Key Insights

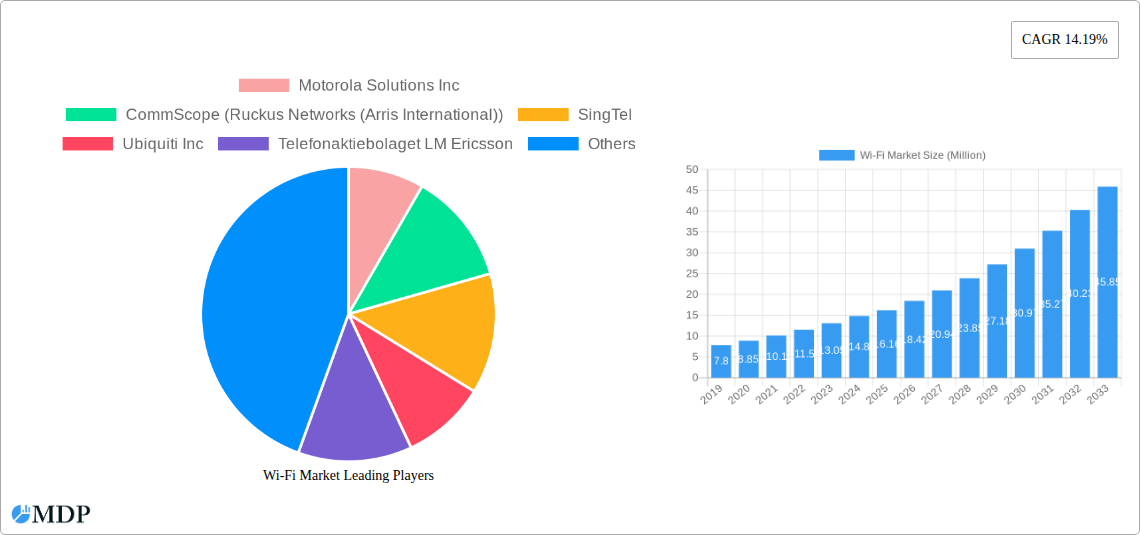

The Wi-Fi market is experiencing robust expansion, projected to reach a substantial $16.16 million value unit by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 14.19%. This upward trajectory is primarily fueled by the escalating demand for seamless, high-speed internet connectivity across diverse sectors, including residential, enterprise, and educational environments. The proliferation of IoT devices, the increasing adoption of cloud-based services, and the continuous need for enhanced mobile data offloading are key drivers propelling market growth. Furthermore, the ongoing development and deployment of advanced Wi-Fi technologies, such as Wi-Fi 6 and Wi-Fi 6E, are significantly improving network performance, capacity, and efficiency, thereby stimulating further market penetration. The market's dynamism is also evident in its segmentation. The Product Type segment is dominated by Access Points and Gateways, which are fundamental to establishing robust Wi-Fi networks. Services, encompassing design, implementation, and support, are also crucial, reflecting the complexity and critical nature of Wi-Fi infrastructure deployment and maintenance. On the Application Type front, Indoor Wi-Fi solutions, particularly for residential and enterprise use, represent the largest share, driven by remote work trends and the digitalization of businesses.

Wi-Fi Market Market Size (In Million)

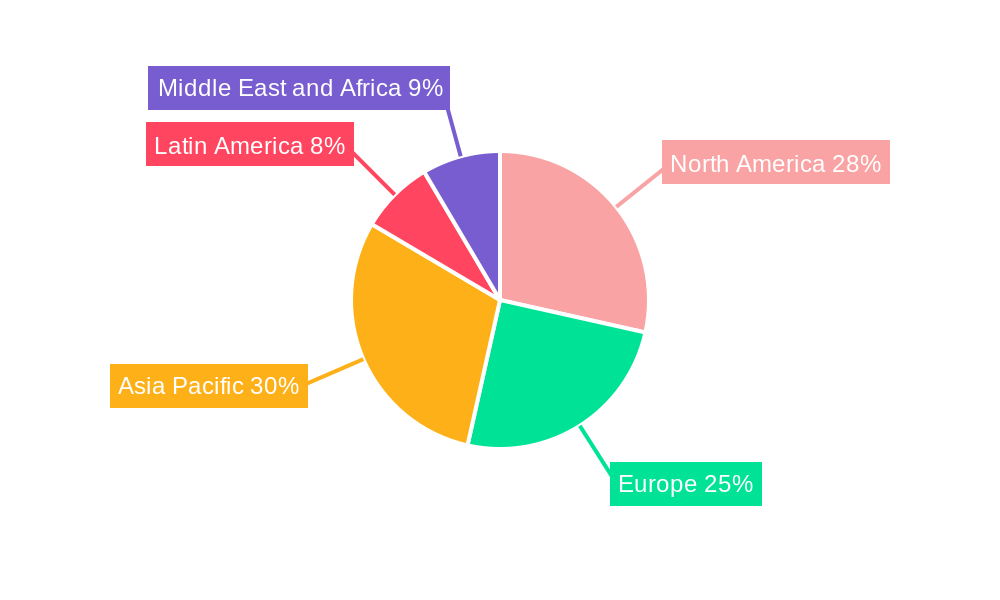

The market's growth, while promising, is not without its challenges. Restraints such as increasing cybersecurity concerns, the need for significant infrastructure investment, and the complexity of managing large-scale wireless networks can temper the pace of adoption in certain segments. However, these challenges are being addressed through innovative security protocols, more accessible deployment models, and advancements in network management solutions. Key industry players like Cisco Systems Inc., Huawei Technologies Co. Ltd., and CommScope (Ruckus Networks) are at the forefront of innovation, consistently introducing cutting-edge products and services. Geographically, North America and Asia Pacific are expected to lead market growth due to their advanced technological infrastructure, high internet penetration rates, and substantial investments in smart city initiatives and enterprise digital transformation. The ongoing evolution towards Wi-Fi 7 and beyond, coupled with the increasing integration of Wi-Fi with other connectivity solutions, suggests a sustained period of strong growth and innovation in the Wi-Fi market for the foreseeable future.

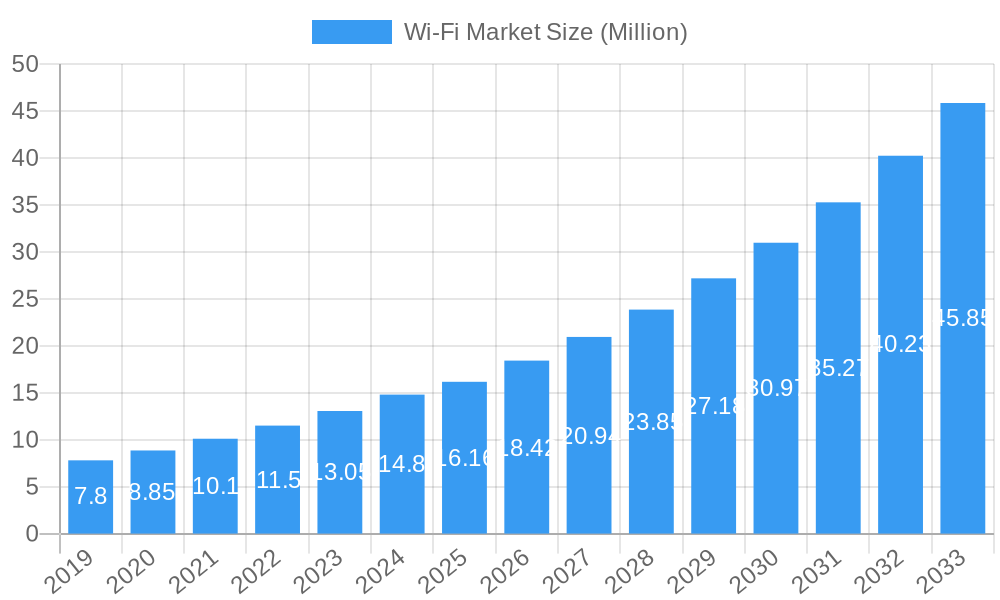

Wi-Fi Market Company Market Share

Dive into the dynamic and rapidly expanding Wi-Fi market with this in-depth report, offering unparalleled insights from 2019 to 2033. This essential resource for industry stakeholders analyzes current trends, future projections, and competitive landscapes, covering everything from the latest Wi-Fi 7 deployments to essential security services. Discover how global connectivity demands, technological advancements, and evolving end-user preferences are shaping the future of wireless networking. The report leverages cutting-edge data and expert analysis to provide a clear roadmap for navigating this complex and high-growth sector.

Wi-Fi Market Market Dynamics & Concentration

The global Wi-Fi market exhibits a moderate to high concentration, with a significant portion of the market share held by a few major players. Innovation drivers are primarily fueled by the relentless pursuit of higher speeds, lower latency, and enhanced security, exemplified by the ongoing transition to Wi-Fi 7 and the integration of AI and cloud-based solutions. Regulatory frameworks, while generally supportive of connectivity expansion, can vary by region, impacting deployment timelines and standards. Product substitutes, such as wired Ethernet and cellular data, continue to exist, but the convenience and ubiquity of Wi-Fi keep it dominant for most applications. End-user trends are increasingly leaning towards seamless, high-performance connectivity for a multitude of devices, driving demand for robust and scalable Wi-Fi infrastructure in both residential and enterprise settings. Mergers and acquisitions (M&A) activities are a notable feature, with an estimated xx M&A deals in the historical period (2019-2024), as companies seek to consolidate market positions, acquire innovative technologies, and expand their service offerings. Key market share players are anticipated to maintain their dominance, but strategic acquisitions can rapidly shift competitive dynamics.

Wi-Fi Market Industry Trends & Analysis

The Wi-Fi market is experiencing robust growth, driven by the insatiable demand for ubiquitous and high-speed wireless connectivity across diverse applications. The Compound Annual Growth Rate (CAGR) is projected to be substantial, estimated at xx% during the forecast period (2025-2033). This expansion is fueled by several key market growth drivers. The proliferation of connected devices, including IoT sensors, smart home appliances, and wearable technology, necessitates ever-increasing Wi-Fi capacity and reliability. Furthermore, the digital transformation initiatives undertaken by enterprises across all sectors are heavily reliant on advanced wireless networking solutions for seamless operations and enhanced productivity. Technological disruptions are at the forefront, with the recent introduction of Wi-Fi 7 promising multi-gigabit speeds, lower latency, and improved efficiency, poised to revolutionize applications ranging from immersive gaming and augmented reality to industrial automation. Consumer preferences are shifting towards mesh Wi-Fi systems for superior home coverage and subscription-based managed Wi-Fi services that offer convenience and enhanced performance. The competitive landscape is characterized by intense innovation and strategic alliances, as established technology giants and agile startups vie for market dominance. Market penetration is steadily increasing globally, with a significant portion of the population and businesses now relying on Wi-Fi for their primary internet access. The ongoing evolution of standards, coupled with significant investments in research and development, ensures that the Wi-Fi market remains at the cutting edge of technological advancement.

Leading Markets & Segments in Wi-Fi Market

The Wi-Fi market's dominance is most pronounced in Indoor applications, particularly within Enterprises and Residential settings, which collectively represent the largest segment by revenue. The increasing adoption of smart office technologies, remote work trends, and the burgeoning smart home ecosystem are key drivers behind this segment's growth.

Product Type Dominance:

- Access Points (APs): This segment is foundational to the Wi-Fi market.

- Key Drivers: Demand for high-density Wi-Fi deployments in offices, educational institutions, and public venues; advancements in Wi-Fi standards (e.g., Wi-Fi 6E, Wi-Fi 7) demanding more sophisticated AP hardware; growing need for secure and managed wireless networks.

- Gateways, Routers, and Extenders: Essential for network connectivity and expansion.

- Key Drivers: Increasing internet penetration in homes and small businesses; the rise of smart home ecosystems requiring robust gateway functionality; the need to extend Wi-Fi coverage in larger homes and commercial spaces.

- Services (Design, Implementation, and Support): A critical enabler for complex deployments.

- Key Drivers: The complexity of enterprise-grade Wi-Fi deployments, requiring specialized expertise; growing demand for network security and performance optimization; the need for ongoing maintenance and support to ensure network reliability.

- Other Device Types & Solutions: This encompasses a broad range, including Wi-Fi enabled IoT devices and specialized wireless infrastructure.

- Key Drivers: The explosive growth of the Internet of Things (IoT) across various industries; specialized applications in industrial settings requiring robust wireless communication.

Application Type Dominance:

- Indoor: This category is further segmented into:

- Residential: Fueled by smart home adoption, remote work, and increased reliance on home entertainment.

- Enterprises: Driven by digital transformation, BYOD policies, and the need for secure, high-performance wireless networks.

- Education: Essential for e-learning initiatives, campus-wide connectivity, and digital classrooms.

- Outdoor: While smaller than indoor, this segment is growing, driven by smart city initiatives, public Wi-Fi hotspots, and outdoor event connectivity.

- Key Drivers: Government investments in smart city infrastructure; increasing demand for public Wi-Fi access in urban areas and transportation hubs; growing adoption of outdoor wireless solutions for hospitality and retail.

The Asia-Pacific region is a significant contributor to market growth, driven by rapid urbanization, increasing disposable incomes, and substantial investments in digital infrastructure. Government initiatives promoting digital connectivity further bolster the market in countries like China and India.

Wi-Fi Market Product Developments

Product development in the Wi-Fi market is heavily focused on enhancing speed, capacity, and intelligence. The ongoing rollout of Wi-Fi 7 devices for consumers, enterprises, and ISPs signifies a major technological leap, promising unprecedented performance for bandwidth-intensive applications. Innovations in mesh networking continue to provide seamless coverage for larger spaces, while advanced security features are being integrated directly into access points and gateways, offering enhanced protection against cyber threats. The integration of AI and cloud-based management platforms is revolutionizing network administration, enabling predictive maintenance, automated optimization, and improved user experience. These advancements are driven by a clear market fit for seamless connectivity, superior performance, and robust security across residential, enterprise, and industrial sectors.

Key Drivers of Wi-Fi Market Growth

The Wi-Fi market's exponential growth is propelled by a confluence of powerful factors. Technological advancements like the evolution to Wi-Fi 6E and the nascent Wi-Fi 7 standard are continuously pushing the boundaries of speed, capacity, and latency. The explosion of the Internet of Things (IoT), with billions of connected devices demanding constant wireless connectivity, is a significant catalyst. Economically, the increasing digitalization of businesses and the widespread adoption of remote work necessitate robust and pervasive Wi-Fi networks. Government initiatives aimed at expanding broadband access and promoting digital inclusion also play a crucial role, especially in developing economies. The demand for high-definition video streaming, online gaming, and augmented/virtual reality applications further fuels the need for high-performance Wi-Fi.

Challenges in the Wi-Fi Market Market

Despite its robust growth, the Wi-Fi market faces several challenges. Spectrum congestion in certain frequency bands can lead to interference and performance degradation, especially in densely populated areas. Regulatory hurdles related to spectrum allocation and certification can sometimes slow down product deployment. Supply chain disruptions, as seen in recent years, can impact the availability of essential components and increase lead times for hardware. Intense competitive pressure among numerous vendors, including both established giants and new entrants, can lead to price erosion and pressure on profit margins. Furthermore, ensuring robust security against evolving cyber threats remains a constant challenge, requiring continuous investment in advanced security protocols and solutions.

Emerging Opportunities in Wi-Fi Market

Several catalysts are driving long-term growth in the Wi-Fi market. The continued expansion of the Internet of Things (IoT) ecosystem across smart homes, smart cities, and industrial automation presents vast opportunities for Wi-Fi-enabled devices and infrastructure. Strategic partnerships between hardware manufacturers, software providers, and service providers are crucial for developing integrated solutions that address complex connectivity needs. The growing demand for managed Wi-Fi services, offering enhanced reliability, security, and performance for businesses, represents a significant revenue stream. Furthermore, advancements in AI and machine learning are opening up opportunities for intelligent network management, predictive analytics, and personalized user experiences, differentiating offerings and driving customer loyalty. The ongoing development of Wi-Fi sensing capabilities also promises new applications beyond traditional connectivity.

Leading Players in the Wi-Fi Market Sector

- Motorola Solutions Inc

- CommScope (Ruckus Networks (Arris International))

- SingTel

- Ubiquiti Inc

- Telefonaktiebolaget LM Ericsson

- Fortinet Inc

- Purple Wi-Fi Ltd

- Aerohive Networks (Extreme Networks)

- Aruba Networks (HP Enterprise)

- Cisco Systems Inc

- Cloud4Wi Inc

- Juniper Networks Inc

- MetTel Inc

- Huawei Technologies Co Ltd

- New H3C Technologies Co Ltd

Key Milestones in Wi-Fi Market Industry

- November 2022: Zyxel Networks, a secure, AI- and cloud-powered business and home networking solution provider, announced bundling its Connect and Protect security service with select Zyxel WiFi access points. This development enhances cybersecurity for small business Wi-Fi networks and optimizes connectivity for improved customer satisfaction.

- November 2022: TP-Link announced the launch of Wi-Fi 7 devices for consumers, enterprises, and internet service providers (ISPs). This strategic move aims to strengthen TP-Link's position in the WLAN market and expands their portfolio of routers, gaming routers, mesh systems, and enterprise access points.

Strategic Outlook for Wi-Fi Market Market

The strategic outlook for the Wi-Fi market is overwhelmingly positive, driven by sustained demand for high-performance wireless connectivity. Growth accelerators include the ongoing adoption of Wi-Fi 7, which will unlock new levels of speed and efficiency for demanding applications. The continued expansion of the IoT ecosystem and the increasing reliance on cloud-based services will further necessitate robust and scalable Wi-Fi infrastructure. Companies are expected to focus on developing integrated solutions that combine hardware, software, and services, with an emphasis on security and intelligent network management powered by AI. Strategic partnerships and mergers will remain crucial for market players seeking to expand their technological capabilities and geographical reach, ensuring the Wi-Fi market remains a dynamic and pivotal sector in the global digital landscape.

Wi-Fi Market Segmentation

-

1. Product Type

- 1.1. Access Points

- 1.2. Gateways

- 1.3. Routers and Extenders

- 1.4. Services (Design, Implementation, and Support)

- 1.5. Other Device Types

- 1.6. Other Solutions

-

2. Application Type

- 2.1. Indoor (Residential, Enterprises, Education)

- 2.2. Outdoor

Wi-Fi Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Wi-Fi Market Regional Market Share

Geographic Coverage of Wi-Fi Market

Wi-Fi Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in Demand for Smart Consumer Electronics Devices in the Major Markets; Ongoing Smart City Projects Focused on Deployment of Outdoor Wi-Fi in Emerging Regions; Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation

- 3.2.2 Etc.)

- 3.3. Market Restrains

- 3.3.1. Skilled Workforce Availability and Security Concerns

- 3.4. Market Trends

- 3.4.1. Indoor is Expected to Account For Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wi-Fi Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Access Points

- 5.1.2. Gateways

- 5.1.3. Routers and Extenders

- 5.1.4. Services (Design, Implementation, and Support)

- 5.1.5. Other Device Types

- 5.1.6. Other Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Indoor (Residential, Enterprises, Education)

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Wi-Fi Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Access Points

- 6.1.2. Gateways

- 6.1.3. Routers and Extenders

- 6.1.4. Services (Design, Implementation, and Support)

- 6.1.5. Other Device Types

- 6.1.6. Other Solutions

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Indoor (Residential, Enterprises, Education)

- 6.2.2. Outdoor

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Wi-Fi Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Access Points

- 7.1.2. Gateways

- 7.1.3. Routers and Extenders

- 7.1.4. Services (Design, Implementation, and Support)

- 7.1.5. Other Device Types

- 7.1.6. Other Solutions

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Indoor (Residential, Enterprises, Education)

- 7.2.2. Outdoor

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Wi-Fi Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Access Points

- 8.1.2. Gateways

- 8.1.3. Routers and Extenders

- 8.1.4. Services (Design, Implementation, and Support)

- 8.1.5. Other Device Types

- 8.1.6. Other Solutions

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Indoor (Residential, Enterprises, Education)

- 8.2.2. Outdoor

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Wi-Fi Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Access Points

- 9.1.2. Gateways

- 9.1.3. Routers and Extenders

- 9.1.4. Services (Design, Implementation, and Support)

- 9.1.5. Other Device Types

- 9.1.6. Other Solutions

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Indoor (Residential, Enterprises, Education)

- 9.2.2. Outdoor

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Wi-Fi Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Access Points

- 10.1.2. Gateways

- 10.1.3. Routers and Extenders

- 10.1.4. Services (Design, Implementation, and Support)

- 10.1.5. Other Device Types

- 10.1.6. Other Solutions

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Indoor (Residential, Enterprises, Education)

- 10.2.2. Outdoor

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Motorola Solutions Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CommScope (Ruckus Networks (Arris International))

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SingTel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ubiquiti Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Telefonaktiebolaget LM Ericsson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fortinet Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Purple Wi-Fi Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aerohive Networks (Extreme Networks)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aruba Networks (HP Enterprise)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cisco Systems Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cloud4Wi Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Juniper Networks Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MetTel Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Huawei Technologies Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 New H3C Technologies Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global Wi-Fi Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wi-Fi Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Wi-Fi Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Wi-Fi Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Wi-Fi Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Wi-Fi Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wi-Fi Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wi-Fi Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Wi-Fi Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Wi-Fi Market Revenue (Million), by Application Type 2025 & 2033

- Figure 11: Europe Wi-Fi Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Wi-Fi Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wi-Fi Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wi-Fi Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Wi-Fi Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Wi-Fi Market Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Wi-Fi Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Wi-Fi Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wi-Fi Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Wi-Fi Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Latin America Wi-Fi Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America Wi-Fi Market Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Latin America Wi-Fi Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Latin America Wi-Fi Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Wi-Fi Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Wi-Fi Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Wi-Fi Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Wi-Fi Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Middle East and Africa Wi-Fi Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Middle East and Africa Wi-Fi Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Wi-Fi Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wi-Fi Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Wi-Fi Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Wi-Fi Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wi-Fi Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Wi-Fi Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Wi-Fi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Wi-Fi Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Wi-Fi Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 11: Global Wi-Fi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Wi-Fi Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Wi-Fi Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Global Wi-Fi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Wi-Fi Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Wi-Fi Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Wi-Fi Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 25: Global Wi-Fi Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Wi-Fi Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Wi-Fi Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 28: Global Wi-Fi Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wi-Fi Market?

The projected CAGR is approximately 14.19%.

2. Which companies are prominent players in the Wi-Fi Market?

Key companies in the market include Motorola Solutions Inc, CommScope (Ruckus Networks (Arris International)), SingTel, Ubiquiti Inc, Telefonaktiebolaget LM Ericsson, Fortinet Inc, Purple Wi-Fi Ltd, Aerohive Networks (Extreme Networks), Aruba Networks (HP Enterprise), Cisco Systems Inc, Cloud4Wi Inc, Juniper Networks Inc, MetTel Inc, Huawei Technologies Co Ltd, New H3C Technologies Co Ltd.

3. What are the main segments of the Wi-Fi Market?

The market segments include Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Smart Consumer Electronics Devices in the Major Markets; Ongoing Smart City Projects Focused on Deployment of Outdoor Wi-Fi in Emerging Regions; Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation. Etc.).

6. What are the notable trends driving market growth?

Indoor is Expected to Account For Significant Market Share.

7. Are there any restraints impacting market growth?

Skilled Workforce Availability and Security Concerns.

8. Can you provide examples of recent developments in the market?

November 2022 : Zyxel Networks, a secure, AI- and cloud-powered business and home networking solution provider, announced bundling its Connect and Protect security service with select Zyxel WiFi access points. It protects small business WiFi networks from cybersecurity hazards and optimizes WiFi connectivity for the business and its patrons to improve connectivity and customer satisfaction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wi-Fi Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wi-Fi Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wi-Fi Market?

To stay informed about further developments, trends, and reports in the Wi-Fi Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence