Key Insights

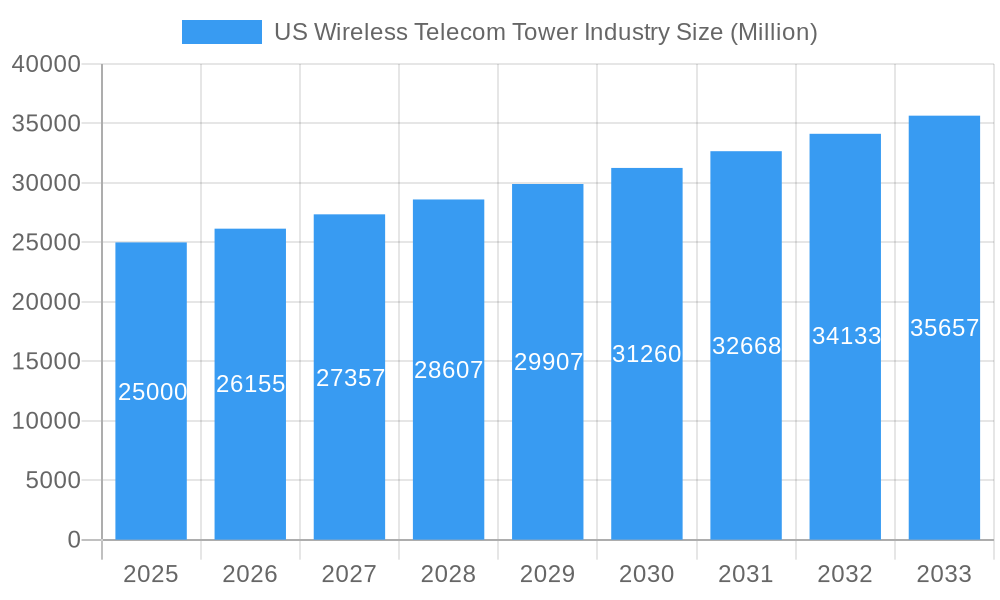

The US Wireless Telecom Tower Industry is projected for significant expansion, anticipated to reach a market size of $14.1 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.7%. This growth is propelled by escalating demand for enhanced mobile broadband, the strategic deployment of 5G networks, and the critical need for robust infrastructure to manage surging data traffic. Key growth drivers include the proliferation of IoT devices, the advancement of smart cities, and the continuous innovation in mobile applications. The industry is also embracing renewable energy solutions for tower power, aligning with sustainability goals and optimizing operational expenditures. Evolving deployment strategies, such as rooftop and ground-based installations, and adaptive ownership models, including joint ventures and operator-captive solutions, underscore a dynamic market. Leading industry participants are prioritizing network densification and the establishment of new tower sites to address burgeoning capacity requirements.

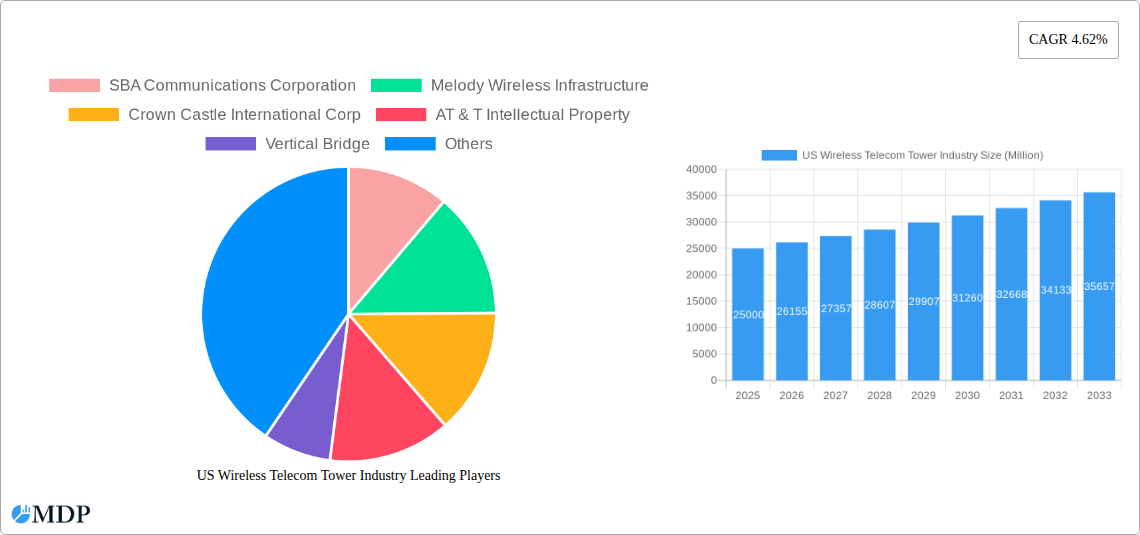

US Wireless Telecom Tower Industry Market Size (In Billion)

While the outlook is positive, the industry encounters challenges. These include substantial capital investment for new constructions and upgrades, complex regulatory approval processes for site acquisition, and dynamic spectrum availability. Consolidation among Mobile Network Operators (MNOs) may also impact tower leasing and investment strategies. Nevertheless, the persistent demand for comprehensive, high-speed wireless connectivity, alongside the rise of enterprise-focused private wireless networks, will sustain market momentum. Innovations in tower sharing, colocation, and novel deployment methods are expected to alleviate these constraints, fostering continued growth and evolution within the US wireless telecom tower sector.

US Wireless Telecom Tower Industry Company Market Share

US Wireless Telecom Tower Industry Market: Comprehensive Analysis & Forecast (2019–2033)

This in-depth report provides a detailed analysis of the US Wireless Telecom Tower Industry, examining market dynamics, trends, growth drivers, challenges, and future opportunities from 2019 to 2033. Leveraging high-traffic keywords such as "telecom towers," "5G infrastructure," "wireless communication," "towers market," and "telecom infrastructure," this report offers unparalleled insights for industry stakeholders, investors, and strategic planners.

US Wireless Telecom Tower Industry Market Dynamics & Concentration

The US wireless telecom tower industry exhibits a moderately concentrated market structure, characterized by a few dominant players and a growing number of specialized entities. Key innovation drivers stem from the relentless demand for enhanced mobile broadband (eMBB), the rollout of 5G networks, and the increasing proliferation of IoT devices, all necessitating robust and expanded tower infrastructure. Regulatory frameworks, while generally supportive of infrastructure development, can introduce complexities related to site acquisition, leasing, and environmental compliance. Product substitutes are limited for core tower services, with fiber backhaul and Wi-Fi offloading being complementary rather than direct replacements for macrocell tower deployment. End-user trends are heavily influenced by consumer demand for faster speeds, lower latency, and ubiquitous connectivity, directly fueling the need for more tower sites and upgraded capacity. Merger and acquisition (M&A) activities remain a significant factor in market concentration, with ongoing consolidation and strategic partnerships aimed at expanding footprints and optimizing portfolios. For instance, the $22.2 Billion acquisition of CoreSite Realty Corporation by American Tower Corporation in January 2022 exemplifies the scale of M&A in this sector, aiming to integrate data center capabilities with tower real estate. The number of significant M&A deals in the historical period (2019-2024) is estimated to be in the range of 80-100 transactions, with an average deal value fluctuating based on the strategic importance of the acquired assets.

US Wireless Telecom Tower Industry Industry Trends & Analysis

The US wireless telecom tower industry is experiencing robust growth, driven by the accelerated deployment of 5G technology and the ever-increasing demand for data consumption. The compound annual growth rate (CAGR) for the industry is projected to be between 6.5% and 7.5% during the forecast period of 2025–2033. This growth is propelled by several key factors. Firstly, the ongoing 5G rollout mandates a denser network of towers and small cells to achieve the promised speeds and low latency, requiring significant investment in new infrastructure and upgrades to existing sites. Secondly, the expanding ecosystem of connected devices, including IoT sensors, smart home devices, and connected vehicles, generates a substantial amount of data traffic, necessitating expanded network capacity that towers provide. Consumer preferences are shifting towards seamless, high-speed connectivity across all locations, driving demand for ubiquitous wireless coverage, especially in suburban and rural areas previously underserved. This also includes a growing need for in-building solutions and distributed antenna systems (DAS) within large venues and dense urban environments. Technological disruptions, such as advancements in antenna technology, spectral efficiency, and the integration of edge computing capabilities at tower sites, are further enhancing the value proposition of telecom towers. The competitive dynamics are characterized by intense competition among tower owners for long-term leasing agreements with Mobile Network Operators (MNOs) and a continuous drive to optimize site utilization through colocation. Market penetration for advanced wireless services is rapidly increasing, with 5G service availability expanding across major metropolitan areas and beginning to reach smaller towns. The base year of 2025 is expected to see total tower site count in the US exceeding 350,000, with a significant portion already equipped for 5G.

Leading Markets & Segments in US Wireless Telecom Tower Industry

The US wireless telecom tower industry is dominated by ground-based installations due to their scalability, cost-effectiveness for macro coverage, and ease of access for maintenance and upgrades, particularly in suburban and rural landscapes. This segment is expected to hold a market share of approximately 70% by 2025.

Installation Type Dominance:

- Ground-based: The primary driver for the dominance of ground-based towers is the extensive coverage required for nationwide wireless networks. Their ability to support multiple tenant leases and accommodate significant equipment makes them the cornerstone of MNO expansion strategies, especially for 4G LTE and 5G deployments. Government initiatives promoting broadband expansion in underserved areas further bolster the demand for ground-based towers.

- Rooftop: While not as dominant in terms of sheer numbers, rooftop installations are crucial for urban density and indoor coverage solutions. They are often favored in densely populated areas where land acquisition is difficult or expensive, and they play a vital role in filling coverage gaps within city centers and large commercial buildings. The growth of small cell deployments, often integrated with rooftop infrastructure, is a key trend here.

Fuel Type:

- Non-renewable: Currently, non-renewable fuels are the predominant power source for most telecom towers due to established infrastructure and cost-effectiveness. However, increasing environmental consciousness and the drive for sustainable operations are leading to greater adoption of renewable energy sources.

- Renewable: The market share of renewable fuels is on an upward trajectory, driven by utility-scale solar and wind power integration, as well as advancements in battery storage solutions. Many tower companies are actively investing in renewable energy to reduce operational costs and their carbon footprint.

Ownership Structure:

- Private-owned: This segment is significant, encompassing a diverse range of independent tower companies and specialized infrastructure providers that own and lease tower space. They are often agile and can cater to specific MNO needs.

- Operator-owned: Historically, MNOs owned a significant portion of their tower infrastructure. While many have divested these assets to focus on network operations, some MNOs, such as AT&T Intellectual Property and United States Cellular Co., still maintain substantial tower portfolios, often for strategic control or specific network requirements.

- Joint Venture: Joint ventures are becoming more prevalent, especially for large-scale projects or in emerging markets, allowing for shared risk and capital investment between multiple stakeholders.

- MNO Captive: This refers to towers owned and operated by an MNO solely for its own use, though this model is becoming less common as the benefits of tower sharing are recognized.

The dominance of ground-based installations is underpinned by economic policies that favor infrastructure development and the inherent scalability of these structures for nationwide network build-outs. The sheer geographical expanse of the United States necessitates a widespread network of robust ground-based towers to ensure broad coverage.

US Wireless Telecom Tower Industry Product Developments

Product development in the US wireless telecom tower industry is increasingly focused on enhancing network efficiency, capacity, and sustainability. Innovations include the development of lighter, stronger tower materials for faster deployment and reduced environmental impact, as well as modular tower designs that allow for flexible configurations and quick upgrades. The integration of edge computing capabilities directly at tower sites is a significant trend, enabling faster data processing and reduced latency for applications like AI, IoT, and autonomous systems. Furthermore, advancements in remote monitoring and management systems are improving operational efficiency and reducing the need for on-site maintenance. The competitive advantage lies in offering versatile, future-proof infrastructure solutions that can adapt to evolving technological demands and support a multi-gigabit wireless future.

Key Drivers of US Wireless Telecom Tower Industry Growth

The US wireless telecom tower industry's growth is primarily propelled by the accelerated deployment of 5G networks, which requires a denser network of macrocell towers and small cells to deliver enhanced mobile broadband, low latency, and massive machine-type communications. The exponential increase in data consumption, fueled by video streaming, online gaming, and the proliferation of connected devices, necessitates continuous network expansion and capacity upgrades. Regulatory initiatives promoting broadband access in underserved areas also contribute significantly. Economic factors such as significant capital investments by major MNOs and the growth of the IoT ecosystem further drive demand for tower infrastructure.

Challenges in the US Wireless Telecom Tower Industry Market

Key challenges in the US wireless telecom tower market include the increasing complexity and cost of site acquisition and permitting, often involving extensive negotiations with landowners and navigating local zoning regulations. Supply chain disruptions for critical components and construction materials can lead to project delays and cost overruns. The fierce competition among tower owners for long-term colocation agreements puts pressure on rental rates. Furthermore, the high upfront capital expenditure required for new tower construction and upgrades presents a barrier to entry for smaller players. The need to constantly adapt to evolving technological standards and the lifecycle management of aging infrastructure also pose ongoing challenges.

Emerging Opportunities in US Wireless Telecom Tower Industry

Emerging opportunities in the US wireless telecom tower industry are centered around the continued expansion of 5G networks, particularly in the mid-band and millimeter-wave spectrums, which require a denser deployment of both macrocells and small cells. The growing demand for enhanced indoor coverage solutions and distributed antenna systems (DAS) in large venues, stadiums, and commercial buildings presents a significant growth avenue. Strategic partnerships between tower companies and hyperscale cloud providers to develop edge computing infrastructure at tower sites offer new revenue streams and value-added services. Furthermore, the increasing adoption of private wireless networks by enterprises for industrial applications and the potential for tower infrastructure to support fixed wireless access (FWA) solutions are creating new market segments.

Leading Players in the US Wireless Telecom Tower Industry Sector

- SBA Communications Corporation

- Melody Wireless Infrastructure

- Crown Castle International Corp

- AT & T Intellectual Property

- Vertical Bridge

- Helios Towers plc

- Tillman Infrastructure LLC

- United States Cellular Co

- ATC IP LLC

- Insite Wireless Group

- BNSF Railroad

Key Milestones in US Wireless Telecom Tower Industry Industry

- January 2022: T-Mobile US, Inc. and Crown Castle International Corp. announced a new 12-year collaboration, granting T-Mobile enhanced access to Crown Castle's towers and small cell sites to support its national 5G network expansion and generate financial synergies.

- January 2022: American Tower Corporation announced the successful acquisition of CoreSite Realty Corporation by merging one of its wholly-owned subsidiaries with CoreSite, aiming to leverage CoreSite's networked data center capabilities and cloud on-ramps for future growth and value enhancement of tower real estate.

Strategic Outlook for US Wireless Telecom Tower Industry Market

The strategic outlook for the US wireless telecom tower industry is highly optimistic, driven by the foundational role towers play in the ongoing digital transformation. The continued evolution and widespread adoption of 5G services, coupled with the burgeoning demand for IoT connectivity and enhanced mobile broadband, will necessitate substantial investment in new tower construction and the upgrading of existing infrastructure. Key growth accelerators include the expansion of fixed wireless access (FWA) as a viable broadband alternative, the integration of edge computing capabilities at tower sites, and the development of private wireless networks for industrial and enterprise applications. Strategic partnerships, agile site acquisition strategies, and a focus on operational efficiency through technology will be crucial for capturing future market potential and maintaining a competitive edge in this dynamic sector. The industry is poised for sustained growth throughout the forecast period, with a strong emphasis on innovation and adaptability.

US Wireless Telecom Tower Industry Segmentation

-

1. Fuel Type

- 1.1. Renewable

- 1.2. Non-renewable

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Ownership

- 3.1. Operator-owned

- 3.2. Joint Venture

- 3.3. Private-owned

- 3.4. MNO Captive

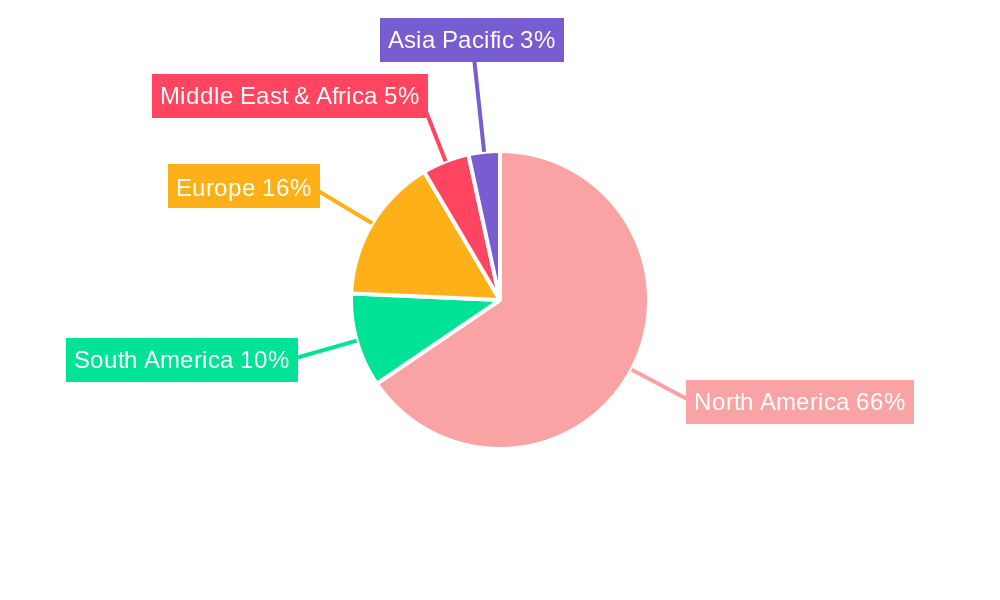

US Wireless Telecom Tower Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Wireless Telecom Tower Industry Regional Market Share

Geographic Coverage of US Wireless Telecom Tower Industry

US Wireless Telecom Tower Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G deployments are a major catalyst for growth in the cell-tower leasing environment

- 3.3. Market Restrains

- 3.3.1. Availability of Limited Spectrum

- 3.4. Market Trends

- 3.4.1. Adoption of 5G to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Wireless Telecom Tower Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Renewable

- 5.1.2. Non-renewable

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Ownership

- 5.3.1. Operator-owned

- 5.3.2. Joint Venture

- 5.3.3. Private-owned

- 5.3.4. MNO Captive

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. North America US Wireless Telecom Tower Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Renewable

- 6.1.2. Non-renewable

- 6.2. Market Analysis, Insights and Forecast - by Installation

- 6.2.1. Rooftop

- 6.2.2. Ground-based

- 6.3. Market Analysis, Insights and Forecast - by Ownership

- 6.3.1. Operator-owned

- 6.3.2. Joint Venture

- 6.3.3. Private-owned

- 6.3.4. MNO Captive

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. South America US Wireless Telecom Tower Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Renewable

- 7.1.2. Non-renewable

- 7.2. Market Analysis, Insights and Forecast - by Installation

- 7.2.1. Rooftop

- 7.2.2. Ground-based

- 7.3. Market Analysis, Insights and Forecast - by Ownership

- 7.3.1. Operator-owned

- 7.3.2. Joint Venture

- 7.3.3. Private-owned

- 7.3.4. MNO Captive

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Europe US Wireless Telecom Tower Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Renewable

- 8.1.2. Non-renewable

- 8.2. Market Analysis, Insights and Forecast - by Installation

- 8.2.1. Rooftop

- 8.2.2. Ground-based

- 8.3. Market Analysis, Insights and Forecast - by Ownership

- 8.3.1. Operator-owned

- 8.3.2. Joint Venture

- 8.3.3. Private-owned

- 8.3.4. MNO Captive

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Middle East & Africa US Wireless Telecom Tower Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Renewable

- 9.1.2. Non-renewable

- 9.2. Market Analysis, Insights and Forecast - by Installation

- 9.2.1. Rooftop

- 9.2.2. Ground-based

- 9.3. Market Analysis, Insights and Forecast - by Ownership

- 9.3.1. Operator-owned

- 9.3.2. Joint Venture

- 9.3.3. Private-owned

- 9.3.4. MNO Captive

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Asia Pacific US Wireless Telecom Tower Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10.1.1. Renewable

- 10.1.2. Non-renewable

- 10.2. Market Analysis, Insights and Forecast - by Installation

- 10.2.1. Rooftop

- 10.2.2. Ground-based

- 10.3. Market Analysis, Insights and Forecast - by Ownership

- 10.3.1. Operator-owned

- 10.3.2. Joint Venture

- 10.3.3. Private-owned

- 10.3.4. MNO Captive

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SBA Communications Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melody Wireless Infrastructure

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Crown Castle International Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AT & T Intellectual Property

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vertical Bridge

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Helios Towers plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tillman Infrastructure LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 United States Cellular Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ATC IP LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Insite Wireless Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BNSF Railroad

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SBA Communications Corporation

List of Figures

- Figure 1: Global US Wireless Telecom Tower Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global US Wireless Telecom Tower Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America US Wireless Telecom Tower Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 4: North America US Wireless Telecom Tower Industry Volume (K Unit), by Fuel Type 2025 & 2033

- Figure 5: North America US Wireless Telecom Tower Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: North America US Wireless Telecom Tower Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 7: North America US Wireless Telecom Tower Industry Revenue (billion), by Installation 2025 & 2033

- Figure 8: North America US Wireless Telecom Tower Industry Volume (K Unit), by Installation 2025 & 2033

- Figure 9: North America US Wireless Telecom Tower Industry Revenue Share (%), by Installation 2025 & 2033

- Figure 10: North America US Wireless Telecom Tower Industry Volume Share (%), by Installation 2025 & 2033

- Figure 11: North America US Wireless Telecom Tower Industry Revenue (billion), by Ownership 2025 & 2033

- Figure 12: North America US Wireless Telecom Tower Industry Volume (K Unit), by Ownership 2025 & 2033

- Figure 13: North America US Wireless Telecom Tower Industry Revenue Share (%), by Ownership 2025 & 2033

- Figure 14: North America US Wireless Telecom Tower Industry Volume Share (%), by Ownership 2025 & 2033

- Figure 15: North America US Wireless Telecom Tower Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America US Wireless Telecom Tower Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America US Wireless Telecom Tower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America US Wireless Telecom Tower Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: South America US Wireless Telecom Tower Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 20: South America US Wireless Telecom Tower Industry Volume (K Unit), by Fuel Type 2025 & 2033

- Figure 21: South America US Wireless Telecom Tower Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 22: South America US Wireless Telecom Tower Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 23: South America US Wireless Telecom Tower Industry Revenue (billion), by Installation 2025 & 2033

- Figure 24: South America US Wireless Telecom Tower Industry Volume (K Unit), by Installation 2025 & 2033

- Figure 25: South America US Wireless Telecom Tower Industry Revenue Share (%), by Installation 2025 & 2033

- Figure 26: South America US Wireless Telecom Tower Industry Volume Share (%), by Installation 2025 & 2033

- Figure 27: South America US Wireless Telecom Tower Industry Revenue (billion), by Ownership 2025 & 2033

- Figure 28: South America US Wireless Telecom Tower Industry Volume (K Unit), by Ownership 2025 & 2033

- Figure 29: South America US Wireless Telecom Tower Industry Revenue Share (%), by Ownership 2025 & 2033

- Figure 30: South America US Wireless Telecom Tower Industry Volume Share (%), by Ownership 2025 & 2033

- Figure 31: South America US Wireless Telecom Tower Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: South America US Wireless Telecom Tower Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America US Wireless Telecom Tower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America US Wireless Telecom Tower Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe US Wireless Telecom Tower Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 36: Europe US Wireless Telecom Tower Industry Volume (K Unit), by Fuel Type 2025 & 2033

- Figure 37: Europe US Wireless Telecom Tower Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 38: Europe US Wireless Telecom Tower Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 39: Europe US Wireless Telecom Tower Industry Revenue (billion), by Installation 2025 & 2033

- Figure 40: Europe US Wireless Telecom Tower Industry Volume (K Unit), by Installation 2025 & 2033

- Figure 41: Europe US Wireless Telecom Tower Industry Revenue Share (%), by Installation 2025 & 2033

- Figure 42: Europe US Wireless Telecom Tower Industry Volume Share (%), by Installation 2025 & 2033

- Figure 43: Europe US Wireless Telecom Tower Industry Revenue (billion), by Ownership 2025 & 2033

- Figure 44: Europe US Wireless Telecom Tower Industry Volume (K Unit), by Ownership 2025 & 2033

- Figure 45: Europe US Wireless Telecom Tower Industry Revenue Share (%), by Ownership 2025 & 2033

- Figure 46: Europe US Wireless Telecom Tower Industry Volume Share (%), by Ownership 2025 & 2033

- Figure 47: Europe US Wireless Telecom Tower Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe US Wireless Telecom Tower Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe US Wireless Telecom Tower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe US Wireless Telecom Tower Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa US Wireless Telecom Tower Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 52: Middle East & Africa US Wireless Telecom Tower Industry Volume (K Unit), by Fuel Type 2025 & 2033

- Figure 53: Middle East & Africa US Wireless Telecom Tower Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 54: Middle East & Africa US Wireless Telecom Tower Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 55: Middle East & Africa US Wireless Telecom Tower Industry Revenue (billion), by Installation 2025 & 2033

- Figure 56: Middle East & Africa US Wireless Telecom Tower Industry Volume (K Unit), by Installation 2025 & 2033

- Figure 57: Middle East & Africa US Wireless Telecom Tower Industry Revenue Share (%), by Installation 2025 & 2033

- Figure 58: Middle East & Africa US Wireless Telecom Tower Industry Volume Share (%), by Installation 2025 & 2033

- Figure 59: Middle East & Africa US Wireless Telecom Tower Industry Revenue (billion), by Ownership 2025 & 2033

- Figure 60: Middle East & Africa US Wireless Telecom Tower Industry Volume (K Unit), by Ownership 2025 & 2033

- Figure 61: Middle East & Africa US Wireless Telecom Tower Industry Revenue Share (%), by Ownership 2025 & 2033

- Figure 62: Middle East & Africa US Wireless Telecom Tower Industry Volume Share (%), by Ownership 2025 & 2033

- Figure 63: Middle East & Africa US Wireless Telecom Tower Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East & Africa US Wireless Telecom Tower Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa US Wireless Telecom Tower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa US Wireless Telecom Tower Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific US Wireless Telecom Tower Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 68: Asia Pacific US Wireless Telecom Tower Industry Volume (K Unit), by Fuel Type 2025 & 2033

- Figure 69: Asia Pacific US Wireless Telecom Tower Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 70: Asia Pacific US Wireless Telecom Tower Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 71: Asia Pacific US Wireless Telecom Tower Industry Revenue (billion), by Installation 2025 & 2033

- Figure 72: Asia Pacific US Wireless Telecom Tower Industry Volume (K Unit), by Installation 2025 & 2033

- Figure 73: Asia Pacific US Wireless Telecom Tower Industry Revenue Share (%), by Installation 2025 & 2033

- Figure 74: Asia Pacific US Wireless Telecom Tower Industry Volume Share (%), by Installation 2025 & 2033

- Figure 75: Asia Pacific US Wireless Telecom Tower Industry Revenue (billion), by Ownership 2025 & 2033

- Figure 76: Asia Pacific US Wireless Telecom Tower Industry Volume (K Unit), by Ownership 2025 & 2033

- Figure 77: Asia Pacific US Wireless Telecom Tower Industry Revenue Share (%), by Ownership 2025 & 2033

- Figure 78: Asia Pacific US Wireless Telecom Tower Industry Volume Share (%), by Ownership 2025 & 2033

- Figure 79: Asia Pacific US Wireless Telecom Tower Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Asia Pacific US Wireless Telecom Tower Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific US Wireless Telecom Tower Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific US Wireless Telecom Tower Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 3: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Installation 2020 & 2033

- Table 4: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Installation 2020 & 2033

- Table 5: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Ownership 2020 & 2033

- Table 6: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Ownership 2020 & 2033

- Table 7: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 11: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Installation 2020 & 2033

- Table 12: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Installation 2020 & 2033

- Table 13: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Ownership 2020 & 2033

- Table 14: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Ownership 2020 & 2033

- Table 15: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 24: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 25: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Installation 2020 & 2033

- Table 26: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Installation 2020 & 2033

- Table 27: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Ownership 2020 & 2033

- Table 28: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Ownership 2020 & 2033

- Table 29: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Argentina US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 38: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 39: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Installation 2020 & 2033

- Table 40: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Installation 2020 & 2033

- Table 41: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Ownership 2020 & 2033

- Table 42: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Ownership 2020 & 2033

- Table 43: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Germany US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Italy US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Spain US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Russia US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Benelux US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Nordics US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 64: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 65: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Installation 2020 & 2033

- Table 66: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Installation 2020 & 2033

- Table 67: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Ownership 2020 & 2033

- Table 68: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Ownership 2020 & 2033

- Table 69: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Turkey US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Israel US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: GCC US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: North Africa US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 84: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Fuel Type 2020 & 2033

- Table 85: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Installation 2020 & 2033

- Table 86: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Installation 2020 & 2033

- Table 87: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Ownership 2020 & 2033

- Table 88: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Ownership 2020 & 2033

- Table 89: Global US Wireless Telecom Tower Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 90: Global US Wireless Telecom Tower Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: China US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: India US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Japan US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: South Korea US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: ASEAN US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Oceania US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific US Wireless Telecom Tower Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific US Wireless Telecom Tower Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Wireless Telecom Tower Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the US Wireless Telecom Tower Industry?

Key companies in the market include SBA Communications Corporation, Melody Wireless Infrastructure, Crown Castle International Corp, AT & T Intellectual Property, Vertical Bridge, Helios Towers plc, Tillman Infrastructure LLC, United States Cellular Co, ATC IP LLC, Insite Wireless Group, BNSF Railroad.

3. What are the main segments of the US Wireless Telecom Tower Industry?

The market segments include Fuel Type, Installation, Ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.1 billion as of 2022.

5. What are some drivers contributing to market growth?

5G deployments are a major catalyst for growth in the cell-tower leasing environment.

6. What are the notable trends driving market growth?

Adoption of 5G to Drive the Market.

7. Are there any restraints impacting market growth?

Availability of Limited Spectrum.

8. Can you provide examples of recent developments in the market?

January 2022 - The announcement of a new 12-year collaboration between T-Mobile US, Inc. and Crown Castle International Corp. would enable T-Mobile to have more access to Crown Castle's towers and small cell sites as the company expands its national 5G network. With the help of the deal, the Un-carrier may serve customers across the United States by further extending and broadening the coverage of the company's 5G network and generating financial synergies after its merger. Additionally, the deal assists Crown Castle in developing long-term income development from small cells and towers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Wireless Telecom Tower Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Wireless Telecom Tower Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Wireless Telecom Tower Industry?

To stay informed about further developments, trends, and reports in the US Wireless Telecom Tower Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence