Key Insights

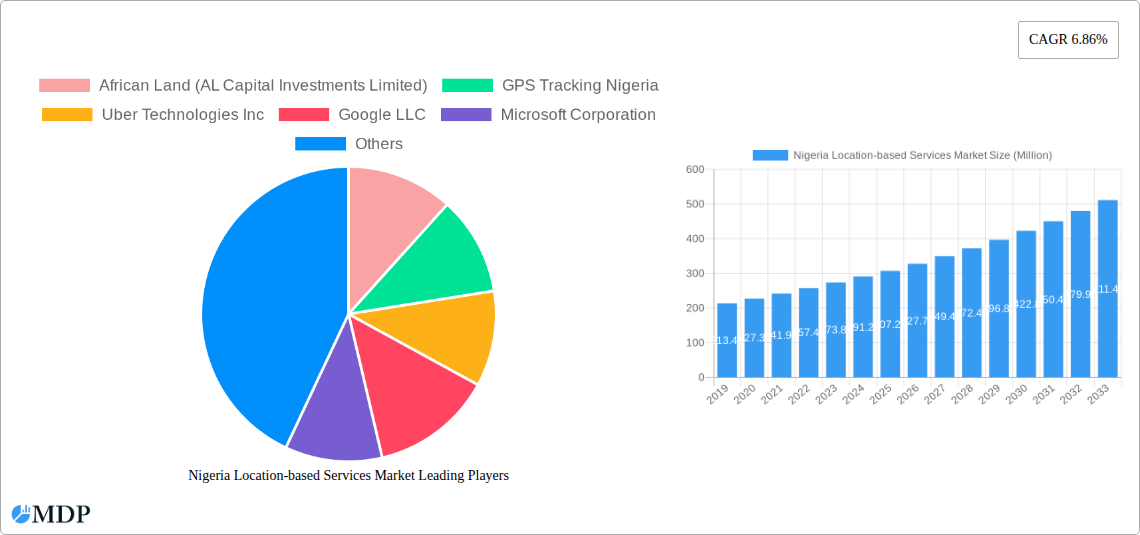

The Nigeria Location-based Services (LBS) Market is poised for substantial growth, projected to reach $307.27 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.86% over the forecast period. This expansion is primarily driven by the increasing adoption of mobile devices, the burgeoning e-commerce sector, and the critical need for enhanced logistics and fleet management solutions across various industries. The integration of LBS in transportation and logistics, manufacturing, and retail is a significant catalyst, enabling businesses to optimize operations, improve customer service, and gain a competitive edge through real-time tracking, navigation, and proximity-based marketing. The rise of smart city initiatives and the growing demand for location-aware applications in areas like public safety and resource management further bolster market prospects.

Nigeria Location-based Services Market Market Size (In Million)

The market landscape is characterized by a dynamic interplay of established tech giants and specialized LBS providers, all contributing to the innovation and expansion of services. Key trends include the proliferation of indoor LBS solutions for retail and industrial environments, the increasing demand for professional and managed LBS services for complex deployments, and the development of advanced analytics and AI-powered location intelligence. While growth is strong, potential restraints might include data privacy concerns and the need for robust infrastructure to support widespread LBS deployment. Nevertheless, the inherent value proposition of LBS in enhancing efficiency, safety, and customer engagement across Nigeria's diverse economic sectors ensures a positive and promising trajectory for the market.

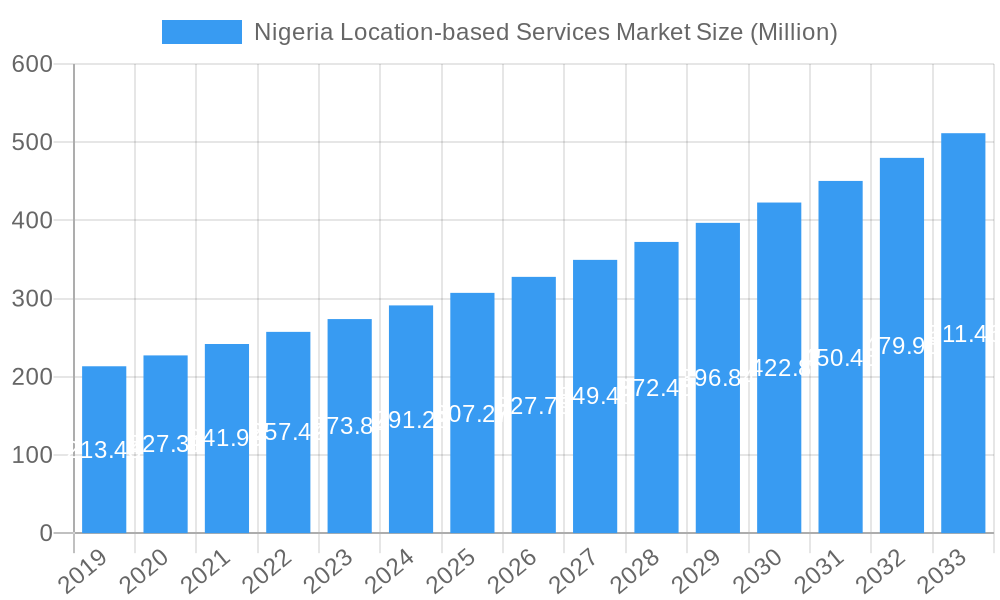

Nigeria Location-based Services Market Company Market Share

Nigeria Location-based Services Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock the potential of Nigeria's rapidly evolving Location-based Services (LBS) market with this in-depth report. Analyzing the period from 2019 to 2033, with a base year of 2025, this report provides a detailed examination of market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities. Leveraging high-traffic keywords such as "Nigeria LBS market," "location intelligence Nigeria," "GPS tracking Nigeria," "indoor positioning Nigeria," and "outdoor navigation Nigeria," this report is meticulously crafted to maximize search visibility and attract key industry stakeholders. Gain actionable insights into market concentration, innovation, regulatory landscapes, and the competitive strategies of leading players like Uber Technologies Inc., Google LLC, Microsoft Corporation, and HERE Technologies.

Nigeria Location-based Services Market Market Dynamics & Concentration

The Nigeria Location-based Services (LBS) market is characterized by moderate to high concentration, driven by a few dominant technology providers and increasingly by specialized LBS application developers. Innovation is a key differentiator, fueled by advancements in 5G deployment, IoT integration, and sophisticated AI algorithms that enhance accuracy and real-time data processing for both indoor and outdoor applications. Regulatory frameworks are still developing, with government initiatives focusing on data privacy, security, and the integration of LBS into smart city projects and national infrastructure development. Product substitutes are emerging, particularly in the realm of advanced mapping and analytics, challenging traditional LBS offerings. End-user trends indicate a growing demand for personalized location-based marketing, efficient logistics and transportation management, and enhanced safety features in automotive and public services. Mergers and Acquisitions (M&A) activities, while not yet at peak levels, are anticipated to increase as larger tech players seek to acquire niche LBS capabilities and expand their market footprint. The market share is currently fragmented, but key players are consolidating their positions through strategic partnerships and product innovation. M&A deal counts are expected to rise in the forecast period as companies look to strengthen their offerings in this dynamic sector.

Nigeria Location-based Services Market Industry Trends & Analysis

The Nigeria Location-based Services (LBS) market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing adoption of smartphones, widespread internet penetration, and the burgeoning demand for location-aware applications across various sectors. The ongoing digital transformation in Nigeria, coupled with government initiatives aimed at fostering innovation and smart city development, is creating a fertile ground for LBS expansion. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) with LBS platforms, are enabling more precise analytics, predictive modeling, and personalized user experiences. For instance, the use of AI in traffic prediction and route optimization is revolutionizing the transportation and logistics sector. Consumer preferences are shifting towards hyper-personalized services, with users expecting seamless integration of location data into their daily lives, from retail recommendations to navigation and social networking. The competitive dynamics of the market are intensifying, with global technology giants like Google and Apple vying for market dominance alongside local players and specialized service providers. The penetration of advanced LBS solutions, particularly in urban centers, is steadily increasing, driving demand for both indoor and outdoor positioning services. The proliferation of smart devices, including wearables and IoT sensors, is further expanding the scope and utility of LBS, creating new revenue streams and opportunities for market participants. The development of robust data infrastructure and the growing availability of high-quality geospatial data are also critical factors supporting the market's upward trajectory. The increasing need for precise asset tracking, supply chain visibility, and real-time monitoring in industries such as manufacturing and retail is also a significant growth driver.

Leading Markets & Segments in Nigeria Location-based Services Market

The Outdoor location segment currently dominates the Nigeria Location-based Services (LBS) market, driven by the widespread use of GPS-enabled devices and the high demand for navigation, tracking, and mapping services in transportation, logistics, and automotive sectors. The Transportation and Logistics end-user industry stands out as the largest consumer of LBS solutions, owing to the critical need for route optimization, fleet management, real-time tracking of goods, and efficient delivery operations across the country. Economic policies promoting trade and commerce, coupled with significant investments in infrastructure development, further bolster the growth of this segment.

- Dominance Drivers for Outdoor Location:

- Ubiquitous Smartphone Adoption: High smartphone penetration fuels the demand for outdoor navigation and location-based apps.

- Logistics and E-commerce Growth: The burgeoning e-commerce sector necessitates efficient outdoor tracking and delivery management.

- Fleet Management Solutions: Businesses rely heavily on LBS for tracking and managing their vehicle fleets for operational efficiency.

The Professional service type commands a significant market share within Nigeria's LBS landscape. This is attributed to the complex and specialized needs of businesses requiring custom LBS solutions for asset management, field force automation, and sophisticated geospatial analysis. The Automotive industry is another key segment, with increasing integration of LBS for navigation, advanced driver-assistance systems (ADAS), and in-car infotainment services.

- Dominance Drivers for Professional Service Type:

- Enterprise-Level Solutions: Businesses require tailored LBS for critical operations, driving demand for professional services.

- Custom Geospatial Analytics: Demand for specialized data analysis and insights for strategic decision-making.

- System Integration: Complex integration of LBS into existing business workflows and IT systems.

While Indoor location services are at an earlier stage of development compared to outdoor, they are projected for rapid growth, especially in sectors like retail for in-store analytics and customer engagement, and healthcare for asset and patient tracking. The Retail and Consumer Goods industry is showing increasing interest in LBS for personalized marketing, loyalty programs, and understanding customer footfall patterns. Government initiatives to develop smart infrastructure and enhance public safety also contribute to the overall market expansion across various end-user industries.

Nigeria Location-based Services Market Product Developments

Recent product developments in the Nigeria Location-based Services (LBS) market are focusing on enhanced accuracy, real-time data processing, and AI-driven insights. Companies are innovating in areas such as advanced indoor positioning systems that leverage Wi-Fi, Bluetooth, and inertial sensors for precise navigation within complex structures like shopping malls and airports. Outdoor LBS is seeing advancements in predictive traffic analysis and optimized routing algorithms, significantly improving efficiency for logistics and ride-sharing services. The integration of LBS with IoT devices is enabling sophisticated asset tracking and monitoring solutions across manufacturing and supply chains. Competitive advantages are being built through the development of user-friendly interfaces, robust data analytics platforms, and specialized LBS applications catering to niche industry needs, thereby increasing market fit and adoption.

Key Drivers of Nigeria Location-based Services Market Growth

Several key drivers are propelling the growth of the Nigeria Location-based Services (LBS) market. The rapid increase in smartphone penetration and mobile internet accessibility across the country is fundamental. This forms the bedrock for the widespread adoption of LBS applications. Furthermore, the burgeoning e-commerce sector and the associated demand for efficient logistics and delivery services are significant growth catalysts. Government initiatives supporting digital transformation and smart city development are also playing a crucial role. Investments in infrastructure, coupled with a growing awareness of the benefits of location intelligence in sectors like transportation, manufacturing, and retail, are further accelerating market expansion. Technological advancements, including the integration of AI and IoT, are enhancing the capabilities and appeal of LBS solutions.

Challenges in the Nigeria Location-based Services Market Market

Despite the promising growth trajectory, the Nigeria Location-based Services (LBS) market faces several challenges. Inconsistent and unreliable internet connectivity in certain regions can hinder the real-time functionality of LBS applications. The high cost of advanced LBS hardware and software can be a barrier for small and medium-sized enterprises (SMEs). Regulatory frameworks concerning data privacy and security are still evolving, creating uncertainty for businesses and consumers. Furthermore, a lack of skilled personnel proficient in developing and implementing sophisticated LBS solutions poses a significant challenge. Supply chain issues affecting the availability of specialized hardware components can also impact market growth.

Emerging Opportunities in Nigeria Location-based Services Market

Emerging opportunities in the Nigeria Location-based Services (LBS) market are abundant, driven by technological breakthroughs and evolving consumer needs. The increasing adoption of 5G technology promises to enhance the speed and reliability of LBS, enabling more sophisticated real-time applications. Strategic partnerships between LBS providers and mobile network operators, e-commerce platforms, and government agencies can unlock new market segments and revenue streams. The development of hyper-localized marketing campaigns and personalized customer experiences presents a significant opportunity for the retail and consumer goods sectors. Furthermore, the growing demand for smart city solutions, including intelligent transportation systems and public safety applications, offers vast potential for LBS integration and deployment across the country.

Leading Players in the Nigeria Location-based Services Market Sector

- African Land (AL Capital Investments Limited)

- GPS Tracking Nigeria

- Uber Technologies Inc

- Google LLC

- Microsoft Corporation

- Huawei Technologies Co Ltd

- Auto Tracker Nigeria

- HERE Technologies (HERE Global B V)

- Apple Inc

- GapMaps Pty Ltd

Key Milestones in Nigeria Location-based Services Market Industry

- July 2023: The Lagos State government commended Uber for introducing an in-trip emergency app help option for both drivers and passengers in the e-hailing industry. This development highlights the increasing focus on safety features and the supportive regulatory environment for the e-hailing sector.

- February 2023: The Nigerian Airspace Management Agency (NAMA) announced a collaboration with the Nigerian Communications Satellite Limited (NIGCOMSAT) to enhance its satellite-based navigation system (SBAS). This initiative is crucial for improving airspace safety, reducing operational costs for airlines, and providing precise guidance to pilots, impacting aviation LBS significantly.

Strategic Outlook for Nigeria Location-based Services Market Market

The strategic outlook for the Nigeria Location-based Services (LBS) market is highly positive, driven by a confluence of technological advancements, increasing digital adoption, and evolving consumer demands. Future market potential lies in the deeper integration of LBS with emerging technologies like 5G, AI, and IoT to offer more predictive and personalized services. Strategic opportunities include focusing on the development of robust indoor positioning solutions, expanding LBS applications in the healthcare and manufacturing sectors, and collaborating with government bodies on smart city initiatives. The growth of the fintech sector also presents avenues for location-based payment and fraud detection services. Continued investment in data analytics and the development of industry-specific LBS platforms will be crucial for sustained market leadership and expansion.

Nigeria Location-based Services Market Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Service Type

- 2.1. Professional

- 2.2. Managed

-

3. End-User Industry

- 3.1. Transportation and Logistics

- 3.2. Manufacturing

- 3.3. Retail and Consumer Goods

- 3.4. Automotive

- 3.5. Healthcare

- 3.6. Other End-User Industries

Nigeria Location-based Services Market Segmentation By Geography

- 1. Niger

Nigeria Location-based Services Market Regional Market Share

Geographic Coverage of Nigeria Location-based Services Market

Nigeria Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce and On-demand Delivery Services in the Country; Rapid Increase in Smartphone Adoption

- 3.3. Market Restrains

- 3.3.1. Concerns about Data Privacy and Security; Limited Access to high-speed internet in Some Regions

- 3.4. Market Trends

- 3.4.1. Rapid Increase in Smartphone Adoption to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Location-based Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Professional

- 5.2.2. Managed

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Transportation and Logistics

- 5.3.2. Manufacturing

- 5.3.3. Retail and Consumer Goods

- 5.3.4. Automotive

- 5.3.5. Healthcare

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 African Land (AL Capital Investments Limited)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GPS Tracking Nigeria

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uber Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Auto Tracker Nigeri

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HERE Technologies (HERE Global B V)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GapMaps Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 African Land (AL Capital Investments Limited)

List of Figures

- Figure 1: Nigeria Location-based Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria Location-based Services Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Location-based Services Market Revenue Million Forecast, by Location 2020 & 2033

- Table 2: Nigeria Location-based Services Market Volume K Unit Forecast, by Location 2020 & 2033

- Table 3: Nigeria Location-based Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Nigeria Location-based Services Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 5: Nigeria Location-based Services Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Nigeria Location-based Services Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 7: Nigeria Location-based Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Nigeria Location-based Services Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Nigeria Location-based Services Market Revenue Million Forecast, by Location 2020 & 2033

- Table 10: Nigeria Location-based Services Market Volume K Unit Forecast, by Location 2020 & 2033

- Table 11: Nigeria Location-based Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Nigeria Location-based Services Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 13: Nigeria Location-based Services Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Nigeria Location-based Services Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 15: Nigeria Location-based Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Nigeria Location-based Services Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Location-based Services Market?

The projected CAGR is approximately 6.86%.

2. Which companies are prominent players in the Nigeria Location-based Services Market?

Key companies in the market include African Land (AL Capital Investments Limited), GPS Tracking Nigeria, Uber Technologies Inc, Google LLC, Microsoft Corporation, Huawei Technologies Co Ltd, Auto Tracker Nigeri, HERE Technologies (HERE Global B V), Apple Inc, GapMaps Pty Ltd.

3. What are the main segments of the Nigeria Location-based Services Market?

The market segments include Location, Service Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 307.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce and On-demand Delivery Services in the Country; Rapid Increase in Smartphone Adoption.

6. What are the notable trends driving market growth?

Rapid Increase in Smartphone Adoption to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Concerns about Data Privacy and Security; Limited Access to high-speed internet in Some Regions.

8. Can you provide examples of recent developments in the market?

July 2023: The Lagos State government commended Uber for introducing an in-trip emergency app help option for both drivers and passengers in the e-hailing industry. Speaking at the launch of Uber's new safety features in Lagos, Mr. Lanre Mojola, the Director General of the Lagos State Safety Commission, affirmed the commitment of Governor Babajide Sanwo-Olu's administration to foster an enabling environment for the e-hailing industry's growth in line with the THEMES agenda.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Location-based Services Market?

To stay informed about further developments, trends, and reports in the Nigeria Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence