Key Insights

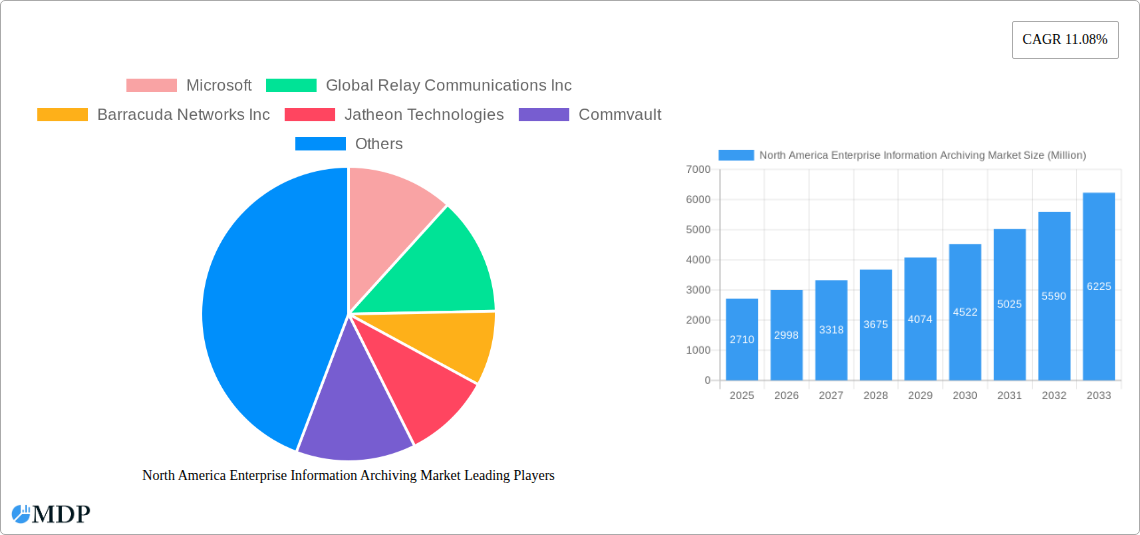

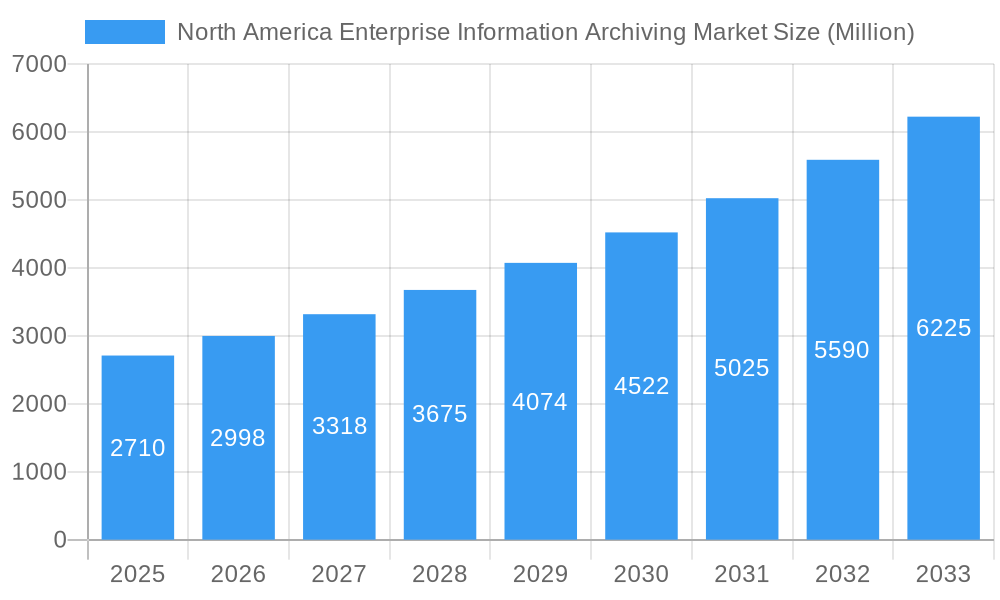

The North America Enterprise Information Archiving Market is poised for significant expansion, projected to reach $2.71 Billion by 2025, driven by a robust CAGR of 11.08% through 2033. This substantial growth is fueled by an increasing volume of unstructured data generated across industries, stringent regulatory compliance demands, and the growing need for effective data governance and e-discovery capabilities. Businesses are increasingly recognizing the critical role of enterprise information archiving in safeguarding sensitive data, ensuring business continuity, and enabling efficient data retrieval for legal and operational purposes. The market is witnessing a pronounced shift towards cloud-based archiving solutions, attributed to their scalability, cost-effectiveness, and ease of deployment, especially for Small and Medium-sized Enterprises (SMEs). Key market drivers include the escalating need for data security and privacy, the rise of remote work environments, and the continuous evolution of data management technologies that enhance searchability and analytics.

North America Enterprise Information Archiving Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established technology giants and specialized archiving solution providers. Prominent players like Microsoft, Google, Commvault, and Veritas are actively innovating their offerings, focusing on integrated solutions that encompass archiving, backup, and data analytics. Emerging trends include the adoption of artificial intelligence (AI) and machine learning (ML) for intelligent data classification, automated retention policy management, and advanced threat detection within archived data. However, challenges such as the high initial investment costs for certain on-premises solutions and concerns regarding data sovereignty and vendor lock-in present potential restraints. Despite these hurdles, the overall outlook for the North America Enterprise Information Archiving Market remains highly positive, with sustained demand expected across diverse end-user industries including BFSI, IT and Telecom, Healthcare, and Government sectors.

North America Enterprise Information Archiving Market Company Market Share

North America Enterprise Information Archiving Market: Unveiling Growth Strategies & Key Trends (2019-2033)

This comprehensive report delves into the dynamic North America Enterprise Information Archiving Market, offering an in-depth analysis of market dynamics, key trends, leading segments, product developments, growth drivers, challenges, opportunities, and the competitive landscape. Covering the historical period from 2019 to 2024 and a forecast period extending to 2033, with a base and estimated year of 2025, this report provides actionable insights for stakeholders seeking to navigate and capitalize on this rapidly evolving sector. The market is projected to reach USD XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period.

North America Enterprise Information Archiving Market Market Dynamics & Concentration

The North America Enterprise Information Archiving market is characterized by a moderate to high level of concentration, with major players like Microsoft, Global Relay Communications Inc., Barracuda Networks Inc., Commvault, and Open Text Corporation holding significant market share. Innovation drivers are predominantly centered around the increasing stringency of regulatory frameworks, such as GDPR and CCPA, which mandate robust data retention and discovery capabilities. The burgeoning volume of unstructured data, coupled with the rise of hybrid work models, fuels the demand for sophisticated archiving solutions. Product substitutes, while existing in rudimentary forms like basic file storage, lack the compliance and eDiscovery functionalities crucial for enterprises. End-user trends highlight a growing preference for cloud-based archiving solutions due to their scalability, cost-effectiveness, and accessibility. Mergers and Acquisitions (M&A) activities are a constant feature, with companies strategically acquiring smaller players to expand their product portfolios and customer bases. For instance, the market has witnessed several strategic acquisitions in recent years aimed at consolidating market share and enhancing technological capabilities, contributing to the market's dynamic nature. The number of M&A deals in the past five years is estimated to be around XX globally, with a notable portion impacting the North American landscape.

- Key Innovation Drivers:

- Strict regulatory compliance requirements

- Explosion of unstructured data

- Adoption of hybrid and remote work environments

- Advancements in AI and machine learning for data analytics and classification

- End-User Trends:

- Shift towards cloud-native archiving solutions

- Demand for integrated compliance and eDiscovery tools

- Focus on data security and privacy preservation

- M&A Activities:

- Strategic acquisitions to gain market share and technology

- Consolidation of niche players by larger enterprises

North America Enterprise Information Archiving Market Industry Trends & Analysis

The North America Enterprise Information Archiving market is experiencing robust growth, primarily driven by the escalating need for regulatory compliance and the exponential increase in data generation across organizations. The market is witnessing a significant shift towards cloud-based archiving solutions, propelled by their inherent scalability, cost-efficiency, and ease of deployment compared to traditional on-premises infrastructure. This transition is further accelerated by the growing adoption of Software-as-a-Service (SaaS) models, offering flexibility and reduced upfront investment for businesses of all sizes. Technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) in archiving platforms, are revolutionizing how data is managed, classified, and retrieved. These advanced technologies enable intelligent data deduplication, sentiment analysis, and predictive analytics, enhancing the efficiency and effectiveness of archiving strategies. Consumer preferences are increasingly leaning towards unified archiving solutions that consolidate data from various sources – email, social media, instant messaging, and file shares – into a single, searchable repository. This consolidation simplifies compliance management and streamlines legal discovery processes. The competitive dynamics of the market are intense, with established players continuously innovating and emerging startups challenging the status quo with specialized solutions. Companies are investing heavily in R&D to develop advanced features like immutable archiving, automated data retention policy enforcement, and advanced threat detection within archiving platforms. The increasing demand for data privacy and security measures also plays a pivotal role, pushing vendors to offer robust encryption, access controls, and audit trails. Furthermore, the growing adoption of Big Data analytics and the subsequent need to archive vast datasets for future analysis are contributing significantly to market expansion. The market penetration of advanced archiving solutions is estimated to be around XX% in large enterprises and XX% in SMEs within North America, indicating substantial room for growth. The overall market size is projected to reach USD XXX Million by 2033, with a CAGR of XX.XX% during the forecast period. This sustained growth is underpinned by ongoing digital transformation initiatives and the ever-present regulatory imperative to manage corporate information effectively.

Leading Markets & Segments in North America Enterprise Information Archiving Market

The North America Enterprise Information Archiving market exhibits significant variations across its diverse segments, with certain regions and industry verticals demonstrating particularly strong adoption and growth.

Dominant Region: The United States stands as the largest and most influential market within North America for enterprise information archiving, driven by its large corporate base, stringent regulatory environment, and high adoption rates of advanced technologies. Canada follows, with a growing awareness of compliance needs and increasing investment in digital transformation initiatives.

Offering: The Software segment is currently the largest and fastest-growing offering, reflecting the demand for sophisticated archiving solutions that can be deployed flexibly. Services, including implementation, support, and managed services, are also crucial and are experiencing steady growth as organizations seek expert assistance in managing complex archiving strategies.

Software:

- Key Drivers: Advanced features, AI/ML integration, cloud-native architecture, comprehensive compliance tools.

- Dominance Analysis: Software solutions form the core of modern archiving, enabling granular control over data, robust security, and efficient retrieval. The ongoing development of intelligent features for data classification and analysis further solidifies its leading position.

Service:

- Key Drivers: Expertise in compliance, managed archiving, integration services, ongoing support.

- Dominance Analysis: While software provides the tools, services ensure their effective implementation and ongoing management. Organizations often rely on service providers to navigate complex regulatory landscapes and optimize their archiving infrastructure.

Deployment: The Cloud deployment model has surpassed on-premises solutions in terms of market share and growth rate. This is attributed to the cloud's inherent scalability, cost-effectiveness, disaster recovery capabilities, and reduced IT overhead.

Cloud:

- Key Drivers: Scalability, cost savings, accessibility, disaster recovery, reduced IT burden.

- Dominance Analysis: The flexibility and agility offered by cloud archiving are highly attractive to businesses of all sizes, enabling them to adapt to changing data volumes and compliance requirements without significant capital expenditure.

On-premises:

- Key Drivers: Data sovereignty concerns, existing infrastructure investments, highly sensitive data requirements.

- Dominance Analysis: While declining in dominance, on-premises solutions remain relevant for organizations with specific data residency needs or highly sensitive data that cannot be entrusted to external cloud environments.

Organization Size: Both SMEs and Large Enterprises are significant contributors to the market. SMEs are increasingly adopting cloud-based archiving solutions to achieve compliance and manage data efficiently without substantial IT investments, while large enterprises leverage comprehensive archiving suites for complex regulatory needs and large-scale data management.

SMEs:

- Key Drivers: Affordability, ease of use, compliance necessity, cloud adoption.

- Dominance Analysis: SMEs are rapidly adopting archiving solutions, often through bundled SaaS offerings, to level the playing field in terms of compliance and data management against larger competitors.

Large Enterprises:

- Key Drivers: Complex regulatory environments, vast data volumes, sophisticated eDiscovery needs, integration with existing systems.

- Dominance Analysis: Large enterprises are the primary drivers of advanced archiving features and services due to their intricate compliance obligations and the sheer scale of their data holdings.

End-user Industries: The BFSI sector leads in the adoption of enterprise information archiving due to its highly regulated nature and the critical need for data integrity and auditability. IT and Telecom, Government, and Healthcare are also significant sectors, driven by data privacy regulations and the increasing volume of digital information.

BFSI:

- Key Drivers: Stringent financial regulations (e.g., SEC, FINRA), risk management, fraud prevention, audit trails.

- Dominance Analysis: The financial services industry faces some of the most rigorous compliance mandates, making robust information archiving an essential operational requirement.

IT and Telecom:

- Key Drivers: Data privacy laws, intellectual property protection, customer data management, regulatory oversight.

- Dominance Analysis: These sectors generate and manage massive amounts of data, necessitating efficient archiving for compliance, operational efficiency, and data analytics.

Government:

- Key Drivers: Public records laws, FOIA requests, transparency requirements, secure data handling.

- Dominance Analysis: Government agencies are increasingly investing in archiving solutions to manage public records effectively, ensure transparency, and comply with legal mandates for information accessibility.

Healthcare:

- Key Drivers: HIPAA compliance, patient data privacy, medical records archiving, research data management.

- Dominance Analysis: The sensitive nature of patient data and strict regulations like HIPAA make comprehensive information archiving indispensable for healthcare organizations.

Retail and E-commerce:

- Key Drivers: Customer transaction data, compliance with consumer protection laws, loyalty program data, e-discovery for disputes.

- Dominance Analysis: With the surge in online transactions and customer data collection, these industries require robust archiving for compliance and business intelligence.

Media and Entertainment:

- Key Drivers: Content archiving, intellectual property rights management, broadcast logs, regulatory compliance for advertising.

- Dominance Analysis: Archiving is critical for managing vast media assets, protecting intellectual property, and complying with broadcasting and advertising regulations.

Education:

- Key Drivers: Student records, research data, administrative communications, compliance with educational privacy laws.

- Dominance Analysis: Educational institutions are increasingly digitizing their operations, leading to a greater need for secure and compliant information archiving.

North America Enterprise Information Archiving Market Product Developments

Product development in the North America Enterprise Information Archiving market is heavily influenced by the need for enhanced compliance, advanced analytics, and seamless integration. Vendors are increasingly focusing on developing intelligent archiving solutions that leverage AI and ML for automated data classification, deduplication, and sentiment analysis. Innovations include the integration of archiving capabilities directly into collaboration platforms like Microsoft 365, as demonstrated by Preservica's FOIA tool launched in December 2023. This move simplifies compliance for users by centralizing data management within existing workflows. Furthermore, there's a strong emphasis on immutable archiving to prevent data tampering and ensure data integrity for legal and regulatory purposes. The development of user-friendly interfaces and robust eDiscovery tools that can quickly search and retrieve specific information from massive archives remains a key competitive advantage for leading players like Smarsh Inc. and Global Relay Communications Inc. These advancements cater to the growing demand for efficient and secure handling of corporate data.

Key Drivers of North America Enterprise Information Archiving Market Growth

The growth of the North America Enterprise Information Archiving market is propelled by a confluence of critical factors. Foremost is the ever-increasing stringency of regulatory compliance mandates across various sectors, including BFSI, healthcare, and government, necessitating robust data retention, legal hold, and discovery capabilities. The exponential growth of unstructured data from sources like emails, social media, and collaboration tools presents a significant challenge that archiving solutions effectively address. The widespread adoption of cloud computing offers a scalable and cost-effective platform for archiving, driving demand for cloud-native solutions. Furthermore, growing concerns around data privacy, cybersecurity threats, and the need for efficient eDiscovery for litigation and investigations are compelling organizations to invest in comprehensive archiving strategies. The market is also benefiting from technological advancements, such as AI and machine learning, which enhance data classification, analysis, and retrieval capabilities, making archiving more intelligent and efficient.

- Regulatory Compliance: Evolving legal frameworks demand compliant data retention and discovery.

- Data Volume Growth: Proliferation of unstructured data requires organized storage.

- Cloud Adoption: Scalability, cost-efficiency, and accessibility of cloud archiving.

- Data Privacy & Security: Protecting sensitive information from breaches and misuse.

- eDiscovery Needs: Facilitating efficient retrieval of data for legal proceedings.

- Technological Advancements: AI/ML for intelligent data management.

Challenges in the North America Enterprise Information Archiving Market Market

Despite its robust growth, the North America Enterprise Information Archiving market faces several significant challenges. The sheer volume and complexity of data generated by organizations can overwhelm existing archiving infrastructure and expertise, leading to storage and management issues. Integrating disparate data sources from legacy systems and modern applications into a unified archiving platform can be technically challenging and time-consuming. Ensuring comprehensive compliance with evolving and often conflicting global and regional regulations poses a persistent hurdle for businesses. The cost associated with implementing and maintaining advanced archiving solutions, particularly for SMEs with limited IT budgets, can be a deterrent. Moreover, the ongoing threat of cyberattacks and data breaches necessitates continuous investment in robust security measures to protect archived data, adding to the overall operational expenses.

- Data Volume & Complexity: Managing the ever-increasing and diverse data landscape.

- Integration Challenges: Harmonizing data from diverse sources.

- Evolving Regulations: Navigating a complex and changing compliance environment.

- Cost of Implementation & Maintenance: Significant investment required for advanced solutions.

- Data Security Threats: Protecting archived data from cyberattacks.

Emerging Opportunities in North America Enterprise Information Archiving Market

The North America Enterprise Information Archiving market is ripe with emerging opportunities, driven by technological innovation and evolving business needs. The increasing adoption of AI and machine learning presents a significant opportunity for vendors to develop more intelligent archiving solutions that offer advanced analytics, predictive insights, and automated data governance. The growing trend of hybrid and multi-cloud environments creates a demand for archiving solutions that can seamlessly manage data across different cloud platforms and on-premises infrastructure. Furthermore, the rise of data privacy regulations like CCPA and others worldwide is driving the need for granular data access controls, consent management, and data subject rights fulfillment within archiving platforms. Strategic partnerships between archiving vendors and cloud service providers, as well as cybersecurity firms, will open new avenues for integrated solutions and expanded market reach. The burgeoning market for compliance automation tools that integrate with archiving solutions also represents a substantial growth area.

Leading Players in the North America Enterprise Information Archiving Market Sector

- Microsoft

- Global Relay Communications Inc.

- Barracuda Networks Inc.

- Jatheon Technologies

- Commvault

- Veritas Technologies LLC

- Proofpoint Inc.

- Smarsh Inc.

- Open Text Corporation

- Dell Technologie

Key Milestones in North America Enterprise Information Archiving Market Industry

- December 2023: Preservica launched a FOIA tool and public records archiving service. This new tool integrates with Microsoft 365, automating the process of archiving minutes, communications, and other documents, significantly reducing manual efforts for officials and staff. It enables a unified information governance strategy across the entire records lifecycle, eliminating the need for separate compliance archiving and discovery tools.

- June 2023: Accenture Federal Services secured a USD 329 million contract to manage the information assurance and privacy program for the United States Agency for International Development (USAID). This contract, which includes risk management, compliance support, and privacy program delivery for the US government agency, highlights the escalating demand for enterprise information archiving needs within the government sector and is expected to fuel future market growth in the region.

Strategic Outlook for North America Enterprise Information Archiving Market Market

The strategic outlook for the North America Enterprise Information Archiving market is exceptionally positive, driven by a sustained demand for robust compliance, advanced data management, and enhanced security. Future growth will be significantly influenced by the continued evolution and adoption of AI and machine learning within archiving platforms, enabling smarter data classification, analysis, and governance. The ongoing shift towards hybrid and multi-cloud environments will necessitate flexible and interoperable archiving solutions that can manage data seamlessly across diverse infrastructures. Strategic partnerships between archiving vendors, cloud providers, and cybersecurity firms will be crucial for delivering integrated and comprehensive solutions, addressing the growing concerns around data privacy and cyber threats. Furthermore, the increasing focus on data lifecycle management and the need for organizations to extract actionable insights from archived data will fuel innovation in analytics and reporting capabilities. The market is poised for continued expansion as enterprises prioritize digital transformation and navigate an increasingly complex regulatory landscape.

North America Enterprise Information Archiving Market Segmentation

-

1. Offering

- 1.1. Software

- 1.2. Service

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premises

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprises

-

4. End-user Industries

- 4.1. BFSI

- 4.2. IT and Telecom

- 4.3. Retail and E-commerce

- 4.4. Healthcare

- 4.5. Government

- 4.6. Media and Entertainment

- 4.7. Education

- 4.8. Other End-user Industries

North America Enterprise Information Archiving Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Enterprise Information Archiving Market Regional Market Share

Geographic Coverage of North America Enterprise Information Archiving Market

North America Enterprise Information Archiving Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Cloud-based and Subscription-based Model; Rapid Increase in the Data Volumes in Enterprises; Integration of Big Data Analytics and AI Technologies

- 3.3. Market Restrains

- 3.3.1. Lack of Technical Expertise in Dealing With High Content Volume; Concerns Related to Security and Privacy of Enterprise Data

- 3.4. Market Trends

- 3.4.1. Cloud Segment to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Enterprise Information Archiving Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. BFSI

- 5.4.2. IT and Telecom

- 5.4.3. Retail and E-commerce

- 5.4.4. Healthcare

- 5.4.5. Government

- 5.4.6. Media and Entertainment

- 5.4.7. Education

- 5.4.8. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Relay Communications Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Barracuda Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jatheon Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Commvault

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veritas Technologies LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Google

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Proofpoint Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Smarsh Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Open Text Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dell Technologie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: North America Enterprise Information Archiving Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Enterprise Information Archiving Market Share (%) by Company 2025

List of Tables

- Table 1: North America Enterprise Information Archiving Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: North America Enterprise Information Archiving Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: North America Enterprise Information Archiving Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: North America Enterprise Information Archiving Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 5: North America Enterprise Information Archiving Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Enterprise Information Archiving Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 7: North America Enterprise Information Archiving Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: North America Enterprise Information Archiving Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 9: North America Enterprise Information Archiving Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 10: North America Enterprise Information Archiving Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Enterprise Information Archiving Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Enterprise Information Archiving Market?

The projected CAGR is approximately 11.08%.

2. Which companies are prominent players in the North America Enterprise Information Archiving Market?

Key companies in the market include Microsoft, Global Relay Communications Inc, Barracuda Networks Inc, Jatheon Technologies, Commvault, Veritas Technologies LLC, Google, Proofpoint Inc, Smarsh Inc, Open Text Corporation, Dell Technologie.

3. What are the main segments of the North America Enterprise Information Archiving Market?

The market segments include Offering, Deployment, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Cloud-based and Subscription-based Model; Rapid Increase in the Data Volumes in Enterprises; Integration of Big Data Analytics and AI Technologies.

6. What are the notable trends driving market growth?

Cloud Segment to Witness Major Growth.

7. Are there any restraints impacting market growth?

Lack of Technical Expertise in Dealing With High Content Volume; Concerns Related to Security and Privacy of Enterprise Data.

8. Can you provide examples of recent developments in the market?

December 2023- Preservica launched a FOIA tool and public records archiving service. The new tool can save officials from labor-intensive efforts to keep minutes, communications, and other documents because it integrates with Microsoft 365. Officials and staff can use a unified information government strategy across the complete records life cycle without learning and using separate vendors' specific compliance archiving and discovery tools due to the new technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Enterprise Information Archiving Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Enterprise Information Archiving Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Enterprise Information Archiving Market?

To stay informed about further developments, trends, and reports in the North America Enterprise Information Archiving Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence