Key Insights

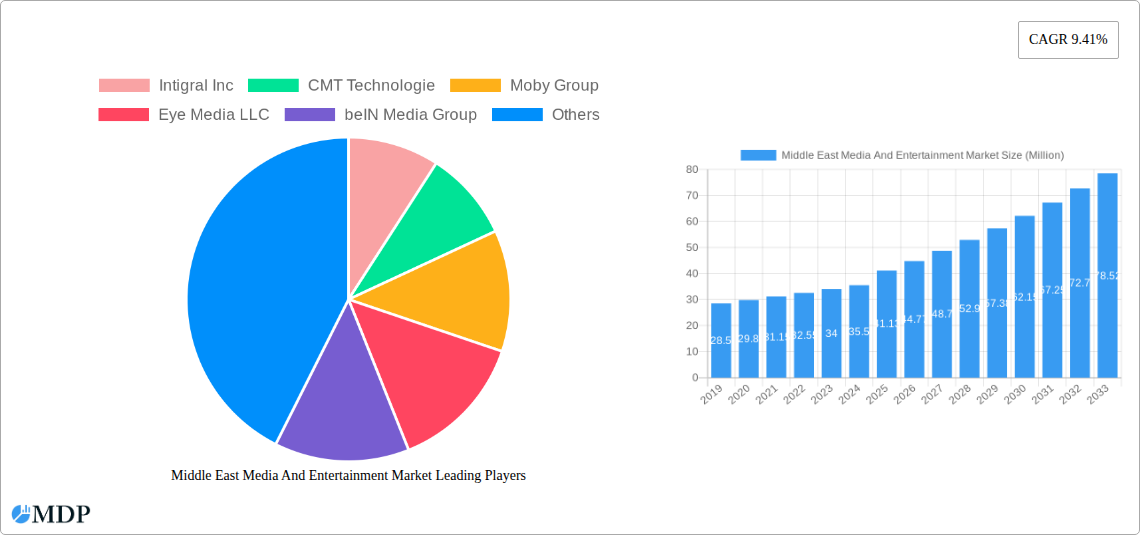

The Middle East Media and Entertainment Market is poised for significant expansion, projected to reach 41.13 Million value units by 2025 and expand at a robust 9.41% CAGR through 2033. This growth is underpinned by several key drivers, including the escalating adoption of digital platforms for content consumption, substantial investments in content creation and infrastructure, and a burgeoning young, tech-savvy population with increasing disposable income. The digital transformation is reshaping traditional media landscapes, with streaming services, video games, and digital advertising emerging as dominant forces. The increasing penetration of high-speed internet and mobile devices across countries like Saudi Arabia and the United Arab Emirates further fuels this digital shift, making content more accessible and personalized than ever before. Furthermore, government initiatives aimed at diversifying economies and promoting the creative industries are acting as powerful catalysts for innovation and investment within the region's media and entertainment sector.

Middle East Media And Entertainment Market Market Size (In Million)

The market's trajectory is also being shaped by evolving consumer preferences and technological advancements. Video-on-demand (VoD) services, encompassing both subscription-based (SVoD) and transactional (TVoD) models, are witnessing remarkable uptake, driven by the demand for diverse and on-demand entertainment options. E-publishing is also gaining traction, reflecting a broader shift towards digital content. While the market is propelled by these dynamic forces, certain restraints, such as fluctuating advertising revenues and the need for continuous technological upgrades to combat piracy and ensure quality, warrant strategic attention. Despite these challenges, the strong underlying growth in digital music, video games, and a diversified advertising mix, supported by established players and emerging innovators, paints a promising picture for the Middle East Media and Entertainment Market over the forecast period, with a particular focus on the dynamic and high-growth markets within the Middle East region.

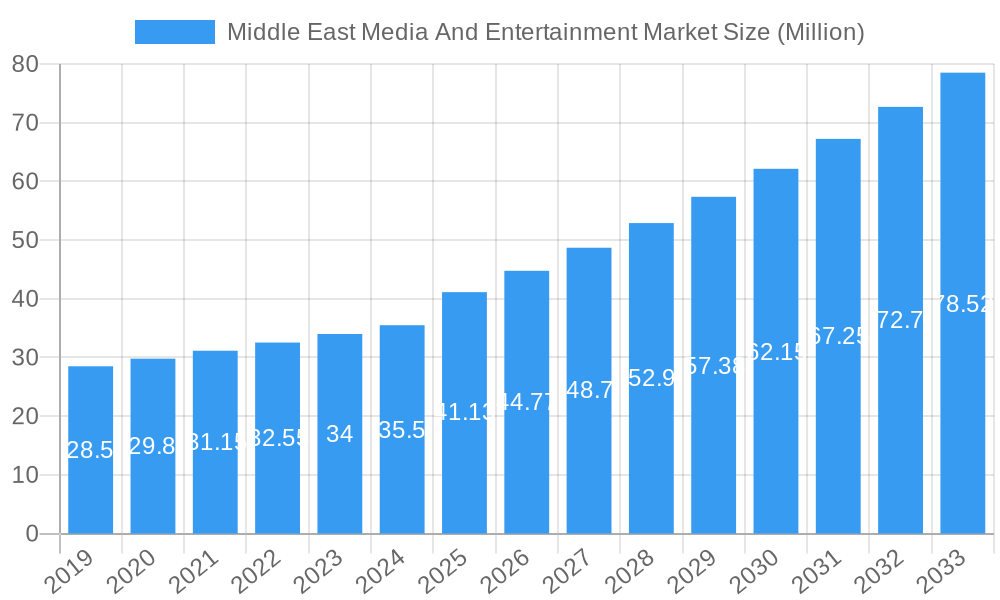

Middle East Media And Entertainment Market Company Market Share

This comprehensive report provides an in-depth analysis of the Middle East Media and Entertainment Market, forecasting its trajectory from 2019 to 2033 with a robust base year of 2025. Delve into the evolving landscape of digital music, video games, video-on-demand (SVoD, TVoD), e-publishing, advertising (digital, traditional), and internet access. Discover critical industry developments, market dynamics, emerging trends, and strategic insights crucial for stakeholders navigating this rapidly expanding sector.

Middle East Media And Entertainment Market Market Dynamics & Concentration

The Middle East Media and Entertainment Market is characterized by a moderate to high concentration, with a few dominant players like beIN Media Group, MBC Group, and Abu Dhabi Media holding significant market share, estimated at over 70% collectively in the traditional broadcasting segment. Innovation drivers are primarily fueled by increasing digital adoption, the proliferation of smartphones and high-speed internet, and a young, tech-savvy population. Regulatory frameworks, while evolving, generally support content localization and digital transformation, though variations exist across countries like Saudi Arabia, UAE, and Qatar. Product substitutes are abundant, with streaming services increasingly challenging traditional TV, and mobile gaming competing with console and PC gaming. End-user trends point towards a strong preference for on-demand content, personalized experiences, and short-form video. Mergers and acquisitions (M&A) activities are on the rise, with an estimated XX M&A deals in the historical period (2019-2024), indicating strategic consolidation and market expansion efforts. Key M&A activities are often driven by the pursuit of content libraries, technological capabilities, and subscriber bases.

Middle East Media And Entertainment Market Industry Trends & Analysis

The Middle East Media and Entertainment Market is poised for substantial growth, driven by a confluence of technological advancements, shifting consumer preferences, and robust economic development across the region. The Compound Annual Growth Rate (CAGR) for the overall market is projected to be around XX% during the forecast period (2025–2033). Digital transformation is a paramount trend, with a significant surge in the adoption of digital music streaming services, video-on-demand platforms, and online gaming. The market penetration of internet access continues to expand, creating a fertile ground for digital content consumption. Advertising expenditure is witnessing a pronounced shift towards digital channels, including social media advertising and programmatic advertising, as brands seek to reach a more engaged and digitally native audience. Mobile gaming has emerged as a dominant segment within the video games sector, propelled by accessible pricing and the widespread availability of smartphones. Furthermore, the rise of local content creation and the increasing demand for culturally relevant entertainment are shaping the competitive landscape. Content creators and distributors are investing heavily in localized productions to cater to diverse regional tastes. The evolving consumption patterns, characterized by a preference for personalized content and interactive experiences, are compelling players to innovate and adapt their offerings.

Leading Markets & Segments in Middle East Media And Entertainment Market

The dominant region for the Middle East Media and Entertainment Market is the United Arab Emirates (UAE), driven by its advanced digital infrastructure, high disposable income, and a liberal regulatory environment that encourages foreign investment and technological innovation. Saudi Arabia is a rapidly growing market, fueled by government initiatives like Vision 2030 which prioritize media and entertainment sector development.

Key segments experiencing significant growth and dominance include:

- Video-on-demand (VoD): This segment is experiencing robust expansion, particularly SVoD (Subscription Video-on-Demand), with platforms like Netflix, Shahid, and OSN Streaming rapidly acquiring subscribers.

- Key Drivers: Growing disposable incomes, increasing smartphone penetration, availability of diverse content libraries, and competitive pricing strategies.

- Digital Advertising: This segment is outperforming traditional advertising due to its measurable ROI, targeted reach, and ability to engage with younger demographics.

- Key Drivers: Dominance of social media platforms, growth of e-commerce, and the increasing reliance of businesses on digital marketing for customer acquisition.

- Internet Access: The foundational pillar for all digital media consumption, the expansion of high-speed internet, including 5G networks, is crucial for the growth of other segments.

- Key Drivers: Government investments in telecommunications infrastructure, increasing demand for seamless online experiences, and the proliferation of connected devices.

- Digital Music: Music streaming services are gaining traction, offering a vast catalog of local and international music.

- Key Drivers: Affordable subscription models, convenience of access, and the growing popularity of regional artists.

While other segments like Video Games and E-publishing are also growing, VoD and Digital Advertising currently represent the most significant revenue streams and growth catalysts within the Middle East Media and Entertainment Market.

Middle East Media And Entertainment Market Product Developments

Product developments in the Middle East Media and Entertainment Market are increasingly focused on enhanced user experience, personalization, and the integration of emerging technologies. Companies are investing in AI-driven content recommendation engines to provide tailored viewing and listening experiences. The rise of high-definition content, including 4K and HDR, is becoming standard across video streaming platforms. Innovations in interactive content and gaming integrations within media platforms are also gaining traction, aiming to boost user engagement. The development of localized content in Arabic and other regional languages, coupled with culturally relevant themes, represents a significant competitive advantage. Furthermore, the seamless integration of advertising within content, employing formats that are less intrusive yet effective, is a key area of product innovation.

Key Drivers of Middle East Media And Entertainment Market Growth

The Middle East Media and Entertainment Market is propelled by a potent mix of factors. Technological advancements, particularly the widespread adoption of smartphones and high-speed internet, are fundamental enablers. Economic diversification initiatives across countries like Saudi Arabia and the UAE are significantly boosting disposable incomes and consumer spending on entertainment. Government support for the media sector through policies promoting local content creation and investment is also a crucial driver. The young and growing population with a strong affinity for digital content and global trends fuels demand for diverse entertainment offerings. Furthermore, the increasing availability of localized content is resonating with regional audiences, further stimulating market growth.

Challenges in the Middle East Media And Entertainment Market Market

Despite robust growth, the Middle East Media and Entertainment Market faces several challenges. Regulatory complexities and varying censorship laws across different countries can create hurdles for content distribution and localization. Intense competition among established global players and emerging regional platforms puts pressure on pricing and market share. Piracy and intellectual property rights infringement remain persistent concerns, impacting revenue streams. High content production costs for localized and high-quality programming can also pose a challenge. Furthermore, building sustainable revenue models beyond advertising and subscriptions requires continuous innovation and adaptation to evolving consumer behaviors.

Emerging Opportunities in Middle East Media And Entertainment Market

Emerging opportunities in the Middle East Media and Entertainment Market are abundant and diverse. The metaverse and immersive technologies present a new frontier for content creation and engagement. Strategic partnerships between regional and international media giants are fostering content co-production and market expansion. The growing demand for e-sports and competitive gaming offers significant potential for new leagues, tournaments, and related content. Furthermore, the increasing focus on educational and edutainment content catering to the region's youth represents a promising niche. The expansion of over-the-top (OTT) services into underserved markets and the development of niche streaming platforms catering to specific cultural interests are also key growth catalysts.

Leading Players in the Middle East Media And Entertainment Market Sector

- Intigral Inc

- CMT Technologie

- Moby Group

- Eye Media LLC

- beIN Media Group

- Zawya Ltd (Refinitiv)

- Orbit Showtime Network

- Arab Media Group

- Abu Dhabi Media

- MBC Group

Key Milestones in Middle East Media And Entertainment Market Industry

- March 2024: Intigral, the media arm of STC Group, announced a partnership with Moonbug Entertainment, a subsidiary of Candle Media. The partnership aims to launch a new linear channel called "Blippi & Friends" on its streaming platforms, STC TV and Jawwy TV, available across the MENA region.

- November 2023: Arabian Publishing Media partnered with Beautiful Minds Media GmbH to bring the Madame brand to the region. This partnership combined the legacy of Madame, a luxury lifestyle brand, with Arabian Publishing Media's expertise in creating content that resonates with the market. Madame Magazine features a rich heritage, covering print, digital, social media, events, and e-commerce.

Strategic Outlook for Middle East Media And Entertainment Market Market

The strategic outlook for the Middle East Media and Entertainment Market is overwhelmingly positive, driven by a combination of demographic advantages and rapid technological integration. Future growth accelerators will include continued investment in original, localized content that appeals to diverse regional tastes and cultural nuances. The expansion of 5G infrastructure and affordable mobile data plans will further democratize access to digital media. Strategic partnerships and mergers and acquisitions will continue to consolidate the market and foster innovation. A key focus will be on leveraging data analytics and AI to personalize user experiences and optimize advertising strategies. The exploration of emerging platforms like the metaverse and the continued growth of the gaming industry present substantial untapped potential.

Middle East Media And Entertainment Market Segmentation

-

1. Type

-

1.1. Digital Music

- 1.1.1. Music Downloads

- 1.1.2. Music Streaming

- 1.2. Video Games

-

1.3. Video-on-demand

- 1.3.1. SvoD

- 1.3.2. TVoD

- 1.3.3. Video Downloads

- 1.3.4. Video Downloads/EST

- 1.4. E-publishing

-

1.5. Advertising

- 1.5.1. Digital Advertising

- 1.5.2. Newspaper

- 1.5.3. Magazine

- 1.5.4. Television

- 1.5.5. Radio

- 1.5.6. Outdoor Advertising

- 1.6. Internet Access

-

1.1. Digital Music

Middle East Media And Entertainment Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Media And Entertainment Market Regional Market Share

Geographic Coverage of Middle East Media And Entertainment Market

Middle East Media And Entertainment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming

- 3.2.2 OTT

- 3.2.3 and Internet Advertising

- 3.3. Market Restrains

- 3.3.1. Significant Increase in Piracy Leading to Loss of Revenue

- 3.4. Market Trends

- 3.4.1. Internet Access Segment to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Media And Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Digital Music

- 5.1.1.1. Music Downloads

- 5.1.1.2. Music Streaming

- 5.1.2. Video Games

- 5.1.3. Video-on-demand

- 5.1.3.1. SvoD

- 5.1.3.2. TVoD

- 5.1.3.3. Video Downloads

- 5.1.3.4. Video Downloads/EST

- 5.1.4. E-publishing

- 5.1.5. Advertising

- 5.1.5.1. Digital Advertising

- 5.1.5.2. Newspaper

- 5.1.5.3. Magazine

- 5.1.5.4. Television

- 5.1.5.5. Radio

- 5.1.5.6. Outdoor Advertising

- 5.1.6. Internet Access

- 5.1.1. Digital Music

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intigral Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMT Technologie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Moby Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eye Media LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 beIN Media Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zawya Ltd (Refinitiv)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Orbit Showtime Network

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arab Media Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abu Dhabi Media

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MBC Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intigral Inc

List of Figures

- Figure 1: Middle East Media And Entertainment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Media And Entertainment Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Media And Entertainment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East Media And Entertainment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Middle East Media And Entertainment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Middle East Media And Entertainment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East Media And Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Media And Entertainment Market?

The projected CAGR is approximately 9.41%.

2. Which companies are prominent players in the Middle East Media And Entertainment Market?

Key companies in the market include Intigral Inc, CMT Technologie, Moby Group, Eye Media LLC, beIN Media Group, Zawya Ltd (Refinitiv), Orbit Showtime Network, Arab Media Group, Abu Dhabi Media, MBC Group.

3. What are the main segments of the Middle East Media And Entertainment Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming. OTT. and Internet Advertising.

6. What are the notable trends driving market growth?

Internet Access Segment to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Significant Increase in Piracy Leading to Loss of Revenue.

8. Can you provide examples of recent developments in the market?

March 2024 - Intigral, the media arm of STC Group, announced a partnership with Moonbug Entertainment, a subsidiary of Candle Media. The partnership aims to launch a new linear channel called "Blippi & Friends" on its streaming platforms, STC TV and Jawwy TV. The channel will be available for viewers across the MENA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Media And Entertainment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Media And Entertainment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Media And Entertainment Market?

To stay informed about further developments, trends, and reports in the Middle East Media And Entertainment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence