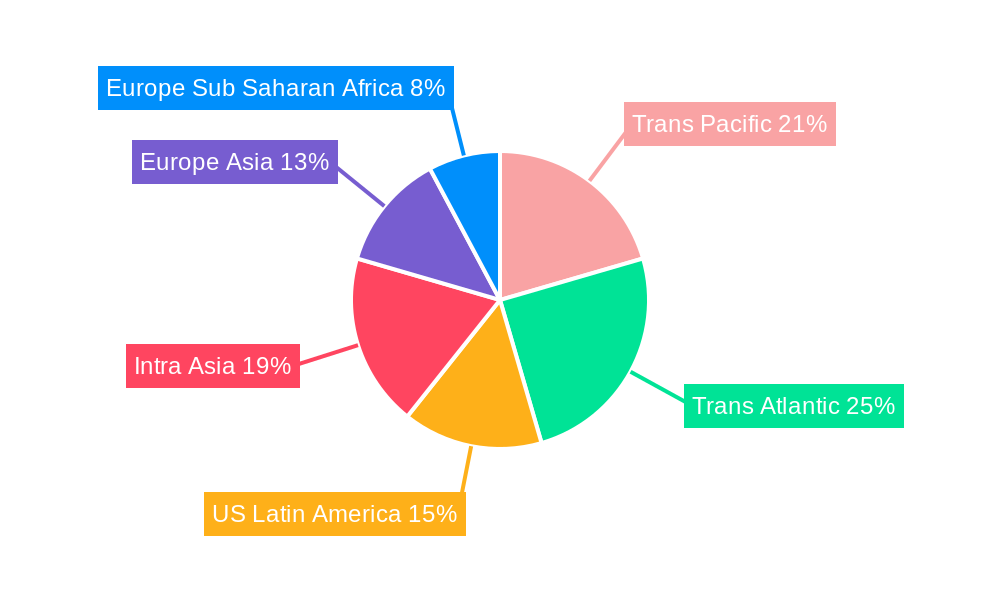

Submarine Cabling Systems Market Segmentation By Geography

- 1. Trans Pacific

- 2. Trans Atlantic

- 3. US Latin America

- 4. Intra Asia

- 5. Europe Asia

- 6. Europe Sub Saharan Africa

Submarine Cabling Systems Market Regional Market Share

Geographic Coverage of Submarine Cabling Systems Market

Submarine Cabling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Internet Bandwidth from Content Providers; Increasing Submarine Cable Connectivity in Emerging Regions; Growing Investments in Offshore Wind Farms

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Localization Initiatives; Geopolitical Tensions Limiting Projects

- 3.4. Market Trends

- 3.4.1. Dry Plant Products to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dry Plant Products

- 5.1.2. Wet Plant Products

- 5.2. Market Analysis, Insights and Forecast - by Ownership Type

- 5.2.1. Multiple Ownership System

- 5.2.2. Single Ownership System

- 5.2.3. Multilateral Development Banks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Trans Pacific

- 5.3.2. Trans Atlantic

- 5.3.3. US Latin America

- 5.3.4. Intra Asia

- 5.3.5. Europe Asia

- 5.3.6. Europe Sub Saharan Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Trans Pacific Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dry Plant Products

- 6.1.2. Wet Plant Products

- 6.2. Market Analysis, Insights and Forecast - by Ownership Type

- 6.2.1. Multiple Ownership System

- 6.2.2. Single Ownership System

- 6.2.3. Multilateral Development Banks

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Trans Atlantic Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dry Plant Products

- 7.1.2. Wet Plant Products

- 7.2. Market Analysis, Insights and Forecast - by Ownership Type

- 7.2.1. Multiple Ownership System

- 7.2.2. Single Ownership System

- 7.2.3. Multilateral Development Banks

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. US Latin America Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dry Plant Products

- 8.1.2. Wet Plant Products

- 8.2. Market Analysis, Insights and Forecast - by Ownership Type

- 8.2.1. Multiple Ownership System

- 8.2.2. Single Ownership System

- 8.2.3. Multilateral Development Banks

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Intra Asia Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dry Plant Products

- 9.1.2. Wet Plant Products

- 9.2. Market Analysis, Insights and Forecast - by Ownership Type

- 9.2.1. Multiple Ownership System

- 9.2.2. Single Ownership System

- 9.2.3. Multilateral Development Banks

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Europe Asia Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dry Plant Products

- 10.1.2. Wet Plant Products

- 10.2. Market Analysis, Insights and Forecast - by Ownership Type

- 10.2.1. Multiple Ownership System

- 10.2.2. Single Ownership System

- 10.2.3. Multilateral Development Banks

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Europe Sub Saharan Africa Submarine Cabling Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Dry Plant Products

- 11.1.2. Wet Plant Products

- 11.2. Market Analysis, Insights and Forecast - by Ownership Type

- 11.2.1. Multiple Ownership System

- 11.2.2. Single Ownership System

- 11.2.3. Multilateral Development Banks

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 JDR Cable Systems LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 NTT Communications Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nexans SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Google LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fujitsu Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alcatel Submarine Networks

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 SubCom LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NEC Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sumitomo Electronics Industries Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 PT Communication Cable System Indonesia Tb

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 JDR Cable Systems LLC

List of Figures

- Figure 1: Global Submarine Cabling Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Submarine Cabling Systems Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: Trans Pacific Submarine Cabling Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 4: Trans Pacific Submarine Cabling Systems Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: Trans Pacific Submarine Cabling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Trans Pacific Submarine Cabling Systems Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Trans Pacific Submarine Cabling Systems Market Revenue (Million), by Ownership Type 2025 & 2033

- Figure 8: Trans Pacific Submarine Cabling Systems Market Volume (K Unit), by Ownership Type 2025 & 2033

- Figure 9: Trans Pacific Submarine Cabling Systems Market Revenue Share (%), by Ownership Type 2025 & 2033

- Figure 10: Trans Pacific Submarine Cabling Systems Market Volume Share (%), by Ownership Type 2025 & 2033

- Figure 11: Trans Pacific Submarine Cabling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Trans Pacific Submarine Cabling Systems Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: Trans Pacific Submarine Cabling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Trans Pacific Submarine Cabling Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Trans Atlantic Submarine Cabling Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Trans Atlantic Submarine Cabling Systems Market Volume (K Unit), by Type 2025 & 2033

- Figure 17: Trans Atlantic Submarine Cabling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Trans Atlantic Submarine Cabling Systems Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Trans Atlantic Submarine Cabling Systems Market Revenue (Million), by Ownership Type 2025 & 2033

- Figure 20: Trans Atlantic Submarine Cabling Systems Market Volume (K Unit), by Ownership Type 2025 & 2033

- Figure 21: Trans Atlantic Submarine Cabling Systems Market Revenue Share (%), by Ownership Type 2025 & 2033

- Figure 22: Trans Atlantic Submarine Cabling Systems Market Volume Share (%), by Ownership Type 2025 & 2033

- Figure 23: Trans Atlantic Submarine Cabling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Trans Atlantic Submarine Cabling Systems Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Trans Atlantic Submarine Cabling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Trans Atlantic Submarine Cabling Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 27: US Latin America Submarine Cabling Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 28: US Latin America Submarine Cabling Systems Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: US Latin America Submarine Cabling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: US Latin America Submarine Cabling Systems Market Volume Share (%), by Type 2025 & 2033

- Figure 31: US Latin America Submarine Cabling Systems Market Revenue (Million), by Ownership Type 2025 & 2033

- Figure 32: US Latin America Submarine Cabling Systems Market Volume (K Unit), by Ownership Type 2025 & 2033

- Figure 33: US Latin America Submarine Cabling Systems Market Revenue Share (%), by Ownership Type 2025 & 2033

- Figure 34: US Latin America Submarine Cabling Systems Market Volume Share (%), by Ownership Type 2025 & 2033

- Figure 35: US Latin America Submarine Cabling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 36: US Latin America Submarine Cabling Systems Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: US Latin America Submarine Cabling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: US Latin America Submarine Cabling Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Intra Asia Submarine Cabling Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Intra Asia Submarine Cabling Systems Market Volume (K Unit), by Type 2025 & 2033

- Figure 41: Intra Asia Submarine Cabling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Intra Asia Submarine Cabling Systems Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Intra Asia Submarine Cabling Systems Market Revenue (Million), by Ownership Type 2025 & 2033

- Figure 44: Intra Asia Submarine Cabling Systems Market Volume (K Unit), by Ownership Type 2025 & 2033

- Figure 45: Intra Asia Submarine Cabling Systems Market Revenue Share (%), by Ownership Type 2025 & 2033

- Figure 46: Intra Asia Submarine Cabling Systems Market Volume Share (%), by Ownership Type 2025 & 2033

- Figure 47: Intra Asia Submarine Cabling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Intra Asia Submarine Cabling Systems Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Intra Asia Submarine Cabling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Intra Asia Submarine Cabling Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Europe Asia Submarine Cabling Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Europe Asia Submarine Cabling Systems Market Volume (K Unit), by Type 2025 & 2033

- Figure 53: Europe Asia Submarine Cabling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Europe Asia Submarine Cabling Systems Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Europe Asia Submarine Cabling Systems Market Revenue (Million), by Ownership Type 2025 & 2033

- Figure 56: Europe Asia Submarine Cabling Systems Market Volume (K Unit), by Ownership Type 2025 & 2033

- Figure 57: Europe Asia Submarine Cabling Systems Market Revenue Share (%), by Ownership Type 2025 & 2033

- Figure 58: Europe Asia Submarine Cabling Systems Market Volume Share (%), by Ownership Type 2025 & 2033

- Figure 59: Europe Asia Submarine Cabling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Europe Asia Submarine Cabling Systems Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Europe Asia Submarine Cabling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Asia Submarine Cabling Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Europe Sub Saharan Africa Submarine Cabling Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Europe Sub Saharan Africa Submarine Cabling Systems Market Volume (K Unit), by Type 2025 & 2033

- Figure 65: Europe Sub Saharan Africa Submarine Cabling Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Europe Sub Saharan Africa Submarine Cabling Systems Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Europe Sub Saharan Africa Submarine Cabling Systems Market Revenue (Million), by Ownership Type 2025 & 2033

- Figure 68: Europe Sub Saharan Africa Submarine Cabling Systems Market Volume (K Unit), by Ownership Type 2025 & 2033

- Figure 69: Europe Sub Saharan Africa Submarine Cabling Systems Market Revenue Share (%), by Ownership Type 2025 & 2033

- Figure 70: Europe Sub Saharan Africa Submarine Cabling Systems Market Volume Share (%), by Ownership Type 2025 & 2033

- Figure 71: Europe Sub Saharan Africa Submarine Cabling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Europe Sub Saharan Africa Submarine Cabling Systems Market Volume (K Unit), by Country 2025 & 2033

- Figure 73: Europe Sub Saharan Africa Submarine Cabling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Europe Sub Saharan Africa Submarine Cabling Systems Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 4: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 5: Global Submarine Cabling Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 10: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 11: Global Submarine Cabling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 16: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 17: Global Submarine Cabling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 22: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 23: Global Submarine Cabling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 28: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 29: Global Submarine Cabling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 34: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 35: Global Submarine Cabling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Submarine Cabling Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global Submarine Cabling Systems Market Revenue Million Forecast, by Ownership Type 2020 & 2033

- Table 40: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Ownership Type 2020 & 2033

- Table 41: Global Submarine Cabling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Submarine Cabling Systems Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Submarine Cabling Systems Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Submarine Cabling Systems Market?

Key companies in the market include JDR Cable Systems LLC, NTT Communications Corporation, Nexans SA, Google LLC, Fujitsu Ltd, Alcatel Submarine Networks, SubCom LLC, NEC Corporation, Sumitomo Electronics Industries Ltd, PT Communication Cable System Indonesia Tb.

3. What are the main segments of the Submarine Cabling Systems Market?

The market segments include Type, Ownership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Internet Bandwidth from Content Providers; Increasing Submarine Cable Connectivity in Emerging Regions; Growing Investments in Offshore Wind Farms.

6. What are the notable trends driving market growth?

Dry Plant Products to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Data Privacy and Localization Initiatives; Geopolitical Tensions Limiting Projects.

8. Can you provide examples of recent developments in the market?

September 2023: Google LLC announced the launch of Nuvem, a novel transatlantic subsea cable system designed to interconnect Portugal, Bermuda, and the United States. This initiative aims to bolster network resiliency across the Atlantic, meeting the burgeoning demand for digital services. The new cable route will introduce international route diversity, supporting the advancement of information and communications technology (ICT) infrastructure across the involved continents and countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Submarine Cabling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Submarine Cabling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Submarine Cabling Systems Market?

To stay informed about further developments, trends, and reports in the Submarine Cabling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence