Key Insights

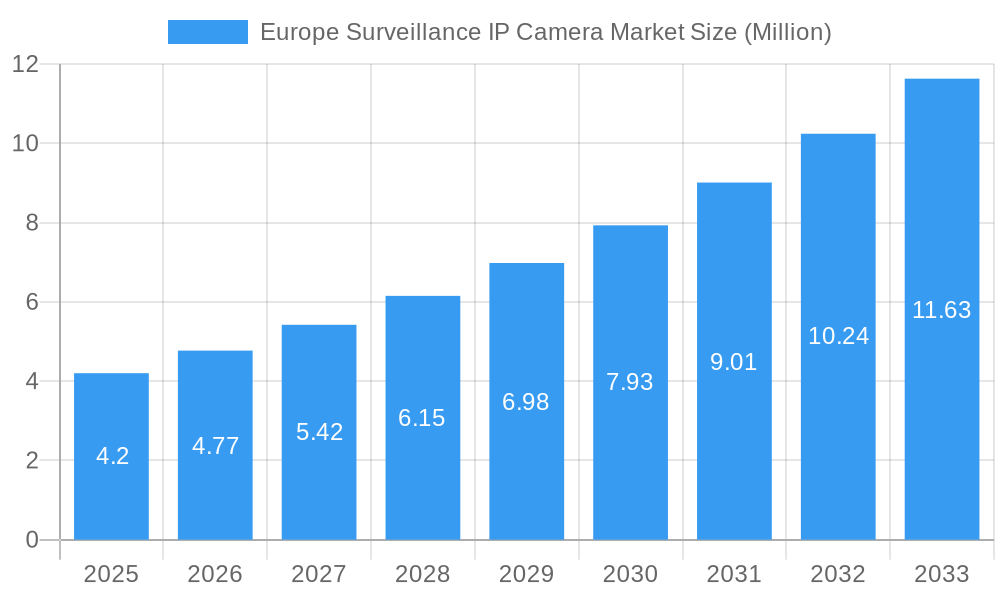

The Europe Surveillance IP Camera Market is poised for substantial expansion, with a current market size of $4.20 million and a projected Compound Annual Growth Rate (CAGR) of 13.90% during the forecast period of 2025-2033. This robust growth is fueled by an increasing emphasis on enhanced security across various sectors, including government, banking, healthcare, and transportation. The rising adoption of sophisticated surveillance technologies, driven by the need to prevent crime, monitor critical infrastructure, and ensure public safety, is a primary catalyst. Furthermore, the continuous evolution of IP camera technology, incorporating advanced features like artificial intelligence (AI) for video analytics, superior image resolution, and enhanced connectivity options, is contributing significantly to market penetration. The integration of these cameras into broader smart city initiatives and the growing demand for remote monitoring solutions further bolster market prospects.

Europe Surveillance IP Camera Market Market Size (In Million)

However, the market is not without its challenges. Data privacy concerns and stringent regulatory frameworks surrounding data collection and storage in the European region present a notable restraint. The initial investment cost associated with high-end IP surveillance systems, while decreasing, can still be a barrier for some smaller organizations and businesses. Despite these hurdles, the persistent and growing need for comprehensive security solutions, coupled with ongoing technological advancements and increasing affordability of IP camera systems, indicates a strong upward trajectory for the Europe Surveillance IP Camera Market. Key industry players like Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology, and Axis Communications AB are actively innovating and expanding their product portfolios to meet the diverse and evolving demands of the European market.

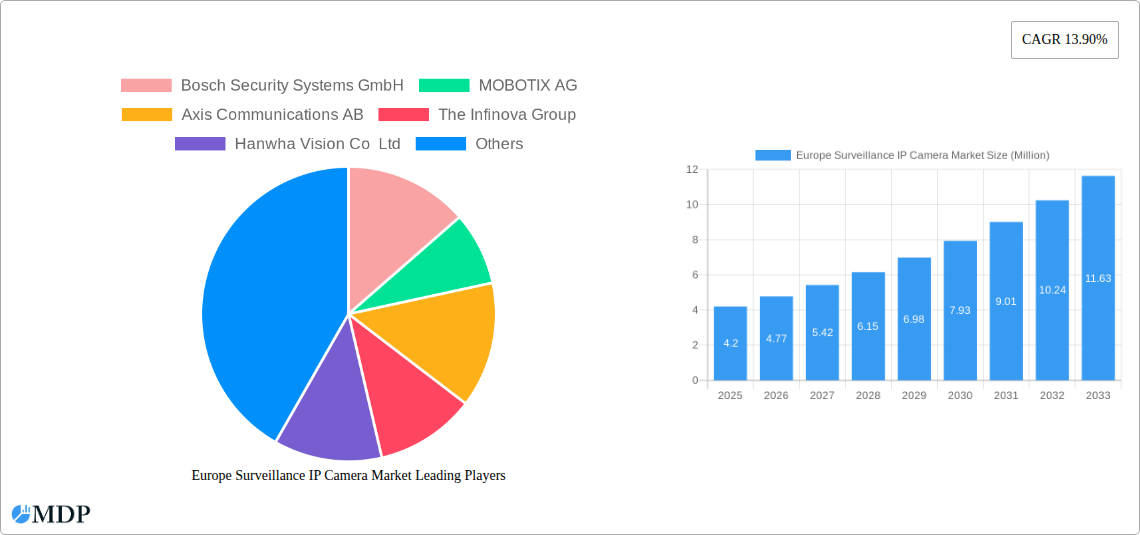

Europe Surveillance IP Camera Market Company Market Share

Unlock critical insights into the Europe Surveillance IP Camera Market, a dynamic sector experiencing robust growth driven by escalating security concerns and technological advancements. This comprehensive report offers an in-depth analysis of market trends, key players, and future projections, providing actionable intelligence for stakeholders in the IP camera security landscape. With a forecast period extending to 2033, this study details the market's trajectory, empowering strategic decision-making for video surveillance solutions and network camera providers.

Europe Surveillance IP Camera Market Market Dynamics & Concentration

The Europe Surveillance IP Camera Market is characterized by a moderate to high concentration, with a few dominant players holding significant market share, estimated at over 60% in 2025. Innovation remains a primary driver, fueled by advancements in artificial intelligence, edge computing, and cloud-based surveillance, pushing the boundaries of smart security cameras. Regulatory frameworks, particularly stringent data privacy laws like GDPR, continue to shape product development and deployment strategies, emphasizing secure and ethical data handling. While traditional CCTV systems are being replaced by more advanced IP solutions, product substitutes in the form of integrated security platforms and advanced alarm systems pose a competitive challenge. End-user trends are leaning towards more intelligent, scalable, and user-friendly surveillance solutions, with a growing demand for analytics and remote accessibility. Mergers and acquisitions (M&A) activities, though not overtly frequent, are strategic, aimed at consolidating market presence, acquiring niche technologies, or expanding geographical reach. For instance, an estimated 5-8 significant M&A deals focused on technology acquisition or market consolidation are anticipated between 2023 and 2027.

Europe Surveillance IP Camera Market Industry Trends & Analysis

The Europe Surveillance IP Camera Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. This upward trajectory is propelled by several interconnected trends. The increasing adoption of AI and machine learning in surveillance cameras is transforming them from mere recording devices into intelligent security tools. Features like facial recognition, object detection, anomaly detection, and predictive analytics are becoming standard, enabling proactive threat identification and enhanced operational efficiency across various industries. The surge in smart city initiatives across Europe is a significant growth catalyst, requiring comprehensive networked video surveillance for public safety, traffic management, and infrastructure monitoring. The rising sophistication of cyber threats necessitates robust security features within IP cameras, including end-to-end encryption and secure network protocols. Furthermore, the increasing demand for remote monitoring and management capabilities, driven by the widespread adoption of cloud computing and mobile technologies, is fueling the market for cloud-based surveillance systems and wireless IP cameras. The shift from analog to digital solutions continues, with organizations upgrading their existing CCTV infrastructure to more efficient and feature-rich IP-based systems. The growing emphasis on integration with other security and building management systems is also a key trend, creating a more cohesive and intelligent security ecosystem. Consumer preferences are evolving towards higher resolution cameras, wider field-of-view options, and enhanced low-light performance, catering to diverse surveillance needs. The market penetration of IP cameras, particularly in sectors like retail and transportation, is expected to reach over 70% by 2025.

Leading Markets & Segments in Europe Surveillance IP Camera Market

Within the Europe Surveillance IP Camera Market, several end-user industries are demonstrating significant dominance and growth.

Government: This sector is a leading adopter of IP cameras, driven by national security imperatives, smart city projects, and the need for public safety.

- Key Drivers: Increased government spending on homeland security, critical infrastructure protection, and urban surveillance initiatives. Favorable regulatory frameworks promoting the use of advanced video analytics for crime prevention and public order.

- Dominance Analysis: The government segment consistently accounts for the largest market share, estimated at around 25-30% in 2025. Investments in smart city projects across major European capitals, such as London, Paris, and Berlin, are fueling demand for high-resolution and AI-enabled surveillance camera systems. The need for comprehensive monitoring of public spaces, transportation hubs, and borders makes this segment a consistent growth area.

Banking: Financial institutions are prioritizing the security of their premises, ATMs, and customer data, making IP cameras indispensable.

- Key Drivers: Heightened concerns over financial fraud, theft, and the need for regulatory compliance. Adoption of high-definition IP cameras for forensic analysis and transaction monitoring.

- Dominance Analysis: The banking sector represents a significant portion of the market, estimated at 18-22% in 2025. The continuous need for secure transaction monitoring, fraud detection, and compliance with stringent financial regulations drives the demand for advanced IP camera solutions. Banks are increasingly deploying cameras with sophisticated analytics for crowd management and access control.

Healthcare: The healthcare industry is increasingly leveraging IP cameras for patient monitoring, facility security, and preventing unauthorized access.

- Key Drivers: Growing emphasis on patient safety and well-being, along with the need to secure sensitive medical data and equipment. The integration of smart surveillance for remote patient monitoring and telehealth applications.

- Dominance Analysis: This segment is experiencing rapid growth, projected to reach 12-15% of the market share by 2025. The increasing use of IP cameras for monitoring patients, especially the elderly and vulnerable, and for securing pharmaceutical inventory and medical facilities is a key factor. The potential for AI-powered analytics in healthcare, such as fall detection and patient behavior monitoring, further bolsters its importance.

Transportation and Logistics: The need for enhanced security and operational efficiency in airports, train stations, ports, and logistics hubs makes IP cameras crucial.

- Key Drivers: Increasing passenger and cargo volumes, along with the need to monitor traffic flow, prevent accidents, and enhance supply chain visibility. The deployment of advanced video surveillance for security at critical transportation infrastructure.

- Dominance Analysis: This segment holds an estimated 15-18% market share in 2025. The continuous expansion of transportation networks and the growing complexity of logistics operations necessitate robust surveillance solutions. Airports and railway networks are major consumers of IP camera technology for passenger safety, baggage tracking, and perimeter security.

Industrial: Manufacturing plants, power generation facilities, and other industrial sites are adopting IP cameras for process monitoring, safety compliance, and asset protection.

- Key Drivers: The need for real-time monitoring of production processes, ensuring worker safety, and preventing industrial espionage or theft. Demand for ruggedized IP cameras suitable for harsh environments.

- Dominance Analysis: This segment represents a substantial market, estimated at 13-16% in 2025. Industries are increasingly relying on IP surveillance systems for quality control, operational efficiency, and adherence to safety regulations. The ability of network cameras to provide high-resolution imagery for detailed process analysis is a key advantage.

Others: This category includes retail, hospitality, education, and residential sectors, all of which are contributing to the overall market growth.

- Key Drivers: Increasing adoption of IP cameras for loss prevention in retail, enhanced guest security in hospitality, and campus surveillance in educational institutions. Growing demand for smart home security solutions in the residential sector.

- Dominance Analysis: While individually smaller, these segments collectively represent a significant portion of the market, projected to be around 10-12% in 2025. The retail sector, in particular, is a strong adopter of video analytics for customer behavior analysis and inventory management.

Europe Surveillance IP Camera Market Product Developments

Recent product developments in the Europe Surveillance IP Camera Market are significantly enhancing capabilities. Axis Communications unveiled a versatile dome camera in April 2024, featuring high-definition video, two-way audio, actionable analytics, and LED indicators, designed to improve safety, security, and operational efficiency. This innovation allows for proactive resource allocation and streamlined surveillance, exemplified by its use in patient monitoring and retail loitering identification. The camera's analytics for coughing fits and stressed voices further bolster its active incident management potential. Similarly, Vivotek announced in February 2024 an industry-leading five-year global warranty extension for its network cameras and NVRs, including the European region, reinforcing customer confidence and emphasizing robust after-sales support. These advancements highlight a market trend towards intelligent, reliable, and customer-centric video surveillance technology.

Key Drivers of Europe Surveillance IP Camera Market Growth

The Europe Surveillance IP Camera Market is experiencing robust growth driven by several pivotal factors. The escalating global security threats and concerns over crime rates are compelling organizations and governments to invest in advanced video surveillance solutions. The rapid evolution of technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) is enabling the development of smarter and more feature-rich IP cameras, offering enhanced analytics and predictive capabilities. Government initiatives focused on smart city development, critical infrastructure protection, and public safety further fuel demand. The ongoing digital transformation across industries, leading to increased adoption of networked solutions, also supports the shift towards IP-based surveillance. Furthermore, the declining cost of network cameras and their associated infrastructure is making them more accessible to a wider range of businesses and consumers.

Challenges in the Europe Surveillance IP Camera Market Market

Despite its growth, the Europe Surveillance IP Camera Market faces several challenges. Stringent data privacy regulations, such as GDPR, require careful consideration and adherence, potentially increasing implementation costs and complexity for surveillance system providers and users. The evolving landscape of cybersecurity threats poses a significant risk, necessitating continuous investment in secure IP camera technologies and robust network protection. Supply chain disruptions and component shortages, exacerbated by geopolitical events, can impact manufacturing timelines and product availability. Intense market competition among established players and emerging vendors can lead to price pressures, affecting profit margins. The high initial investment cost for sophisticated enterprise-grade surveillance systems, though decreasing, can still be a barrier for small and medium-sized enterprises (SMEs).

Emerging Opportunities in Europe Surveillance IP Camera Market

The Europe Surveillance IP Camera Market is ripe with emerging opportunities. The increasing demand for integrated security solutions, combining video surveillance with access control, intrusion detection, and alarm systems, presents a significant avenue for growth. The burgeoning adoption of cloud-based surveillance platforms offers scalable and accessible video management solutions, particularly attractive for businesses seeking flexibility and reduced on-site infrastructure. The expansion of smart city projects across Europe creates substantial demand for AI-powered surveillance cameras capable of traffic management, public safety monitoring, and environmental sensing. The growing trend of remote work and the need for distributed monitoring solutions also presents opportunities for wireless and highly mobile IP camera offerings. Furthermore, the development of specialized surveillance camera solutions for niche applications, such as industrial inspection, retail analytics, and healthcare monitoring, offers untapped market potential.

Leading Players in the Europe Surveillance IP Camera Market Sector

- Bosch Security Systems GmbH

- MOBOTIX AG

- Axis Communications AB

- The Infinova Group

- Hanwha Vision Co Ltd

- Hangzhou Hikvision Digital Technology Co Ltd

- Dahua Technology

- Vivotek Inc (A Delta Group Company)

- Tyco (A Johnson Controls Brand)

- Honeywell Security (Honeywell International Inc)

- Sony Corporation

Key Milestones in Europe Surveillance IP Camera Market Industry

- April 2024: Axis Communications unveiled a versatile dome camera, integrating high-definition video, two-way audio, actionable analytics, and LED indicators. This innovative device enhances safety, security, and operational efficiency. It empowers users to streamline surveillance operations, enabling proactive resource allocation. For example, it can facilitate tele-sitting for patient monitoring in healthcare settings or aid in identifying and addressing loitering in retail spaces. The AXIS Q9307-LV Dome Camera is equipped with analytics for coughing fits and stressed voices, enhancing its capabilities for active incident management. It serves as an ideal tool for both remote monitoring and communication.

- February 2024: Vivotek is enhancing its after-sales service by extending the warranty on its network cameras and network video recorders (NVRs) to five years globally, including in the European region, aligning with the industry's highest standards. All Vivotek network cameras and NVRs of designated models, when shipped by Vivotek, will automatically come with a five-year warranty. This warranty includes robust after-sales service and technical support. Notably, Vivotek confirms that this warranty extension covers products bought through their authorized distributors.

Strategic Outlook for Europe Surveillance IP Camera Market Market

The strategic outlook for the Europe Surveillance IP Camera Market remains highly optimistic, driven by an unyielding demand for enhanced security and intelligent monitoring capabilities. The continued integration of AI and IoT technologies will propel innovation in smart surveillance, leading to more sophisticated analytics and proactive threat detection. The market will likely witness a consolidation of players through strategic partnerships and acquisitions, as companies seek to expand their technological portfolios and market reach. The growing emphasis on cybersecurity will mandate stricter security protocols and certifications for IP camera solutions. Furthermore, the increasing adoption of cloud-based video surveillance platforms will democratize access to advanced features, making scalable and flexible solutions more attainable for a broader customer base. The ongoing expansion of smart city infrastructure across Europe will continue to be a significant market driver, creating sustained demand for advanced networked video solutions. The focus will shift towards holistic security ecosystems that seamlessly integrate IP cameras with other security and operational technologies, offering comprehensive end-to-end security management.

Europe Surveillance IP Camera Market Segmentation

-

1. End-User Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Others (

Europe Surveillance IP Camera Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

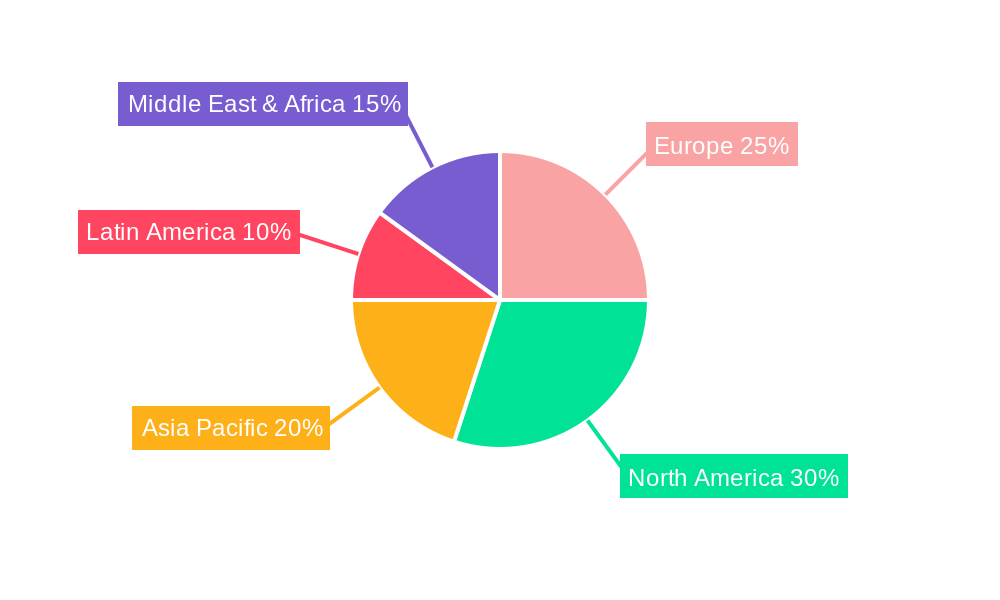

Europe Surveillance IP Camera Market Regional Market Share

Geographic Coverage of Europe Surveillance IP Camera Market

Europe Surveillance IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI

- 3.4. Market Trends

- 3.4.1. Transportation and Logistics End-User Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Surveillance IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bosch Security Systems GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MOBOTIX AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axis Communications AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Infinova Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanwha Vision Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dahua Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vivotek Inc (A Delta Group Company)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tyco (A Johnson Controls Brand)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honeywell Security (Honeywell International Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sony Corporatio

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bosch Security Systems GmbH

List of Figures

- Figure 1: Europe Surveillance IP Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Surveillance IP Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Surveillance IP Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Europe Surveillance IP Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Europe Surveillance IP Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Surveillance IP Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Europe Surveillance IP Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe Surveillance IP Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Europe Surveillance IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Surveillance IP Camera Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Surveillance IP Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Surveillance IP Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Surveillance IP Camera Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the Europe Surveillance IP Camera Market?

Key companies in the market include Bosch Security Systems GmbH, MOBOTIX AG, Axis Communications AB, The Infinova Group, Hanwha Vision Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology, Vivotek Inc (A Delta Group Company), Tyco (A Johnson Controls Brand), Honeywell Security (Honeywell International Inc ), Sony Corporatio.

3. What are the main segments of the Europe Surveillance IP Camera Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI.

6. What are the notable trends driving market growth?

Transportation and Logistics End-User Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Adoption of Surveillance IP Cameras Across Several Industries; Growing Integration of Advanced Technologies like IoT and AI.

8. Can you provide examples of recent developments in the market?

April 2024: Axis Communications unveiled a versatile dome camera, integrating high-definition video, two-way audio, actionable analytics, and LED indicators. This innovative device enhances safety, security, and operational efficiency. It empowers users to streamline surveillance operations, enabling proactive resource allocation. For example, it can facilitate tele-sitting for patient monitoring in healthcare settings or aid in identifying and addressing loitering in retail spaces. The AXIS Q9307-LV Dome Camera is equipped with analytics for coughing fits and stressed voices, enhancing its capabilities for active incident management. It serves as an ideal tool for both remote monitoring and communication.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Surveillance IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Surveillance IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Surveillance IP Camera Market?

To stay informed about further developments, trends, and reports in the Europe Surveillance IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence