Key Insights

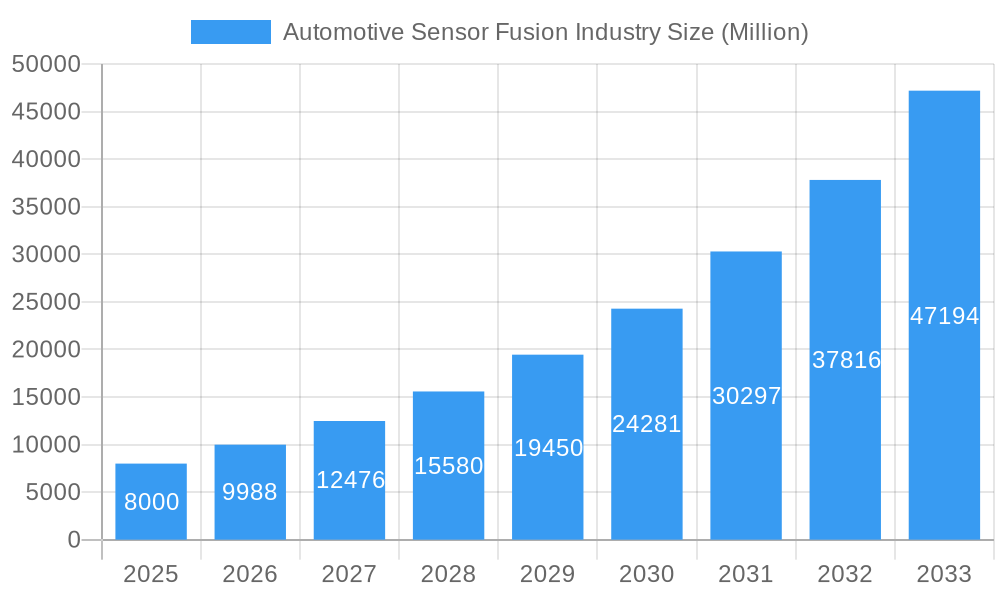

The Automotive Sensor Fusion market is experiencing an unprecedented surge, projected to reach USD 8 billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 24.71% during the forecast period of 2025-2033. This robust growth is primarily propelled by the escalating demand for advanced driver-assistance systems (ADAS) and the accelerating development of autonomous driving technologies. The increasing integration of sophisticated sensors like radar, lidar, cameras, and ultrasonic sensors, coupled with the imperative for accurate and reliable data processing through sensor fusion algorithms, is fundamental to enhancing vehicle safety, navigation, and overall driving experience. Key drivers include stringent automotive safety regulations worldwide, the growing consumer appetite for next-generation vehicle features, and significant investments by leading automotive manufacturers in R&D for autonomous mobility solutions.

Automotive Sensor Fusion Industry Market Size (In Billion)

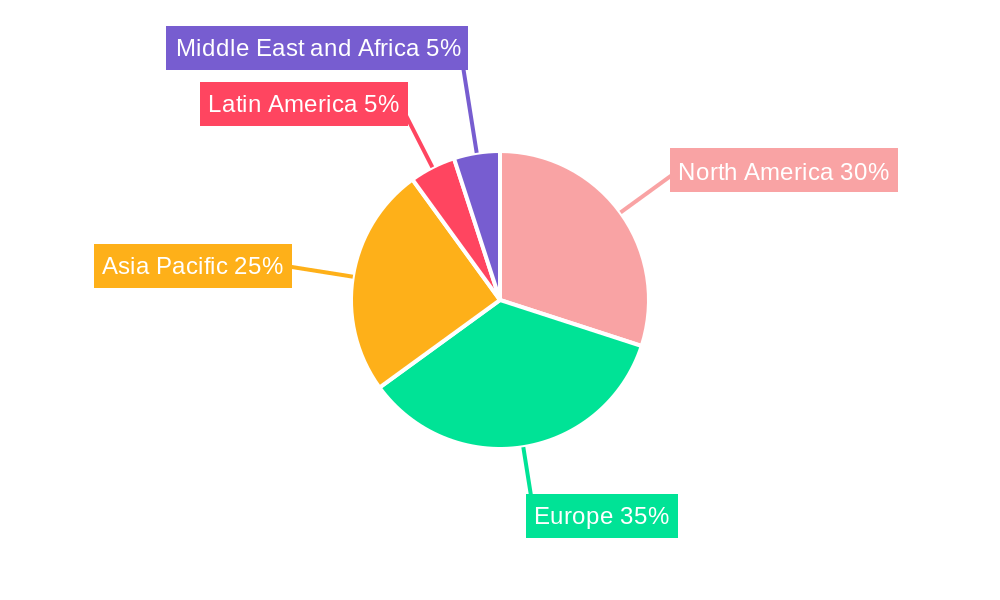

The market landscape is characterized by distinct segments, with Passenger Cars leading the adoption of sensor fusion technologies, followed by Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs). The "Other Autonomous Vehicles" segment, encompassing specialized autonomous systems, is also poised for significant expansion. While the market is brimming with opportunities, certain restraints such as the high cost of advanced sensor technologies and the complexities associated with data processing and cybersecurity do pose challenges. However, continuous innovation in AI and machine learning algorithms, coupled with advancements in processing power and miniaturization of sensors, are steadily mitigating these concerns. Key industry players like Infineon Technologies AG, NXP Semiconductors, Continental AG, and Robert Bosch GmbH are at the forefront, driving innovation and expanding their product portfolios to cater to the evolving needs of the automotive industry. Geographically, North America and Europe are expected to lead in adoption due to early regulatory frameworks and high consumer demand, while the Asia Pacific region is anticipated to witness the fastest growth, fueled by a burgeoning automotive manufacturing base and increasing technological adoption.

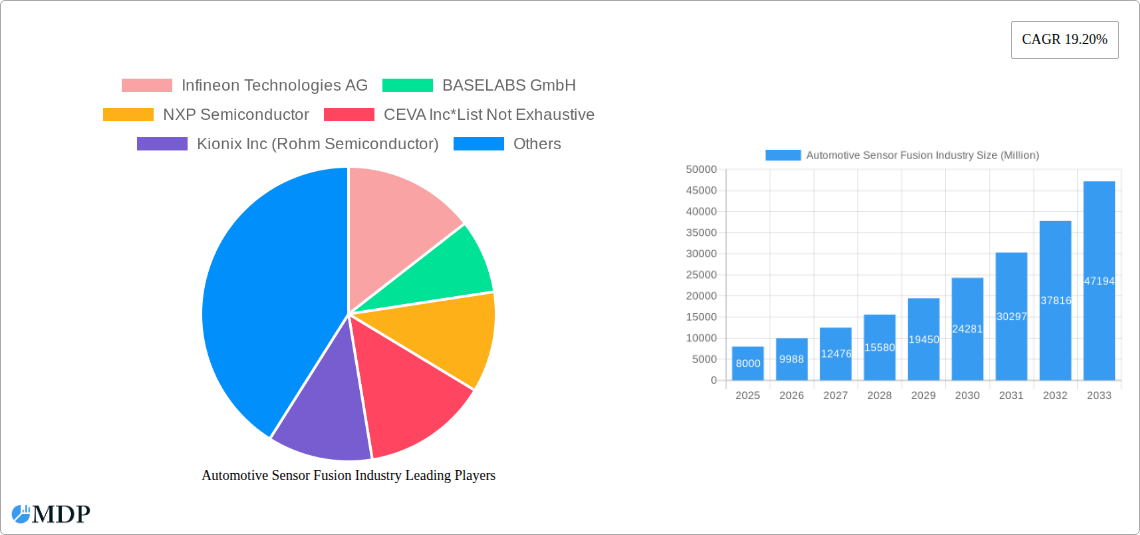

Automotive Sensor Fusion Industry Company Market Share

Automotive Sensor Fusion Industry Market Dynamics & Concentration

The Automotive Sensor Fusion industry is experiencing rapid growth and dynamic market concentration, driven by the burgeoning demand for advanced driver-assistance systems (ADAS) and autonomous driving capabilities. The market is characterized by a blend of established automotive giants and specialized technology providers, all vying for a significant share. Key innovation drivers include advancements in AI, machine learning, and miniaturization of sensor technologies, enabling more sophisticated and integrated sensor fusion solutions. Regulatory frameworks, particularly those focused on vehicle safety standards and emissions, are indirectly boosting the adoption of sensor fusion for enhanced performance and compliance. While direct product substitutes are limited, the continuous improvement in individual sensor technologies can be seen as a form of indirect competition, pushing fusion algorithms to become more robust. End-user trends are heavily influenced by consumer demand for safer, more comfortable, and automated driving experiences. Mergers and acquisitions (M&A) are becoming increasingly prevalent as larger players seek to acquire specialized expertise or secure key technologies. For instance, recent M&A activities in the broader automotive electronics sector, involving companies like those in the sensor manufacturing space, indicate a consolidation trend. The market share distribution sees leading Tier-1 suppliers and semiconductor manufacturers holding substantial portions, though the landscape is constantly evolving with new entrants and strategic alliances. The number of M&A deals in related automotive technology sectors has seen a notable increase over the historical period, signifying heightened strategic maneuvering.

Automotive Sensor Fusion Industry Industry Trends & Analysis

The Automotive Sensor Fusion industry is poised for substantial growth, propelled by a confluence of technological advancements and evolving automotive paradigms. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025–2033, reaching an estimated market size of over $50 billion by 2033. This impressive growth is fundamentally driven by the increasing sophistication of ADAS features, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking, which necessitate the seamless integration of data from multiple sensors like cameras, LiDAR, radar, and ultrasonic sensors. The penetration of these advanced safety features in both passenger cars and commercial vehicles is a key market differentiator. Technological disruptions, particularly in the realm of artificial intelligence and machine learning algorithms, are enabling more accurate and efficient sensor fusion, leading to enhanced vehicle perception and decision-making capabilities. Consumer preferences are increasingly shifting towards vehicles equipped with these advanced technologies, driven by a desire for enhanced safety, convenience, and a glimpse into the future of autonomous mobility. The competitive dynamics within the industry are intense, characterized by strategic partnerships between automakers, Tier-1 suppliers, and semiconductor manufacturers. Companies are heavily investing in R&D to develop next-generation sensor fusion solutions that are not only more performant but also cost-effective and power-efficient. The integration of software-defined architectures and over-the-air updates is also becoming a significant trend, allowing for continuous improvement of sensor fusion algorithms post-deployment. Furthermore, the growing adoption of electric vehicles (EVs) and the concurrent development of highly automated driving systems for them are creating new avenues for sensor fusion technology, especially for complex urban driving scenarios. The trend towards centralized processing architectures for sensor fusion data, moving away from distributed ECU-based solutions, is another significant development shaping the industry's technological landscape.

Leading Markets & Segments in Automotive Sensor Fusion Industry

Dominant Region: North America and Europe

North America and Europe currently represent the dominant regions in the Automotive Sensor Fusion industry. This leadership is attributed to several factors:

- Strong Regulatory Frameworks: Both regions have stringent safety regulations and mandates that encourage the adoption of advanced driver-assistance systems (ADAS), directly fueling the demand for sensor fusion technologies.

- High Consumer Adoption of Advanced Technologies: Consumers in these markets exhibit a strong willingness to adopt and pay for vehicles equipped with advanced safety and convenience features, including semi-autonomous driving capabilities.

- Robust Automotive Manufacturing Base: The presence of major global automakers and a well-established Tier-1 supplier ecosystem fosters innovation and widespread implementation of sensor fusion solutions.

- Investment in Autonomous Driving Research and Development: Significant investments in R&D for autonomous vehicles are primarily concentrated in these regions, leading to accelerated development and deployment of sensor fusion technologies.

Dominant Segment: Passenger Cars

Within the Type of Vehicles segment, Passenger Cars emerge as the dominant segment for Automotive Sensor Fusion:

- High Production Volumes: Passenger cars constitute the largest share of global vehicle production, naturally leading to a higher volume demand for sensor fusion components and systems.

- ADAS Integration: The widespread integration of ADAS features, driven by consumer demand and regulatory pressures, is most pronounced in the passenger car segment, ranging from basic safety enhancements to more advanced semi-autonomous driving functionalities.

- Technological Advancement Accessibility: Automakers are prioritizing the inclusion of advanced sensor fusion capabilities in passenger cars to differentiate their offerings and cater to evolving consumer expectations for safety and convenience.

- Economies of Scale: The high production volumes enable manufacturers to achieve economies of scale in sensor fusion system development and production, making them more accessible and cost-effective for passenger vehicles.

While Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) are increasingly adopting sensor fusion for safety and efficiency, and "Other Autonomous Vehicles" represent a future growth frontier, the current market dominance firmly rests with passenger cars due to their sheer volume and the widespread adoption of ADAS features.

Automotive Sensor Fusion Industry Product Developments

Product innovations in the Automotive Sensor Fusion industry are characterized by enhanced integration, improved accuracy, and reduced power consumption. Companies are focusing on developing robust algorithms capable of fusing data from diverse sensor modalities like cameras, radar, LiDAR, and ultrasonic sensors to achieve a comprehensive understanding of the vehicle's environment. This leads to more reliable ADAS and autonomous driving functions. For example, recent developments emphasize machine learning-based sensor fusion, allowing for adaptability and continuous learning. The competitive advantage lies in providing solutions that offer superior perception, reduced latency, and seamless integration into vehicle architectures, catering to the growing demand for safer and more automated driving experiences.

Key Drivers of Automotive Sensor Fusion Industry Growth

The growth of the Automotive Sensor Fusion industry is primarily propelled by technological advancements, evolving regulatory landscapes, and shifting consumer preferences. The relentless pursuit of enhanced vehicle safety through the implementation of advanced driver-assistance systems (ADAS) is a paramount driver. Stricter government regulations mandating safety features in vehicles further accelerate adoption. Furthermore, the escalating consumer demand for autonomous driving capabilities and a superior in-car experience fuels innovation and market expansion. The increasing computational power and decreasing cost of sensors are also critical enablers, making sophisticated sensor fusion solutions more viable for mass-market vehicles.

Challenges in the Automotive Sensor Fusion Industry Market

Despite robust growth, the Automotive Sensor Fusion industry faces several challenges. The complexity of integrating and calibrating data from disparate sensors poses significant technical hurdles. High development and implementation costs can be a restraint, especially for entry-level vehicles. Stringent regulatory approval processes for safety-critical systems add time and expense. Furthermore, the cybersecurity of sensor fusion systems is a growing concern, requiring robust protection against potential threats. Supply chain disruptions for critical sensor components can also impact production timelines and costs, presenting a constant challenge for manufacturers.

Emerging Opportunities in Automotive Sensor Fusion Industry

Emerging opportunities in the Automotive Sensor Fusion industry are abundant, driven by the relentless march towards full autonomy and the increasing sophistication of vehicle functionalities. The development of AI-powered, highly robust sensor fusion algorithms capable of handling diverse and challenging environmental conditions presents a significant opportunity. Strategic partnerships between sensor manufacturers, software developers, and automotive OEMs are crucial for co-developing integrated solutions. Furthermore, the expansion of sensor fusion applications beyond ADAS into areas like in-cabin monitoring, predictive maintenance, and enhanced vehicle diagnostics offers substantial market growth potential. The increasing electrification of vehicles also opens new avenues for tailored sensor fusion solutions.

Leading Players in the Automotive Sensor Fusion Industry Sector

- Infineon Technologies AG

- BASELABS GmbH

- NXP Semiconductor

- CEVA Inc

- Kionix Inc (Rohm Semiconductor)

- Memsic Inc

- STMicroelectronics NV

- Continental AG

- Robert Bosch GmbH

- TDK Corporation

Key Milestones in Automotive Sensor Fusion Industry Industry

- September 2022: Rutronik System Solutions launched its state-of-the-art sensor fusion solution with the Rutronik Adapter Board RAB1. This platform enables machine learning (ML) based sensor fusion, forming the basis for future artificial intelligence (AI) applications. Equipped with high-performance sensors from Bosch, Infineon, and Sensirion, it is ideal for diverse sensor fusion applications.

- June 2022: CEVA expanded its sensor fusion product family with the launch of FSP201, a high-performance, low-power sensor hub MCU designed for precise motion tracking, orientation, and heading detection. It utilizes industry-standard I2C and UART interfaces for seamless chip connectivity.

Strategic Outlook for Automotive Sensor Fusion Industry Market

The strategic outlook for the Automotive Sensor Fusion industry is overwhelmingly positive, driven by the inevitable progression towards higher levels of vehicle autonomy and the continued demand for enhanced safety features. Key growth accelerators include the ongoing miniaturization and cost reduction of sensor technologies, enabling wider adoption across vehicle segments. The increasing focus on software-defined vehicles and over-the-air updates will allow for continuous improvement of sensor fusion algorithms, extending product lifecycles and creating recurring revenue opportunities. Strategic collaborations and acquisitions will continue to shape the market, consolidating expertise and accelerating innovation. The industry is on a trajectory to become an indispensable component of future mobility.

Automotive Sensor Fusion Industry Segmentation

-

1. Type of Vehicles

- 1.1. Passenger Cars

- 1.2. Light Commercial Vehicle (LCV)

- 1.3. Heavy Commercial Vehicle (HCV)

- 1.4. Other Autonomous Vehicles

Automotive Sensor Fusion Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automotive Sensor Fusion Industry Regional Market Share

Geographic Coverage of Automotive Sensor Fusion Industry

Automotive Sensor Fusion Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Miniaturization in Automotive Electronics; Increasing Demand for ADAS system and Autonomous Vehicle

- 3.3. Market Restrains

- 3.3.1. Absence of Standardization in Sensor Fusion System

- 3.4. Market Trends

- 3.4.1. Growing Technological Trends in Automotive Sector to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 5.1.1. Passenger Cars

- 5.1.2. Light Commercial Vehicle (LCV)

- 5.1.3. Heavy Commercial Vehicle (HCV)

- 5.1.4. Other Autonomous Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 6. North America Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 6.1.1. Passenger Cars

- 6.1.2. Light Commercial Vehicle (LCV)

- 6.1.3. Heavy Commercial Vehicle (HCV)

- 6.1.4. Other Autonomous Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 7. Europe Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 7.1.1. Passenger Cars

- 7.1.2. Light Commercial Vehicle (LCV)

- 7.1.3. Heavy Commercial Vehicle (HCV)

- 7.1.4. Other Autonomous Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 8. Asia Pacific Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 8.1.1. Passenger Cars

- 8.1.2. Light Commercial Vehicle (LCV)

- 8.1.3. Heavy Commercial Vehicle (HCV)

- 8.1.4. Other Autonomous Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 9. Latin America Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 9.1.1. Passenger Cars

- 9.1.2. Light Commercial Vehicle (LCV)

- 9.1.3. Heavy Commercial Vehicle (HCV)

- 9.1.4. Other Autonomous Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 10. Middle East and Africa Automotive Sensor Fusion Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 10.1.1. Passenger Cars

- 10.1.2. Light Commercial Vehicle (LCV)

- 10.1.3. Heavy Commercial Vehicle (HCV)

- 10.1.4. Other Autonomous Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicles

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASELABS GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CEVA Inc*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kionix Inc (Rohm Semiconductor)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Memsic Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 STMicroelectronics NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Continental AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Robert Bosch GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TDK Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Automotive Sensor Fusion Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Sensor Fusion Industry Revenue (undefined), by Type of Vehicles 2025 & 2033

- Figure 3: North America Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2025 & 2033

- Figure 4: North America Automotive Sensor Fusion Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Automotive Sensor Fusion Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Automotive Sensor Fusion Industry Revenue (undefined), by Type of Vehicles 2025 & 2033

- Figure 7: Europe Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2025 & 2033

- Figure 8: Europe Automotive Sensor Fusion Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Automotive Sensor Fusion Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Automotive Sensor Fusion Industry Revenue (undefined), by Type of Vehicles 2025 & 2033

- Figure 11: Asia Pacific Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2025 & 2033

- Figure 12: Asia Pacific Automotive Sensor Fusion Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Automotive Sensor Fusion Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Automotive Sensor Fusion Industry Revenue (undefined), by Type of Vehicles 2025 & 2033

- Figure 15: Latin America Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2025 & 2033

- Figure 16: Latin America Automotive Sensor Fusion Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America Automotive Sensor Fusion Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Automotive Sensor Fusion Industry Revenue (undefined), by Type of Vehicles 2025 & 2033

- Figure 19: Middle East and Africa Automotive Sensor Fusion Industry Revenue Share (%), by Type of Vehicles 2025 & 2033

- Figure 20: Middle East and Africa Automotive Sensor Fusion Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Automotive Sensor Fusion Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Type of Vehicles 2020 & 2033

- Table 2: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Type of Vehicles 2020 & 2033

- Table 4: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Type of Vehicles 2020 & 2033

- Table 6: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Type of Vehicles 2020 & 2033

- Table 8: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Type of Vehicles 2020 & 2033

- Table 10: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Type of Vehicles 2020 & 2033

- Table 12: Global Automotive Sensor Fusion Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Sensor Fusion Industry?

The projected CAGR is approximately 24.71%.

2. Which companies are prominent players in the Automotive Sensor Fusion Industry?

Key companies in the market include Infineon Technologies AG, BASELABS GmbH, NXP Semiconductor, CEVA Inc*List Not Exhaustive, Kionix Inc (Rohm Semiconductor), Memsic Inc, STMicroelectronics NV, Continental AG, Robert Bosch GmbH, TDK Corporation.

3. What are the main segments of the Automotive Sensor Fusion Industry?

The market segments include Type of Vehicles.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Miniaturization in Automotive Electronics; Increasing Demand for ADAS system and Autonomous Vehicle.

6. What are the notable trends driving market growth?

Growing Technological Trends in Automotive Sector to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Absence of Standardization in Sensor Fusion System.

8. Can you provide examples of recent developments in the market?

September 2022 - Rutronik System Solutions launched its latest state-of-the-art sensor fusion solution with the Rutronik Adapter Board RAB1. According to the company, the adapter board offers its own platform, allowing machine learning (ML) based sensor fusion that forms the basis and the future of artificial intelligence (AI). Equipped with the highest performance sensors from Bosch, Infineon, and Sensirion, the board is ideal for a wide range of sensor fusion applications, like smoke and gas detectors or air quality measurements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Sensor Fusion Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Sensor Fusion Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Sensor Fusion Industry?

To stay informed about further developments, trends, and reports in the Automotive Sensor Fusion Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence