Key Insights

The global Spa & Salon Software market is poised for significant expansion, with an estimated market size of USD 0.91 Million in 2025, driven by a robust CAGR of 10.90%. This projected growth is largely fueled by the increasing adoption of digital solutions across the beauty and wellness industry, aiming to streamline operations, enhance customer experiences, and boost revenue. Key drivers include the growing demand for personalized beauty services, the rise of independent beauty professionals and small businesses seeking cost-effective management tools, and the need for large enterprises to optimize complex scheduling, inventory, and client relationship management. The trend towards integrated cloud-based solutions is particularly strong, offering scalability, accessibility, and advanced analytics. Furthermore, the growing emphasis on customer retention through loyalty programs and targeted marketing, facilitated by sophisticated software, is a major growth catalyst.

Spa & Salon Software Industry Market Size (In Million)

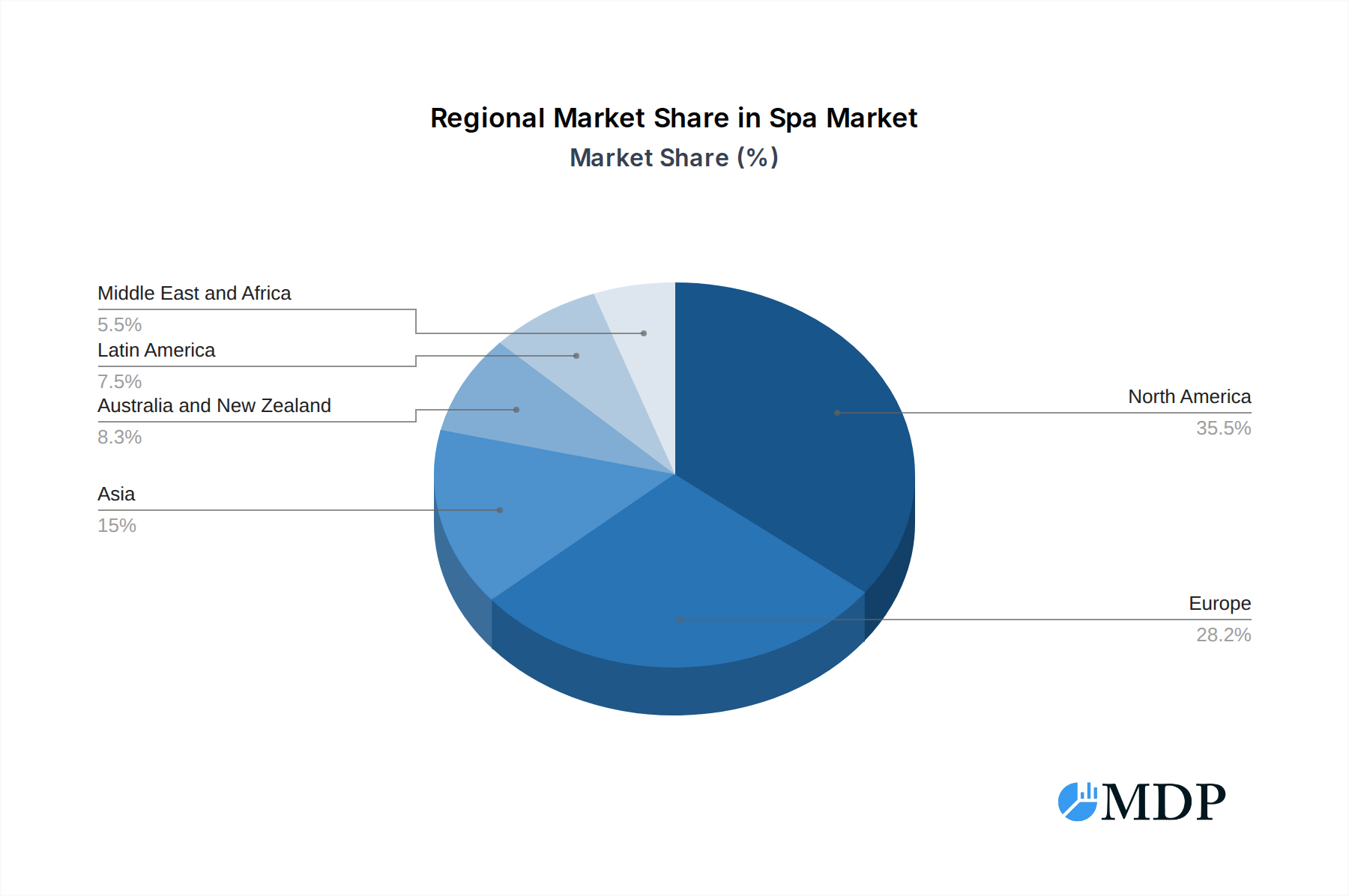

The market's expansion will also be influenced by emerging economies and the increasing disposable income that allows for greater spending on spa and salon services. While the adoption of on-premise solutions will continue for some organizations with specific security or control requirements, the agility and cost-effectiveness of cloud deployments are expected to dominate. Restraints such as the initial cost of software implementation for smaller businesses and concerns over data security, though diminishing with advancements in cybersecurity, are factors that market players need to address. Segmentation analysis indicates substantial opportunities across small and individual professionals, medium enterprises, and large enterprises, each with unique software needs. Geographically, North America is expected to lead, followed by Europe and the rapidly growing Asia-Pacific region, as digital transformation gains momentum globally.

Spa & Salon Software Industry Company Market Share

Spa & Salon Software Industry Market Dynamics & Concentration

The global Spa & Salon Software market is characterized by a dynamic interplay of innovation, increasing end-user adoption, and evolving regulatory landscapes. Market concentration is moderate, with several key players vying for dominance. Innovation drivers are primarily fueled by the demand for enhanced customer experience, streamlined operational efficiency, and robust data analytics. For instance, the integration of AI-powered recommendation engines and personalized marketing tools significantly contributes to this innovation. Regulatory frameworks, while generally supportive of business growth, are increasingly focusing on data privacy and security, impacting software development and deployment strategies. Product substitutes, such as manual management systems and fragmented software solutions, are gradually being phased out as the benefits of integrated spa and salon software become more apparent. End-user trends highlight a strong preference for cloud-based solutions offering scalability, accessibility, and reduced IT overhead. Mobile accessibility and contactless payment integrations are also critical adoption drivers. Mergers and Acquisition (M&A) activities are prevalent, driven by the pursuit of market consolidation, expanded service offerings, and accelerated technological integration. The number of M&A deals in the historical period (2019-2024) is estimated to be around 100+, with strategic acquisitions by larger players aiming to absorb innovative technologies and customer bases. Market share is distributed, with leading providers holding significant portions, but the fragmented nature of the industry still allows for substantial opportunities for niche players.

Spa & Salon Software Industry Industry Trends & Analysis

The Spa & Salon Software industry is poised for robust growth, driven by a confluence of transformative trends. The increasing demand for personalized customer experiences is a primary market growth driver. Consumers now expect tailored recommendations, appointment reminders, and loyalty programs, all of which are efficiently managed by advanced spa and salon software. Technological disruptions, particularly the widespread adoption of cloud computing and mobile applications, are revolutionizing how businesses operate. Cloud-based solutions offer unparalleled scalability, accessibility from any device, and reduced infrastructure costs, making them attractive to businesses of all sizes. AI and machine learning are increasingly being integrated to automate tasks, provide predictive analytics for customer behavior, and personalize marketing efforts. The market penetration of sophisticated spa and salon management software is expected to witness a significant surge. Consumer preferences are shifting towards convenience and seamless digital interactions. This includes online booking systems, digital payment options, and virtual consultations. The rise of the gig economy and an increasing number of independent beauty professionals and small salon owners are also contributing to market expansion, as these entities seek cost-effective and user-friendly solutions to manage their operations. Competitive dynamics are intensifying, with established players continuously innovating and new entrants emerging with specialized solutions. The overall Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be substantial, estimated at approximately 12% to 15%, reflecting the industry's strong upward trajectory. This growth is further propelled by the growing awareness among spa and salon owners about the significant operational efficiencies and revenue-boosting capabilities offered by integrated software platforms.

Leading Markets & Segments in Spa & Salon Software Industry

North America currently represents the dominant region in the Spa & Salon Software industry, driven by a mature beauty and wellness sector and high adoption rates of advanced technological solutions. Within North America, the United States leads in market penetration, fueled by a large consumer base and a robust ecosystem of spa and salon businesses. The segment of Medium Enterprises is exhibiting particularly strong growth, as these businesses leverage sophisticated software to manage multiple locations, complex scheduling, and detailed customer data. However, the Small and Individual Professionals segment remains a significant and rapidly expanding market. This is due to the increasing number of independent practitioners and small boutique salons recognizing the necessity of digital tools for efficiency and competitiveness.

Cloud deployment is the prevailing and fastest-growing deployment model. Key drivers for this dominance include its inherent scalability, accessibility from anywhere at any time, and lower upfront investment compared to on-premise solutions. Cloud-based platforms also facilitate easier updates and maintenance, reducing the IT burden on businesses.

Key Drivers for Segment Dominance:

- Economic Policies: Favorable business environments and incentives for small business adoption of technology in regions like the United States bolster the growth of the Small and Individual Professionals segment.

- Infrastructure: Widespread internet penetration and reliable connectivity are critical enablers for the widespread adoption of cloud-based solutions, benefiting all enterprise sizes.

- Consumer Demand: A growing consumer appetite for convenient online booking, personalized services, and seamless digital payment experiences directly translates into demand for advanced software features, particularly benefiting medium enterprises seeking to enhance customer engagement.

- Technological Advancements: The continuous evolution of mobile technology and cloud infrastructure makes sophisticated software solutions more accessible and affordable, further driving adoption across all enterprise sizes, with a particular impact on the efficiency of medium enterprises and the professionalization of small businesses.

The market is witnessing a gradual shift, with on-premise solutions becoming less popular due to their inflexibility and higher maintenance costs, further solidifying the dominance of cloud deployments across all enterprise segments.

Spa & Salon Software Industry Product Developments

Recent product developments in the Spa & Salon Software industry are heavily focused on enhancing user experience, automating administrative tasks, and providing deeper insights into business performance. Innovations include the integration of AI-powered chatbots for customer inquiries and appointment booking, sophisticated marketing automation tools for personalized client outreach, and advanced analytics dashboards that offer real-time data on sales, customer retention, and inventory management. Many platforms are now offering comprehensive loyalty program management features and seamless integration with e-commerce capabilities, allowing salons to sell products online. The emphasis is on creating an all-in-one solution that streamlines operations from appointment scheduling and payment processing to client relationship management and staff performance tracking. Competitive advantages are being carved out through intuitive user interfaces, mobile-first design, and specialized features tailored to the unique needs of different beauty and wellness services.

Key Drivers of Spa & Salon Software Industry Growth

The Spa & Salon Software industry's growth is propelled by several critical factors. Technological advancements, particularly the widespread adoption of cloud computing and mobile technologies, have made sophisticated management tools accessible and affordable. The increasing demand for enhanced customer experience necessitates software that can manage online bookings, personalized marketing, and loyalty programs. Growing entrepreneurialism within the beauty and wellness sector, with more individuals starting independent practices and small salons, fuels the need for efficient, user-friendly software solutions. Furthermore, the operational inefficiencies of manual management are becoming increasingly apparent, driving adoption of digital solutions for better scheduling, payment processing, and client data management. The market is also benefiting from the digital transformation initiatives across various industries, including the service sector.

Challenges in the Spa & Salon Software Industry Market

Despite the strong growth trajectory, the Spa & Salon Software industry faces several challenges. High initial investment and implementation costs can be a barrier for some smaller businesses, particularly those with limited capital. Resistance to change and adoption of new technology among established practitioners who are accustomed to traditional methods can also hinder market penetration. Data security and privacy concerns are paramount, and ensuring compliance with evolving regulations like GDPR and CCPA requires continuous investment and vigilance from software providers. Intense competition among numerous software vendors, some offering highly specialized solutions, can lead to market fragmentation and make it difficult for businesses to choose the most suitable platform. Integration complexities with existing systems and third-party applications can also present technical hurdles.

Emerging Opportunities in Spa & Salon Software Industry

Emerging opportunities within the Spa & Salon Software industry are significant and multifaceted. The growing trend of personalization and AI-driven customer engagement presents a vast avenue for innovation, with opportunities to develop more sophisticated recommendation engines and tailored marketing campaigns. The integration of telehealth and virtual consultations for certain beauty and wellness services offers a new service delivery model that software can support. Strategic partnerships between software providers and complementary service providers (e.g., product suppliers, training academies) can unlock new revenue streams and expand market reach. Furthermore, the untapped potential in emerging economies and underserved markets represents a substantial growth opportunity for scalable and affordable spa and salon software solutions. The continuous development of mobile-first solutions catering to the on-the-go nature of many beauty professionals also presents a key area for expansion.

Leading Players in the Spa & Salon Software Industry Sector

- DaySmart Software

- Simple Spa

- Salonist io

- Millennium Systems International

- Vagaro Inc

- MindBody Inc

- Springer-Miller Systems

- Zenoti (Soham Inc)

- Waffor Inc

- Phorest Salon Software

Key Milestones in Spa & Salon Software Industry Industry

- Apr 2022: Tippy announced an embedded workforce payments platform with Branch to launch an all-in-one solution for acquiring and disbursing cashless tips. Tippy and Branch's integrated solution aims to optimize the entire tipping experience, from the customer's wallet to the service professional's wallet.

- Jan 2022: Salon management software startup, Glamplus, raised USD 700,000 in a Pre-Series A round from Blume Ventures, Ramakant Sharma (COO- Livspace), and participation from existing investors IPV. The company clarified that the funds raised would be utilized in vertical tech SAAS capabilities and expand the B2B marketplace business to 10,000 partners.

Strategic Outlook for Spa & Salon Software Industry Market

The strategic outlook for the Spa & Salon Software industry is overwhelmingly positive, driven by continued technological innovation and an increasing reliance on digital solutions within the beauty and wellness sector. Key growth accelerators include the further integration of AI and machine learning for predictive analytics and personalized customer journeys, the expansion of integrated payment and booking systems, and the development of more comprehensive loyalty and marketing automation tools. Strategic opportunities lie in catering to the evolving needs of independent professionals and small businesses with affordable, scalable solutions, as well as expanding into new geographic markets. Furthermore, strategic partnerships and potential mergers and acquisitions will continue to shape the competitive landscape, driving consolidation and fostering the development of more robust, all-encompassing software platforms that empower spa and salon businesses to thrive in an increasingly digital world.

Spa & Salon Software Industry Segmentation

-

1. Size of the Enterprise

- 1.1. Small and Individual Professionals

- 1.2. Medium Enterprises

- 1.3. Large Enterprise

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

Spa & Salon Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

-

3. Asia

- 3.1. India

- 3.2. China

- 3.3. Japan

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Spa & Salon Software Industry Regional Market Share

Geographic Coverage of Spa & Salon Software Industry

Spa & Salon Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Healthy and Standard Lifestyle; Automation in Business Processes

- 3.3. Market Restrains

- 3.3.1. Requirement of Frequent Maintenance; Growing Customization Demands (Frequent Modification in Design Required according to Fluid Properties)

- 3.4. Market Trends

- 3.4.1. Cloud-based Software to Gain Maximum Market Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 5.1.1. Small and Individual Professionals

- 5.1.2. Medium Enterprises

- 5.1.3. Large Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 6. North America Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 6.1.1. Small and Individual Professionals

- 6.1.2. Medium Enterprises

- 6.1.3. Large Enterprise

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 7. Europe Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 7.1.1. Small and Individual Professionals

- 7.1.2. Medium Enterprises

- 7.1.3. Large Enterprise

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 8. Asia Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 8.1.1. Small and Individual Professionals

- 8.1.2. Medium Enterprises

- 8.1.3. Large Enterprise

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 9. Australia and New Zealand Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 9.1.1. Small and Individual Professionals

- 9.1.2. Medium Enterprises

- 9.1.3. Large Enterprise

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 10. Latin America Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 10.1.1. Small and Individual Professionals

- 10.1.2. Medium Enterprises

- 10.1.3. Large Enterprise

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 11. Middle East and Africa Spa & Salon Software Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 11.1.1. Small and Individual Professionals

- 11.1.2. Medium Enterprises

- 11.1.3. Large Enterprise

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.1. Market Analysis, Insights and Forecast - by Size of the Enterprise

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DaySmart Software

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Simple Spa

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Salonist io

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Millennium Systems International*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Vagaro Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MindBody Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Springer-Miller Systems

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Zenoti (Soham Inc )

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Waffor Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Phorest Salon Software

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 DaySmart Software

List of Figures

- Figure 1: Spa & Salon Software Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spa & Salon Software Industry Share (%) by Company 2025

List of Tables

- Table 1: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 2: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Spa & Salon Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 5: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Spa & Salon Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 10: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Spa & Salon Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 16: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 17: Spa & Salon Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: India Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: China Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Spa & Salon Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 22: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Spa & Salon Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 25: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 26: Spa & Salon Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Spa & Salon Software Industry Revenue Million Forecast, by Size of the Enterprise 2020 & 2033

- Table 28: Spa & Salon Software Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 29: Spa & Salon Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spa & Salon Software Industry?

The projected CAGR is approximately 10.90%.

2. Which companies are prominent players in the Spa & Salon Software Industry?

Key companies in the market include DaySmart Software, Simple Spa, Salonist io, Millennium Systems International*List Not Exhaustive, Vagaro Inc, MindBody Inc, Springer-Miller Systems, Zenoti (Soham Inc ), Waffor Inc, Phorest Salon Software.

3. What are the main segments of the Spa & Salon Software Industry?

The market segments include Size of the Enterprise, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Healthy and Standard Lifestyle; Automation in Business Processes.

6. What are the notable trends driving market growth?

Cloud-based Software to Gain Maximum Market Traction.

7. Are there any restraints impacting market growth?

Requirement of Frequent Maintenance; Growing Customization Demands (Frequent Modification in Design Required according to Fluid Properties).

8. Can you provide examples of recent developments in the market?

Apr 2022: Tippy announced that it has an embedded workforce payments platform Branch to launch an all-in-one solution for acquiring and disbursing cashless tips. Tippy and Branch's integrated solution aims to optimize the entire tipping experience, from the customer's wallet to the service professional's wallet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spa & Salon Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spa & Salon Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spa & Salon Software Industry?

To stay informed about further developments, trends, and reports in the Spa & Salon Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence