Key Insights

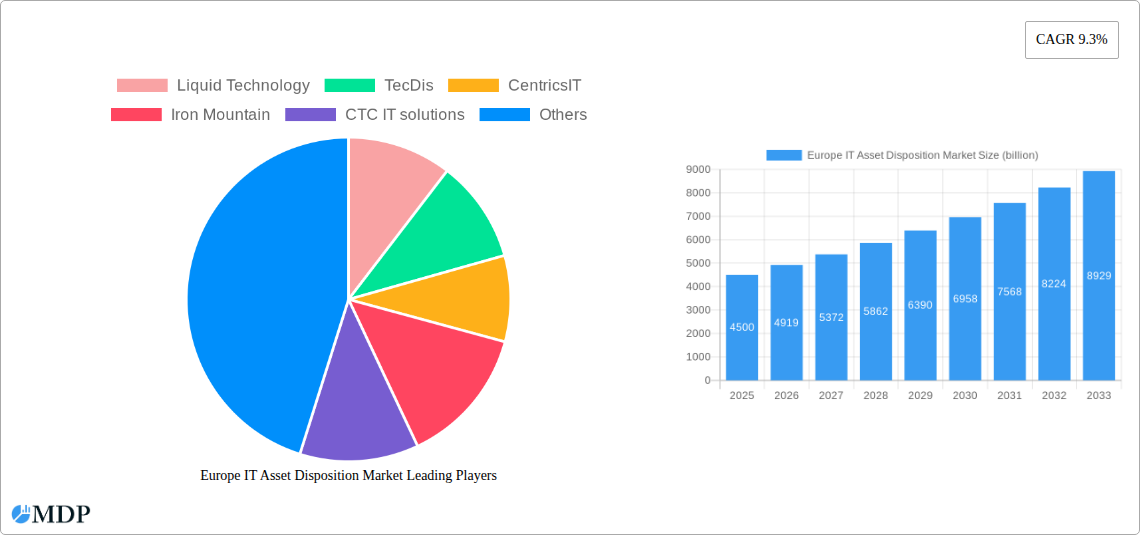

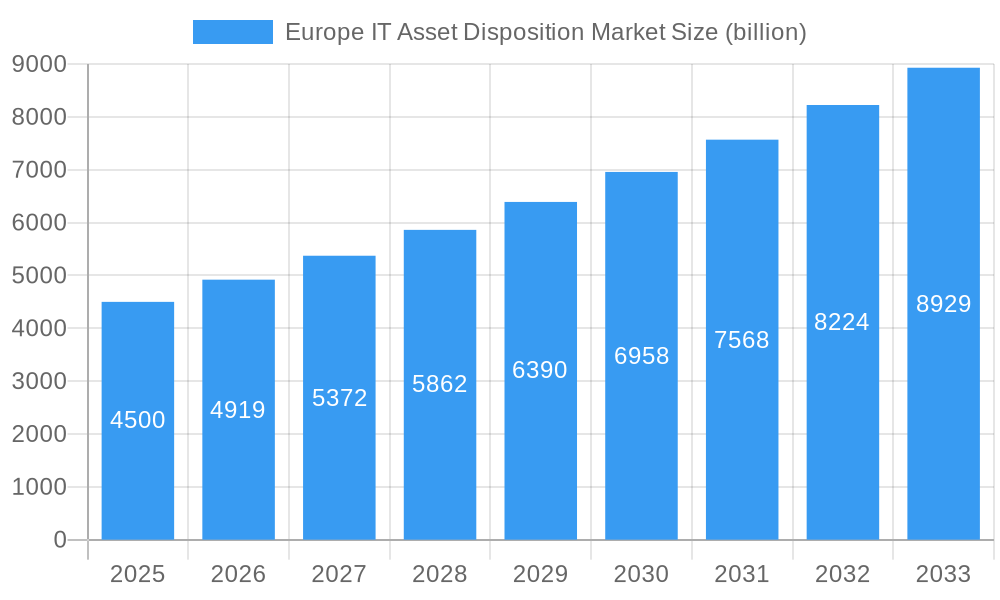

The Europe IT Asset Disposition (ITAD) market is poised for significant expansion, driven by increasing data security concerns, stringent environmental regulations, and the growing need for cost-effective IT lifecycle management. With a market size of $4.5 billion in 2025, the sector is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.3% through 2033. This upward trajectory is fueled by organizations across various sectors, including BFSI, IT and Telecom, Healthcare, and Government, actively seeking to securely and responsibly dispose of their retired IT assets. Key drivers include the escalating volume of electronic waste, the imperative to comply with data privacy laws like GDPR, and the adoption of circular economy principles. The increasing prevalence of Large Enterprises, alongside a growing commitment from Small and Medium Enterprises (SMEs) to professional ITAD services, further solidifies this growth. Leading companies such as Iron Mountain, Liquid Technology, and TecDis are at the forefront, offering comprehensive solutions encompassing data destruction, refurbishment, resale, and recycling, catering to the evolving needs of the European market.

Europe IT Asset Disposition Market Market Size (In Billion)

The European ITAD landscape is characterized by a dynamic interplay of trends and challenges. While the push for sustainability and data security remains paramount, market restraints such as the initial cost of adopting professional ITAD services and the complexity of cross-border regulations present hurdles. Nevertheless, the market is adapting, with innovative solutions emerging to address these concerns. The forecast period (2025-2033) anticipates a surge in demand for specialized ITAD services, particularly in countries like the United Kingdom, Germany, and France, which are leading the adoption of advanced IT asset management strategies. The ongoing digital transformation across industries necessitates continuous hardware upgrades, thereby generating a steady stream of end-of-life IT assets. This, coupled with a heightened awareness of the environmental impact of e-waste, positions the Europe ITAD market for sustained and impressive growth, making it a critical component of corporate IT strategies and sustainability initiatives.

Europe IT Asset Disposition Market Company Market Share

Europe IT Asset Disposition Market: Comprehensive Market Analysis and Growth Forecast (2019-2033)

Unlock critical insights into the booming Europe IT Asset Disposition (ITAD) market. This in-depth report provides a strategic overview of market dynamics, key trends, leading players, and future opportunities within the European ITAD landscape. With a study period spanning from 2019 to 2033, this analysis delivers unparalleled visibility into the market's trajectory. Explore detailed segmentation by enterprise size and end-user verticals, alongside an in-depth examination of influential industry developments and strategic initiatives from key market participants.

This comprehensive report is your essential guide to understanding the evolving ITAD market in Europe, enabling informed decision-making for IT asset managers, recyclers, manufacturers, and investors. The estimated market size for 2025 is projected to be in the billions, with significant growth anticipated over the forecast period.

Europe IT Asset Disposition Market Market Dynamics & Concentration

The Europe IT Asset Disposition (ITAD) market is characterized by a moderate to high concentration, with a blend of large, established global players and a growing number of regional specialists. Innovation in secure data erasure, environmentally responsible recycling, and remarketing strategies are key drivers shaping market dynamics. Stringent regulatory frameworks, particularly around data privacy (e.g., GDPR) and e-waste management (e.g., WEEE Directive), are paramount, pushing companies towards compliant and sustainable ITAD solutions. Product substitutes, such as internal refurbishment or donation programs, exist but often fall short of the comprehensive security and environmental assurances offered by professional ITAD services. End-user trends are heavily influenced by the increasing need for cost optimization, data security compliance, and corporate social responsibility (CSR) initiatives. Merger and Acquisition (M&A) activities are notable, reflecting the industry's consolidation and the pursuit of expanded service offerings and geographical reach. For instance, the acquisition of FGD by Vyta in May 2022 exemplifies this trend, strengthening Vyta's position in a fragmented market. The number of M&A deals is expected to rise as larger entities seek to absorb smaller, innovative companies and expand their market share.

Europe IT Asset Disposition Market Industry Trends & Analysis

The Europe IT Asset Disposition market is experiencing robust growth, driven by a confluence of factors including escalating data security concerns, increasing regulatory compliance demands, and a growing emphasis on sustainability and the circular economy. The projected market size, estimated to reach billions by 2025, is expected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period of 2025–2033. This expansion is fueled by organizations actively seeking to mitigate the risks associated with sensitive data residing on retired IT assets, thereby driving demand for secure data destruction services. The stringent data protection regulations across Europe, such as GDPR, necessitate thorough and certified data erasure processes, making professional ITAD services indispensable. Furthermore, the global push towards environmental responsibility and the reduction of electronic waste (e-waste) is a powerful catalyst. Businesses are increasingly adopting sustainable practices, and ITAD plays a crucial role in extending the lifecycle of IT equipment through refurbishment, resale, or responsible recycling. This aligns with the principles of the circular economy, where resources are kept in use for as long as possible. Technological disruptions, such as advancements in diagnostic tools for asset assessment and more efficient remarketing platforms, are enhancing the value proposition of ITAD services. The competitive dynamics are evolving, with companies differentiating themselves through specialized services, certifications, and robust supply chain management. Market penetration for formal ITAD services is steadily increasing as more organizations recognize the financial and environmental benefits. The trend towards IT modernization and the subsequent frequent refresh cycles of hardware further contribute to a consistent supply of assets requiring disposition. Consumer preferences are shifting towards solutions that offer transparency, security, and demonstrable environmental impact, pushing ITAD providers to innovate and offer more sophisticated reporting and certification. The increasing digitalization across various sectors, from BFSI to Healthcare, generates a continuous stream of IT assets that need secure and environmentally sound disposal.

Leading Markets & Segments in Europe IT Asset Disposition Market

The Large Enterprise segment within the Europe IT Asset Disposition Market commands a significant market share, driven by their substantial IT infrastructure, complex data management needs, and rigorous compliance requirements. These organizations handle vast amounts of sensitive data across sectors like BFSI (Banking, Financial Services, and Insurance) and IT and Telecom, making secure and certified ITAD paramount to avoid costly data breaches and regulatory penalties. The BFSI sector, in particular, is a leading end-user vertical due to the highly sensitive nature of financial data and stringent regulations like MiFID II and GDPR. Key drivers for their dominance include:

- Regulatory Compliance: Strict data privacy laws necessitate robust and certified data erasure processes, often requiring third-party validation.

- Data Security Imperatives: The potential financial and reputational damage from a data breach compels large enterprises to invest in the most secure ITAD solutions.

- Cost Optimization: While the initial investment in secure ITAD might seem high, effective remarketing and recycling can offset disposal costs and even generate revenue, a crucial factor for large-scale operations.

- Environmental, Social, and Governance (ESG) Initiatives: Large enterprises are increasingly focused on demonstrating their commitment to sustainability and corporate social responsibility, with responsible e-waste management being a key component.

The IT and Telecom sector also represents a significant end-user, owing to the continuous upgrade cycles of their sophisticated hardware and the inherent need for secure data handling. Their extensive networks and customer data necessitate highly secure disposition processes.

While Small and Medium Enterprises (SMEs) represent a growing segment, their ITAD needs are often met through different service models, sometimes consolidated or outsourced to managed service providers. However, as SMEs become more aware of data security and environmental responsibilities, their demand for specialized ITAD services is increasing, particularly in sectors like Healthcare where patient data privacy is critical. Government and Public Institutions are also substantial users, driven by security mandates and budget constraints, requiring secure disposal and often seeking cost-effective solutions. The "Other End-User Verticals" category is diverse and includes sectors like retail, manufacturing, and education, each with unique IT asset disposition requirements that contribute to the overall market growth. Germany, the UK, and France are consistently leading markets within Europe, due to their strong economies, advanced technological adoption, and well-established regulatory frameworks governing data privacy and e-waste.

Europe IT Asset Disposition Market Product Developments

Product developments in the Europe IT Asset Disposition market are primarily focused on enhancing security, sustainability, and efficiency. Innovations include advanced software solutions for remote data wiping, ensuring data is irrecoverably destroyed without physical presence, and specialized hardware for physical shredding that meets stringent security standards. Remarketing platforms are increasingly leveraging AI and machine learning to better assess asset value and identify optimal resale channels, maximizing residual value for clients. Furthermore, there is a growing emphasis on the development of comprehensive lifecycle management tools that provide end-to-end visibility and traceability of assets from deployment to disposition. Companies are also developing certifications and auditing processes that go beyond basic compliance, offering clients greater assurance of ethical and environmentally sound practices. These developments provide a competitive advantage by addressing the evolving needs of businesses seeking secure, cost-effective, and environmentally responsible IT asset management solutions.

Key Drivers of Europe IT Asset Disposition Market Growth

Several key factors are propelling the growth of the Europe IT Asset Disposition market. Firstly, the escalating importance of data security and privacy regulations such as GDPR mandates that organizations handle sensitive data with the utmost care, making certified data erasure a non-negotiable aspect of IT asset disposition. Secondly, the growing emphasis on corporate social responsibility (CSR) and sustainability is driving companies to adopt environmentally friendly disposal methods, promoting the circular economy and reducing e-waste. This aligns with EU directives on e-waste management. Thirdly, technological advancements and frequent hardware refresh cycles across industries lead to a continuous influx of retired IT assets requiring professional disposition. Finally, the economic benefits of remarketing and responsible recycling, which can offset disposal costs and even generate revenue, are attractive to businesses looking for cost optimization in their IT asset management strategies.

Challenges in the Europe IT Asset Disposition Market Market

Despite its robust growth, the Europe IT Asset Disposition market faces several challenges. Regulatory complexity and evolving compliance standards across different European countries can create operational hurdles for pan-European ITAD providers. Supply chain disruptions, exacerbated by global events, can impact the logistics of asset collection and processing, leading to delays and increased costs. Intense competitive pressure from both established players and new entrants can drive down profit margins. Furthermore, customer education and awareness regarding the full scope of ITAD benefits, especially concerning data security and environmental impact, remains an ongoing effort. The cost of investing in advanced, certified data destruction and recycling technologies can also be a barrier for smaller market participants.

Emerging Opportunities in Europe IT Asset Disposition Market

Emerging opportunities in the Europe IT Asset Disposition market are significant, driven by several catalysts. The increasing adoption of cloud computing and the Internet of Things (IoT) creates new categories of IT assets with unique disposition requirements, opening up niche markets. Technological breakthroughs in data erasure and recycling are enabling more efficient and environmentally friendly processes, creating opportunities for providers who invest in these innovations. Strategic partnerships between ITAD companies, original equipment manufacturers (OEMs), and managed service providers can expand service reach and offer integrated solutions. Market expansion into developing European economies where ITAD adoption is still nascent presents substantial untapped potential. Furthermore, the growing demand for certified, transparent, and auditable ITAD services for ESG reporting provides a strong differentiator for proactive market players.

Leading Players in the Europe IT Asset Disposition Market Sector

- Liquid Technology

- TecDis

- CentricsIT

- Iron Mountain

- CTC IT solutions

- Flex IT

- Wisetek

- CXtec Inc (Atlantix)

- BNP Paribas

- CNE Direct

Key Milestones in Europe IT Asset Disposition Market Industry

- May 2022: Vyta, a secure IT disposal business, acquired FGD, an Essex-based provider of comparable services. This acquisition significantly bolstered Vyta Group's presence in the fast-growing yet fragmented European ITAD industry, consolidating its position as a more substantial business in a competitive landscape.

- February 2022: Circular Computing, a United Kingdom-based leader in remanufactured IT, launched a brand-new international IT Asset Disposition (ITAD) program. Positioned as the most sustainable ITAD program of its kind, this initiative aims to assist ITAD thought leaders in providing sustainable solutions to minimize e-waste.

Strategic Outlook for Europe IT Asset Disposition Market Market

The strategic outlook for the Europe IT Asset Disposition Market is exceptionally positive, underpinned by persistent growth drivers and emerging opportunities. The ongoing digital transformation across all sectors, coupled with increasingly stringent data privacy and environmental regulations, will continue to fuel demand for secure and sustainable ITAD services. Companies that can demonstrate robust data sanitization, ethical recycling practices, and transparent reporting will be best positioned for success. Strategic investments in advanced technologies for asset lifecycle management, data erasure, and remarketing will be crucial for maintaining a competitive edge. Furthermore, fostering strategic alliances and expanding service offerings to encompass emerging IT asset categories, such as IoT devices, will unlock new revenue streams. The focus on the circular economy and ESG compliance will remain a dominant theme, presenting opportunities for market leaders to innovate and provide value-added services that resonate with environmentally conscious businesses. The market is expected to witness continued consolidation and specialization, rewarding agile and forward-thinking ITAD providers.

Europe IT Asset Disposition Market Segmentation

-

1. Enterprise Size

- 1.1. Large Enterprise

- 1.2. Small and Medium Enterprise

-

2. End-User

- 2.1. BFSI

- 2.2. IT and Telecom

- 2.3. Healthcare

- 2.4. Government and Public Institutions

- 2.5. Other End-User Veticals

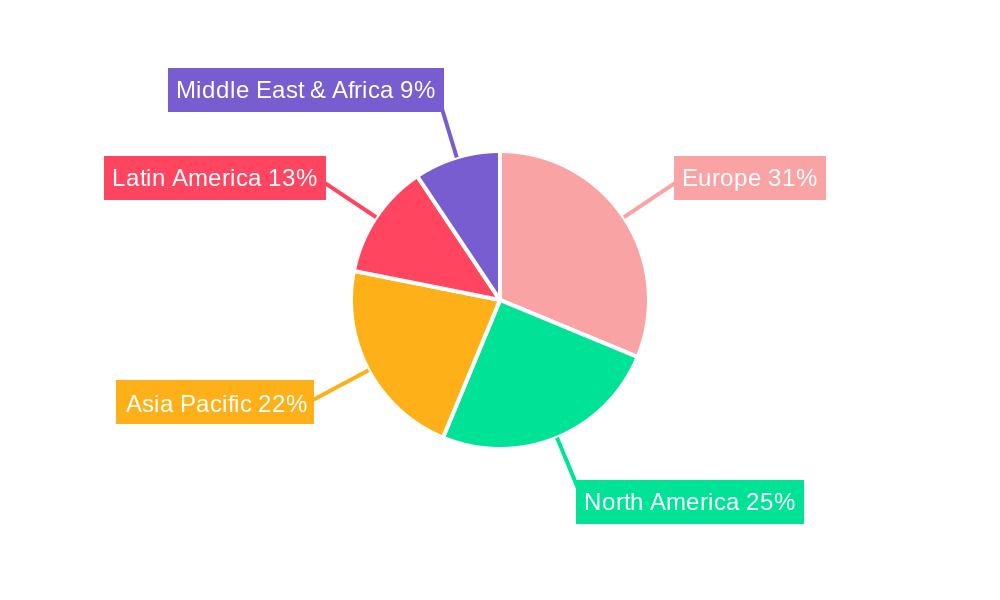

Europe IT Asset Disposition Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe IT Asset Disposition Market Regional Market Share

Geographic Coverage of Europe IT Asset Disposition Market

Europe IT Asset Disposition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technological advancements and digitalization leading to the replacement of old equipment; Rising concerns about conserving the environment

- 3.2.2 prevention of data breaches

- 3.2.3 and regulatory compliance

- 3.3. Market Restrains

- 3.3.1. Lack of Knowledge and High Service Costs

- 3.4. Market Trends

- 3.4.1. BFSI to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe IT Asset Disposition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Large Enterprise

- 5.1.2. Small and Medium Enterprise

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. BFSI

- 5.2.2. IT and Telecom

- 5.2.3. Healthcare

- 5.2.4. Government and Public Institutions

- 5.2.5. Other End-User Veticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Liquid Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TecDis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CentricsIT

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iron Mountain

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CTC IT solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flex IT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wisetek

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CXtec Inc (Atlantix)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CNE Direct

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Liquid Technology

List of Figures

- Figure 1: Europe IT Asset Disposition Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe IT Asset Disposition Market Share (%) by Company 2025

List of Tables

- Table 1: Europe IT Asset Disposition Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 2: Europe IT Asset Disposition Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe IT Asset Disposition Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe IT Asset Disposition Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 5: Europe IT Asset Disposition Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe IT Asset Disposition Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe IT Asset Disposition Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe IT Asset Disposition Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the Europe IT Asset Disposition Market?

Key companies in the market include Liquid Technology, TecDis, CentricsIT, Iron Mountain, CTC IT solutions, Flex IT, Wisetek, CXtec Inc (Atlantix), BNP Paribas , CNE Direct.

3. What are the main segments of the Europe IT Asset Disposition Market?

The market segments include Enterprise Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological advancements and digitalization leading to the replacement of old equipment; Rising concerns about conserving the environment. prevention of data breaches. and regulatory compliance.

6. What are the notable trends driving market growth?

BFSI to Show Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Knowledge and High Service Costs.

8. Can you provide examples of recent developments in the market?

May 2022: Vyta, a secure IT disposal business, acquired FGD, an Essex-based provider of comparable services. The fast-growing yet fragmented European ITAD industry offers a sizable opportunity for Vyta Group. Vyta is a more substantial business in a cutthroat industry with this purchase.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe IT Asset Disposition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe IT Asset Disposition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe IT Asset Disposition Market?

To stay informed about further developments, trends, and reports in the Europe IT Asset Disposition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence