Key Insights

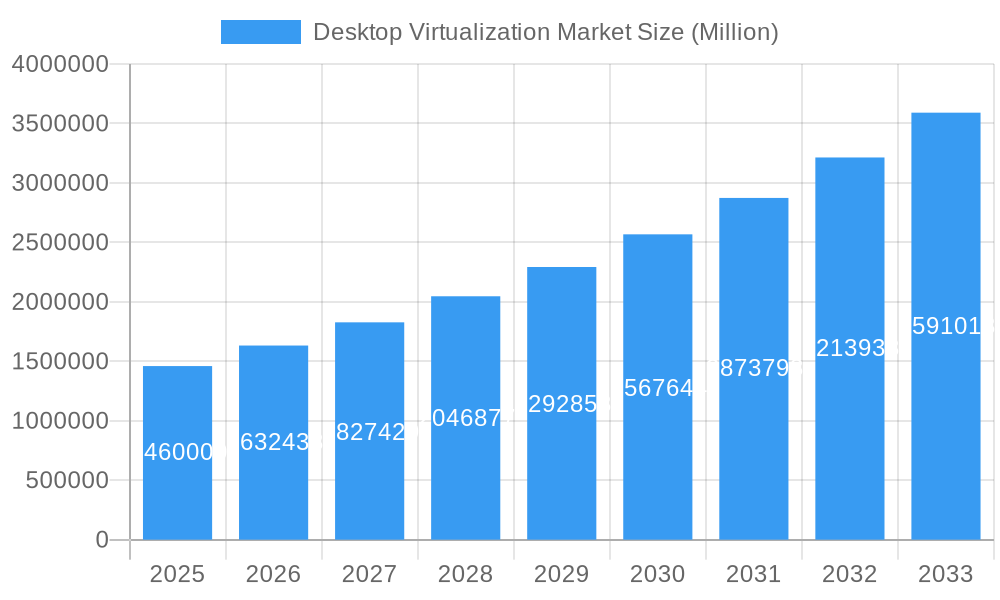

The global Desktop Virtualization Market is poised for significant expansion, projected to reach approximately 1.46 Million Units by 2025. This robust growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 11.79% during the forecast period of 2025-2033. The increasing demand for enhanced security, improved accessibility, and cost-efficiency in IT infrastructure are primary drivers for this market surge. Businesses are increasingly adopting desktop virtualization solutions to empower remote workforces, streamline IT management, and offer a consistent user experience across various devices. The shift towards flexible work models and the growing need for centralized data management are further accelerating the adoption of VDI (Virtual Desktop Infrastructure) and DaaS (Desktop as a Service) solutions. Moreover, advancements in cloud computing and the growing acceptance of hybrid cloud environments are creating new avenues for market growth, enabling organizations to scale their virtual desktop deployments more effectively and affordably.

Desktop Virtualization Market Market Size (In Million)

The market is segmented into Hosted Virtual Desktop (HVD) and Hosted Shared Desktop (HSD) under desktop delivery platforms, with both on-premise and cloud deployment modes gaining traction. While on-premise solutions offer greater control and security for sensitive data, cloud-based deployments provide scalability, flexibility, and reduced upfront costs, making them attractive for a wider range of organizations. Emerging trends such as the integration of AI and machine learning for optimizing virtual desktop performance, and the rise of edge computing to reduce latency, are expected to shape the future of desktop virtualization. Key players like Microsoft Corporation, Citrix Systems Inc., and VMware Inc. are at the forefront of innovation, continuously introducing advanced solutions to meet evolving market demands and maintain a competitive edge in this dynamic landscape. The market's robust growth trajectory underscores the strategic importance of desktop virtualization in modern enterprise IT strategies.

Desktop Virtualization Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Desktop Virtualization Market, providing critical insights for stakeholders navigating the evolving landscape of digital workspace solutions. Explore market dynamics, key trends, leading segments, and strategic opportunities that will shape the future of virtual desktop infrastructure (VDI) and desktop-as-a-service (DaaS). With a forecast period spanning 2025–2033, this report leverages historical data from 2019–2024 and a base year of 2025 to deliver actionable intelligence. Discover how advancements in VDI solutions, cloud desktops, and remote work technologies are driving unprecedented growth and innovation. This report covers virtual desktop delivery platforms including Hosted Virtual Desktop (HVD) and Hosted Shared Desktop (HSD), and deployment modes such as On-premise and Cloud.

Desktop Virtualization Market Market Dynamics & Concentration

The Desktop Virtualization Market is characterized by a dynamic blend of innovation, evolving regulatory frameworks, and increasing end-user demand for flexible and secure digital workspaces. Market concentration is moderate, with key players like VMware Inc., Microsoft Corporation, and Citrix Systems Inc. holding significant shares. However, the emergence of niche solution providers and open-source alternatives contributes to a competitive environment. Innovation is primarily driven by the demand for enhanced user experience, improved security features, and seamless integration with cloud services. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), are increasingly influencing deployment strategies and demanding robust compliance measures. Product substitutes, including traditional physical desktops and SaaS-based applications, remain a consideration, but the unique benefits of VDI, such as centralized management and cost savings, are gaining traction. End-user trends heavily favor remote and hybrid work models, accelerating the adoption of desktop virtualization solutions for workforce mobility and business continuity. Merger and acquisition (M&A) activities, while not at an extreme level, are present as larger players acquire innovative startups to expand their technological capabilities and market reach. For instance, there have been approximately 10-15 significant M&A deals in the VDI space over the past three years, aimed at consolidating market share and acquiring cutting-edge technologies.

Desktop Virtualization Market Industry Trends & Analysis

The Desktop Virtualization Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period of 2025–2033. This expansion is fueled by several key industry trends. The accelerating adoption of remote and hybrid work models globally is a primary growth driver, compelling organizations to invest in secure and scalable virtual desktop solutions to support their distributed workforces. The ongoing digital transformation initiatives across industries, including finance, healthcare, and education, are further bolstering demand for flexible and cost-effective IT infrastructure. Technological advancements, such as the proliferation of high-speed internet, the maturation of cloud computing technologies, and the increasing power of endpoint devices, are creating a fertile ground for VDI and DaaS adoption. Consumers are increasingly preferring accessible, device-agnostic work environments, which desktop virtualization effectively delivers. Competitive dynamics are intensifying, with established players like Microsoft and VMware continuously enhancing their offerings while agile startups introduce specialized solutions. The market penetration of virtual desktop solutions is steadily increasing, moving beyond large enterprises to small and medium-sized businesses (SMBs) seeking to leverage enterprise-grade IT capabilities without significant capital expenditure. The global market size is estimated to reach over $50 Million in 2025, with significant potential for further growth driven by these interconnected trends.

Leading Markets & Segments in Desktop Virtualization Market

The Desktop Virtualization Market is experiencing dominance in several key regions and segments. North America currently leads the market, driven by a strong technological infrastructure, early adoption of cloud technologies, and a significant presence of large enterprises in sectors like finance and technology, which are prime candidates for virtual desktop infrastructure (VDI). Within North America, the United States spearheads adoption due to a high concentration of businesses with robust IT budgets and a forward-thinking approach to remote work.

Dominant Region: North America, with an estimated 40-45% market share.

- Key Drivers: Early adoption of cloud computing, significant investments in IT infrastructure, strong presence of enterprise clients, and a progressive attitude towards remote and hybrid work models.

- Economic Policies: Favorable business environments and government initiatives supporting digital transformation.

- Infrastructure: Advanced internet connectivity and robust data center capabilities.

Desktop Delivery Platform: The Hosted Virtual Desktop (HVD) segment is anticipated to witness substantial growth, accounting for an estimated 55-60% of the market share in 2025. HVD offers dedicated virtual desktops to individual users, providing a personalized and high-performance computing experience, ideal for specialized applications and users requiring maximum control and customization.

- Key Drivers for HVD: Enhanced user experience, greater control over individual desktop environments, suitable for resource-intensive applications and specialized roles.

- Market Penetration: Steadily increasing as organizations prioritize individual user productivity and security.

Deployment Mode: The Cloud deployment mode is projected to be the fastest-growing segment, capturing approximately 60-65% of the market by 2025. The scalability, cost-efficiency, and agility offered by cloud-based VDI solutions are highly attractive to businesses of all sizes, enabling them to adapt quickly to changing demands and reduce upfront capital expenditures.

- Key Drivers for Cloud Deployment: Reduced IT overhead, enhanced scalability and flexibility, disaster recovery capabilities, and faster deployment times.

- Market Penetration: Rapidly outpacing on-premise solutions due to the inherent advantages of cloud services.

Desktop Virtualization Market Product Developments

Product developments in the Desktop Virtualization Market are continuously enhancing user experience, security, and management capabilities. Innovations focus on optimizing performance for resource-intensive applications, improving remote access protocols, and simplifying deployment and administration. Solutions are increasingly incorporating advanced AI and machine learning for predictive analytics and automated resource allocation. The competitive advantage lies in offering seamless integration with existing IT ecosystems, robust security features like multi-factor authentication and granular access controls, and flexible licensing models. This focus on user-centric design and robust backend infrastructure is driving the market towards more intelligent and efficient virtual desktop solutions.

Key Drivers of Desktop Virtualization Market Growth

The growth of the Desktop Virtualization Market is primarily driven by the increasing adoption of remote and hybrid work models, compelling organizations to provide secure and accessible work environments. The need for enhanced data security and compliance with stringent regulations, such as GDPR, is a significant catalyst, as VDI centralizes data and reduces endpoints' vulnerability. Furthermore, the ongoing digital transformation across industries, coupled with the demand for cost optimization and IT agility, is pushing businesses towards scalable and flexible virtual desktop solutions. Technological advancements in cloud computing and networking infrastructure further enable and accelerate this trend.

Challenges in the Desktop Virtualization Market Market

Despite its promising growth, the Desktop Virtualization Market faces several challenges. High initial implementation costs and the complexity of managing large-scale VDI deployments can be a barrier for some organizations, particularly SMBs. Ensuring optimal performance for graphics-intensive applications and catering to a diverse range of end-user devices requires careful planning and robust infrastructure. Security concerns, though mitigated by VDI's centralized nature, still require diligent management and continuous updates against evolving cyber threats. Furthermore, the availability of skilled IT professionals to implement and manage VDI solutions can be a constraint.

Emerging Opportunities in Desktop Virtualization Market

Emerging opportunities in the Desktop Virtualization Market are largely driven by advancements in cloud-native VDI, the expansion into emerging economies, and the increasing demand for specialized VDI solutions for industries like healthcare and education. The integration of AI and machine learning for enhanced user experience and resource management presents a significant opportunity. Strategic partnerships between VDI vendors and cloud providers are also creating more integrated and cost-effective solutions. The growing emphasis on employee experience and productivity in hybrid work environments will continue to fuel the demand for flexible and secure desktop virtualization.

Leading Players in the Desktop Virtualization Market Sector

- Parallels International GmbH

- Toshiba Corporation

- Ncomputing Inc

- Microsoft Corporation

- Dell Inc

- Huawei Technologies Co Ltd

- Ericom Software Inc

- Citrix Systems Inc

- Red Hat Inc (IBM Corporation )

- Tems Inc

- Vmware Inc

Key Milestones in Desktop Virtualization Market Industry

- January 2023: VMware revealed a new solution for global retailers to modernize point of sale (POS) and unlock more financial value from their POS devices. VMware Retail POS modernization solutions enable operations, IT, marketing, and security teams to become more agile and responsive to drive critical business, customer, and IT outcomes.

- July 2022: Microsoft announced Azure virtual desktop support for virtual machines with "Trusted Launch" protections. Trusted Launch was Microsoft's phrase for technologies that add protections at the OS boot-up level to block viruses and malware, known as bootkits.

Strategic Outlook for Desktop Virtualization Market Market

The strategic outlook for the Desktop Virtualization Market is exceptionally positive, driven by the sustained global shift towards flexible work arrangements and the continuous need for secure, scalable, and cost-effective IT infrastructure. Future growth will be accelerated by the increasing adoption of Desktop-as-a-Service (DaaS) models, which lower the barrier to entry for SMBs. Innovations in AI-powered resource optimization and enhanced security features will further solidify VDI's position. Strategic partnerships, expanding into untapped geographical markets, and offering tailored solutions for specific industry verticals will be key growth accelerators, ensuring continued market expansion and technological advancement in the virtual desktop space.

Desktop Virtualization Market Segmentation

-

1. Desktop delivery platform

- 1.1. Hosted Virtual Desktop (HVD)

- 1.2. Hosted Shared Desktop (HSD)

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

Desktop Virtualization Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Desktop Virtualization Market Regional Market Share

Geographic Coverage of Desktop Virtualization Market

Desktop Virtualization Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud Computing; Growth in Automation in Retail

- 3.3. Market Restrains

- 3.3.1. Infrastructure Deployment Constraints

- 3.4. Market Trends

- 3.4.1. Hosted Virtual Desktop Accounts for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 5.1.1. Hosted Virtual Desktop (HVD)

- 5.1.2. Hosted Shared Desktop (HSD)

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 6. North America Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 6.1.1. Hosted Virtual Desktop (HVD)

- 6.1.2. Hosted Shared Desktop (HSD)

- 6.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 7. Europe Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 7.1.1. Hosted Virtual Desktop (HVD)

- 7.1.2. Hosted Shared Desktop (HSD)

- 7.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 8. Asia Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 8.1.1. Hosted Virtual Desktop (HVD)

- 8.1.2. Hosted Shared Desktop (HSD)

- 8.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 9. Australia and New Zealand Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 9.1.1. Hosted Virtual Desktop (HVD)

- 9.1.2. Hosted Shared Desktop (HSD)

- 9.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 10. Latin America Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 10.1.1. Hosted Virtual Desktop (HVD)

- 10.1.2. Hosted Shared Desktop (HSD)

- 10.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 11. Middle East and Africa Desktop Virtualization Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 11.1.1. Hosted Virtual Desktop (HVD)

- 11.1.2. Hosted Shared Desktop (HSD)

- 11.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.1. Market Analysis, Insights and Forecast - by Desktop delivery platform

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Parallels International GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Toshiba Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ncomputing Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microsoft Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dell Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Huawei Technologies Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ericom Software Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Citrix Systems Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Red Hat Inc (IBM Corporation )

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tems Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Vmware Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Parallels International GmbH

List of Figures

- Figure 1: Global Desktop Virtualization Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 3: North America Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 4: North America Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 5: North America Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 6: North America Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 9: Europe Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 10: Europe Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 11: Europe Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 12: Europe Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 15: Asia Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 16: Asia Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 17: Asia Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 18: Asia Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 21: Australia and New Zealand Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 22: Australia and New Zealand Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 23: Australia and New Zealand Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 24: Australia and New Zealand Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 27: Latin America Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 28: Latin America Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 29: Latin America Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 30: Latin America Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Desktop Virtualization Market Revenue (Million), by Desktop delivery platform 2025 & 2033

- Figure 33: Middle East and Africa Desktop Virtualization Market Revenue Share (%), by Desktop delivery platform 2025 & 2033

- Figure 34: Middle East and Africa Desktop Virtualization Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 35: Middle East and Africa Desktop Virtualization Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 36: Middle East and Africa Desktop Virtualization Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Desktop Virtualization Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 2: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 3: Global Desktop Virtualization Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 5: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 6: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 8: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 9: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 11: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 12: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 14: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 15: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 17: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 18: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Desktop Virtualization Market Revenue Million Forecast, by Desktop delivery platform 2020 & 2033

- Table 20: Global Desktop Virtualization Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 21: Global Desktop Virtualization Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Desktop Virtualization Market?

The projected CAGR is approximately 11.79%.

2. Which companies are prominent players in the Desktop Virtualization Market?

Key companies in the market include Parallels International GmbH, Toshiba Corporation, Ncomputing Inc, Microsoft Corporation, Dell Inc, Huawei Technologies Co Ltd, Ericom Software Inc, Citrix Systems Inc, Red Hat Inc (IBM Corporation ), Tems Inc, Vmware Inc.

3. What are the main segments of the Desktop Virtualization Market?

The market segments include Desktop delivery platform, Deployment Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud Computing; Growth in Automation in Retail.

6. What are the notable trends driving market growth?

Hosted Virtual Desktop Accounts for Significant Market Share.

7. Are there any restraints impacting market growth?

Infrastructure Deployment Constraints.

8. Can you provide examples of recent developments in the market?

January 2023 - VMware revealed a new solution for global retailers to modernize point of sale (POS) and unlock more financial value from their POS devices. VMware Retail POS modernization solutions enable operations, IT, marketing, and security teams to become more agile and responsive to drive critical business, customer, and IT outcomes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Desktop Virtualization Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Desktop Virtualization Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Desktop Virtualization Market?

To stay informed about further developments, trends, and reports in the Desktop Virtualization Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence