Key Insights

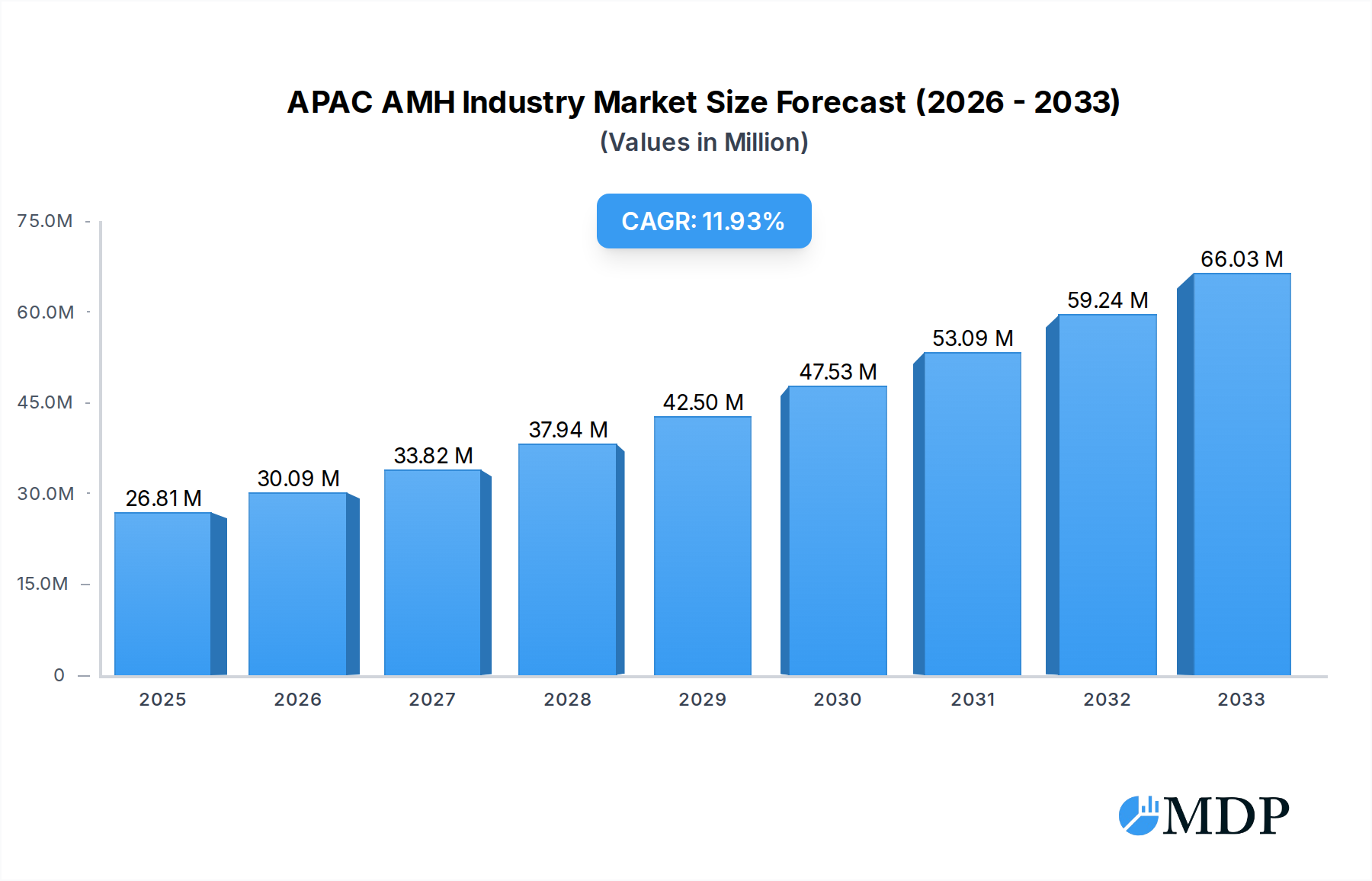

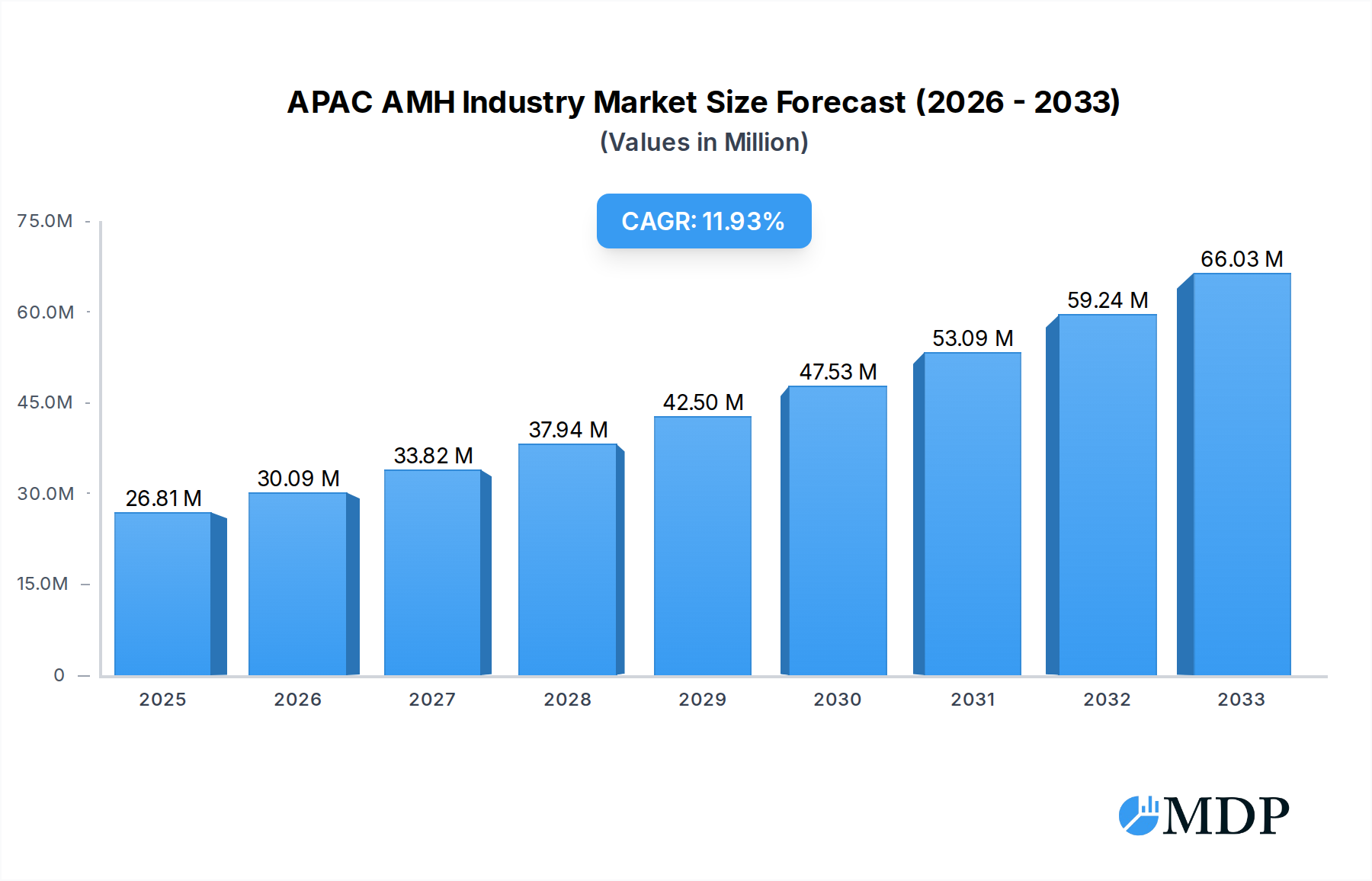

The Asia Pacific (APAC) Automated Material Handling (AMH) market is poised for significant expansion, driven by robust economic growth and an increasing emphasis on operational efficiency across various industries. The market is projected to reach an estimated $26.81 million by 2025, demonstrating a compelling compound annual growth rate (CAGR) of 12.07% from 2019 to 2033. This rapid ascent is primarily fueled by the escalating adoption of advanced technologies like Automated Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (ASRS) in sectors such as e-commerce, retail, and automotive manufacturing. The region's burgeoning manufacturing base, coupled with a growing demand for streamlined logistics and supply chain solutions, are key accelerators for AMH adoption. Furthermore, government initiatives supporting industrial automation and smart manufacturing are providing a fertile ground for market players.

APAC AMH Industry Market Size (In Million)

Key trends shaping the APAC AMH landscape include the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) for optimized warehouse operations, and the growing preference for flexible and scalable AMH solutions. While the market exhibits strong growth prospects, potential restraints include high initial investment costs for sophisticated AMH systems and the need for skilled personnel to manage and maintain these technologies. However, the clear benefits in terms of reduced operational costs, improved accuracy, and enhanced safety are expected to outweigh these challenges. The market is segmented across various product types, equipment types, and end-user verticals, with significant opportunities in sectors like food and beverage, pharmaceuticals, and post and parcel, reflecting the region's diverse industrial ecosystem.

APAC AMH Industry Company Market Share

APAC Automated Material Handling (AMH) Industry Market Report: 2025-2033

Unlock unparalleled insights into the dynamic APAC Automated Material Handling (AMH) market. This comprehensive report offers a deep dive into industry growth drivers, technological advancements, competitive landscapes, and emerging opportunities. Forecasted to reach USD X Million by 2033, with a robust CAGR of XX% from 2025-2033, this study is essential for stakeholders seeking to navigate and capitalize on the booming APAC AMH sector. Discover key trends in Mobile Robots (AGVs, AMRs), ASRS, Automated Conveyors, and Palletizers across vital end-user verticals like Automotive, Food & Beverage, and E-commerce. Analyze critical market dynamics, leading players, and strategic imperatives shaping the future of material handling in Asia Pacific.

APAC AMH Industry Market Dynamics & Concentration

The APAC Automated Material Handling (AMH) market is characterized by a moderate to high concentration of key players, with a significant portion of market share held by established global and regional leaders. Innovation serves as a primary driver, fueled by rapid technological advancements in robotics, AI, and IoT, pushing for greater automation efficiency and flexibility. Regulatory frameworks, while evolving, are increasingly supportive of automation to enhance productivity and address labor shortages. Product substitutes exist, primarily in the form of manual labor and less advanced automation solutions, but the clear advantages in efficiency, safety, and cost-effectiveness of AMH systems are steadily diminishing their relevance. End-user trends are heavily influenced by the burgeoning e-commerce sector, demanding faster fulfillment times and sophisticated logistics. The food & beverage, automotive, and pharmaceuticals industries are also significant contributors, driven by stringent quality control and safety requirements. Mergers and Acquisitions (M&A) activities are notable, with companies strategically acquiring smaller innovators or consolidating to expand their market reach and technological capabilities. For instance, the cooperative business agreement between AFT Industries AG and Daifuku in September 2021 signifies a strategic move to leverage combined capabilities, indicating a trend towards consolidation for competitive advantage. The market is projected to see continued M&A activity as companies seek to strengthen their portfolios and gain market share.

APAC AMH Industry Industry Trends & Analysis

The APAC Automated Material Handling (AMH) industry is experiencing phenomenal growth, propelled by a confluence of powerful market growth drivers. The escalating demand for efficient and cost-effective logistics solutions across diverse end-user verticals such as e-commerce, automotive, food & beverage, and pharmaceuticals is a primary catalyst. Businesses are increasingly recognizing the ROI associated with AMH systems, leading to significant investments aimed at enhancing operational throughput, reducing labor costs, and improving safety standards. Technological disruptions are at the forefront, with the rapid evolution of Autonomous Mobile Robots (AMRs) and sophisticated Automated Storage and Retrieval Systems (ASRS) revolutionizing warehouse and factory floor operations. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into AMH solutions is further enhancing their capabilities, enabling predictive maintenance, optimized routing, and intelligent decision-making. Consumer preferences are also playing a crucial role, with the expectation of faster delivery times and personalized services in the retail and e-commerce sectors directly translating into a need for more agile and responsive material handling. The competitive dynamics within the APAC AMH market are intense, featuring both global giants and rapidly growing local players vying for market dominance. Companies are investing heavily in research and development to offer innovative solutions that address specific industry challenges. The market penetration of advanced AMH technologies is steadily increasing, driven by pilot projects and successful implementations that showcase tangible benefits. The projected CAGR of XX% during the forecast period (2025-2033) underscores the immense potential and sustained expansion anticipated for this sector.

Leading Markets & Segments in APAC AMH Industry

The APAC Automated Material Handling (AMH) industry exhibits dominance across several key segments and geographical markets, driven by distinct economic and technological factors.

- Dominant Region: Asia Pacific itself is the central hub for growth, with China leading the charge due to its vast manufacturing base, burgeoning e-commerce market, and significant government initiatives supporting industrial automation. Other key markets include Japan, South Korea, and Southeast Asian nations like Vietnam and India, all experiencing rapid industrialization and urbanization.

- Dominant Product Type:

- Hardware: This segment is critical, encompassing the physical infrastructure of AMH. Within hardware, Mobile Robots, particularly Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) such as automated forklifts, are witnessing explosive growth due to their flexibility and adaptability in dynamic environments.

- Equipment Type:

- Automated Storage and Retrieval Systems (ASRS): Fixed Aisle ASRS, including stacker crane and shuttle systems, remain foundational for high-density storage solutions in large distribution centers and manufacturing facilities. However, Vertical Lift Modules (VLMs) and Carousel systems are gaining traction for their space-saving capabilities in smaller footprints.

- Automated Conveyor Systems: Belt and roller conveyors are ubiquitous, but pallet and overhead conveyors are increasingly important for large-scale material flow in industries like automotive and post & parcel.

- Palletizers: Both Conventional and Robotic Palletizers are crucial for automating the loading and unloading of goods, with robotic palletizers offering greater flexibility for handling diverse product types.

- Sortation Systems: Essential for high-volume order fulfillment, particularly in e-commerce and postal services.

- Dominant End-user Verticals:

- E-commerce & Retail/Wholesale: This sector is a powerhouse, demanding rapid order processing and last-mile delivery solutions, making AMH indispensable.

- Automotive: The automotive industry has long been an early adopter of automation, with AMH playing a vital role in streamlining production lines, internal logistics, and component handling. The cooperative business agreement between AFT Industries AG and Daifuku specifically highlights the focus on this vertical.

- Food & Beverage: Driven by the need for hygiene, traceability, and efficient cold chain logistics, this sector is increasingly investing in AMH.

- General Manufacturing: Across various manufacturing sub-sectors, AMH is crucial for improving efficiency, reducing waste, and ensuring worker safety.

- Airport & Post and Parcel: These sectors are experiencing significant investment in AMH for cargo handling, baggage management, and package sorting to meet growing volumes and speed demands. The installation of a new automated air cargo terminal at Chengdu Tianfu International Airport by Lodige Industries exemplifies this trend.

Key drivers for dominance in these segments include economic policies promoting industrial upgrades, substantial investments in infrastructure, and the clear ROI demonstrated by successful AMH implementations.

APAC AMH Industry Product Developments

The APAC AMH market is witnessing a surge in product innovation, with a strong focus on enhancing intelligence, flexibility, and sustainability. Companies are developing more agile Autonomous Mobile Robots (AMRs) capable of navigating complex and dynamic environments with advanced AI for obstacle avoidance and fleet management, as exemplified by VisionNav Robotics' demonstrated applications of counterbalanced automated forklifts. Automated Storage and Retrieval Systems (ASRS) are becoming more modular and scalable, catering to diverse facility footprints and throughput requirements. Integration of IoT sensors and cloud-based platforms is enabling real-time data analytics for predictive maintenance and operational optimization. Furthermore, there is a growing emphasis on energy-efficient designs and the development of robotic solutions for specialized applications, such as handling delicate goods or operating in extreme environments, ensuring a competitive edge through technological superiority and tailored market fit.

Key Drivers of APAC AMH Industry Growth

The APAC AMH industry's growth is predominantly fueled by several interconnected factors. Economically, the region's robust manufacturing output and the exponential rise of e-commerce necessitate sophisticated logistics to handle increased volumes and delivery speed expectations. Technological advancements, particularly in AI, robotics, and IoT, are making AMH solutions more accessible, efficient, and intelligent. Regulatory frameworks in many APAC countries are increasingly supportive of automation to boost productivity and address aging workforces. For instance, KION Group's establishment of a new forklift truck manufacturing site in Jinan, China, underscores the strategic importance of the region for production and market expansion. The increasing need for supply chain resilience and the pursuit of operational excellence across all industries are further accelerating the adoption of AMH.

Challenges in the APAC AMH Industry Market

Despite its strong growth trajectory, the APAC AMH market faces several hurdles. High initial capital investment for advanced AMH systems can be a significant barrier for small and medium-sized enterprises (SMEs). The availability of skilled labor for the installation, maintenance, and operation of complex AMH systems remains a challenge in certain regions, necessitating robust training programs. Cybersecurity concerns related to interconnected automated systems also require careful consideration and robust protective measures. Furthermore, varying regulatory landscapes across different APAC countries can create complexities for global deployment. Competitive pressures from both established players and emerging local manufacturers, alongside potential supply chain disruptions for critical components, also present ongoing challenges.

Emerging Opportunities in APAC AMH Industry

The APAC AMH industry is ripe with emerging opportunities. The continued expansion of e-commerce and the increasing demand for same-day or next-day delivery are creating a massive market for high-speed sortation and fulfillment solutions. The growing adoption of Industry 4.0 principles and smart factory initiatives is driving the integration of AMH with other automated systems, creating synergistic benefits. Furthermore, the increasing focus on sustainability and green logistics presents an opportunity for AMH providers to offer energy-efficient solutions and solutions that reduce waste. Strategic partnerships and collaborations, such as the one between AFT Industries AG and Daifuku, are key to leveraging complementary expertise and expanding market reach into new verticals and geographies. The development of specialized AMH solutions for niche industries like healthcare and agriculture also represents a significant untapped market potential.

Leading Players in the APAC AMH Industry Sector

- System Logistics

- Jungheinrich AG

- Murata Machinery Ltd

- DAIFUKU Co Ltd

- Interroll Group

- BEUMER Group GmbH & Co KG

- VisionNav Robotics

- SSI Schaefer AG

- Witron Logistik

- KION Group

- Kardex Group

- JBT Corporation

- Honeywell Intelligrated Inc

- Toyota Industries Corporation

- Kuka AG

Key Milestones in APAC AMH Industry Industry

- August 2022: Juki Automation Systems (JAS), Inc. announced plans to exhibit at the SMTA Guadalajara Expo & Tech Forum to demonstrate its award-winning Autonomous Material Handling System and JM-50, highlighting innovation in automated assembly and material handling.

- June 2022: Lodige Industries announced the installation of a new fully automated air cargo terminal at Chengdu Tianfu International Airport, featuring an advanced ULD storage and handling system with elevating transfer vehicles, showcasing significant developments in airport logistics.

- March 2022: VisionNav Robotics demonstrated the VNP15 counterbalanced automated forklift in multi-layer material frame stacking scenarios at MODEX 2022, emphasizing advancements in automated forklift capabilities for warehousing.

- December 2021: The KION Group established a new forklift truck manufacturing site in Jinan, China, a substantial 2,400,000-square-foot facility, indicating a strategic expansion of manufacturing capacity in the key APAC market for its Linde Material Handling and Baoli brands.

- September 2021: AFT Industries AG and Daifuku of Japan formed a cooperative business agreement to leverage their material handling capabilities in the automobile industry, signifying strategic partnerships aimed at global reach and increased demand within the automotive sector.

Strategic Outlook for APAC AMH Industry Market

The strategic outlook for the APAC AMH industry is overwhelmingly positive, driven by sustained demand for automation across its core and emerging verticals. Growth accelerators include the continued digital transformation of supply chains, the relentless expansion of e-commerce, and the ongoing pursuit of operational efficiency by businesses in response to global economic pressures. Future market potential lies in the deeper integration of AI for predictive analytics and autonomous decision-making, as well as the development of more sustainable and energy-efficient AMH solutions. Strategic opportunities will arise from companies that can offer end-to-end solutions, catering to the entire material flow from inbound logistics to outbound fulfillment, and those that can adapt their offerings to the specific needs of diverse regional markets within APAC. The ongoing focus on innovation in robotics, IoT, and software platforms will be crucial for maintaining a competitive edge.

APAC AMH Industry Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Equipment Type

-

2.1. Mobile Robots

-

2.1.1. Automated Guided Vehicle (AGV)

- 2.1.1.1. Automated Forklift

- 2.1.1.2. Automated Tow/Tractor/Tug

- 2.1.1.3. Unit Load

- 2.1.1.4. Assembly Line

- 2.1.1.5. Special Purpose

- 2.1.2. Autonomous Mobile Robots (AMR)

- 2.1.3. Laser Guided Vehicle

-

2.1.1. Automated Guided Vehicle (AGV)

-

2.2. Automated Storage and Retrieval System (ASRS)

- 2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 2.2.3. Vertical Lift Module

-

2.3. Automated Conveyor

- 2.3.1. Belt

- 2.3.2. Roller

- 2.3.3. Pallet

- 2.3.4. Overhead

-

2.4. Palletizer

- 2.4.1. Conventional (High Level + Low Level)

- 2.4.2. Robotic

- 2.5. Sortation System

-

2.1. Mobile Robots

-

3. End-user Vertical

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Other End-Users

APAC AMH Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

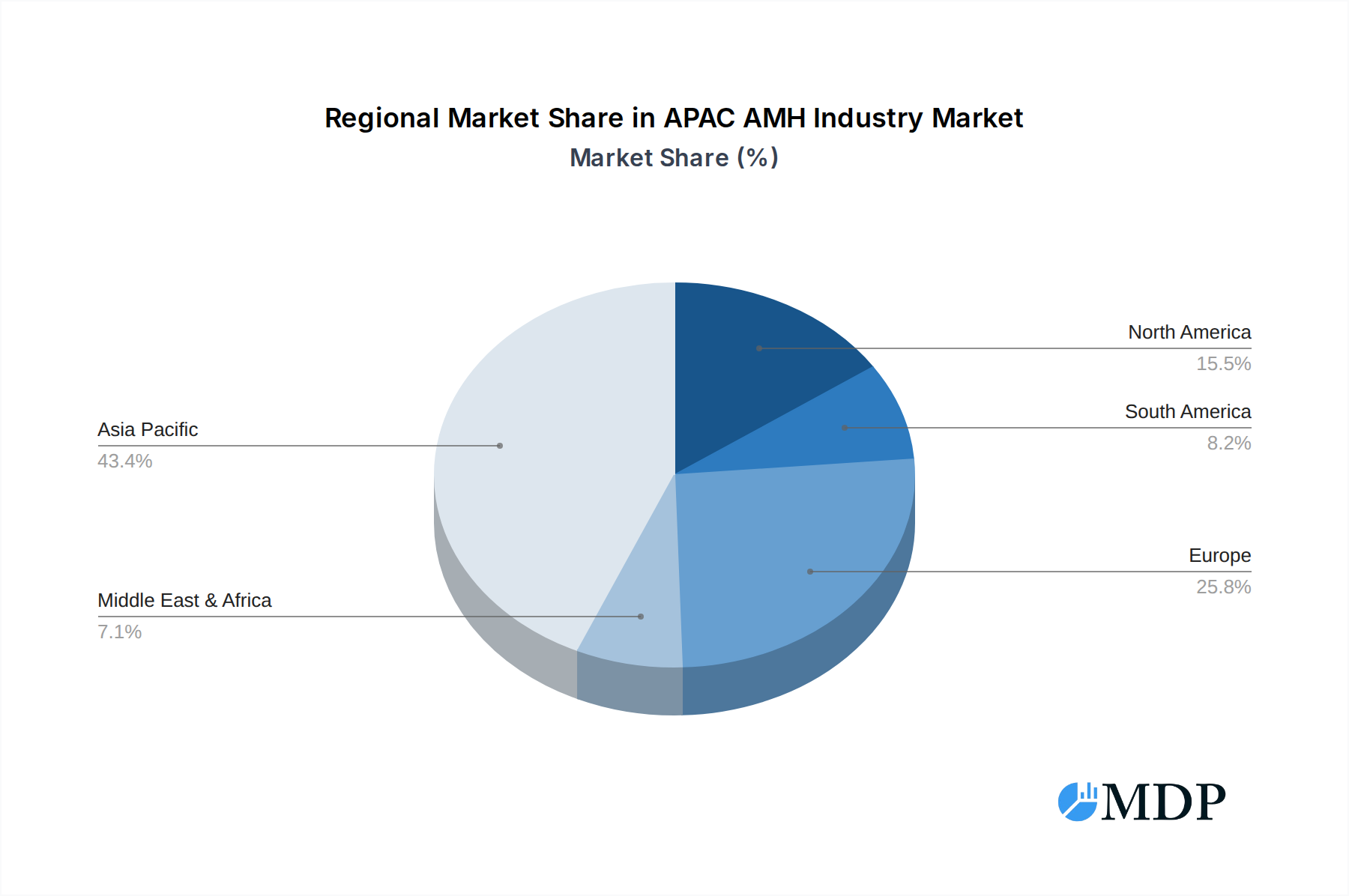

APAC AMH Industry Regional Market Share

Geographic Coverage of APAC AMH Industry

APAC AMH Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancments Aiding Market Growth; Industry 4.0 Investments Driving The Demand For Automation And Material Handling; Rapid Growth In E-commerce

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Unavailability Of Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Airports to Hold a Dominant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC AMH Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Mobile Robots

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.1.1.1. Automated Forklift

- 5.2.1.1.2. Automated Tow/Tractor/Tug

- 5.2.1.1.3. Unit Load

- 5.2.1.1.4. Assembly Line

- 5.2.1.1.5. Special Purpose

- 5.2.1.2. Autonomous Mobile Robots (AMR)

- 5.2.1.3. Laser Guided Vehicle

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.2. Automated Storage and Retrieval System (ASRS)

- 5.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3. Vertical Lift Module

- 5.2.3. Automated Conveyor

- 5.2.3.1. Belt

- 5.2.3.2. Roller

- 5.2.3.3. Pallet

- 5.2.3.4. Overhead

- 5.2.4. Palletizer

- 5.2.4.1. Conventional (High Level + Low Level)

- 5.2.4.2. Robotic

- 5.2.5. Sortation System

- 5.2.1. Mobile Robots

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America APAC AMH Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Mobile Robots

- 6.2.1.1. Automated Guided Vehicle (AGV)

- 6.2.1.1.1. Automated Forklift

- 6.2.1.1.2. Automated Tow/Tractor/Tug

- 6.2.1.1.3. Unit Load

- 6.2.1.1.4. Assembly Line

- 6.2.1.1.5. Special Purpose

- 6.2.1.2. Autonomous Mobile Robots (AMR)

- 6.2.1.3. Laser Guided Vehicle

- 6.2.1.1. Automated Guided Vehicle (AGV)

- 6.2.2. Automated Storage and Retrieval System (ASRS)

- 6.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.2.3. Vertical Lift Module

- 6.2.3. Automated Conveyor

- 6.2.3.1. Belt

- 6.2.3.2. Roller

- 6.2.3.3. Pallet

- 6.2.3.4. Overhead

- 6.2.4. Palletizer

- 6.2.4.1. Conventional (High Level + Low Level)

- 6.2.4.2. Robotic

- 6.2.5. Sortation System

- 6.2.1. Mobile Robots

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Airport

- 6.3.2. Automotive

- 6.3.3. Food and Beverage

- 6.3.4. Retail/W

- 6.3.5. General Manufacturing

- 6.3.6. Pharmaceuticals

- 6.3.7. Post and Parcel

- 6.3.8. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America APAC AMH Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Mobile Robots

- 7.2.1.1. Automated Guided Vehicle (AGV)

- 7.2.1.1.1. Automated Forklift

- 7.2.1.1.2. Automated Tow/Tractor/Tug

- 7.2.1.1.3. Unit Load

- 7.2.1.1.4. Assembly Line

- 7.2.1.1.5. Special Purpose

- 7.2.1.2. Autonomous Mobile Robots (AMR)

- 7.2.1.3. Laser Guided Vehicle

- 7.2.1.1. Automated Guided Vehicle (AGV)

- 7.2.2. Automated Storage and Retrieval System (ASRS)

- 7.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 7.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 7.2.2.3. Vertical Lift Module

- 7.2.3. Automated Conveyor

- 7.2.3.1. Belt

- 7.2.3.2. Roller

- 7.2.3.3. Pallet

- 7.2.3.4. Overhead

- 7.2.4. Palletizer

- 7.2.4.1. Conventional (High Level + Low Level)

- 7.2.4.2. Robotic

- 7.2.5. Sortation System

- 7.2.1. Mobile Robots

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Airport

- 7.3.2. Automotive

- 7.3.3. Food and Beverage

- 7.3.4. Retail/W

- 7.3.5. General Manufacturing

- 7.3.6. Pharmaceuticals

- 7.3.7. Post and Parcel

- 7.3.8. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe APAC AMH Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Mobile Robots

- 8.2.1.1. Automated Guided Vehicle (AGV)

- 8.2.1.1.1. Automated Forklift

- 8.2.1.1.2. Automated Tow/Tractor/Tug

- 8.2.1.1.3. Unit Load

- 8.2.1.1.4. Assembly Line

- 8.2.1.1.5. Special Purpose

- 8.2.1.2. Autonomous Mobile Robots (AMR)

- 8.2.1.3. Laser Guided Vehicle

- 8.2.1.1. Automated Guided Vehicle (AGV)

- 8.2.2. Automated Storage and Retrieval System (ASRS)

- 8.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 8.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 8.2.2.3. Vertical Lift Module

- 8.2.3. Automated Conveyor

- 8.2.3.1. Belt

- 8.2.3.2. Roller

- 8.2.3.3. Pallet

- 8.2.3.4. Overhead

- 8.2.4. Palletizer

- 8.2.4.1. Conventional (High Level + Low Level)

- 8.2.4.2. Robotic

- 8.2.5. Sortation System

- 8.2.1. Mobile Robots

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Airport

- 8.3.2. Automotive

- 8.3.3. Food and Beverage

- 8.3.4. Retail/W

- 8.3.5. General Manufacturing

- 8.3.6. Pharmaceuticals

- 8.3.7. Post and Parcel

- 8.3.8. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa APAC AMH Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Mobile Robots

- 9.2.1.1. Automated Guided Vehicle (AGV)

- 9.2.1.1.1. Automated Forklift

- 9.2.1.1.2. Automated Tow/Tractor/Tug

- 9.2.1.1.3. Unit Load

- 9.2.1.1.4. Assembly Line

- 9.2.1.1.5. Special Purpose

- 9.2.1.2. Autonomous Mobile Robots (AMR)

- 9.2.1.3. Laser Guided Vehicle

- 9.2.1.1. Automated Guided Vehicle (AGV)

- 9.2.2. Automated Storage and Retrieval System (ASRS)

- 9.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 9.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 9.2.2.3. Vertical Lift Module

- 9.2.3. Automated Conveyor

- 9.2.3.1. Belt

- 9.2.3.2. Roller

- 9.2.3.3. Pallet

- 9.2.3.4. Overhead

- 9.2.4. Palletizer

- 9.2.4.1. Conventional (High Level + Low Level)

- 9.2.4.2. Robotic

- 9.2.5. Sortation System

- 9.2.1. Mobile Robots

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Airport

- 9.3.2. Automotive

- 9.3.3. Food and Beverage

- 9.3.4. Retail/W

- 9.3.5. General Manufacturing

- 9.3.6. Pharmaceuticals

- 9.3.7. Post and Parcel

- 9.3.8. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific APAC AMH Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Equipment Type

- 10.2.1. Mobile Robots

- 10.2.1.1. Automated Guided Vehicle (AGV)

- 10.2.1.1.1. Automated Forklift

- 10.2.1.1.2. Automated Tow/Tractor/Tug

- 10.2.1.1.3. Unit Load

- 10.2.1.1.4. Assembly Line

- 10.2.1.1.5. Special Purpose

- 10.2.1.2. Autonomous Mobile Robots (AMR)

- 10.2.1.3. Laser Guided Vehicle

- 10.2.1.1. Automated Guided Vehicle (AGV)

- 10.2.2. Automated Storage and Retrieval System (ASRS)

- 10.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 10.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 10.2.2.3. Vertical Lift Module

- 10.2.3. Automated Conveyor

- 10.2.3.1. Belt

- 10.2.3.2. Roller

- 10.2.3.3. Pallet

- 10.2.3.4. Overhead

- 10.2.4. Palletizer

- 10.2.4.1. Conventional (High Level + Low Level)

- 10.2.4.2. Robotic

- 10.2.5. Sortation System

- 10.2.1. Mobile Robots

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Airport

- 10.3.2. Automotive

- 10.3.3. Food and Beverage

- 10.3.4. Retail/W

- 10.3.5. General Manufacturing

- 10.3.6. Pharmaceuticals

- 10.3.7. Post and Parcel

- 10.3.8. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 System Logistics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jungheinrich AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Murata Machinery Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DAIFUKU Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Interroll Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BEUMER Group GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VisionNav Robotics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SSI Schaefer AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Witron Logistik

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KION Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kardex Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 JBT Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Honeywell Intelligrated Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Toyota Industries Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Kuka AG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 System Logistics

List of Figures

- Figure 1: Global APAC AMH Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC AMH Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America APAC AMH Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America APAC AMH Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 5: North America APAC AMH Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 6: North America APAC AMH Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America APAC AMH Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America APAC AMH Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC AMH Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC AMH Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America APAC AMH Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America APAC AMH Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 13: South America APAC AMH Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 14: South America APAC AMH Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: South America APAC AMH Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: South America APAC AMH Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC AMH Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC AMH Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe APAC AMH Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe APAC AMH Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 21: Europe APAC AMH Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Europe APAC AMH Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Europe APAC AMH Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Europe APAC AMH Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC AMH Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC AMH Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa APAC AMH Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa APAC AMH Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 29: Middle East & Africa APAC AMH Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 30: Middle East & Africa APAC AMH Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Middle East & Africa APAC AMH Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Middle East & Africa APAC AMH Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC AMH Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC AMH Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific APAC AMH Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific APAC AMH Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 37: Asia Pacific APAC AMH Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 38: Asia Pacific APAC AMH Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Asia Pacific APAC AMH Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Asia Pacific APAC AMH Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC AMH Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 3: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global APAC AMH Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 7: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global APAC AMH Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 14: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global APAC AMH Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 21: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global APAC AMH Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 34: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global APAC AMH Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 44: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 45: Global APAC AMH Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC AMH Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC AMH Industry?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the APAC AMH Industry?

Key companies in the market include System Logistics, Jungheinrich AG, Murata Machinery Ltd, DAIFUKU Co Ltd, Interroll Group, BEUMER Group GmbH & Co KG, VisionNav Robotics, SSI Schaefer AG, Witron Logistik, KION Group, Kardex Group, JBT Corporation, Honeywell Intelligrated Inc, Toyota Industries Corporation, Kuka AG.

3. What are the main segments of the APAC AMH Industry?

The market segments include Product Type, Equipment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancments Aiding Market Growth; Industry 4.0 Investments Driving The Demand For Automation And Material Handling; Rapid Growth In E-commerce.

6. What are the notable trends driving market growth?

Airports to Hold a Dominant Market Share.

7. Are there any restraints impacting market growth?

High Initial Costs; Unavailability Of Skilled Workforce.

8. Can you provide examples of recent developments in the market?

August 2022 - Juki Automation Systems (JAS), Inc., a world-leading provider of automated assembly products and systems, announced plans to exhibit at the SMTA Guadalajara Expo & Tech Forum to demonstrate the award-winning Autonomous Material Handling System and JM-50 to demonstrate the award-winning Autonomous Material Handling System and JM-50.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC AMH Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC AMH Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC AMH Industry?

To stay informed about further developments, trends, and reports in the APAC AMH Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence