Key Insights

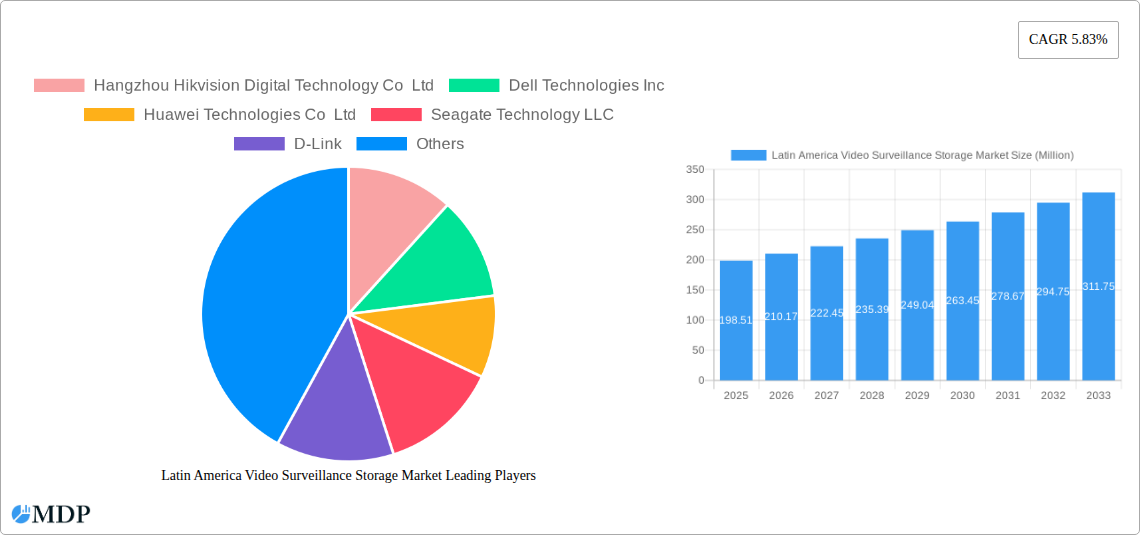

The Latin America Video Surveillance Storage Market is poised for significant expansion, driven by a confluence of factors including increasing security concerns, the proliferation of smart city initiatives, and the growing adoption of high-definition surveillance systems. This market, valued at 198.51 million in 2025, is projected to experience a robust CAGR of 5.83% over the forecast period of 2025-2033. The escalating need for efficient data management, longer retention periods, and enhanced analytics capabilities fuels demand for sophisticated storage solutions. Key growth drivers include rising crime rates in urban centers, the imperative for robust public safety infrastructure, and the integration of AI and machine learning for intelligent video analysis. Furthermore, the increasing deployment of cloud-based storage solutions is democratizing access to advanced surveillance capabilities, particularly for small and medium-sized enterprises, thereby broadening the market's reach.

Latin America Video Surveillance Storage Market Market Size (In Million)

Technological advancements in storage media, such as the increasing adoption of Solid State Drives (SSDs) for their speed and durability, alongside the continued relevance of Hard Disk Drives (HDDs) for bulk storage, are shaping market dynamics. The market is segmented across various product types including Network Attached Storage (NAS) and Storage Area Networks (SAN), with a growing demand for integrated video recorders. While on-premises deployments remain significant, the shift towards cloud-based solutions offers scalability and cost-efficiency. Key end-user verticals like Retail, BFSI, and Government and Defense are major contributors to market growth, investing heavily in comprehensive surveillance systems. Emerging trends also point towards the increasing demand for edge computing solutions that enable localized data processing, reducing latency and bandwidth requirements. Addressing the challenges of data security, interoperability, and the sheer volume of data generated will be crucial for sustained market development.

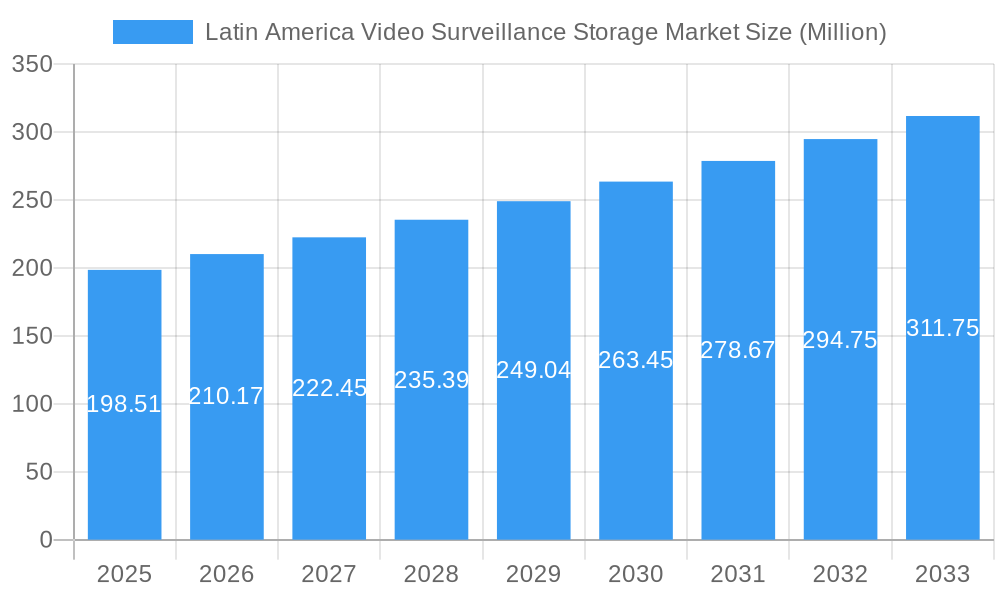

Latin America Video Surveillance Storage Market Company Market Share

Latin America Video Surveillance Storage Market: Comprehensive Analysis & Forecast (2019-2033)

Gain unparalleled insights into the burgeoning Latin America Video Surveillance Storage Market with this in-depth report. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and an extensive forecast period up to 2033, this report provides a definitive roadmap for stakeholders. Explore the intricate dynamics, key trends, leading segments, and competitive landscape driving the growth of video surveillance storage solutions across retail, BFSI, government, home security, healthcare, transportation, education, and other vital sectors. With a projected market size of $3,850.5 Million by 2025 and a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period, this analysis is essential for understanding market penetration and future expansion.

Latin America Video Surveillance Storage Market Market Dynamics & Concentration

The Latin America Video Surveillance Storage Market is characterized by moderate to high concentration, with key players like Hangzhou Hikvision Digital Technology Co Ltd, Dell Technologies Inc, Huawei Technologies Co Ltd, Seagate Technology LLC, and Dahua Technology Co Ltd holding significant market shares. Innovation drivers are primarily fueled by the escalating demand for high-resolution video, AI-powered analytics, and the increasing adoption of edge computing solutions, pushing for more sophisticated and efficient storage. Regulatory frameworks, particularly concerning data privacy and security in countries like Brazil and Mexico, are influencing storage solutions, favoring robust and compliant options. Product substitutes include cloud storage solutions and traditional DVRs, but the increasing data volume and security needs are solidifying the dominance of dedicated video surveillance storage. End-user trends reveal a strong preference for scalable, reliable, and cost-effective solutions across all verticals, with a growing emphasis on cybersecurity. Merger and acquisition (M&A) activities, though currently at a low to moderate level (estimated 5-8 deals annually), are expected to increase as larger players seek to expand their regional footprint and integrate advanced technologies, especially in the Storage Area Network (SAN) and Network Attached Storage (NAS) segments.

Latin America Video Surveillance Storage Market Industry Trends & Analysis

The Latin America Video Surveillance Storage Market is experiencing robust growth driven by an escalating need for enhanced security and surveillance across diverse end-user verticals. The increasing adoption of high-definition (HD) and ultra-high-definition (UHD) cameras, coupled with the rise of sophisticated video analytics and Artificial Intelligence (AI) capabilities, necessitates significant advancements in storage capacity and performance. This trend is projected to push the market from an estimated $3,850.5 Million in 2025 towards a projected $8,500.0 Million by 2033, exhibiting a strong CAGR of 12.5%. Technological disruptions, such as the evolution of Solid State Drives (SSDs) offering faster access times and greater durability compared to traditional Hard Disk Drives (HDDs), are reshaping storage solutions. However, the cost-effectiveness and higher density of HDDs continue to make them a preferred choice for bulk storage, particularly in large-scale deployments. Consumer preferences are shifting towards integrated solutions that offer not just storage but also intelligent data management and seamless playback capabilities. The competitive dynamics are intense, with established global players vying for market share against emerging regional providers. The expansion of broadband internet infrastructure across Latin America is also a crucial growth driver, enabling greater adoption of cloud-based storage solutions and remote access to surveillance data. Furthermore, government initiatives aimed at improving public safety and smart city development are significantly boosting the demand for advanced video surveillance storage systems. The Retail and Government and Defense sectors are currently leading in terms of market penetration, driven by the need for comprehensive monitoring and evidence management. The BFSI sector is also a significant contributor, prioritizing secure and tamper-proof storage for financial transactions and compliance. The push towards On-Premises deployments remains strong due to data sovereignty concerns, although Cloud-based solutions are gaining traction for their scalability and flexibility, particularly among small and medium-sized enterprises. The Video Recorders segment, including NVRs and DVRs, continues to be a dominant product type due to its integrated functionality and cost-effectiveness for many applications.

Leading Markets & Segments in Latin America Video Surveillance Storage Market

The Latin America Video Surveillance Storage Market exhibits a dynamic segmentation, with distinct leaders across product types, deployment models, storage media, and end-user verticals.

Dominant Product Type:

- Video Recorders: This segment, encompassing Network Video Recorders (NVRs) and Digital Video Recorders (DVRs), continues to dominate the market. Key drivers include their integrated functionality, ease of installation, and cost-effectiveness for many small to medium-sized deployments. The widespread availability of these devices and their compatibility with various camera types solidifies their leading position.

Leading Deployment Model:

- On-Premises: Despite the rise of cloud solutions, On-Premises deployment remains the preferred choice for a significant portion of the Latin American market. This preference is heavily influenced by data privacy regulations, concerns over internet connectivity reliability in certain regions, and the desire for direct control over sensitive surveillance data. Government and BFSI sectors, in particular, heavily favor on-premises solutions.

Dominant Storage Media:

- Hard Disk Drives (HDDs): For mass storage requirements in video surveillance, Hard Disk Drives (HDDs) continue to lead. Their cost-per-terabyte advantage, coupled with increasing capacities, makes them the go-to choice for long-term video retention. Manufacturers like Seagate Technology LLC and Western Digital are key suppliers, continually innovating to offer higher densities and improved reliability for surveillance applications.

Key End-User Vertical Leaders:

- Government and Defense: This vertical is a significant driver of the Latin America Video Surveillance Storage Market.

- Drivers: Increased government spending on public safety initiatives, border security, smart city projects, and the need for robust evidence management in law enforcement are key accelerators.

- Retail: The retail sector also represents a major segment.

- Drivers: The growing emphasis on loss prevention, customer behavior analysis, inventory management, and the need to monitor multiple store locations contribute to the demand for advanced surveillance storage.

- BFSI (Banking, Financial Services, and Insurance): This sector demands high levels of security and compliance.

- Drivers: The need for secure storage of transaction data, fraud prevention, compliance with regulatory mandates, and monitoring of sensitive areas within financial institutions drive market growth.

Emerging Segments to Watch:

- Cloud Deployment: While currently smaller than on-premises, the Cloud segment is poised for significant growth, driven by its scalability, flexibility, and remote accessibility. This is particularly attractive for SMEs and sectors that require rapid deployment and lower upfront infrastructure costs.

- Solid State Drives (SSDs): As SSD technology matures and prices decline, they are increasingly being adopted for critical applications requiring high read/write speeds and enhanced durability, such as AI-powered analytics and front-end recording.

Latin America Video Surveillance Storage Market Product Developments

The Latin America Video Surveillance Storage Market is witnessing a rapid evolution in product development, driven by the need for enhanced performance, capacity, and intelligence. Manufacturers are focusing on higher density Hard Disk Drives (HDDs), such as Seagate's SkyHawk AI 24 TB, optimized for video analytics and continuous recording. Concurrently, advancements in Solid State Drives (SSDs), like ADATA's BiCS5 3D(e)TLC solutions, are addressing the demand for faster data access, greater endurance (high DWPD), and improved reliability in harsh operating environments with features like anti-sulfuration and wide temperature ranges. These innovations are crucial for supporting the increasing volume of high-resolution video data and the growing implementation of AI-driven surveillance systems across diverse end-user verticals, ensuring data integrity and efficient retrieval.

Key Drivers of Latin America Video Surveillance Storage Market Growth

The Latin America Video Surveillance Storage Market is propelled by several key drivers. Firstly, the escalating concerns for public safety and security across the region are a primary catalyst, leading to increased deployment of surveillance systems by governments and private entities. Secondly, the rapid urbanization and growth of businesses, particularly in the Retail and BFSI sectors, necessitate comprehensive monitoring and data management solutions. Thirdly, technological advancements, including the proliferation of high-resolution cameras, AI-powered analytics, and the trend towards smart cities, are demanding more sophisticated and higher-capacity storage solutions. Finally, government initiatives and investments in infrastructure development and smart city projects further stimulate the demand for advanced video surveillance storage.

Challenges in the Latin America Video Surveillance Storage Market Market

Despite its growth potential, the Latin America Video Surveillance Storage Market faces several challenges. Economic volatility and currency fluctuations in several countries can impact purchasing power and create pricing uncertainties for imported technologies. Inadequate or inconsistent internet infrastructure in some remote areas can hinder the adoption of cloud-based storage solutions and remote access capabilities. Cybersecurity threats and data privacy regulations, while driving the need for secure storage, also present complex compliance challenges for manufacturers and end-users. Furthermore, intense competition and price sensitivity in certain market segments can put pressure on profit margins for vendors. Supply chain disruptions and logistical complexities across the vast Latin American region can also affect product availability and delivery times.

Emerging Opportunities in Latin America Video Surveillance Storage Market

The Latin America Video Surveillance Storage Market presents several emerging opportunities for growth. The increasing adoption of Artificial Intelligence (AI) and machine learning for video analytics creates a demand for high-performance storage capable of handling complex data processing. The expansion of smart city initiatives across major urban centers will significantly boost the need for integrated surveillance and storage infrastructure. Strategic partnerships between storage providers and AI solution developers can unlock new revenue streams. Furthermore, the growing adoption of edge computing for real-time data analysis at the source presents an opportunity for specialized, ruggedized, and compact storage solutions. The increasing focus on data security and compliance also drives demand for advanced encryption and tamper-proof storage technologies.

Leading Players in the Latin America Video Surveillance Storage Market Sector

- Hangzhou Hikvision Digital Technology Co Ltd

- Dell Technologies Inc

- Huawei Technologies Co Ltd

- Seagate Technology LLC

- D-Link

- AXIS Communications

- Wester Digital

- Dahua Technology Co Ltd

- Rasilient Systems Inc

- Vivotek

Key Milestones in Latin America Video Surveillance Storage Market Industry

- December 2023: Seagate Technology Holdings PLC introduced the Seagate SkyHawk AI 24 TB hard disk drive (HDD), specifically designed for video and imaging applications (VIA), further catering to the growing demand for mass data storage in the edge security sector.

- March 2024: ADATA Technology Co. Ltd revealed plans to present its latest BiCS5 3D(e)TLC storage solutions, high DWPD SSDs, and high-performance/low-power industrial-grade ECC memory modules. These products offer enhanced durability, improved data security, and wide operating temperature ranges, catering to demanding surveillance environments.

Strategic Outlook for Latin America Video Surveillance Storage Market Market

The strategic outlook for the Latin America Video Surveillance Storage Market is highly positive, driven by sustained demand for enhanced security and the rapid adoption of intelligent surveillance technologies. Key growth accelerators include the continued expansion of smart city projects, the increasing integration of AI analytics with video surveillance, and the growing need for high-capacity, reliable storage solutions across diverse verticals. Vendors focusing on developing solutions that offer a combination of robust performance, scalability, advanced data management, and strong cybersecurity features will be well-positioned for success. Strategic partnerships with system integrators and AI solution providers will be crucial for capturing market share. The gradual shift towards cloud-based solutions, alongside continued strength in on-premises deployments, presents a dual-pronged opportunity for market expansion.

Latin America Video Surveillance Storage Market Segmentation

-

1. Product Type

- 1.1. Storage Area Network (SAN)

- 1.2. Network Attached Storage (NAS)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Video Recorders

- 1.5. Services

-

2. Deployment

- 2.1. On-Premises

- 2.2. Cloud

-

3. Storage Media

- 3.1. Solid State Drives (SSDs)

- 3.2. Hard Disk Drives (HDDs)

-

4. End-user Vertical

- 4.1. Retail

- 4.2. BFSI

- 4.3. Government and Defense

- 4.4. Home Security

- 4.5. Healthcare

- 4.6. Media & Entertainment

- 4.7. Transportation and Logistics

- 4.8. Education

- 4.9. Others

Latin America Video Surveillance Storage Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Video Surveillance Storage Market Regional Market Share

Geographic Coverage of Latin America Video Surveillance Storage Market

Latin America Video Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing

- 3.2.2 Data Analytics

- 3.2.3 and Cloud

- 3.3. Market Restrains

- 3.3.1 The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing

- 3.3.2 Data Analytics

- 3.3.3 and Cloud

- 3.4. Market Trends

- 3.4.1. Solid State Drive (SSDs) is Expected to Register the Fastest Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Video Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Storage Area Network (SAN)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Video Recorders

- 5.1.5. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premises

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Storage Media

- 5.3.1. Solid State Drives (SSDs)

- 5.3.2. Hard Disk Drives (HDDs)

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Retail

- 5.4.2. BFSI

- 5.4.3. Government and Defense

- 5.4.4. Home Security

- 5.4.5. Healthcare

- 5.4.6. Media & Entertainment

- 5.4.7. Transportation and Logistics

- 5.4.8. Education

- 5.4.9. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Huawei Technologies Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Seagate Technology LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 D-Link

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXIS Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wester Digital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dahua Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rasilient Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vivotek*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: Latin America Video Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Video Surveillance Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Video Surveillance Storage Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Latin America Video Surveillance Storage Market Volume Million Forecast, by Deployment 2020 & 2033

- Table 5: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 6: Latin America Video Surveillance Storage Market Volume Million Forecast, by Storage Media 2020 & 2033

- Table 7: Latin America Video Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Latin America Video Surveillance Storage Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Latin America Video Surveillance Storage Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Latin America Video Surveillance Storage Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 13: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Latin America Video Surveillance Storage Market Volume Million Forecast, by Deployment 2020 & 2033

- Table 15: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 16: Latin America Video Surveillance Storage Market Volume Million Forecast, by Storage Media 2020 & 2033

- Table 17: Latin America Video Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Latin America Video Surveillance Storage Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 19: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Latin America Video Surveillance Storage Market Volume Million Forecast, by Country 2020 & 2033

- Table 21: Brazil Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Brazil Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Argentina Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Chile Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Chile Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Colombia Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Colombia Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Peru Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Peru Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Venezuela Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Venezuela Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Ecuador Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Ecuador Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Bolivia Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Bolivia Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 39: Paraguay Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Paraguay Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Video Surveillance Storage Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Latin America Video Surveillance Storage Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Dell Technologies Inc, Huawei Technologies Co Ltd, Seagate Technology LLC, D-Link, AXIS Communications, Wester Digital, Dahua Technology Co Ltd, Rasilient Systems Inc, Vivotek*List Not Exhaustive.

3. What are the main segments of the Latin America Video Surveillance Storage Market?

The market segments include Product Type, Deployment, Storage Media, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 198.51 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing. Data Analytics. and Cloud.

6. What are the notable trends driving market growth?

Solid State Drive (SSDs) is Expected to Register the Fastest Growth in the Market.

7. Are there any restraints impacting market growth?

The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing. Data Analytics. and Cloud.

8. Can you provide examples of recent developments in the market?

March 2024: ADATA Technology Co. Ltd revealed its plans to present its latest BiCS5 3D(e)TLC storage solutions, high DWPD SSDs, and high-performance/low-power industrial-grade ECC memory modules such as U-DIMM, SO-DIMM, and R-DIMM. These products have a wide operating temperature range, anti-sulfuration properties, enhanced durability, improved data security measures, moisture-proofing capabilities, and anti-fouling technology.December 2023: Seagate Technology Holdings PLC introduced the latest addition to their product line, the Seagate SkyHawk AI 24 TB hard disk drive (HDD) designed specifically for video and imaging applications (VIA). This new release comes after the successful launch of the Seagate Exos X24 24 TB conventional magnetic recording (CMR) hard drive, further catering to the growing demand for mass data storage in the edge security sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Video Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Video Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Video Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the Latin America Video Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence