Key Insights

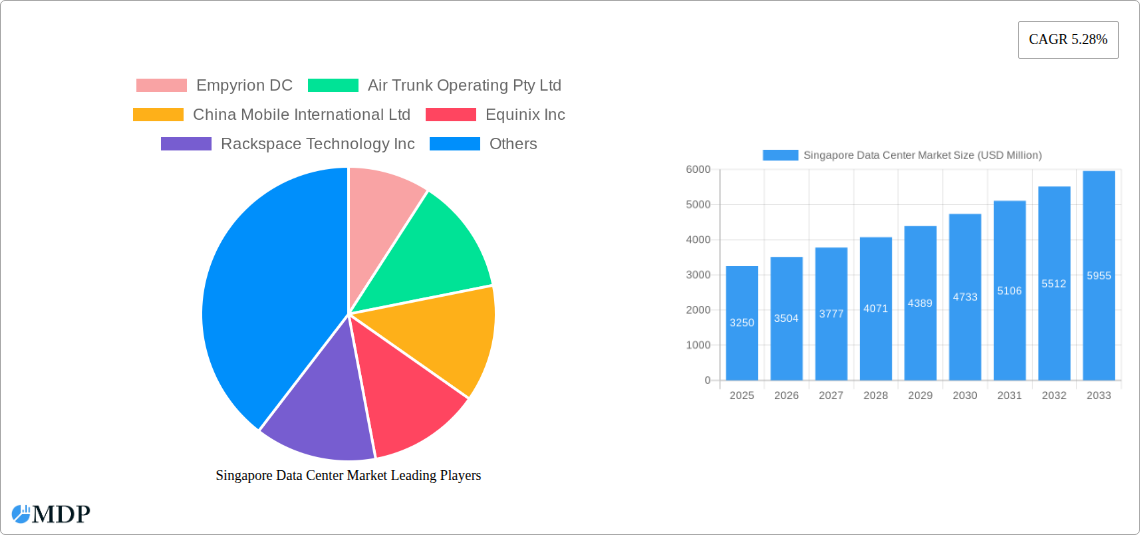

The Singapore Data Center Market is poised for robust expansion, projected to reach a significant USD 3.25 billion in 2025 and experience a compelling CAGR of 7.84% through 2033. This growth is fundamentally driven by the escalating demand for digital infrastructure, fueled by rapid cloud adoption across various sectors. The burgeoning e-commerce landscape, the increasing digitization efforts within the BFSI and government sectors, and the continuous expansion of the media and entertainment industry are key catalysts. Furthermore, the proliferation of 5G networks and the burgeoning IoT ecosystem necessitate more advanced and scalable data center solutions, thereby contributing to market expansion. The strategic geographical location of Singapore, coupled with its status as a leading digital hub in Asia, continues to attract significant investments, further bolstering the market's upward trajectory.

Singapore Data Center Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. East and West Singapore are identified as key hotspots, likely due to existing infrastructure and connectivity. The demand for data center capacity is diversifying, with significant growth expected across all size segments from Small to Mega, indicating a need for flexible solutions catering to various enterprise requirements. The increasing complexity and criticality of data underscore the importance of higher-tier facilities, with a notable shift towards Tier 3 and Tier 4 certifications driving infrastructure upgrades. While robust demand exists, potential restraints may include the escalating operational costs associated with power consumption and the ongoing need for skilled talent. However, the sustained investment in advanced cooling technologies and energy-efficient designs are expected to mitigate these challenges, ensuring continued growth and innovation within the Singapore data center market.

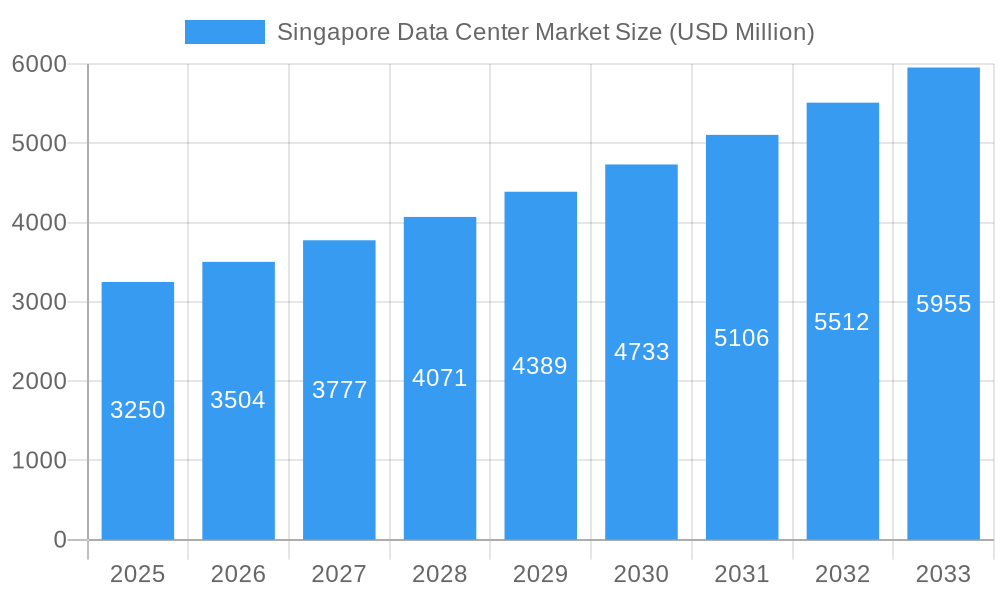

Singapore Data Center Market Company Market Share

Singapore Data Center Market: Comprehensive Industry Analysis, Trends, and Forecasts (2019-2033)

This in-depth report provides a definitive analysis of the Singapore Data Center Market, offering unparalleled insights into its dynamics, trends, and future trajectory. Delving into historical data from 2019-2024 and projecting growth through 2033, this study is an indispensable resource for data center operators, investors, technology providers, cloud service providers, and end-users seeking to capitalize on the region's burgeoning digital infrastructure demands. With a focus on high-traffic keywords such as "Singapore data center," "hyperscale data centers," "colocation Singapore," "data center investment," "cloud infrastructure Singapore," and "digital transformation APAC," this report ensures maximum visibility and engagement for all industry stakeholders. We cover market size in billions, CAGR, M&A activities, and crucial developments.

Singapore Data Center Market Market Dynamics & Concentration

The Singapore Data Center Market is characterized by a dynamic interplay of innovation, robust regulatory frameworks, and evolving end-user demands. Market concentration is observed among key players, with a significant portion of the market share held by established hyperscale operators and colocation providers. Innovation drivers include the relentless pursuit of energy efficiency, advanced cooling technologies, and the integration of AI and machine learning for operational optimization. Regulatory frameworks, particularly those concerning data sovereignty and environmental sustainability, are shaping investment decisions and operational strategies. Product substitutes, while evolving, largely remain within the realm of on-premises solutions, though the agility and scalability of cloud services continue to drive demand for outsourced data center capacity. End-user trends indicate a strong shift towards cloud adoption, BFSI, and e-commerce, with increasing investments from government and manufacturing sectors seeking to leverage digital infrastructure for growth. Mergers and acquisitions (M&A) activities are a prominent feature, reflecting consolidation and strategic expansion within the market, with approximately 5 major M&A deals observed during the historical period.

- Market Concentration: Dominated by a few large hyperscale providers and colocation specialists.

- Innovation Drivers: Energy efficiency, advanced cooling, AI/ML integration.

- Regulatory Frameworks: Data sovereignty, environmental sustainability, security compliance.

- Product Substitutes: On-premises infrastructure versus scalable cloud solutions.

- End-User Trends: Rapid growth in Cloud, BFSI, E-commerce, with increasing interest from Government and Manufacturing.

- M&A Activities: Active consolidation and strategic partnerships.

Singapore Data Center Market Industry Trends & Analysis

The Singapore Data Center Market is experiencing an unprecedented growth trajectory, driven by its strategic location, government support for digital transformation, and a robust ecosystem of technology providers and service integrators. The market's expansion is fueled by the escalating demand for digital services across various sectors, including cloud computing, Artificial Intelligence, and the Internet of Things (IoT). A significant Compound Annual Growth Rate (CAGR) is projected for the forecast period, underscoring the market's potential. Technological disruptions are a constant, with advancements in power management, high-density computing, and liquid cooling technologies enabling data centers to operate more efficiently and sustainably. Consumer preferences are increasingly leaning towards hyperscale solutions and specialized colocation facilities that offer high levels of reliability, security, and connectivity. The competitive dynamics are intense, with global players vying for market share alongside local enterprises, fostering an environment of continuous innovation and service enhancement. The market penetration of advanced data center solutions is rapidly increasing, reflecting the maturity of Singapore's digital infrastructure landscape. The estimated market size for Singapore's data center sector is projected to reach over $10 billion by 2025, with continued robust growth anticipated.

Leading Markets & Segments in Singapore Data Center Market

The Singapore Data Center Market exhibits distinct dominance across several key segments, driven by a confluence of factors including economic policies, advanced infrastructure, and specific industry demands. East Singapore emerges as a dominant hotspot due to its proximity to key business districts and established telecommunications infrastructure, facilitating low-latency connectivity crucial for high-frequency trading and cloud services. Within data center size, Mega and Large facilities are leading the charge, catering to the insatiable demands of hyperscale cloud providers and large enterprises requiring massive capacity and scalability. The Tier 3 and Tier 4 classifications are paramount, reflecting the critical need for high availability, fault tolerance, and robust power and cooling systems essential for mission-critical applications in sectors like BFSI and government. The Cloud end-user segment holds the lion's share of demand, driven by the global migration to cloud-based services. However, the BFSI, E-Commerce, and Telecom sectors are also significant contributors, requiring specialized infrastructure for their complex operations and high transaction volumes.

- Hotspot Dominance: East Singapore leads due to superior connectivity and proximity to business hubs.

- Data Center Size Leadership: Mega and Large facilities are crucial for hyperscale deployments and enterprise scalability.

- Key Drivers: Demand for high-density computing, scalability for growth.

- Tier Type Prevalence: Tier 3 and Tier 4 are essential for mission-critical operations and high availability.

- Key Drivers: Regulatory compliance, business continuity, risk mitigation.

- End User Dominance: Cloud is the primary driver, followed closely by BFSI, E-Commerce, and Telecom.

- Key Drivers: Digital transformation initiatives, consumer behavior shifts, industry-specific needs for data processing and storage.

- Absorption: While non-utilized capacity exists, strategic planning for future demand ensures sustained growth.

Singapore Data Center Market Product Developments

Product development in the Singapore Data Center Market is intensely focused on enhancing efficiency, sustainability, and performance. Innovations in liquid cooling solutions are becoming increasingly prevalent, allowing for higher rack densities and improved thermal management, essential for advanced computing workloads. Furthermore, the integration of AI and machine learning into data center management systems is enabling predictive maintenance, optimized energy consumption, and enhanced security protocols. The development of modular and prefabricated data center components is also gaining traction, offering faster deployment times and greater flexibility to meet rapidly evolving market demands. These advancements provide a significant competitive advantage by enabling operators to offer more sophisticated, cost-effective, and environmentally responsible solutions.

Key Drivers of Singapore Data Center Market Growth

The Singapore Data Center Market is propelled by several interconnected growth drivers. The rapid expansion of cloud computing services, fueled by digital transformation initiatives across all industries, is a primary catalyst. The government's commitment to fostering a robust digital economy, including attractive incentives and policies, further bolsters investment. Increasing demand for AI and big data analytics necessitates advanced infrastructure for processing and storage. Furthermore, Singapore's strategic position as a regional hub for connectivity and business operations attracts global enterprises seeking reliable and secure data center solutions. The growing trend of data localization also contributes to the demand for local data center capacity.

Challenges in the Singapore Data Center Market Market

Despite its robust growth, the Singapore Data Center Market faces several challenges. One significant hurdle is the increasing scarcity and rising cost of land, coupled with stringent planning regulations. The intense competition among providers also puts pressure on pricing and profitability. Furthermore, the growing emphasis on environmental sustainability presents challenges in managing energy consumption and water usage, requiring continuous investment in green technologies. Supply chain disruptions for specialized equipment and skilled labor shortages can also impede expansion efforts.

Emerging Opportunities in Singapore Data Center Market

Emerging opportunities in the Singapore Data Center Market are abundant, driven by technological breakthroughs and strategic market expansion. The burgeoning demand for edge computing solutions, driven by the proliferation of IoT devices and the need for low-latency processing, presents a significant growth avenue. Strategic partnerships between data center operators, cloud providers, and telecommunications companies are crucial for developing integrated ecosystems. Furthermore, the increasing adoption of renewable energy sources and sustainable cooling technologies creates opportunities for environmentally conscious operators to differentiate themselves and attract a growing segment of clients. The continued growth of AI and machine learning workloads will also spur demand for specialized, high-performance data center infrastructure.

Leading Players in the Singapore Data Center Market Sector

- Empyrion DC

- Air Trunk Operating Pty Ltd

- China Mobile International Ltd

- Equinix Inc

- Rackspace Technology Inc

- 1-Net Singapore Pte Ltd (Mediacorp)

- PhoenixNAP

- Princeton Digital Group

- Cyxtera Technologies

- Digital Realty Trust Inc

- Global Switch Holdings Limited

Key Milestones in Singapore Data Center Market Industry

- November 2022: AirTrunk completed the final phase of SGP1 data center, expanding its total capacity to more than 78 MW, enabling hyperscale capacity deployment at unprecedented speed and scale.

- September 2022: Equinix, Inc. announced a partnership with the Centre for Energy Research & Technology (CERT) under the National University of Singapore's (NUS) College of Design and Engineering to explore hydrogen as a green fuel source for mission-critical data center infrastructure.

- June 2022: phoenixNAP announced a partnership with Pliops, a leading provider of data processors for cloud and enterprise data centers, to deliver on-demand cloud services for performance-sensitive users.

Strategic Outlook for Singapore Data Center Market Market

The strategic outlook for the Singapore Data Center Market remains exceptionally positive. Continued investment in hyperscale facilities, driven by global cloud providers, will remain a cornerstone of growth. The increasing adoption of edge computing and specialized data solutions for AI and IoT applications presents significant expansion opportunities. Strategic collaborations among stakeholders will be crucial for optimizing connectivity, power infrastructure, and service offerings. Furthermore, a strong emphasis on sustainability and the adoption of green technologies will be a key differentiator and a driver of long-term market success, ensuring Singapore's continued prominence as a leading digital hub in Asia.

Singapore Data Center Market Segmentation

-

1. Hotspot

- 1.1. East Singapore

- 1.2. West Singapore

- 1.3. Rest of Singapore

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1

- 3.2. Tier 2

- 3.3. Tier 3

- 3.4. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. End User

- 5.1. Cloud

- 5.2. BFSI

- 5.3. E-Commerce

- 5.4. Government

- 5.5. Manufacturing

- 5.6. Media & Entertainment

- 5.7. Telecom

- 5.8. Other End User

Singapore Data Center Market Segmentation By Geography

- 1. Singapore

Singapore Data Center Market Regional Market Share

Geographic Coverage of Singapore Data Center Market

Singapore Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Energy Consumption Control

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. East Singapore

- 5.1.2. West Singapore

- 5.1.3. Rest of Singapore

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1

- 5.3.2. Tier 2

- 5.3.3. Tier 3

- 5.3.4. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Cloud

- 5.5.2. BFSI

- 5.5.3. E-Commerce

- 5.5.4. Government

- 5.5.5. Manufacturing

- 5.5.6. Media & Entertainment

- 5.5.7. Telecom

- 5.5.8. Other End User

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Empyrion DC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Air Trunk Operating Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Mobile International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equinix Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rackspace Technology Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 1-Net Singapore Pte Ltd (Mediacorp)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PhoenixNAP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Princeton Digital Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cyxtera Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Digital Realty Trust Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Global Switch Holdings Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Empyrion DC

List of Figures

- Figure 1: Singapore Data Center Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Singapore Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 2: Singapore Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Singapore Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 4: Singapore Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Singapore Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 6: Singapore Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Singapore Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Singapore Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Singapore Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Singapore Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Singapore Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Singapore Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: Singapore Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 14: Singapore Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 15: Singapore Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 16: Singapore Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 17: Singapore Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 18: Singapore Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 19: Singapore Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 20: Singapore Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 21: Singapore Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Singapore Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Singapore Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Singapore Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Data Center Market?

The projected CAGR is approximately 7.84%.

2. Which companies are prominent players in the Singapore Data Center Market?

Key companies in the market include Empyrion DC, Air Trunk Operating Pty Ltd, China Mobile International Ltd, Equinix Inc, Rackspace Technology Inc, 1-Net Singapore Pte Ltd (Mediacorp), PhoenixNAP, Princeton Digital Group, Cyxtera Technologies, Digital Realty Trust Inc, Global Switch Holdings Limited.

3. What are the main segments of the Singapore Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Energy Consumption Control.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Risk Associated with Data.

8. Can you provide examples of recent developments in the market?

November 2022: AirTrunk completed the final phase of SGP1 data center expanding the total capacity of the data center to more than 78 MW to deploy hyperscale capacity at at unprecedented speed and scale.September 2022: Equinix, Inc. announced a partnership with the Centre for Energy Research & Technology (CERT) under the National University of Singapore's (NUS) College of Design and Engineering to explore technologies that enable the use of hydrogen as a green fuel source for mission-critical data center infrastructure.June 2022: phoenixNAP announced that it has entered into a partnership with Pliops, a leading provider of data processors for cloud and enterprise data centers. Through this collaboration, phoenixNAP will delivers on-demand cloud services that meet the needs of performance-sensitive users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Data Center Market?

To stay informed about further developments, trends, and reports in the Singapore Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence