Key Insights

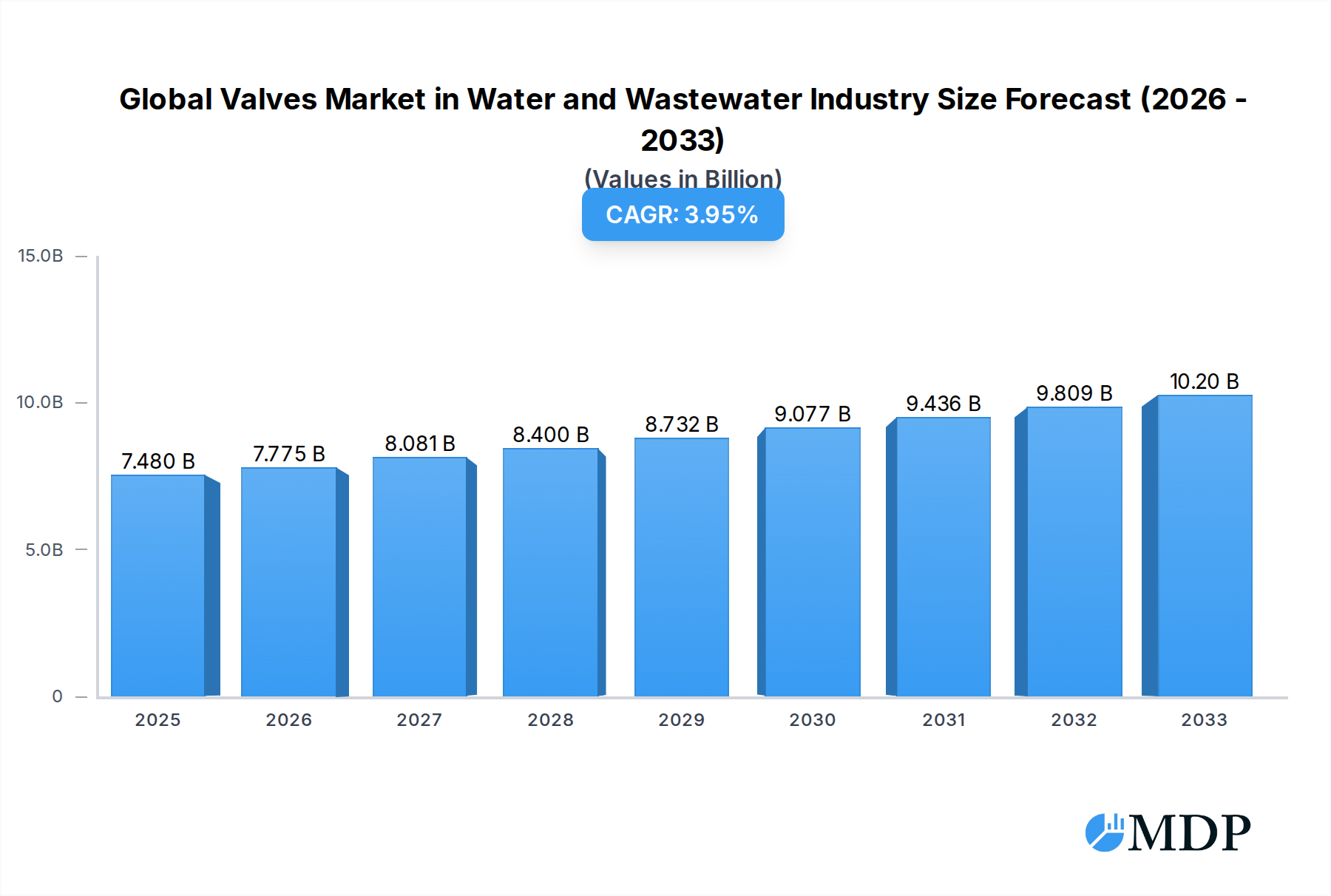

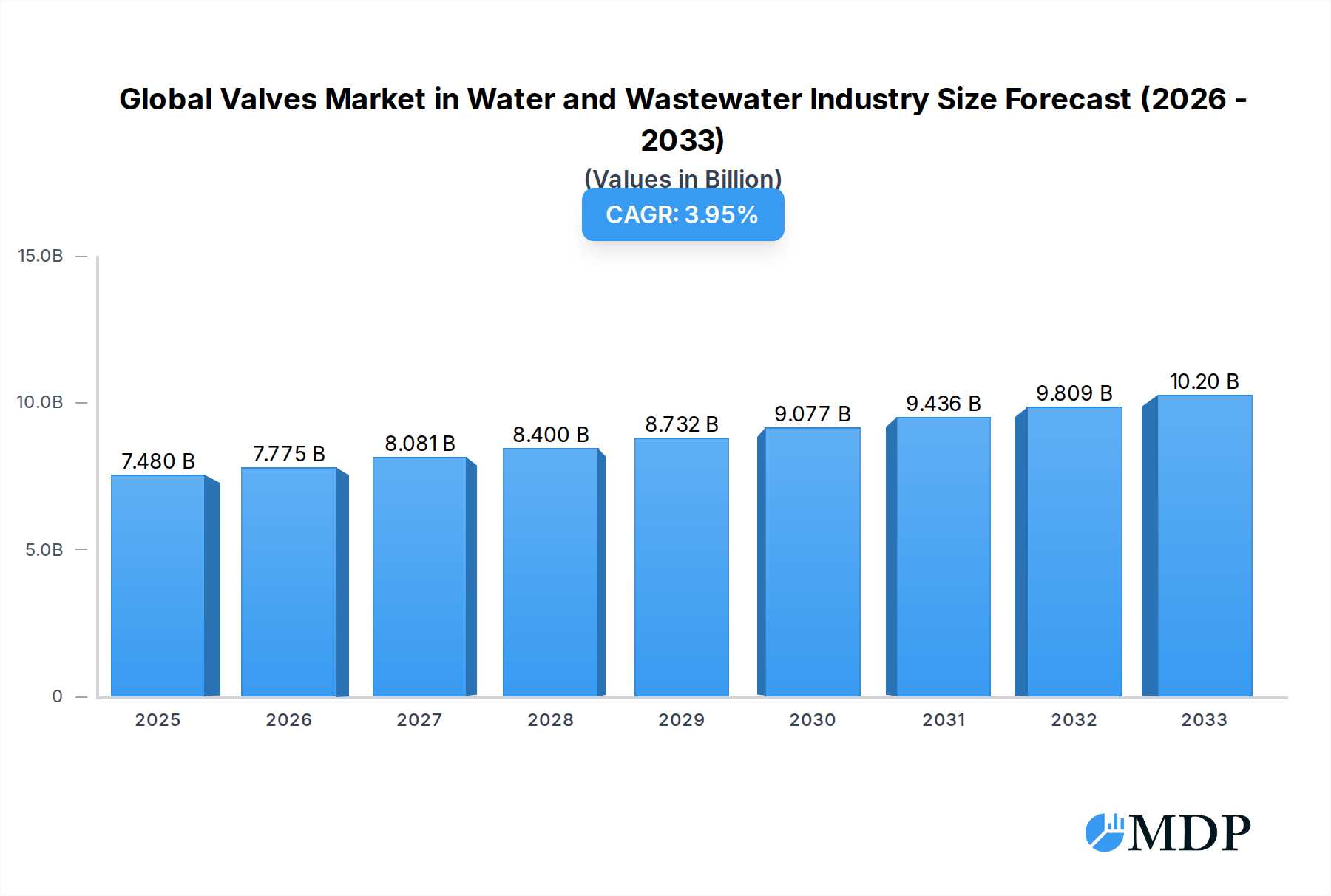

The Global Valves Market in the Water and Wastewater Industry is poised for steady expansion, with an estimated market size of 7480 Million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 3.94% through 2033. This robust growth is propelled by a confluence of factors, most notably the increasing global focus on water conservation and the imperative to upgrade aging water and wastewater infrastructure. Governments worldwide are investing heavily in expanding and modernizing their water treatment facilities to meet the demands of a growing population and address the challenges posed by water scarcity. Furthermore, the rising adoption of advanced water management technologies, including smart grids and automated systems, necessitates the deployment of sophisticated valve solutions for precise flow control and efficient operation. The demand for high-performance valves that can withstand corrosive environments and ensure reliable operation in critical water and wastewater applications is a significant market driver.

Global Valves Market in Water and Wastewater Industry Market Size (In Billion)

Key trends shaping the market include the increasing preference for automated and intelligent valve systems, which offer enhanced monitoring, control, and diagnostic capabilities, thereby improving operational efficiency and reducing maintenance costs. The development of smart valves with integrated sensors and IoT connectivity is a notable trend, facilitating real-time data analysis and predictive maintenance. Moreover, the growing emphasis on sustainability is driving the demand for energy-efficient valve designs that minimize water loss and energy consumption in treatment processes. However, the market also faces certain restraints, such as the high initial investment costs associated with advanced valve technologies and the availability of counterfeit products that can compromise performance and safety. Stringent regulatory frameworks governing water quality and environmental protection, while ultimately beneficial, can also present challenges in terms of compliance and adoption timelines for new valve technologies.

Global Valves Market in Water and Wastewater Industry Company Market Share

Dive deep into the critical infrastructure of water and wastewater management with our comprehensive report on the Global Valves Market. This in-depth analysis, covering the period from 2019 to 2033 with a base year of 2025, provides invaluable insights for industry stakeholders seeking to navigate this dynamic and essential sector. From municipal treatment plants to industrial processes, valves are the silent guardians of fluid control, and this report illuminates their evolving role and market trajectory.

This report offers a granular breakdown of market dynamics, segmentation, key players, and future prospects, equipping you with the knowledge to make informed strategic decisions. Discover the latest innovations, understand the competitive landscape, and identify emerging opportunities in a market projected to witness significant growth driven by increasing global demand for clean water and efficient wastewater treatment.

The Global Valves Market in Water and Wastewater Industry is a cornerstone of sustainable development and public health. With an estimated market size of $12.5 Million in 2025, this sector is experiencing a substantial Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2025–2033. This growth is fueled by critical factors such as aging infrastructure requiring upgrades, stringent environmental regulations, and the rising global population's demand for reliable water and wastewater services.

Global Valves Market in Water and Wastewater Industry Market Dynamics & Concentration

The Global Valves Market in the Water and Wastewater Industry is characterized by a moderate to high market concentration, with a few key players holding significant market share. Innovation drivers are primarily focused on enhancing valve efficiency, durability, and smart capabilities for remote monitoring and control. Regulatory frameworks, particularly those concerning water quality standards and environmental discharge, play a crucial role in shaping market demand and driving the adoption of advanced valve technologies. Product substitutes are limited due to the specialized nature of valve applications in water and wastewater treatment, but advancements in alternative fluid control mechanisms are continually monitored. End-user trends indicate a growing preference for automated and digitally integrated valve systems that offer greater operational efficiency and reduced maintenance costs. Mergers and Acquisitions (M&A) activities are a significant aspect of market dynamics, with companies strategically acquiring competitors or complementary technology providers to expand their product portfolios and geographic reach. For instance, the 2022 M&A deal count was approximately 15, signaling robust consolidation efforts. Market share for the top 5 players in 2025 is estimated at around 45%, reflecting a competitive yet consolidated landscape.

Global Valves Market in Water and Wastewater Industry Industry Trends & Analysis

The Global Valves Market in the Water and Wastewater Industry is experiencing robust growth, driven by a confluence of compelling trends and underlying market forces. The increasing global population and rapid urbanization are placing unprecedented strain on existing water and wastewater infrastructure, necessitating substantial investments in new facilities and the upgrading of aging systems. This, in turn, fuels consistent demand for a wide array of industrial valves, from robust gate and globe valves for large-scale distribution to sophisticated control valves for precise process management. Environmental regulations are becoming increasingly stringent worldwide, pushing municipalities and industries to adopt more efficient and environmentally friendly water treatment and wastewater discharge practices. This regulatory push directly translates into a greater demand for high-performance, leak-proof, and energy-efficient valve solutions that minimize environmental impact and ensure compliance. Technological disruptions are profoundly reshaping the industry. The integration of the Internet of Things (IoT) and advanced sensor technologies is leading to the development of "smart" valves capable of real-time monitoring, predictive maintenance, and remote control. These smart valves offer significant advantages in terms of operational efficiency, reduced downtime, and optimized resource management, making them a key focus for market players. Consumer preferences, while indirectly influencing this B2B market, are shifting towards greater awareness of water scarcity and conservation. This societal shift translates into governmental and industrial impetus for water reuse and recycling initiatives, which often require specialized valving solutions for advanced treatment processes. Competitive dynamics are characterized by a mix of large, established global manufacturers and niche players specializing in specific valve types or applications. The competitive landscape is marked by continuous innovation, with companies vying to offer differentiated products that meet evolving performance, sustainability, and cost-efficiency demands. The estimated market penetration of smart valves is projected to reach 30% by 2033, indicating a significant technological shift. The market penetration of advanced material valves, offering enhanced corrosion resistance and longevity, is also on an upward trajectory.

Leading Markets & Segments in Global Valves Market in Water and Wastewater Industry

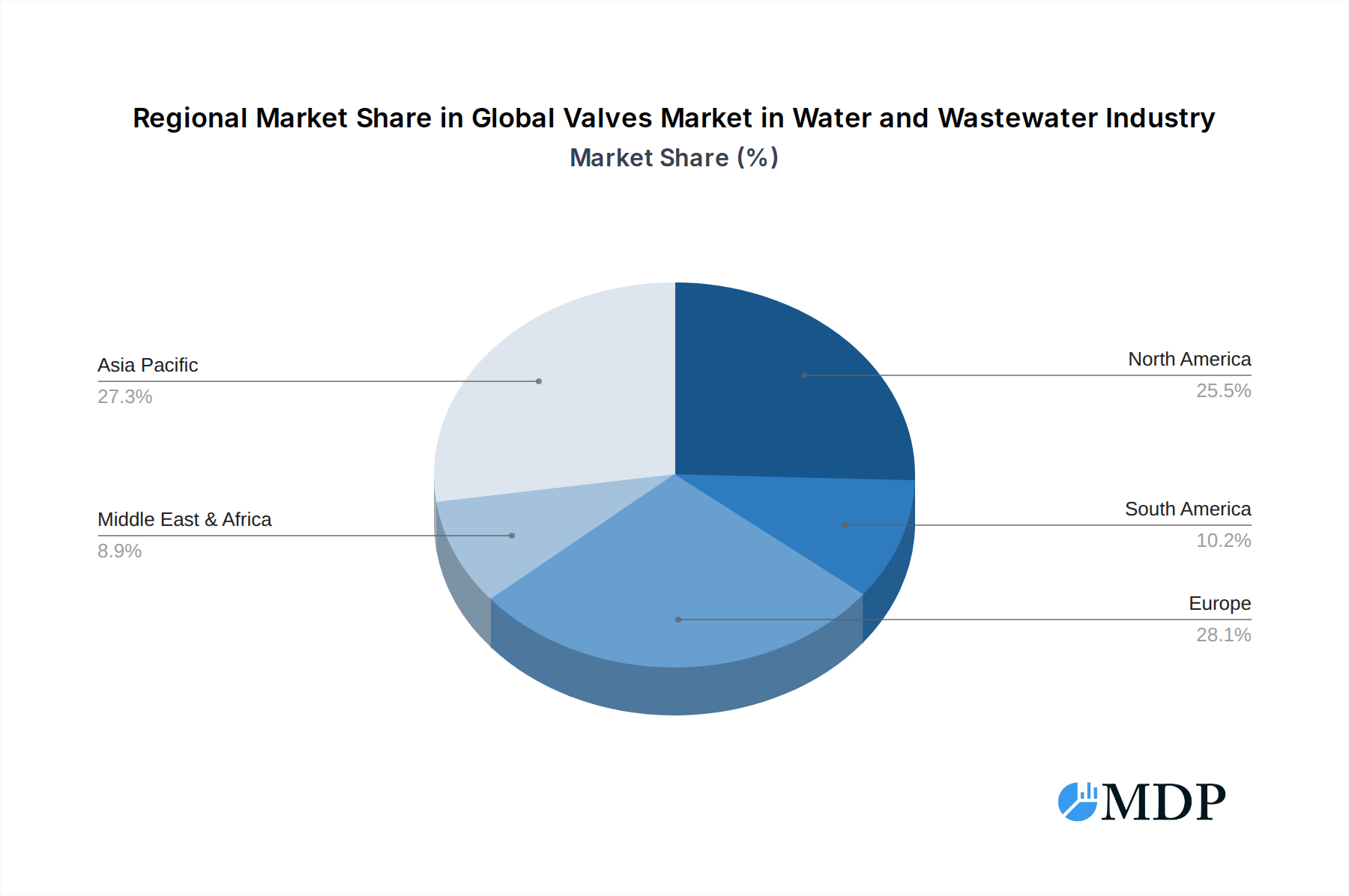

The North America region currently stands as the dominant market for valves in the water and wastewater industry, with the United States leading the charge. This dominance is attributed to a combination of factors, including significant investments in upgrading aging water infrastructure, stringent environmental regulations, and a high concentration of industrial water users. The presence of well-established municipal water treatment facilities and robust industrial sectors, such as manufacturing and energy, further bolsters demand.

Among the valve types, Control Valves are experiencing substantial growth, driven by the increasing need for precise flow regulation and process optimization in advanced water treatment and distribution systems. Their ability to automatically adjust to changing conditions ensures efficient operation and resource conservation. The Gate/Globe/Check valve segment continues to hold a significant market share due to their reliability and widespread application in basic fluid control and isolation across various water and wastewater applications. However, the market is also witnessing a notable upward trend in the demand for Ball Valves and Butterfly Valves owing to their cost-effectiveness, ease of operation, and suitability for a wide range of flow conditions.

Key drivers for this segment dominance include:

- Government Funding and Infrastructure Projects: Substantial government initiatives and funding allocated to modernizing water and wastewater infrastructure in North America are primary catalysts.

- Strict Environmental Compliance: Stringent regulations concerning water quality, discharge limits, and water conservation necessitate the use of high-performance and reliable valve systems.

- Industrial Demand: A strong presence of diverse industries requiring consistent and controlled water supply and wastewater management contributes significantly to market volume.

- Technological Adoption: Early adoption and integration of smart valve technologies and advanced monitoring systems in the region enhance operational efficiency and decision-making.

The Asia-Pacific region is projected to exhibit the highest growth rate in the coming years, fueled by rapid industrialization, population growth, and increasing investments in water and wastewater infrastructure development across emerging economies.

Global Valves Market in Water and Wastewater Industry Product Developments

Product development in the Global Valves Market for the Water and Wastewater Industry is sharply focused on enhancing reliability, sustainability, and smart functionalities. Innovations are centered around advanced materials offering superior corrosion and abrasion resistance, extending valve lifespan in harsh environments. The integration of IoT sensors for real-time performance monitoring, predictive maintenance alerts, and remote diagnostics is a key trend, enabling operational efficiency and reducing downtime. Furthermore, manufacturers are developing more energy-efficient valve designs to minimize operational costs and environmental impact. These advancements are driven by a growing demand for intelligent water management systems that ensure water quality, optimize resource utilization, and comply with stringent environmental regulations, thereby providing a competitive edge in the market.

Key Drivers of Global Valves Market in Water and Wastewater Industry Growth

The growth of the Global Valves Market in the Water and Wastewater Industry is primarily propelled by critical factors. Firstly, the increasing global demand for clean water and the imperative for efficient wastewater treatment due to population growth and urbanization are significant drivers. Secondly, stringent environmental regulations worldwide mandating improved water quality and reduced pollution necessitate advanced and reliable valve technologies. Thirdly, substantial investments in upgrading and expanding aging water infrastructure, particularly in developed and developing economies, are creating consistent demand for various valve types. Lastly, the rising adoption of smart technologies and automation in water management systems, enabling remote monitoring and control, is further accelerating market expansion.

Challenges in the Global Valves Market in Water and Wastewater Industry Market

Despite robust growth, the Global Valves Market in the Water and Wastewater Industry faces several challenges. High initial investment costs for advanced valve technologies can be a deterrent for smaller municipalities and developing regions. Supply chain disruptions, exacerbated by geopolitical events and material shortages, can impact lead times and manufacturing costs. Stringent and evolving regulatory landscapes require continuous adaptation and compliance, adding complexity and cost to product development and deployment. Furthermore, competition from low-cost manufacturers in emerging economies can put pressure on profit margins for established players. The lack of skilled technicians for installation, maintenance, and operation of sophisticated smart valve systems also poses a constraint.

Emerging Opportunities in Global Valves Market in Water and Wastewater Industry

Emerging opportunities in the Global Valves Market for the Water and Wastewater Industry are diverse and promising. The increasing focus on water reuse and recycling initiatives presents a significant avenue for specialized valve solutions in advanced treatment processes. Smart water grids and digital transformation are creating demand for IoT-enabled valves with advanced analytics capabilities. The growing awareness of water scarcity is driving demand for leak detection and water conservation technologies, where precise valve control is paramount. Furthermore, emerging economies with rapidly developing infrastructure offer substantial untapped market potential for valve manufacturers willing to invest and adapt to local needs. Strategic partnerships between valve manufacturers and water technology providers are also emerging as a key strategy for innovation and market penetration.

Leading Players in the Global Valves Market in Water and Wastewater Industry Sector

- Samson Controls Inc

- Rotork Plc

- Flowserve Corporation

- Alfa Laval Corporate AB

- Emerson Electric Co

- IMI Critical Engineering

- Metso Oyj

- Crane Co

- Schlumberger Limited

- KITZ Corporation

Key Milestones in Global Valves Market in Water and Wastewater Industry Industry

- March 2022 - Flowserve Corporation entered into a non-exclusive partnership agreement with Gradiant to accelerate its growth in the water technology market. The partnership would be combining Flowserve's flow control solutions and product with Gradiant's innovative tailored water treatment technology to provide unparalleled total water treatment solutions for its customers.

- March 2022 - DXP Enterprises, Inc. completed the acquisitions of Drydon Equipment, Inc., a distributor and manufacturer representative of pumps, valves, controls, and process equipment focused on serving the water and wastewater industry, and Burglingame Engineers, a provider of water and wastewater equipment in the industrial and municipal sectors. With the acquisition, DXP Enterprises would be strengthening its position in the water and wastewater treatment markets along with enhancing its product portfolio.

Strategic Outlook for Global Valves Market in Water and Wastewater Industry Market

The strategic outlook for the Global Valves Market in the Water and Wastewater Industry is one of sustained and robust growth. Future success will hinge on embracing digital transformation through the integration of smart valve technologies and IoT connectivity, enabling predictive maintenance and remote operations. Companies that prioritize sustainability by developing energy-efficient and durable valve solutions will gain a competitive advantage. Strategic partnerships and acquisitions will remain crucial for expanding market reach and technological capabilities. Furthermore, focusing on emerging markets with significant infrastructure development needs and adapting product offerings to meet local requirements will be key growth accelerators. The increasing global emphasis on water security and environmental protection ensures a strong and enduring demand for innovative and reliable valve solutions.

Global Valves Market in Water and Wastewater Industry Segmentation

-

1. Type

- 1.1. Ball

- 1.2. Butterfly

- 1.3. Gate/Globe/Check

- 1.4. Plug

- 1.5. Control

- 1.6. Other Types

Global Valves Market in Water and Wastewater Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Global Valves Market in Water and Wastewater Industry Regional Market Share

Geographic Coverage of Global Valves Market in Water and Wastewater Industry

Global Valves Market in Water and Wastewater Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising automation in the water and wastewater industry; Proactive defect detection with the use of simulation software

- 3.3. Market Restrains

- 3.3.1. ; Stagnant Industrial Growth in Developed Countries

- 3.4. Market Trends

- 3.4.1. Increasing Automation in the Water and Wastewater Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Valves Market in Water and Wastewater Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ball

- 5.1.2. Butterfly

- 5.1.3. Gate/Globe/Check

- 5.1.4. Plug

- 5.1.5. Control

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Valves Market in Water and Wastewater Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ball

- 6.1.2. Butterfly

- 6.1.3. Gate/Globe/Check

- 6.1.4. Plug

- 6.1.5. Control

- 6.1.6. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Global Valves Market in Water and Wastewater Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ball

- 7.1.2. Butterfly

- 7.1.3. Gate/Globe/Check

- 7.1.4. Plug

- 7.1.5. Control

- 7.1.6. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Global Valves Market in Water and Wastewater Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ball

- 8.1.2. Butterfly

- 8.1.3. Gate/Globe/Check

- 8.1.4. Plug

- 8.1.5. Control

- 8.1.6. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Global Valves Market in Water and Wastewater Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ball

- 9.1.2. Butterfly

- 9.1.3. Gate/Globe/Check

- 9.1.4. Plug

- 9.1.5. Control

- 9.1.6. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Global Valves Market in Water and Wastewater Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ball

- 10.1.2. Butterfly

- 10.1.3. Gate/Globe/Check

- 10.1.4. Plug

- 10.1.5. Control

- 10.1.6. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Samson Controls Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rotork Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flowserve Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alfa Laval Corporate AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IMI Critical Engineering

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Metso Oyj

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crane Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KITZ Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Samson Controls Inc

List of Figures

- Figure 1: Global Global Valves Market in Water and Wastewater Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Global Valves Market in Water and Wastewater Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Valves Market in Water and Wastewater Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Global Valves Market in Water and Wastewater Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: South America Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Global Valves Market in Water and Wastewater Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Valves Market in Water and Wastewater Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Valves Market in Water and Wastewater Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Global Valves Market in Water and Wastewater Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Global Valves Market in Water and Wastewater Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Valves Market in Water and Wastewater Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Valves Market in Water and Wastewater Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Global Valves Market in Water and Wastewater Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Valves Market in Water and Wastewater Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Global Valves Market in Water and Wastewater Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Valves Market in Water and Wastewater Industry?

The projected CAGR is approximately 3.94%.

2. Which companies are prominent players in the Global Valves Market in Water and Wastewater Industry?

Key companies in the market include Samson Controls Inc, Rotork Plc, Flowserve Corporation, Alfa Laval Corporate AB, Emerson Electric Co, IMI Critical Engineering, Metso Oyj, Crane Co, Schlumberger Limited, KITZ Corporation.

3. What are the main segments of the Global Valves Market in Water and Wastewater Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising automation in the water and wastewater industry; Proactive defect detection with the use of simulation software.

6. What are the notable trends driving market growth?

Increasing Automation in the Water and Wastewater Industry.

7. Are there any restraints impacting market growth?

; Stagnant Industrial Growth in Developed Countries.

8. Can you provide examples of recent developments in the market?

March 2022 - Flowserve Corporation entered into a non-exclusive partnership agreement with Gradiant to accelerate its growth in the water technology market. The partnership would be combining Flowserve's flow control solutions and product with Gradiant's innovative tailored water treatment technology to provide unparalleled total water treatment solutions for its customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Valves Market in Water and Wastewater Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Valves Market in Water and Wastewater Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Valves Market in Water and Wastewater Industry?

To stay informed about further developments, trends, and reports in the Global Valves Market in Water and Wastewater Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence