Key Insights

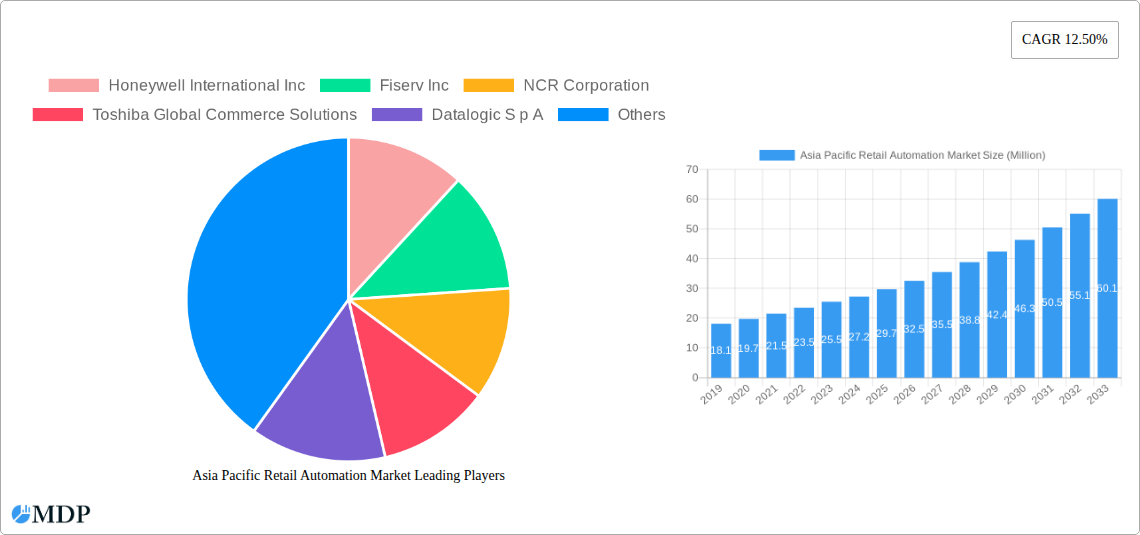

The Asia Pacific Retail Automation Market is poised for significant expansion, demonstrating robust growth fueled by increasing adoption of innovative technologies across the retail landscape. In 2024, the market was valued at an estimated USD 27.2 billion, a figure expected to surge with a Compound Annual Growth Rate (CAGR) of 9.57% through the forecast period ending in 2033. This impressive trajectory is primarily driven by the escalating demand for enhanced customer experiences, operational efficiency, and cost reduction among retailers. Key growth catalysts include the widespread implementation of self-checkout systems, advanced barcode readers, and sophisticated point-of-sale (POS) terminals. The burgeoning e-commerce sector and the subsequent need for streamlined in-store operations further bolster this market. Furthermore, rising disposable incomes and an expanding middle class across major economies like China, India, and Southeast Asian nations are contributing to increased consumer spending, thereby necessitating advanced retail solutions to manage higher transaction volumes and diverse product offerings. The sector's dynamic evolution is further characterized by the integration of AI and IoT, enabling predictive analytics, personalized customer engagement, and optimized inventory management.

Asia Pacific Retail Automation Market Market Size (In Million)

The market’s segmentation reveals a diverse adoption landscape. Within product types, Point-of-Sale (POS) systems and Barcode Readers represent foundational components, while Kiosks and Self-Checkout Systems are gaining substantial traction, directly addressing the need for faster, contactless transactions and reduced labor dependency. The application spectrum is equally broad, with Food/Non-Food retail, Hospitality, and Transportation and Logistics emerging as key sectors leveraging automation. These sectors are increasingly investing in technologies that improve checkout speed, manage complex inventory, and enhance supply chain visibility. While the market presents immense opportunities, potential restraints such as high initial investment costs for certain advanced solutions and a need for skilled personnel to manage and maintain these systems could pose challenges. However, the clear benefits in terms of improved customer satisfaction, operational efficiency, and competitive advantage are compelling retailers to overcome these hurdles, positioning the Asia Pacific region as a frontrunner in the global retail automation revolution.

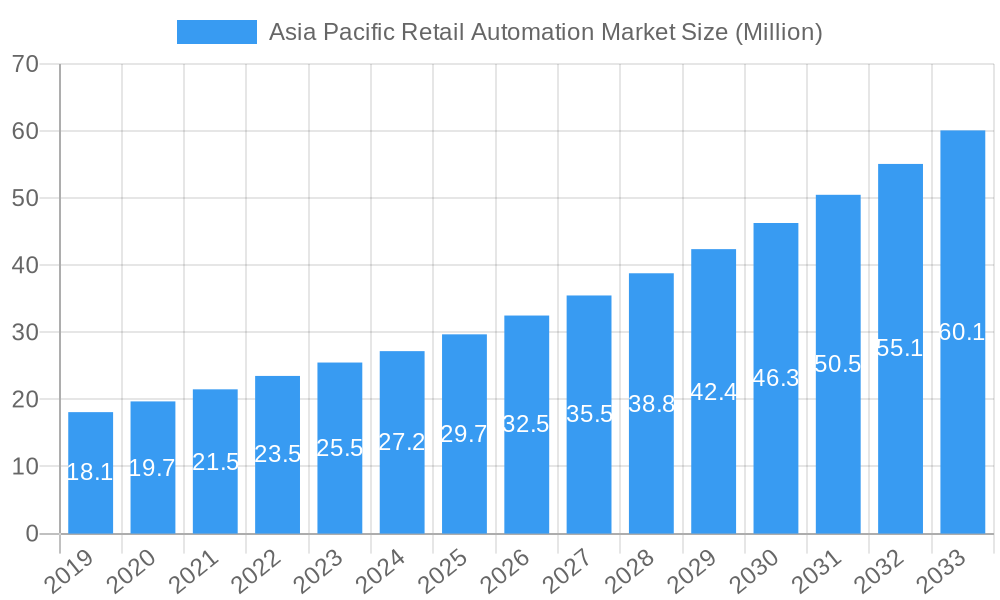

Asia Pacific Retail Automation Market Company Market Share

This comprehensive report delves into the dynamic Asia Pacific Retail Automation Market, projecting a valuation of $78.9 billion by 2033. The market, valued at $35.2 billion in 2025, is poised for significant expansion at a Compound Annual Growth Rate (CAGR) of 9.8% from 2025 to 2033. Examining the historical period of 2019–2024, this study provides unparalleled insights into market dynamics, key trends, leading segments, and the competitive landscape, offering actionable intelligence for stakeholders seeking to capitalize on this burgeoning sector. Explore the transformative impact of automated solutions on retail operations across the Asia Pacific region.

Asia Pacific Retail Automation Market Dynamics & Concentration

The Asia Pacific Retail Automation Market is characterized by a moderate concentration of leading players, with a handful of global giants like Honeywell International Inc., Fiserv Inc., NCR Corporation, and Toshiba Global Commerce Solutions holding significant market share. Innovation remains a primary driver, fueled by the increasing demand for enhanced customer experiences, operational efficiency, and cost reduction. Regulatory frameworks are evolving to accommodate advanced technologies, although varying regional policies can present challenges. Product substitutes, primarily manual processes and less sophisticated technologies, are steadily being displaced by automated solutions. End-user trends are heavily influenced by the rise of e-commerce, the growing need for contactless solutions, and the demand for personalized shopping experiences. Merger and acquisition (M&A) activities are moderately prevalent as companies seek to expand their product portfolios, geographical reach, and technological capabilities. The number of M&A deals in the historical period was approximately 25, indicating a strategic consolidation phase. Key metrics include the top five players holding an estimated 45% market share.

Asia Pacific Retail Automation Market Industry Trends & Analysis

The Asia Pacific Retail Automation Market is experiencing a paradigm shift, driven by a confluence of robust growth drivers and transformative technological disruptions. The increasing adoption of self-checkout systems and unattended terminals is a testament to retailers' pursuit of operational efficiency and enhanced customer convenience. The penetration of barcode readers and smart weighing scales is steadily increasing across diverse retail verticals, optimizing inventory management and transaction speeds. Consumer preferences are increasingly leaning towards seamless, personalized, and quick shopping experiences, which automated solutions are perfectly positioned to deliver. This shift is further accelerated by the digital native demographic and the pervasive use of smartphones for retail interactions. Technological advancements, including AI-powered analytics, IoT integration, and advanced robotics, are continuously reshaping the retail landscape, enabling predictive maintenance, personalized marketing, and hyper-efficient supply chains. The competitive dynamics are intensifying, with both established players and agile startups vying for market dominance. The market penetration of advanced retail automation solutions is estimated to reach 40% by the end of the forecast period, up from approximately 20% in the historical period. The CAGR of 9.8% is largely attributed to the rapid digital transformation initiatives undertaken by governments and private enterprises across the region. The influx of investment in smart city initiatives and the growing disposable income of consumers in emerging economies are also significant contributors to this upward trajectory. Furthermore, the ongoing labor shortages and rising labor costs in several Asia Pacific nations are compelling retailers to invest in automation as a sustainable solution for maintaining service levels and profitability. The integration of cloud-based solutions is also gaining traction, offering scalability and flexibility for retailers of all sizes.

Leading Markets & Segments in Asia Pacific Retail Automation Market

The Asia Pacific Retail Automation Market is segmented across various product types, product categories, and end-user applications, with distinct segments exhibiting varying growth trajectories.

- Product Type Dominance:

- Point-of-Sale (POS) Systems: POS systems continue to be the backbone of retail operations, with a significant market share driven by the need for efficient transaction processing and customer data management. The increasing adoption of cloud-based POS solutions further fuels this segment's dominance. Key drivers include the rising number of retail outlets and the demand for integrated inventory and sales management.

- Unattended Terminals: This segment, encompassing self-checkout systems and kiosks, is experiencing exponential growth. The demand for reduced customer wait times and optimized labor allocation makes unattended terminals a critical component of modern retail. Economic policies promoting digitalization and infrastructure development in urban centers are key enablers.

- Product Category Dominance:

- Barcode Readers: Essential for inventory management and point-of-sale operations, barcode readers remain a high-volume product. Technological advancements in scanning speed and accuracy, coupled with decreasing costs, ensure sustained demand.

- Self-Checkout Systems: As mentioned, these are pivotal in the unattended terminals segment. Their widespread adoption is driven by consumer acceptance and the operational benefits for retailers.

- Kiosks: Interactive kiosks are becoming increasingly popular for information dissemination, order placement, and self-service, particularly in larger retail formats and food service.

- End-user Application Dominance:

- Food/Non-Food Retail: This broad category, encompassing grocery stores, supermarkets, department stores, and convenience stores, represents the largest end-user application. The sheer volume of transactions and the need for efficient stock management make this segment a primary adopter of retail automation. Infrastructure development supporting large retail formats and a growing middle class in countries like China, India, and Southeast Asian nations are critical drivers.

- Transportation and Logistics: While seemingly distinct, retail automation plays a crucial role in optimizing logistics within the retail supply chain, from warehousing to last-mile delivery. The efficiency gains achieved through automated sorting and tracking systems are vital for this sector.

- Hospitality: Hotels and restaurants are increasingly integrating automation for check-in/check-out, order taking, and payment processing, enhancing guest experiences and operational fluidity.

Asia Pacific Retail Automation Market Product Developments

Recent product developments in the Asia Pacific Retail Automation Market are focused on enhancing intelligence, user experience, and integration capabilities. Innovations are centered around AI-powered analytics for personalized customer engagement, advanced robotics for inventory management and delivery, and the seamless integration of physical and digital retail touchpoints. For instance, the development of more compact and user-friendly self-checkout systems, coupled with sophisticated scanning technologies, is improving checkout speed and accuracy. Furthermore, the integration of IoT sensors with retail automation hardware is enabling real-time data collection and predictive maintenance, ensuring operational continuity. These advancements are crucial for retailers seeking to differentiate themselves and optimize their operations in a highly competitive market.

Key Drivers of Asia Pacific Retail Automation Market Growth

The growth of the Asia Pacific Retail Automation Market is propelled by several key factors. Firstly, the escalating demand for enhanced customer experiences, characterized by faster checkouts and personalized interactions, is a significant driver. Secondly, the increasing need for operational efficiency and cost reduction in the face of rising labor costs and complex supply chains is compelling retailers to adopt automated solutions. Thirdly, rapid technological advancements, including artificial intelligence, IoT, and robotics, are making automation more accessible, affordable, and effective. Finally, supportive government initiatives promoting digitalization and smart retail infrastructure further accelerate market expansion.

Challenges in the Asia Pacific Retail Automation Market Market

Despite its promising growth, the Asia Pacific Retail Automation Market faces several challenges. High initial investment costs for advanced automation solutions can be a significant barrier for small and medium-sized enterprises (SMEs). Furthermore, the lack of skilled personnel to manage and maintain complex automated systems poses a considerable hurdle in certain regions. Data security and privacy concerns surrounding the collection and utilization of customer data through automated systems require robust regulatory frameworks and technological safeguards. Interoperability issues between different automated systems and existing legacy infrastructure can also complicate adoption. Finally, the varying pace of technological adoption and infrastructure development across different countries within the Asia Pacific region creates market fragmentation.

Emerging Opportunities in Asia Pacific Retail Automation Market

The Asia Pacific Retail Automation Market is ripe with emerging opportunities driven by technological breakthroughs and evolving consumer behaviors. The burgeoning demand for contactless payment and checkout solutions presents a significant growth avenue, further accelerated by recent global health events. The expansion of e-commerce and the need for efficient last-mile delivery logistics are creating opportunities for automated warehousing and delivery systems. Furthermore, the increasing adoption of "retail-as-a-service" models, leveraging automation for enhanced customer engagement and personalized experiences, is poised for substantial growth. Strategic partnerships between technology providers and retailers, focusing on co-creating innovative solutions tailored to specific market needs, will also be critical catalysts for future expansion.

Leading Players in the Asia Pacific Retail Automation Market Sector

- Honeywell International Inc.

- Fiserv Inc.

- NCR Corporation

- Toshiba Global Commerce Solutions

- Datalogic S p A

- Fujitsu Limited

- Seiko Epson Corporation

- KUKA AG

- Zebra Technologies

- Diebold Nixdorf

Key Milestones in Asia Pacific Retail Automation Market Industry

- December 2020: Fujitsu Limited partnered with Zippin as a distributor of the company's checkout-free solution across Japan. This agreement enabled Fujitsu to develop a retail solution to provide a novel customer experience, leveraging Zippin's checkout-free SaaS platform with cashless operations to enhance bandwidth and save staff time, which the businesses see as being especially important during the epidemic.

- January 2020: Honeywell International Inc. worked with KOAMTAC Inc. to improve the performance of its barcode scanner by incorporating a barcode decoder via the SwiftDecoderTM app. SwiftDecoder, using a tablet or smartphone's camera, is slightly slower and less handy than a dedicated barcode scanner, but it is also less expensive.

Strategic Outlook for Asia Pacific Retail Automation Market Market

The strategic outlook for the Asia Pacific Retail Automation Market is exceptionally positive, driven by sustained demand for enhanced efficiency and superior customer experiences. Future growth accelerators will include the continued integration of AI and machine learning to personalize retail journeys, the expansion of autonomous store formats, and the development of more sophisticated robotics for supply chain optimization. Strategic opportunities lie in addressing the specific needs of emerging economies through localized solutions and fostering collaborations that bridge technological gaps. The increasing focus on sustainability and circular economy principles within retail will also drive demand for automation solutions that reduce waste and optimize resource utilization. The market is expected to witness further consolidation and the emergence of specialized solution providers catering to niche retail segments.

Asia Pacific Retail Automation Market Segmentation

-

1. Product Type

- 1.1. Point-of

- 1.2. Unattended Terminals

-

2. Product

- 2.1. Barcode reader

- 2.2. Weighing scale

- 2.3. Currency Counter

- 2.4. Bill Printer

- 2.5. Cash Register

- 2.6. Card Reader

- 2.7. Kiosks

- 2.8. Self-Checkout Systems

- 2.9. Others

-

3. End-user Application

- 3.1. Food/Non-Food

- 3.2. Oil and Gas

- 3.3. Transportation and Logistics

- 3.4. Health and Personal Care

- 3.5. Hospitality

- 3.6. Others

Asia Pacific Retail Automation Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Retail Automation Market Regional Market Share

Geographic Coverage of Asia Pacific Retail Automation Market

Asia Pacific Retail Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing retail stores; Increase in the adoption of digitization across retail sector

- 3.3. Market Restrains

- 3.3.1 At unattended terminals

- 3.3.2 there is a risk of theft

- 3.4. Market Trends

- 3.4.1. Significant Upsurge in E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Retail Automation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Point-of

- 5.1.2. Unattended Terminals

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Barcode reader

- 5.2.2. Weighing scale

- 5.2.3. Currency Counter

- 5.2.4. Bill Printer

- 5.2.5. Cash Register

- 5.2.6. Card Reader

- 5.2.7. Kiosks

- 5.2.8. Self-Checkout Systems

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Application

- 5.3.1. Food/Non-Food

- 5.3.2. Oil and Gas

- 5.3.3. Transportation and Logistics

- 5.3.4. Health and Personal Care

- 5.3.5. Hospitality

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fiserv Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NCR Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Global Commerce Solutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Datalogic S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujitsu Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Seiko Epson Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KUKA AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zebra Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Diebold Nixdorf

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Retail Automation Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Retail Automation Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Retail Automation Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Retail Automation Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Asia Pacific Retail Automation Market Revenue undefined Forecast, by End-user Application 2020 & 2033

- Table 4: Asia Pacific Retail Automation Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Retail Automation Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Asia Pacific Retail Automation Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Asia Pacific Retail Automation Market Revenue undefined Forecast, by End-user Application 2020 & 2033

- Table 8: Asia Pacific Retail Automation Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Retail Automation Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Retail Automation Market?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Asia Pacific Retail Automation Market?

Key companies in the market include Honeywell International Inc, Fiserv Inc, NCR Corporation, Toshiba Global Commerce Solutions, Datalogic S p A, Fujitsu Limited, Seiko Epson Corporation, KUKA AG, Zebra Technologies, Diebold Nixdorf.

3. What are the main segments of the Asia Pacific Retail Automation Market?

The market segments include Product Type, Product, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing retail stores; Increase in the adoption of digitization across retail sector.

6. What are the notable trends driving market growth?

Significant Upsurge in E-commerce Sector.

7. Are there any restraints impacting market growth?

At unattended terminals. there is a risk of theft.

8. Can you provide examples of recent developments in the market?

December 2020, Fujitsu Limited partnered with Zippin as a distributor of the company's checkout-free solution across Japan. The agreement enables Fujitsu to develop a retail solution to provide a novel customer experience, leveraging Zippin's checkout-free SaaS platform with cashless operations to enhance bandwidth and save staff time, which the businesses see as being especially important during the epidemic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Retail Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Retail Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Retail Automation Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Retail Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence