Key Insights

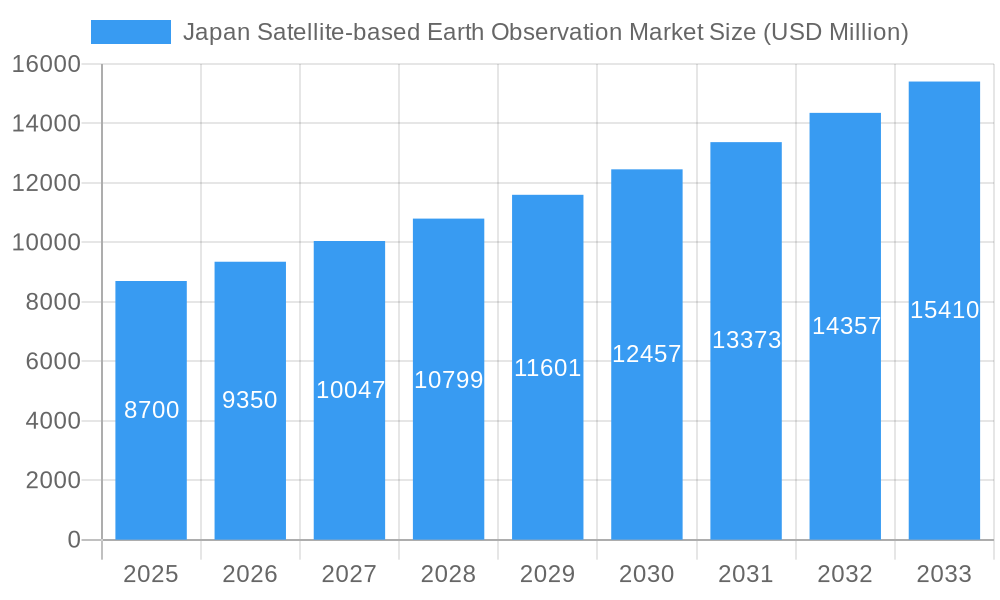

The Japan Satellite-based Earth Observation Market is poised for significant growth, projected to reach USD 8.7 billion in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This expansion is fueled by increasing demand for high-resolution imagery and advanced analytics across various sectors. The market encompasses diverse segments, including Earth Observation Data and Value-Added Services, catering to critical applications such as urban development, agriculture, climate services, and infrastructure monitoring. The dominance of Low Earth Orbit (LEO) satellites, offering frequent revisits and higher resolution, is a key driver, complemented by the strategic importance of Medium Earth Orbit (MEO) and Geostationary Orbit (GEO) for continuous monitoring and broad coverage.

Japan Satellite-based Earth Observation Market Market Size (In Billion)

Key growth drivers include the escalating need for precise data in disaster management and response, the burgeoning smart city initiatives in Japan, and the growing adoption of satellite-derived insights for sustainable agriculture and environmental monitoring. Advancements in sensor technology and data processing capabilities are enabling more sophisticated analysis and applications, further stimulating market expansion. While the market is characterized by intense competition among established players like Airbus SE, Maxar Technologies, and JAXA, alongside emerging innovators, the overall outlook remains highly positive. The Japanese government's continued investment in space technology and its commitment to leveraging satellite data for national development and scientific research provide a strong foundation for sustained market momentum.

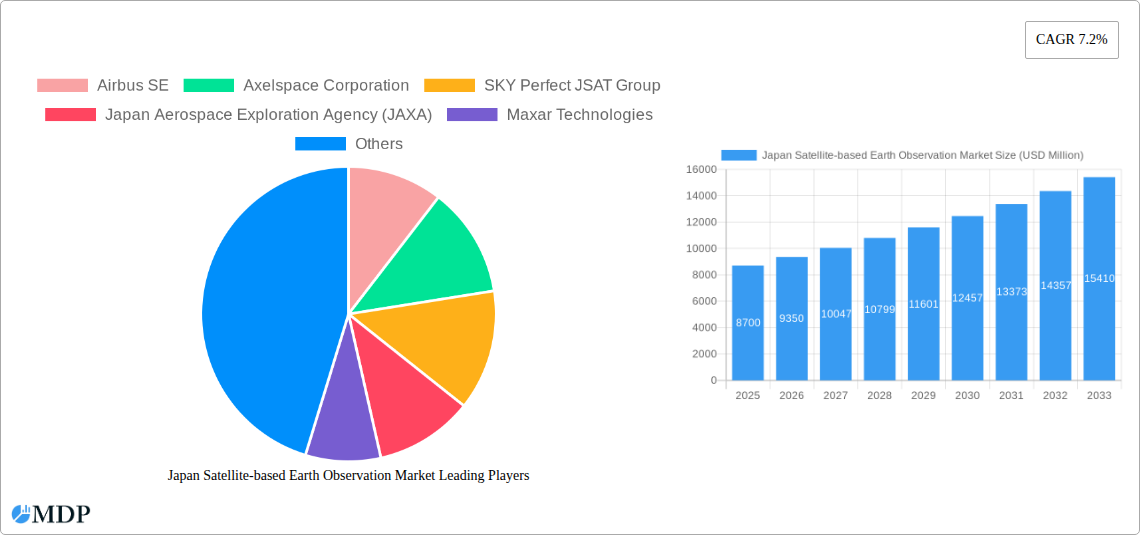

Japan Satellite-based Earth Observation Market Company Market Share

Japan Satellite-based Earth Observation Market: Comprehensive Analysis & Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Japan satellite-based earth observation market, offering a deep dive into its growth trajectory, key players, and future potential. Leveraging cutting-edge remote sensing technology, the Japan space economy is poised for significant expansion, driven by advancements in earth observation data and value-added services. Our analysis spans the historical period of 2019-2024, with a base year of 2025 and a detailed forecast period extending to 2033. We examine critical segments including Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO) satellites, alongside vital end-use industries such as urban development, agriculture, climate services, energy and raw materials, and infrastructure. This report provides actionable insights for industry stakeholders, investors, and policymakers navigating the evolving landscape of Japan's space sector.

Japan Satellite-based Earth Observation Market Market Dynamics & Concentration

The Japan satellite-based earth observation market is characterized by a dynamic interplay of innovation drivers, stringent regulatory frameworks, and evolving end-user needs. Market concentration remains moderate, with a growing number of specialized startups and established corporations vying for market share. Key innovation drivers include the increasing demand for high-resolution earth observation data for diverse applications, coupled with advancements in satellite technology enabling more frequent and precise data acquisition. Regulatory frameworks, while robust in ensuring data security and national interests, also present opportunities for companies that can navigate these requirements effectively. Product substitutes are emerging, particularly in terrestrial-based sensing, but satellite-based solutions offer unparalleled coverage and scale. End-user trends show a strong preference for integrated solutions that combine raw data with actionable insights through value-added services. Merger and acquisition (M&A) activities are anticipated to increase as larger players seek to consolidate capabilities and acquire innovative technologies. While specific market share percentages are proprietary, the competitive landscape indicates a gradual shift towards specialized providers and integrated service platforms. The number of M&A deals in the broader Asia-Pacific earth observation market has seen a steady increase, suggesting a similar trend for Japan as the market matures.

Japan Satellite-based Earth Observation Market Industry Trends & Analysis

The Japan satellite-based earth observation market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of approximately xx% between 2025 and 2033. This expansion is primarily fueled by the increasing adoption of earth observation data across a multitude of sectors, ranging from precision agriculture and environmental monitoring to urban planning and disaster management. Technological disruptions are at the forefront, with advancements in Artificial Intelligence (AI) and Machine Learning (ML) enabling sophisticated analysis of vast satellite datasets, unlocking new insights and applications. The development of smaller, more agile satellites, particularly in Low Earth Orbit (LEO), is reducing launch costs and increasing data acquisition frequency, making satellite data more accessible and cost-effective. Consumer preferences are shifting towards integrated solutions that provide not just raw data, but also tailored value-added services, such as predictive analytics, risk assessment, and customized reporting. This trend is driving innovation in data processing, interpretation, and delivery mechanisms. Competitive dynamics are intensifying, with both domestic and international players investing heavily in research and development. The Japanese government's proactive support for the space sector, including funding for research institutions and startups, further bolsters market growth. Market penetration is expected to deepen as awareness of the benefits of satellite-based earth observation grows among small and medium-sized enterprises (SMEs) and non-traditional end-users. The increasing focus on climate change mitigation and adaptation is also a major growth driver, creating demand for satellite data to monitor environmental changes, assess natural resource depletion, and track carbon emissions.

Leading Markets & Segments in Japan Satellite-based Earth Observation Market

Within the Japan satellite-based earth observation market, Earth Observation Data stands as the dominant segment, forming the foundational layer for all subsequent applications. Its dominance is driven by the escalating need for high-resolution imagery and diverse spectral data to inform critical decision-making across various industries. Following closely are Value Added Services, which are experiencing rapid growth as end-users increasingly seek actionable intelligence rather than raw data. This segment translates complex satellite information into practical solutions for specific industry challenges.

In terms of Satellite Orbit, Low Earth Orbit (LEO) satellites are currently leading the market and are expected to maintain their prominence. This is attributed to their ability to offer high-resolution imagery with frequent revisits, crucial for applications requiring real-time or near-real-time monitoring. Their lower operational altitude also contributes to more detailed data acquisition.

Among the End-use sectors, Infrastructure and Urban Development and Cultural Heritage are significant contributors to market demand.

- Infrastructure: This segment drives demand for satellite data for planning, construction monitoring, maintenance of roads, bridges, utilities, and other critical infrastructure. Economic policies encouraging large-scale infrastructure development directly correlate with increased satellite data utilization.

- Urban Development and Cultural Heritage: Satellite imagery plays a crucial role in urban planning, sprawl monitoring, heritage site preservation, and smart city initiatives. Government initiatives promoting sustainable urban growth and the protection of historical sites further amplify demand.

- Agriculture: Precision agriculture applications, including crop health monitoring, yield prediction, and resource management, are increasingly reliant on satellite data, driving growth in this segment.

- Climate Services: The growing global imperative to address climate change fuels demand for satellite data in monitoring weather patterns, sea-level rise, deforestation, and other environmental indicators.

- Energy and Raw Materials: Exploration, extraction, and monitoring of natural resources, as well as pipeline integrity checks, are significant drivers for satellite data in this sector.

The dominance of these segments is underpinned by government investments in space technology, advancements in remote sensing techniques, and a growing understanding of the economic and societal benefits derived from satellite-based earth observation. The continuous development of more sophisticated sensors and analytical tools further solidifies the leading position of these segments within the Japanese market.

Japan Satellite-based Earth Observation Market Product Developments

Product developments in the Japan satellite-based earth observation market are focused on enhancing data resolution, expanding spectral capabilities, and improving data processing efficiency. Innovations in synthetic aperture radar (SAR) technology, for instance, are enabling all-weather, day-and-night imaging, offering significant competitive advantages for applications in areas like disaster monitoring and infrastructure inspection. Furthermore, the integration of AI and machine learning into data analysis platforms is creating smarter, more automated value-added services, providing users with faster, more accurate insights. Companies are also developing specialized data products tailored to specific end-user needs, such as highly accurate elevation models for urban planning or detailed vegetation indices for precision agriculture, further solidifying their market fit.

Key Drivers of Japan Satellite-based Earth Observation Market Growth

Several key drivers are propelling the growth of the Japan satellite-based earth observation market. Technological advancements, including the miniaturization of satellites and the development of advanced sensor technologies, are increasing data quality and reducing costs. Government initiatives and funding for space exploration and application development play a pivotal role, fostering innovation and market adoption. The increasing global and domestic focus on climate change and environmental sustainability necessitates comprehensive monitoring solutions, directly boosting demand for earth observation data. Furthermore, the growing demand for data-driven decision-making across sectors like agriculture, infrastructure, and urban planning is a significant economic factor.

Challenges in the Japan Satellite-based Earth Observation Market Market

Despite its robust growth, the Japan satellite-based earth observation market faces several challenges. High upfront investment costs for satellite development and launch remain a significant barrier, particularly for smaller companies. Navigating complex regulatory frameworks and data licensing agreements can be time-consuming and resource-intensive. Competition from established global players and emerging local startups creates pricing pressures. Supply chain disruptions, though less prevalent than in some other sectors, can impact satellite component availability and project timelines. Lastly, a skills gap in specialized earth observation data analysis and interpretation can hinder the full utilization of available technologies.

Emerging Opportunities in Japan Satellite-based Earth Observation Market

Emerging opportunities in the Japan satellite-based earth observation market are abundant, driven by technological breakthroughs and strategic collaborations. The increasing development of constellations of small satellites promises more frequent data acquisition and enhanced coverage, opening new avenues for real-time monitoring applications. Strategic partnerships between satellite operators, data analytics firms, and end-user industries are creating synergistic opportunities for co-developed solutions. The growing demand for geospatial intelligence in emerging markets within Asia, coupled with Japan's advanced technological capabilities, presents significant market expansion strategies. Furthermore, the increasing integration of satellite data with other data sources, such as IoT devices and ground sensors, will unlock novel insights and create new service offerings.

Leading Players in the Japan Satellite-based Earth Observation Market Sector

- Airbus SE

- Axelspace Corporation

- SKY Perfect JSAT Group

- Japan Aerospace Exploration Agency (JAXA)

- Maxar Technologies

- Japan Space Systems

- NTT Data Corporation

- Geospatial Information Authority of Japan

- Remote Sensing Technology Center of Japan (RESTEC)

- NEC Corporation

- Kokusai Kogyo Co Ltd

- PASCO Corporation

Key Milestones in Japan Satellite-based Earth Observation Market Industry

- January 2023: The European Union and Japan strengthened their space research collaboration by agreeing to exchange Earth observation data. Japan's Ministry of Economy, Trade, and Industry gained access to Copernicus data and services, with the European Commission receiving unrestricted access to data from Japan's non-commercial earth observation satellites. This milestone signifies enhanced international cooperation and data sharing, boosting global earth observation capabilities.

- December 2022: Synspective, a Japanese startup specializing in synthetic aperture radar (SAR) satellite data and solutions, partnered with Topcon Positioning Asia (TPA). This collaboration aims to provide integrated satellite data solution services, leveraging Topcon's expertise in surveying and construction to drive innovation and create new market opportunities in Japan and globally.

Strategic Outlook for Japan Satellite-based Earth Observation Market Market

The strategic outlook for the Japan satellite-based earth observation market is exceptionally positive, driven by a confluence of technological innovation, strong governmental support, and expanding market applications. Future growth accelerators include the continued development of advanced AI and machine learning algorithms for sophisticated data analysis, enabling more predictive and prescriptive insights. The establishment of more integrated data platforms that consolidate information from various satellite constellations and ground sources will enhance usability and value. Strategic partnerships between Japanese entities and international organizations will further expand market reach and foster cross-border data utilization. Investments in developing next-generation satellite technologies, such as hyperspectral imaging and enhanced resolution capabilities, will remain crucial for maintaining a competitive edge and addressing evolving end-user demands. The focus on sustainability and climate resilience will continue to be a significant market driver, creating sustained demand for earth observation solutions.

Japan Satellite-based Earth Observation Market Segmentation

-

1. Type

- 1.1. Earth Observation Data

- 1.2. Value Added Services

-

2. Satellite Orbit

- 2.1. Low Earth Orbit

- 2.2. Medium Earth Orbit

- 2.3. Geostationary Orbit

-

3. End-use

- 3.1. Urban Development and Cultural Heritage

- 3.2. Agriculture

- 3.3. Climate Services

- 3.4. Energy and Raw Materials

- 3.5. Infrastructure

- 3.6. Others

Japan Satellite-based Earth Observation Market Segmentation By Geography

- 1. Japan

Japan Satellite-based Earth Observation Market Regional Market Share

Geographic Coverage of Japan Satellite-based Earth Observation Market

Japan Satellite-based Earth Observation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and Investments; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Budget Constraints and Technological Limitations; Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Government Initiatives and Investments to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Satellite-based Earth Observation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Earth Observation Data

- 5.1.2. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Satellite Orbit

- 5.2.1. Low Earth Orbit

- 5.2.2. Medium Earth Orbit

- 5.2.3. Geostationary Orbit

- 5.3. Market Analysis, Insights and Forecast - by End-use

- 5.3.1. Urban Development and Cultural Heritage

- 5.3.2. Agriculture

- 5.3.3. Climate Services

- 5.3.4. Energy and Raw Materials

- 5.3.5. Infrastructure

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Airbus SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axelspace Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SKY Perfect JSAT Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Japan Aerospace Exploration Agency (JAXA)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maxar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Space Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NTT Data Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geospatial Information Authority of Japan*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Remote Sensing Technology Center of Japan (RESTEC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NEC Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kokusai Kogyo Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PASCO Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Airbus SE

List of Figures

- Figure 1: Japan Satellite-based Earth Observation Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Satellite-based Earth Observation Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by Satellite Orbit 2020 & 2033

- Table 3: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by End-use 2020 & 2033

- Table 4: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by Satellite Orbit 2020 & 2033

- Table 7: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by End-use 2020 & 2033

- Table 8: Japan Satellite-based Earth Observation Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Satellite-based Earth Observation Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Japan Satellite-based Earth Observation Market?

Key companies in the market include Airbus SE, Axelspace Corporation, SKY Perfect JSAT Group, Japan Aerospace Exploration Agency (JAXA), Maxar Technologies, Japan Space Systems, NTT Data Corporation, Geospatial Information Authority of Japan*List Not Exhaustive, Remote Sensing Technology Center of Japan (RESTEC), NEC Corporation, Kokusai Kogyo Co Ltd, PASCO Corporation.

3. What are the main segments of the Japan Satellite-based Earth Observation Market?

The market segments include Type, Satellite Orbit, End-use.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and Investments; Technological Advancements.

6. What are the notable trends driving market growth?

Government Initiatives and Investments to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Budget Constraints and Technological Limitations; Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

January 2023: The European Union and Japan established a stronger connection in space research by collaborating to exchange Earth observation data. The European Commission approved granting Japan's Ministry of Economy, Trade, and Industry access to Copernicus data and services-the Earth observation component of the EU Space Programme. In exchange, the European Commission will receive unrestricted access to data from Japan's non-commercial Earth observation satellites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Satellite-based Earth Observation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Satellite-based Earth Observation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Satellite-based Earth Observation Market?

To stay informed about further developments, trends, and reports in the Japan Satellite-based Earth Observation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence