Key Insights

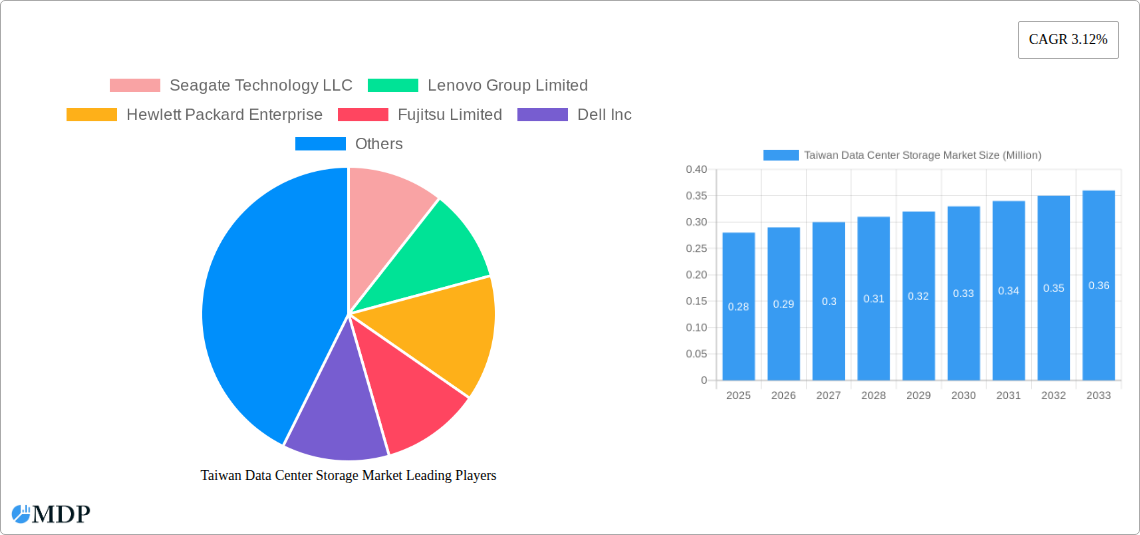

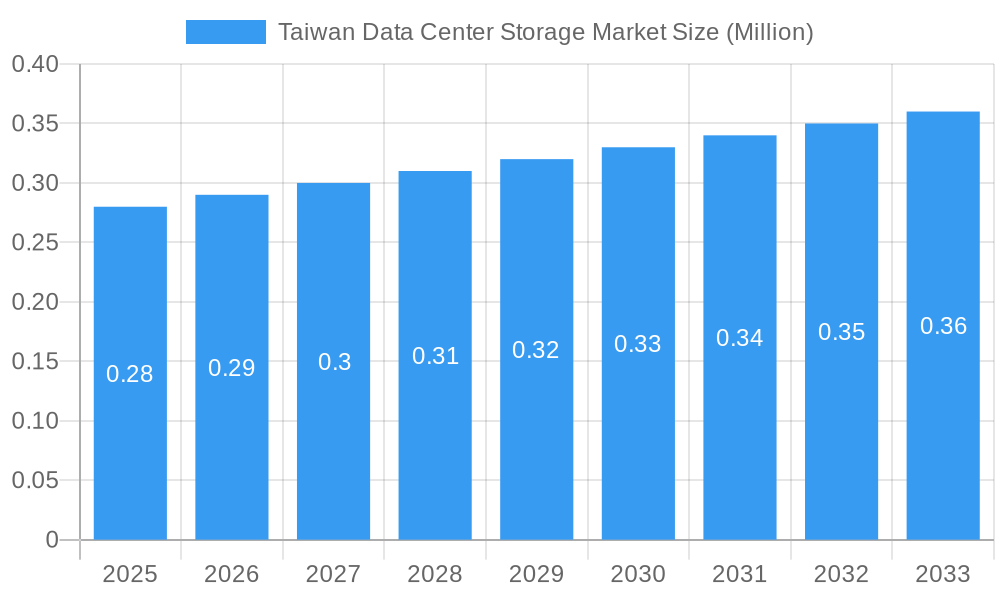

The Taiwan Data Center Storage Market is poised for significant expansion, projected to reach an estimated $0.28 million by 2025. This growth is fueled by a steady Compound Annual Growth Rate (CAGR) of 3.12% over the forecast period of 2025-2033. The burgeoning digital transformation across industries, coupled with the increasing demand for robust data management solutions, is a primary driver. Key sectors like IT & Telecommunication, BFSI, and Government are heavily investing in advanced storage infrastructure to support their expanding data volumes and processing needs. The shift towards All-Flash Storage and Hybrid Storage solutions is a dominant trend, offering superior performance and efficiency compared to traditional storage methods. Furthermore, the increasing adoption of Network Attached Storage (NAS) and Storage Area Network (SAN) technologies signifies a move towards more scalable and centralized data storage architectures within Taiwanese data centers.

Taiwan Data Center Storage Market Market Size (In Million)

Despite a generally positive outlook, certain restraints could impact the market's trajectory. High initial capital expenditure for advanced storage systems and the ongoing cybersecurity concerns surrounding data breaches might temper the pace of adoption for some organizations. However, the persistent need for high-performance, reliable, and secure data storage solutions for critical applications, analytics, and cloud services is expected to outweigh these challenges. Companies like Seagate Technology, Dell Inc., and Huawei Technologies are actively competing in this space, introducing innovative products and solutions to meet the evolving demands of the Taiwanese data center market, thereby ensuring a competitive and dynamic environment. The market's segmentation by storage technology and type indicates a strong preference for solutions that offer both speed and cost-effectiveness.

Taiwan Data Center Storage Market Company Market Share

Taiwan Data Center Storage Market: Market Research Report & Forecast (2019–2033)

Gain critical insights into the dynamic Taiwan Data Center Storage Market with our comprehensive report. This in-depth analysis covers market size, growth drivers, trends, competitive landscape, and future projections, equipping industry stakeholders with actionable intelligence. Explore the burgeoning demand for advanced storage solutions driven by digital transformation, AI, and IoT adoption across key sectors.

Taiwan Data Center Storage Market Market Dynamics & Concentration

The Taiwan Data Center Storage Market is characterized by a moderate level of concentration, with established global players like Seagate Technology LLC, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, and Pure Storage Inc holding significant market shares. Innovation remains a key driver, fueled by the continuous evolution of storage technologies such as NVMe, object storage, and software-defined storage. Regulatory frameworks, while generally supportive of technological advancement, can influence data sovereignty and compliance requirements. The market faces competition from emerging cloud storage solutions, but dedicated on-premises and hybrid storage remain crucial for mission-critical applications and data security. End-user trends highlight an increasing demand for high-performance, scalable, and cost-effective storage solutions, particularly from the IT & Telecommunication, BFSI, and Government sectors. Mergers and acquisition (M&A) activities, though not overtly dominant, contribute to market consolidation and technological integration. Over the historical period of 2019-2024, we observed an average of 2-3 significant M&A deals annually, impacting approximately 5-10% of the market’s collective value. Future market share projections indicate a gradual shift towards all-flash and hybrid solutions, driven by performance demands and evolving TCO considerations.

Taiwan Data Center Storage Market Industry Trends & Analysis

The Taiwan Data Center Storage Market is poised for significant expansion, driven by a confluence of technological advancements, evolving end-user needs, and supportive economic policies. The forecast period of 2025–2033 is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5%, propelling the market from an estimated size of $7,500 Million in 2025 to over $18,000 Million by 2033. This robust growth is primarily fueled by the relentless digital transformation initiatives across various industries, including IT & Telecommunication, Banking, Financial Services, and Insurance (BFSI), Government, and Media & Entertainment. The escalating adoption of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) generates colossal volumes of data, necessitating advanced and scalable storage infrastructure.

Technological disruptions are reshaping the storage landscape. The transition from traditional hard disk drives (HDDs) to Solid-State Drives (SSDs) in all-flash arrays is accelerating, offering superior performance, lower latency, and enhanced energy efficiency. Hybrid storage solutions, which combine the speed of SSDs with the cost-effectiveness of HDDs, are also gaining traction, catering to a wider range of application requirements and budget constraints. Furthermore, the rise of software-defined storage (SDS) offers greater flexibility, scalability, and cost optimization by abstracting storage hardware from its underlying infrastructure.

Consumer preferences are evolving towards data-centric architectures that prioritize data accessibility, security, and analytics capabilities. Businesses are increasingly seeking storage solutions that can seamlessly integrate with cloud environments, enabling hybrid and multi-cloud strategies. This trend is particularly pronounced in the IT & Telecommunication sector, which constantly requires high-performance storage for cloud services and data analytics. The BFSI sector's stringent regulatory requirements and the need for secure, compliant data storage also contribute significantly to market growth. The Government sector’s increasing investment in smart city initiatives and digital governance further boosts demand for reliable and high-capacity storage.

Competitive dynamics are intensifying, with global giants like Dell Inc, Hewlett Packard Enterprise, and NetApp Inc vying for market dominance. However, local Taiwanese players and specialized storage solution providers are also carving out niches by offering tailored solutions and responsive customer support. The market is also witnessing a growing emphasis on data protection, disaster recovery, and business continuity solutions, as organizations recognize the critical importance of data resilience in an increasingly complex threat landscape. The ongoing advancements in storage density, data reduction technologies (deduplication and compression), and automated storage tiering are crucial in managing the ever-increasing data volumes while optimizing costs. The increasing demand for high-performance computing (HPC) environments for research and development also drives the adoption of specialized storage solutions. The market penetration for all-flash storage is projected to grow from approximately 40% in 2025 to over 70% by 2033, indicating a significant shift in consumer preference towards high-speed storage.

Leading Markets & Segments in Taiwan Data Center Storage Market

The Taiwan Data Center Storage Market exhibits strong dominance across several key segments, driven by technological advancements, specific end-user demands, and strategic infrastructure investments.

Storage Technology Dominance:

- Network Attached Storage (NAS): This segment is a significant contributor to the overall market, particularly for small to medium-sized businesses (SMBs) and departmental use within larger enterprises. Its ease of deployment, centralized file sharing capabilities, and cost-effectiveness make it a popular choice for general data storage and collaboration. The IT & Telecommunication sector heavily utilizes NAS for storing unstructured data and supporting cloud infrastructure. Economic policies encouraging digitalization have further bolstered the adoption of NAS solutions.

- Storage Area Network (SAN): SANs are paramount for mission-critical applications demanding high performance, low latency, and robust scalability. The BFSI sector is a leading adopter of SAN technology, utilizing it for transactional databases, trading platforms, and core banking systems where data integrity and speed are non-negotiable. Government agencies responsible for critical infrastructure and national security also rely heavily on SANs. The increasing complexity of financial regulations and the need for real-time data processing in BFSI are key drivers for SAN dominance.

- Direct Attached Storage (DAS): While traditionally associated with individual servers, DAS continues to hold its ground in specific scenarios where direct, high-speed access to storage is required for single applications or workstations. Its simplicity and direct performance benefits appeal to certain segments within Media & Entertainment for video editing workflows and in research environments. However, its scalability and management limitations tend to restrict its widespread adoption in large-scale data center deployments compared to NAS and SAN.

- Other Technologies: This category encompasses emerging storage solutions like object storage and hyperconverged infrastructure (HCI) storage. Object storage is increasingly adopted for unstructured data, cloud-native applications, and archival purposes due to its scalability and cost-efficiency. The Media & Entertainment industry, dealing with vast amounts of video and image assets, is a significant driver for object storage. HCI, which integrates compute, storage, and networking into a single system, is gaining traction for its simplified management and deployment, particularly in SMBs and edge computing environments.

Storage Type Dominance:

- All-Flash Storage: This segment is experiencing the most rapid growth. The inherent performance advantages of Solid-State Drives (SSDs) – superior speed, lower latency, and higher IOPS – are crucial for demanding applications in BFSI, IT & Telecommunication, and High-Performance Computing (HPC). Taiwan's strong technological manufacturing base supports the integration of advanced SSD technologies, further driving this trend. The government’s push for smart city initiatives also necessitates high-performance data processing, benefiting all-flash adoption.

- Hybrid Storage: Hybrid storage solutions, blending the speed of SSDs with the cost-effectiveness of HDDs, offer a balanced approach for a wide range of workloads. This makes them highly attractive to organizations seeking to optimize their Total Cost of Ownership (TCO) while still meeting performance requirements. The Government and Media & Entertainment sectors, managing diverse data types and access patterns, find hybrid solutions particularly appealing. Economic policies aimed at encouraging enterprise IT modernization have contributed to the sustained demand for hybrid storage.

- Traditional Storage: While declining in market share, traditional storage (primarily HDD-based) still holds relevance for archival purposes, backup solutions, and applications where cost is the primary consideration and high performance is not critical. Organizations with significant existing investments in HDD infrastructure may continue to leverage these solutions for specific use cases.

End-User Dominance:

- IT & Telecommunication: This is the largest and most dynamic end-user segment. The rapid expansion of cloud computing, 5G infrastructure deployment, and the growing demand for data analytics services necessitate massive investments in high-capacity, high-performance data center storage. Taiwanese tech companies and global telecom providers operating in the region are key consumers of these solutions.

- BFSI: The financial sector's increasing reliance on digital services, online transactions, and big data analytics for fraud detection and customer insights drives substantial demand for secure, reliable, and high-performance storage solutions like SANs and all-flash arrays. Stringent regulatory compliance and data sovereignty mandates further influence their storage choices.

- Government: With ongoing initiatives in smart cities, e-governance, and national defense, government agencies are investing heavily in data center infrastructure. This includes solutions for data aggregation, citizen services, and secure data storage. The demand for scalable and robust storage to manage vast amounts of public data is a significant market driver.

- Media & Entertainment: The proliferation of high-definition content, streaming services, and digital media creation fuels the need for high-capacity and high-throughput storage solutions. NAS and object storage are particularly relevant for managing large media assets and facilitating collaborative workflows.

Taiwan Data Center Storage Market Product Developments

Product innovation in the Taiwan Data Center Storage Market is primarily focused on enhancing performance, scalability, and data management capabilities. Key trends include the widespread adoption of NVMe technology for ultra-low latency storage, the evolution of software-defined storage (SDS) architectures offering greater flexibility and automation, and advancements in data reduction techniques like deduplication and compression to optimize storage capacity. Companies are also developing more integrated solutions, combining storage with compute and networking in hyperconverged infrastructure (HCI) for simplified deployments. Emerging applications in AI, IoT, and edge computing are driving the development of specialized storage solutions optimized for these workloads, emphasizing high-speed data ingest and real-time analytics. Competitive advantages are being derived from solutions offering seamless hybrid and multi-cloud integration, robust data protection features, and adherence to stringent data security and compliance standards.

Key Drivers of Taiwan Data Center Storage Market Growth

The Taiwan Data Center Storage Market is propelled by several key drivers. The rapid expansion of the digital economy, fueled by government initiatives and private sector investments in areas like AI, IoT, and 5G, generates immense data volumes requiring robust storage solutions. Increasing digital transformation across industries, particularly BFSI and IT & Telecommunication, necessitates upgrades to high-performance and scalable storage infrastructure. The growing emphasis on data analytics and big data processing for business insights and competitive advantage further amplifies demand. Furthermore, the need for enhanced data security, disaster recovery, and compliance with evolving data protection regulations compels organizations to invest in advanced storage technologies and architectures. The push towards cloud adoption, both public and private, also drives the demand for scalable and flexible storage solutions.

Challenges in the Taiwan Data Center Storage Market Market

Despite its robust growth, the Taiwan Data Center Storage Market faces several challenges. Intense competition among global and local vendors leads to price pressures and can impact profit margins for some players. The rapid pace of technological evolution requires continuous investment in research and development, posing a significant financial challenge for smaller companies. Supply chain disruptions, particularly for critical components like semiconductors, can lead to delays in product delivery and increased costs. Evolving cybersecurity threats necessitate ongoing investment in advanced security features for storage solutions, adding to development and operational expenses. Additionally, the integration of new storage technologies with legacy systems can be complex and costly, creating a barrier for some organizations looking to upgrade their infrastructure. Talent acquisition and retention of skilled professionals in data storage and management also present an ongoing challenge.

Emerging Opportunities in Taiwan Data Center Storage Market

The Taiwan Data Center Storage Market is ripe with emerging opportunities. The accelerating adoption of AI and machine learning applications is creating a massive demand for high-performance storage that can handle massive datasets and facilitate rapid processing. The expansion of edge computing, driven by IoT deployments across various sectors like manufacturing and smart cities, presents an opportunity for specialized, distributed storage solutions. The growing trend of data repatriation and a focus on data sovereignty in certain sectors are leading to increased demand for localized, on-premises, and hybrid storage solutions. Furthermore, the increasing complexity of data management, coupled with a desire for simplified operations, is creating opportunities for hyperconverged infrastructure (HCI) and software-defined storage (SDS) solutions that offer integrated capabilities. Strategic partnerships between storage vendors, cloud service providers, and system integrators can unlock new market segments and co-innovation opportunities.

Leading Players in the Taiwan Data Center Storage Market Sector

- Seagate Technology LLC

- Lenovo Group Limited

- Hewlett Packard Enterprise

- Fujitsu Limited

- Dell Inc

- NetApp Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc

Key Milestones in Taiwan Data Center Storage Market Industry

- 2019: Increased adoption of NVMe SSDs for higher performance in enterprise storage.

- 2020: Significant growth in hybrid cloud storage solutions to balance on-premises and cloud needs.

- 2021: Introduction of advanced software-defined storage (SDS) platforms offering greater flexibility.

- 2022: Rising demand for object storage for unstructured data and cloud-native applications.

- 2023: Enhanced focus on data security and ransomware protection features in storage solutions.

- 2024: Growing interest in hyperconverged infrastructure (HCI) for simplified data center management.

- 2025 (Estimated): Continued expansion of all-flash storage adoption driven by performance demands.

- 2026-2030: Proliferation of edge data storage solutions to support IoT and distributed computing.

- 2031-2033: Further integration of AI and machine learning capabilities within storage management and analytics.

Strategic Outlook for Taiwan Data Center Storage Market Market

The strategic outlook for the Taiwan Data Center Storage Market is exceptionally promising, driven by sustained digital transformation and the exponential growth of data. Future market potential will be shaped by the continued evolution of high-performance storage technologies, including further advancements in SSDs and NVMe, alongside the increasing maturity of software-defined storage architectures. Strategic opportunities lie in catering to the burgeoning demand for AI and big data analytics infrastructure, as well as supporting the growing edge computing ecosystem. Companies that can offer integrated, scalable, and secure storage solutions with seamless cloud connectivity will be well-positioned for success. Furthermore, a focus on providing comprehensive data management services, including backup, disaster recovery, and data lifecycle management, will be crucial for long-term growth and customer retention in this dynamic market.

Taiwan Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-Users

Taiwan Data Center Storage Market Segmentation By Geography

- 1. Taiwan

Taiwan Data Center Storage Market Regional Market Share

Geographic Coverage of Taiwan Data Center Storage Market

Taiwan Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost To Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Seagate Technology LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fujitsu Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NetApp Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pure Storage Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology LLC

List of Figures

- Figure 1: Taiwan Data Center Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Taiwan Data Center Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 2: Taiwan Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 3: Taiwan Data Center Storage Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Taiwan Data Center Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Taiwan Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 6: Taiwan Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 7: Taiwan Data Center Storage Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Taiwan Data Center Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Data Center Storage Market?

The projected CAGR is approximately 3.12%.

2. Which companies are prominent players in the Taiwan Data Center Storage Market?

Key companies in the market include Seagate Technology LLC, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc.

3. What are the main segments of the Taiwan Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment Cost To Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Taiwan Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence