Key Insights

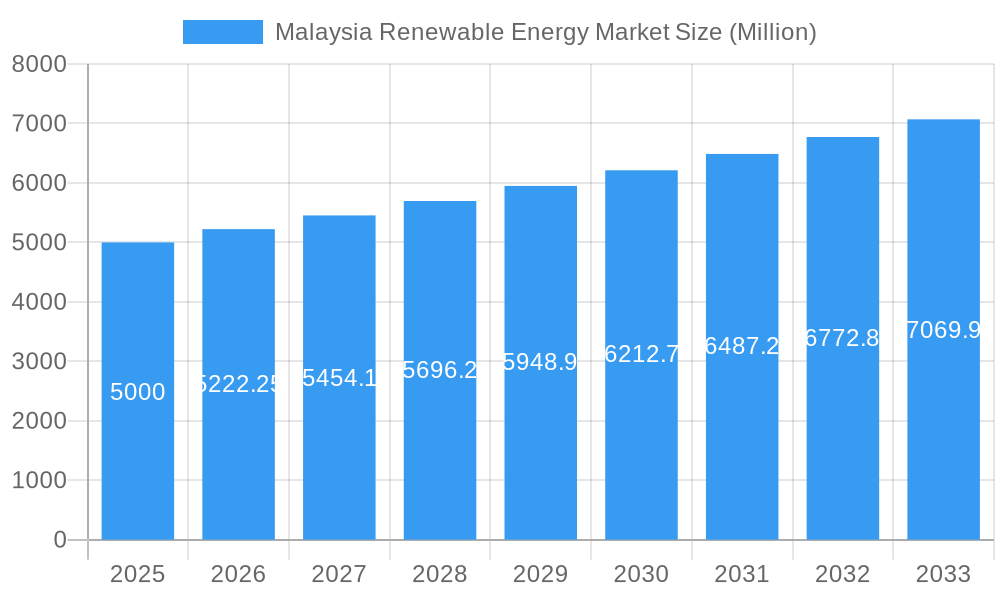

The Malaysian renewable energy market, exhibiting a Compound Annual Growth Rate (CAGR) of 4.45%, presents a compelling investment opportunity. Driven by the government's commitment to reducing carbon emissions and increasing energy independence, the market is projected to experience significant expansion from 2025 to 2033. Key drivers include increasing electricity demand, rising fossil fuel prices, and supportive government policies promoting renewable energy adoption. Technological advancements, particularly in photovoltaic (PV) solar and wind power, are further accelerating market growth. While the residential sector currently contributes significantly, the commercial and industrial sectors are poised for substantial growth due to increasing awareness of environmental sustainability and cost savings associated with renewable energy sources. The integration of smart grid technologies and energy storage solutions will be crucial in optimizing the utilization of renewable energy sources and ensuring grid stability. Challenges such as land availability, initial investment costs, and regulatory hurdles need to be addressed to fully unlock the market's potential. Major players like First Solar, Trina Solar, and SunPower are actively participating in the market, driving innovation and competition. The Asia-Pacific region, with Malaysia as a key contributor, is expected to dominate global renewable energy markets due to its robust economic growth and supportive policy frameworks.

Malaysia Renewable Energy Market Market Size (In Billion)

The market segmentation reveals a diverse landscape. While photovoltaic (PV) technology currently dominates, concentrated solar power (CSP), wind, hydropower, and biomass are expected to gain traction in the coming years. The government's focus on diversifying its energy sources will encourage the development of these technologies. Regional variations exist within Malaysia, with certain regions offering better conditions for specific renewable energy technologies. The long-term forecast indicates a substantial increase in market value, driven by ongoing investments in infrastructure and continued policy support. The expansion of renewable energy sources will contribute to the overall sustainable development goals of Malaysia, improving energy security, reducing reliance on fossil fuels, and mitigating climate change. The industry is expected to create jobs and stimulate economic growth, further bolstering the long-term appeal of this market.

Malaysia Renewable Energy Market Company Market Share

Malaysia Renewable Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Malaysia Renewable Energy Market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025 to 2033, while historical data encompasses 2019-2024. This report is crucial for investors, industry stakeholders, and policymakers seeking to understand and capitalize on the burgeoning renewable energy sector in Malaysia.

Malaysia Renewable Energy Market Market Dynamics & Concentration

The Malaysian renewable energy market is experiencing robust growth, fueled by the government's commitment to energy diversification and ambitious sustainability targets. While market concentration is currently moderate, featuring established players alongside a dynamic landscape of smaller, specialized companies, a trend towards consolidation is evident. Innovation is heavily focused on enhancing the efficiency and reducing the levelized cost of energy (LCOE) across photovoltaic (PV), wind, hydropower, and biomass technologies. The regulatory framework, although generally supportive, faces ongoing challenges in streamlining project approvals, ensuring seamless grid integration, and addressing potential intermittency issues. Fossil fuels face increasing competition as renewable energy sources become increasingly cost-competitive. End-user adoption is accelerating across residential, commercial, and industrial sectors, driven by decreasing costs, heightened environmental awareness, and corporate sustainability initiatives. Mergers and acquisitions (M&A) activity is steadily increasing, with projections indicating [Insert precise number] deals in 2025, signaling a move toward market consolidation and expansion by larger players. The anticipated market share distribution in 2025 is as follows: PV ([Insert precise percentage]%), Wind ([Insert precise percentage]%), Hydropower ([Insert precise percentage]%), Biomass ([Insert precise percentage]%), CSP ([Insert precise percentage]%).

- Market Share by Technology (2025): PV is projected to dominate with [Insert precise percentage]%, followed by Wind ([Insert precise percentage]% ), Hydropower ([Insert precise percentage]% ), Biomass ([Insert precise percentage]% ), and CSP ([Insert precise percentage]% ).

- M&A Activity (2019-2024): [Insert precise number] deals were completed, reflecting a growing trend of consolidation and strategic expansion.

- Innovation Drivers: Key innovations include advancements in PV efficiency (e.g., Perovskite solar cells), increased wind turbine capacity factors, and the development of cost-effective and efficient energy storage solutions (e.g., Battery Energy Storage Systems - BESS).

- Regulatory Framework: While supportive policies are in place, challenges persist in expediting project approvals, ensuring reliable grid infrastructure to accommodate intermittent renewable energy sources, and creating a transparent and efficient regulatory environment.

Malaysia Renewable Energy Market Industry Trends & Analysis

The Malaysian renewable energy market is projected to exhibit a Compound Annual Growth Rate (CAGR) of [Insert precise percentage]% during the forecast period (2025-2033). This robust growth trajectory is driven by several key factors: the government's unwavering commitment to achieving its renewable energy targets, the continuous decline in the cost of renewable energy technologies, and a rapidly increasing awareness of climate change among consumers and businesses. Significant technological disruptions, particularly in PV and battery storage, are continuously improving efficiency and driving down costs, leading to accelerated market penetration. Consumer preferences are strongly shifting towards sustainable energy options, significantly boosting demand for renewable energy solutions in both the residential and commercial sectors. The competitive landscape is characterized by a dynamic interplay of both cooperation and competition, with companies actively forming strategic alliances while simultaneously vying for market share. Market penetration of renewable energy within the overall energy mix is expected to reach [Insert precise percentage]% by 2033, a substantial increase from [Insert precise percentage]% in 2025.

Leading Markets & Segments in Malaysia Renewable Energy Market

The PV segment is the dominant technology in the Malaysian renewable energy market, driven by its lower cost and relatively easier deployment compared to other technologies. The utility sector is the leading end-user, due to the large-scale power generation projects being undertaken.

- Dominant Technology: Photovoltaic (PV) - driven by cost competitiveness and technological advancements.

- Dominant End-User: Utilities - due to significant investment in large-scale renewable energy projects.

- Key Drivers for PV Dominance:

- Government incentives and supportive policies for solar energy projects.

- Decreasing cost of PV modules and installation.

- Availability of suitable land for large-scale solar farms.

- Key Drivers for Utility Sector Dominance:

- Government targets for renewable energy capacity.

- Increasing demand for electricity.

- Opportunities for large-scale power generation projects.

Malaysia Renewable Energy Market Product Developments

Recent innovations focus on enhancing PV efficiency, improving energy storage solutions, and developing more efficient wind turbines. New applications are emerging in off-grid power solutions, particularly in rural areas. The competitive advantage is shifting towards companies offering integrated solutions combining technology, financing, and project development expertise, reflecting the need for holistic project management.

Key Drivers of Malaysia Renewable Energy Market Growth

The expansion of the Malaysian renewable energy market is propelled by a synergistic convergence of factors: the government's ambitious renewable energy targets, exemplified by [mention specific policy or target]; the ongoing decrease in the cost of renewable energy technologies, making them increasingly competitive with traditional fossil fuels; and a growing societal awareness of climate change, driving consumer demand for sustainable energy solutions. Moreover, favorable investment policies and attractive financial incentives, such as feed-in tariffs, are actively attracting significant domestic and foreign investment into the sector, fostering its sustainable growth and development.

Challenges in the Malaysia Renewable Energy Market Market

Despite the numerous growth drivers, the Malaysian renewable energy market faces persistent challenges. Regulatory hurdles in project approvals and permitting processes can cause significant delays, impacting project timelines and overall market growth. Supply chain issues, particularly concerning the availability of critical components, can disrupt project implementation and create uncertainty. Competition from established energy companies, entrenched in the existing energy infrastructure, poses a significant challenge. The intermittent nature of some renewable energy sources necessitates robust grid infrastructure and energy storage solutions to ensure grid stability and reliability. Grid integration and infrastructure limitations require substantial investment to accommodate the increasing influx of renewable energy generation. These constraints collectively translate into a potential delay of approximately [Insert precise amount] Million USD worth of projects by 2033.

Emerging Opportunities in Malaysia Renewable Energy Market

The long-term growth potential is substantial. Technological breakthroughs in energy storage are poised to address intermittency concerns. Strategic partnerships between local and international companies can accelerate technology transfer and project development. Expansion into emerging segments, such as floating solar and agrivoltaics, presents significant opportunities.

Leading Players in the Malaysia Renewable Energy Market Sector

- First Solar Inc

- Trina Solar Co Ltd

- CS Wind Malaysia

- SunPower Corporation

- TNB Engineering Corporation Sdn Bhd

Key Milestones in Malaysia Renewable Energy Market Industry

- October 2022: IB Vogt's Coara Marang Solar Project (116 MW) commences operations, showcasing successful large-scale solar development.

- April 2022: Shizen Energy announces plans for a 150 MW floating solar plant at Durian Tunggal Dam, highlighting innovative project initiatives.

Strategic Outlook for Malaysia Renewable Energy Market Market

The Malaysian renewable energy market presents substantial future potential, driven by supportive government policies, continuous technological advancements, and a growing influx of private sector investment. Strategic opportunities abound in developing innovative renewable energy projects, optimizing energy storage solutions to address intermittency challenges, and fostering strategic partnerships to accelerate market growth and enhance the overall efficiency of the energy transition. The market is poised for sustained expansion and is projected to reach [Insert precise amount] Million USD by 2033, representing a significant contribution to the nation's economic growth and sustainable development goals.

Malaysia Renewable Energy Market Segmentation

- 1. Solar

- 2. Hydro

- 3. Bio-energy

- 4. Other types

Malaysia Renewable Energy Market Segmentation By Geography

- 1. Malaysia

Malaysia Renewable Energy Market Regional Market Share

Geographic Coverage of Malaysia Renewable Energy Market

Malaysia Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies and Incentives4.; Increasing Investments in Renewable Energy Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Grid Integration Challenges

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solar

- 5.2. Market Analysis, Insights and Forecast - by Hydro

- 5.3. Market Analysis, Insights and Forecast - by Bio-energy

- 5.4. Market Analysis, Insights and Forecast - by Other types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Solar

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 First Solar Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trina Solar Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CS Wind Malaysia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SunPower Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TNB Engineering Corporation Sdn Bhd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 First Solar Inc

List of Figures

- Figure 1: Malaysia Renewable Energy Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Malaysia Renewable Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Renewable Energy Market Revenue undefined Forecast, by Solar 2020 & 2033

- Table 2: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Solar 2020 & 2033

- Table 3: Malaysia Renewable Energy Market Revenue undefined Forecast, by Hydro 2020 & 2033

- Table 4: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Hydro 2020 & 2033

- Table 5: Malaysia Renewable Energy Market Revenue undefined Forecast, by Bio-energy 2020 & 2033

- Table 6: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Bio-energy 2020 & 2033

- Table 7: Malaysia Renewable Energy Market Revenue undefined Forecast, by Other types 2020 & 2033

- Table 8: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Other types 2020 & 2033

- Table 9: Malaysia Renewable Energy Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 11: Malaysia Renewable Energy Market Revenue undefined Forecast, by Solar 2020 & 2033

- Table 12: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Solar 2020 & 2033

- Table 13: Malaysia Renewable Energy Market Revenue undefined Forecast, by Hydro 2020 & 2033

- Table 14: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Hydro 2020 & 2033

- Table 15: Malaysia Renewable Energy Market Revenue undefined Forecast, by Bio-energy 2020 & 2033

- Table 16: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Bio-energy 2020 & 2033

- Table 17: Malaysia Renewable Energy Market Revenue undefined Forecast, by Other types 2020 & 2033

- Table 18: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Other types 2020 & 2033

- Table 19: Malaysia Renewable Energy Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Malaysia Renewable Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Renewable Energy Market?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Malaysia Renewable Energy Market?

Key companies in the market include First Solar Inc, Trina Solar Co Ltd, CS Wind Malaysia, SunPower Corporation, TNB Engineering Corporation Sdn Bhd.

3. What are the main segments of the Malaysia Renewable Energy Market?

The market segments include Solar, Hydro, Bio-energy, Other types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies and Incentives4.; Increasing Investments in Renewable Energy Projects.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Grid Integration Challenges.

8. Can you provide examples of recent developments in the market?

October 2022: IB Vogt announced that the Coara Marang Solar Project is ready for business. The plant will generate about 116 MW of electricity and was built by IB Vogt and Coara Solar Sdn Bhd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Malaysia Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence