Key Insights

The Global Wireless Temperature Sensors Market is projected for substantial expansion, estimated to reach $2.97 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 6.59%. This growth is driven by escalating demand for real-time monitoring in critical sectors like military and security, medical devices, automotive safety, and industrial process optimization. Key advantages include simplified installation, reduced cabling, enhanced flexibility, and improved data accessibility. The proliferation of the Internet of Things (IoT) and smart infrastructure further accelerates adoption. Innovations in miniaturized, highly accurate sensors and low-power communication technologies also contribute to market expansion.

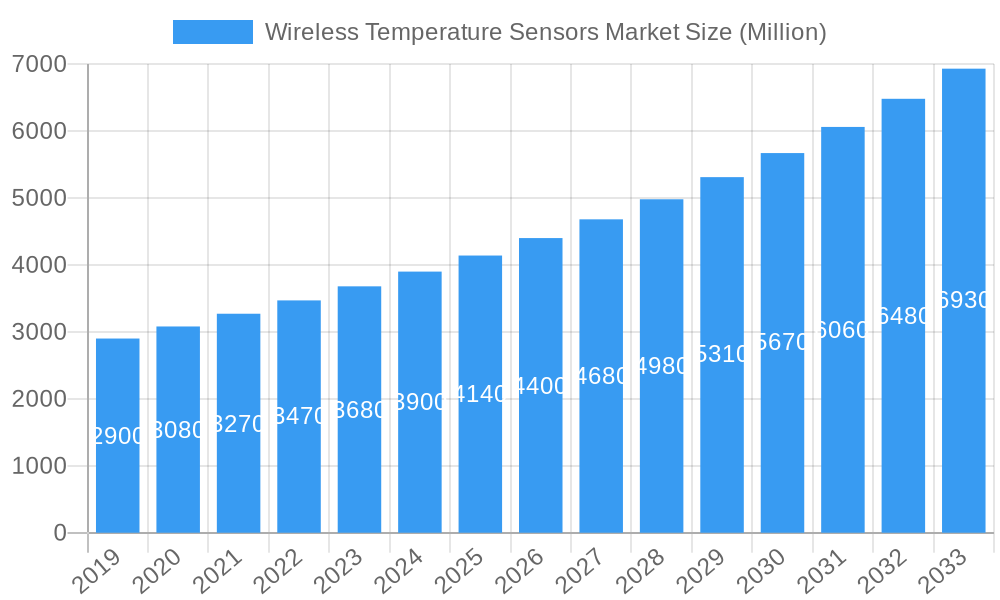

Wireless Temperature Sensors Market Market Size (In Billion)

Challenges such as initial implementation costs, data security concerns, potential interference, and the need for standardized protocols may influence market penetration. However, technological advancements and a clearer understanding of long-term ROI are expected to overcome these hurdles. Significant growth is anticipated in Military and Security, Medical, and Automotive segments due to stringent regulations and the critical nature of temperature monitoring. Emerging applications in industrial monitoring and building automation are also gaining momentum, driven by energy efficiency and operational safety goals. Leading companies like Honeywell International Inc., ABB Ltd., and Siemens AG are investing in R&D to offer advanced solutions and secure market share.

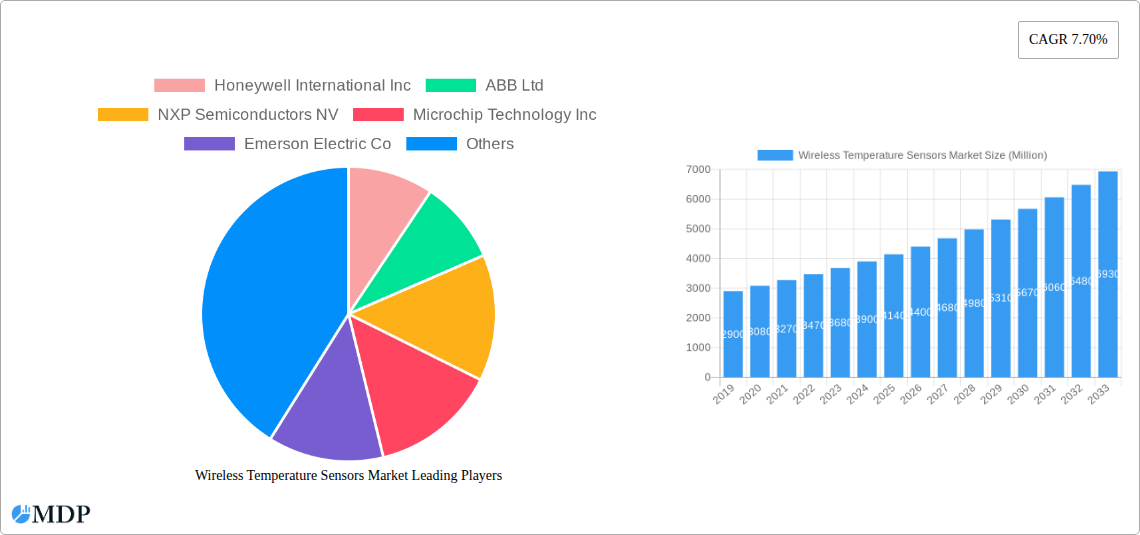

Wireless Temperature Sensors Market Company Market Share

Unlocking Growth: A Comprehensive Report on the Global Wireless Temperature Sensors Market (2019-2033)

Report Description:

Dive deep into the dynamic Wireless Temperature Sensors Market with this in-depth, SEO-optimized industry report. Analyzing the market from 2019 to 2033, with a base year of 2025, this comprehensive study provides critical insights into market dynamics, industry trends, leading segments, and key players. Discover the forces driving innovation in industrial monitoring, building automation, medical, and automotive applications, and understand the competitive landscape shaped by giants like Honeywell International Inc, ABB Ltd, and Siemens AG. This report is an indispensable resource for stakeholders seeking to capitalize on the projected market growth, estimated to reach XX Million by 2033, with a CAGR of XX% during the forecast period (2025-2033). Navigate the complexities of IoT temperature sensing, smart building technology, and wireless sensor networks with actionable intelligence and forward-looking strategies.

Wireless Temperature Sensors Market Market Dynamics & Concentration

The Wireless Temperature Sensors Market exhibits a moderately concentrated landscape, with key players like Honeywell International Inc, ABB Ltd, NXP Semiconductors NV, Microchip Technology Inc, Emerson Electric Co, Siemens AG, Schneider Electric SE, Texas Instruments Incorporated, Yokogawa Electric Corporation, and Analog Devices Inc holding significant market share. Innovation is a primary driver, fueled by advancements in IoT integration, miniaturization of sensors, and enhanced battery life. The proliferation of connected devices and the growing demand for real-time temperature monitoring across industries are key innovation catalysts. Regulatory frameworks, particularly concerning data security and industrial safety standards, are evolving and influencing product development and adoption. While direct product substitutes are limited, the market faces indirect competition from wired temperature sensing solutions in certain niche applications where installation costs are less of a concern. End-user trends are strongly leaning towards smart solutions, predictive maintenance, and energy efficiency, pushing demand for wireless temperature sensors in sectors such as Industrial Monitoring, Building Automation, and Medical. Merger and acquisition (M&A) activities, while not at an extremely high volume, are strategic, aimed at acquiring new technologies or expanding market reach. For instance, recent M&A deal counts have been in the range of 5-10 annually, focusing on companies with expertise in specific wireless communication protocols or end-user applications. The market share of the top 5 players is estimated to be around 55-60%, indicating a competitive yet established market structure.

Wireless Temperature Sensors Market Industry Trends & Analysis

The Wireless Temperature Sensors Market is experiencing robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and increasing industrial digitalization. The market penetration of wireless temperature sensors is rapidly expanding, moving beyond traditional industrial settings into burgeoning sectors like smart homes and advanced healthcare. A key growth driver is the pervasive adoption of the Internet of Things (IoT), which necessitates ubiquitous sensing capabilities for data collection and analysis. Wireless temperature sensors are integral to IoT ecosystems, providing critical environmental data for applications ranging from cold chain monitoring in the pharmaceutical industry to optimized HVAC control in commercial buildings. Technological disruptions, including the development of low-power wide-area network (LPWAN) technologies like LoRaWAN and NB-IoT, are enabling longer communication ranges and extended battery life for sensors, making them more cost-effective and practical for a wider array of applications. Furthermore, the increasing sophistication of AI and machine learning algorithms for analyzing sensor data is unlocking new possibilities for predictive maintenance, anomaly detection, and process optimization, thereby enhancing the value proposition of wireless temperature sensors. Consumer preferences are increasingly shifting towards convenience, automation, and energy efficiency. In residential and commercial building automation, wireless temperature sensors are key to creating intelligent environments that adapt to occupancy and external conditions, leading to significant energy savings. The automotive sector is also witnessing a surge in demand for these sensors, driven by the need for precise temperature monitoring in electric vehicle battery management systems and cabin climate control. The competitive dynamics within the market are characterized by intense innovation, with companies vying to offer more accurate, reliable, and cost-effective solutions. This includes developing sensors with enhanced accuracy, wider operating temperature ranges, and improved data security features. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033, reaching an estimated market size of XX Million by the end of the period. This upward trajectory is supported by ongoing investments in research and development and the continuous expansion of use cases across diverse industries.

Leading Markets & Segments in Wireless Temperature Sensors Market

The Wireless Temperature Sensors Market is witnessing significant traction across various end-user applications, with Industrial Monitoring and Building Automation emerging as dominant segments.

Industrial Monitoring: This segment's leadership is propelled by the increasing adoption of Industry 4.0 principles and the growing need for real-time data acquisition to optimize manufacturing processes, ensure equipment reliability, and enhance worker safety.

- Economic Policies: Government initiatives promoting industrial automation and smart manufacturing are providing a significant boost.

- Infrastructure: Investments in modernizing industrial facilities and integrating advanced sensing technologies are widespread.

- Key Drivers: Predictive maintenance to minimize downtime, energy efficiency improvements in industrial operations, and stringent safety regulations mandating continuous monitoring of critical parameters.

Building Automation: This segment is experiencing rapid expansion due to the global focus on energy efficiency, smart city initiatives, and the desire for enhanced occupant comfort and security.

- Economic Policies: Incentives for green building certifications and smart home technology adoption are fueling growth.

- Infrastructure: The rise of smart buildings and connected infrastructure creates a natural demand for integrated sensing solutions.

- Key Drivers: Cost savings through optimized HVAC systems, improved indoor air quality monitoring, remote management capabilities, and integration with broader building management systems (BMS).

While Industrial Monitoring and Building Automation currently lead, the Medical and Automotive sectors are exhibiting substantial growth potential. The Medical segment benefits from the stringent requirements for temperature monitoring in healthcare settings, including patient monitoring, pharmaceutical cold chain logistics, and laboratory environments. The Automotive segment is driven by the burgeoning electric vehicle (EV) market, where precise battery temperature management is critical for performance, safety, and lifespan. The Military and Security segment, while smaller, contributes to the market through applications requiring robust and reliable environmental monitoring in challenging conditions.

Wireless Temperature Sensors Market Product Developments

Product innovation in the Wireless Temperature Sensors Market is characterized by advancements in miniaturization, power efficiency, and connectivity. Companies are actively developing highly accurate sensors with extended battery life, supporting various wireless protocols such as Bluetooth Low Energy (BLE), Wi-Fi, and LoRaWAN to cater to diverse application needs. These developments enable seamless integration into IoT ecosystems, providing real-time data for sophisticated analytics. Key technological trends include the integration of self-calibrating sensors and tamper-proof designs for enhanced reliability and security. These innovations offer competitive advantages by providing greater precision, lower maintenance costs, and more versatile deployment options, fitting perfectly into the growing demand for smart and connected solutions across industries.

Key Drivers of Wireless Temperature Sensors Market Growth

The Wireless Temperature Sensors Market is being propelled by several key drivers. The ubiquitous adoption of the Internet of Things (IoT) is a primary catalyst, requiring widespread sensing capabilities for data-driven decision-making. The growing emphasis on energy efficiency across all sectors, from industrial processes to commercial buildings, makes wireless temperature sensors crucial for optimizing energy consumption. Furthermore, stringent regulatory requirements for safety and quality control in industries like healthcare and food processing necessitate reliable temperature monitoring. Technological advancements, including the development of low-power, long-range wireless communication protocols and miniaturized sensor components, are making these solutions more accessible and cost-effective. The increasing demand for predictive maintenance in industrial settings, aiming to prevent equipment failure and reduce downtime, also significantly fuels market growth.

Challenges in the Wireless Temperature Sensors Market Market

Despite robust growth, the Wireless Temperature Sensors Market faces several challenges. Cybersecurity concerns remain a significant barrier, as the transmission of sensitive temperature data wirelessly necessitates robust security protocols to prevent unauthorized access or manipulation. Interoperability issues between different wireless communication standards and existing legacy systems can hinder seamless integration and widespread adoption. The initial cost of deployment, particularly for large-scale installations across extensive facilities, can be a restraint for some organizations, although this is being mitigated by decreasing sensor costs and increasing ROI. Furthermore, reliance on battery power can pose challenges related to battery life management, replacement logistics, and disposal, especially in remote or hard-to-access locations. Stringent regulatory compliance in specific sectors, such as medical and aerospace, can add complexity and time to product development and market entry.

Emerging Opportunities in Wireless Temperature Sensors Market

The Wireless Temperature Sensors Market is ripe with emerging opportunities driven by technological breakthroughs and evolving market needs. The expansion of smart city initiatives presents a significant avenue for growth, with sensors being deployed for environmental monitoring, infrastructure management, and public safety. The increasing adoption of electric vehicles (EVs) creates a burgeoning demand for sophisticated battery thermal management systems, where wireless temperature sensors play a vital role. The integration of AI and machine learning with sensor data is opening up new frontiers for predictive analytics and smart automation, enabling proactive identification of potential issues before they escalate. Strategic partnerships between sensor manufacturers and software providers are also creating opportunities for developing comprehensive end-to-end solutions that offer enhanced data insights and value-added services to end-users.

Leading Players in the Wireless Temperature Sensors Market Sector

- Honeywell International Inc

- ABB Ltd

- NXP Semiconductors NV

- Microchip Technology Inc

- Emerson Electric Co

- Siemens AG

- Schneider Electric SE

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

- Analog Devices Inc

Key Milestones in Wireless Temperature Sensors Market Industry

- 2019: Increased adoption of low-power wide-area networks (LPWAN) for industrial IoT deployments.

- 2020: Significant advancements in miniaturization of temperature sensors, enabling integration into smaller devices.

- 2021: Growing demand for wireless temperature sensors in cold chain logistics for pharmaceuticals and food.

- 2022: Enhanced focus on cybersecurity features for wireless sensor networks due to rising cyber threats.

- 2023: Introduction of self-calibrating wireless temperature sensors, reducing maintenance overhead.

- 2024: Surging interest in wireless temperature sensing for electric vehicle battery management systems.

- 2025: Estimated widespread adoption of AI-driven predictive maintenance fueled by sensor data.

- 2026: Expected further integration of wireless temperature sensors into smart home and building automation systems.

- 2028: Potential for new wireless communication standards to emerge, offering improved efficiency and range.

- 2030: Growing market for specialized wireless temperature sensors in niche medical applications.

- 2033: Projected significant market penetration across almost all industrial and commercial sectors.

Strategic Outlook for Wireless Temperature Sensors Market Market

The Wireless Temperature Sensors Market is poised for continued expansion, driven by the relentless march of digitalization and the increasing demand for intelligent, connected solutions. Key growth accelerators include the ongoing development and adoption of IoT platforms, advancements in wireless communication technologies, and the growing need for real-time environmental monitoring across diverse sectors. Strategic opportunities lie in focusing on high-growth application areas such as electric vehicle thermal management, advanced healthcare monitoring, and sustainable building automation. Companies that can offer integrated solutions, robust cybersecurity, and exceptional data analytics capabilities will be well-positioned to capture a significant share of the future market, leveraging the projected growth to XX Million by 2033.

Wireless Temperature Sensors Market Segmentation

-

1. End-user Application

- 1.1. Military and Security

- 1.2. Medical

- 1.3. Automotive

- 1.4. Industrial Monitoring

- 1.5. Building Automation

- 1.6. Other End-user Applications

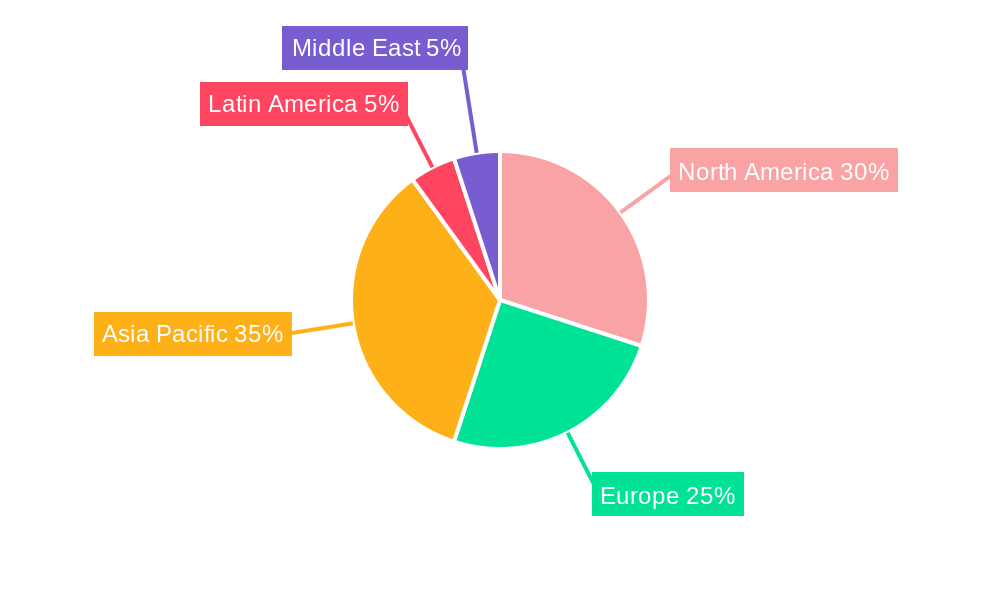

Wireless Temperature Sensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Wireless Temperature Sensors Market Regional Market Share

Geographic Coverage of Wireless Temperature Sensors Market

Wireless Temperature Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Declining Unit Cost of Wireless Sensors

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Building Automation Sector Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Temperature Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Application

- 5.1.1. Military and Security

- 5.1.2. Medical

- 5.1.3. Automotive

- 5.1.4. Industrial Monitoring

- 5.1.5. Building Automation

- 5.1.6. Other End-user Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End-user Application

- 6. North America Wireless Temperature Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Application

- 6.1.1. Military and Security

- 6.1.2. Medical

- 6.1.3. Automotive

- 6.1.4. Industrial Monitoring

- 6.1.5. Building Automation

- 6.1.6. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by End-user Application

- 7. Europe Wireless Temperature Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Application

- 7.1.1. Military and Security

- 7.1.2. Medical

- 7.1.3. Automotive

- 7.1.4. Industrial Monitoring

- 7.1.5. Building Automation

- 7.1.6. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by End-user Application

- 8. Asia Pacific Wireless Temperature Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Application

- 8.1.1. Military and Security

- 8.1.2. Medical

- 8.1.3. Automotive

- 8.1.4. Industrial Monitoring

- 8.1.5. Building Automation

- 8.1.6. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by End-user Application

- 9. Latin America Wireless Temperature Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Application

- 9.1.1. Military and Security

- 9.1.2. Medical

- 9.1.3. Automotive

- 9.1.4. Industrial Monitoring

- 9.1.5. Building Automation

- 9.1.6. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by End-user Application

- 10. Middle East Wireless Temperature Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Application

- 10.1.1. Military and Security

- 10.1.2. Medical

- 10.1.3. Automotive

- 10.1.4. Industrial Monitoring

- 10.1.5. Building Automation

- 10.1.6. Other End-user Applications

- 10.1. Market Analysis, Insights and Forecast - by End-user Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductors NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microchip Technology Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Emerson Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Texas Instruments Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yokogawa Electric Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Analog Devices Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Wireless Temperature Sensors Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Wireless Temperature Sensors Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Wireless Temperature Sensors Market Revenue (billion), by End-user Application 2025 & 2033

- Figure 4: North America Wireless Temperature Sensors Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 5: North America Wireless Temperature Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 6: North America Wireless Temperature Sensors Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 7: North America Wireless Temperature Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America Wireless Temperature Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Wireless Temperature Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Wireless Temperature Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Wireless Temperature Sensors Market Revenue (billion), by End-user Application 2025 & 2033

- Figure 12: Europe Wireless Temperature Sensors Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 13: Europe Wireless Temperature Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 14: Europe Wireless Temperature Sensors Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 15: Europe Wireless Temperature Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe Wireless Temperature Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Wireless Temperature Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Wireless Temperature Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Wireless Temperature Sensors Market Revenue (billion), by End-user Application 2025 & 2033

- Figure 20: Asia Pacific Wireless Temperature Sensors Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 21: Asia Pacific Wireless Temperature Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 22: Asia Pacific Wireless Temperature Sensors Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 23: Asia Pacific Wireless Temperature Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific Wireless Temperature Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Wireless Temperature Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Wireless Temperature Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Wireless Temperature Sensors Market Revenue (billion), by End-user Application 2025 & 2033

- Figure 28: Latin America Wireless Temperature Sensors Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 29: Latin America Wireless Temperature Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 30: Latin America Wireless Temperature Sensors Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 31: Latin America Wireless Temperature Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Latin America Wireless Temperature Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America Wireless Temperature Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Wireless Temperature Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East Wireless Temperature Sensors Market Revenue (billion), by End-user Application 2025 & 2033

- Figure 36: Middle East Wireless Temperature Sensors Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 37: Middle East Wireless Temperature Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 38: Middle East Wireless Temperature Sensors Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 39: Middle East Wireless Temperature Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Middle East Wireless Temperature Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East Wireless Temperature Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Wireless Temperature Sensors Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Temperature Sensors Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 2: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 3: Global Wireless Temperature Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Wireless Temperature Sensors Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 6: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 7: Global Wireless Temperature Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global Wireless Temperature Sensors Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 10: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 11: Global Wireless Temperature Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Wireless Temperature Sensors Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 14: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 15: Global Wireless Temperature Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Wireless Temperature Sensors Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 18: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 19: Global Wireless Temperature Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global Wireless Temperature Sensors Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 22: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 23: Global Wireless Temperature Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Wireless Temperature Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Temperature Sensors Market?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Wireless Temperature Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, NXP Semiconductors NV, Microchip Technology Inc , Emerson Electric Co, Siemens AG, Schneider Electric SE, Texas Instruments Incorporated, Yokogawa Electric Corporation, Analog Devices Inc.

3. What are the main segments of the Wireless Temperature Sensors Market?

The market segments include End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.97 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Declining Unit Cost of Wireless Sensors.

6. What are the notable trends driving market growth?

Building Automation Sector Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Temperature Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Temperature Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Temperature Sensors Market?

To stay informed about further developments, trends, and reports in the Wireless Temperature Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence