Key Insights

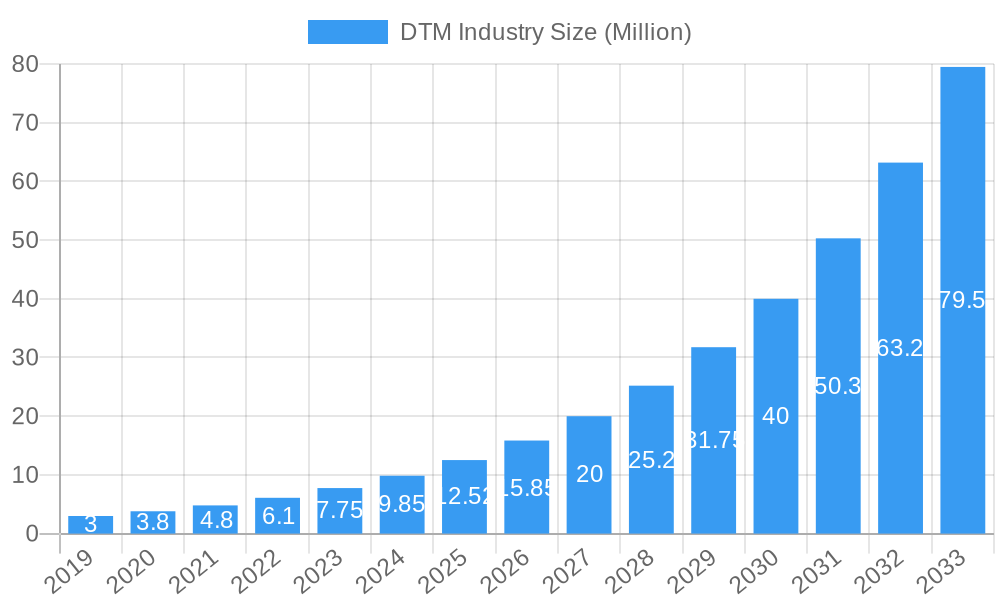

The Digital Transaction Management (DTM) market is experiencing explosive growth, projected to reach $12.52 million by 2025, with a remarkable compound annual growth rate (CAGR) of 24.54% through 2033. This surge is primarily fueled by the accelerating digital transformation across industries and the increasing demand for secure, efficient, and legally compliant electronic signature solutions. Key drivers include the imperative for streamlined document workflows, enhanced customer experience, and regulatory adherence. Small and medium-sized enterprises (SMEs) are rapidly adopting DTM solutions to level the playing field with larger organizations, driven by the cost-effectiveness and scalability of these platforms. The IT and Telecommunication sector, along with Healthcare and BFSI, are leading the charge in DTM adoption due to their high volume of sensitive data and stringent compliance requirements. Other end-user industries are also progressively integrating DTM to optimize their operations.

DTM Industry Market Size (In Million)

The DTM market's trajectory is characterized by several key trends, including the increasing integration of DTM solutions with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems, enabling end-to-end digital workflow automation. The rise of mobile-first solutions and the growing adoption of blockchain technology for enhanced security and audit trails are further shaping the market landscape. Despite the robust growth, certain restraints such as data privacy concerns and the initial investment required for system integration can pose challenges. However, the overwhelming benefits in terms of cost savings, improved efficiency, and accelerated deal closures are poised to propel the market forward, making DTM an indispensable tool for businesses navigating the digital age. Leading companies like DocuSign, Adobe, and PandaDoc are at the forefront, driving innovation and expanding the reach of DTM solutions globally.

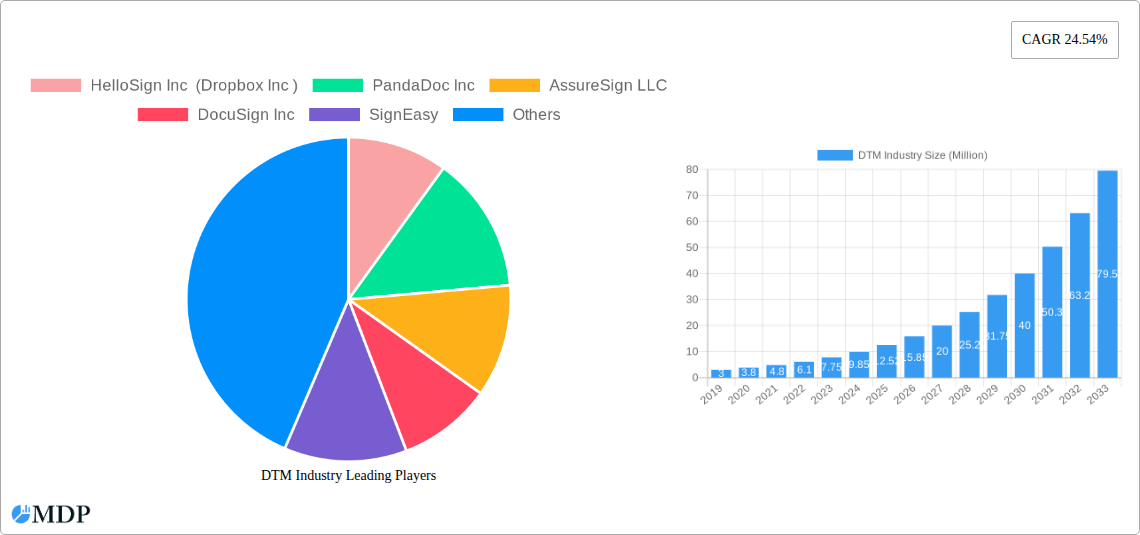

DTM Industry Company Market Share

DTM Industry Market Dynamics & Concentration

The Digital Transaction Management (DTM) market, a critical component of digital transformation, is characterized by dynamic evolution and strategic concentration. Driven by the increasing demand for streamlined workflows, enhanced security, and improved compliance, the DTM industry is experiencing robust growth. Innovation remains a primary catalyst, with companies continuously investing in AI-driven document analysis, advanced e-signature capabilities, and blockchain integration for enhanced security and immutability. Regulatory frameworks, such as e-signature laws and data privacy regulations, are shaping market entry and operational strategies, creating a competitive landscape where compliance is paramount. Product substitutes, including traditional paper-based processes and less integrated digital solutions, are steadily being displaced by comprehensive DTM platforms. End-user trends highlight a growing preference for cloud-based solutions, mobile accessibility, and seamless integration with existing enterprise systems. Mergers and acquisitions (M&A) activities are significant indicators of market concentration. Several key DTM players have engaged in strategic acquisitions to expand their product portfolios, customer base, and geographical reach. For instance, DocuSign's acquisition of SpringCM for an estimated 500 Million significantly bolstered its contract lifecycle management capabilities. The market sees a growing number of M&A deals each year, reflecting the consolidation and maturation of the DTM sector. Market share is currently led by a few major players, with DocuSign holding a substantial portion, estimated at over 60% of the global DTM market share. Other significant players like Adobe Inc. and PandaDoc Inc. are also capturing considerable market presence.

DTM Industry Industry Trends & Analysis

The Digital Transaction Management (DTM) industry is poised for substantial growth, driven by an accelerating digital transformation across all sectors. The compound annual growth rate (CAGR) for the DTM market is projected to be 18.5% from 2025 to 2033, reaching an estimated market size of 55 Billion by the end of the forecast period. This expansion is fueled by the escalating need for efficient, secure, and legally compliant document processes. Technological disruptions are at the forefront of this trend, with advancements in artificial intelligence (AI) and machine learning (ML) revolutionizing how DTM platforms handle document generation, review, and approval. These technologies enable predictive analytics for contract risk, automated clause identification, and intelligent workflow optimization, significantly reducing manual effort and potential errors. Furthermore, the integration of blockchain technology is gaining traction, offering enhanced security, immutability, and audit trails for digital transactions, particularly appealing to highly regulated industries like BFSI and Healthcare. Consumer preferences are increasingly leaning towards seamless, user-friendly digital experiences. Businesses are demanding DTM solutions that are intuitive, accessible across multiple devices (desktops, tablets, and smartphones), and offer robust mobile capabilities. The demand for integrated solutions that connect with existing CRM, ERP, and other enterprise software is also a dominant trend, enabling end-to-end workflow automation. Competitive dynamics are intensifying as new players enter the market and existing ones expand their offerings. The DTM market penetration is already significant, estimated to be around 45% globally for enterprise solutions, with significant room for growth in small and medium-sized enterprises (SMEs) and emerging economies. Companies are differentiating themselves through specialized features, superior customer support, and competitive pricing models. The shift from standalone e-signature solutions to comprehensive DTM platforms that manage the entire agreement lifecycle, from creation to execution and archiving, is a key strategic imperative for market leaders. The adoption of DTM solutions is also being propelled by the growing remote workforce, necessitating digital tools for collaborative document management and secure approvals.

Leading Markets & Segments in DTM Industry

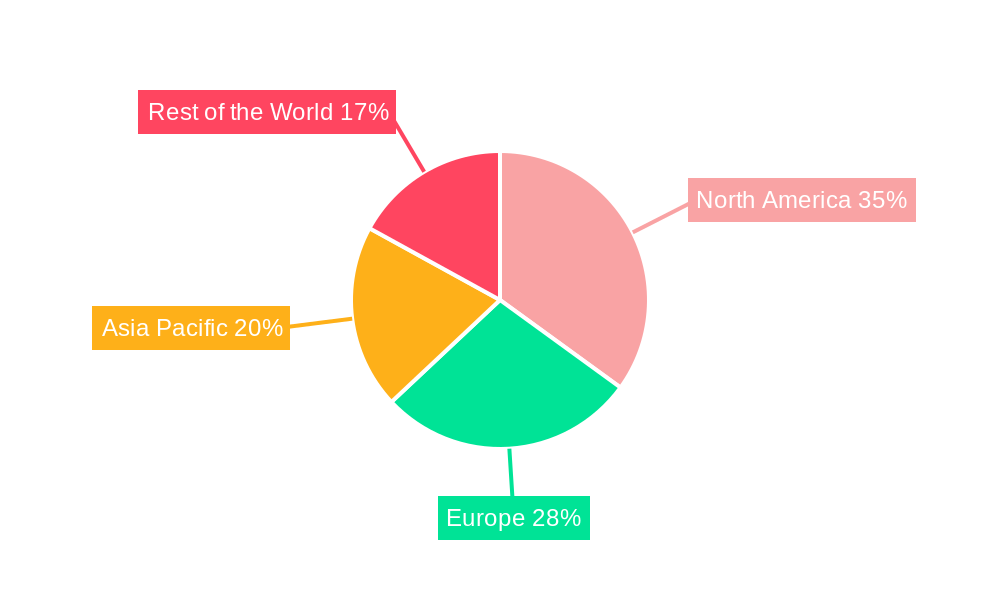

The Digital Transaction Management (DTM) industry exhibits strong regional dominance, with North America, particularly the United States, leading the market due to early adoption of digital technologies and a robust regulatory environment supporting electronic transactions. The IT and Telecommunication sector is a leading end-user industry, driven by the high volume of contracts, service agreements, and customer onboarding processes that require efficient digital management. The BFSI (Banking, Financial Services, and Insurance) sector follows closely, owing to stringent compliance requirements, the need for secure transaction processing, and the extensive use of digital signatures for loan agreements, insurance policies, and account openings. The DTM market size within the IT and Telecommunication sector is estimated to be over 15 Billion in 2025.

- Component: The Solution segment is currently the dominant force within the DTM industry, encompassing the software platforms, e-signature capabilities, workflow automation tools, and document management features. This segment is projected to grow at a CAGR of 19% during the forecast period, driven by continuous innovation and increasing enterprise adoption. The Service segment, including implementation, support, and consulting, is also experiencing significant growth, albeit at a slightly lower pace, as organizations require expert assistance to integrate and optimize DTM solutions.

- Organization Size: Both Small and Medium Enterprises (SMEs) and Large Enterprises are significant contributors to the DTM market. However, Large Enterprises represent a larger market share due to their higher volume of transactions and greater investment capacity in comprehensive DTM solutions. The market value for Large Enterprise DTM solutions is projected to reach 30 Billion by 2033. SMEs are rapidly increasing their adoption, driven by the availability of cost-effective cloud-based solutions and the compelling need to streamline operations and improve efficiency. The SME segment is expected to witness a higher CAGR of 20%.

- End-user Industry:

- IT and Telecommunication: Dominates due to the high volume of service level agreements, software licenses, and customer contracts.

- BFSI: A strong second, driven by the critical need for secure, compliant, and efficient transaction processing for loans, insurance, and account management.

- Healthcare: Growing rapidly due to the adoption of electronic health records (EHRs), patient consent forms, and compliance with HIPAA regulations.

- Retail: Significant adoption for sales contracts, purchase orders, and employee onboarding.

- Other End-user Industries: A broad category including government, real estate, legal services, and education, all contributing to the overall market growth as digital transformation accelerates.

DTM Industry Product Developments

The DTM industry is witnessing a surge in product innovation, focusing on enhancing user experience, security, and integration capabilities. Companies are developing advanced AI-powered features for intelligent document analysis, such as automated data extraction, risk assessment, and clause identification, significantly reducing manual review time. Enhanced mobile accessibility and offline capabilities are becoming standard, allowing users to manage transactions seamlessly from any device, anywhere. Furthermore, the integration of blockchain technology is offering unparalleled security and transparency for critical transactions, ensuring data integrity and tamper-proof records. These developments are not only improving operational efficiency but also bolstering compliance and trust in digital processes, making DTM solutions more appealing across a wider range of industries, including BFSI, Healthcare, and IT.

Key Drivers of DTM Industry Growth

The Digital Transaction Management (DTM) industry's growth is propelled by several key factors. The escalating need for digital transformation across all business sectors is a primary driver, pushing organizations to adopt efficient, paperless workflows. Increasing government initiatives and regulations promoting e-signatures and electronic record-keeping globally provide a strong legal and compliance impetus. The growing adoption of cloud-based solutions and mobile technologies enhances accessibility and user experience, encouraging wider adoption. Furthermore, the inherent benefits of DTM, such as cost reduction, improved security, enhanced audit trails, and faster transaction cycles, are compelling enterprises to invest in these solutions. The surge in remote work also necessitates digital tools for seamless collaboration and transaction management.

Challenges in the DTM Industry Market

Despite its robust growth, the DTM industry faces several challenges. Regulatory hurdles and varying legal frameworks across different jurisdictions can complicate cross-border transactions and compliance efforts. Ensuring comprehensive data security and privacy remains a critical concern for many organizations, especially those handling sensitive information. The initial cost of implementing advanced DTM solutions and the required training for employees can be a barrier for smaller businesses. Moreover, the resistance to change from traditional paper-based processes and the lack of digital literacy among certain user groups can hinder widespread adoption. The competitive landscape also presents challenges, with a large number of vendors offering diverse solutions, making it difficult for buyers to choose the most suitable platform.

Emerging Opportunities in DTM Industry

The Digital Transaction Management (DTM) industry is ripe with emerging opportunities. The growing demand for comprehensive contract lifecycle management (CLM) solutions, which extend beyond e-signatures to manage the entire contract journey, presents a significant avenue for growth. The integration of AI and machine learning for advanced analytics, risk management, and intelligent automation of contract processes offers immense potential. As more industries adopt digital workflows, opportunities in specialized verticals like healthcare, legal, and government are expanding rapidly. Furthermore, the increasing focus on data privacy and security creates demand for DTM solutions with advanced encryption and blockchain capabilities. Strategic partnerships between DTM providers and other enterprise software vendors, as well as expansion into emerging economies, also represent substantial growth catalysts.

Leading Players in the DTM Industry Sector

- HelloSign Inc (Dropbox Inc)

- PandaDoc Inc

- AssureSign LLC

- DocuSign Inc

- SignEasy

- ZorroSign Inc

- Adobe Inc

- Nintex Group Pty Ltd

- InfoCert

- Mitratech Holdings Inc

- OneSpan Inc

- PactSafe Inc

- Topaz Systems Inc

- Namirial SpA

- eOriginal Inc

Key Milestones in DTM Industry Industry

- December 2022: Skyslope announced a new partnership with Weichert, Realtors for its innovative digital transaction management to Weichert's over 7,000 corporate associates. This innovative partnership expands Skyslope's capability by adding several thousands of agents to the current members in the USA and Canada. In addition to the core transaction platform, Skyslope offers a prominent digital signature solution to send real estate documents out for e-signature.

- September 2022: DocuSign partners with Zavvie to integrate MoxiEngage CRM to provide unparalleled integration to their fully digital transaction management program so that agents can seamlessly manage transaction and agreement workflows with their clients.

Strategic Outlook for DTM Industry Market

The strategic outlook for the Digital Transaction Management (DTM) industry is exceptionally positive, driven by the unstoppable momentum of digital transformation and the increasing reliance on secure, efficient digital processes. Future growth accelerators include the deeper integration of AI and blockchain technologies to offer enhanced security, predictive analytics, and intelligent automation of the entire agreement lifecycle. The continued expansion of cloud-based DTM solutions, making advanced capabilities accessible to a wider range of businesses, will further fuel market penetration. Strategic opportunities lie in developing specialized DTM solutions tailored to the unique needs of high-growth verticals such as healthcare and legal services, and in expanding geographical reach into emerging markets. Partnerships and acquisitions will continue to play a crucial role in consolidating the market and expanding service offerings, ensuring that DTM remains at the forefront of modern business operations.

DTM Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Service

-

2. Organization Size

- 2.1. Small and Medium Enterprise

- 2.2. Large Enterprise

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. IT and Telecommunication

- 3.5. Other End-user Industries

DTM Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

DTM Industry Regional Market Share

Geographic Coverage of DTM Industry

DTM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-signatures and Adoption of Cloud Services; Focus on Business Automation; BFSI Industry is Expected to Hold a Significant Market Share

- 3.3. Market Restrains

- 3.3.1. Geopolitical Situation and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DTM Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprise

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. IT and Telecommunication

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America DTM Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Enterprise

- 6.2.2. Large Enterprise

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Retail

- 6.3.4. IT and Telecommunication

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe DTM Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Enterprise

- 7.2.2. Large Enterprise

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Retail

- 7.3.4. IT and Telecommunication

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific DTM Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Enterprise

- 8.2.2. Large Enterprise

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Retail

- 8.3.4. IT and Telecommunication

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World DTM Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Enterprise

- 9.2.2. Large Enterprise

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Retail

- 9.3.4. IT and Telecommunication

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 HelloSign Inc (Dropbox Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PandaDoc Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 AssureSign LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DocuSign Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SignEasy

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ZorroSign Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Adobe Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nintex Group Pty Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 InfoCert

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mitratech Holdings Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 OneSpan Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 PactSafe Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Topaz Systems Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Namirial SpA

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 eOriginal Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 HelloSign Inc (Dropbox Inc )

List of Figures

- Figure 1: Global DTM Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America DTM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 13: Europe DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe DTM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Pacific DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific DTM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Rest of the World DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Rest of the World DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Rest of the World DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Rest of the World DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World DTM Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global DTM Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 7: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 11: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 15: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 19: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DTM Industry?

The projected CAGR is approximately 24.54%.

2. Which companies are prominent players in the DTM Industry?

Key companies in the market include HelloSign Inc (Dropbox Inc ), PandaDoc Inc, AssureSign LLC, DocuSign Inc, SignEasy, ZorroSign Inc, Adobe Inc, Nintex Group Pty Ltd, InfoCert, Mitratech Holdings Inc, OneSpan Inc, PactSafe Inc, Topaz Systems Inc, Namirial SpA, eOriginal Inc.

3. What are the main segments of the DTM Industry?

The market segments include Component, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-signatures and Adoption of Cloud Services; Focus on Business Automation; BFSI Industry is Expected to Hold a Significant Market Share.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Geopolitical Situation and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

December 2022 - Skyslope announced a new partnership with Weichert, Realtors for its innovative digital transaction management to Weichert's over 7,000 corporate associates. This innovative partnership expands Skyslope's capability by adding several thousands of agents to the current members in the USA and Canada. In addition to the core transaction platform, Skyslope offers a prominent digital signature solution to send real estate documents out for e-signature.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DTM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DTM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DTM Industry?

To stay informed about further developments, trends, and reports in the DTM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence